Intro: The Growing Popularity of Investing in Stocks Online

Where do you go to invest in stocks? Hollywood movies like Boiler Room and The Wolf of Wall Street have left many of us with images of phones ringing off the hook in busy offices and stockbrokers in suits waving slips of paper on trade floors. However, investing in stocks online has been growing in popularity since the late 1990s.

While there was once a time when you’d need to hire an expensive firm on Wall Street and spend hours consulting on the phone in order to be successful in the stock market, that’s not the case today. From stocks as low as $4.95 per share to high-net options, there are a variety of ways to invest in stocks online from the comfort of your computer or mobile phone.

All the same, there are some things you should know before you get started. We’ll explore how to invest in stocks online, types of stock, where to go to invest in stocks, pros and cons of online trading platforms, and some red flags to avoid when investing in stocks online.

Click any of the links below to jump directly to that section:

- What Are the First Steps to Investing In Stocks Online?

- What Types of Stocks Can I Invest In?

- Where Do I Go to Invest in Stocks Online?

- How Can I Invest in Stocks Online?

- What Are Red Flags to Avoid when Investing in Stocks Online?

Image Source: How To Start Investing In Stocks Online

See Also: Best Online Stock Trading Sites for Investors – Top Rankings

What Are the First Steps of Investing in Stocks Online?

Before you jump ahead to asking “How Can I Invest In Stocks,” there are a few questions that must first be answered. Sure, you’re eager to learn how to invest in stocks online and where to go invest in stocks, but, if you want to be successful, there are five keys things you should do first.

1. Eliminate all high-interest debt. Before you start investing in stocks online, make sure that all your high-interest debt is eliminated. Believe it or not, this is the first step to planning for the future and increasing your cash flow.

2. Decide how much you want to spend. You can have a clear understanding of how to invest in stocks online and still fail if you don’t set a budget. There’s a certain thrill when it comes to investing in stocks online that can be similar to the way you feel when winning a hand of poker—so make sure to set a limit for yourself ahead of time.

3. Determine how much counsel you will need. When it comes to investing in stocks online, will it be important to you to be able to speak to a live helpline on the phone? Are you comfortable reviewing and choosing your own opportunities? Will you need someone to help monitor you account? These are all factors that will come into play when choosing an online trading platform.

4. Set realistic goals. You’re probably not going to become a millionaire overnight, but why would you invest in stocks online if you didn’t expect a profit? Set weekly, monthly, and yearly goals, and be sure to review them regularly.

5. Reach out to your network. You might not be a financial wizard, but chances are someone in your network is. Take advantage of social media connections via LinkedIn to gather advice from people you know and trust about how to start investing in stocks online. An update in the form of a simple question, such as “Where do you go to invest in stocks” or “How can I invest in stocks online,” will yield best results.

What Types of Stocks Can I Invest In?

Now that the basics are nailed down, you’ll want to get a feel for different types of investment opportunities before deciding where to go to invest in stocks. Online trading platforms specialize in different options, making this an important step in learning how to invest in stocks online.

- Common Stocks: Bottom-rung ownership in a company or corporation. As revenue rises and falls, so will your payouts, but in the case of liquidations, preferred shareholders and other debtors will have first dibs on assets. Common stocks are a popular option for those who are new to investing in stocks online.

- Preferred Stocks: A step-up from common stocks, preferred stocks generate more revenue and are paid before common shareholders in the case of liquidation.

- Bonds: Bonds are a less popular way of investing in stocks online, but some prefer the slow and steady income they provide. While bonds lose value if they are sold before a predetermined date, hanging on to them yields a yearly interest rate. Once the bond matures, you collect.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

- Mutual Funds: If you have no clue how to start investing in stocks online and no time to learn, a mutual fund might be right for you. The partnership consists of a group of investors who pool their funds and turn them over to a money manager. Everyone shares in gains and losses in proportion to their contribution.

- Money Markets: Money markets have high liquidity and short maturity, which makes them a good place for investors to store or borrow money for the short term. They include CDs, U.S. Treasury bills, municipal notes, and repurchase (repo) agreements. They are a less popular ways to invest in stocks online.

Each type of stock then has different transaction options, which we’ll learn more about under “How Can I Invest In Stocks?”

Image Source: How To Invest In Stocks Online

Don’t Miss: Top Online Stock Brokers (Ranking of the Top Discount Brokerage Firms)

Where Do I Go to Invest in Stocks Online?

You’ve dotted your ’’s and crossed your t’s—now, where do you go to invest in stocks? Below are five popular online trading platforms, as well as links to other highly-rated reviews that can get you started on the path to investing in stocks online.

1. TD Ameritrade: TD Ameritrade has been helping individuals learn how to invest in stocks online since 1994. With more than six million customer accounts and $667 billion total assets under management, they are one of the oldest and most successful online trading platforms.

Pros: Options for common and preferred stocks, mutual funds, and cash management. 24/7 live customer support from former traders via phone or instant messaging. Highly rated—the thinkorswim platform was rated #1 Desktop Platform in 2016. A variety of tools for user needs.

Cons: TD Ameritrade’s success has not made it impervious to controversies, including a security breach in 2007 and client lawsuit in 2009. $9.99 is the base fee per trade.

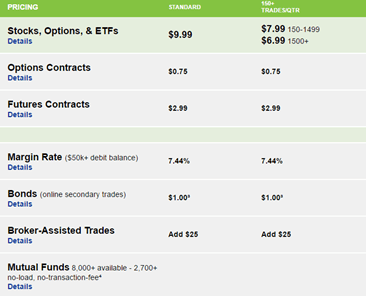

2. E*TRADE: Although E*Trade has half the clients of TD Ameritrade at about three million, they manage assets totaling over $7 billion. E*Trade is a popular option for investors who are just learning to how to start investing in stocks online. Check out pricing options below.

Image Source: E*Trade

Pros: Investment options include independent, some assistance, and full portfolio management. In 2016, E*Trade was rated the #1 Mobile Trading app.

Cons: Full portfolio management is only available for a minimum investment of #150,000. $7.99–$9.99 is the base fee per trade.

Related: Best Options Trading Platforms

3. Scottstrade: Since 1998, Scottstrade has been offering options to invest in stocks online starting as low as $7.99. Like E*Trade, they are a popular option for investors who are just starting out. Total assets under management is roughly $15 million.

Pros: Services are available in English and Chinese. 24/7 live customer support via phone or instant messaging. Consistently listed as one of the “100 Best Companies to Work For” by Forbes. Check out prices for equity trades below.

Cons: In 2015, Scottstrade experienced a large security breach. More than 4.6 million personal records, including names, social security numbers, and account numbers, were compromised.

4. TradeKing: TradeKing has only been around since 2005, but in that time they have certainly made their mark. With $3 billion total assets under management, they are where to go to invest in stocks on a budget. Check out prices for equity trades below.

Pros: Fess as low as $4.95. Four stars in Barron’s annual survey of Best Browser-Based Online Brokers for the past eight years.

Cons: No nuts and bolts offices for live consultation. Live support limited to Monday through Friday, 8 a.m. to 6 p.m. EST.

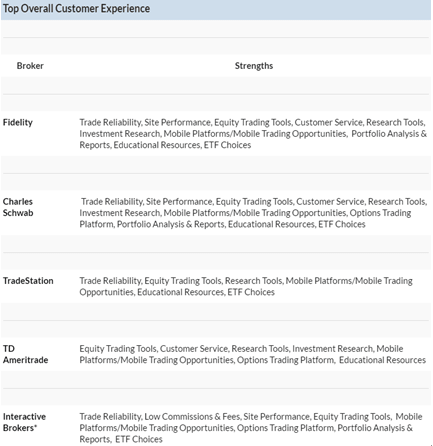

5. Fidelity: With $2 trillion total assets under management, Fidelity just might be the best of the best when exploring where to go to invest in stocks. Barron’s and Investor’s Business Daily certainly thought so when they rated them the #1 overall online broker in 2016! Check out how their customer experience ranks in comparison to other online platforms.

Image Source: Investor’s Business Daily

Pros: Highly rated. Brand new app with a customized feed. Customized options for portfolio, account management, and pricing.

Cons: For those just learning how to invest in stocks online or looking to spend very little, Fidelity’s services may be too robust. Minimum balance to open an account is $2,500.

Want to learn more about where to go to invest in stocks online? Check out our website for a review of the five best online investment companies or Barron’s 2016 review of best online brokers.

Popular Article: Best Penny Stock Brokers & Trading Platforms | This year’s Ranking

How Can I Invest in Stocks Online?

So you’re ready to invest in stocks online. Now what? Once you’ve chosen an online trading platform and created an account, you’ll need to decide what type of online transaction is going to be the most bang for your buck. If it’s your first time investing in stocks online, there will no doubt be many terms that are unfamiliar. A firm understanding of your individual needs makes all the difference when choosing the transaction that is right for you.

- Market Orders: Market orders are the simplest, most popular way to invest in stocks online. These orders are filled immediately at current market prices; therefore, they are useful when certainty of the deal takes priority over order price.

- Limit Orders: The reverse is true for limit orders, which become active only when a stock reaches a predetermined price (or lower). While this can be a good way to get your feet wet in the market while on a budget, there’s no guarantee that the order will execute. It could be weeks, months, or years before the market reaches the prices you’ve chosen.

- Stop Orders: Stop orders wait until a certain price point is surpassed, then transfer to a market order. By allowing investors to enter and exit the market quickly, these are a popular way to assure profits and minimize losses.

- Conditional Orders: These orders execute or cancel based on a variety of predetermined criteria, such as price, volume, time of day, and more. There are six common types of conditional orders that you may run into while investing in stocks online: minute stocks (expire after a specified number of minutes); day stocks (expires at the end of a trading day); Immediate or Cancel (known as IOC, this order must be filled in its entirety immediately, or it will be canceled); All or None (must be filled in its entirety by the end of the day, or it will be canceled); Good Till Canceled (known as GTG, this is valid until filled, or if you cancel it); and Good Till Date (known as GTD, this is valid until a predetermined date).

Free Wealth & Finance Software - Get Yours Now ►

What Are Red Flags to Avoid When Investing in Stocks Online?

- Penny stocks: Penny stocks are any stocks less than $3 that are traded outside of the major market. Lack of public information about these stocks make them highly susceptible to “pump-and-dump” schemes, along with other types of fraud. Watch this video from Investopedia to learn more.

- Stock manipulators: From cross-trading to locking, Investor’s Hub has a comprehensive list of ways that you can be manipulated while investing in stocks online with stock manipulators.

- Insiders are selling: If high-level shareholders are abandoning their stocks, it probably doesn’t mean that you’ve stumbled upon a great opportunity that’s up for grabs. Often, it’s a sign a company is nearing bankruptcy.

- Email schemes: Investment fraud that used to take place over the phone has now moved to email. Investigate any “great opportunity” emails that land in your inbox with extreme caution.

With the basics of how to invest in stocks online covered, you’re ready to get started. Good luck!

Read More: How to Invest in Bonds – Complete Guide (Buying and Investing in Bonds)

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.