Guide to IRA Contribution Limits, Roth IRA, SEP, and Traditional IRA Contribution Limits

Your golden years may be rapidly approaching, but are you making the most adequate preparations for them?

Saving for retirement is a daunting task for many individuals, consumed by the fear of the future but unable to make the moves necessary in the here and now. In part, this lack of preparation could very well stem from not being aware of the IRA contribution limits they are capable of making each year.

AdvisoryHQ wants nothing more than to help you enter retirement financially prepared for the years ahead of you. To help you make wise decisions for your future, we intend to cover the Roth IRA contribution limits, SEP IRA contribution limits, and the traditional IRA contribution limits in greater detail within this article.

By the end of this guide, you could be an expert on IRA contribution limits.

See Also: How to Open IRA Accounts | Guide to Opening an IRA Account

What Are the IRA Contribution Limits?

In a nutshell, the Internal Revenue Service (more commonly known as the IRS) sets some pretty firm limits on just how much the average individual can contribute to an IRA account.

These IRA contribution limits can be altered and changed by personal circumstances, including the specific type of individual retirement account you have (for example, there are specific Roth IRA contribution limits) and your modified adjusted gross income. However, we’re going to cover the very basic concept of how much you can expect the IRS to allow you to contribute without these exclusions.

Keep in mind that making excess contributions above and beyond the general IRA contribution limits or the Roth IRA limits can result in a 6 percent tax on the amount over the allotted contribution. Alternatively, you are also able to withdraw your excess contributions or withdraw the earned income on the excess contribution portion.

There are two major IRA contribution limits that most individuals will encounter (apart from specific rules pertaining to Roth IRA contribution limits, traditional IRA contribution limits, or SEP IRA contribution limits):

Annual IRA Contribution Limits

On an annual basis, the IRA contribution limits put a cap on investments at just $5,500 per year if you’re under the age of 50.

As you approach retirement, the catch-up provision from the IRS will allow you to make slightly greater investments with increased IRA contribution limits of $6,500 per year. These are the limits that you can expect to encounter across the board for all of your IRA contribution limits including Roth IRA limits.

Do you have a traditional IRA, SEP IRA, and a Roth IRA all at the same time? Don’t be fooled into thinking that you can contribute $5,500 into each one of these accounts per year. The IRS puts strict IRA contribution limits in place that allows $5,500 as the grand total for the year across all of your accounts.

For example, if you have a traditional IRA that has already received a contribution of $2,000, then you will have $3,500 left in potential contributions for the year among either of the other two account types.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

You have to pay close attention to the IRA contribution limits to make sure you don’t exceed this amount. In the upcoming sections, we will go over specific exclusions and rules for each type of IRA contribution limits.

Source: Bankrate

Don’t Miss: Ways to Find the Best IRA Companies & Providers Guide to Finding the Top IRA Providers

Income IRA Contribution Limits

Beyond the limits made by the IRS as the general IRA contribution limits, you can expect to encounter a few more roadblocks here. IRA contribution limits restrict you from contributing more than you earned in a given year. These IRA limits exclude you from the ability to deposit tax refunds, birthday money, or any other sort of unexpected income into your account.

For example, if you earned $3,000 in wages from you job this year, that would be the maximum amount that you could make according to the IRA limits. This could be particularly frustrating for those who are nearing retirement and working minimally but downsizing. An IRA contribution rule like this one limits your ability to contribute money from the downsizing toward your retirement savings account.

Roth IRA Contribution Limits

The Roth IRA limits are fairly flexible, especially when compared to a traditional IRA account. So long as you maintain some source of earned income, you may make contributions to your account without any sort of Roth IRA age limit imposed upon you. If you want to continue to work (and make contributions) until you’re 80 years old, the IRS isn’t going to stop you.

Not only that, but you are never required to take minimum distribution payments at any point in your lifetime. Your savings account can continue to accrue earnings and grow for when you need it most depending on your personal financial situation and your own discretion. These same two factors cannot be said of a traditional IRA or an SEP IRA.

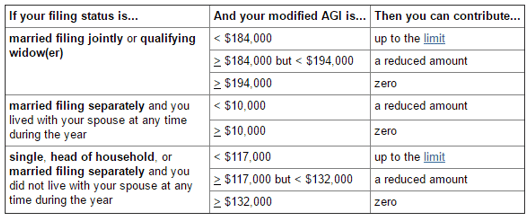

Unfortunately, there are still Roth IRA limits to what you can contribute. A Roth IRA limits the amount you can contribute based on your income as well as the basic annual IRA contribution limits. There may be no Roth IRA age limit, but there most certainly is an income limit. You can see the various brackets in the chart below issued from the IRS, but we will cover the major points in this section.

Source: IRS.gov

The Roth IRA contribution limits primarily exclude high income earners from taking advantage of the tax benefits of this sort of account. Individuals who plan to file their taxes as married filing jointly or as a qualifying widow or widower will have their Roth IRA contribution limits cut lower if they make between $184,000 and $194,000 per year according to the IRS modified adjusted gross income (calculated with this worksheet). After this amount, Roth limits prevent them from making any contributions at all.

Expect similar roadblocks with Roth IRA limits for those planning to file as single, head of household, or married filing separately (but without living together during the year). With a modified AGI of between $117,000 and $132,000, Roth IRA limits allow you to make partial contributions, but income over this amount excludes you from any contributions at all.

Keep in mind that there is no Roth IRA penalty for withdrawing your funds after the age of 59 ½ and five years after your first contribution. This tax savings in retirement is a huge advantage for this type of account and is the reason that most individuals will prefer to maximize their potential Roth IRA contribution limits in this type of account.

Related: Best IRA Rates | Guide | Best Roth IRA Interest Rates & Rates of Return

Traditional IRA Contribution Limits

The traditional IRA limits have fewer restrictions placed on them than you’ll find included in the Roth limits. Depending on your desired usage, these may deter you from opening a traditional IRA simply based on the traditional IRA contribution limits.

Perhaps one of the biggest differences between them is that a traditional IRA contribution is subject to an age limit whereas the Roth IRA age limit is nonexistent. By the age of 70 ½, the IRS requires a traditional IRA to begin issuing minimum required distributions and no longer allows continuing contributions.

If you were hoping to use your traditional IRA much later into retirement, this cuts into the potential growth and earnings that you could accrue based on continued traditional IRA contributions.

While that may be a great disadvantage for some individuals, it may be the best option for those who earn a higher income. With traditional IRA limits, there are no income limits as there are with the Roth limits. You can earn as much as you would typically acquire with an annual salary or wage and still make your maximum contribution of $5,500 ($6,500 if you’re over the age of 50). However, there are IRA contribution limits that may limit the amount that you can claim on your taxes based on your income.

Traditional versus Roth IRA Limits

Not only is there a significant difference between the Roth IRA limits and the traditional IRA limits, but there is a difference in how that money will be taxed moving forward into retirement. Be prepared for what lies ahead with each of these types of accounts.

A traditional IRA will require you to pay taxes on the money that you withdraw during your retirement. This could put you at a disadvantage if you expect to be at a higher tax bracket at this point in time. IRA limits surrounding the Roth make that type of account significantly more tax-favored with no Roth IRA penalty for withdrawals under certain conditions.

If you found that you did not qualify for a Roth IRA, you can make your contributions initially to a traditional IRA instead. In the future, you could consider rolling your traditional account into a Roth IRA to take advantage of the tax benefits and penalty-free withdrawals in your retirement. This could be a great choice for you if the Roth IRA limits are preventing you from opening an account or contributing to this type of account on a regular basis.

Bear in mind that this will be taxed transaction, and you will owe money upfront on the amount that you rollover into a Roth IRA. It is a great method of getting around the restrictions imposed with the Roth IRA contribution limits, but only if you can afford the initial cost. The best time to make the transaction is when you find yourself in a lower tax bracket (between jobs, in a lower-paying profession, going back to school, etc.).

Popular Article: IRA Distribution & Roth IRA Withdrawals | Guide | What You Need to Know About IRAs

SEP IRA Contribution Limits

Compared to the Roth IRA contribution limits and the traditional IRA limits, the SEP IRA has a few more restrictions to cover. An SEP IRA is simply a traditional IRA that holds and stores contributions that were made by your employer under this type of retirement savings plan. SEP IRA rules are slightly different because someone else (your employer) is making contributions on your behalf to a retirement savings account. However, they will remain the same as the traditional IRA rules to an extent.

The maximum SEP IRA contribution limits come in at 25 percent of your income or a maximum of $53,000. This maximum amount could be adjusted in years to come based on the cost of living, but this is where the IRS has currently set its SEP IRA contribution limits.

The benefit to SEP IRA rules is that it does allow you to still make contributions of your own volition. For example, if your employer contributes the maximum allotted amount of $53,000 to your SEP IRA account on your behalf, you are still permitted to contribute up to the initial IRA contribution limits of $5,500 to $6,500 depending on your age. This means that if your employer makes the maximum allowable contribution of $53,000, you could potentially have $59,500 worth of contributions for the year.

The SEP IRA rules allow you to make your additional contributions either to your SEP IRA (just another form of traditional IRA, really) or to a traditional IRA or Roth IRA of your own choosing. Alternatively, you can also split your SEP IRA contribution limits between the SEP IRA and accounts of your own choosing. You may choose to invest half of your money in each type of account so long as you do not invest above and beyond the SEP IRA contribution limits.

Making additional contributions to your SEP IRA may force you to waive your ability to deduct these contributions on your taxes at the end of the year. If this is a benefit that you were looking forward to and anticipating, you may want to consider investing those funds elsewhere into a traditional IRA of your own selection.

Bear in mind that an SEP IRA will be taxed just as a traditional IRA is taxed – when you withdraw your funds as you face retirement. You may be able to deduct your contributions on your taxes now, but you will face these taxes as you consider withdrawing or are forced to withdraw your funds by age 70 ½.

Conclusion

Managing your retirement effectively is a critical component to ensuring your future financial freedom during your golden years. Don’t allow the tricky IRA limits put in place by the IRS deter you from making the most of your contributing years.

You should have a thorough understanding of the Roth IRA contribution limits, SEP IRA contribution limits, and the traditional IRA contribution limits to make sure that you have a retirement savings account that is the right fit for you.

Not only should you be aware of the IRA contribution policy, but you should have some understanding and knowledge of the benefits of each type of account. These seemingly small facts can make a big difference in the comfort level of your retirement and need to be weighed accordingly. Particularly, factors like the nonexistent Roth IRA age limit or the lack of Roth IRA penalty when it comes time to withdraw funds can be significant.

With this guide, we set out to give you the information you would need to navigate the IRA contribution limits with ease. Keep making regular deposits into your retirement savings account, up to the maximum, in order to help you prepare as best you can for the retirement ahead of you.

Read More: How Much to Save for Retirement – Retirement Planning Advice at Any Age

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.