Guide to Opening an IRA Account

An individual retirement account (IRA) is one of the best savings options for retirement.

However, with so many savings and retirement options, you may be left wondering, “What is an IRA account, and how does it work? And how is it different than the other options?”

We know that saving for retirement is important for our future, but we often do not know the basics, like what options are the best, how to open an IRA, or what is a Roth IRA account? With such extensive options, the retirement savings process can become quickly confusing.

Image Source: How to Open IRA Accounts

This article will walk you through the ins and outs of an IRA to help answer your questions.

In addition to explaining what an IRA account is and how it works, we will also provide tips to consider before opening a Roth IRA and teach you how to open a Roth IRA.

See Also: Betterment IRA Review | Read Before Rolling Over Your 401(k), ROTH or SEP IRA

What Is an IRA Account and How Does It Work?

An IRA is one of the most popular retirement savings options because of its tax breaks, interest rates, and other options to tailor the account to your needs.

Many choose to open an IRA account rather than opt for other savings options, such as a 401(k), because of its flexibility with employment.

You do not have to be employed by a participating employer to open an IRA account.

Image Source: Teens Guide to Money

Investors also choose opening an IRA over other retirement savings options because:

- You receive tax breaks. After you open an IRA account, your contributions grow without tax penalties. When you open a Roth IRA, your withdrawals are tax-free. A traditional IRA allows you to deduct your contributions on your taxes. Either way, you do not get penalized with hefty taxes from opening an IRA.

- There are unlimited investment options. Once you learn how to open an IRA, you will see that your investment options are much wider than those of a 401(k). 401(k) plans have a pre-selected number of investments, like stocks and bonds. However, opening an IRA allows you unlimited access to investments through your financial institution.

- Any employed individual can open an IRA account. Who can open a Roth IRA? Unlike a 401(k) where you have to be an employee of a participating employer, any employed individual can open a Roth IRA to begin saving for retirement. You can also choose to open an IRA account as a supplement to your 401(k) plan.

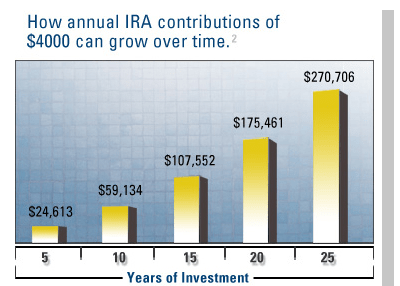

Before you learn how to open an IRA account, consider the maximum contributions you are allowed each year.

Unlike a 401(k) plan that has a higher maximum contribution range per year, an IRA will allow you to contribute a maximum of $5,500 in 2016. Some people who can open a Roth IRA might be content with this, but those looking to invest more each year may not see an IRA as a good fit for their retirement.

Learning how to open an IRA account can seem like a confusing, daunting process. But, once you understand the difference between the types of IRAs, like what is a Roth account, you will better understand your own financial needs and goals and discover what type of IRA is right for you. The following steps will help you learn how to open an IRA retirement account.

Don’t Miss: Sep IRA Rules| What You Need to Know about SEP Withdrawal, Contributions, and Plan Rules

How to Open an IRA Account

Before you learn how to open a Roth IRA or traditional IRA, there are a few things you should keep in mind:

- Current income level

- Expected income level at retirement

- Your future financial retirement goals

- When you want access to your contributions

These factors can change the type of retirement savings you need and, therefore, should be considered before opening an IRA. Create a plan for yourself, jot down notes, and do some research on the internet before deciding if opening a Roth IRA is right for you.

Once you have your goals defined and a plan outlined, you can move on to learning how to open an IRA account.

1. Consider Types of IRAs

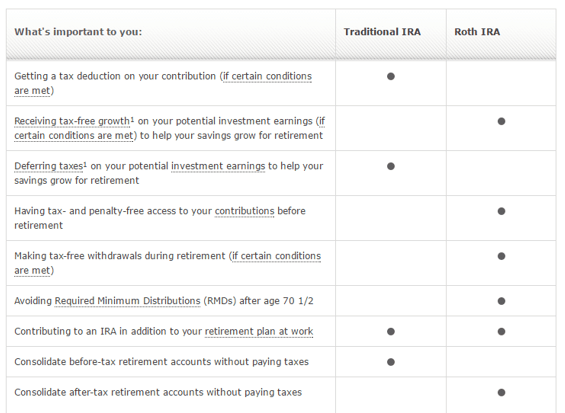

During your planning process and research, you probably came across the terms “traditional IRA” and “Roth IRA” frequently. What is a Roth account, and how is it different from a traditional IRA? If you are considering how to open a Roth IRA, you should first understand the difference between the two accounts.

A Roth IRA allows tax-free growth of your investment. In fact, one of the biggest differences between a traditional IRA and a Roth IRA is the way in which they handle tax benefits.

A traditional IRA is typically for higher-income individuals who do not qualify for the income guidelines set by a Roth IRA. When you open an IRA account, your financial institution will go over the income guidelines with you to see if you are a saver who can open a Roth IRA.

A Roth IRA allows you to pay taxes on your original contribution in lieu of taxes through the year on your saved amount. Once you learn how to open a Roth IRA, you will also find that you can make tax-free withdrawals from your account during retirement.

Image Source: Wells Fargo

When asking, “What is a Roth IRA account versus a traditional IRA?” the above table can help you decide which is best for you depending on your retirement goals. Once you understand the differences and make an educated financial decision, you can more easily learn how to open an IRA account and make the most of it.

Related: American Funds Review | What You Should Know About American Funds Retirement Solution

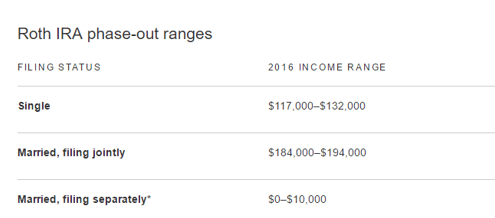

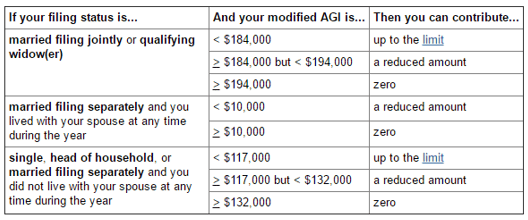

2. Check Your Income Eligibility Before Opening a Roth IRA

As previously mentioned, a Roth IRA requires you to fall within certain eligibility guidelines. Before learning how to open a Roth IRA, you should determine what are Roth IRA account income guidelines.

Image Source: Vanguard

The table above outlines the 2016 income ranges to qualify for opening a Roth IRA. What is a Roth account benefit over a traditional IRA at these income levels? This income cap actually helps you receive your tax-free benefits during the life of your IRA and your withdrawals during retirement.

Source: IRS

Once you check the guidelines for a Roth IRA, you can learn more about how to open a Roth IRA by learning the amount of yearly contributions you can make to your plan. Then, you create a more specific investment plan to further the process.

A traditional IRA, on the other hand, allows you to take tax deductions on your contributions while also allowing your contributions to grow tax-free. Before you open an IRA account, consider which of these options gets you closer to your retirement goals and immediate needs.

3. Choose Your Investments

Now that you know what is a Roth IRA account, who can open a Roth IRA, and whether a traditional or Roth IRA is the right choice for you, you can learn more about opening an IRA and choosing investments.

Unlike a 401(k), when you open an IRA account, you have the responsibility of choosing your own investments. This allows for a lot more control over your account, but it also requires more research to choose the investments that make sense for your plan.

You should consider allocating your investment between a variety of investment options, like stocks and bonds. The best assets for you depend on your age and current assets, if any. Before opening an IRA, consider paying for a consultation with a professional financial advisor who can start you off in the right direction.

He or she will tell you how to open an IRA with investment options that work for you and will benefit your retirement plan in the long run. Remember, allocating your investment to a variety of assets gives your account the most potential for growth and less potential for risk.

4. Consider How Much You Should Invest

Once you know what you should invest in, figuring out how much to invest when you open an IRA account is your next step. This varies from person to person because every individual’s retirement plan is different.

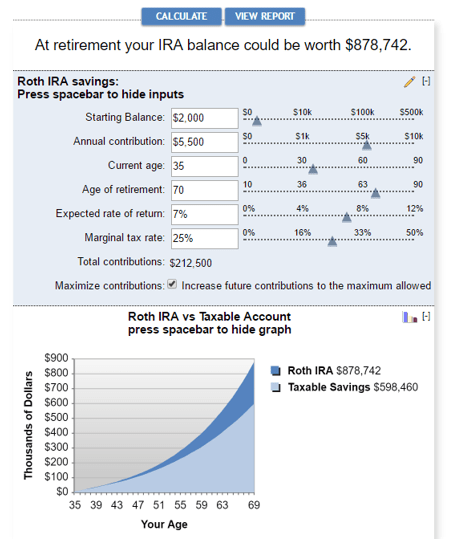

Image Source: Bankrate

Bankrate offers a variety of retirement calculators to help you understand your investment and how much you should contribute to meet your goals before opening an IRA.

If you are specifically interested in learning how to open a Roth IRA, Bankrate’s Roth IRA calculator provides an in-depth look at how your starting balance, annual contribution, current age, and expected retirement age will affect your total contribution by the age of retirement.

Before you open a Roth IRA, you can benefit from using such a calculator to adjust numbers and see the change in results immediately. This will help you determine whether you should adjust your initial contribution and annual contributions to meet your retirement goals.

You may even find that your expected contributions will far exceed your original retirement goal, which is beneficial to your financial situation.

Popular Article: Average Retirement Savings By Age 30, 35, 40, 45, 50, 60, 65

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

5. Open a Roth IRA Online

Once you are ready to open an IRA account, consider opening an IRA online. There are several reputable online brokers who can set you up with an online IRA with just a few simple steps.

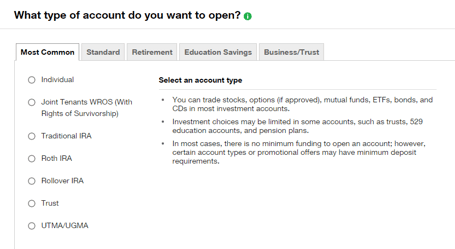

Image Source: Ameritrade

Ameritrade, for example, moves you through the process of opening a Roth IRA or traditional IRA completely online, using your personal information and retirement goals.

Ameritrade and other online brokers give you access to educational resources, like how to open a Roth IRA and utilize its benefits toward your retirement goals. Whether you are a beginning investor or skilled trader, you can benefit from the tools and resources that online brokers provide.

When you open an IRA account online, you typically also have access to a variety of customer service options to help when needed, such as e-mail, phone, or live chat. Charles Schwab, for example, provides 24/7 customer support, and you can actively view and manage your account from your mobile phone.

6. Start Funding Your IRA

Now you’ve been through the process of opening an IRA and learning how much to invest and how to invest it. But how should you start to fund it?

After learning how much to contribute initially and each year after you open an IRA account, you should make a plan to efficiently set aside the money that will fund your IRA. You should aim to contribute the maximum allowed yearly amount per IRS guidelines, or as close as you can get.

Try to create an automatic contribution schedule by bank transfer to your IRA account. After you’ve finished opening an IRA, most financial institutions will allow you to quickly set up a schedule so funds move directly from your bank to your IRA as often as you want. If you can only afford $50 every two weeks, do that. Any amount is better than nothing, and $100 per month turns into $1200 per year every time.

Read More: Retirement Planning | Complete Guide to Help You Plan for Retirement

Conclusion

Learning how to open a Roth IRA or traditional IRA can be confusing to those new to investing. Fortunately, with some research and a retirement goal plan, you can quickly be on your way to investing in your future using an IRA.

Before opening an IRA, remember to understand what type of investments you should allocate your initial investment to, use a calculator to determine how much you should invest, and consider using automatic transfers to fund your account and keep you on track with saving.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.