LendUp Reviews—What You Need to Know about LendUp. Is LendUp Legit? Is it Safe?

When you are looking for personal loans, it is critical to do plenty of research to determine where you can find the best service.

Borrowing money can be extremely convenient, but it is also a decision that must be made carefully to protect your credit score and assets.

If you have been in the market for loans, then you may have already heard of LendUp, an online direct lending financial service.

LendUp is a relatively new company, and it offers some unique opportunities for people who are looking for loans. In order to find out more about it, it is natural that you would want to look up some LendUp reviews.

At AdvisoryHQ, we pride ourselves on providing you with the latest and most accurate information on all types of financial services. We know that you want to keep your money and credit safe, so one of the most common questions that consumers have is whether a financial service is reputable.

In this LendUp review, we will answer the two most pressing questions for LendUp: “Is LendUp legit?” and “Is LendUp safe?” First, we will outline a brief history of the company. Next, we will provide a thorough exploration of the services offered.

We will summarize actual client reviews to give you a complete picture of LendUp, and finally, we will conclude with our analysis on the safety and legitimacy of LendUp. With this Lend Up review, we aim to equip you with all of the necessary information you need to determine whether using LendUp financial services is right for you.

See Also: Blue Trust Loans Review—What You Should Know! (Loan Reviews)

Helping The World, One Loan At A Time

LendUp is not your typical loan company. It fact, it touts the title of a Payday Loan Alternative. LendUp was founded in 2012 by two stepbrothers, Sasha Orloff and Jacob Rosenberg, who have significant banking and high-tech experience, respectively.

Its first major accomplishment was gaining the support of the seed accelerator Y Combinator. Y Combinator is a prestigious company that specifically invests in promising start-ups. It selects companies and then provides them with funding, advice, and networking opportunities.

In addition to Y Combinator, the company has received support from other well-known tech investors, including Google Ventures, Kleiner Perkins, and Andreessen Horowitz.

The purpose of LendUp is “to expand access to credit and lower the cost of borrowing.” It aims to achieve this goal by offering lending services to people who are not likely to be approved by banks for loans.

According to a report from TheStreet.com, the average credit score in the US is 695, and it has been rising over the past few years. In spite of this, the company asserts that more than 150 million Americans still have credit scores below 680, leaving them vulnerable to being unable to get a loan if they really need one.

In addition, this segment of the population has difficulty improving their credit scores with the current options that do exist for credit. Therefore, LendUp wants to help these people by replacing the unhelpful structure of the payday loan establishment with a better way to lend.

The Four Tenets of LendUp

If you are still wondering what is LendUp exactly, then the clearest answer may come from understanding the company’s four ideals, detailed on its about page.

The ideals are as follows:

- Ladders: Providing a path for customers to gradually get access to more credit.

- Not chutes: Working with customers to find solutions, and not penalizing them.

- Transparency: Making products easy to understand and settling terms up front.

- Building credit matters: Encouraging and rewarding higher credit scores.

These principles set LendUp apart from typical payday loan operations. Payday loan companies often have debt traps that exploit borrowers, and they can be very unclear about fees and deadlines.

Payday loan companies also make borrowers pay the same high fees and rates, regardless of how consistently they are paying back their loans. On top of that, many of these companies avoid regulatory scrutiny and put their customers at risk.

Don’t Miss: Best Quick Cash Loans | Ways to Get Quick Loans, Even with Bad Credit

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

A New Type of Lending

Image Source: Pixabay

Image Source: Pixabay

LendUp’s self-imposed status as a Payday Loan Alternative demonstrates the company’s desire to change the way that people with low credit can borrow. It aims to accomplish this by offering four different types of services: short-term loans, long-term loans, a credit card, and online education courses.

A Quick Fix: Short-Term Loans

The first type of financial service we will cover in this LendUp review is a short-term financial loan. This is a loan with a maximum term of 30 days and $250.

For these loans, the Annual Percentage Rate (APR) varies depending on the specific amount of the loan. As an example, it can vary from 228.13% ($12.50 in interest) for a $100 loan to 260.98% ($35.75 in interest) for a $250 loan.

In comparison, a 2013 paper from the Consumer Financial Protection Bureau reported an average payday loan APR of 339%. Even before any of the additional services are considered, the loans at LendUp offer better APRs than the average. The company uses big data to analyze potential borrowers and to keep interest rates low.

Some payday operations can take up to four days to transfer the money, which can be extremely detrimental when you need it to pay for something immediately. On the contrary, LendUp boasts that you can apply for a loan in as little as five minutes, get an instant decision, and receive the money in your account in fifteen minutes.

Climbing the LendUp Ladder

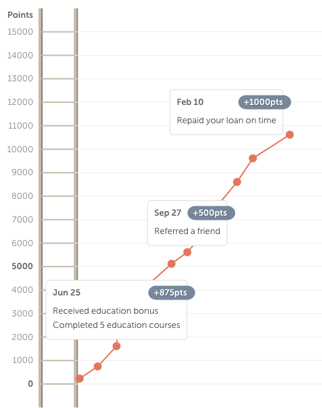

The Ladder strategy at LendUp is another unique characteristic of its loans. The Ladder is a points-based program that offers incentives and rewards for practicing good credit behavior.

Source: The LendUp Ladder

There are multiple actions you can complete to get points. When you first get a loan, you will get 125 points. Repaying your loan on time rewards you with 1,000 points, and even repaying after an extension gets you 500 points.

You can also earn points by completing the education courses, which we will cover later in the LendUp review, and referring friends to LendUp.

Points cannot be redeemed for anything; they symbolize your level on the Ladder. As you earn more points, your ranking will ascend from Silver to Gold, Platinum, and Prime. These tiers indicate the types of loans to which you will have access. Upper-level loans have higher maximums and lower APRs.

Another problem that LendUp tries to alleviate is that most major credit bureaus do not accept information from payday loan services. As a result of this, your credit does not improve even with good behavior. However, once you are at the Platinum level or higher at LendUp, your repayment behavior can be reported.

Related: LendUp Reviews | Is LendUp Legit? A Scam? What You Need to Know about LendUp.com

A Lengthier Arrangement: Long-Term Installment Loans

Right now, LendUp only offers short-term loans. However, as the company grows, it plans to expand and add another type of loan to the repertoire, Installment Loans.

These loans will be for up to $1,000. They will be repayable in installments, and have rates as low as 29.99% APR.

Customers in certain states will be eligible to apply for them soon. Currently, you can submit your information on the LendUp website to receive an alert when applications are available.

Credit for Those Who Need It: The L Card

In addition to loans, LendUp has recently rolled out another venture, the L Card. The L Card is a credit card specifically for people who have not used a credit card before or who have previously had credit problems.

The card is issued by Beneficial State Bank, a member of the FDIC. The card is in its beta version, so only limited access is available. Similar to the long-term loans, you can leave your email so that you will get an invitation to apply when the applications are available.

Popular Article: Trusted Payday Review—Get All the Facts! (Payday Loan Reviews)

Understanding Your Finances: LendUp Educational Services

As mentioned earlier in this Lend Up Review, you can also earn points in the LendUp Ladder through completing online education courses about finances. These short courses are completely free, and each one gives you 125 points. After completing your first six courses, you will get an extra 250-point bonus!

Each course includes a short video and an online quiz. The following courses are available:

- Credit Building Unveiled

- Know Your Credit Rights

- The True Cost of Credit

- Roadmap to Your Credit Report

- Build Your Credit: Ladder to Success

- How to Protect Yourself Online

- Pay Yourself First

- Better Budgeting

- Benefits of Your Credit Card

- Beating Credit Card Risk

- What’s Up with Your Finance Charges?

- Building Your Financial Future

- Your Finances: A Tool for Life

Completing these courses is an easy way to improve your ranking within the company and get access to better loans—and learn some new things about credit!

LendUp.Com Reviews and Customer Feedback

Now that we have covered the services available at LendUp, let’s check out some actual ratings of LendUp and customer feedback about loans from LendUp reviews.

LendUp is not accredited by the Better Business Bureau, and is rated with a B. The company has had 37 complaints submitted against it, and they have all been resolved.

On CreditKarma.com, the company has a rating of 3.4 based on 343 reviews. The positive reviews highlight the ease of the application, the up-front explanations of all of the services, and the Ladder strategy for helping improve credit scores.

Some negative reviews complain about having to provide bank information, being denied loans, and technical issues while applying. A few people accuse it of being a LendUp scam because it will perform a credit inquiry that can lower your credit score if you are not approved.

The Lend Up reviews at Supermoney.com and at Highya.com praise many of the same things as the LendUp reviews at Credit Karma. Supermoney.com gives the service an overall rating of 4/5 stars, while Highya.com gives it 3.5/5. A few negative reviews mention problems with customer service.

There is a complaint against the company at RipoffReport.com. However, the CEO of LendUp responded directly to it, and the original poster now wants it to be removed. With so many positive LendUp reviews and resolved issues, it is pretty clear there is no LendUp scam.

Read More: Top Best Fintech Startups | Ranking & Reviews of Best Financial Technology Startups

Free Wealth & Finance Software - Get Yours Now ►

Is Using the Loan Services at LendUp Right for Me?

If you are one of millions of Americans with less-than-stellar credit, it makes sense that you are looking for a reputable way to get some money and improve your credit score. As we have outlined in our LendUp review, the company offers multiple services specifically for people with no or poor credit history.

After examining the services provided and the LendUp reviews online, the assertion that LendUp is a socially responsible alternative to payday loans seems to be valid.

Similar to payday loans, the APRs for the loans at LendUp can be high. However, that seems to be inevitable when it comes to loans for people with low credit scores. What sets LendUp apart is the fact that these APRs can reduce over time with responsible repayment.

On top of that, once you are in good standing with the company, you can actually improve your credit score—something that is nearly impossible with traditional payday loans. The free financial education courses at LendUp are also a bonus.

As with all financial decisions, it is wise to fully analyze your personal situation, possibly consult an advisor, and proceed with some caution before borrowing money.

Hopefully, this article has cleared up the answers to the questions “What is LendUp?”, “Is LendUp safe?”, and “Is LendUp legit?” Overall, it seems that LendUp has helped many people with their services. Therefore, if you need a loan and want to improve your credit, you may want to look into using the services at LendUp to help you start your journey to credit success.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.