Overview: Low Interest Personal Loans Guide

In a world overrun by credit card debt and expensive living rates, seeking out the advantageous situation of obtaining personal loans with low interest rates may be just the solution for you.

Here at AdvisoryHQ, we’ve noticed a growing trend in curiosity in regards to low interest loans and low interest personal loans.

In order to help consumers better understand what loans with low interest rates are and how to secure low interest loans, we’ve created this review on personal loans with low interest.

Below we’ll provide answers to some of the most frequently asked questions from consumers regarding low interest unsecured loans, such as:

- What are low interest personal loans?

- How do I get approved for personal loans with low interest rates?

- Do low interest personal loans from Chase bank offer the best rates?

- How do I find low interest installment loans?

By providing consumers with answers to many of these hot topic questions surrounding loans with low interest, we hope to provide you with the necessary information to make the best financial decision.

Our goal is to address all of your questions and more in order to clear up any confusion with securing a low interest personal loan.

Finding low interest personal loans should not be a difficult process. Understanding what lenders are looking for before applying for a loan with low interest is the best way to get approved for personal loans with low interest.

See Also: Home Interest Rates | Tips for Finding the Best Home Mortgage Interest Rates

What Are Low Interest Personal Loans?

Before jumping into the process of how to acquire loans with low interest rates, it pays to understand what exactly a low interest personal loan is.

Personal loans with low interest rates, also known as low interest unsecured loans, are low interest installment loans borrowed from a lender without any form of collateral.

Unlike a mortgage or car loan, where lenders have the ability to repossess your property if you default on the payments, with a low interest personal loan there is no such collateral that the lender can collect.

However, if you do default on your low interest personal loans, your credit score will be greatly affected.

Why Take Out Personal Loans with Low Interest Rates?

Image source: Pixabay

There are many reasons behind looking into taking out low interest unsecured loans. One of the top reasons people look into these low interest loans, according to certified financial planner, Adam Hagerman, is to consolidate their debt.

Most personal loans with low interest rates allow you to take out between $5,000 and $35,000.

When consolidating their debt, especially credit card debt, many individuals hope to lessen their interest rates through low interest loans instead. Credit cards often come with fluctuating interest rates that can go up to 10 or even 20 percent.

With low interest installment loans, many individuals could be looking at interest rates that are more than half as low as their soaring credit card interest rate.

While consolidating their debt, consumers can quite possibly save up to thousands of dollars by taking out low interest loans.

However, there are many other reasons individuals look into loans with low interest rates.

Low interest personal loans are also often used to finance home renovations, moving expenses, medical bills, funeral expenses, and even weddings.

Low interest unsecured loans are a great way for consumers to improve their financial situation, confidently knowing that they’ll be able to make their payments on such low interest loans.

Don’t Miss: How to Find the Highest Savings Account Rates | This Year’s Guide | Highest Savings Rates

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

How to Get Approved for Personal Loans with Low Interest Rates

Getting approved for loans with low interest rates involves taking a good look at what lenders will be expecting. Before sending out your application to any and all major banks and lenders, it pays to understand the requirements for approval for personal loans with low interest.

There are a few key factors that you must get in line before you’ll be approved for a loan with low interest.

Credit Score

Before you send in your application for low interest personal loans, you’ll want to make sure that your credit score is at a healthy number. Without any formal forms of collateral, lenders will be more hesitant to hand out loans with low interest to individuals with bad credit scores.

Certain low interest loan lenders will have minimum credit score requirements that you’ll have to meet to be approved for your low interest personal loan. Others will just want you to be within a certain credit range.

Whatever the case may be making sure to research each low interest loan lender’s requirements is a great way to ensure you’ll be approved for personal loans with low interest.

Debt-to-Income Ratio

If your credit score is less than spectacular, low interest loans lenders may be willing to overlook it if your debt-to-income ratio is low.

With a low debt-to-income ratio, low interest loans lenders will see that you have the income necessary to pay off your personal loans with low interest rates.

While some loans with low interest rate applications may not ask for verified proof of your income, it is still best to not exaggerate or embellish your funds. You want to be able to pay back the low interest installments loans within your financial means, and lying can cause you to default more quickly on your low interest personal loan.

Be Wary of Scammers & Shady Online Low Interest Loans Lenders

With so many online lenders to choose from, it can be quite tempting to go with low interest loans lenders that approve you right on the spot. Often, it pays to go with reputable lenders that give out personal loans with low interest.

Going with low interest personal loans from an unreliable low interest loans lender can leave you signing up for advance fee loan scams.

To avoid getting scammed on your search for personal loans with low interest rates, make sure to not pay any upfront fees, verify the low interest loans lender by looking them up on the Better Business Bureau, and avoid low interest personal loans lenders that guarantee you approval right after discussing your eligibility for loans with low interest rates.

Getting Personal Loans with Low Interest

After figuring out what you need to do to get a stamp of approval from low interest loans lenders on your low interest unsecured loans, you’ll want to know how exactly you can snag up a loan with low interest.

Getting the lowest rate on your loan involves partaking in a few key decisions. These basic factors will improve your ability of getting low interest personal loans for the lowest rate.

Keep these factors in mind before you apply to your low interest loans lenders in order to be offered loans with low interest rates.

Credit Score Is Key

Just like we discussed in the approval process, having a healthy credit score is a fantastic way to secure loans with low interest. Your credit score will help determine your loans with low interest rate.

Average Estimates of Personal Loans with Low Interest Rates:

- Estimated APR for an excellent score range of 720 – 850 is 10.94%

- Estimated APR for a good score range of 690 – 719 is 14.56%

- Estimated APR for an average score range of 630 – 689 is 19.84%

- Estimated APR for a bad score of 580 – 629 is 28.64%

Any credit score at 579 or lower will likely be ineligible for loans with low interest rates unless they have a high or steady income and low debt in comparison.

Those of you with good or excellent credit scores will find that many lenders will offer you some amazing personal loans with low interest rates.

Pay Off As Much of Your Credit Card Debt as You Can

In order to get offered loans with low interest, it is very helpful to pay off as much of your credit card debt as you can.

Any outstanding debt that you currently have on your credit cards can be used against you when trying to get low interest installment loans. If you are able to, attempting to pay off as much as you comfortably can will help you get amazing deals on your low interest personal loans.

The less credit card debt you have to consolidate, the better off your loans with low interest rates will be.

Length of Your Repayment Plan

The amount of time it takes you to pay off your low interest personal loan will greatly affect loans with low interest rates. Delegating the terms of your plan is essential to getting personal loans with low interest rates.

Shorter repayment plans on your low interest unsecured loans will often leave you with higher monthly payments but lower interest rates. Going with a shorter loan term will help you save money in the long run, as your low interest loans will be worth it financially.

Just be sure that you can afford your low interest installment loans after you get approved for low interest loans.

Related: Money Market Interest Rates | Ways to Find the Best Money Market Rates

To Co-Sign or Not to Co-Sign

Another huge factor in getting loans with low interest rates is to look into getting somebody to co-sign on the low interest personal loan with you.

Getting a co-signer for low interest personal loans is a great option for somebody whose credit score is not great or an individual that has never taken out loans with low interest before.

Image source: Pixabay

A co-signer with an excellent credit history can actually allow you to share in the accomplishments of their credit, helping you to get personal loans with low interest rates.

Signing off on a low interest personal loan with a co-signer can save you up to thousands of dollars on your loans with low interest. Your loans with low interest rates can drop by at least 1 to even 5 percent interest with the right co-signer by your side, assisting you with your low interest, unsecured loans.

Shop Around for Personal Loans with Low Interest Rates

Finally, one of the best ways to guarantee that you’ll get a low interest personal loan is to shop around for the best loans with low interest. Looking into many reputable low interest loan lenders is a fantastic way to see what loans with low interest rates are currently available to you.

Low interest, unsecured loans can vary in their rates and fees depending on the low interest loan lender you choose. Depending on the qualifications that you have based on your finances and credit history, you may want to go with certain low interest loans lenders that will be able to give you the best personal loans with low interest.

A huge inquiry that we see come up often revolves around the low interest personal loans from Chase bank. Low interest personal loans from Chase bank are a great and reputable source to look into getting a low interest personal loan.

The process of getting low interest personal loans from Chase bank is quite the same as with any other bank lender, as they’ll look into your credit history and income to see if you are eligible for low interest personal loans.

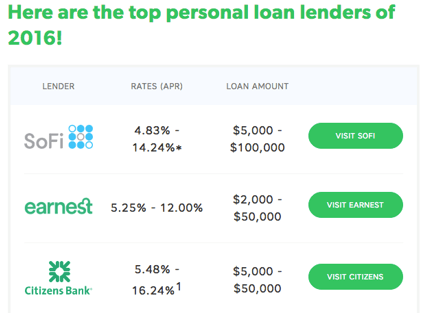

However, there are many other low interest loans lenders that you can look into, especially if you have a good credit score. SoFi is a great source for low interest personal loans for individuals with credit scores in the 680+ range, as they offer loans with low interest rates of 4.83% – 14.24%.

Earnest is another reputable lender for individuals that don’t have the greatest credit score to back them up, as they have no minimum FICO score requirements. Earnest offers personal loans with low interest rates of 5.25% – 12.00%.

With so many top low interest loans lenders to choose from, finding low interest personal loans has never been easier.

Popular Article: Mortgage Interest Rates Trend | Key Mortgage Rate Predictions, Trends, and Graphs

Conclusion: How to Get Personal Loans with Low Interest Rates

For consumers looking to consolidate their credit card debt, pay for medical bills, remodel their home, cover funeral or wedding costs, or get some extra cash for a project, taking out low interest personal loans is a great way to borrow the money.

Having a great credit score history behind you and minimal debt-to-income ratios are a few of the most important aspects that factor into whether you’ll get approved for your low interest personal loan.

After taking time out to see whether you are eligible for low interest personal loans, finding the right lenders to offer you loans with low interest rates involves shopping around for the right low interest loans lenders.

Meeting FICO credit requirements, paying off as much of your credit card debt as you can, and/or getting a co-signer to sign off with you on the low interest personal loan will also greatly help you in receiving the best loans with low interest rates.

With all of this information about personal loans with low interest rates at your disposal, you can confidently make a decision regarding your finances and the possibility of taking out low interest installment loans.

Personal loans with low interest rates can ultimately save you hundreds or even thousands of dollars, helping you to restructure your financial situation exponentially.

Read More: How to Find the Best VA Mortgage Loan Rates Today | Tips for U.S. Veterans

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.