A Brief Overview of Low-Interest Student Loans

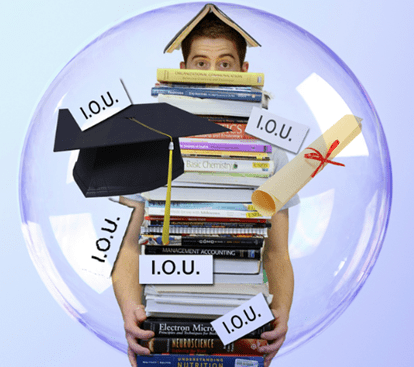

Regardless of your credit score, searching for the best low-interest auto and home loans is tough. But when you are a student, it gets even tougher. Where does one even begin to look for low-interest student loans?

The answer is not the same for everyone. Many factors affect students, including their financial standing, the school they choose, and the funding they are provided. Therefore, everyone will approach student loans with low interest differently.

Say you are a student and want to purchase a car. Whether you can afford that car while in college will depend on what low-interest auto loans you find. The same goes for buying a house.

We should not have to put our lives on hold while pursuing a college degree. Sometimes going to school even requires you to own a car for the sake of transportation, or a house to live close enough to the school. This is where low-interest auto loans and low-interest home loans come into play.

Everyone needs a little help figuring out which low interest student loans are right for them. Therefore, we will answer several of the most commonly asked questions about low-interest student loans, including:

- How do I get low-interest auto loans as a student?

- How do I get low-interest home loans as a student?

- What can I do to improve my chances of getting student loans with low interest rates in the future?

As we have already mentioned, there is not a singular, ideal path for all students to take. For this reason, we will not spend time reviewing specific low-interest rate student loans; rather, we will discuss ways to improve your chances of finding and securing the one that is right for you.

We will begin by discussing some of the best ways to get low-interest student loans before moving onto more specific types, such as low-interest auto loans and low-interest home loans. We will briefly mention low-interest business loans along the way, but our intention is to focus primarily on auto and home.

Do not worry if you have been unable to find the perfect low-interest student loans just yet. By following a few of our basic suggestions, you should be able to hit the ground running and attack this difficult process with added confidence.

See Also: Top Best BB&T Credit Cards | Reviews | BBT Bank Credit Cards Review

Beginning Your Search for Low-Interest Student Loans

Before you can even begin to think about low-interest car loans and low-interest home loans, you will first have to look into low-interest rate student loans to start your college career.

Image source: Pixabay

While FAFSA is one of the most dreaded terms associated with paying for college, it is essential that you begin your search for student loans with low interest there. Offered by the Department of Education, FAFSA or the Free Application for Federal Student Aid, is a way to vocalize your family’s financial standing in order to get more help with funding.

On the website, you will be asked to enter information about your ability to pay for college, and you must do so before the yearly deadlines. Be sure to keep track of these when necessary. While the form does take time and energy, it will be the best way to get student loans with low interest rates.

Why is FAFSA right for you? Most colleges will require you and your family to submit a FAFSA form to assess what kind of financial aid you can be offered before you even apply for low-interest student loans. If you have a low credit score because you have not had enough time to build your credit, colleges will be willing to offer you a bigger grant or government-backed gift.

This last point is important to note. Most college students do not have high credit scores because they have not had enough time to pay off bills or make enough purchases to build credit. As a result, it is harder to get student loans with low interest because poor credit scores are seen as a liability.

That being said, it does not make sense for a loan provider to punish you simply because you are young and have not had time to build credit. For this reason, we recommend that when you look for low-interest student loans, you approach it by following these three steps:

- First, look for free money. This includes grants and scholarships that do not require repayment after you graduate.

- Second, use federal loans. The government will be your best bet to get low-interest rate student loans. We will discuss this more in the next section.

- Finally, look for private loans, but only if you still need financial help. Private loans are generally not going to be considered low-interest student loans because their rates are typically much higher than federal loans.

Don’t Miss: Karrot Loans Review – Does Karrot Provide the Best Personal Loans?

A Closer Look at Low-Interest Student Loans

We mentioned above that we would discuss federal loans in more detail, and we wanted to do so before switching to low-interest auto loans and low-interest home loans.

If you have not had enough time to build credit for the best student loans with low interest rates, you’re still in luck. Federal loans do not require a credit score.

You will notice when filling out your FAFSA form that the information will cover your finances but will not ask you about your credit scores. If you are worried about high interest rates, the Federal Direct Student Loans will offer the best low-interest rate student loans.

Federal Direct Student Loans used to be known as Stafford Loans. This funding source has become one of the most common ways of getting student loans with low interest because they will never surprise anyone with a credit check.

To qualify, make sure you meet all the necessary criteria:

- You have filled out an accurate FAFSA form.

- You are a U.S. citizen.

- You have demonstrated that you need financial help.

- You are enrolled at least half-time in a qualified school.

As long as you meet the criteria, you can begin to apply. Generally, the interest rates hover around 3.4%, qualifying them as low-interest student loans. Additionally, your loan will apply to all college expenses, and you will not be expected to put any money toward them until after you have graduated.

Keep in mind that, while the Federal Direct Student Loan may seem like the best way to get low-interest rate student loans, you will only be offered a limited amount of money. Therefore, you must apply for additional loans if you need a larger sum.

Examining Low-Interest Auto Loans

While it might seem scary to buy a car while in school, it is sometimes a necessity in order to travel to and from your classes. As a result, you may find yourself searching for low-interest auto loans.

When you approach low-interest auto loans, it will be essential that you plan ahead. Ask yourself a few questions: How much can you afford to pay each month? What is your general price range? How long do you plan to keep this car?

Once you know exactly what you are looking for, you can search for low-interest car loans that will allow you to continue your education while also owning a vehicle. To make this process as easy to follow as possible, we will break it down by steps:

Avoid Large Loans

Before you narrow down your options on low-interest car loans, you should know exactly how much you can spend. One of the most important things you can do is to keep your loan small. But how small is small enough?

Start by using an auto finance calculator. Auto finance calculators will help you determine what you can afford, both as monthly payments and as a total cost of your loan. Many auto finance calculators will also offer a way to look at a range of low APR auto loans in your area. Remember that the lower your low-interest auto loans are, the less they will cost in the long run.

Sign Low-Interest Auto Loans with a Cosigner

As we mentioned earlier, it will be difficult to get any type of low-interest student loans if you have not been able to build credit. This includes loans for school, auto, low-interest home loans, and the list goes on.

Luckily, to get the best low-interest student loans, you can sign a loan with the help of a cosigner who has good credit. This will also be helpful if you are applying for low-interest business loans and low-interest home loans.

The cosigner will be held responsible if you cannot afford the monthly payments, so be sure you pay your low APR auto loans off in a timely manner. You should simply see your cosigner as a way of getting you closer to your low-interest auto loans, rather than as a safety net.

Make a Down Payment

This step will also be important for all types of low-interest student loans. If you can make a down payment on your car, house, or business, your loan will be much more manageable in the long run.

Remember that the amount of interest you spend on low APR auto loans is affected by how big your loan is and how long it takes you to pay it off. The smaller your loan, the less interest you will accumulate.

Apply to Auto Finance Lenders

Roadloans is a good place to start your search for low-interest car loans because they specifically accept applications from students. If you have not had time to build credit, you can still get approved by a lender before you even purchase a car.

Once you are approved, you can take the loan approval to a dealership to prove you can afford the car.

Negotiate the Terms

To make sure you get the most from your low-interest car loans, you should negotiate some of the terms, including your APR. Over time, this will lower your payments and will also help you build credit, since you will be more capable of paying your bills on time.

There are other things you can negotiate with a provider such as the length of your low-interest auto loans and whether or not you will face late penalties or other fees along the way.

Finally, Keep Your Payments Up-to-Date

Perhaps the most important advice we can give you when looking for low-interest student loans is to keep your payments up-to-date. Now is the time to build credit. By paying off your loans, no matter what type they are, you will be able to afford larger purchases in the future.

We would not recommend looking for auto, home, or low-interest business loans if you cannot afford to pay them off every month. As long as you can afford them, you will build your credit while also bettering your life through school.

Related: Affirm Reviews | What Is Affirm and Is It Safe to Use? (Affirm.com Loan Reviews)

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

A Closer Look at Low-Interest Home Loans, Low-Interest Home Improvement Loans, and Low-Interest Business Loans

Source Image: Free Images

Luckily, a lot of the information we covered above also applies to low-interest home loans and low-interest home improvement loans. One thing you will want to keep in mind, however, is where to find financial lenders.

For low-interest home loans, one of the best places to begin your search is at Bankrate. Bankrate does an excellent job of showing you what type of interest rates you can expect when applying for home loans. They will keep in mind your credit score, loan balance, the location of your property, and other necessary information to give you the best low-interest home loans possible.

For low-interest home improvement loans, consider looking at Lending Tree. Lending Tree is a good place to start because they offer multiple ranges of competitive quotes, and the fees are clearly disclosed. This site will also push you toward some of the lowest low-interest home improvement loans you could possible find.

For low-interest business loans, the Small Business Administration may be the way to go. Here, you will be able to find loans that fit your specific needs; plus, you can customize them while keeping your business goals in mind.

While the financial lenders are all different for home, auto, and business loans, the process of finding low-interest student loans is virtually the same. Remember to sign with a cosigner if your credit score is too low and try to make a large enough down payment. Once you have found the right lender, be sure to negotiate your terms and make all payments on time.

For more specifics, simply look at the section above regarding low-interest car loans. As long as you follow these guidelines, you should have no problem acquiring the perfect loan, even as a student.

Popular Article: CashAdvance.com Review – What You Should Know Before Using CashAdvance.com

Conclusion: Low-Interest Student Loans Really Do Exist

Going to college is not the time to put your life on hold. If you need a car, a home, or want to start a business, there are low-interest student loans to help you along the way.

While many financial lenders see college students as high-risk candidates due to low credit scores, it is always possible to sign with a cosigner. This is true for low-interest auto loans, low-interest home loans, and the list goes on.

Once you have a cosigner and have found the loan that is right for you, you can start to build your credit. School is about helping you make it in the real world, and one of the best ways to do so is by building your credit score.

Low-interest student loans will open brand new doors as long as you pay them off on time. If you begin to build your credit in college, there is no telling what you can afford in the future. And the day after graduation, you will be able to hit the ground running.

Read More: Avant Reviews – Get All the Facts Before Getting an Avant Loan

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.