Introduction: Finding the Top Mortgage Servicing Companies

There are many factors to be considered when finding top mortgage servicing companies. You might search for the largest mortgage servicers, or you might look for companies with high customer satisfaction.

Financial companies are ranked in many different ways. Mortgage servicers lists are published by financial publications each quarter, ranking them according to profit growth.

This makes it easy to keep track of which mortgage servicing companies have grown and which have not.

Image Source: Pixabay

Since mortgage servicers work more closely with lenders than with the general public, it can be difficult to find information. A few good questions to keep in mind are:

- What is mortgage loan servicing?

- Which mortgage servicing companies have the happiest customers?

- Are mortgage servicing companies different from regular lenders?

In order to find top mortgage servicers, it is important to understand how mortgage loan servicing works and how it differs from loan writing. It is also necessary to examine which factors distinguish top companies and how these companies improve and grow.

Mortgage servicers may seem like a bit of an enigma in the mortgage industry, but armed with the right questions and knowledge, it is easy to understand how they work as well as to find the best and largest mortgage servicers.

See Also: AmeriSave Reviews What You Need to Know Before Using AmeriSave Mortgage

What Is a Servicing Company?

Before you can find the top largest mortgage servicers, you must understand exactly what a servicing company is and how it operates. To understand, people generally ask two questions:

- What is mortgage servicing?

- How are mortgage loan servicing companies different from mortgage originating companies?

Mortgage servicing is a term that covers certain services provided to conduct the day-to-day business of managing mortgages and mortgage-backed securities. Mortgage servicers perform some of the following services:

- Accepting and recording mortgage loan payments

- Calculating the payment of taxes and insurance fees on associated escrow accounts

- Calculating changeable interest rates on variable rate loans

- Negotiating changes made to loans due to payment difficulties

Mortgage originating, or mortgage writing, is very different from mortgage servicing. Mortgage originating is the creation and closing of a mortgage. Lending companies perform mortgage originating only when a borrower wants to take out a new loan.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Mortgage servicing and mortgage writing do not have much to do with each other because they do not overlap. Once the mortgage is written, that process is finished, and it is time for the loan to be serviced and managed.

Once you have closed your mortgage and finalized the details with your lender, whatever institution you have chosen to work with now owns the rights to your mortgage. It has a variety of options of what it can do with your mortgage and carte blanche to transfer ownership as it sees fit.

It may choose to keep your mortgage, sell the rights to another lender or any number of mortgage loan servicing companies or it may choose to retain ownership but hire a mortgage servicer to manage the daily grind of the loan.

Mortgage servicing is important to keep in mind in regard to property foreclosure. Only the company that owns the rights to a mortgage is legally able to enact a foreclosure. Even if a mortgage servicing company manages a loan, it does not have the right to foreclose unless it holds the actual rights to the mortgage.

While the housing market is in constant flux, mortgages can be surprisingly mobile. Ownership of your mortgage may be transferred many times over its lifetime. It can be difficult to know what company owns your mortgage and if that company is the same one that is servicing it.

Don’t Miss: Best Banks for Mortgages – A Complete Guide (Best Mortgage Rates & Reviews)

What Are the Largest, Most Profitable Servicing Companies?

The housing market is volatile and ever-changing. Certain mortgage servicing companies might be at the top of the heap one quarter only to fall from grace the next. It is important to find the most current information possible to determine which mortgage servicers are the best at any given time.

However, some loan servicing companies rise to the top and stay there. Wells Fargo, for example, has consistently been the top ranked mortgage servicing company and originator.

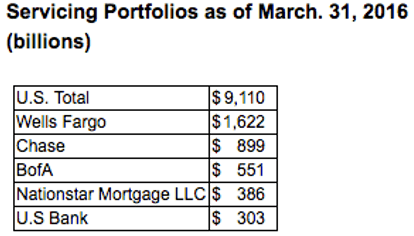

In the first quarter of 2016, Wells Fargo led the pack with $354 billion in mortgage originations and again with $1,622 billion in mortgage servicing. Wells Fargo is currently the largest of the loan servicing companies in the U.S. and services about 18% of all mortgages in the nation.

It might seem like the largest loan servicing companies would have to be the companies producing the most mortgages by necessity, but this is not necessarily true. Since mortgages can be bought and sold by the companies creating them, the largest loan servicing companies and the largest mortgage originators could easily be two different companies.

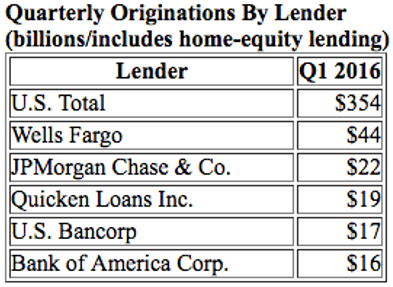

In July of 2016, Mortgage Daily published a list of the top performing mortgage originators and a separate mortgage servicers list for the first quarter of 2016.

In the first quarter of 2016, the top mortgage lenders were the following:

Source: Mortgage Daily

In the first quarter of 2016, the top mortgage servicers were as follows:

Source: Mortgage Daily

When searching for the largest mortgage servicers, it is important to keep in mind that mortgage servicing and mortgage originating are not the same things. A company can perform highly originating mortgages without retaining and servicing those loans.

Some of the top mortgage lenders did not rank as servicers, meaning that there is a split in the market. Some companies are writing a high number of mortgages while servicing a very small amount of those.

At the same time, other companies are writing fewer mortgages but picking up a large number to service.

Related: Caliber Home Loans Reviews – What You Need to Know Before Using Caliber

What Mortgage Loan Servicing Companies Have the Best Customer Satisfaction?

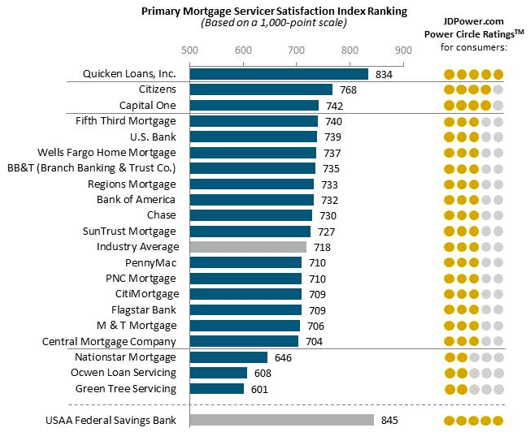

Customer satisfaction scores might be a good way to decide which mortgage servicing companies are top rated. In 2015, J.D. Power conducted a U.S. Primary Mortgage Servicer Satisfaction Study to assess the level of customer satisfaction associated with loan servicing companies. Quicken Loans, Inc. was the highest ranked mortgage servicer in the study. It was followed by Citizens in second and Capitol One in third.

The top scoring loan servicing companies were ranked and published as follows:

Source: J.D. Power

Keeping customers happy is really important as far as business growth is concerned. Of the satisfied customers in the survey, 85% claimed that they would recommend their mortgage servicing company. Furthermore, 74% claimed that they would use the same mortgage servicing company again for their next mortgage.

This means that even if company growth and profit are the main factor in determining which servicing companies are best, customer satisfaction is still inescapable because, in the long term, it leads to company growth and client retention.

The study focused on factors that might cause mortgage servicers to lose or retain customers. It was found that when loan servicing companies spend less time and resources on customers who remain current on payments, as opposed to more at-risk customers, the majority of customers are dissatisfied with the company.

At-risk customers are defined as people who are currently delinquent on mortgage payments or who have concerns about staying up to date on their payments in the next twelve months. This makes up only 15% of all survey participants.

Despite the fact that at-risk customers make up a small portion of the customer base for loan servicing companies, major resources have been assigned to the management of their mortgages. This is because if borrowers do not make their mortgage payments, mortgage servicers are not able to turn a profit and obviously suffer. The hope is that by creating policies that focus on at-risk customers, they may better avoid regulatory or legal actions in the future.

However, because there is this focus on one small portion of the customer base, resources that could be used to improve customer experience, like better websites or customer service, are diverted away from most customers.

The study found that when customers are not able to solve their own issues using a mortgage servicing company’s website, 67% will resort to working with an actual employee, which increases the company’s workload and the cost of mortgage servicing.

The study also found that 14% of customers actually give up before they are able to resolve their issues at all.

These instances would make it more likely for customers to lodge complaints with regulatory agencies, which defeats the purpose of using funds to focus on high-risk customers in the first place.

Popular Article: ConsumerDirect Mortgage Reviews – What You Need to Know! (FirstBank Mortgage & Review)

How Can I Find a Mortgage Servicing Company for My Loan?

If you are looking for top mortgage servicing companies, and if you have a mortgage already, you might be interested in finding out about your own mortgage servicers and holder. Besides general curiosity, there are a few reasons that you might need this information, including:

- Gathering general information about your mortgage, like when your next payment is due

- If you are delinquent in your payments and want to negotiate new terms

- If you want to apply for a relief program with your state

Since mortgages can change hand so quickly, it can be difficult to know who is handling your mortgage. The first place to start your search would be your monthly billing statement for you mortgage – this should have the name of your mortgage serving company.

Another source for locating the identity of your mortgage servicer would be your mortgage coupon book.

This is a good way to find the names of mortgage servicing companies, but it will not tell you the name of the agency that owns the rights to your loan unless they happen to be the same.

The company that owns the rights to your mortgage is called the mortgage or note holder. This is the only party with the right to collect your mortgage or foreclose upon your house.

It does have the right to delegate the day-to-day management of the mortgage to any mortgage servicing companies of its choice. It also has the right to enforce your loan agreement, which consists of your mortgage and promissory note.

If your mortgage holder is different from your mortgage servicers, you will need to dig a bit deeper.

The best way to find your mortgage holder is to request information from your mortgage servicing company. You can do this over the phone or you can send an official written request. Mortgage servicers are obligated by law to inform you, to the best of their ability, about who owns your mortgage.

You might need to contact your mortgage holder in the event of a foreclosure. If you do not think that the correct company is enacting your foreclosure, you can legally force them to produce your note as proof. It can be tricky to know if the right company is contacting you without a little investigation because your mortgage can bounce from company to company so quickly.

Do I Have Any Say in Who Services My Loan?

The short answer to this question is no. You do not have any say in choosing mortgage servicing companies. Technically, this is because, you, as a borrower, do not own your own mortgage.

However, the law requires that all borrowers be notified in the event that their mortgages are sold or switched to different mortgage servicing companies. Both the seller and purchaser of your mortgage are required to send notice within a specific period of time. This is to ensure that the borrower is aware of which company he or she needs to contact in the event of an issue.

Mortgage servicing companies do not consider borrowers to be their primary customers. Instead, their focus is on the entity that holds the rights to the mortgage – that is, the lender or whoever has purchased the rights from the lender.

This leaves borrowers with a very limited voice and minimum power to choose the company that services their loan.

While there is little you can do about changing mortgage servicing companies, it is not necessarily a bad thing for your loan to change hands.

Unless you are delinquent on your payments or have a variable rate, nothing about your mortgage should change except where you send your payment. Mortgages are usually sold to bring capital into the selling company and not because there are any issues or problems.

Free Wealth & Finance Software - Get Yours Now ►

Conclusion: Top Mortgage Servicing Companies Reviews

The mortgage industry is very complex and constantly evolving. Since loans are bought and sold so frequently and top companies gain and lose ground every day, it can be difficult to find the top loan servicing companies.

Consider our key questions when searching for a mortgage servicing company:

- What do mortgage servicers do?

- Which are the largest mortgage servicers?

- Which mortgage servicing companies have the highest customer satisfaction rates?

- How can I find the company that services my mortgage?

- Should I worry if my mortgage servicer changes?

Determine which factors are most important to you when searching for the top loan servicing companies – some may be more significant to certain people than to others. Equipped with the right tools and knowledge, making a mortgage servicers list for the top companies for you should become easier and clearer.

Read More: Getting an Interest-Only Mortgage This Year? What You Need to Know

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.