Motif Investing Review

Most people realize the value of investing their money and making it grow. However, there is also the potential for loss in investing, primarily because it usually involves something of a learning curve. And let’s face it; that learning curve leaves very little room for error, especially for those who are just starting out, because they usually don’t have a lot of money to spare.

It is with this in mind that Motif Investing was created. One of a new breed of online brokerage services, Motif was started by Hardeep Walia, a former executive with Microsoft, with assistance from a number of finance-oriented business partners including Goldman Sachs.

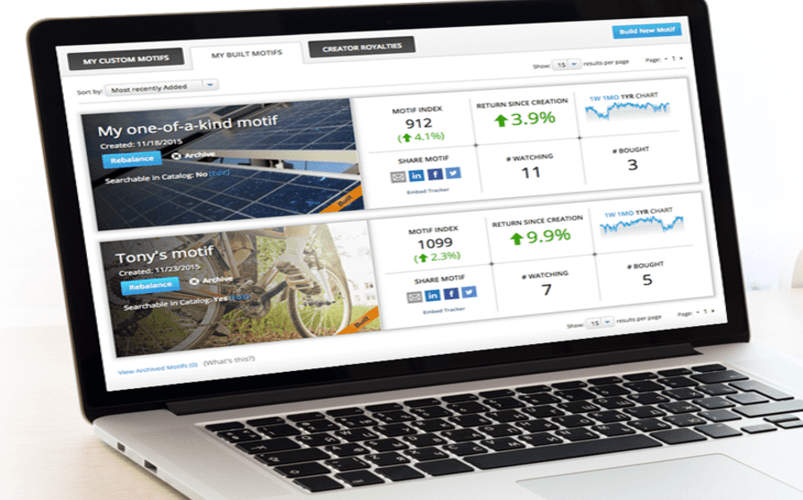

Image Source: Motif Investing

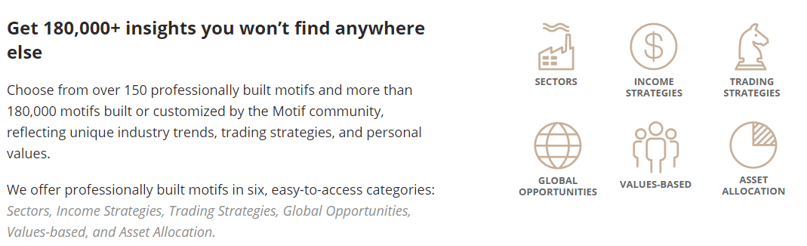

According to its website, the primary intent of Motif Investing is to create a space in which investors have a lot more control over their investments while limiting investment risks, especially with regard to investments in the wrong stocks.

Looking at the rather large number of Motif Investing reviews, it seems that many people truly like the feeling they get when using this platform.

Review of Motif Investing

With this detailed Motif review, AdvisoryHQ News has provided a detailed review of Motif Investing, including what makes it unique as well as the various pros and cons of using Motif Investing services and products.

Review of Motif Investing’s Website

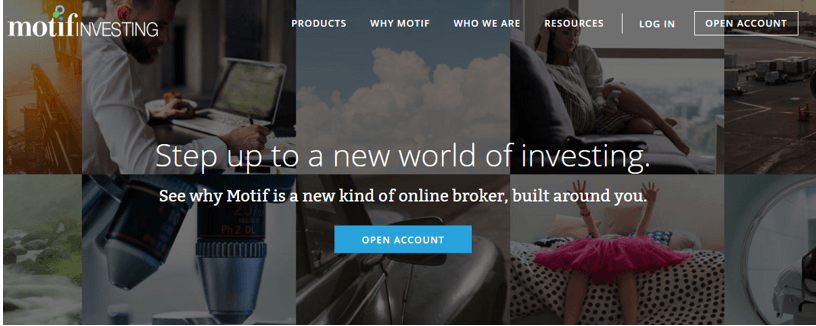

In a Motif review, as would be the case with a review of any other online brokerage, you have to start at the beginning, and the company’s website is the first thing that people see.

The Motif Investing website does not disappoint. It is a very professional looking website, with a homepage that briefly and completely explains what a motif is and gives numerous examples of how the Motif platform works.

The first impression is that this website is geared toward experienced investors, who understand all of the ins and outs of investing. However, there is a prominently displayed “How It Works” section, and that section actually does a very good job of explaining, in plain language, the basics of the investing process.

Image Source: Motif Investing

Thankfully, signing up with Motif Investing is actually a simple process, and access to the sign-up process is available on every page. You start with registration, which is free, and you register by filling in an online form or using an existing Facebook account to register. Its basic registration is free, but, obviously, there are fees in order to begin investing and customizing your motifs.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Motif Investing Review: The Motifs

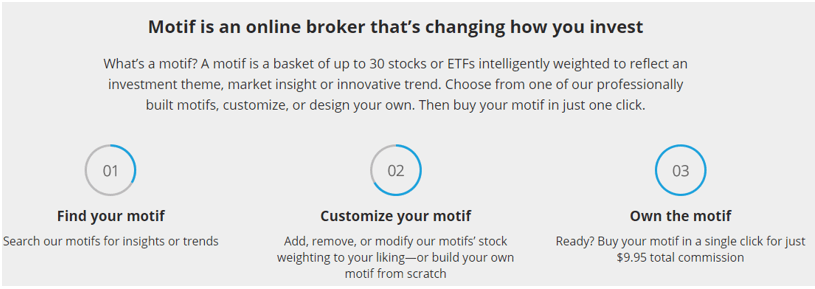

It’s the motifs that make Motif Investing unique when compared to other online brokerage firms. According to information from its website, its goal is to create a “concept-driven trading platform that allows you to act on your investing desires.”

It essentially means that you can use keywords or simply use one of its preselected categories to create what it calls a motif, which is kind of like a shopping bag full of as many as 30 stocks or exchange-traded funds based on a single theme. This allows the investor to choose a trading strategy that works for him/her.

Image Source: Motif Investing

For example, you may decide that you only want to invest in stocks dealing with improving the environment, so you go through the motif catalog to look for motifs dealing with green issues and choose one of those. That motif will contain as many as 30 stocks, all grouped together based on the motif’s theme.

Unfortunately, the names Motif Investing has chosen for many of them tend to be relatively cutesy and not necessarily indicative of the actual content of the motif.

Some are more obvious, such as the Cleantech Everywhere motif that contains a lot of clean energy stocks for solar and wind power developers and companies like Tesla; building electric cars is pretty easy to figure out. However, there are others, like the Disappointing the Street motif, which contains a list of companies with relatively mediocre stock growth and with no actual relation among them.

In other words, it is definitely necessary to look over every motif to see what you’re investing in. This seems like an unnecessary complication, but given that everything is disclosed and easily available at the click of a mouse, it’s probably not a deal breaker for many investors.

The Motif Investing platform is an excellent idea for a new investor who is a little bit skittish because it allows him/her to stick a toe into the investing waters without wading all the way in blindly.

All of the information is right there, and investment decisions are relatively easy to make. Once you have a little experience and you are ready to branch out and create a motif of your own, you can. Just input a word or phrase, and the platform will assemble a motif for you.

For example, if you want to invest in companies engaged in biotech, you can input “biotech companies,” and a grid will come up containing a list of stocks that are all related to biotech research and companies, from which you can choose which stocks to include in your motif.

When you consider that many online brokerages expect you to know the names, and possibly the stock symbols, for companies in order to choose to invest in them, it’s easy to see why the motif system may be a great idea for the beginning investor.

How Much Does Motif Investing Cost?

A Motif Investing review would not be complete without a highlight of Motif Investing’s fees. The reasonable and highly simplified nature of its fee structure seems to be one major reason why Motif Investing has become a fairly popular choice for new day traders and other investors. To buy or sell a motif of up to 30 stocks only costs $9.95, and that includes the cost to transfer all of the stocks within that motif. If you want to buy or sell individual stocks, however, each one of those trades will cost $4.95.

For newer investors who stick to the default stocks within the motif concept, this is a very inexpensive way to trade, but for those experienced investors who frequently buy and sell individual stocks in order to get the most out of their cash, the price can be prohibitive. It can also make swapping out the stocks in a motif relatively costly.

Investors can create their own motifs of up to 30 stocks and pay a one-time fee of $9.95 rather than paying $238.50 in commissions for 30 individual stocks. Then, they only pay $4.95 in commission for those times when they just want to maximize their cash by selling one or two stocks. Again, the way the Motif Investing platform is set up, it seems to be custom-made for new investors.

Another sign that it’s going after the beginning investor is that users of the platform can begin to invest with as little as $250 in their account, which makes it very attractive to someone who just wants to try it out. All in all, Motif Investings’ fee structure is a pretty fair one, based on Motif reviews by its harshest critics.

Is Motif Investing a Great Online Brokerage?

Motif Investing is quite obviously oriented to new investors, and it does its job very well, which is something that its users normally state on the various Motif Investing reviews that can be found online.

It offers a high level of safety and provides new people with the information that they need to handle their investment decisions. Of course, as is the case with anything investment-related, risks and returns are closely related, which means that the safety of having a platform that walks you through the investment process, using something of a paint-by-numbers approach, will necessarily limit the potential yield. This means that its basic platform isn’t necessarily for everyone.

One interesting thing to note is the reliance on motifs. The potential risk to the typical investor comes when a motif constantly rebalances and changes to try to get people to trade. This may cause a lot of investors to buy and sell motifs more often, which makes the company a lot of extra commission, but it can also wreak havoc on many investors.

However, some are suggesting that private equity investors treat the motif model more like an exchange-traded fund (ETF) or index fund. This could serve as a very strong model that could turn Motif Investing into a powerhouse among online brokers.

In the meantime, some trading experts suggest that Motif is a great platform for new traders to get started, but as they become more savvy and experienced, instead of getting out to another platform for more complex and potentially higher-yield trading, they consider themselves as their own fund managers and manage their portfolios through motifs.

It’s definitely also possible for investors to allocate some of their investment allocation to Motif and use other platforms for the more complex, one-stock-at-a-time trading.

Motif Investing Review: Pros and Cons of Motif Investing

Pros (Motif Review)

- It has a beautiful, easy-to-use website that fully explains the motif concept for beginners.

- The platform allows for an easy allocation of investment resources.

- Anyone with access to a computer can register and open an account with any amount of cash, although an individual must have at least $250 to begin trading.

- Margin trading is offered, as long as the trader keeps a minimum of $2,000 in his/her account.

- A wide variety of motifs are available at any given time, and all investors have the ability to create their own.

Cons (Motif Review)

- The default options available offer a high level of safety but a low level of rewards.

- The company has a tendency to name its motifs strangely, making them hard to understand.

- Trading whole motifs is easy, but the cost of optimizing one can be prohibitive.

- Experienced investors won’t find a lot here.

Free Wealth & Finance Software - Get Yours Now ►

Conclusion – Motif Reviews

Motif Investing’s promotional materials say that it believes that every investor is unique, and a case can be made that its investing model does make it easier for someone to get into day trading or investing through its 150 “professionally-built portfolios,” which it calls motifs.

However, from an objective Motif Investing review perspective, while it can be said that its platform is a step up from simple mutual funds, it is hard to see this type of platform as an ideal way to diversify a portfolio. Getting into it is easy, but changing things and customizing them to your needs is a lot harder and costlier.

The real value of Motif Investing will depend greatly on your level of experience and your approach to investing.

Don’t Miss:

- Identity Guard Review | Get All of the Facts Before Using Identity Guard

- Best Credit Monitoring Service 2016 | Top Ranking and Comparison

- Prosper Reviews – All You Need to Know Before Using Prosper.com

- WorldRemit Reviews – Get All of the Facts Before Using Worldremit.com

- Best Robo-Advisors | Comparison, Ranking and Detailed Reviews

- Vanguard Reviews – Vanguard Fees, ETFs, IRAs, 401(k)s & Funds Review

- Complete List of All Vanguard Funds & Expense Ratios

- Top Best Financial Advisors – Portland, Oregon (Ranking and Reviews)

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.