Overview: What You Need to Know About One Reverse Mortgage

If you are looking for a comprehensive One Reverse Mortgage review, you have come to the right place. Here, we offer a guide that will not only inform you of reverse mortgages and how they work but also let you know if One Reverse Mortgage is right for you.

Quicken Loans has been providing lending options to consumers across America for more than thirty years. It is actually America’s largest online lending company. Whether you are looking for a mortgage or, in particular, a reverse mortgage, it is sure to help you get approved.

The problem is that not enough people know that reverse mortgages even exist. One Reverse Mortgage’s spokesperson, Henry Winkler, stated, “Reverse mortgages provide homeowners with options, and unfortunately, not enough people know they exist.”

One Reverse Mortgage Review

Reverse mortgages are becoming more and more popular as people hear about them, and One Reverse Mortgage Quicken Loans knows that you need to be able to retire with freedom. After all, people seem to live longer these days, and basic retirement plans just aren’t enough to make ends meet.

See Also: What Is a Reverse Mortgage Loan? Terms & Definition | Reverse Mortgage Explained

In this day and age, everyone is looking for a way to effectively retire and still have enough money to get by comfortably. One of the most popular ways that people are getting the money that they need is by retiring with a line of credit through their mortgage. One Reverse Mortgage offers retirement plans that will meet your needs.

Here are some of the most common questions asked by consumers when it comes to One Reverse Mortgage Quicken Loans:

- How do reverse mortgages work?

- Does the lender take ownership of the home?

- Is good credit required for a reverse mortgage?

- Do you have to pay off a current mortgage to be able to get a loan from One Reverse Mortgage?

- Are there restrictions on spending the money from the loan?

- What happens to the loan if you pass away?

- What are the eligibility requirements?

- Are reverse mortgages a good idea?

- Are there many One Reverse Mortgage complaints?

We will answer these questions, along with a few others that you may have, in this One Reverse Mortgage review. That way, you will be able to decide if it is a financial planning option for retirement that is right for you.

How Does a Reverse Mortgage Work?

A lot of people are not really familiar with reverse mortgages, leading them to ask a very important question: How do reverse mortgages work? This One Reverse Mortgage review will provide a guide that answers your questions regarding this type of equity loan.

Most consumers want to know the similarities between a reverse mortgage and a traditional mortgage. Here are a few of the ways that they are the same:

- The amount borrowed is based on the total value of the home

- You keep ownership of the home

- You are able to sell the home or pay it off without having a penalty fee charged

How Does a Reverse Mortgage Work?

Now that you know the similarities, it is important to also understand what makes One Reverse Mortgage unique. Here are just a few insights into the ever-popular question: How does a reverse mortgage work?

- You don’t have to make payments every month like you would with a traditional mortgage loan.

- Your credit is based on the equity you have built in your home, and it may change over time.

- You can get the money all up front or have it disbursed a little each month to help you with your cost of living once you retire.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

If you choose not to make a monthly payment towards your loan, the interest incurred will be added to the total amount of the loan. This will ultimately decrease the equity that you have built in your home but still allow you to live there. As long as you keep living in the home, you may continue to choose whether to make the payment or not. If you ever leave the property for some reason, at that point, you will assume the payments as usual.

The good news is that you will never have to pay more than the actual value of your home – making it ideal in an ever-changing economy.

Another perk is that there is not a required minimum credit score in order to get approved with One Reverse Mortgage Quicken Loans. While credit score is taken into consideration, the lending specialists will look more closely at your financial profile and your ability to take care of your financial obligations.

Now that you know the answer to the ever-popular question, “How do reverse mortgages work?” you can rest assured in knowing that you can make an informed decision about your future.

Don’t Miss: Best Reverse Mortgage Lenders | This Year’s Ranking and Comparison

Are Reverse Mortgages a Good Idea?

Once you have your home paid off, you may not feel like it is a good idea to get another loan based on the equity in your home. That is why so many people don’t want to consider a reverse mortgage for retirement. Sadly, most consumers just don’t know the benefits that come along with reverse mortgages.

With the housing market being pretty shaky, depreciation in the value of a home is uncertain but sometimes likely. The good news is that if you go with One Reverse Mortgage Quicken Loans, you will be protected in this dynamic economy. The value of your home won’t decrease, even if the housing market takes a turn for the worst. This is actually one of the main reasons that retirees decide to opt for this financial planning tool.

With that being said, if you have built up good retirement savings for yourself and don’t need the extra cash flow, a reverse mortgage may not be a good idea for you. The truth is this isn’t the case for many Americans as they reach the age of retirement. That means more and more people are looking into other options to bring in additional money.

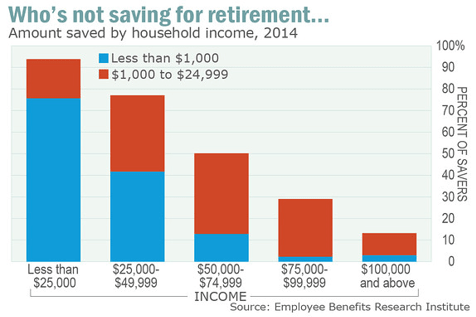

Here, you will see a chart based on a survey done by the Employee Benefit Research Institute showing the amount saved versus household income. The results are actually pretty scary.

Amount Saved by Household Income

According to Jamie Hopkins from Forbes, “Strategic uses of home equity, especially reverse mortgages, could save many people from financial failure in retirement and help stem the overall retirement income crisis facing Americans.” He even goes as far as calling it a “retiree’s saving grace.”

One Reverse Mortgage Review

Before you decide if One Reverse Mortgage is right for you, you will probably want to continue reading our One Reverse Mortgage review. Most consumers do a hefty amount of research before making such a big financial decision. Let’s see what other consumers have to say about reverse mortgages from One Reverse Mortgage Quicken Loans.

First, we will look at the One Reverse Mortgage complaints. When doing business with a new company, you definitely want to read about other consumers’ experiences. The good news is that it is rated an A+ with the Better Business Bureau. There are actually only five One Reverse Mortgage complaints that have been reported in the past three years, according to the Better Business Bureau.

Furthermore, the company did, in good faith, try to resolve the issues that were addressed. One out of the five One Reverse Mortgage complaints was resolved while the other four did not offer a response when ORM reached out. For having been an accredited business with the Better Business Bureau since 2008, the fact that there were only five One Reverse Mortgage complaints over three years is actually pretty impressive.

Related: What Is a Reverse Mortgage? – What You Need to Know

Why You Should Consider One Reverse Mortgage

Now that we have answered most of your questions with our One Reverse Mortgage review, you may be wondering why you should choose One Reverse Mortgage over many of the other lending companies across the United States. So, without further ado, here are a few of the reasons that you should choose ORM:

- It is federally insured and has been since 1989.

- It is the largest reverse mortgage lending company in the U.S., serving 47 states.

- It has been featured in the news on multiple occasions.

- It has licensed specialists that are ready and willing to help you with your financial needs.

A major stumbling block for many consumers, when it comes to considering a reverse mortgage for retirement, is what happens to the loan after they pass away. This is where a lot of the One Reverse Mortgage complaints come in before consumers really understand how it works. Does the financial obligation go on to your heirs? There are actually a few options available when you pass away.

First, your heirs may choose to sell the home and use the money from the sale to pay the balance of the loan, keeping the remaining balance. They may also decide to keep the home, paying back 95% of the value of the home or the balance of the loan – whichever is lower. If the balance, however, is higher than the value of the home, the heirs may choose to just surrender the property to the servicer so that they can sell it and apply the money toward the loan.

Getting Started with One Reverse Mortgage

To get started with One Reverse Mortgage, you must first make sure that you meet the eligibility requirements. To be eligible for a reverse mortgage through One Reverse Mortgage Quicken Loans, you must meet the following criteria:

- Be a homeowner

- Be 62 years of age or older

- Be able to meet financial responsibilities

A lot of consumers hold a common misconception that you must pay off your existing mortgage before you are able to get a reverse mortgage for retirement – and this is another one of the commonly misinterpreted One Reverse Mortgage complaints.

That isn’t the case.

You can actually still be paying on your existing mortgage and also be approved for a reverse mortgage. You just may not have as much equity built up as those who have already paid off their home in full.

Popular Article: How Does a Reverse Mortgage Work? What You Need to Know

Free Wealth & Finance Software - Get Yours Now ►

Conclusion: One Reverse Mortgage Reviews

How does a reverse mortgage work? Are reverse mortgages a good idea? Hopefully, we have answered some of your most pressing questions about this type of loan.

Recently, media and other outlets have been informing consumers like you about reverse mortgages and what they can do to offer you financial freedom in your retirement.

If you are over 62 years old and have good equity built up in your home, One Reverse Mortgage may be able to help you. Call the company to speak to a licensed reverse mortgage specialist who can further address any questions or concerns you have regarding getting a reverse mortgage.

Image Source:

- https://media.consumeraffairs.com/files/company/One_Reverse_Mortgage__Henry_Winkler.png

- https://pixabay.com/photos/house-money-euro-coin-coins-167734/

- https://www.marketwatch.com/newsroom/opinion

- https://www.ebri.org/

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.