Introduction: PayPal Prepaid MasterCard® vs. American Express Bluebird® vs. Western Union Prepaid Card vs. Kaiku Visa® Prepaid Card

Owning a credit card has become almost a necessity in today’s modern world where cash is being increasingly replaced by plastic. Many businesses only accept forms of electronic payment, and with the surge of online businesses and shopping, owning a credit card has never been more important.

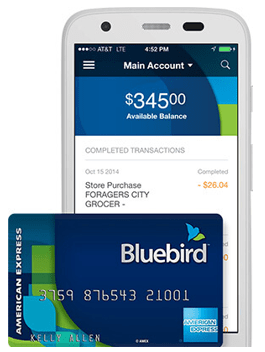

There are more than 68 million people in the United States who don’t have a checking account, meaning that they also don’t have access to any sort of debit card. Luckily, there are a number of prepaid credit cards such as the Bluebird by American Express, Western Union prepaid card, Kaiku Visa® Prepaid Card, and the PayPal Prepaid MasterCard®.

These top prepaid cards offer millions of people access to a form of electronic payment. If your credit score is so low that you simply can’t apply for a regular credit, card of if you simply prefer to avoid the hassle of dealing with banks, prepaid cards might be the best option for you.

In this brief article, AdvisoryHQ will review four of the top prepaid credit cards on the market today: the Bluebird prepaid card, the Western Union® Netspend® Prepaid MasterCard®, the Kaiku Visa® Prepaid Card, and the PayPal Prepaid MasterCard®.

We will begin by explaining how a prepaid credit card functions before offering a comparative table of the top features of the Bluebird by American Express, Western Union prepaid card, Kaiku Visa® Prepaid Card, and the PayPal Prepaid MasterCard®.

We will then offer a complete comparison of the top features of these four quality prepaid card options including:

- Reloading options on each of these prepaid cards

- The fees associated with these prepaid cards

- Cash access with each of these prepaid cards

- Online bill pay options

- Extra perks and options for each of these prepaid cards

See Also: Top Best Credit Cards | Ranking & Reviews

What Is a Prepaid Credit Card?

A prepaid credit card looks like a credit card, spends like a credit card, but is in reality more like a debit card. In order to use these types of cards, you are required to load a certain amount of money onto the card. When that money runs out, you must reload funds in order to continue to use the card.

Image Source: Pixabay

Since you are using your own money as credit, and not the banks, these prepaid cards are more like debit cards than credit.

However, the best prepaid cards such as the Bluebird by American Express, Western Union prepaid card, Kaiku Visa® Prepaid Card, and the PayPal Prepaid MasterCard® are offered by the most well-known and respected credit card companies such as MasterCard, Visa, American Express, and Discover. You can use your prepaid card anywhere regular credit cards are accepted.

One common myth associated with prepaid cards is that they can help you build credit. Since no credit check is required to get a Bluebird card or any other type of prepaid card, many people believe that through the responsible use of their card, they can build credit. However, a Bluebird prepaid card and all other types of prepaid credit cards aren’t reported to the credit bureaus, meaning that your credit score won’t be affected through your use of the card.

There are several different types of prepaid cards, many of which are linked to certain companies and other forms of online payment. The PayPal prepaid card, for example, can be linked to your online PayPal account, while the Western Union® Netspend® Prepaid MasterCard® is associated with Western Union money transfers. Other cards, such as the Bluebird prepaid card, are more for general use.

Comparison Review List

The list below is sorted alphabetically

- PayPal Prepaid MasterCard®

- American Express Bluebird®

- Western Union Prepaid Card

- Kaiku Visa® Prepaid Card

High Level Comparison Table

Credit Card Names | Type of Credit Card | Monthly or Annual Fee | Foreign Transaction Fee |

| PayPal Prepaid MasterCard® | Prepaid | $4.95/month | 2.50% |

| American Express Bluebird® | Prepaid | None | N/A |

| Western Union Prepaid Card | Prepaid | $0–$9.95.month | 3.50% |

| Kaiku Visa® Prepaid Card | Prepaid | $3.00/month | N/A |

Table: The above list is sorted alphabetically

How to Add Funds

One of the most important features of any prepaid card is how you are able to reload money onto your card. After your initial deposit on the card runs out, you need to be able to have an easy and efficient way to have more money deposited to your card so that you can continue to use it.

Kaiku Visa® Prepaid Card

No one wants to have to drive across town or wait in lines just to reload money onto a credit card, and luckily today’s best prepaid credit cards have made it easier than ever to keep your card loaded with funds.

The Bluebird card offered by American Express offers free direct deposit, meaning that you can have your employer deposit all or a portion of your paycheck directly to your card. Also, with a Bluebird card, you can reload your card with cash or check at any Walmart store across America.

The Western Union prepaid card also offers free direct deposit from your employer, government payments, or other regular payments. Also, you can receive a deposit directly onto your Western Union prepaid card through receiving a Western Union wire transfer from virtually anywhere in the world.

The PayPal Prepaid MasterCard® offers three easy ways to reload your card. With the PayPal prepaid card you can either reload funds through direct deposit, through transferring money from your PayPal account, or at the more than 130,000 NetSpend Reload Network locations nationwide.

The Kaiku Visa® Prepaid Card offers the most varied options for reloading your card. With the Kaiku Visa® Prepaid Card you can reload funds through the following options:

- Load checks on iPhone and Android

- Direct deposit

- Load cash at Visa ReadyLink

- Transfer from PayPal or Amazon

- Card to card transfers

Don’t Miss: Top Best Zero Interest Balance Transfer Credit Cards | Ranking | Interest Free Balance Transfer Cards

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Fees

No one enjoys paying fees, and when you use a prepaid card, you are basically using your own money. Fortunately, the Bluebird American Express Card, PayPal Prepaid Card, Western Union Prepaid Card, and Kaiku Visa® Prepaid Card all come with very few fees.

Image source: American Express Corporation

The American Express Bluebird® card comes with no monthly or annual fee nor any activation fee. You can even get the American Express Bluebird® for free online. If you buy the Bluebird card at a retail location, it will cost you up to $5. The only fees associated with this card are a $3–$9 fee for Cash Pickup Powered by Ria at Walmart locations and a 1% charge on Money in Minutes cash advances.

The Western Union® Netspend® Prepaid MasterCard® does have a variable monthly fee depending on how you use the card that tops out at $9.95 per month. However, you can earn up to 5% interest on the money you load onto your card with an optional savings account that comes with your Western Union prepaid card.

The PayPal prepaid card fees are higher than some of the other prepaid cards reviewed here. For example, one of the PayPal prepaid card fees is a $4.95 monthly fee charge.

However, if you can convince a friend to sign up for a PayPal prepaid card, you will receive a $5 statement credit, effectively offsetting the monthly charge. Another of the PayPal prepaid card fees is a 2.50% foreign transaction fee. However, since other prepaid cards don’t allow you to use them when abroad, this fee might be worth it if you want to use a prepaid card during your travels.

Kaiku Visa® Prepaid Card has a monthly fee of $3. However these Kaiku fees can be waived if you meet the minimum monthly deposit of $750 per month. For someone who plans to use this card regularly, it should be easy enough to avoid any Kaiku fees.

Cash Access

The PayPal Prepaid MasterCard®, American Express Bluebird®, Western Union® Netspend® Prepaid MasterCard®, and the Kaiku Visa® Prepaid Card all offer quality access to the cash you’ve loaded onto your card through quality ATM providers. The American Express Bluebird® offers free withdrawal at all Money Pass ATMs while charging $2.50 for withdrawals at other ATMs.

Image source: PayPal

The PayPal Prepaid MasterCard® does charge you PayPal prepaid card fees for accessing your money. You will be charged $1.95 for all domestic ATM withdrawals and $2.50 for over-the-counter cash withdrawals at financial institutions.

The Kaiku Visa® Prepaid Card doesn’t charge anything if you access your cash at Allpoint ATMs, but will charge you $3.00 per transaction at out-of-network ATMs.

Extra Options

Most all prepaid credit cards also offer quality perks and bonuses depending on how you plan to use the card. The American Express Bluebird® allows you to set up a family account for up to four people, where you can set limits on how much each person can spend per month.

Image source: Western Union

The Western Union prepaid card allows you to send and receive global wire transfers with your card, which can be a big benefit if you have friends or family living around the world.

The PayPal prepaid card comes with a quality mobile app that will help you manage your money and stay on top of your account balance. The Kaiku Visa® Prepaid Card similarly offers mobile banking features that will allow you to avoid the bank altogether through depositing even personal checks onto your card funds.

Popular Article: Best Credit Card Comparison | Guide | Best Ways to Compare Credit Cards Offers

Conclusion: Top Benefits of the PayPal Prepaid MasterCard®, American Express Bluebird®, Western Union® Netspend® Prepaid MasterCard®, or Kaiku Visa® Prepaid Card

For people who are fed up with banks and want to take better control of their own financial management, prepaid credit cards are a great option. Through fantastic mobile banking features and apps offered by the PayPal Prepaid MasterCard®, American Express Bluebird®, Western Union® Netspend® Prepaid MasterCard®, and Kaiku Visa® Prepaid Card, you can effectively become your own banker.

With so many different ways to load and reload your prepaid card, you can rest assured that your card will always have the necessary funds to keep you on the move. As direct deposit is offered by the PayPal Prepaid MasterCard®, American Express Bluebird®, Western Union® Netspend® Prepaid MasterCard®, and Kaiku Visa® Prepaid Card, you can pretty much avoid having to use cash at all.

The best prepaid credit card for you will largely depend on your own financial needs and how you plan to use the card. However, the PayPal Prepaid MasterCard®, American Express Bluebird®, Western Union® Netspend® Prepaid MasterCard®, or Kaiku Visa® Prepaid Card are among the best prepaid cards on the market today.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.