Guide: Finding Top Refinance Interest Rates

With refinance rates reaching record lows, growing surges of current homeowners have begun to look into refinance interest rates.

Many homeowners are growing curious about the prospects of a house refinance and the possibility of a loan refinance that will lower their interest rates and payment plans.

Here, at AdvisoryHQ, we’ve taken note of the many questions homeowners have surrounding refinance rates. To help apprehensive homeowners make the right decisions about their house refinance and in finding the best refinance interest rates, we’ve compiled this comprehensive guideline.

Some of the most asked questions that we’ve come across are:

- Should I refinance?

- Am I eligible to refinance?

- How do I find the best refinance interest rates?

- Is it a good idea to take on a no closing cost refinance?

- When should I look into a refinance loan?

- Will I get a lower interest rate if I refinance a house?

A house refinance is a huge decision, especially if you choose to follow up on the no-cost refinance route. Before jumping into the process of accepting the first refinance loan that you’re offered, it helps to know what to look for to get the best refinance rates.

The lower your refinance interest rates, the more money you’ll save on your mortgage.

Our goal is to provide homeowners with the knowledge necessary to complete a loan refinance for the lowest possible rates available to them.

See Also: Charles Schwab Checking Account Review | What You Should Know about Schwab Bank

Should I Refinance? The Top Reasons to Look into a House Refinance

A commonly asked question from homeowners considering a refinance on their mortgage is, “Should I refinance?”

Image source: Pixabay

There are many reasons for individuals to look into a refinance loan. What a refinance loan does is replace your existing loan with a new one. This can benefit homeowners in many ways by providing them with lower refinance interest rates than their original loan.

There are many benefits that homeowners will find in going after a house refinance. Here are some of the top reasons:

- Save Money on Lower Refinance Interest Rates

One of the most lucrative reasons to refinance a house is to gain lower refinance interest rates. Historically, lenders have suggested that a loan refinance is economically worth it if homeowners can save even 1% on their on their new refinance rates. Receiving lower refinance rates can also lower your monthly payments and help you build more equity in your home.

- Change Over from an Adjustable-Rate Loan to a Fixed-Rate Mortgage

When first taking out a home loan, many homeowners opt for an ARM due to the initial low interest rates. However, throughout the years, these rates tend to fluctuate and increase greatly.

For many homeowners looking to refinance a house, refinance interest rates are lowered when changing over to a fixed-rate mortgage.

When you refinance to a fixed-rate loan, as a homeowner, you can be assured that your rates will stay the same for as long as you take out the house refinance loan for.

- Consolidate Debt and Gain Access to Your Home’s Equity

For some homeowners, the strategy behind a house refinance is to help pay off any outstanding debts by tapping into their home’s equity.

Oftentimes, a loan refinance will provide lower refinance interest rates than those associated with credit card debt. This can give homeowners access to extra cash that is needed to pay off outstanding debt.

This extra cash from a loan refinance can also be used to pay for home remodeling, a child’s college tuition or a new car.

Don’t Miss: Discover Bank Reviews (Online Banking Rates, CD, Savings, Bank Locations)

How to Get the Best Refinance Interest Rates

Once you’ve decided to refinance a house, you’ll then want to find the best refinance rates available to you.

Although, at first, it may seem intimidating to sort through potential loan refinance lenders and figure out what you need to qualify for the best refinance interest rates, it can actually be a quite simple process – with the right guidelines.

There are a few steps that you can take to guarantee yourself the lowest refinance rates. Below, you’ll find the main points that you should follow through with to get the best refinance loan and receive the lowest refinance interest rates.

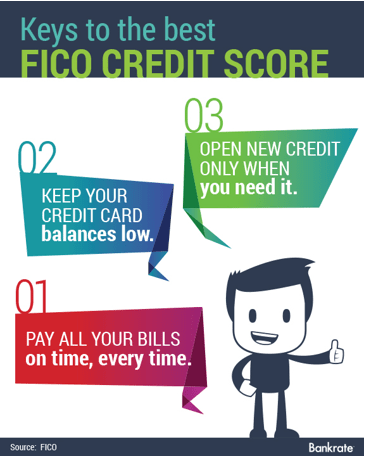

- Improve Your FICO Credit Score

When looking to refinance a house, your credit score will have a huge impact on the refinance rates you are offered by lenders.

In order to be eligible for some of the lowest and most competitive refinance interest rates, it helps to have a credit score of 740 or higher.

Image ource: FICO Score

For many refinance loan lenders, homeowners must have at least a minimum credit score of 620 or 640 to even be approved for a refinance. However, credit scores below 740 will likely not receive some of the better refinance interest rates.

Improving your FICO score can give you an advantage in receiving the lowest refinance rates. Many homeowners will find themselves eligible for refinance rates as low as 3.64% with a 30-year fixed mortgage, according to recent mortgage refinance rates trends.

With a 15-year fixed mortgage, borrowers can expect refinance interest rates of 2.93%.

Related: Top Best Credit Cards for Fair Credit | Ranking & Reviews | Best Fair Credit Credit Cards

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Pay off Any Outstanding Debts

Your debt-to-income ratio can greatly affect the type of refinance rates that lenders will offer up to you. If your debt levels are higher than your income, you can expect to not be offered the greatest refinance interest rates.

Lowering your debt-to-income ratio by paying off any credit card debt within your means can seriously increase your chances of being offered the lowest rates for your refinance.

Be sure to avoid making any big purchases before applying for your refinance, such as buying a new car or placing large purchases on your credit card, as it can negatively impact your credit score and the refinance rates that you receive from lenders.

- Compare Rates and Shop Around

An easy way to find the lowest refinance rates is to simply shop around for different offers from various lenders. Being aware of the current refinance rates that borrowers are being offered will help you get a better idea of what to expect.

A quick look at the weekly rate data provided by Freddie Mac and the MBA can give you a clear insight into the current refinance interest rates being offered to various borrowers with different financial situations.

After looking into the current refinance rates, your next best step is to shop around for refinance loan offers from different lenders. Many homeowners decide to refinance a house with their original lender. There are many positives associated with sticking with your original lender. One of the greatest reasons is due to the fact that you and your lender already have an established relationship, making it more likely that you’ll receive a great deal on your refinance rates with him or her.

However, borrowers shouldn’t feel obligated to stick with their original lender to refinance with. Completing simple online research regarding a house refinance has proven successful in helping borrowers find the most competitive refinance rates.

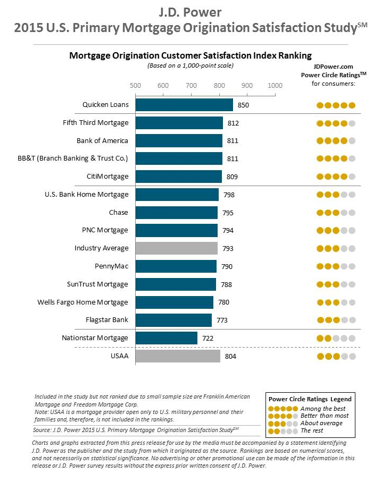

A fantastic guide on the most up-to-date refinance loan lenders is the J.D. Power and Associates’ annual mortgage lender customer satisfaction survey.

Image source: J.D. Power Mortgage Origination

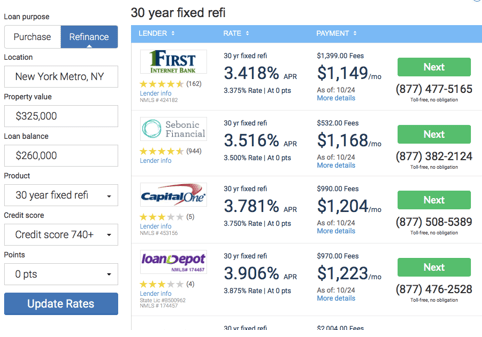

You can also log onto sites such as Bankrate and make use of its “Compare Rates” option. Simply click on the refinance option and then follow through to the field that states “View rates in your area.” Type in your zip code to view a list of refinance loan offers available from nearby lenders.

Image source: Bankrate

Look into both local lenders and big-name companies, making sure to compare their refinance rates to find the lowest interest rate for your refinance loan.

- Pay More up Front on Your Down Payment to Reduce Refinance Interest Rates

Although it may seem intimidating at first, saving up for your down payment can greatly improve your refinance interest rates. Not only will your refinance rates be lower with a higher down payment, but you may also be able to avoid mortgage insurance that many lenders require for a house refinance with a low down payment.

Those with better credit scores will be eligible for lower down payment percentages on their loan refinance – sometimes with rates as low as 3.5%. With such low down payment rates available to those who hold a healthy credit score, it will certainly pay off to put down as much as you can on your down payment to ensure the best refinance interest rates.

Popular Article: NBH Bank Ranking & Review

Decide How You’ll Pay for Your Refinance

After going through the motions of improving your financial situation and shopping around for competitive refinance interest rates, it finally comes time to decide how you’ll cover your refinance costs.

Closing costs associated with a refinance loan can average around 2 percent of the actual loan refinance. These refinance loan fees include application fees, an appraisal of your home, processing fees, origination fees, and even tax transfer fees, just to name a few.

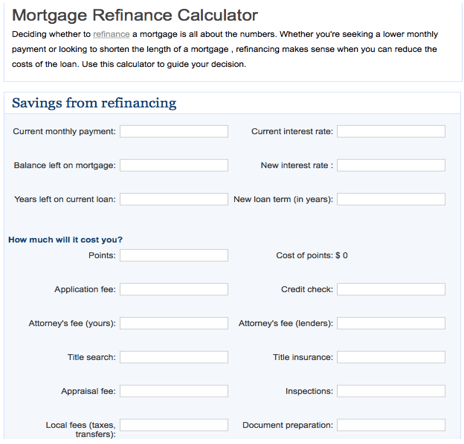

Refinance Calculator

A refinance calculator is a great tool to utilize in order to figure out the potential refinance rates you’ll be offered and how much you’ll wind up paying on loan refinance closing costs. When using a refinance calculator, you’ll be asked to input your current monthly payments and interest rates which you’ll then be comparing to your new refinance loan offers.

The refinance calculator will allow you to discern how much you’ll wind up saving or spending on your new refinance loan terms. It can also provide you with answers on whether or not to look into a no-closing cost refinance.

Image source: Bankrate Mortgage Calculator

No-Closing Cost Refinance

For many homeowners considering a house refinance, the particularly high closing costs associated with a refinance can quickly deter them from even attempting to refinance a house. Since closing costs can add up to thousands of dollars, homeowners may look into no-cost refinance loans. Essentially, a no-cost refinance is a loan refinance that you take out without paying for any of the closing costs.

While receiving a no-closing cost refinance may seem incredibly tempting, since it is essentially “free,” there are many aspects that borrowers should be aware of before signing on the dotted line.

With a no-closing cost refinance, you will leave the closing costs for the lender to cover. In exchange for the lender offering you a no-cost refinance, you’ll be given a higher refinance interest rate.

There is only one main reason to go after a no-cost refinance, which is to completely avoid the closing costs associated with a house refinance. However, by following through, you will eventually wind up paying more money in the long term, due to the higher refinance rates.

A no-closing cost refinance will increase your refinance rates; however, the increase will be around only one-eighth to one-fourth percent higher. If you are willing to pay overall higher costs, which will save you initially on closing costs, then a no-closing cost refinance loan may be the right choice for you.

Calculating the numbers in a refinance calculator can actually show you how much more you’ll be paying with your no-cost refinance, allowing you to compare the final refinance interest rates.

Read More: SunTrust Bank Review & Ranking | What You Should Know About SunTrust Bank

Conclusion: Finding the Top Refinance Interest Rates

To answer the original question, posed by homeowners, “Should I refinance?” our guide has shown that many homeowners would benefit from refinancing.

A house refinance can provide homeowners with extra cash that could be helpful in necessary financial situations, such as debt consolidation and home repairs, as well as lower their current mortgage interest rates.

In order to find and receive the top and most competitive refinance interest rates, borrowers must be aware of a few key steps. Taking proactive steps, including elevating the FICO credit score to at least 740, paying off any substantial debt, and putting down a large down payment will all positively influence the refinance rates offered.

With an improved financial standing, borrowers can begin their search for the best refinance interest rates online. There are many online sources available to compare refinance rates, receive quotes from potential lenders regarding loan refinance, and calculate the overall costs with a refinance calculator.

Finding the top refinance interest rates involves comparing rates, being aware of the current refinance rates offered to borrowers, and deciding on your refinance payment strategy.

AdvisoryHQ (AHQ) Disclaimer: Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info. Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.