2017 Guide on How To Refinance a Car Loan

When you first purchased your car, you probably imagined you were getting the best deal possible.

Over time though, you’ve started to ask yourself a different question: should I refinance my car? Refinancing a car can dramatically change your monthly payment and could even save you thousands of dollars on the interest for your current loan.

An auto loan refinance is beneficial for many individuals who have a change in their personal financial status or who just want to keep their money out of the pockets of their lender.

Image Source: Pexels

Questions surrounding how to refinance your car seem to be popping up with increasing regularity. We want to walk you through the reasons you may want to consider a car loan refinance and what your first steps should be.

Learning how to refinance a car doesn’t have to be difficult or headache-inducing, and we want to break it down for you.

So, should you refinance your car? Let’s find out if this option is right for you.

See Also: DCU Reviews – What Is DCU? (Auto Loan, Bank, & Mortgage Review)

Lower Your Interest Rate with Auto Loan Refinance

Before they determine whether or not you are a trustworthy individual to loan money to, lenders will almost always pull your credit score.

Auto loan rates are heavily influenced by your credit score, so it makes sense that a higher interest rate would correspond with a lower credit score. However, your interest rates can also be the result of the market at the time you make your purchase.

Here are a few ways that you can determine whether or not you may be able to lower your interest rate with an auto loan refinance:

- Your credit has improved. If your credit was less than stellar when you initially purchased your car, you probably didn’t get the best interest rates. Refinancing a car loan gives you an opportunity to acquire a new interest rate, and your car loan refinance rate would reflect the increase in your credit score. Sometimes purchasing a car is a necessity, even if your credit is abysmal. However, after a year of making regular on-time payments, your credit has likely seen an uptick. It may be worth talking to your lender about what rates you would receive for an auto loan refinance.

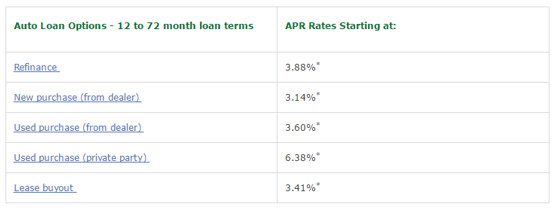

- Interest rates have gone down. The market fluctuates on a regular basis and so do the average interest rates. Pay close attention to the interest rate listed on your current loan statement, and then compare it to rates from lenders online. You can take a quick glance at the current rates on most lenders’ websites. For example, Bank of America lists their current auto loan refinance rates here, and Wells Fargo posts a brief rate summary here.

Source: Auto Loan Rates – Wells Fargo

- You have a lengthy loan term. Your interest rates may not be lowered significantly by making alterations to the length of your loan by refinancing a car loan. However, if you have been asking yourself, “Should I refinance my car?” and your loan term is between five and eight years, you will likely want to consider it. You are likely paying more in interest over the course of your loan term than you would once you figure out how to refinance a car loan. A shorter term keeps more money in your pocket overall, even if it doesn’t drastically affect your monthly payment. If you can reduce your interest rate at the same time you do your car loan refinance, that is even better.

Don’t Miss: Navy Federal Credit Union Reviews | Mortgage, Personal Loan, & Auto Loan

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Personal Conditions for Refinancing a Car

While some of the most important reasons that an individual will consider refinancing a car loan are financial, there are definitely a few personal reasons to keep in mind.

These tips and qualifications for considering a car loan refinance will definitely impact your monthly finances, but their primary category is mostly personal. It might be time to refinance your car loan if you fall into one of these categories:

- Your financial status has changed. And it might not have been for the better. If you lost your job or received a significant pay decrease, your monthly expenditures might need to be decreased. In order to free up some cash flow on a monthly basis, refinancing a car might be a good choice. Defaulting on a loan won’t do your credit any favors, so opting for an auto loan refinance can save your credit for future loans even though it may not save you any money in the long-run.

- You didn’t do much research prior to purchasing. You may have spent hours poring over the various makes and models, but did you do your research on loan options? Should you refinance your car because of the deal you got initially? While some dealerships do offer the lowest rates around, you may not have gotten the best deal possible. Lending managers can sometimes pocket some of the money they overcharge you on your financing. Refinancing a car early on in the loan can help you to repair some of the damage or recoup some of the money that decision cost you.

Should you refinance your car? You may find that deciding to refinance your car loan is significant to your monthly budget for any number of reasons. However, these are some of the most common considerations for refinancing a car.

Saving on your monthly expenses as well as lowering your interest rate can be motivating factors when it comes to refinancing a car.

How to Refinance a Car Loan

Should I refinance my car? That question is often followed by a closely related question: how do I go about getting a car loan refinance?

Learning how to refinance a car loan isn’t as complicated as refinancing a mortgage or some other types of financial transactions. In fact, you can sometimes complete the entire process in just a few hours from the comfort of your own home.

To get started, here are a few of the first steps you may want to look over before you begin to refinance your car loan:

- Gather up your information. Pull out all the necessary information you will need to refinance your car. Learning how to refinance your car can really be as simple as having all the right information at your fingertips. Know all of the details of your current auto loan as well as pertinent information about your vehicle. You may want to have your most recent loan statement handy as well as your car insurance and registration. For lenders that will verify your income, keeping your pay stubs handy will prove helpful as well.

- Evaluate your credit history. Know what types of loans you will qualify for when you do a car loan refinance by taking a close look at your credit report and credit score. There are a number of online places you can visit to obtain a free copy of both. You are entitled to one free credit report each year through www.annualcreditreport.com or you can view more detailed information regarding your VantageScore credit score through sites like Credit Karma.

- Apply for your car loan refinance. Don’t limit yourself to just one option to refinance your car. Apply with several companies or brokers in order to make sure that you are receiving the best interest rates and most favorable terms. Making multiple inquiries can damage your credit report, but you can avoid these dings by submitting all of your loan applications close together. You have approximately fifteen days in which to submit your inquiries for an auto loan refinance to comparison shop.

According to several experts, you can finish your auto loan refinance in just a few hours. You will simply select which loan option you want to go with, sign your new paperwork, and set up the payments with your new lender.

What happens behind the scenes? Your new lender will take the money from refinancing a car and pay off your previous lender.

This allows them to clear out the old loan that has now been satisfied so that the only open loan on your credit report should be your car loan refinance. You will immediately begin making new payments to your new lender at your new rates.

Related: LendingTree Auto Loans Reviews | What You Need to Know! (Pros, Complaints, & Review)

Does an Auto Loan Refinance Save You Money?

Now that you know how to refinance a car, how do you know if it will actually save you any money? There’s no sense in investigating a way to refinance your car if it won’t actually save you any money in the long run.

Typically, you will see more money saved when you figure out how to refinance your car early on in the loan term. The closer you are to the end of your auto loan, the less likely it is that you will benefit from finding a way to refinance your car.

Figure out how to refinance a car to save money before you make any leaps. It might seem like a lot of math to consider whether or not it is worthwhile, but there are a number of tools available online to help you discover how to refinance a car for maximum savings. The best part? They will do the math for you.

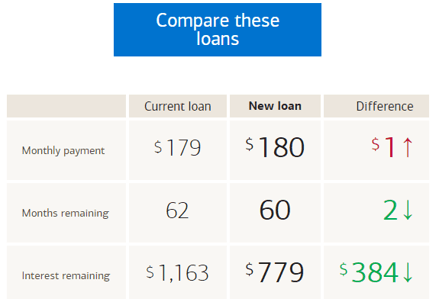

- Bank of America: Their auto loan refinance calculator allows you to input the data from your pre-existing loan into four simple spaces: your loan balance, monthly payment, refinance amount, and interest rate. They will fill in the current refinance rates and terms on the right hand side in order to produce a chart that shows you the exact difference between what you are currently paying, will pay in the future, and pinpoint roughly how much money you’ll save over the course of your loan. From there, it’s simple to apply for refinancing a car through their application.

Source: Bank of America – Auto Refinance

- Nationwide: Nationwide produces a very similar calculator for refinancing a car and determining whether you are actually generating any savings. Pay attention to how many payments you’ve already made on your loan, the initial loan amount, interest rate, and term compared to the loans you’re considering. Instead of a chart, they will display the end result in a colorful bar graph for easy viewing and reading. Of course, you can quickly apply for a car loan refinance and see their current rates.

Be sure to take time to evaluate if refinancing a car is going to produce the desired effect for you. If it doesn’t seem likely to save you money monthly or over the length of your loan, refinancing a car won’t do you much good.

It’s important to review the loan options available to you before you can really see exactly how much money you will save. It may also be a good idea to view the advertised rates from lenders to see if it’s possible to save money before making specific applications for refinancing a car.

Additional Fees for Auto Loan Refinance

Can you expect to pay any additional fees when you refinance your car? Much like purchasing a home, you can sometimes find yourself paying a number of unexpected fees. Unfortunately, unexpected fees from closing on a new loan can eat into any savings you may have had with an auto loan refinance.

For example, some lenders may require an appraisal for your vehicle. According to lending experts from Ford dealerships, this is an unnecessary (and costly) step. Plenty of lenders are available that are happy to look at refinancing a car without seeing an appraisal upfront.

Others may charge processing or administrative fees on the loan itself. This covers the cost of their paperwork and any legwork they did to earn your business for your car loan refinance. Often, you can bundle this amount into the overall refinance to save yourself the money upfront.

Keep an eye out for any mandatory extras that a refinancing company places on your auto loan refinance. If they require you to purchase additional insurance or to make use of an extended warranty, you should highly consider finding a different resource for refinancing a car. Unless you were already leaning toward initiating some of these extra costs for your own personal benefit and use, there are a number of lenders out there that will help with refinancing a car without these additional expenses on your part.

Popular Article: Ameriprise Insurance Reviews | Is Ameriprise’s Home & Auto Insurance Worth Using?

Conclusion: Is a Car Loan Refinance for You?

Should you refinance your car? The decision is ultimately determined by the unique situation that you find yourself in.

Many individuals could benefit from refinancing a car in order to lower their interest rates or just to reduce the amount of interest they are shelling out for over the length of their loan.

If you’ve had a change in circumstances — whether that means that the market has better rates, you’ve done more research, or a change in your income necessitates it — investigating the finer details of an auto loan refinance could be beneficial for your wallet.

That being said, not everyone will see significant savings on a car loan refinance. The closer you are to the end of your loan term, the less likely it is that you will see extra savings from a car loan refinance.

Take the time to examine your current loan beside new auto loan refinance options. Using the online calculators is an easy and painless way to evaluate if a car loan refinance is for you. If you can save money both now and in the long-run, why notlook into an auto loan refinance?

Read More: Car Finance 247 Reviews | What You Should Know Before Using Carfinance

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.