Intro: DCU Reviews

If you’re based in Massachusetts or New Hampshire, you have likely heard of DCU. But DCU is worth looking into, no matter your location.

We’ve compiled information and detailed DCU reviews to help you decide if DCU is a good fit for you.

What Is DCU?

DCU is a not-for-profit financial cooperative with headquarters in Marlborough, Massachusetts. DCU reviews rank the credit union among the top 20 in the United States. Like all credit unions, DCU is owned by and run for its 500,000 members in all 50 states. It is the largest New England-based credit union based on its assets.

Still not sure exactly what DCU is?

Read on for details and DCU reviews.

Image Source: What is DCU?

See Also: CreditReport.com Reviews – What You Need to Know (CreditReport.com Review)

What Does DCU Stand for?

Are you wondering, “What does DCU stand for?” You’re not alone!

Though it is formally called the Digital Federal Credit Union, the institution is better known simply as DCU.

While DCU may not be as well-known as mainstream banks, DCU reviews identify it as a full-service institution. Products and services include personal and business banking and lending, including checking, savings, mortgages, equity loans, auto loans, and credit cards, among others.

Products and Services

DCU has numerous products and services available to consumers and businesses. Here, we’ll focus on everyday banking, auto loans, and mortgages, plus reviews of these products.

A great feature of the credit union’s website is that it includes DCU reviews, including DCU auto loan, bank, and mortgage reviews written by its members. While Digital Federal Credit Union reviews are largely positive; negative reviews are included too, giving current and prospective members a genuine idea of the experience others had with the institution.

Banking

The following checking and savings accounts are available through DCU.

1. Checking

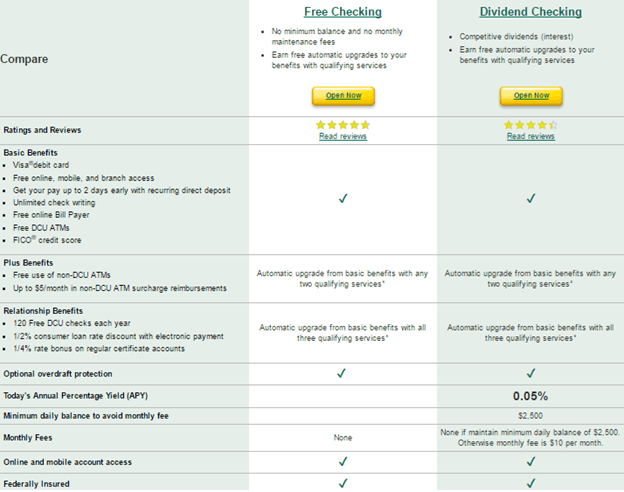

According to DCU bank reviews on the credit union’s website, the checking account is popular among customers. You can choose from the Free Checking or the Dividend Checking option. True to its name, the Free Checking account comes with no monthly maintenance fees and no minimum balance.

Image Source: DCU Checking Account Options

While the Dividend Checking account costs $10 per month in maintenance fees, that fee is waived if a minimum balance of $2,500 is maintained. Dividend Checking holders earn competitive dividends, an attractive element of this account.

Both account types can be easily opened online and provide convenient monthly account and loan statements electronically.

Don’t Miss: eSmart Reviews (What You Should Know Before Signing Up with eSmart)

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

2. Savings Accounts

For those looking for greater dividends, savings and money market accounts may be the way to go. They include:

- Primary Savings

- Money Market

- Ltd Savings

- Holiday Club

- Member Described

APY (annual percentage yield) rates range from 0.05% on the Holiday Club account to as high as 3.04% with the Primary Savings account. The Ltd Savings account, however, boasts the highest variable rates, while the Money Market account may be ideal for those with a knack for saving, as the rate increases as your account balance increases.

Image Source: DCU Savings Account

No monthly fees, online and mobile account access, and federal insurance by the National Credit Union Administration (NCUA)are among the additional benefits of all five DCU savings and money market accounts.

Like its checking accounts, DCU bank reviews for savings and money market accounts are generally positive, with all account types receiving an average rank of 4 out of 5 stars.

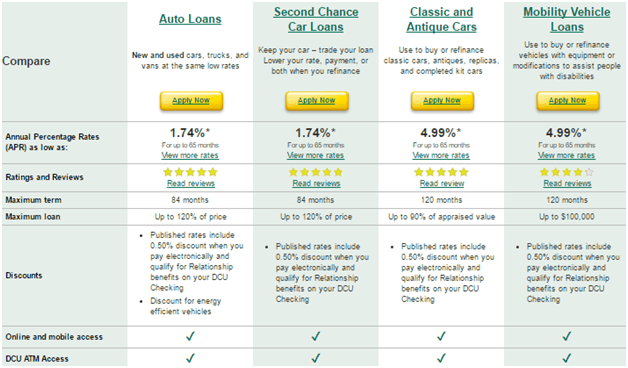

Auto Loans

Four types of auto loans are offered by DCU: auto loans for new and used cars, second chance car loans, loans for classic and antique cars, and mobility vehicle loans. You can use the auto loan calculator to determine what rates and monthly payments you may be eligible for, and you can apply online for all four types of loans.

1. Auto Loans

Regular auto loans are available for new and used cars, trucks, and vans. Qualified borrowers can finance up to 120% of the purchase price for a maximum term of 84 months. Rates depend on the length of the loan term and your credit rating, with annual percentage rates (APR) ranging from 1.74% on terms up to 65 months to 4.24% for 84 month loans.

More than 3,000 members have provided DCU reviews of auto loans on DCU’s website. Of these, over 2,600 reviewers gave the product a ranking of 5 stars. One DCU auto loan review succinctly described the experience with the credit union as “excellent service, easy to apply, best rates.”

2. Second Chance Car Loans

Want to reduce your monthly car payment or rate? A second chance car loan with DCU might be suitable for you. By switching your loan to DCU you can likely lower your monthly payment. This is because car dealerships and many financial institutions charge more than they need to – often over 20% for used vehicles.

How much you’ll save depends on an evaluation of a number of factors, including:

- The make and model of the vehicle

- The remaining loan balance

- The current monthly payment and interest rate

- The original number of payments and how many payments are left

- The name, address, telephone number, and loan account number for your current lender

- Your personal credit history and repayment method

Staying true to its mission that “All members achieve their financial goals,” DCU commits to providing honest evaluations, including telling you if lowering your payment isn’t possible.

Based on DCU auto loan reviews found on its website, 2,959 second chance car loan holders gave the product 5 stars. Only 35 of the 3,316 DCU auto loan reviews ranked second chance car loans with just1 of 5 stars.

3. Classic and Antique Cars

These loans are used to buy or refinance classic cars, antiques, replicas, and completed car kits. Classic and antique auto loans allow qualified borrowers to borrow up to 90% of the appraised value for a term of up to 10 years. Keep in mind that rates for classic and antique car loans are significantly higher, starting at 4.99%.

Fewer of these borrowers provided DCU auto loan reviews, likely due to the smaller number of classic and antique cars on the road compared to other vehicles. However, all five reviewers gave this product 5 stars. In each DCU auto loan review, members painted a positive picture. One DCU auto loan review credits DCU with making the dream to purchase a Mustang a reality.

4. Mobility Vehicle Loans

If you or someone you know has a disability, a mobility vehicle loan can help you secure a vehicle with modifications or special equipment. New or used vehicle purchases and refinancing qualify for loans up to $100,000 for a maximum 120 month term. Rates start at 4.99%.

Image Source: DCU Auto Loans

Modified vehicles to help those with disabilities get around can be expensive. DCU aims to help borrowers afford modified vehicles by spreading the cost over time.

DCU auto loan reviews for mobility vehicle loans reflect overall member satisfaction in meeting the unique transportation needs of those with disabilities. One DCU auto loan review said, “When nobody else would help out in getting an accessible van, DCU stepped up to the plate and made it happen!”

Another pleased member gave a glowing DCU auto loan review: “Thanks to digital Federal Credit Union (DCU) our family has been able to enjoy getting around in our ramp van with our wheelchair-dependent son, Ben…it’s been so wonderful having payments we could afford.”

Related: Prosper Reviews – All You Need to Know Before Using Prosper.com

Mortgages

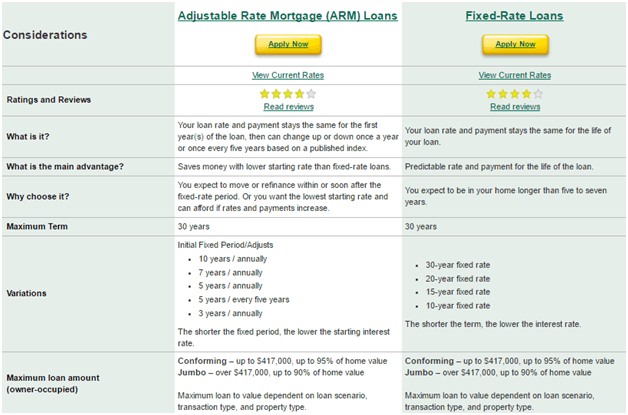

The DCU mortgage center helps current and prospective members buy or refinance their homes. It enables you to check rates, calculate your monthly payment using the mortgage calculator, and apply online for a mortgage loan.

Whether you’re looking to buy or refinance, you can choose from fixed-rate and adjustable-rate mortgage (ARM) loans. With a fixed-rate loan, your rate and payment remains the same over the full course of the loan. This is ideal if you value predictable payments.

Image Source: DCU Mortgages

If you opt for an ARM loan, the rate is fixed for a given term, after which your rate and payment may go up or down until the end of the loan. If you can handle a little uncertainty, you can benefit from lower starting rates than with fixed-rate mortgages. Both loan options have a maximum term of 30 years.

DCU mortgage reviews are slightly lower than DCU reviews for its other product offerings. However, about 75% of members still recommend it as a provider, based on DCU mortgage reviews on the credit union’s website.

Popular Article: Quizzle Reviews – What Is Quizzle? (Is Quizzle Safe & How Accurate)

Digital Federal Credit Union Reviews

Many Digital Federal Credit Union reviews are available online. So far, we’ve covered DCU credit union reviews that are easily available on the credit union’s website, including DCU bank reviews, DCU auto loan reviews, and DCU mortgage reviews. Now, let’s look at external DCU credit union reviews that are also accessible online.

An examination of Digital Federal Credit Union reviews from three sources – Credit Karma, WalletHub, and Yelp – reveals a lower average ranking than the 5 star rankings found on DCU’s website. However, reviews are still largely positive, with an average ranking of 3.5 out of 5 stars.

DCU bank reviews on WalletHub are highest, with an overall rating of 4 of 5 stars. Reviewers identify the checking account as DCU’s top rated product, with 5 stars. DCU mortgage reviews didn’t fare so well. Indeed, mortgages were identified as the worst rated product, with a so-so ranking of 3 stars.

Of 37 total recommendations on WalletHub, four reviewers gave the credit union only 1 star. One negative DCU review warns that, with physical branches only located in New England, members in other regions may have difficulty dealing with the credit union remotely.

Credit Karma houses 97 DCU reviews, with an average of 3.5 out of 5 stars. Of these, 56% of reviewers give the credit union 5 stars, while 28% have a less favorable opinion, giving it only 1 star. Of 63 total Yelp reviews, DCU receives a ranking of 3 out of 5 stars.

Opinions are mixed: One DCU review indicates the intention to move all accounts to DCU due to its low rates and exemplary products. On the other hand, several other reviewers complained of poor customer service.

Free Wealth & Finance Software - Get Yours Now ►

The Verdict

Navigating the financial realm to decipher the best products and rates can be challenging. We hope answering common consumer questions such as “What is DCU?” and “What does DCU stand for?” along with a summary of products and DCU credit union reviews helps you understand what the institution has to offer.

DCU offers a plethora of banking and loan products at low rates. If you like the convenience of remote banking, DCU may be right for you. DCU reviews are generally positive, with the majority of current members recommending its services.

However, a modest number of reviewers have negative feelings about the credit union. Therefore, it’s important to speak with a representative and make your own informed decision. Nonetheless, DCU could be a great starting point!

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.