What You Need to Know about Reverse Mortgages, Including the Facts, Rules, Examples, and Qualifications

When purchasing a home, whether it’s for the first time, as an income property, or for a vacation destination, you likely consider all the factors that come with owning a home.

Buying a piece of property takes a great deal of commitment, as once it is purchased, your home because a substantial asset.

Owning a home is a fundamental part of life that provides countless benefits, including the ability to take out a special type of loan known as a reverse mortgage when you’ve reached a certain age.

A reverse mortgage allows you to convert a share of the equity in your home into cash in times of need.

Before you consider embarking on the process of applying for a reverse mortgage, there are numerous reverse mortgage facts you need to consider.

This article serves as your reverse mortgage guide to help you through the process and will cover the following reverse mortgage information:

- An overview of reverse mortgage information

- Reverse mortgage facts

- Reverse mortgage rules

- Reverse mortgage basics

- A reverse mortgage example

- Reverse mortgage qualifications

- A reverse mortgage purchase calculator

In order to best determine whether this type of loan is right for you, you need to gain an understanding of how the reverse mortgage process works and how you might benefit.

See Also: Best Reverse Mortgage Lenders | Ranking and Comparison

Reverse Mortgage Information Overview

In general terms, a reverse mortgage, also known as a home equity conversion mortgage (HECM), is a distinct type of home loan for homeowners who are 62 years old and older that enables you to turn some of the equity in your home into cash.

The reverse mortgage was designed to assist retirees in covering their basic living expenses when steady income is no longer available.

While it seems simple, those who are approaching the age of 62 and considering a reverse mortgage should understand all the reverse mortgage information presented in this article in order to make the best decision for their future.

Image Source: Reverse Mortgage Information

While many retired people rely on social security to cover their basic expenses, including groceries, bills, and health care, for a majority of retirees, it does not provide enough income to live comfortably.

Additionally, according to LendingTree.com, two-thirds of borrowers use a reverse mortgage to pay off their debt.

A reverse mortgage is a suitable option for those who need to use their home as a source of additional income, as this loan makes the equity accumulated over years of mortgage payments available.

The important reverse mortgage information to understand is that this is not a traditional home equity loan or second mortgage.

A reverse mortgage differs from these other types of loans, as the borrower is not obligated to repay the reverse mortgage loan until the borrower no longer utilizes the home as their primary residence, or they no longer fulfill certain reverse mortgage qualifications.

The borrower does not need to make any monthly payments toward the balance of the loan as long as they live in the home. However, another important piece of reverse mortgage information to understand is that the borrower must remain current on property taxes, homeowners’ insurance, and Homeowners’ Association (HOA) dues (if applicable).

Don’t Miss: What Is a Reverse Mortgage?—What You Need to Know (Pros & Cons, Disadvantages & Basics)

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Reverse Mortgage Facts

In addition to understanding the basic reverse mortgage information presented above, it’s also critical to know all reverse mortgage facts before initiating the loan process. Some of the most essential reverse mortgage facts to recognize include:

- Reverse mortgage loans offer various payout options

- A reverse mortgage only provides a fraction of the equity in your home

- It is possible to lose your home with a reverse mortgage

- You should be careful who you list on your reverse mortgage loan

- Not all reverse mortgage lenders are equal

One of the basic reverse mortgage facts to know is that the Federal Housing Administration (FHA) is the government agency that insures loans made by banks and other private lenders. The FHA offers five different payment plan options for people who are working with lenders on a reverse mortgage.

The first option is for the borrower to receive equal monthly payments for the length of time that the borrower is alive and resides in the home.

The second option is for the borrower to receive payments for a fixed period of time. In the third option, the reverse mortgage facts are that a line of credit is made available, and the borrower can select the amount and time frame in which they withdraw money within the set limit.

The final two payment options allow the borrower to combine lines of credit for the first two monthly payment options, which enable the borrower to use some of the money for a line of credit and receive the rest through a monthly payment.

Among the most important reverse mortgage facts to acknowledge is the point that this type of loan does not provide access to the total equity you have in your home.

The FHA determines the amount based on the youngest borrower’s age, current interest rates, and the value of the home. In addition, the reverse mortgage facts you must understand are that you are also required to pay mortgage insurance, lender charges, and other service fees.

Another one of the most critical reverse mortgage facts to know is that it is possible to lose your home with a reverse mortgage. According to an article on AOL.com, most lenders are quite strict with borrowers to ensure they maintain their payment responsibilities.

If the borrower misses a payment or falls behind, the lender can take action on the loan, including foreclosure.

While one of the reverse mortgage facts to consider is that listing one borrower on the loan can increase the monthly payment or loan amount, doing this only guarantees that this borrower can remain in the home. If the borrower passes or moves into a supported-living facility, the lender can foreclose on the home because no one else was listed on the loan.

The final of the most important reverse mortgage facts to recognize is that there are a number of different reverse mortgage lenders, but they are not all reliable.

According to ReverseMortgageAlert.org, popular banking institutions such as Wells Fargo, Bank of America, and MetLife Bank have all exited the business as a reverse mortgage guide and lender, leaving smaller brands to compensate the market.

Smaller lenders such as American Advisors Group, One Reverse Mortgage, LLC, and Nationwide Equities Corporation may not be as well-known or trusted based on lack of reverse mortgage information or experience.

Related: Full Review: Reverse Mortgage Disadvantages, Pitfalls, Cost, and Problems

Reverse Mortgage Rules

The reverse mortgage loan first came into existence back in 1961, according to the American Advisors Group, so since then, a number of new reverse mortgage rules have been implemented by the FHA.

According to the American Advisors Group’s website, the following reverse mortgage rules are applicable today:

Borrower Reverse Mortgage Rules

- Borrowers must be 62 years of age or older

- Borrowers must own their home

- The home must be the borrower’s principal residence

- A counseling session with an agency approved by the U.S. Department of Housing and Urban Development (HUD) must occur

Home Reverse Mortgage Rules

- The borrower’s home must qualify as a “single-family home” or otherwise must be a “multiple-family home” with four units, in which one unit is occupied by the borrower.

- The home may be a “manufactured home” that meets the FHA’s reverse mortgage rules. According to the American Advisor’s Group, a manufactured home is one with a steel frame and axle that was built in a factory and moved to a permanent site on wheels.

- If approved by HUD, the home may actually be a condominium.

Financial Reverse Mortgage Rules

- As previously mentioned in the section titled “Reverse Mortgage Facts,” one of the most important reverse mortgage facts to remember is that the borrower is still responsible for property taxes, insurance, home maintenance, and HOA fees (if applicable). This is also one of the critical reverse mortgage rules that apply to all borrowers.

- Borrowers must stay current with all financial responsibilities and may not fall behind.

Reverse Mortgage Basics

The reverse mortgage basics may be easier to understand now that you’ve read an overview of reverse mortgage information, learned some reverse mortgage facts, and identified the reverse mortgage rules.

However, there are still some critical reverse mortgage basics that you need to know before determining if this is the step you want to take in your financial plan.

First, you should know that the bank issues your payments based on the approved equity of the borrower.

Second, the reverse mortgage loan must only be paid back if the borrower passes away or sells the home on which the reverse mortgage was taken out.

Third, one of the reverse mortgage basics that was set in place as a precaution is that it is not possible for the borrower to owe more money than the actual value of the home, according to a Huffington Post article.

If the balance of the loan is lower than the amount borrowed after the borrower passes or moves, the difference is paid to the borrower or the borrower’s inheritors.

Finally, one of the most crucial reverse mortgage basics to understand is that the amount borrowed is paid in one lump sum if the borrower selected a fixed-rate mortgage. As mentioned in the section about reverse mortgage facts, however, borrowers may also choose monthly payment plans.

Popular Article: How Does a Reverse Mortgage Work? What You Need to Know about Reverse Mortgages

Reverse Mortgage Example

While all the reverse mortgage information, reverse mortgage facts, reverse mortgage rules, and reverse mortgage basics may be somewhat confusing to comprehend, what may really help you understand is a reverse mortgage example.

The website Reverse.org provides a reverse mortgage example that describes a situation in which John and Anne, a retired couple, are interested in a reverse mortgage in order to cover basic living expenses and take a vacation.

In this example, John is 72 years old, and Anne is 68 years old, and they want to stay in the home in which they currently reside. After contacting a reverse mortgage guide to learn all the reverse mortgage facts and reverse mortgage rules, they meet with an FHA appraiser to determine their home’s value.

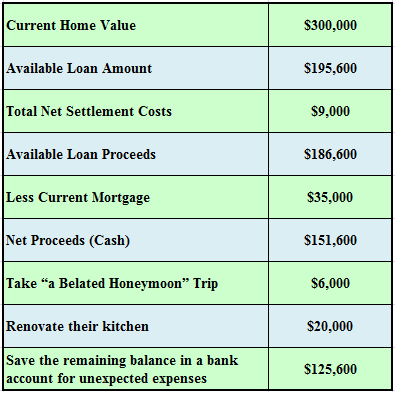

According to this reverse mortgage example, their home is appraised at $300,000, and the couple owes $35,000 on their mortgage. The below chart from the Reverse.org reverse mortgage example outlines the couple’s loan breakdown.

Image Source: Reverse.org

Reverse Mortgage Qualifications

Now that you are equipped with a fair amount of reverse mortgage information, you should identify whether you meet all the reverse mortgage qualifications. The following reverse mortgage qualifications exist today and should be carefully considered before you apply for a reverse mortgage loan.

- You are 62 years old or older

- You own your home outright or have a low outstanding balance

- You hold the title to your home

- The home is your primary residence

- The home is in good condition without needing substantial repairs

- You are not overdue on income tax payments or other loans

- You have or will undergo mortgage counseling

- You have or will include both you and your spouse on your reverse mortgage contract

If you meet all of these reverse mortgage qualifications, you are in a good position to apply for a reverse mortgage loan, and it is more likely to get approved.

Free Wealth & Finance Software - Get Yours Now ►

Reverse Mortgage Purchase Calculator

While there are so many reverse mortgage rules and reverse mortgage facts to consider, one of the tools that will help you best determine how a reverse mortgage will help you is to use a reverse mortgage purchase calculator.

Fortunately, ReverseMortgage.org provides an easy-to-use reverse mortgage purchase calculator that incorporates all of the key factors that go into determining your reverse mortgage loan. The reverse mortgage purchase calculator includes the following components:

- Your zip code

- The year in which you were born

- The year in which your spouse or co-owner was born

- The appraised value of your home

- Your monthly mortgage payment amount

- Any additional cash needed

- The estimated home repairs that may be required

- Your preferred line of credit

In order to best calculate your potential reverse mortgage loan, fill in this necessary reverse mortgage information and use the reverse mortgage purchase calculator found on ReverseMortgage.org. Once you complete the form, click on the “calculate” button, and you will determine your reverse mortgage loan amount.

Now that you’ve learned a great deal of reverse mortgage information, you should be better equipped to make the right decision about whether a reverse mortgage is for you. If you meet all the reverse mortgage qualifications and require additional funds in order to pay your expenses or fulfill a certain need, your next step is to contact a professional reverse mortgage guide to begin the process.

While the reverse mortgage basics outlined in this article may present all the rewards of a reverse mortgage, posing it as a viable option for obtaining additional income, you should also become acutely aware of the risks involved with a reverse mortgage.

For example, if your spouse or other family members living in the home do not go in on the reverse mortgage loan with you, they may be forced to vacate after you pass, according to an article on Forbes.com. In addition, a reverse mortgage may become quite costly depending on the interest rate, up-front costs, and other terms of the loan.

In order to ensure you are making the best decision for your future and have all the reverse mortgage information you need, reach out to an experienced reverse mortgage professional who will serve as your qualified reverse mortgage guide.

Read More: Top Mortgage Loan Originators | Ranking | Top Loan Origination Companies

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.