Guide to Roth IRA Rules & Requirements

Retirement approaches quickly, which is why most people try to plan for it financially before the future arrives.

A multitude of retirement savings accounts exist to make this endeavor easier, but many prefer the tax-favored Roth IRA accounts. Unfortunately, there seems to be an air of mystery surrounding the Roth IRA rules (and maybe even IRA rules in general).

Exactly what are the IRA rules for any type of account? More specifically, what are the IRA withdrawal rules, the IRA rollover rules, and more?

The Internal Revenue Service, better known as the IRS, tries to make these IRA rules clear, but it sometimes falls a little short. AdvisoryHQ wants to offer you some assistance by putting the Roth IRA rules that you want to know into easy-to-understand terms.

We’ll even briefly compare the Roth IRA rules to the traditional IRA rules (as well as basic IRA rules) so you can decide which type of account might work best for you.

Don’t let retirement sneak up on you without having savings set aside. Take a closer look at these Roth IRA rules so you can be on track for a comfortable retirement financially.

See Also: IRA Distribution & Roth IRA Withdrawals | Guide

What Is a Roth IRA?

Covering the more detailed needs of IRA withdrawal rules and IRA rollover rules won’t make much sense without first understanding what a Roth IRA is.

Do you know whether you even qualify to make contributions to this type of retirement savings account? According to the Roth IRA rules, there are a few eligibility requirements you should be aware of before diving headfirst into investing.

Roth IRA Rules & Requirements

Simply put, you can open and contribute to a Roth IRA so long as you have access to an earned income. As long as you have a job that provides some sort of taxable income, the IRS deems you eligible to open this type of savings account.

There are even a few exceptions in terms of the requirement for taxable income. Money that comes from any of the following sources allows you to make contributions, according to the IRA rules:

- Wages and salaries

- Tips or bonuses

- Commissions

- Nontaxable combat pay or military differential pay

- Taxable alimony and separate maintenance payments

A working spouse can even make contributions for a nonworking spouse and remain in line with the rules for Roth IRA options. IRA rules are fairly flexible when it comes to who is eligible for one of these accounts and how those individuals can benefit from them. Of course, there are Roth IRA contribution rules that we will cover in more depth in a later section.

The major draw for most individuals lies in the IRA withdrawal rules, which give you access to tax-free withdrawals at any time. Unfortunately, this advantage also has a drawback that makes some hesitate before opening an account. According to the Roth IRA rules, you cannot deduct contributions made to a Roth IRA on your taxes.

Roth IRA Contribution Rules

The IRS sets a few firm rules in place regarding IRA contribution rules and limits for those who may be interested in saving for retirement. The IRA rules are the same for traditional IRAs as well as for the Roth IRAs that we are specifically covering in this article. On an annual basis, individuals under the age of 50 can contribute a total of $5,500. Individuals over this age may make additional contributions up to $6,500 annually.

The traditional IRA rules are right in line with the Roth IRA contribution rules set out by the IRS in terms of these types of accounts. What many people don’t realize is that these IRA rules are describing your total contribution limits across every type of IRA account that you might possess.

For example, you may decide to deposit $3,000 into your Roth IRA account. If you are under the age of 50, this means that you only have $2,500 left in contributions that you could make to a traditional IRA account for the remainder of the year.

Once you retire completely, you won’t be eligible to make any more contributions to your Roth IRA. One of the stipulations for having this type of account is maintaining some sort of earned income determined eligible by the IRS.

Without any sort of earned income, you will not be able to make contributions throughout the year. While you continue to work, Roth IRA rules allow you to make contributions past the age of 70½, which is impossible with traditional IRA rules.

You also may not contribute more than you make throughout the year. For example, someone who works only a fraction of the time may find that they are limited by the Roth IRA contribution rules. An individual who makes only $1,000 per year can only contribute up to that amount.

Don’t Miss: Top Best Starter, First, Beginner Credit Cards for Beginners

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Contribution Limits and Roth IRA Rules

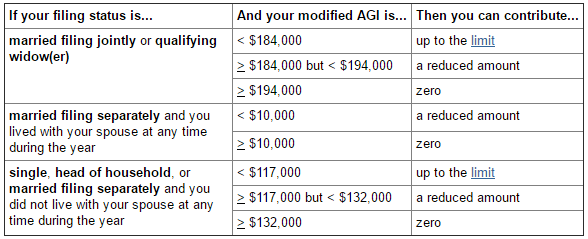

High-income earners may not find the Roth IRA rules conducive to their retirement savings plans. The IRS has put several standards in place that make contributions to this type of account out of the realm of possibility for individuals who make over a certain amount annually. For others, they have limited the amount of contributions they are eligible to make based on their modified adjusted gross income (AGI).

You will want to calculate your modified AGI to make sure you are complying with IRA rules on this worksheet available from the IRS. You can see the breakdown of the Roth IRA rules for contribution limits in the chart below. However, we will go over some of the more important details in the upcoming sections.

IRA Withdrawal Rules

If you are married filing jointly or a qualifying widow(er), you can earn up to $184,000 before your contributions become affected. At this rate, Roth IRA rules allow you to make a reduced contribution until you reach $194,000 per year at which point no contributions can be made.

The pattern is similar for single individuals, head-of-household filers, or those who file their taxes as married filing separately but did not live with their spouses. Modified AGI that came in between $117,000 and $132,000 allows you to make partial contributions, but income in excess of this amount disqualifies you entirely.

If your deposits exceed the IRA contribution rules, the IRS will issue a 6 percent tax or you may withdraw your excess contributions for the year.

IRA Withdrawal Rules

The IRA withdrawal rules seem to have a heavy amount of consumer interest, and for good reason. In an emergency situation or when desperate financial hardships hit, many people find it necessary to withdraw money from their retirement savings account. The IRA withdrawal rules are a part of the reason that so many consumers choose to invest in a Roth IRA to begin with.

Unlike traditional IRA rules, which require withdrawals to be taxed, Roth IRA withdrawal rules allow you to make tax-free withdrawals. Income is taxed as it is placed into a Roth IRA, negating the need to tax it twice.

Even better, the IRS is generous enough with their Roth IRA withdrawal rules to allow your deductions from the account to come first from your contributions instead of the earnings in your account. Of course, other IRA withdrawal rules apply for these types of accounts as well. Any penalty-free withdrawal can be made from a Roth IRA or from the Roth IRA earnings under certain circumstances.

First, earnings cannot be withdrawn penalty-free until after you pass the age of 59½. Second, the Roth IRA withdrawal rules make it so that all contributions and earnings may be withdrawn after age 59½ and five years after the initial contribution without taxes or penalties.

As an added bonus, IRA withdrawal rules allow you to withdraw a maximum of $10,000 penalty-free for qualified first-time homebuyer expenses just five tax years after your initial contribution. You do not have to meet any minimum age requirements to take advantage of this significant benefit of the IRA withdrawal rules.

Related: 6 Ways to Find the Best IRA Companies & Providers

Roth IRA Distribution Rules

Unlike the IRA contribution rules where the two major types of accounts were relatively similar in their contribution limits, their distribution rules are vastly different. As a result of the vast differences in these types of accounts, we often encounter a lot of questions surrounding what the Roth IRA distribution rules really are. We will first take a look at the rules for a traditional IRA so it’s easier to understand the differences.

According to traditional IRA rules, account holders must begin to make required minimum distributions at age 70½ regardless of their financial need or desire to do so. This corresponds with the traditional IRA rules that put a stop to contributions at the same age regardless of income or your continued desire to work.

The Roth IRA distribution rules are significantly different. Just as there was no maximum age limit for making contributions, there is not a minimum age at which you must begin to take distribution payments from your account. Roth IRA distribution rules allow the money to continue to grow in its entirety until you feel the need to make a withdrawal from your account.

The benefit of the Roth IRA distribution rules is that it allows you to pass your retirement savings accounts onto your beneficiaries as a form of inheritance upon your death. This could be especially important to you if you know that you are unlikely to deplete the entire savings account. In fact, no withdrawals at all are required by you to keep your account active if you find them unnecessary.

Roth IRA rules make it so that your beneficiaries won’t pay penalties or taxes on the withdrawal of those funds upon your death either (though they may find that they owe estate taxes on it). They can use the IRA rollover rules in order to put the money into their own retirement savings account or the rules for Roth IRA options often require the distribution to be completed within five years of the date of death.

IRA Rollover Rules

Think that you might be ready to make the switch to a Roth IRA from your traditional IRA or from a 401(k) plan? You’ll want to familiarize yourself with IRA rollover rules to make sure that you’re following all of the IRS standards before you begin.

IRA rollover rules allow individuals with higher incomes to gain “backdoor” access into the tax-free withdrawals that a Roth IRA has to offer. Roth IRA conversion rules allow you to take the money from various other types of retirement savings accounts and put it into this new account with no income restrictions on the rollover.

IRA rollover rules do require you to pay taxes on any other account that is transferred to a Roth IRA. Because a traditional IRA does not tax contributions on the front-end, the IRS is ensured to receive their money when you eventually make withdrawals in the future. Without requiring the rollover to be taxed by IRA rollover rules, it would essentially allow investors to invest and withdraw their money in retirement savings accounts without ever paying taxes.

Because of the way that Roth IRA rollover rules are set up, the best time to perform the switch from other savings accounts to a Roth IRA is when your income bracket is low. You will be paying taxes based on your current income level, so the best time to do this would be when that bracket is as low possible. If you can afford it, Betterment recommends making the switch and maximizing the benefit of these Roth IRA rollover rules when you are:

- Laid off of work or otherwise experiencing a prolonged period of unemployment

- Starting a new business

- Going back to college or graduate school

- Switching to a new but lower-paying profession

Popular Article: How to Open IRA Accounts | Guide to Opening an IRA Account

How to Do a Rollover

It’s clear that the IRA rollover rules make converting to this type of retirement savings account relatively attractive. It is especially helpful when you expect that your future tax rate will be higher than your current one. The rules of a Roth IRA allow you to take tax-free withdrawals in retirement, while a traditional IRA will need to tax you at that higher amount.

IRA Rollover Rules

Once you understand the IRA rollover rules, the rest of the process is relatively simple. It could be as easy as telling your brokerage firm or wealth management company to designate your funds from the old type of retirement savings account into the Roth IRA.

You may want to consider asking them to confirm the Roth IRA rollover rules with you so that you know what sort of tax bill to expect from the exchange.

Similarly, you can also perform a trustee-to-trustee transfer that can come in handy in a variety of circumstances. This method will work when you need to maximize the IRA rollover rules from one firm to another. Alternatively, you can also use it to convert your employer-sponsored account into a Roth IRA upon termination of your current employment, according to the Roth IRA conversion rules.

Reassigning the money from one account to another is relatively simple. Your firm should be able to walk you through the process quickly and efficiently, if they understand the IRA rollover rules as well as you would hope that they do.

It will be critical for you to ask what sort of tax bill you can expect during this exchange. You wouldn’t want to try to take advantage of the Roth IRA conversion rules only to find out that you can’t afford the up-front fees associated with such a change.

Read More: Average Retirement Savings by Age 30, 35, 40, 45, 50, 60, 65

Conclusion

For many consumers, the benefits of tax-free and penalty-free withdrawals in retirement make the Roth IRA an especially attractive option for retirement savings.

However, you first need to know if you qualify for this type of account based on the IRA rules (specifically the Roth IRA rules) set in place by the IRS itself. Eligibility isn’t complicated, but everything that comes next could be if you aren’t prepared.

Have a thorough understanding of the IRA withdrawal rules, the Roth IRA contribution rules, and the IRA rollover rules or rules for Roth IRA conversion before making any major decisions.

Your retirement is an important part of your quickly approaching future. Make sure that you are preparing adequate savings and that the Roth IRA rules are well-suited to your particular lifestyle and income levels.

Image Sources:

- https://hackyourwealth.com/wp-content/uploads/2016/05/ira-vs-roth.jpg

- https://www.irs.gov/retirement-plans/plan-participant-employee/amount-of-roth-ira-contributions-that-you-can-make-for-2020

- https://www.bankrate.com/investing/

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.