Overview of Space Coast Credit Union Review

SCCU online banking (Space Coast Credit Union), is a not-for-profit web company headquartered in Melbourne, FL.

Space Coast Credit Union reviews applaud the site’s diverse services, which include help with mortgages, credit cards, checking and savings accounts, auto loans, business services for small- to medium-sized businesses, and more. SCCU online banking allows its user to make deposits and loans, and it also boasts better rates and lower fees than their competition.

The general purpose of this Space Coast Credit Union review is to provide you with information from a wide array of positive and negative reviews.

Image source: sccu.com

This Space Coast Credit Review will more specifically explore the following aspects of SCCU online banking:

- SCCU online banking financial services

- SCCU online banking member benefits

- Security: SCCU’s member watchdog

- Honest Space Coast Credit Union reviews

- SCCU online banking customer service concerns

See Also: DCU Reviews—What Is DCU? (Auto Loan, Bank, & Mortgage Review)

SCCU Online Banking Financial Services

Space Coast Credit Union online banking offers financial services that are vast, and those can be separated into five distinct categories:

- Savings

- Business services

- Checking and debit

- Loans

- Additional business services

Savings

SCCU online banking allows its customers to open a basic business share savings account that they can access and manage with ease. Opening a savings account ($10 minimum requirement: $5 deposit and $5 membership fee) also establishes you as an official Space Coast online banking member. If you do become an official member, you can access your money with a free Visa ATM/debit card. You’ll also receive free online banking and statements, and earn monthly dividends.

Image Source: Space Coast Credit Union

There is a $300 minimum account balance, and only a $3 service change if you don’t meet that requirement.

SCCU online banking features more convenient reference business rates information online as well.

SCCU online banking also offers money market accounts with higher yields. Some of the features of the money market savings account include the following:

- Deposits insured by NCUA up to $250,000

- Minimum opening deposit: $2,500

- Minimum daily balance: $2,500 to avoid monthly service fee ($12)

- Unlimited ATM and over-the-counter transactions

- Limited to six other monthly transactions (checks, overdraft transfers, phone transfers)

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Business Services

As a potential financial partner to your small- to mid-sized business, SCCU online banking offers plenty of incentives. They strive to respond quickly to inquiries or requests. They also have local decision-makers and loan officers to help you with loan approvals and offer assistance when choosing the right products to benefit your business.

Checking Accounts

SCCU online banking offers five different checking accounts: Business platinum interest checking; free business checking; business interest checking; business advantage checking; and health savings checking.

All five accounts offer a Visa debit card, online and mobile banking, an online bill payer, telephone banking, and ATM transactions in 100+ locations—all of this for free. Consult the following list for more specifics on each type of account:

- Business platinum interest checking account: More free transactions; high-yield earning premium account; no monthly charge with minimum balance.

- Free business checking account: No minimum volume requirement; up to 250 transactions.

- Business interest checking account: No-sweep account; competitive interest rates; no minimum balance requirements; up to 250 transactions.

- Business advantage checking account: Non-interest bearing account; higher transaction allowances; no monthly charge with minimum balance; up to 500 transactions.

- Health savings checking account: Interest bearing; tax-advantaged account for people with high deductible health plans; free transactions; high-yield earning premium account.

Don’t Miss: Credit Union of Texas Review | What You Need to Know (Online Banking, Hours, Reviews)

Loans

Space Coast online banking will also help customers with a myriad of different loan types, including commercial real estate and construction loans, vehicle loans, aircraft/boat loans, and credit card loans.

- Commercial real estate: Low-rate loans for customers who want to buy, refinance, or build.

- Vehicle: Low-rate loans for customers who want to buy or refinance (must be current or new purchase).

- Aircraft/boat: Loans for customers who want to buy or refinance (private or commercial use and any size with proper documentation).

- Credit card: No annual fees; other cards are free; must be in business for two years.

Additional Business Services

In addition to the business services mentioned above, SCCU online banking offers a wide array of other helpful options to improve your business. They speed up the payroll process, giving you direct deposit ability, in-house check printing, tax management, and reporting. Your customers will also be able to pay for your product with credit or debit cards.

Space Coast online banking allows you to deposit checks electronically to your account and take care of a lot of other processes online or through your mobile phone. This makes it easier to inquire about balances, transfer funds, view account information, and make payments.

Source image: sccu.com

Potential customers should also consider Space Coast Credit Union hours of operation before ultimately deciding to do business with them. Review the following SCCU hours:

It’s important to make sure Space Coast Credit Union hours are right for your schedule, and that they won’t cause issues for you or your business.

SCCU’s Member Benefits

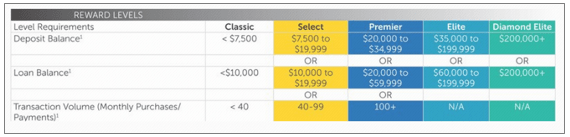

SCCU online banking has a member reward program that offers users benefits like free or discounted services. Essentially, as you invest more with SCCU, they invest more in you, providing the most value to the best customers. Space Coast Credit Union reviews agree that the rewards are appealing.

Rewards are given out annually at the beginning of each year and are based on average deposit balances, total monthly loan balances, and transaction activity.

Image source: sccu.com

Security: SCCU’s Member’s Watchdog

SCCU online banking has a feature called member’s watchdog, which is a program invented to protect customer’s finances. It helps to ensure that no SCCU user gets ripped off or lied to, an extreme positive when it comes to banking.

Of course, people want to feel like their money is safe. Consult the following list for some specific ways that the member’s watchdog program claims to ensure your safety:

- SCCU employs team members that are reputable and enthusiastic.

- SCCU creates transparent policies and straightforward terms.

- SCCU displays uncensored reviews and ratings.

- SCCU safeguards customers during transactions.

Related: Navy Federal Credit Union Reviews | Mortgage, Personal Loan, & Auto Loan

Honest Space Coast Credit Union Reviews

SCCU online banking has a policy of showing uncensored Space Coast Credit Union reviews on their website, which is an interesting tactic to earn potential customers’ trust. Space Coast Credit Union reviews on their website and elsewhere seem, in general, fairly positive and include some of the following from users:

Positive Reviews

- “Have had my personal account with the bank for over 5 years, use direct deposit and deposit by phone, and never had any issues. Financed my two cars with them with a pretty good rate and only took me a call, and it came with a credit card with a decent rate.” —Anonymous

- “I’ve never had any problem with them in the several years I have been a member. I have never been charged a fee or been treated poorly. Their mobile app is also the most accurate I have ever used. They go out of their way anytime I ask for assistance with anything. I have to keep a savings account with $5 in it, but big deal.” —Corrine W., New Smyrna Beach, FL

Negative Reviews

- “I lost my bank card and called to cancel it and receive a new one. I was told it would take 7–10 business days. It is now 19 business days, and I still haven’t received it. I get different answers, depending upon to whom I speak. Not a fan. Living off my credit cards now and have no access to my cash. They offer no suggestions or solutions.” —Mary M., Cocoa Beach, FL

In summation, the Space Coast Credit Union reviews for SCCU online banking are somewhat diverse. There are both positive and negative comments about the banking firm. The main theme of most complaints, however, is customer service.

SCCU Online Banking Customer Service Concerns

Based on Space Coast Credit Union reviews, it seems fair to say that there are legitimate customer service concerns. Bad customer service can definitely be a deal-breaker when it comes to banking, but one can hope that SCCU makes the necessary adjustments within the company. The following are examples of some of the poor Space Coast Credit Union reviews about customer service:

- “From start to finish this credit union is lacking even basic skills when handling customer service calls. No one seems to know their systems or policies or even the basics of setting up an account and informing the customers on general information about their account.” —G.P., Orlando, FL

- “They apparently have a phone system that allows them to add your number so you can never reach your contact again after the initial contact. The rep won’t answer, and the only option is to redial their extension upon which it responds: ‘I don’t recognize that extension’. I’ve tried twice to get another human, and all they do is transfer you to the same extension. Tried to reach rep many times a day for weeks.” —Anonymous

- “Absolutely horrific on so many levels! The employees here don’t know which way is up—nor do they care. No two employees—much less different branches—do the same things twice.” —Mary D., Cocoa FL

Many additional Space Coast Credit Union reviews go on to say that the customer service is so remiss as to not even respond to calls or emails. These kind of reviews are disheartening for potential customers—that such a simple task as communication can be overlooked.

Free Wealth & Finance Software - Get Yours Now ►

Conclusion of Space Coast Credit Union Review

After much research, Space Coast Credit Union online banking appears to have both pros and cons. The program details, benefits, and rewards program that they openly advertise seem appropriate for small- to mid-sized businesses and their banking needs, as well as for individuals.

However, while there are both positive and negative Space Coast Credit Union reviews, and a significant amount of users complain about poor customer service. Consider both the positives and negatives to SCCU:

Positives

- Good general banking/business services

- Loan assistance

- Reward program for loyal users

- Useful mobile app

Negatives

- Poor Space Coast Credit Union reviews

- Questionable customer service

- Unprofessional team members

To conclude, SCCU online banking may be a good choice for you or your business based on features and services, but something like poor customer service is hard to overlook. It is not only frustrating, but it makes it hard to trust them to protect your finances. If you do choose to go with this company, despite negative Space Coast Credit Union reviews, use caution and try to build a good relationship with your SCCU representative.

Popular Article: (PenFed) Pentagon Federal Credit Union Reviews—What You Need to Know! (Mortgage, Loan & Review)

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.