Overview: How to Get the Best 2nd Mortgage Rates & Mortgage Lenders

With the increasingly beneficial aspects associated with a second mortgage, many homeowners have begun to look into second mortgage rates and mortgage lenders to borrow from.

Here, at AdvisoryHQ, we’ve taken note of many of the apprehensions that homeowners have with a second mortgage.

In order to better assist homeowners with the grueling task of dealing with mortgage companies and finding the best second mortgage rates, we’ve compiled this comprehensive second home mortgage guide. Below, we’ll provide homeowners with answers to some of their most asked inquiries regarding a second mortgage, such as:

- What is a second mortgage?

- Am I eligible for a 2nd mortgage?

- How can I get the best 2nd mortgage rates?

- How do I apply for a mortgage?

Regardless of whether you’re a homeowner with vast experience in second home mortgage rates or a homeowner still asking the question, “What is a second mortgage?” this guideline will help bring clarity to all of your reservations regarding a second home mortgage.

With so much varying information available on the Internet in regard to a 2nd mortgage, 2nd mortgage rates, and how to use a second mortgage calculator, it can make any homeowner feel overwhelmed.

Our goal is to take all of that information and simplify it to leave homeowners feeling confident in their decisions regarding a second mortgage.

See Also: Best Mortgage Rates Today | 8 Ways to Get the Best Home Mortgage Interest Rates Info

What Is a Second Mortgage?

Image Source: What is a Second Mortgage

So, what is a second mortgage? A second mortgage is a mortgage that you take out on your home that already has an original mortgage. When you apply for a mortgage, you are taking out a loan to pay for your home; however, with a 2nd mortgage, you are taking out a loan to use a bit differently.

With a second home mortgage, many homeowners look forward to paying off credit card debt, paying for a child’s college tuition, purchasing a new vehicle or using a 2nd mortgage for home improvements and repairs and avoiding paying PMI on their first mortgage.

Using a second mortgage calculator can help you determine whether a second mortgage will help you avoid PMI payments.

Second Home Mortgage

Homeowners that are looking to apply for a mortgage on their already mortgaged home would benefit from knowing the two different types of second mortgage loans.

Two of the most common loans associated with a second home mortgage are a home equity loan and a home equity line of credit loan. With a home equity loan choice for your 2nd mortgage, you will be borrowing money against the equity of your home.

On the other hand, with a home equity line of credit 2nd mortgage loan, you will be provided with a line of credit similar to a credit card that you may use as needed.

Both second mortgage options have their share of pros and cons. With a home equity loan choice for your second mortgage, you’ll know exactly how much money you’ll be borrowing and will generally have a fixed interest rate. On the downside, a home equity loan often locks you in at a certain amount, keeping you from being able to take out more money if needed.

With a home equity line of credit second mortgage loan, you’ll be able to gain a line of credit that you don’t have to use until you’re ready. You can also continue to borrow with this second mortgage option as long as you continue to pay off what you originally borrowed.

The downside to this second home mortgage option is that the 2nd mortgage rates on this loan vary and can be quite higher than with a home equity loan. Keep in mind that second home mortgage rates are usually higher than original mortgage rates.

Don’t Miss: Average Mortgage Interest Rates & Historical Mortgage Rates | Mortgage Rate Chart & Guide

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Second Home Mortgage Rate Factors to Consider

Homeowners should understand that a second home mortgage will always come with second home mortgage rates that are higher than the original mortgage. The reason behind the higher 2nd mortgage rates is that if you default on your payments, your original mortgage lender will be reimbursed first. With a 2nd mortgage, the second mortgage lender will only be repaid from the remaining balance.

Despite high second home mortgage rates, finding the best second mortgage rates is still possible. Below, you’ll find some of the main factors that will affect your 2nd mortgage rates and what you can do for each one.

Market Conditions

If you are looking to take out a second home mortgage, then you better hope that the market is on your side. Second mortgage rates are dependent on the home market, so when the market is booming, you can expect high 2nd mortgage rates. However, if the market is headed down, your second home mortgage rates will also go down.

Plan accordingly with the market in order to get the best 2nd mortgage rates.

Mortgage Lenders

When taking out a second mortgage, the mortgage lenders and mortgage companies that you go with will affect your 2nd mortgage rates.

Different mortgage companies will have varying policies on their second mortgage rates. It is greatly advised for homeowners to look into many mortgage lenders to get the best second home mortgage rates.

Getting quotes from various mortgage lenders will give you a better idea on the best 2nd mortgage rates that you can get.

Your Credit History

As with your original home loan, your credit score will come into play. Homeowners often overlook their credit history when looking into a second mortgage. If you have a healthy credit history, then you will have more leeway to negotiate with your mortgage lenders on second mortgage rates.

However, if your credit history is not so great at the moment, then looking into improving it will help you get the best 2nd mortgage rates. Otherwise, you’ll be stuck with incredibly high second home mortgage rates.

Promotions & Special Offers

Oftentimes, in order to compete with other mortgage companies, lenders will offer homeowners special offers or promotions on their 2nd mortgage rates.

You may be offered low rates for the first year by mortgage lenders that are looking to win you over. Or they may offer you 2nd mortgage rates that are a few points lower than the usual rate.

If you find that some of the promotions offered by mortgage companies is what you are looking for, then this is a great way to find some amazing deals on a second home mortgage.

Related: Mortgage Rate Trends & Forecast | What You Need to Know about Mortgage Interest Rate Trends

Fixed & Variable Second Home Mortgage Rates

Another huge factor in the kinds of second mortgage rates homeowners will have available to them is the structure of their loans. If a second mortgage is structured properly, then you can look forward to low second mortgage rates.

Every type of loan comes with specific 2nd mortgage rates that are unique to that loan. A fixed rate mortgage is going to be quite different than an adjustable rate mortgage. Keeping these differences in mind will help when it comes down to deciding on the right second mortgage loan for you.

2nd Mortgage Types

When it comes to varying second mortgage rates, there are two main kinds that will affect the second mortgage.

2nd Mortgage Rates: Fixed Rates

Second mortgage rates that are fixed are associated with a home equity loan. Home equity loans usually have a low, fixed interest rate.

To figure out how much you could take out in a home equity loan, simply subtract the money you owe on your original mortgage from your property’s value.

Image Source: Home Equity

After determining your home equity, you typically take up to 80% of that in a second home mortgage.

These types of second mortgage loans are great for people looking for a low interest rate whose monthly payments will stay the same until you pay off your 2nd mortgage.

2nd Mortgage Rates: Varying Rates

A home equity line of credit loan offers homeowners varying second mortgage rates. This can be both a positive or negative outcome in terms of how high your second mortgage rates will be.

Homeowners will take note that the varying 2nd mortgage rates on line of credit loans is greatly based and affected by the changeability of the home market.

Fixed Rates vs. Varying Rates: Which Has the Best Second Home Mortgage Rates?

Deciding on the right second mortgage depends on your own financial situation. Both fixed and varying second mortgage rates can give homeowners low interest rates depending on their second mortgage loan factors.

Image Source: Mortgage vs Home Equity

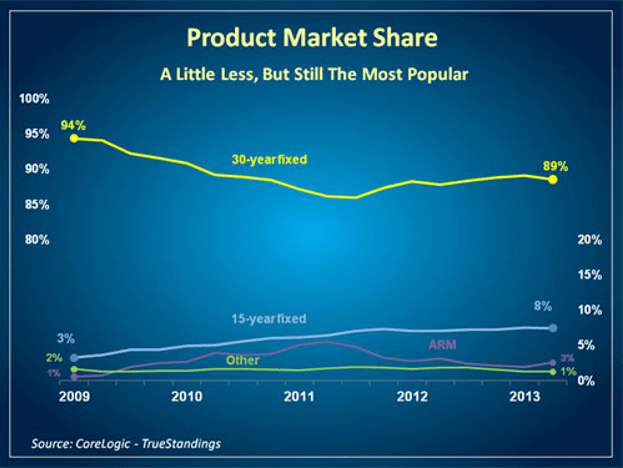

In the United States alone, nearly 90% of all loans are fixed rate loans. One of the benefits of taking out a fixed rate loan for your second home mortgage is the stability of the loan. With a fixed rate second mortgage, your 2nd mortgage rates will remain the same from the time you agree to the loan.

Looking out for the best 2nd mortgage rates from mortgage lenders for a fixed loan is highly important since the rate can never be changed after you sign your papers. With a second mortgage with a fixed rate, shopping for the lowest offer is imperative.

Unlike fixed rate loans, a varying loan can change its second mortgage rates at any time. You may be able to find low second mortgage rates with a varying loan, but you will want to pay off the loan quickly in order to avoid the second mortgage rates from highly increasing on you.

Since you only have to take out as much money as you need with a varying second mortgage loan, you can actually wind up saving on interest in the long run.

Deciding on the second home mortgage that you need should eventually come down to what you require the extra loan money for. If you know exactly how much money you want to take out, then a fixed loan will give you the best second mortgage rates.

However, if you’re working on a remodeling project without a definite end cost, then a varying second home mortgage may be the best one for you in terms of low rates.

Popular Article: Getting an Interest-Only Mortgage This Year? What You Need to Know

Choosing the Right Mortgage Lenders & Mortgage Companies for Your 2nd Mortgage

When it comes time to apply for a mortgage, choosing the right mortgage lenders can make a huge difference in your second home mortgage rates.

One option that many homeowners may not be aware of is looking to get a second home mortgage from their original mortgage lenders. Going with your original mortgage lenders can help you get better rates. If you have continuously paid your original mortgage on time, then your original mortgage lenders may give you great 2nd mortgage rates that are lower than fellow competitors.

However, you do not have to feel obligated to stick with your original mortgage lenders for your second mortgage. Shopping around for different second mortgage rates is your best bet to compare the different rates available to you.

There are several top mortgage lenders that you may want to look into when you apply for a mortgage. Some of the top mortgage lenders for a second mortgage are HFC/Beneficial, Lending Tree, E-Loan, and Wells Fargo Financial. These banks offer homeowners competitive second mortgage rates.

Free Wealth & Finance Software - Get Yours Now ►

Conclusion: How to Get the Best 2nd Mortgage Rates & Mortgage Lenders

For homeowners looking to take out a 2nd mortgage, there are many factors to consider for receiving the best 2nd mortgage rates. The current housing market, a homeowner’s credit score, and the structure of the second mortgage loan all affect second mortgage rates. Homeowners that keep these factors in mind before they apply for a mortgage will likely find some very low 2nd mortgage rate offers.

Choosing the right second mortgage loan for your situation involves using a second mortgage calculator to possibly avoid PMI payments and to take your financial situation into account.

Fixed or varying rate second mortgage loans are two of the main options made available to homeowners. While interest rates are usually higher on a second mortgage, it is possible to receive low second mortgage rates for your loan.

Whether you choose to go with your original mortgage lenders or new mortgage companies, it pays to shop around to find the best 2nd mortgage rates available.

Doing your own research will provide you with competitive second home mortgage rates that will help you in terms of paying off your second mortgage for the least amount of interest.

Read More: Home Equity Line of Credit Rates Comparison | How to Find the Best HELOC Interest Rates

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.