Summary: Best Mortgage Rates Today | 8 Tips to Finding the Best Home Mortgage Interest Rates Information

Purchasing your own home can be a great long-term investment, but not if you are overpaying in interest.

Home interest rates today are still relatively low, making it a great climate for locking in low monthly payments on the home of your dreams.

While the mortgage rates today may not be the same as the rates that preview tomorrow or even next month, it’s expected that we will continue to see low mortgage interest rates as we continue throughout into next year.

Do you know how to take advantage of those low home mortgage rates?

Image Source: Finding the Best Mortgage Rates

For anyone who has been wondering what they need to do to find the best mortgage rates, look no further. AdvisoryHQ has crafted this list of tips and places to help you take advantage of great mortgage rates today.

What do you need to know about today’s mortgage interest rates? Everything you need to know is in these quick and easy tips to help you get the best home interest rates today.

If you are on the path to homeownership and need a little bit of guidance to make sure you get today’s mortgage interest rates at the lowest possible number, keep reading as we tell you all of the essential information.

See Also: AmeriSave Reviews—What You Need to Know Before Using AmeriSave Mortgage

Fine Tune Your Credit Score

Mortgage rates today are highly dependent on your personal FICO credit score, and it’s usually for good reason. A high credit score indicates that you are more trustworthy to repay your loan over the course of the next fifteen to thirty years.

Understanding where your credit score is and how you can best improve that number may not give you the most impressive mortgage rates today, but it will help for the future.

You should already be checking your credit report at least annually. Your credit score is slightly different, but various versions of your credit score are available for free through sites like Credit Karma. It isn’t likely to be the same FICO score that banks are going to be looking at, but they may be able to offer free advice to improve that number, which can help you to get the best mortgage rates.

According to My FICO, home interest rates today are the lowest for individuals who have credit scores higher than 760. For information regarding how the home mortgage rates increase, take a look at the sample of credit scores and figures in our table below:

FICO Credit Score | Sample APR for Today’s Mortgage Rate |

760–850 | 3.118% |

700–759 | 3.34% |

680–699 | 3.517% |

660–679 | 3.731% |

640–659 | 4.161% |

620–639 | 4.707% |

Don’t Miss: Bank of America Mortgage Reviews—Get All the Facts (Loan Help, Mortgage Payoff, Foreclosure…)

Save More Money on Your Down Payment

In one study, it was shown that an increase in home loan rates today by just 1.5 percent could cost nearly $100,000 over the span of a 30-year fixed-rate home mortgage of $300,000. That difference in home mortgage rates today could be the difference between a great credit score and a poor one, as evidenced in the table above.

Most experts would concede that a larger down payment leads to lower home interest rates today. Saving up money for your down payment can already be an excruciatingly painful and slow process for some individuals and families. However, if the mortgage rates today aren’t the best mortgage rates you could get, you may want to consider putting down additional money upfront.

Low down payments can lead to additional fees such as private mortgage insurance (PMI) as well as rates that tend toward the higher end of today’s mortgage rates. Your monthly payments as a whole could be more than you would anticipate when you opt for the minimum possible down payment accepted by your lender.

You could get away with paying as little as five percent in a down payment through some lenders. However, experts would recommend that you put down at least twenty percent if you are able to. Obtaining the best mortgage rates can sometimes be as simple as increasing the amount of cash you bring to the table for your mortgage. If you have the ability to scrape a little bit more money out of your savings account, it is worth asking your lender if they would be able to offer lower home interest rates today in exchange.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Know What Programs You Qualify For

With all of the various mortgage products on the market today apart from conventional or traditional fixed-rate mortgages, you may find that today’s mortgage rates would be lower for you on one of these products. Do you know what you qualify for?

Be sure to discuss the possibility of an FHA loan, VA loan, or a USDA loan with your potential lender and compare the home loan rates today. You may find that the more lenient lending rules surrounding these particular programs (including low to no down payments) will give you the lowest home mortgage rates today.

Even if you didn’t qualify for a conventional mortgage, you may get the best mortgage rates through one of these other types of products.

First-time home buyers should definitely do a little bit of research regarding whether or not they would qualify for these programs that could have low home mortgage rates. Some of the finer details of eligibility for these programs depends on each individual lender and on the location of the home, but you should have a general knowledge of what programs you can consider.

Credit scores are generally required to be around 620 or higher in order to qualify for these types of programs. Just as with conventional products, the higher your credit score is, the more likely it will be for you to find low versions of today’s mortgage rate.

You may have more flexibility with lower credit scores with these type of programs, but keep in mind that it may come with some of the higher rates seen on home mortgage rates today.

Related: Caliber Home Loans Reviews – What You Need to Know Before Using Caliber

Paying for Points

Consider how long you intend to live in the house you’re attempting to purchase. If you’re planning on residing there through most of the duration of the loan, it may be worth purchasing points to lower today’s mortgage interest rates. The policy on how this works may vary slightly from lender to lender, if they allow you to pay for points.

A point, in terms of your today’s mortgage rate, is a fee that you pay prior to closing to help reduce today’s mortgage interest rates. Usually this fee equates to one percent of your mortgage amount ($1,000 per each $100,000 on your loan). In exchange for this sometimes handsome sum of money, you can get the best mortgage rates around by lowering it a specified amount. Each point reduces today’s mortgage rates, usually by increments of 0.125 percent.

Be sure to take a look at a loan calculator (such as this one from Bankrate) to determine if the interest difference would be worth it in the long run. See how much money you would save by capitalizing on low home loan rates today and then weigh it against how long you intend to live in the home. It may not be worth the initial investment, even if it does get you the best mortgage rates, if you aren’t going to live in the house long-term.

Even if you plan to live in the house for the duration of the loan, it may not be the best idea to pay for points. Refinancing your home in the near future before the cost savings would negate receiving lower home interest rates today by paying for points.

You should have a clear vision in mind of what your mortgage will look like over the course of the years ahead before deciding if paying for points to get lower mortgage interest rates is a worthwhile investment for you.

Popular Article: Carrington Mortgage Reviews—All You Need to Know (Mortgage Services Reviews)

Shop Around for the Best Mortgage Rates

Don’t just settle for the very first place you find that offers you halfway decent mortgage interest rates. By comparing the various terms and conditions of mortgages through the different lenders available to you, you can be sure that you are seeing the home interest rates today at their lowest points.

Many people are afraid to apply at multiple lenders for fear of decreasing their credit score and thus receiving higher mortgage rates today. Not everyone realizes that the credit bureaus can often group those inquiries into one lump sum.

They recognize that you are shopping around for the best mortgage rates, and they give you a period of time for “window shopping” for today’s mortgage rates.

You generally have between 14 and 45 days to consider additional lenders and see what home mortgage rates today you could be granted.

Utilize Online Tools for Low Mortgage Interest Rates

Without even applying, you can use some tools on the Internet to determine what today’s mortgage interest rates look like in your area.

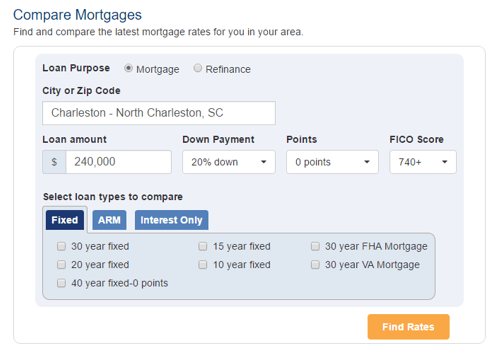

Bankrate features a loan comparison tool to help you find the best mortgage rates based on your loan amount, down payment percentage, points, and credit score, as well as your zip code.

You can view the home mortgage rates for most options, but you won’t be able to view jumbo mortgage rates through this tool.

Image Source: Bankrate.com

Brokers like Lending Tree can also help to find the best of today’s mortgage rates by pairing you up with multiple lenders that match your application and information.

You can take a look at today’s mortgage rates and the various terms and conditions that each lender is willing to offer you. You can view fixed-rate, adjustable-rate, and jumbo mortgage rates all in one convenient location.

Keep in mind that jumbo mortgage rates can vary more significantly than the home mortgage rates from conventional mortgage products. These aren’t as affected by mortgage news because they lack the standardization of eligibility and mortgage interest rates set out by the federal government, including entities such as Fannie Mae and Freddie Mac.

Consider Online Lenders

While some people can’t fathom the idea of going somewhere other than a large, well-known financial institution, you may want to consider some of the up-and-coming online lenders. Mortgage rates today are often lowest through these online lenders because they don’t have the overhead to maintain that is associated with brick-and-mortar locations.

The most significant disadvantage of an online lender is that an online mortgage lender doesn’t give you the ability to meet with a representative face-to-face.

- Best Rated Top Online Mortgage Lenders | Ranking & Reviews

- Best Mortgage Lenders for First-Time Buyers | Ranking

- Best Subprime Mortgage Lenders in America

- Top Rated Best Banks to Get a Mortgage from | Ranking of Best Banks for Home Loans

- The Top Mortgage Lenders in America | Reviews of the Best & Largest Mortgage Lenders

- Top Mortgage Loan Originators | Ranking | Top Loan Origination Companies

However, the benefits far outweigh this: you save time and money by avoiding in-person meetings, you can find the best mortgage rates today, and the lowest closing costs. You may even find that you can qualify for a mortgage through an online lender when you were unable to do so with a traditional bank.

You should consider checking mortgage rates today through some of these top online mortgage lenders. Today’s mortgage rate should be easy to find through these companies:

- AmeriSave

- Guaranteed Rate

- Sebonic Financial

- Quicken Loans

You can check for the best mortgage rates quickly and easily without ever having to leave your current home. Mortgage rates today can be found with ease, perhaps even without contacting or speaking with a live representative.

For those who prefer not to discuss home mortgage rates or mortgage news with a representative, one of these top online mortgage lenders may be your favorite choice to find the best mortgage rates.

Check with Credit Unions

If an online mortgage lender isn’t for you, you probably want to consider checking with your local credit unions. Credit unions do have one major advantage over online mortgage lenders by giving you an actual physical location that you can frequent if you have questions or concerns regarding home interest rates today.

You’ll often find today’s mortgage interest rates are lower at credit unions because they are not-for-profit lending institutions instead of other financial institutions that utilize the mortgage rates today in order to make a larger profit. On your list of potential lenders, you should prioritize the credit unions that are close by your home or your potential new home before you consider other lenders.

Read More: Freedom Mortgage Reviews—Get All the Facts! (Customer Service, Complaints & Review)

Free Wealth & Finance Software - Get Yours Now ►

Conclusion

Searching for mortgage rates today can be intimidating. After all, even a slight increase in the home interest rates today can lead to a hefty increase in the amount of money that you will pay out of the long-term length of your loan. For mortgages you expect to have for the duration of thirty years, finding the best mortgage rates is imperative, so you can keep your money out of a lender’s pocket.

The current trend in mortgage news regarding today’s mortgage rates is that they are planning on staying low. However, experts are beginning to make predictions that home interest rates today could start to slowly tick upward. Professionals like CNBC are predicting that home interest rates today will increase during the fall.

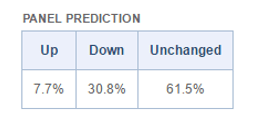

In another study from Bankrate, their mortgage news determined that today’s mortgage rates may not be moving all that much. Less than 10 percent of those surveyed believed they would increase, and 61.5 percent believed they would remain relatively the same (within two basis points).

Image Source: Bankrate Mortgage Rate Trends

With the uncertainty over where mortgage news leads us to believe that today’s mortgage rates are headed, you should start searching for the best mortgage rates now. Following these tips and tricks for hunting down home loan rates today can help you to secure the best mortgage rates without worrying about whether they will increase in the future.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.