2017 RANKING & REVIEWS

TOP RANKING BEST MORTGAGE RATES

The Importance of a Mortgage Comparison

Everyone knows that your mortgage is likely to be the longest running debt that you will ever incur for a single purchase.

With a longer term than most minor forms of debt, such as auto loans, your interest rates can really rack up if you don’t take the time to compare mortgages before you sign on the dotted line.

New research from the United States Bureau of Labor Statistics shows that consumers are spending upward of 8% of their income on their mortgage.

Of course, this price tag includes more than just their house payment: it also features their interest rates, insurance, taxes, and the cost of home maintenance.

Award Emblem: Top 6 Sites to Get Best Mortgage Rates Today

Taking the time to find the best mortgage rates before you commit to a long-term loan is key to saving money. Conducting a mortgage comparison regularly before you purchase your home is critical because today’s mortgage rates are constantly changing.

You need to know where to go to find the lowest 10-year mortgage rates or 30-year mortgage rates – or anything in between.

Here at AdvisoryHQ, we understand that you want to be able to compare mortgages and find the absolute lowest mortgage rates for your pending loan.

To help you make a wise decision that can have a positive impact on your finances, we compiled a list of the top six websites to help you locate the best mortgage rates. Your mortgage comparison can start with these websites right here to help you save money on your monthly bills.

See Also: Top Credit Cards for Students with No Credit or Bad, Poor or No Credit History

AdvisoryHQ’s List of the Top 6 Best Mortgage Rates

List is sorted alphabetically (click any of the mortgage websites below to go directly to the detailed review section for that mortgage comparison):

Top 6 Best Mortgage Rates | Brief Comparison & Ranking

Websites to Compare Mortgages | Services | Highlights |

| Amerisave |

|

|

| Bankrate |

|

|

| LendingTree |

|

|

| Nerdwallet |

|

|

| Realtor.com |

|

|

| Zillow |

|

|

Table: Top 6 Best Sites for Mortgage Comparison | Above list is sorted alphabetically

Why Do Today’s Mortgage Rates Change?

If you’re set on finding the best mortgage rates, you have to be prepared to constantly compare mortgages due to regular fluctuations in the market. Today’s mortgage rates may not be the same tomorrow, next month, or next year. Before you sign at the closing of your home, you’ll need to evaluate the current rates in a thorough mortgage comparison.

First, the type of loan that you choose to go with will partly determine the best mortgage rates that you’re entitled to. During your mortgage comparison, you will want to consider the advantages and disadvantages of the various loan types.

You will often find that the 15-year fixed mortgage rates or 20-year mortgage rates will be lower because they feature a shorter loan term.

Image Source: Sites to Get Best Mortgage Rates

Second, different factors within the economy can have a serious impact on the available best mortgage rates at any given time. Lenders take a look at market indicators to decide how the rates should be adjusted depending on factors that are outside of the control of consumers. Some of these variables include:

- Global events including natural disasters or wars

- Economic growth or slowdown

- Inflation

- Housing market conditions

- Bond market

Consumers can do little to affect change when it comes to the best mortgage rates at any given time. In fact, the only option they have is to wait it out until rates come down if they feel it is too high to justify purchasing a home.

Keep in mind that taking the time to complete a thorough mortgage comparison is critical to getting the best mortgage rates.

While the best mortgage rates may be similar across the board for different lenders, each financial institution has the right to set their own interest rates. Therefore, you may find that one lender has a significantly lower rate or more favorable terms to their loan than another.

While your mortgage or refinance mortgage rates are an important piece of the puzzle when it comes to buying a home, they aren’t the final thing you should consider. Some loans will have more favorable terms such as a lower down payment or no private mortgage insurance (PMI). The savings that these terms represent should be factored into your decision when you compare mortgages.

Creating the most accurate mortgage comparison is an important step toward making a wise financial investment in your next home. Understand where the best mortgage rates come from and how to get the best deal on your house to avoid overpaying over the course of your loan term.

Don’t Miss: The Best FD Interest Rates | Guide | How to Find the Best Fixed-Term Deposit Rates

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Best Mortgage Rates

Below, please find the detailed review of each website on our list of sites to compare mortgages. We have highlighted some of the factors that allowed these mortgage comparison sites to score so highly in our selection ranking.

Amerisave Review

Amerisave is a well-known lender that offers potential homeowners a variety of the best mortgage rates to choose from. Because Amerisave offers so many different choices, including some of the federal loan programs, it is an ideal first choice to perform a mortgage comparison and see today’s mortgage rates.

Consumers who are interested in Amerisave should note that they are recognized by other major players within the homeownership industry. LendingTree named them one of the top ten providers for customer service early in 2016. They also boast a 5-star review from Zillow and are an approved lender for Fannie Mae.

You’ll find the answers to frequently asked questions during a mortgage comparison and have access to a well fleshed-out education center.

Mortgage Comparison

From the very first page, you can catch a quick glimpse of what their best mortgage rates will look like on an example property. This snapshot allows you to compare mortgages based on several categories:

- 30-year fixed mortgage rates

- 15-year fixed mortgage rates

- Adjustable rate mortgages from 3 to 7 years

- FHA loan rates

- VA loan rates

- USDA loan rates

Once you can compare mortgages using these general categories and examples, you can apply to receive personalized rates for a new mortgage or refinance mortgage rates. It takes less than one minute to fill out the loan amount, property value, and other dropdown boxes to receive the best mortgage rates.

Bankrate Review

Consumers have found a lot to love about the calculators and financial services offered through Bankrate. Now, you can conduct a thorough mortgage comparison, particularly of today’s mortgage rates, using their service as well. The Bankrate mortgage rates will show you several financial institutions that you may not have considered yet.

Bankrate is a trusted source for many consumers when it comes to staying abreast of current financial information. Their website features a section for top stories (many of which pertain to the housing market). You can also search for calculators that estimate your mortgage payment, show you a full amortization schedule, and more information that could be useful during your mortgage comparison.

Mortgage Comparison

Finding the best mortgage rates or refinance mortgage rates through Bankrate is relatively simple. You can walk yourself through the process of entering key information regarding the property you are looking to refinance or purchase to receive the most up-to-date Bankrate mortgage rates.

You’ll be asked questions about your loan amount, expected down payment, and the type of mortgage you are considering. Unlike Amerisave, you will not be able to compare mortgages side-by-side. The Bankrate mortgage rates do allow you to view uncommon categories such as the 10-year mortgage rates and 20-year mortgage rates on a fixed-rate loan.

One of the features that makes Bankrate ideal when it comes to creating a mortgage comparison is the level of detail provided. It not only allows you to view the best mortgage rates, but it also demonstrates what you can expect your monthly payment to look like. Each of the Bankrate mortgage rates shows you any additional fees and points you have to purchase to obtain the best mortgage rates from that lender.

Related: Wells Fargo Mortgage Rates vs Chase Mortgage Rates | Which Bank Really Has the Best Rates?

LendingTree Review

Unlike many of the traditional mortgage lending sites, LendingTree allows consumers to do a thorough mortgage comparison. Functioning as a broker that coordinates and suggests various loan products, LendingTree can assist in covering almost every type of mortgage loan from 10-year mortgage rates on a fixed-rate product to FHA loans backed by the federal government.

This website has helped to set up more than 55 million loan requests across any number of financing categories. From mortgages and refinances to personal loans to student loans, LendingTree has sources to help facilitate your loans wherever you need them most. Your application helps them to determine which lenders and products would be a good match for you.

Mortgage Comparison

Completing the initial intake form takes only a few minutes and can present you with valuable information regarding the best mortgage rates. They can help you to compare mortgages on many different types of properties, as well as the various loan products.

Consider the fact that you may find the best mortgage rates to differ on properties such as:

- Single family homes

- Townhomes

- Condos

- Multi-family homes

- Manufactured or mobile homes

They also ask questions to determine whether you would qualify for specific types of loan products, such as VA loans. These qualifying questions are ideal for consumers who are just beginning to compare mortgages and may not fully understand what they will qualify for.

Unfortunately, one of the major disadvantages of the LendingTree mortgage comparison is that you must enter all of your personal information in order to receive the best mortgage rates. This includes your current address, phone number, and email address, required in order to make an account for security purposes. By entering your phone number, you are agreeing that you give consent for LendingTree to contact you via phone.

NerdWallet Review

NerdWallet is great for consumers who are interested not just in today’s mortgage rates but in the overall trends that are seen in today’s housing market. This website has long been trusted to provide high-quality financial advice to consumers from finance calculators to basic personal finance information. Using their mortgage comparison calculator is just another of the many services they offer to help consumers make informed financial decisions.

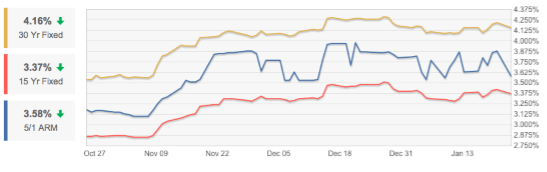

When you head to their mortgage comparison page, NerdWallet shows plenty of valuable information that you’ll want to see while you compare mortgages. They can show you the average rates for 30-year fixed mortgage rates, 15-year fixed mortgage rates, and 5/1 adjustable rate mortgages. The changes are demonstrated across both a single day and over the course of one year.

Image Source: NerdWallet

Mortgage Comparison

When you’re planning to purchase a new home, NerdWallet has one of the most thorough questionnaires on any mortgage comparison website. It will request your annual income and monthly debts, the type of property you intend to purchase, and other qualifying questions for specific loan types. You can view the best mortgage rates on the most popular types of loans:

- 10-year mortgage rates

- 15-year mortgage rates

- 20-year mortgage rates

- 30-year mortgage rates

- Adjustable rate mortgages

The other major benefit to using NerdWallet to compare mortgages is the ability to view each lender’s reviews straight from the results page. Simply because a lender can offer the best mortgage rates doesn’t necessarily mean that they offer the best customer service. By viewing consumer reviews simultaneously, you can ensure that you will receive top-notch service in addition to the best mortgage rates.

Popular Article: Low Interest Personal Loans | Guide | How to Get Personal Loans with Low Interest Rates

Realtor.com Review

Realtor.com allows consumers to take care of all their home buying needs from one convenient location. You can browse through potential property listings as well as find the best mortgage rates all from their main website. You can even view the mortgage trends for a particular area to make sure that you’re buying at the best possible time.

If you’re interested in finding the best mortgage rates, it can be a good idea to look at the overall trend for the home market in your area. Realtor.com makes it easy to compare mortgages and their rates using an interactive graph. You can select the timespan and up to three different loan types to view what their rates have done in the recent past.

Image Source: Realtor.com

Mortgage Comparison

When you use the mortgage comparison tool at Realtor.com, you are given plenty of choices among top financial institutions and lenders. All you need to do is enter your projected mortgage information to find the best mortgage rates or refinance mortgage rates. You’ll need the purchase price of the home as well as the percentage you intend to pay as the down payment.

From here, you can compare mortgages among many of the most popular types:

- FHA mortgage rates

- VA mortgage rates

- Adjustable rate mortgages

- 10-year mortgage rates

- 15-year mortgage rates

- 20-year mortgage rates

- 30-year mortgage rates

In our own example search, we found that more than 100 lenders were able to provide a quote for the best mortgage rates. You can even view what the potential rates would be if you paid for points or any additional fees included in the mortgage. One of the best features of the Realtor.com mortgage comparison is their placement of the monthly payments alongside the best mortgage rates for each lender and type of loan.

Zillow Review

Zillow has become a hub for potential homeowners in recent years with their detailed photo listings of properties currently for sale. However, homeowners are now using Zillow to access much more than just home listings. This website now features great information regarding potential lenders, mortgage calculators, and a mortgage comparison of different rates.

They also track what is going on with today’s mortgage rates according to the national trends they see. From the results page, you can compare mortgages and the way their rates have changed over the past three months based on three different criteria:

- 30-year mortgage rates

- 15-year mortgage rates

- 5/1 adjustable mortgage rates

Mortgage Comparison

The ability to compare mortgages through Zillow’s calculator is relatively simple. All you’ll need is the zip code of your new home, the purchase price, estimated down payment, and a range for your credit score. With a few additional clicks, you can also select more detailed options to get the best mortgage rates for your specific purchase:

- Annual income

- Monthly debts

- Property types

- First-time home buyer

Similar to NerdWallet, you can also view the reviews of each potential lender directly from the results screen when you compare mortgages. You can ensure that you receive both the best mortgage rates and the best customer service all in one place with this additional feature.

One of the best features of the Zillow mortgage comparison tool is the ability to find the best mortgage rates anonymously. While some of the websites included on our ranking require you to enter all of your sensitive personal information, Zillow allows you to complete their rate request form with nothing more than information on your home.

Read More: Cheapest & Lowest Mortgage Rates | Guide | How to Get Low, Cheap Home Mortgage Rates

Conclusion—Top 6 Best Mortgage Rates

Purchasing a new home can fill potential buyers with trepidation at the idea of having to find the best mortgage rates. After all, overpaying when it comes to today’s mortgage rates can cost you thousands of dollars over the lifetime of your loan. The longer your loan term is, the more likely it will become that you will be paying way too much in interest if you don’t qualify for the best mortgage rates.

Consider using some of these websites in order to create a comprehensive mortgage comparison among countless lenders. Each financial institution is likely to offer its own set of rates that should roughly correspond to those you see as a national average. However, certain programs are more likely to offer different terms and varying rates when you start to compare mortgages in greater detail.

You should first evaluate what type of mortgage will be the best suited for your living situation. While the 30-year fixed mortgage rates might be the easiest to find, you should consider whether the terms and advantages of other loan programs will weigh heavier in your favor.

Decide which features are the most important for you and your family in a potential mortgage. Using these mortgage comparison tools should make it simple to find the loan program that will work best for your entire family.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.