Comparison Review: TD Ameritrade IRA vs. Fidelity IRA vs. Vanguard IRA Accounts

Opening an individual retirement account (IRA) is a fairly easy process thanks to the Internet and online brokers who make the application and setup process simple and streamlines.

But with so many IRA options available, like the Vanguard or Fidelity Roth IRA, it is easy to be left wondering which broker to open an account with.

Although most brokers, at first glance, seem similar in what they offer, their fee structures, types of IRAs and investment options can actually be quite different. Vanguard, for example, has the Vanguard SEP IRA specifically for small-business owners.

So, should you choose a Fidelity or Vanguard IRA? What are the differences between the Fidelity vs. TD Ameritrade Roth IRA account? In this article, we will point out the main differences between the IRA options of each broker so you can decide, based on your needs, what broker to choose for your IRA: TD Ameritrade, Vanguard or Fidelity IRA?

Why Open an IRA?

A Fidelity or Vanguard IRA is the perfect investment for those looking to save money for retirement and are either not employed by a 401(k)-participating employer or want extra savings in addition to their 401(k).

The Fidelity Roth IRA, Vanguard Roth IRA and TD Ameritrade Roth IRA are some of the most popular options for prospective investors because they allow your contributions to grow tax-free, and you are not subject to taxes when you withdraw your money upon retirement.

Source: Melrose CU

Before you consider which IRA—TD Ameritrade vs. Fidelity IRA account—is the best option for you, make sure you understand the type of IRA you want.

With a traditional IRA, you pay taxes on your withdrawal when you retire, but your contributions are tax-deductible.

A Roth IRA requires you to pay taxes on your initial contribution, but your withdrawals are usually tax-free. Keep your chosen IRA type in mind when you compare the TD Ameritrade vs. Vanguard vs. Fidelity IRA.

See Also: Ways You Can Retire Early (Detailed Early Retirement Planning Guide)

The Leading Brokers: Vanguard, Fidelity, and TD Ameritrade

Whether you choose TD Ameritrade, Fidelity or Vanguard IRA, it is clear that these companies are leading brokers for a variety of investment options.

TD Ameritrade reviews praise the broker for its wide range of investment options, research and educational tools and helpful customer service. When comparing a TD Ameritrade vs. Fidelity IRA account or other IRAs, reviews also praise TD Ameritrade for its low fees and powerful trading tools.

TD Ameritrade stands up to the comparable Vanguard or Fidelity Roth IRA and their respective broker companies. Vanguard is known for its index funds after its founder created the index fund in 1975. Vanguard IRA funds are some of the most popular in the industry because of low Vanguard Roth IRA fees and unique types of IRAs, like the Vanguard SEP IRA for small-business owners.

Source: The Motley Fool

Fidelity IRA and Fidelity Roth IRAfees stack up well against TD Ameritrade and Vanguard IRA fees, and Fidelity is most known specifically for its IRAs, although it has a wide range of other investment options.

Fidelity IRA reviews state that its trading platform is easy to use and offers comprehensive tools for your trading activities.

As online brokers, Fidelity, Vanguard, and TD Ameritrade are comparable. However, Vanguard vs. Fidelity vs. TD Ameritrade Roth IRA account and their other IRA options have important differences that could help you choose one broker over the other.

Don’t Miss: Retirement Planning | Complete Guide to Help You Plan for Retirement

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Vanguard vs. TD Ameritrade vs. Fidelity IRA Account

When comparing the IRA options from different brokers like Fidelity Roth IRA and Vanguard SEP IRA, it is important to understand your individual retirement needs. Not every IRA or broker will be right for you, so ensure that you have retirement goals and a retirement plan in place first.

Then, you can begin to compare the differences between the TD Ameritrade or Vanguard Roth IRA minimum deposits or Fidelity and Vanguard Roth IRA fees. The most important points to consider when comparing brokers are:

- Types of IRAs offered by the brokers

- Account setup and maintenance fees

- Minimum deposits required by each broker

- Special promotions and rewards offered by the broker

- TD Ameritrade, Vanguard, or Fidelity Roth IRA investment options

Take each one of these factors into consideration, basing them on your individual needs. Vanguard IRA fees differ from TD Ameritrade IRA fees, for example. Vanguard Roth IRA fees are waived if you apply for electronic versus paper statements. If fees are not an important factor in your decision, consider what is and compare your options to help you meet your retirement goals.

Types of IRAs Offered

Fidelity offers two types of Fidelity IRAs: traditional Fidelity IRA and Fidelity Roth IRA. These are the two most common types of IRAs and the basic options most brokers offer. The Fidelity traditional IRA allows for tax-deductible contributions and penalty-free withdrawals for certain significant life events, like buying a home.

The Fidelity Roth IRA allows for tax-free withdrawals, and there is no age limit to open the account. Your Federal Roth IRA also allows for tax-free earning growth. The Fidelity vs. TD Ameritrade Roth IRA accounts are very similar in what they offer. TD Ameritrade also offers a traditional IRA account.

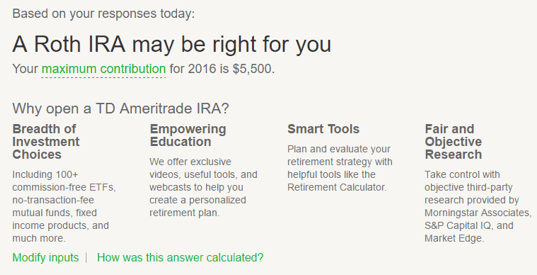

Source: TD Ameritrade

If you are unsure whether you want a traditional or Roth IRA, TD Ameritrade helps you decide with its IRA selection tool.

After answering a few questions about yourself and your income, the selection tool will tell you which type of account will work best for you. Then, you can better compare Vanguard vs. TD Ameritrade vs. Fidelity IRA accounts based on the type you need.

What about Vanguard vs. Fidelity IRA or TD Ameritrade IRA plans? Vanguard also provides traditional Vanguard IRA funds or Roth IRA funds, but Vanguard outperforms TD Ameritrade in this area by offering two more IRA choices: Vanguard SEP IRA and Vanguard SIMPLE IRA. TD Ameritrade also has its own version of these IRA plans.

The Vanguard SEP IRA is for small-business owners who want to provide a low-cost retirement option to employees. Employees fund their own IRA, and the business can contribute an amount it chooses per year.

The Vanguard SIMPLE IRA, like the Vanguard SEP IRA, is for business owners, but there must be fewer than 100 employees to use the plan. The company can match up to 3% of an employee’s Vanguard IRA funds each year.

Between TD Ameritrade, Fidelity, or Vanguard IRA, Vanguard and TD Ameritrade provide the most options for IRA accounts by stepping in to help businesses and employees who may not otherwise be able to afford a retirement plan.

Related: Saving for Retirement | What You Should Know about Saving for Retirement

Account Setup & Maintenance Fees

Many brokers charge fees for their IRA accounts, as brokers depend on the fees to make money from IRAs. How do TD Ameritrade and Fidelity stack up against Vanguard IRA fees?

TD Ameritrade has no fees for account setup or maintenance, making this a great investment broker option for those who do not want to worry about fees cutting into their savings over time or upon opening an account. Vanguard Roth IRA fees are $20 for maintenance, but $0 if you opt for electronic statements, keeping your Vanguard IRA funds safe from fees.

Fidelity gets bonus points for outlining its fees clearly and easily on its website for its Fidelity Roth IRA and traditional IRA, unlike TD Ameritrade and Vanguard IRA fees, which take a little bit of searching to find. Fidelity Roth IRA also has no account setup fee or monthly or annual maintenance fee, nor does its traditional IRA.

Both TD Ameritrade and Vanguard IRA fees differ for the small business IRAs, which charge specific fees to the business but are typically much lower than 401(k) fees.

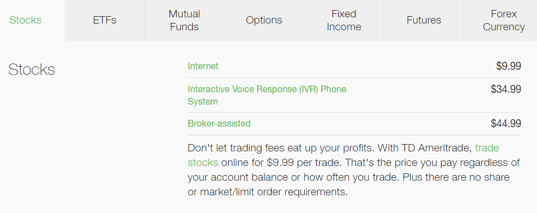

Source: TD Ameritrade

Vanguard Roth IRA minimum fees for trades vary between $2 and $7, which is a respectable cost. Fidelity IRAs charge $7.95 for online U.S. equity trades for both traditional and Fidelity Roth IRAs. TD Ameritrade charges about $9 to $11 per trade made online.

Popular Article: Average Retirement Savings by Age 30, 35, 40, 45, 50, 60, 65

Account Minimums

You should also consider the Fidelity, TD Ameritrade, and Vanguard Roth IRA minimum investment amounts because some might require a high enough investment to be a deal-breaker for you. Minimum investments for IRAs can range from $0 to thousands of dollars, so you will want to consider what you can afford and search from there.

Vanguard Roth IRA minimum investment is $1,000, and this covers what Vanguard considers “start-up” investments. Other investments require a minimum of $3,000. Vanguard vs Fidelity IRA is more expensive to initially invest in, with a Fidelity IRA requiring no minimum investment.

TD Ameritrade also requires no minimum investment, making it and Fidelity Roth IRAs good choices for those with little money to invest at present.

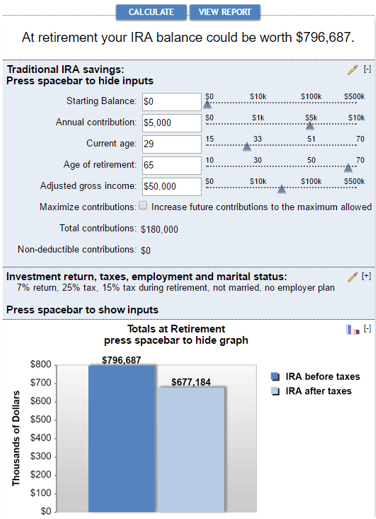

Source: Bankrate

Before you consider choosing a Fidelity Roth IRA or TD Ameritrade IRA because they require no minimum investment, consider using a retirement plan calculator to see how no minimum investment can potentially impact your retirement goals.

Promotions and Rewards

Some retirement plan brokers offer promotions and rewards for those who choose to open IRA accounts with them. These promotions or rewards can seem insignificant at first, but sometimes can add up to big savings throughout the life of your IRA.

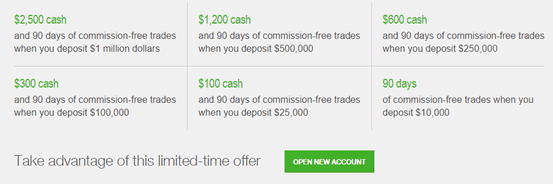

A comparison of TD Ameritrade vs. Fidelity IRA account rewards shows a respectable promotional offer from each broker, although these are subject to change as new promotions begin. TD Ameritrade offers up to $2,500 to those who open a new IRA account plus 90 days of trading without commission.

Source: TD Ameritrade

When you switch your current IRA to a Fidelity IRA, you can also earn up to $1,950 in matched contributions over the next three years. Does TD Ameritrade, Fidelity, or Vanguard IRA offer a better promotion?

Vanguard does not have special promotions or rewards listed on its website. However, Vanguard IRA funds, specifically ETFs, tend to lead to better returns than their competitors based on their history over the past 10 years.

This area proves no clear winner, since each broker provides distinct and comparable benefits to the others.

Individual Investment Options: TD Ameritrade vs. Vanguard vs. Fidelity IRA

Vanguard vs. Fidelity vs. TD Ameritrade Roth IRA accounts provide their customers with different investment options that could help to meet different retirement goals. One of the benefits of IRAs is the ability to spread your investment through different assets to minimize risk and maximize potential returns.

Which broker offers the most diverse investment options? A comparison between TD Ameritrade vs. Vanguard vs. Fidelity IRA shows that all three IRA brokers offer the most popular types of assets:

- Stocks

- Bonds

- Mutual Funds

- ETFs

- Annuities

- CDs

A Fidelity IRA offers an added benefit, though, with its Fund Picks from Fidelity and Fund Evaluator tools. These educational tools help you pick your own assets to invest in to create a portfolio that will help you reach your retirement goals.

Read More: Do I Have Enough to Retire? Find out if You Have Enough Money for Retirement

Free Wealth & Finance Software - Get Yours Now ►

Conclusion: Vanguard vs. Fidelity vs. TD Ameritrade Roth IRA accounts

When choosing between Vanguard vs. Fidelity vs. TD Ameritrade Roth IRA accounts, try not to focus on all of the factors that compare the three brokers. Instead, pick the one or two most important factors to help you reach your retirement savings goals and compare the IRAs based on those factors.

Whether you choose TD Ameritrade, Vanguard, or Fidelity Roth IRA, you can ensure that you are making the first step toward saving for your future with a trusted company designed to help you get there faster.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.