Best Life Insurance Rates: How to Compare Life Insurance Rates

Prepare for the worst but work toward the best. It’s a wise philosophy to follow in work, finance, and personal endeavors. No financial decision epitomizes this more than choosing to buy life insurance and your search for the best life insurance rates.

People often find themselves researching different life insurance types and seeking the best life insurance rates at a time of great change in their lives. A marriage, the birth of a child, or even an unexpected boost in income can all send one searching for the best life insurance rates.

But what is life insurance?

The strict life insurance definition is a financial safety measure designed to help a beneficiary in case of unexpected death. Should the policy holder die — within the conditions set by the policy as there are different life insurance types — the insurer must pay an agreed-upon “death benefit” to the beneficiaries.

Researching life insurance types first requires a difficult admission: our time on this planet with the people we love ends. But taking out a life insurance plan shows a willingness to make sure loved ones are secure for the long term.

Image Source: Pixabay

Still, life insurance policy rates and life insurance rate charts can be difficult to decipher.

Different types of life insurance offer different benefits. Cheap life insurance exists, though it may not always be your best bet. And life insurance policy rates can differ based upon a wide variety of factors.

We’ve put together this guide to help you find your way through the different types of life insurance and choose the best life insurance rates for your situation. In this guide, we will:

- Explore different types of life insurance

- Discuss where to find cheap life insurance

- Dissect how to arrive at the best life insurance rates

- Break down life insurance rates by age

Hopefully, by the time you’ve reached the end of this guide, you’ll navigate the types of life insurance and life insurace rate charts with ease.

See Also: Top Cheap Credit Cards | Ranking | Best Low Credit Card Interest Rates (Cheapest & Lowest)

Life Insurance Definition: How to Choose from Different Types of Life Insurance

Here’s the simplest life insurance definition: a company makes a calculated bet that you’ll live a long enough life. (And you do your best to let make sure the insurance company wins its bet).

The second, more unfortunate half of the life insurance definition: in the event of a death, the life insurance company must pay out a death benefit to named beneficiaries.

The different types of life insurance have varying goals. These, along with other factors, then determine life insurance policy rates, including life insurance rates by age.

The life insurance definition includes three main parts: a death benefit, a premium, and in the case of permanent life insurance policy types, a cash value.

The death benefit is the amount of money your loved ones will receive in the event of your death. You as the policy holder determine the death benefit amount, though the life insurance policy rates offered by companies go up along with the benefit.

All types of life insurance and life insurance policy rates revolve around intricate formulas that all fall into two categories: term life insurance and permanent life insurance.

Term life insurance provides protection up to a certain date or period (a term), which insurance companies promise to cover in case of an unexpected death before the term ends. The life insurance policy rates remain steady for these types of life insurance plans.

Those looking for cheap life insurance often opt for some sort of term policy. Term life insurance can offer a short-term income buffer for your loved ones, should the worst happen, though it often only pays out in lump sums.

Permanent and universal types of life insurance policies offer death benefits regardless of life expectancy. They offer more flexibility, and in some cases, you can even adjust your life insurance policy rates.

Permanent types of life insurance policies have a greater cost but cover more. They’re ideal for estate-planning or long-term income substitution. Some even feature a separate savings component which could lower your premiums.

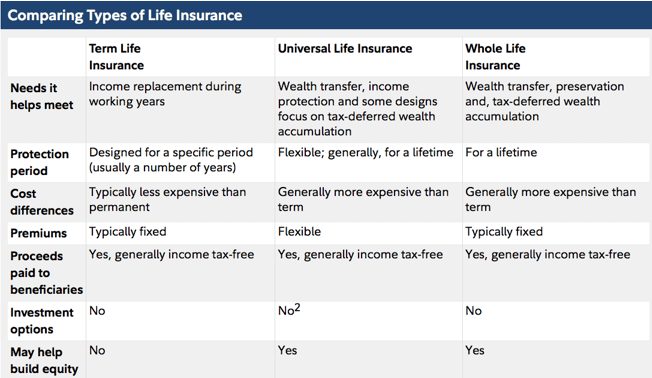

This helpful chart from Fidelity breaks down the various types of life insurance offered, not just by it but all companies.

Image Source: Fidelity.com

It’s important to weigh all potential factors before choosing which life insurance policy is right for you. A good baseline approach to picking the best life insurance rates is settling on a benefit that’s a multiple of your current annual income.

Picking a benefit ten times your current salary is a good start. More is obviously better.

For example, if you currently earn $65,000, you want to explore types of life insurance that pay a death benefit of at least $650,000. This should only be your first step, though.

More intricate math will determine the right benefit amount, and the best life insurance rates to match it. This calculation requires adding up any debts or expenses you want covered, and how long they’ll last. This includes:

- Mortgages

- Child-care expenses

- College tuition

- Income until retirement

- Any current debts or other potential money owed in the future

- Life events you want paid for in your absence, such as a daughter’s wedding

For example, if you have two decades left on your mortgage, try to make sure the term of your policy eclipses those 20 years and that the death benefit covers the remaining debt.

Doing this math will help you better understand which are the best life insurance rates for you. The best life insurance rates also offer such benefits without breaking the bank.

Some insurers even allow you to switch plans to a lower premium, should your debt levels decrease as time passes.

Don’t Miss: Top Credit Cards in Canada | Ranking | Compare the Best Cash Back, Travel, and Top Cards

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Cheap Life Insurance: Affordable Security for You and Your Family

Before you begin searching for cheap life insurance or comparing life insurance rates, consider a few factors:

- Who will be the beneficiary? What will their needs be in the event of your unexpected death? These may include funeral expenses, bills, and school tuition if you’re listing your children as beneficiaries.

- Also consider what sort of standard of living you’ve set and hope your family will maintain. Would the sudden absence of your income cause a steep drop in their budget? Different life insurance types may help cover those costs, at least temporarily.

- Do you foresee any major life changes in the near future? Single and hoping to be married? Can you see yourself switching employers or even careers? Keep these in mind when comparing life insurance rates when you first look and as any changes occur.

Steep premium payments can provide a long-term burden to both you and your family. Don’t make living a long, robust life costly.

Image Source: Pixabay

The trick to choosing the best life insurance rates involves a balance between future financial need and current financial flexibility. You do not want to constrict your current finances for the sake of an unknown future.

Cheap life insurance may not be enough to support your family should they need it.

Some basic math will uncover your family’s potential financial needs. Then search for plans that reach that goal as cost-efficiently as possible.

Compare life insurance rates with this in mind. The key to finding cheap life insurance rests in preparation and research. Here are five steps to make it easier:

- Shop around. Seek out different types of life insurance and providers to see which will offer the right balance of benefits to costs.

- Stay away from add-ons. Many life insurance types include extra services at a cost. If your goal is simply cheap life insurance, avoid these.

- Bundle insurance if you can. Some companies, such as State Farm, allow discounts if you buy multiple varieties of insurance from them. Compare life insurance rates when combined with home or auto, if you can.

- Make sure the insurance company can keep its end of the bargain. Check the financial health of a company on A. M. Best before signing on to any plan.

- Sign up sooner rather than later. Generally speaking, companies offer the young, healthy, and robust cheap life insurance. They are, after all, a safe bet for insurance companies.

Follow these simple tips and you will be closer to finding cheap life insurance. Do not, however, confuse cheap life insurance with good life insurance.

Another effective way to pick life insurance is to work backward: determine the size of the death benefit and then find a plan that meets it.

The web is filled with helpful online tools that allow you to estimate the necessary death benefit and which types of insurance will help you cover it, such as this one from Bankrate.com. Others do the same.

Be sure to include these results when you compare life insurance rates.

Compare Life Insurance Rates: Life Insurance Rates by Age, as Well as Other Factors

After parsing the different life insurance types, you’ll likely arrive at a term life insurance policy. They tend to be cheaper than permanent types of life insurance.

Do not go by bottom line alone when you compare life insurance rates, though. Companies arrive at your life insurance premium using an intricate set of variables, including:

- Overall health: this includes existing conditions or long-term illnesses

- Tobacco use: decreases life span significantly

- Age: may be the biggest determining factor in setting your life insurance policy rates

- Lifestyle: including any extreme sports or hobbies which put you in danger

- Gender: women live longer

- Career: a job which regularly puts you at risk could cost you in increased insurance rates

- Location: life insurance policy rates can be affected by whether you live in the city or a rural area

- Family history: a history of chronic illnesses in your genes could increase your life insurance policy rates

Companies mostly set life insurance rates by age. This may be the biggest factor in determining the best life insurance rates and picking among the types of life insurance.

Term life plans have a set premium determined at the moment of purchase. This makes your age a one-time factor in determining price.

The reason is simple: every year, you’re closer to reaching what insurance companies call your “life expectancy” — the age they assume you’ll live to.

Term life insurance rates by age at 30 will be lower than term life insurance rates by age at 45. A company’s cost of insuring a person increases with their age, an expense they pass onto policy holders. Rather than resetting life insurance rates by age every year, companies spread out the risk over the term of the plan — whether that is 10 years or 30.

You in essence pay for being old from day one. Extending your term life plan can also determine your life insurance rates by age. Policy holders could see a steep increase in their insurance rates from age-adjustments made by insurance companies.

Permanent and universal insurance plans have a different approach to adjusting life insurance rates by age. The premiums offered by these types of life insurance plans are adjustable. You may have to pay more as you get older.

It makes life insurance policy rates difficult to keep steady, and costlier over the long term. If too costly, consider alternative means of setting aside money for your family instead of relying on malleable life insurance rates by age.

Most companies offer a life insurance rate chart to show how life insurances policies by age are determined. This could be a good way to guide your search.

Popular Article: Top Store Credit Cards for Bad/Poor/Fair Credit | Ranking | Department Store Cards for People with Bad-Fair Credit

Conclusion

Considering life insurance types means you’ve already crossed the Rubicon, ditched the myth of immortality, and reached adulthood. Whether spurred on by a spouse, the birth of your first child, or other major life changes, different types of life insurance ensure your family is safe after you’re gone.

While it may be tempting to seek out cheap life insurance, consider your goals. The intricate balances within your family budget cannot be disturbed too much when seeking the best life insurance rates.

Be sure to check life insurance rate charts provided by insurers to get a better sense of your potential expense. Also, find life insurance policy rates which meet your family’s long term financial rates without breaking the bank.

Finally, get to shopping sooner than later; most companies determine life insurance rates by age. Being young is cheaper.

Read More: Good Credit Cards for Excellent & Good Credit | Ranking & Reviews | Top Rated Best Credit Cards

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.