2017 RANKING & REVIEWS

TOP RANKING BANKS FOR FREE BUSINESS CHECKING

Building a Foundation for Success with a Free Business Checking Account

Whether you’re a startup boldly venturing into unknown territory or a small business owner finally separating your business and personal finances, a free business checking account can be a great resource.

A free business checking account isn’t designed only to help you save money, although, for startups and business owners looking for ways to lower costs, that’s a big enough incentive. Free business banking accounts can also serve as a foundation for your business. They can help you grow and strengthen your business with valuable tools and perks, and then as your banking needs expand, you can gradually move on to other accounts.

A free business checking account should not only provide you with simplified ways to track your spending and deposits, but also give you the tools you need to maintain a sense of control and visibility over your business finances. Excellent no-fee business checking accounts also tend to have technology-based platforms that simplify banking, such as online and mobile banking.

The list of the top 12 free small business bank accounts on this list represent all of the above criteria, and many have quite a few other offerings that make them superior.

Award Emblem: Top 12 Best Banks for Free Business Checking

Award Emblem: Top 12 Best Banks for Free Business Checking

AdvisoryHQ List of the Banks for Free Business Checking

This list is sorted alphabetically (click any of the below names to go directly to the detailed review for that bank).

- BBVA Compass

- Capital City Bank

- Capital One

- Everbank

- First Citizens Bank

- First National Bank

- First Bank

- Iberia Bank

- SunTrust Bank

- U.S. Bank

- Wells Fargo

- Zions Bank

Related (Please Review):

- Permission to Use Your FREE Award Emblems

- Promoting Your “Top Ranking” Award Emblem and Recognition

- Can Anyone Request a Review of a Bank?

- Do Banks for Small Business Have a Say in Their Review & Ranking?

- Can Banks for Small Business Request Corrections & Additions to Their Reviews?

Top 12 Banks for Free Business Checking

| Bank | Website |

| BBVA Compass Bank | BBVA Compass Free Business Checking |

| Capital City Bank-Absolutely Free | Capital City Absolutely Free Business Checking |

| Capital One-Spark Business | Capital One Spark Business Free Checking |

| EverBank-Small Business Checking | EverBank-Small Business Checking |

| First Citizens-Basic Business Checking | First Citizens Bank Basic Business Checking |

| First National-Business Free Checking | First National Free Business Checking |

| FirstBank-Free Business Checking | FirstBank Free Business Checking |

| Iberia-Free Business Checking | Iberia Free Business Checking |

| SunTrust-Primary Business Checking | SunTrust Primary Business Checking |

| US Bank-Silver Business Package | US Bank Silver Business Checking |

| Wells Fargo-Business Choice | Wells Fargo Business Choice |

| Zions-Basic Business Checking | Zions Basic Business Checking |

Methodology for Selecting the Best Banks for Free Business Checking

To begin the process to identify the best free business checking accounts, AdvisoryHQ looked at top national, regional, and community banks and compared widely available public resources.

Then, this list was narrowed down to look specifically at factors such as the features available with a free checking account, whether or not minimum balance levels are required, and other similar criteria.

Click here for a detailed explanation of our methodology: AdvisoryHQ’s Methodology for Selecting Top Free Banks for Small Business.

Detailed Review—Top Ranking Banks for No-Fee Business Checking

After carefully considering banks with free small business bank account options, we created the following list of the top 12. As you continue reading, you’ll find detailed reviews for each of our picks, as well as specifics of some of the factors we used in our decision-making process.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

BBVA Compass Review

BBVA Compass is a U.S. bank that’s ranked among the top 25 largest, based on deposits. BBVA operates 688 branches throughout the country, and it’s among the top five largest banks in states including Alabama, Texas, and Arizona. BBVA Compass is also consistently recognized as being one of the top Small Business Administration lenders.

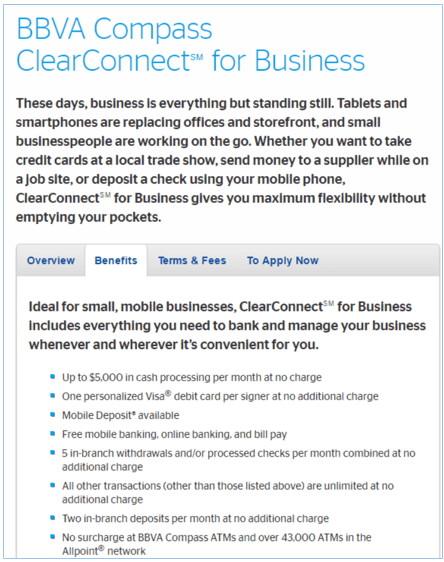

In terms of services and products specifically offered for small business, BBVA offers a range of checking accounts, merchant services, lending solutions, and online banking options. Their Clear Connect Business Checking account is a signature small business account option.

Image Source: BBVA

Key Factors That Enabled This to Rank as a Best Free Business Checking Account

Reasons the BBVA Clear Connect Business Checking account was included in this ranking of the best free business banking accounts are listed below.

Fees and Balance Requirements

When you’re a small business owner who utilizes the Clear Connect checking account from BBVA, you will pay no monthly service charge. Additionally, to open the account requires only a $100 minimum deposit, and there is no minimum balance requirement.

There is a monthly Paper Statement Fee of $3.00 charged to account holders, but this can be eliminated when you opt to turn off your paper statements and receive them instead through your Online Banking account.

Also, there is no BBVA Compass fee to use an ATM at another bank, and there is no surcharge at BBVA Compass ATMs and the 43,000 ATMs that are part of the Allpoint network.

Visa Business Debit Card

Account holders of the BBVA Compass Clear Connect Checking account receive a Visa Business Debit Card, which has cash back rewards, boasts advanced chip technology to prevent fraud, and can be personalized with your company’s name, logo, or image.

The Business Debit Card from BBVA Compass also includes Visa Zero Liability, which protects against fraudulent purchases, offers constant fraud monitoring, and allows business owners and account holders to monitor their own activity anytime through online and mobile banking options.

Business Overdraft Protection Programs

Clear Connect is a selection for the best free business bank account because of the extensive overdraft protection options offered. There are a few tools available to business owners and account holders they can rely on to protect against overdrawing their account.

The first is a Business Overdraft Protection Line of Credit, and the second is a Linked Account Overdraft Sweep service.

With a line of credit, account holders can link their Clear Connect account to a line of credit, protecting against overdrafts, returned checks, and high fees. With the Account Sweep Service, account holders link their checking account to their BBVA Compass savings or money market account to automatically cover overdrafts.

Features

Along with all of the features and benefits listed above, this free small business checking account also includes the following:

- Account holders receive up to $5,000 in cash processing a month, at no charge

- Mobile Deposit is available with this account

- Free mobile banking, online banking, and bill pay are included

- The account includes 5 in-branch withdrawals and/or processed checks per month combined at no additional charge

- All other transactions aside from the ones previously listed are unlimited, with no additional charge

- Receive two in-branch deposits per month at no charge

Capital City Bank Review

Capital City Bank has a history that spans more than 120 years, and today it stands as one of the leading community banks in Florida where it’s based, as well as other states throughout the Southeastern region. Some of the major metro areas served by Capital City Bank include Jacksonville and Orlando, Florida, as well as Birmingham and Atlanta, Alabama.

Business banking services from Capital City are diverse and include online banking, deposit and savings products, loans, treasury management, merchant services, credit cards, and investment planning and advice. Their signature free business bank account is called the Absolutely Free Business Checking account.

Key Factors That Led Us to Rank This as A Best Free Business Checking Account

Below are some of the primary reasons Capital City’s Absolutely Free Business Checking was included in this ranking of the best small business bank accounts with no fees.

Balance and Service Charge

Many small business owners, particularly of startups and newer businesses, seek out ways they can save money while still receiving excellent service, and that’s what they’ll find with the Absolutely Free account from Capital City.

This account not only carries no monthly service charge but also requires no minimum balance. The minimum opening deposit is only $50, and account holders receive 500 free items per month.

Online Banking

Holding the Absolutely Free account means you can utilize online banking for free. You can manage your account information, transfer funds, and make electronic bill payments and client-to-client transfers. Online banking also includes up to 18 months of previous e-statements.

Also available is a CCBMobile Banking App, which simplifies and streamlines money management for busy business owners.

Some of the features include:

- Constant account access

- Real-time transaction history for not just checking information but also CDs, loans, and savings accounts

- Consolidated account information

- Personalized alerts and reminders

- Payment history record

- Images of cleared checks

- Transactions can be downloaded into Quicken or QuickBooks

Business Savings

If you’re also interested in linking your Absolutely Free Business Checking Account to a savings account, an excellent option from Capital City is the Absolutely Free Savings Account. This account is available in addition to money market accounts for businesses, and the Premium Money Market for Business.

With Absolutely Free Savings for Business, account holders earn interest that’s compounded daily and paid quarterly, tiered higher-yield rates, and no accompanying transaction fees.

Business Debit Card

When you bank with Capital City and open an Absolutely Free account, you receive a debit card enabled with an embedded chip, improving security and helping to avoid fraud.

When chip-activated service is available at a terminal, checking out is simple, and the debit cards from Capital City also include the Visa Zero Liability Policy in the event fraud does occur.

It’s also easy to issue debit cards to associates and monitor their spending by using online and mobile banking.

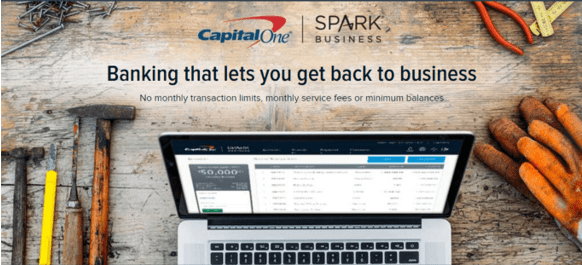

Capital One Review

A leading retail, business, and commercial banking institution, Capital One serves states throughout the U.S. and is based in McLean, Virginia. Capital One is one of the nation’s top 10 biggest banks based on deposits, and it’s a Fortune 500 company. Capital One offers a full range of business banking solutions including checking, savings, credit, and lending options.

Their signature Spark Business Checking is their free online business checking account, ideal for a diverse array of businesses.

Image Source: CapitalOne Spark Business

Key Factors That Enabled This to Rank as a Top Free Business Checking Account

The list below represents some of the primary reasons Spark Business Checking from Capital One was selected as one of the best free small business checking accounts.

No Restrictions

Spark Business Checking has no monthly service charge fees, but it’s also a business account designed to be free of limitations and restrictions in general. There are no limits on monthly transactions, nor are there transaction fees.

No minimum balance is required to maintain this account, and there are no fees for account holders to use the network of Allpoint ATMs.

Free unlimited checking transactions with Spark Business Checking includes deposits, withdrawals, and transfers, regardless of how many are made in a month.

Business Benefits

This no-fee business checking account also carries with it a number of valuable business benefits. These include:

- Deposits are available the next day

- Account holders receive a free debit card

- You can link your digital Spark Business Savings account for overdraft protection

- There are 40,000 nationwide fee-free ATMs

- You can send electronic invoices for free

Spark Business Savings

As mentioned above, account holders with a Spark Checking account can also opt to open a Spark Business Savings account, which can be linked to your checking for overdraft protection.

The Spark Business Savings account includes a competitive interest rate for 12 months, and like the checking account, it has no monthly service fees. There is no minimum balance required, and you can access your savings account anytime and anywhere using the Spark Business mobile app.

This savings account is specifically designed for small business owners who enjoy digital banking and don’t need to make cash deposits.

Mobile Management

Since the Spark Business Checking account is not only a free small business checking account but also a digital account, they have a robust set of offerings available through mobile banking. The Spark Business App features digital tools designed to appeal to business owners who are on-the-go and short on time, yet want to maintain control of their banking.

With Account Tracking, users can view and manage their digital Spark Business accounts from a centralized dashboard. Online Invoicing provides the opportunity to send electronic invoices to customers, receive notification when they’re viewed and paid, and create automatic payment reminders for bills.

With Bill Pay, account holders can pay their bills online, schedule payments, and pay other businesses and individuals.

Mobile Deposit functionality allows Spark account holders to deposit checks into their account from anywhere and at any time.

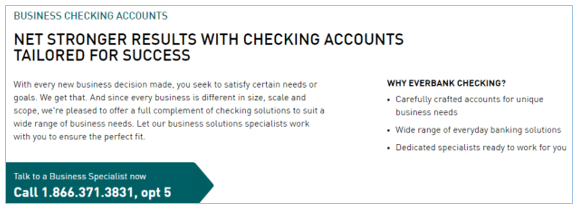

EverBank Review

EverBank maintains assets of nearly $27 billion and is built on thinking outside the box regarding typical banking products and services. EverBank is headquartered in Jacksonville, Florida, and was first established in 1961. EverBank now maintains client across the U.S. and offers banking products, as well as lending and investing services.

Their signature free business checking account is called Small Business Checking, and it’s created exclusively for sole proprietors.

Image Source:EverBank

Key Factors That Allowed This to Rank as a Top Free Business Checking Account

When comparing the best free business bank accounts, the following are details of why EverBank’s Small Business Checking was included in this ranking.

High Yield

Along with no monthly fee, the EverBank Small Business Checking account includes a tiered rate system that lets you earn money while also effectively managing your money. This account includes competitive annual percentage yields that are based on your balance.

For example, the current 1-year intro APY is 1.11% on balances up to $100,000.

When you’re a first-time EverBank Small Business Checking account holder, you can also earn extra interest during your first year of enrollment.

Cash Management

Business banking with EverBank includes a suite of cash management tools and solutions designed to help business owners easily keep their finances moving forward smoothly. These tailored solutions range from tools aimed at bookkeeping and payment methods to options for in-depth financial reporting.

When you decide to open a free small business checking account with EverBank, you can also contact a business specialist who will help you determine which of these cash management tools are right for you and your business.

Online Banking

EverBank offers two different banking platforms to customers, which are designed to meet a range of needs. The Online Financial Center is a no-fee, single-user platform for businesses that have more minimal requirements. It includes all of the standard online banking tasks.

For business account holders who want something more robust, there is the Business Online Banking Platform. This platform is designed specifically for businesses that have more significant cash management requirements, including ACHs and wire transfers. There are monthly maintenance fees for this platform, but those vary depending on the level of service a business uses.

Regardless of the platform a business opts for, they have access to easy fund transfers, eStatements, financial download options, and online bill pay.

Daily Deposits

One of the many reasons the Small Business Checking account was included in this ranking of the best free business bank accounts is because of the multiple convenient deposit options offered to account holders.

These options include:

- Office deposits: Account holders have two options to deposit checks from their office, using a computer a scanner. Remote Deposit Capture service is designed for businesses that make 50 or more deposits per month. Online Check Deposit service doesn’t have a fee and is designed for businesses that have fewer deposits each month.

- Mobile deposits: When you use the Online Financial Center to manage your business bank account, you can also get access to the EverBank online banking app, which will allow you to deposit checks directly by your smartphone.

- Lockbox service: This is specifically for business customers with a high volume of incoming checks, although this service is only available with Business Analysis Checking

First Citizens Bank Review

First Citizens Bank is based in Raleigh, North Carolina, and is part of a company that has more than $31 billion in assets. Values of First Citizens include integrity, stability, and service excellence. First Citizens strives to ensure customer satisfaction by understanding the needs of customers and providing the products and services they find valuable.

Image Source: BigStock

Business banking services include standard deposit accounts, equipment finance, payment acceptance, online payroll, and insurance. First Citizens’ Basic Business Checking is the account we’ll highlight on this ranking of the best free small business checking accounts.

Key Factors That Enabled Us to Rank This as One of the Best Banks for Free Business Checking

Highlighted below are some of the reasons the Basic Business Checking account as included in this ranking of the best free business checking accounts.

Visa Business Debit Card

The Visa Business Debit Card is included with the Basic Business Checking account, and it’s free of charge. It can be used anywhere Visa is accepted, and you receive a monthly statement detailing each transaction related to your account. This debit card can also be given to employees, and you can set individual daily signature spending limits for each card.

The Visa Debit Card from First Citizens also includes the protection of Visa Zero Liability, and you can shop quickly and easily online with Visa Checkout.

Business Online Banking Advantage

Business Online Banking Advantage is a feature of this free business bank account. This lets business owners spend less of their time on managing their banking thanks to convenience and accessibility. Features of Business Online Banking Advantage include:

- You can view up to 13 months of account history

- Log on to look at intra-day activity, which can include ACH transactions as well as wires that are coming in

- View your returned and paid check images

- You can set up multiple users with different authority levels

- Positive Pay Fraud Prevention is included for check transactions

You can also use this service to download your account history into Intuit, QuickBooks, and Quicken.

No Minimum Balance

As well as being one of the best free business checking accounts, the Basic Business Checking option from First Citizens also has no minimum balance. It’s an account designed to work best for the needs of businesses with limited monthly checking activity.

Additionally, there are no per item fees for the first 175 items that are processed in each statement period, and you can avoid the paper statement fee by enrolling for eStatements.

The minimum amount required to open this free business bank account is only $100, and you can take advantage of free coin and currency deposits of up to $5,000 a month.

Overdraft Protection

This no-fee business checking account carries options for overdraft protection, which can be useful for businesses that find themselves in an unexpected situation or facing expenses they hadn’t planned for.

One option is to write a check using a Capital Line, Capital Manager, or Business Equity Line. Another available option is to use a line of credit that’s linked to your business checking account.

Business account holders can also include the Capital Manager’s cash sweep option to their account, and the Business Checkline Reserve is a simple line of credit for small businesses that need a relatively minimal line of credit

First National Bank Review

Founded in 1857, First National Bank serves the needs of a range of clients including private individuals, small businesses, and corporate clients. General services available from First National Bank include deposit products, lending, credit cards, and wealth and investment services. First National Bank has $20 billion in assets and locations throughout the Midwestern United States.

Business services available from First National include checking and savings accounts, credit cards, and both global and community banking. Their top free business checking account is the Business Free Checking option.

Key Factors Leading Us to Rank This as One of the Best Free Business Checking Accounts

The list below highlights some of the essential reasons First National’s Business Free Checking was included in this ranking of the best business checking accounts with no fees.

Balance and Transactions

The First National free small business checking account is designed for those businesses interested in controlling costs, as well as organizations that have a limited number of transactions per month.

Along with having no monthly service fee, it is also a free business checking account with no minimum balance requirement.

It includes 150 free transactions a month, and that amount rises to only $0.25 per item after that limit is met.

Visa Business Debit Cards

All of the business checking accounts from First National, including Business Free Checking, come with a free Visa Business Debit Card. This card is a convenient way to make business purchases and track expenses. It can be used to make up to $5,000 per day in purchases, or you can access up to $1,000 per day in cash from the ATM.

It boasts zero liability fraud protection, and all debit card purchases are deducted directly from your business account. This can be particularly useful in streamlining the control and management of employee spending if multiple employees have access to your business debit card.

Online Banking

This account is a free small business checking option that can be used in conjunction with First National Online Banking. Features of online banking include:

- Users can safely and securely access their account information at any time.

- The dashboard provides a customized glimpse of the accounts you use most frequently, as well as fast links to the most used banking services.

- Account details include account balances, transaction reviews and the option to view check images. You can also download your recent activity in a variety of formats.

- Statements include not only account details but also online tax statements.

- Transaction search includes the ability to use multiple search criteria to go through transactions and checks.

BillPay

Also included with this First National free business banking option is BillPay. BillPay is a free service that lets business account holders track all of their payments, including ones from the past and those that are scheduled for the future. You can opt to make a one-time payment, set up recurring payments, or complete rush payments.

You can use BillPay to move money from a First National account to an external account or directly send money to someone’s account. This tool also includes a link to the IRS so you can conveniently pay your business taxes.

Another free service available to business account holders at First National is Payroll, for up to 50 employees

Free Wealth & Finance Software - Get Yours Now ►

First Bank Review

Founded in 1963, First Bank has more than $15 billion in assets and more than 120 locations throughout the Southwestern United States and California. Along with a strong reputation and a long history, First Bank remains dedicated to core values including convenience, customer service, and loyalty.

Business products available from First Bank include a variety of accounts and loans, as well as online banking and merchant services. Free Business Checking is the signature small business bank account with no fees available from First Bank.

Key Factors That Enabled This to Rank as A Top Free Business Checking Account with No Fees

The details below explain some of the reasons Free Business Checking from First Bank was included in this ranking of the best free business checking accounts.

Charges and Balances

This is an excellent option if you’re seeking free business checking with no minimum balance. It’s a cost-effective way for certain small businesses to bank, because in addition to having no service charge, there is no required minimum balance, as long as your account has 150 transactions or fewer every month.

If you do happen to make more than 150 transactions in a month, then your account automatically becomes eligible for earnings credit, and the charges are minimal for things such as debits, credits, and deposited items.

First Bank Mobile Banking

When you have a Free Business Checking account, you’re eligible for Mobile Banking, which is an incredibly simple yet powerful and user-friendly way to manage your business banking.

Features of Mobile Banking include:

- Mobile Deposit simplifies how you deposit checks, by letting you take pictures with your smartphone.

- Person to Person Transfers are available as a simple way to transfer funds securely using just the recipient’s email address or mobile phone number.

- FirstGlance is a signature feature of Mobile Banking with First Bank, which lets you see a rapid summary of your account information, without requiring that you first log in.

- Apple Pay can be used with an iPhone 6 to pay transactions with one touch.

Internet Cash Management

First Bank recently announced the introduction of an app for business account holders that lets them manage their business finances even when they’re away from the office. This ICM app is available in the App Store and on Google Play, and it gives users the option to start and approve wires, transfers, and ACH bounces at any time and from any location.

Other features of the ICM app include the ability to schedule transfers between companies and deposit checks.

You can also quickly gain insight into what’s happening with your daily transactions, and the app is supported with superior customer service.

Combined Online Banking

One of the unique online banking options available to First Bank account holders is the ability to combine their Personal and Business accounts so they can manage everything in one place, through Consumer Online Banking.

Users can see their business and personal accounts with one login, transfer money between their personal and business accounts, and use the Bill Pay feature to pay both their personal and their business bills.

Users can also access the streamlined version of both of their accounts by using the FirstBank mobile app.

Free Budgeting Software for AdvisoryHQ Readers - Get It Now!

IberiaBank Review

Originally founded in 1887, Iberiabank offers a full array of financial services including retail banking, as well as small business, commercial, and private banking. Based in Louisiana, Iberiabank has 199 branch bank offices, as well as several loan production offices, located throughout the Southeast United States.

There is a full lineup of business banking services available to Iberiabank clients including business checking, loans, treasury management, merchant services, and services related to investment and retirement. This ranking includes coverage of one particular no-fee business checking account, called Free Business Checking.

Key Factors That Led Us to Rank This as One of the Top Free Business Bank Accounts

Listed below are some of the reasons this account was included in this ranking of the best free business checking accounts for small business.

Small Business-Specific

The Free Business Checking account from IberiaBank is distinctive because it’s designed and tailored to the specific needs of small businesses. If you’re a startup or have a limited volume of transactions, this is an ideal banking product. The minimum deposit to open this free business checking account is only $100, and up to 500 transactions are allowed without fees.

There is a deposit limit of $10,000 per statement cycle, and it includes two personal checking accounts as well, with service charges that are waived for small business owners.

If you do exceed the transaction and deposit limits of the Free Business Checking, you’ll be automatically converted to Business Checking Plus, but this account doesn’t carry a monthly service charge either.

Visa Debit Card

Enrolling in this free business checking account gives you access to a Visa Debit Card, which carries no annual fee. This debit card is accepted at millions of locations, and users enjoy surcharge-free transactions at any IberiaBank ATM.

You can request cash back when paying merchants, and all business debit cards from IberiaBank include Visa’s Zero Liability protection.

You can also opt to personalize your debit card with a company image or logo.

Online Banking and Bill Pay

Business account holders at IberiaBank, including those companies that maintain the free business checking account, have access to Online Banking, Mobile Banking, and Bill Pay.

With Mobile Banking, users can do everything from depositing checks to monitoring the financial activity of their business from their mobile device. The app also includes the ability to transfer funds and locate ATM and branch locations.

Mobile Deposit provides the capacity to deposit checks directly into a business account in a matter of minutes.

Online Banking is yet another convenience offered to holders of this free business checking account, with many of the same features of mobile banking as well as free e-statements and the ability to set up free email alerts.

For business owners who want to manage everything through their app or online, there is also Bill Pay, which lets you pay your business’s bills online — and your funds will clear faster.

Direct Connect

Direct Connect is a convenience offered to business checking account customers of IberiaBank in which there is a direct connection to Quicken or QuickBooks.

Business customers can sync their online bank account information in Quicken with a one-step update feature, as well as QuickBooks. This syncing is not only fast, but also highly secure.

This makes it easy to reconcile accounts, and there is a transaction-matching algorithm that ensures you’re not downloading duplicate transactions. Direct Connect is a free service from IberiaBank

Free Wealth Management for AdvisoryHQ Readers

SunTrust Bank Review

Based in Atlanta, SunTrust is one of the largest banks in the country. There are about 1,400 retail branches of SunTrust found throughout the country, as well as 2,160 ATMs. As well as retail and business banking, SunTrust provides corporate services, mortgage options, investment management and capital market services.

Specifically regarding small business banking, SunTrust offers products and services aimed at helping clients optimize their cash flow, manage their receivables, and simplify how they make and receive payments. Primary Business Checking is the signature no-fee business checking account available at SunTrust.

Key Factors Considered When Ranking This as One of the Best Free Business Checking Accounts

Highlighted below are details of why Primary Business Checking was included in this ranking of the best free business banking accounts.

Fee Waiver

There is a small monthly maintenance fee for the Primary Business Checking account, but there are simple ways customers can avoid this fee. The first is by signing up as a new Primary Business Checking client. This means you pay no fees during your first two statement cycles.

Then, as long as you maintain an average balance of at least $1,500, there is no monthly maintenance fee either.

This account is designed for small businesses with limited transactions of up to 150 a month and $5,000 in cash processing per month.

Business Credit Card

When you have both a SunTrust Business deposit account and a SunTrust Business credit card, you can receive a 10% cash back bonus, simply for redeeming your cash back from your credit card.

A SunTrust Business credit card makes it easy to simplify business expenses by allowing users to create custom employee spending limits, to schedule payments, and to make changes to your account whenever you choose.

The Business Card lets users view their pending transactions and their account history, schedule credit card payments, and dispute transactions.

Business Debit Card

As well as business credit cards, SunTrust also offers enrollees in its Primary Business Checking account the opportunity to use the Business Debit Card. The SunTrust MasterCard Business Debit Card is a simplified way to manage business expenses without paying interest or bills.

This debit card is embedded with an EMV Chip for the highest level of security, and it also features standard MasterCard safety features such as Zero Liability, Price Protection, and Purchase Assurance.

Cardholders can also be rewarded for their business spending through programs like MasterCard Easy Savings, which is an opportunity to earn automatic rebates.

Overdraft Protection

Business accounts from SunTrust are eligible for Overdraft Protection so that business owners don’t have to worry about the repercussions of bouncing a check. If you opt into business Overdraft Protection, you link your SunTrust business checking account to one of your other internal accounts.

If you do run into a problem of insufficient funds in your business checking account, the money will be automatically transferred from your linked account.

You can also connect your SunTrust Business Checking account to a credit card or line of credit

Free Money Management Software

U.S. Bank Review

U.S. Bank, operating more than 3,000 banking locations in 25 states and almost 5,000 ATMs, is one of the largest and most diffuse financial institutions in the country. U.S. Bank serves the needs of personal and business banking clients and also offers products and services including investments, mortgages, trusts, and payment services.

Small business services include business savings and checking, packages, nonprofit checking, online banking, credits and loans, and payment processing. The Silver Business Package is a free small business checking account offered by U.S. Bank.

Key Factors That Led to The Inclusion of This as A Top No-Fee Business Checking Account

When comparing business bank accounts with no fees, the list below highlights some of the reasons the Silver Business Package was selected as one of the best.

Fees and Requirements

Not only does the Silver Business Package from U.S. Bank have no checking account maintenance fee, but it was also included in this ranking because it’s an account for free business checking with no minimum balance requirement either.

This free business checking option includes 150 transactions per statement cycle, and if you go beyond that, the cost for a transaction is $0.50. Account holders can take advantage of 25 free cash deposits per statement cycle, and they also receive a 50% discount (up to $50) on their first check order.

Business Edge Debit Card

The Business Edge Debit Card is included with this free business checking account with no fees. This debit card offers a convenient and streamlined way to make and manage business transactions and company expenses.

It can be used everywhere Visa is accepted, as well as at millions of global ATM locations.

As an added bonus, this Visa Debit Card includes Zero Fraud Liability, and you can simplify how you monitor activity by setting up customized text or email alerts.

Perks and Extras

U.S. Bank is a great option if you’re looking for a top free business checking account. The Silver Business Package doesn’t just offer checking essentials, but also extras designed for business owners.

Some of the extras for enrolling in the Silver Business Package include:

- Access to Online Banking, Mobile Banking, and Bill Pay

- A free card reader for customers who sign up for the Clear & Simple Pricing program offered through U.S. Bank Payment Solutions Merchant

- A 50% discount on the Gold Personal Package checking monthly maintenance fee

- A first-year annual fee waiver on the Business Reserve Line

- Preferred interest rates on equipment financing

- An introductory bonus rate on a U.S. Bank Platinum Business Money Market account

Online Banking for Business

Taking advantage of a small business bank account with no fees from U.S. Bank means you also have access to their Online Banking for Business platform. This online system is designed and tailored to the unique needs of business owners and includes a variety of not just banking but also cash management solutions.

Online Cash Management, also called SinglePoint Essentials, lets business owners take complete control of their transactions without having to visit a bank. General online banking options include Bill Pay and Mobile Banking. With Online Bill Payment, business customers of U.S. Bank can manage payables and electronic solutions, making it fast, secure, and easy to pay bills.

Wells Fargo Review

A leading bank based in San Francisco, Wells Fargo is known for its long reputation as a pillar of the U.S. financial and banking system. Wells Fargo excels not only for offering a full range of personal, small business, and commercial services but also because of their many resources that can help clients make smarter financial decisions leading to a stronger future.

Small business options include not just the Business Choice account, which is their signature free small business bank account, but also other checking accounts, loans and credit, merchant services, insurance and payroll options.

Key Factors That Led to Our Ranking of This as a Top Free Business Bank Account

Primary reasons the Wells Fargo Business Choice Checking account was included in this ranking of the best free business accounts are listed below.

Fee Waiver

While the Business Choice Checking account is not technically free, it was selected for this ranking of the best no-fee business checking accounts because Wells Fargo offers customers the following flexible ways to avoid this fee (any single one counts to waive the fee):

- If the account is linked to Direct Pay

- $7,5000 average ledger balance

- $10,000 in combined balances including business checking, savings, CDs, and credit

- If qualifying transactions from a linked Wells Fargo Merchant Services account are made

- When qualifying transactions from a linked Wells Fargo Business Payroll services account are made

- 10 or more business debit card purchases and/or payments being made each month from this checking account

Additionally, the first 200 transactions made each month are not charged, the first $7,500 deposited each month is free, and opening this free business checking account requires only a deposit of $50.

Online Money Management Tools

Opening a business checking account with Wells Fargo means customers get access to online money management tools, which can be used to help businesses gain more control over their finances, improve their cash flow and plan more adequately for future expenses.

The Business Spending Report is a signature Wells Fargo offering designed to show business customers a “snapshot” of their spending. It’s beneficial because expenses are automatically tracked and categorized, as are deposits. You can the view all of the information in graphs and charts to give you an insightful view of your financial picture.

With Budget Watch, you can quickly create a business budget, and then see how you’re spending in comparison to that budget. You’ll receive email alerts showing your progress as well.

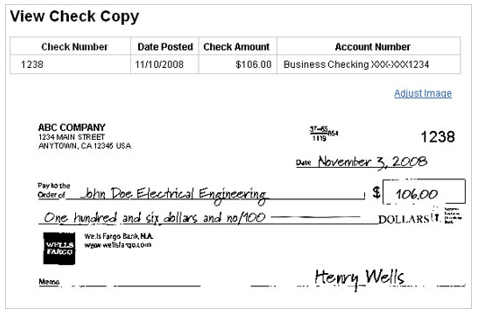

Check Images

One of the unique offerings available to holders of this free business checking account are check images, which are included for free with Wells Fargo Business Online Banking. These check images are automatically added to your online business banking account, which is included with Business Choice.

You can get the information you need from these checks when you need it, and you can view check images for up to 90 days after they’re posted to your account.

This gives you the opportunity to double check things such as payee, amount, and when a particular check was cashed.

You can also download and save checks whenever you choose.

All of this is a great way to streamline your organization and paper storage, which makes it a favorite feature among Wells Fargo business account holders.

Image Source: Wells Fargo

Wells Fargo Business Platinum Debit Card

When you open this particular free business checking account, you’ll receive the Wells Fargo Business Platinum Debit Card, designed to simplify cash flow and how business owners manage their spending.

Along with flexibility and convenience, this debit card has no annual fee, and you can link it to up to 22 Wells Fargo accounts, making it possible to access cash and make business deposits. These cards can be issued to business owners, but also other authorized signers on the accounts.

You can customize your business debit card using the Card Design Studio, and if your card is lost or stolen, you’ll receive a temporary business instant issue debit card so that you don’t lose access to your account.

Zions Bank Review

Zions Bank is a Utah-based community bank that’s been serving the region since 1873, making it one of the oldest financial institutions in the area. There are now Zions locations throughout not only Utah but also Wyoming and Idaho, and services range from retail banking and small business accounts to credit cards and private banking.

Basic Business Checking is designed as a free small business checking account for companies that have limited transactions and cash handling requirements.

Key Factors That Led to Our Ranking of This as One of the Best Free Business Checking Accounts

Zions’s Basic Business Checking account was included in this ranking of the best small business bank accounts with no fees for the following reasons.

Balance Requirements

The Basic Business Checking account is truly designed for startups and smaller organizations that are looking for the essentials, as well as efficiency, without having to pay high banking fees.

Not only is this a free small business checking account with no monthly maintenance fee, but there is also no required minimum daily balance to avoid a maintenance fee. It offers a significant amount of flexibility and cost-savings for account holders. The minimum opening deposit is only $100, and it includes up to 150 monthly combined transactions and $5,000 in monthly cash deposits.

AmaZing Deals

As a Basic Business Checking account holder, you receive a free debit card, which is eligible for the Zions AmaZing Deals program. This entitles cardholders to get anywhere from 10 to 50% cash back by shopping at participating retailers and service providers.

It’s simple to participate, and you can log on to the Zions Online Banking site to browse participating merchants.

Another benefit of this program is the ability to receive 5% cash back when you book your travel plans online at the Zions AmaZing Deals site.

Business Online Banking

Online Banking from Zions lets business owners and other relevant personnel maintain control and a high level of management over business finances. Some of the features of Zions Online Banking that are included to Basic Business Checking account holders are:

- You can provide access to online banking to as many employees as you choose, and you can also determine what information particular accounts can see and manage.

- Dual Authorization can be activated and requires two people to complete a transaction, giving an added level of control over accounts.

- Online Business Bill Pay lets participants receive their bills electronically, see the status of pending bills, schedule recurring payments, and more.

Employee Direct Deposit and Tax Payments

These are optional features business account holders can take advantage of at Zions. With Direct Deposit for employees, you can set up direct deposits as a streamlined way to pay employees without checks or a payroll company. It’s a great option for smaller companies with fewer employees. All you do is create a template, set up recipients, and add their preferred banks.

Also available through Online Banking with Zions are tax payment options. You can pay your taxes directly from the Business Online Banking platform, along with your other bills, and you can set up automatic recurring payments as well.

Conclusion — Top 12 Banks for Free Business Checking

Finding a quality free business checking account can be incredibly advantageous for a business. This is particularly true of businesses that are smaller, have fewer employees, are sole proprietorships, or are startups.

Many of the best free business checking accounts are not only excellent in terms of being cost-effective, but they also have great features and the opportunity to manage your money and business finances conveniently through tools like online and mobile banking. Selecting a free small business checking account doesn’t mean you’re sacrificing on the essentials.

The above ranking represents the best free business checking account options available, many of which are not just free in terms of a monthly service charge, but they also tend to offer perks and benefits to account holders.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.