2017 RANKING & REVIEWS

TOP BEST HEALTH INSURANCE COMPANIES

How to Compare Health Insurance and Find the Best Health Insurance Companies

Health insurance and medical insurance companies have been in the spotlight, particularly with the implementation of the Affordable Care Act.

Changes in laws have impacted how health insurance companies deliver their products and services but have also created new opportunities to access coverage from private health insurance companies.

Award Emblem: Top 10 Health Insurance Companies

When consumers start searching for the best health insurance companies and making their own health insurance comparison, the following are some factors they should consider:

- Out-of-Pocket Costs: Deductibles and co-pays are those costs that consumers have to pay their care providers at the time of service, even when they have coverage from health insurance companies. There are usually out-of-pocket limits that come with plans from health insurance companies, but these can vary pretty significantly. Regarding co-pays, specifically, some of the fees healthcare insurance companies may charge include routine visit co-pays, co-pays on prescriptions, and co-pays for emergency room and hospital visits.

- Deductibles: A deductible charged by health insurance companies is another way to refer to out-of-pocket costs for the consumer. This is one of the biggest factors many consumers use when comparing private health insurance companies because it puts a limit on how much the insured person will be required to pay during the course of a year for their healthcare.

- Benefits: For the most part, since the implementation of the ACA, benefits provided from top health insurance companies have been relatively standard. Some of the main categories that health benefits fall into include emergency services, ambulatory patient services, maternity and newborn care, behavioral health treatment, prescription drugs, and preventative and wellness services. To be certified and offered in the Health Insurance Marketplace, a company has to offer all of these benefits and others as well.

The following is a ranking of the best health insurance companies that offer some of the best services and care coverage along with the most competitive prices. These health care insurance companies excel in terms of their reputation with customers as well.

See Also: Northwestern Mutual Reviews | What you Need to know about Northwestern

List of the Top Health Insurance Companies

This list is sorted alphabetically (click any of the below names to go directly to the detailed review for the health insurance companies)

- Aetna

- Anthem

- Blue Cross Blue Shield

- Cigna

- eHealth

- HCSC

- Humana

- Kaiser Permanente

- Molina Healthcare

- UnitedHealthcare

Methodology for Selecting the Top 10 Health Insurance Companies

The process to compare health insurance and choose the top health insurance companies is a complicated one that involves looking at not only things like price and benefits, but also the reputation of healthcare insurance companies, and how the health insurance companies fit in with the regulatory and legal environment of the industry.

At the same time, as with all AdvisoryHQ reviews, a top priority in the creation of this list of health insurance companies was the consumer.

The following ranking of the top 10 health insurance companies looks at all of the above factors and also is based on a list of rigorous criteria that’s most relevant to the average consumer seeking top health insurance companies.

Top Ranked Best Health Insurance Companies:

Health Insurance Firms | Contact Info/Websites |

| Aetna | https://www.aetna.com/ |

| Anthem (This provider is affiliated with Blue Cross Blue Shield) | https://www.anthem.com/ |

| Assurant | https://www.assuranthealth.com/ |

| Blue Cross Blue Shield | http://www.bcbs.com/ |

| Cigna | http://www.cigna.com/ |

| eHealth | https://www.ehealthinsurance.com/ |

| Humana | https://www.humana.com/ |

| Kaiser Permanente | https://healthy.kaiserpermanente.org/html/kaiser/index.shtml |

| Molina Healthcare | http://www.molinahealthcare.com/en-US/Pages/home.aspx |

| UnitedHealthcare | https://www.uhc.com/ |

Table: Top 10 Health Insurance Companies | above list is sorted alphabetically

Detailed Review—Top 10 Health Insurance Companies

After carefully considering each of the best health insurance companies, we created the following list of the top 10 health insurance companies.

As you continue reading, you’ll find detailed reviews for each of the health care insurance companies, as well as specifics of some of the factors we used in our decision-making process, all of which are part of this health insurance comparison.

Don’t Miss: New York Life Insurance Reviews | Is NY Life a Reliable Company? (Ratings, Pros & Cons)

Aetna Review

One of the country’s leading health care insurance companies, Aetna was founded in Hartford, CT, in 1853 and since that time has remained committed to the provision of insurance and services to individuals, employers, and health care professionals. Aetna defines core values that drive how they provide service to policyholders.

These core values include a simpler health care system and process, promoting focused healthcare, and a connected system where patients are seamlessly in touch with their health care team through technology.

Key Factors That Enabled This to Rank as One of the Top 10 Health Insurance Companies

During the process to review and rank private health insurance companies and compile this list of health insurance companies that excel, the following are key reasons Aetna was included.

Medicare Advantage Plans

It was recently announced that Aetna’s Medicare Advantage Prescription Drug plans have received high ratings from the Centers for Medicare and Medicaid Services in their annual star ratings. For 2017, these MAPD plans earned an overall average rating of 4 out of 5 stars.

The CMS Medicare Star Rating System looks at the performance and quality of prescription drug plans, and is designed as a way to help beneficiaries and their families compare these plans. Additionally, Aetna announced 91 percent of their Medicare members are enrolled in plans with star ratings of 4.0 or higher.

The star rating system looks at five performance measures. These include health, managing chronic and long-term conditions, member experience, member complaints, and health plan customer service.

Business Health Solutions

As one of the country’s best health insurance companies, Aetna provides not only products and services for individual beneficiaries and their families but also works closely with businesses to provide value-creating company health insurance.

Company health insurance options from Aetna include:

- Small business

- Mid-sized business

- National accounts

- Multi-employer labor funds

- Public sector

- International businesses

Aetna also provides additional services and assistance aimed specifically at the needs of small businesses including an online platform where businesses can quickly and conveniently manage benefits, view reports, enroll employees, and pay premiums.

Tools and Apps

Aetna strives to be one of the top health insurance companies by creating a connection between beneficiaries and their health care information. Much of this connection is facilitated through innovative technology including mobile apps.

For example, the iTriage mobile app lets beneficiaries find answers to their medical questions, find nearby care options, connect with care providers, and also maintain their health information securely.

The Member Payment Estimator is an online tool that members can use to estimate the costs of office visits, tests, and procedures and can compare prices from up to 10 providers at one time.

Members can also tweet @Aetna help to receive real-time answers to their questions.

Source: Aetna Health Care Tools

Health Plan Benefits

Aetna offers a variety of different health plans suited for individuals and their families at any stage of their life. Regardless of the plan selected from Aetna, one of the best health insurance companies, some benefits will accompany it.

These standard benefits that extend across all of the plans from Aetna, one of the top 10 health insurance companies and providers of company health insurance, include:

- Tools and resources to help members manage not only the financial aspect of their coverage but also their health and well-being

- Ongoing support is provided to members, including treatments aimed at specific diseases

- Members of Aetna, one of the leading health insurance companies, have access to one of the largest networks of doctors and hospitals in the country

- Comprehensive customer service

Related: Average Life Insurance Cost | Average Cost of Whole Life and Term Life Insurance

Anthem Review

One of the top 10 health insurance companies and providers of company health insurance, Anthem is a BlueCross BlueShield Company. As one of the leading affordable health insurance companies, Anthem excels in providing simple access to care and information, along with greater customer value.

Anthem, as one of the leading private health insurance companies, focuses on several key areas of quality improvement, including chronic disease and prevention care, behavioral health, patient safety, coordinated care, community health, service quality, and care management for members with severe health problems.

Key Factors That Led Us to Rank This as One of the Top 10 Health Insurance Companies

When creating this list of health insurance companies and this health insurance comparison, the following are notable reasons Anthem was included.

Medicare Plans

One of the areas Anthem specializes in, as one of the best health insurance companies, are Medicare plans. Members of Anthem can choose the best Medicare plans not only for their personal needs but also their budget.

In most service areas, Anthem offers Medicare Supplement plans, Prescription Drug Coverage, and Medicare Advantage plans.

With Medicare Advantage Plans, members get all of the coverage from Medicare Parts A, B, and sometimes D in one simplified plan, and it’s more cost-efficient than getting Medicare Supplement plus Part D.

Quality Improvement

Anthem is one of the leading medical insurance companies for many reasons, including not only their focus on Medicare provision but also because of their emphasis on continual quality improvement.

They rank well compared to other private health insurance companies and company health insurance providers because of their accreditation surveys and compliance audits.

They are continually creating new quality improvement goals as well including better collaboration with care providers and hospitals to improve the quality of health care, understanding members’ cultures and languages, improving the health of members, and helping them stay well while effectively managing their health care.

Anthem Anywhere

To remain competitive with other health care insurance companies, technology and innovation are important. Anthem has the Anthem Anywhere App, which is designed to “make healthy happen—wherever you are.”

This app allows members to log in quickly and securely with Touch ID, always have their Member ID card on hand, and estimate their costs so they can plan ahead. It also includes the ability to find a doctor or urgent care facility nearby, check co-pays and deductibles, check on claims, and send and check secure messages about plans.

Plan Options

Anthem is one of the healthcare insurance companies on this list of the top 10 health insurance companies that understands how important it is to consumers that they have plenty of options to select from.

That’s why Anthem offers a wide variety of plan and coverage options, with the most popular options being HMOs and PPOs. In addition to having a broad range of features and benefits, the plans come in a range of prices as well.

The plans are broken down into price levels including Bronze, Silver, Gold, and Platinum. Plans from this leader among private health insurance companies can be simple and affordable or comprehensive.

The Anthem website includes user-friendly tools so that consumers can search and find the appropriate plans for their needs.

Blue Cross Blue Shield Review

A well-rated name on this list of health insurance companies, Blue Cross Blue Shield is a company delivering localized solutions for consumers seeking affordable health insurance companies. There are 36 independent, locally operated Blue Cross Blue Shield Companies.

These independent health insurance companies offer coverage to more than 106 million members in all 50 states as well as in the District of Columbia and Puerto Rico. BCBS has been in the health insurance industry for 80 years and is accepted by more than 90% of doctors and specialists.

Key Factors That Enabled This to Rank as One of the Top 10 Health Insurance Companies

BCBS was included in this health insurance comparison and ranking of the best health insurance companies for the following reasons.

Blue Distinction

BCBS is one of the leading health care insurance companies for many reasons, including their understanding of the importance of health care choices in people’s lives. The doctor or hospital where a patient chooses to receive care can have a significant impact on their health.

That’s why BCBS works with more than 90% of all U.S. doctors and hospitals, and also has a unique perspective on the care providers that are effective in delivering the highest level of patient-focused, coordinated, and affordable care.

BCBC, as one of the country’s top health insurance companies, makes it easy for members to see which care providers are the best by marking them in their online doctor and hospital directories as part of their Blue Distinction program.

Blue Distinction Total Care signifies facilities with the best efforts being made to coordinate total patient care, while the Blue Distinction Center signifies the best-ranked experts delivering specialized care.

The Blue Distinction Center+ ranking denotes health care facilities that combine expertise and efficiency in their delivery of specialty care.

Source: Blue Distinction Total Care

Pathway to Better Health

BCBS is ranked as one of the top health insurance companies because of their dedication to not just provide insurance, but implement large-scale initiatives aimed at improving health care through programs centered on prevention, wellness, disease management, and coordinated care.

The result of these initiatives, including the Pathway to Better Health program, is to not just improve patient care, but also to keep costs lower for everyone, ensuring BCBS remains one of the affordable health insurance companies.

There are more than 700 local patient-centric care programs that are part of the Pathway to Better Health initiative, and almost 327,000 participating providers.

BCBS also reports that are 42 million members who are part of the patient-centered care program.

Popular Article: Best Life Insurance Companies | Ranking | Term Life & Whole Life Insurance Comparison

Blue365 Healthy Discounts

One of the many benefits available to customers of BCBS, one of the top health care insurance companies, is participation in the Blue365 Health Discount Deals program. This program offers members access to deals from top national brands that make it fun and affordable to maintain a healthy lifestyle.

These deals are broken into categories which include fitness, healthy eating, lifestyle, personal care, financial health, and wellness.

Some of the brands included in Blue365 are Jawbone, Reebok, Jenny Craig, Last Minute Travel Club, Quicken Loans, and eMindful.

Participation is available to BCBS members in select locations and nationwide for participants in the Federal Employee Program.

Types of Insurance

To name the companies that were included in this health insurance comparison, it was important they offered consumers choices, and this is an area where BCBS excels. They offer many types of health care coverage, and some of these options include:

- Flexible Spending Accounts

- Health Maintenance Organization (HMO)

- Health Savings Account

- Medicare

- Preferred Provider Organization (PPO)

- Health Reimbursement Arrangements (HRA)

- Indemnity

- Point-of-Service

- Medicaid

Cigna Review

A leader among health care insurance companies, Cigna has a history with roots that go back 200 years, although the company that’s known today was established in 1982. Cigna has sales capabilities in 30 countries and has more than 37,000 employees serving the needs of tens of millions of customers.

Cigna strives to work with customers to help them lead a life that’s healthy and secure. Their focus is on the delivery of relevant products and services and to also remain one of the more affordable health insurance companies.

Key Factors That Allowed This to Rank as One of the Top 10 Health Insurance Companies

When reviewing the best health insurance companies to create this health insurance comparison, the following are primary reasons Cigna ranked well.

Partnership Approach

Unique to Cigna’s provision of health insurance products and services is their partnership approach. Cigna excels as one of the leading health insurance companies because they work to act as an advocate for their customers, providing them with a team that can help them navigate the health care and insurance systems. The result is a level of care and financial protection not available from other health insurance companies.

Cigna also works to empower customers with the information they need to improve their health and well-being, fill gaps in their health, and choose insurance products that maximize affordability and value.

Cigna also collaborates with their extensive network of care professionals and colleagues around the world to meet goals of providing quality, cost-effective health care and benefits.

Affordability and Personalization

As one of the best health insurance companies, Cigna has many initiatives aimed at bringing the most value to members. Their goals include affordability and customization.

In the quest to be one of the most affordable health insurance companies, Cigna helps customers find the right care at the right price and choose benefit plans that bring them the most value. They also work to help customers lower their costs as their health improves.

Personalization occurs as Cigna gathers insights to segment people into groups, which then translates to the development and availability of personally relevant products and services.

Know Your Benefits

The “Know Your Benefits” initiative is something offered by Cigna that’s designed to meet the goals listed above of providing personalized service and products and also being one of the most affordable health insurance companies.

As part of the Know Your Benefits program, members of Cigna, one of the top health insurance companies on this list of private health insurance companies, can go online to explore all of the details of their health plan.

By providing transparency and informational resources, the hope is that members will be able to prevent and manage surprises, while also saving money.

In addition to delivering user-friendly information on available health plans, Cigna also has resources such as their “Health Care Cheat Sheet,” and their guide titled “The Cost of Not Knowing Your Health Risks.”

All of these resources empower members in terms of their health and their financial lives.

Mobile Apps

Cigna is distinctive when compared to other health insurance companies, and it ranked well on this health insurance comparison because of their availability of several different innovative mobile apps, each of which provides a unique set of benefits and value to members.

The primary app is the myCigna mobile app, which is designed to offer a simple, streamlined way to organize and access important health information. It lets users find doctors or health care facilities, view ID card information, review deductibles and claims, and more.

The Cigna Envoy mobile app is for global mobile customers who want to see their health benefit information on the go.

Coach by Cigna is a lifestyle app focused on five primary areas which include exercise, food, sleep, stress, and weight. It delivers recommended programs designed to meet personal needs and goals, and it features a team of health coaches with motivational and instructional video messaging.

Read More: Best Life Insurance Rates & Charts | Tips to Get the Best Life, Term, and Whole Life Rates

eHealth Review

eHealth is unique from the other names on this list of medical insurance companies, because rather than being one of the direct health insurance companies, it’s a marketplace where consumers can go to find top health insurance companies. AdvisoryHQ felt it was important to include eHealth on this list because it is widely considered one of the best resources and marketplaces to connect with health care insurance companies and compare health insurance.

As it stands today, eHealth has enrolled more than five million people in coverage with private health insurance companies, and it’s licensed to market and sell health insurance in all 50 states, as well as in the District of Columbia.

Key Factors That Enabled Us to Rank This as One of the Top Resources to Find the Best Health Insurance Companies

While eHealth isn’t one of the direct private health insurance companies on this list of health insurance companies, the following are some reasons it was included in this health insurance comparison.

Choices

When making a decision that’s as important as choosing which of the top health insurance companies to get coverage from, having the ability to quickly and easily compare the options is important. It’s also important to have a broad selection of providers to choose from, and these are both essential aspects of the eHealth platform.

Site visitors can browse more than 180 health insurance companies that eHealth has partnerships with, and there are more than 10,000 health insurance products offered through these customers.

Customer Promise

As part of their unique business model, eHealth goes beyond just helping consumers compare health insurance and locate the top health insurance companies. They have a detailed Customer Promise that shows their commitment to helping all of their clients shop for health care insurance companies in the best way possible.

This customer promise includes the following:

- eHealth will be the advocate for customers if they ever need help dealing with health insurance companies in terms of claims, billing, or any other needs

- eHealth will have the best prices on any products they sell from medical insurance companies

- This website commits to having the largest selection of health insurance products available online in the U.S.

- The site strives to be available to customers to provide support whether it is by phone, online chat, or email

- There are no fees charged for their services

- They will remain unbiased

- eHealth strives to make the process to compare health insurance and private health insurance companies as simple as possible

Small Business

As well as connecting families and individuals with the best health insurance companies, eHealth also has service areas specifically geared toward the needs of small-business owners searching for company health insurance.

Small-business owners can use the many search tools to find the best options for their employees based on factors such as the number of employees they have, and they can receive free online quotes, with no obligation.

eHealth offers not only tools to find and connect with company health insurance providers and the overall top health insurance companies but also informative resources to help small-business owners make the right decisions when it comes to their employee’s health care and coverage.

For example, eHealth created an in-depth buyer’s guide for self-employed people and small-business owners.

Source: eHealth Insurance

ACA Education and Resources

Much of the service provided by eHealth is based on helping consumers not just find a list of health insurance companies, but instead to understand the ins and outs of health insurance, which can often be a source of frustration and confusion.

As part of this, eHealth offers in-depth guides that are easy to understand and don’t just detail what’s provided by individual health care insurance companies, but also how the Affordable Care Act impacts these providers and consumers.

This dedication to education of consumers is an important reason eHealth was included in this health insurance comparison.

HCSC Review

HCSC (Health Care Service Corporation) is unique from many of the other medical insurance companies included on this list because not only is it not as well-known as other insurance carriers in the U.S., but it’s a customer-owned insurance provider that includes several carriers and their subsidiaries. The largest subsidiaries that make up HCSC include Blue Cross and Blue Shield of Texas, Montana, Illinois, and Oklahoma.

HSCS has more than 20,000 employees and around 15 million policyholders, making it one of the larger health care insurance companies in the country. HSBC was originally created in 1936, and the first policy was written in 1937.

Key Factors Leading Us to Rank This as One of the Top 10 Health Insurance Companies

When reviewing and ranking the best health insurance companies and company health insurance providers, the following are some of the main reasons HCSC stood out and was included on this list of health insurance companies.

Customer-Owned

Perhaps one of the most pivotal reasons HCSC was included in this ranking of the best health insurance companies is because of their customer-owned structure. Many other health insurance companies are owned by stockholders, but when customers own the company, that means it’s able to focus solely on their needs rather than the expectations of the shareholders.

Unlike many other private health insurance companies, HCSC isn’t required to make sure investor returns are maximized, giving them the ability to not just provide the highest possible level of customer care, but also make sure health care financing, access, and delivery are all based on a long-term perspective.

Awards and Recognitions

While HCSC might not be as well-known by consumers as some other health insurance companies, they do garner quite a few awards and recognitions in the industry. Some of the recent ones include:

- Civic 50 Winner

- World’s Most Ethical Companies from Ethisphere.com

- National Business Group on Health Best Employers for Healthy Lifestyles Platinum winner

- Center for Plain Language ClearMark Award

- Training Magazine’s Top 125

- Bronze and Silver Telly Awards

- Military Friendly Employer

- Illinois Healthiest Employer

Programs for Healthy Living

Like many of the top 10 health insurance companies included in this health insurance comparison, HCSC offers quite a few programs aimed at helping members live healthier, more fulfilling lives while being empowered regarding their health and their health care spending.

HCSC features wellness programs including Blue Care Connection, which offers both condition and care management. Members also have access to Well onTarget, a comprehensive wellness package offered through a secure website; lifestyle management programs; and the signature Special Beginnings Maternity program.

The 24/7 Nurseline is available so that members can have constant access to registered nurses who can answer their questions related to health, and the Fitness Program offers affordable access to nationwide fitness centers.

Convenience Tools

When looking at the best health insurance companies, there is a clear move toward making insurance and coverage information as convenient and accessible for possible for beneficiaries.

With that in mind, HCSC, a leader among private health insurance companies, offers several online tools with constant access to account information.

The first is called Blue Access for Members (BAM), and it’s a secure member website where beneficiaries can check the status of their claims, review their Explanation of Benefits statements, find a doctor or hospital, order a replacement ID card or print a temporary card, and use the Cost Estimator to research and estimate the costs of services and treatments.

Members of HCSC can also sign up to receive text or email notifications regarding claims information, prescription drug reminders, and tips for diet, exercise, and condition management.

Related: Top Best Payday Loan Lenders | Ranking | Payday Loans Companies

Humana Review

Humana, named one of the best health insurance companies in this ranking of the top 10 health insurance companies, is headquartered in Louisville, KY. The company works to implement a holistic approach to health care coverage that includes care delivery, member experience, and insights on both the consumer and clinical end.

A for-profit insurance company, it’s been ranked in the past as the third largest health insurance provider in the nation. Humana was originally founded in 1961 as Extendicare, Inc.

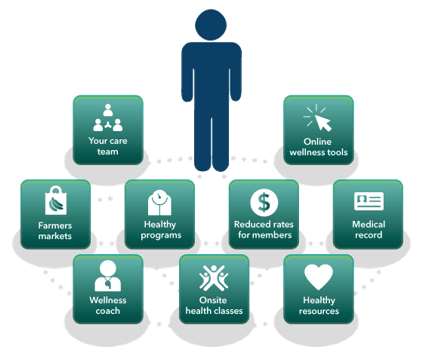

Image Source: Top Health Insurance Companies

Key Factors That Led to Our Ranking of This as One of the Top 10 Health Insurance Companies

Areas Humana excels in compared to other medical insurance companies and private health insurance companies are detailed below.

Care Manager

Humana does well in not only offering excellent coverage options when compared to other health insurance companies, but they also offer members access to some unique benefits.

For example, one of these is the assignment of a dedicated care management for holders of the Medicare Advantage Plan. For 30 days after a hospitalization, the patient will have a care manager who can help them understand what’s happening and create a customized plan for their needs.

Care managers can help members understand the advice of their care providers, learn about their medicines, get to medical appointments, coordinate with their health care team, and be connected to financial resources.

This service is provided at no additional cost to qualifying Humana members.

Simple Tools to Choose Plans

There are so many plan options available from health care insurance companies, and Humana strives to be different from other health insurance companies by making it easy for consumers to compare health insurance and choose the right plan for them.

Choosing a plan from Humana can be done in three simple steps. The first step involves visiting the Humana website and requesting a quote, which will show details of price and coverage details for plans available in the inquiring consumer’s area.

Then, Humana encourages consumers to find a plan that balances the coverage they want with the premium they can afford.

Finally, once a plan is selected, consumers can enroll online using the secure Humana website. At this time, consumers may also be able to sign up for other plans, such as dental coverage, without filling out any other information.

Humana Pharmacy

One area where Humana offers services unique from many other names on even this list of health insurance companies is their comprehensive prescription drug coverage, provided through a program called Humana Pharmacy.

Humana’s pharmacy network includes both retail stores and mail delivery service, and some of the tools available through this program include mail delivery, a Humana Drug List search, a pharmacy locator, and electronic prescribing.

Humana Pharmacy can also be used to help members save money on the cost of prescriptions, and there are patient assistance tools available.

Options for the Self-Employed

A significant source of confusion for many consumers is how to handle insurance if they’re self-employed. They may not be able to get company health insurance, but they are unsure of the right policy for their needs. Humana offers guidance specifically for self-employed consumers, with a range of plans to fit their budget and to provide coverage to their families as well.

Humana outlines the options self-employed people have to find a policy including contacting an agent or finding a plan through the Health Insurance Marketplace.

They also describe the criteria for financial assistance eligibility, and there is a Humana tool called EasyPrice that lets consumers see whether they qualify for financial assistance on the cost of their coverage.

Kaiser Permanente Review

Kaiser Permanente leads the way among affordable health insurance companies, which is one of the many reasons it’s included as one of the top 10 health insurance companies on this ranking. KP has been providing health care for more than 60 years, and the company remains dedicated to improving the health of not only its members but also the communities it serves.

KP was founded in 1945 and today is one of the largest not-for-profit health plans in the United States with more than 10.6 million members. The KP headquarters are in Oakland, California, and regions served include northern and southern California, Colorado, Georgia, Hawaii, the Mid-Atlantic states, and the Pacific Northwest.

Key Factors That Enabled This to Rank as One of the Top 10 Health Insurance Companies

When reviewing health insurance companies to compare health insurance options, the following are some reasons KP was included as part of this list of the top health insurance companies.

A Simplified Experience

One of the primary complaints consumers have when they start to compare health insurance and choose the best health care insurance companies is that they feel like it’s a confusing and challenging experience. Even once they’ve decided between medical insurance companies, they still find that they’re in the dark about many elements of their care and coverage.

One of the primary goals of KP and a big reason they’re included in this ranking of the top health insurance companies is that they create a simple, seamless experience.

It all comes down to something KP calls “hassle-free health,” and it begins right away. It’s easy to find a plan to suit your needs and budget, and once you enroll, you can visit the KP new member online center to choose your doctor, transfer your prescriptions, and do everything else.

Preventative Care

Much of what KP offers to members as one of the leading health care insurance companies on this top-ranking list of health care insurance companies is based on preventative care. They strive to approach care as if the members of their insurance community are “more than the sum of their symptoms.”

KP coverage includes preventative screenings and routine appointments, managed through the patient’s electronic health record, so their dedicated team knows when they’re due for these appointments and preventative checkups.

The collaborative team approach to health care undertaken by KP includes automatic preventative care reminders, tracking exercise as a vital sign, and providing access to classes, personal wellness coaching, and other convenient resources to help them live a healthier lifestyle.

Free Perks and Extras

When a member joins KP for insurance coverage, they receive access to a wide variety of benefits and perks that don’t cost extra.

These include:

- Healthy lifestyle programs on topics like losing weight, quitting smoking, and having better sleep habits

- Health classes

- Personal wellness coaching in a one-on-one setting

- Special rates on fitness clubs, massage therapy, and more

Source: Kaiser Permanente

Company Health Insurance Plans

KP offers a separate segment of their business specifically for employers searching for low-cost, valuable company health insurance plans. Employers can log on to the KP employer website to preview online services and manage their company health insurance coverage.

Available company health insurance plans vary by region, but they are broken down into options for small businesses and large businesses, with 101 or more employees.

Small business plan options available from KP, one of the most affordable health insurance companies, include bronze, silver, gold, and platinum plans. There are also chiropractic benefit options and dental plans available. For larger businesses, options include HMO plans, deductible plans, out-of-area indemnity plans, supplemental benefits, and more.

Don’t Miss: Check Into Cash Reviews—Is it Legit? What You Need to Know about Check-Into-Cash.

Molina Healthcare Review

Molina Healthcare, one of the number one affordable health insurance companies, was founded by an emergency room doctor, C. David Molina, MD, after he realized low-income, uninsured, and non-English speaking patients were using the emergency room for general health care. Dr. Molina wanted to do something to help underserved families, and he started with a clinic for low-income individuals and families in Long Beach, California.

Today, Molina is one of the leading medical insurance companies, and their plans serve patients nationwide. As of 2015, Molina had 3.5 million members.

Key Factors That Led Us to Rank This as One of the Top Health Insurance Companies

During the process to compare health insurance providers and the leading affordable health insurance companies, the following details represent some reasons Molina was included in this ranking.

Molina Health Plans

To compare affordable health insurance companies and select the top health insurance companies, it’s important to look at the specific types of coverage they offer, along with the benefits of each.

Molina health plan options include:

- Molina Medicare: As one of the nation’s leading affordable health insurance companies, Molina offers Medicare Advantage plans for individuals with Medicare or a combination of Medicaid and Medicare coverage. The plans include access to a wide network of doctors, hospitals, and other providers, with little to no out-of-pocket costs.

- Integrated Medicaid/Medicare: Molina is unique from many other health care insurance companies because the company has been selected for dual-demonstration projects to create member-centric health care for people who have eligibility for Medicaid and Medicare.

- Molina Marketplace: The Marketplace offers plans in many of the states where Molina features Medicaid health plans. These plans are designed to help Medicaid members stay with their providers during the transition from Medicaid to the Marketplace, and they alleviate financial barriers to quality care while keeping out-of-pocket expenses low.

Quality Improvement Program

Molina, one of the country’s best health insurance companies and leading affordable health insurance companies, has something called the Quality Improvement Program. The goals of this program include improving the quality of care, safety, and overall quality of service. Along with the elements of this program, Molina works to address unique cultural and language needs of their members and provide coordinated care for members with a complexity of requirements.

As part of this program, Molina, one of the best health insurance companies, looks at safety reports in hospitals, nursing, and surgery centers. This allows them to ensure members and their families are safe.

Molina is also constantly working to expand and improve programs and services based on market research and surveys of patient satisfaction.

My Molina

All of the best medical insurance companies included on this list of the top 10 health insurance companies offer conveniences such as online portals where members can go to access information, manage their care and do other things related to their coverage.

Molina is no exception, and as one of the best health care insurance companies, they offer the My Molina portal.

This online platform lets members log in and change their doctor, update their contact information, or request an ID card. They can also opt in to receive health reminders on the services they need, view their service history, and if applicable, make a payment.

Government-Funded Specialization

One of the most unique things about Molina as compared to other health care insurance companies included in this ranking of the top 10 health insurance companies is that they don’t just offer access to government-funded programs—this is where they specialize.

Molina focuses its service on the delivery of health care and information management solutions for five million people and their families who receive health care through Medicaid, Medicare, and other government-funded programs. This is available across 15 states.

This is important because Molina understands the complexities of government-funded care and can work with members to address various issues they may have as patients enrolled in these programs.

Popular Article: LendUp Reviews—Is LendUp Legit & Safe for a Loan? Competitors & Sites Like LendUp

UnitedHealthcare Review

UnitedHealthcare is one of the most well-known names on this list of the top health insurance companies and operates as a division of UnitedHealth Group. UnitedHealth Group is the largest single health carrier in the United States.

UnitedHealthCare has several goals that make it one of the best health care insurance companies including improving the quality and effectiveness of health care for Americans, offering greater access to health benefits, and designing and offering products and services that increase the affordability of health care. The overall mission of UnitedHealthcare is to help people lead healthier lives while simultaneously paving the way for the health system to work better for everyone.

Key Factors Considered When Ranking This as One of the Top 10 Health Insurance Companies

After taking the time to compare health insurance options and the top health insurance companies, the following are some primary reasons UnitedHealthcare ranked well.

Short-Term Health Insurance

UnitedHealthcare, a leader among private health insurance companies was included on this list of health insurance companies for many reasons including the provision of short-term health insurance, designed to bridge gaps in coverage. It’s a flexible coverage solution specifically for transitional periods.

Short-term insurance from UnitedHealthcare, one of the top affordable health insurance companies, may be ideal for someone who can’t apply for the ACA because they missed Open Enrollment, and they don’t qualify for Special Enrollment.

It can also be used for people waiting for their ACA coverage to begin, looking for a Medicare coverage bridge, people who are turning 26, and those people who are between jobs and waiting for new benefits to become effective at their new place of employment.

Innovation

UnitedHealthcare is one of the country’s leading medical insurance companies for many reasons, and one of the big ones is their dedication to remain innovative and leaders in the industry.

UnitedHealth Group was the top-ranking insurance and managed care company on Fortune’s list of the “World’s Most Admired Companies,” and it’s been ranked number one in its sector for innovation.

Examples of their recent innovations include Solutions for Caregivers, which is a program for people who work for large employers, and it provides resources for caregivers to save money and provide better care for aging or disabled family members. UnitedHealthcare also introduced a fast-track chemotherapy approval program as a new approach to cancer treatment, among many other innovations.

Virtual Visits

When covering UnitedHealthcare and why it’s a leader among the top health insurance companies, it’s important to mention their unique Virtual Visits as well. A Virtual Visit delivers the utmost in convenience, and the costs are usually lower than what a patient would pay when visiting a doctor’s office, urgent care center or emergency room.

To take advantage of this service, members log in to myuhc.com and search for Virtual Visits. They can then register, request appointments, and pay a portion of the appointment cost based on their medical plan. They’re then directed to a virtual waiting room, and they will typically be seen in 15 minutes or less.

Virtual Visits are a great option for non-emergency care when a member’s doctor isn’t available, they become sick while traveling, or they’re thinking about visiting a hospital for a non-emergency condition.

Health4Me Mobile App

When consumers begin to compare health insurance and look for the leading health care insurance companies, convenience and accessibility are often a top priority.

With this in mind, UnitedHealthcare created the Health4Me mobile app, which delivers members instant access to their health information.

Users of Health4Me can search for nearby physicians or facilities, estimate medication costs, manage prescription claims, view and share member health plan ID card information, and contact a registered nurse on-demand with medical questions. The app can also be used to check deductible and out-of-pocket spending status, view and pay claims, and check health reimbursement and flexible spending and health saving account balances.

Conclusion—The Top 10 Health Insurance Companies

This list of health insurance companies focuses on some of the criteria that’s most important to the consumer when they’re choosing health care insurance companies as an individual, or they’re a business owner searching for company health insurance plans.

Some of these considerations include not only the basics such as the price of coverage, but also the range of available plans, whether they support government insurance programs, and features and benefits available to members such as wellness programs and mobile apps.

Another key consideration used when compiling this list of the top health insurance companies? Simplicity and transparency.

Most consumers feel lost when it comes to health insurance in today’s marketplace, but the above names on this list of the best health insurance companies strive to provide services and products that are convenient, straightforward, and easy to understand.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.