2017 RANKING & REVIEWS

TOP RANKING BEST BUSINESS CHECKING ACCOUNTS

Intro: Finding the Best Business Checking Accounts

A business checking account is essential for businesses in many ways.

Selecting a top rated best business checking account will offer you the needed tools for not just monitoring things like spending and deposits, but also for maintaining control over finances even when several partners or employees have access to accounts.

With a top business checking account, you can have debit cards issued to different employees of the firm, and you can also set specific controls to maintain employee spending.

Award Emblem: Top 12 Best Business Checking Accounts

Expected Features: Best Business Bank Accounts for Small Business Owners

In addition, going with a top ranked best small business checking account will offer easy visibility into every aspect of the firm’s money management, including what’s coming in and going out.

Many of the best small business bank account options will also feature added tools such as cash flow management options and tools that promote growth.

The names on this review and list of the best small business checking accounts are superior in terms of the above criteria, and they provide business owners with the flexibility, features, and technology they need to maintain consistent monitoring, security, and efficiency, while also allowing them to focus on the day-to-day operations of their business.

AdvisoryHQ’s List of the Top 12 Best Business Checking Accounts

This list is sorted alphabetically (click any of the below names to go directly to the detailed review for that best checking account for small business).

- Bank of America Business Fundamentals

- Capital One Spark Checking

- Chase Performance Business Checking

- CitiBusiness Flexible Checking Account

- First National Bank 300 Class Checking

- HSBC Business Checking

- PNC Analysis Business Checking

- SunTrust Analyzed Business Checking

- TD Bank Business Premier Checking

- U.S. Bank Platinum Business Package

- Wells Fargo Business Choice Checking

- Wells Fargo Platinum Business Checking

Click here for 2016’s ranking of the Top 12 Best Business Checking Accounts

Top 12 Best Business Checking Accounts for Small Business Owners | Brief Comparison & Ranking

Best Business Checking Accounts | Highlighted Features |

| Bank of America-Business Fundamentals | Robust online banking features |

| Capital One-Spark Checking | Easily link to an interest-bearing Spark Savings account |

| Chase-Performance Business Checking | Account activity can be downloaded to Quicken, QuickBooks, or Microsoft spreadsheet software |

| Citibank-CitiBusiness Flexible Checking | Wide range of receivables management tools |

| First National Bank-300 Class Checking | Money movement services help businesses stay on top of incoming and outgoing cash |

| HSBC-Business Checking | Maximize cash flow with the MasterCard BusinessCard |

| PNC-Analysis Business Checking | Dynamic Cash Flow solutions |

| SunTrust-Analyzed Business Checking | MasterCard Business Debit Card makes it easy for business owners and employees to access funds |

| TD Bank-Business Premier Checking | BusinessDirect mobile app allows for on-the-go financial management |

| US Bank-Platinum Business Package | Preferred interest rates for Cash Flow Manager |

| Wells Fargo-Business Choice Checking | Comprehensive online resource center helps small businesses learn about financial management |

| Wells Fargo-Platinum Business Checking | Discounts on merchant services payment processing |

Table: Top 12 Best Business Checking Accounts | Above list is sorted alphabetically

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review—Top Ranking Best Business Checking Accounts

Below, please find a detailed review of each account on our list of best small business checking accounts. We have highlighted some of the factors that allowed these business checking accounts to score so high in our selection ranking.

See Also: Free Business Banking Guide | Chase, Citi, PNC, Wells Fargo Business Banking Reviews

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Bank of America Business Fundamentals Review

Bank of America describes the Business Fundamentals account as a best checking account for small business needs. Bank of America is part of a global financial community that strives to maintain a local focus to the communities and regions served.

Bank of America has a history spanning more than two hundred years, and today the bank serves 47 million consumer and small business relationships, which includes 4,7000 retail financial centers and 16,000 ATMs.

Specifically, three million small business owners are served through the products and services offered by Bank of America.

Key Factors That Enabled This Account to Rank as a Best Small Business Checking Account

Below are some of the factors that led to the inclusion of the Business Fundamentals Checking account on this ranking of the best bank accounts for small business.

Small Business Online Banking

When small businesses are account holders of the Business Fundamentals checking account, they have access to Small Business Online Banking from Bank of America.

This allows business owners to run their operations more efficiently and effectively, while managing their finances and money in a way that’s secure and simple.

Some of the features of Small Business Online Banking from Bank of America include:

- Real-time balance information

- Access to pending transaction information

- 12 months of sortable online transactions

- 18 months of online checking and savings statements, as well as paperless options

- Transaction downloads to QuickBooks

- Automatic account alerts

- Self-service account requests

- Industry-standard online security

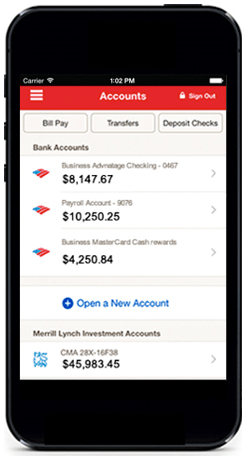

Mobile Banking

When searching for the best small business checking options, as along with offering access to online banking, mobile accessibility can be of the utmost importance.

Having access to your business banking on your mobile device can help you conduct business from anywhere and stay ahead of your finances.

The Bank of America Business Fundamentals account includes mobile banking, which offers the ability to check balances for all accounts, transfer balances between accounts to pay vendors or employees, and make sure your vendor payments have posted. You can also track your recent and pending transactions.

Image Source: Bank of America

Business Debit Cards

Enrollees in the Business Fundamentals account can use Business Debit Cards and Employee Debit Cards, which allow them to streamline how they track and manage their business spending of all kinds. This provides the ability to make transactions at worldwide Bank of America ATMs and retail banking centers.

The Business Debit Card is designed for business checking accounts, and you can link up to 15 accounts to each card.

It replaces petty cash to simplify expense tracking, it’s usable anywhere Visa or MasterCard debit cards are accepted, purchases are itemized in monthly and online statements for easy tracking, and all debit cards include Total Security Protection.

With the employee debit card options, which are designed for employees of business checking account holders, you can create and update monthly debit card spending limits for employees, and it’s an ideal way to track expenses.

Fee Waiver

This best checking account for small business banking does include a $14 monthly fee, but this can be avoided by doing just one of the following:

- Spending $250 on new purchases on a business debit or credit card

- Maintaining an average monthly balance of $5,000 or more

- Maintaining a minimum daily balance of $3,000

- Process $500 in net Clover® Go On Demand sales

- Maintaining a combined average monthly balance of $15,000 or more in your linked Bank of America accounts

Capital One Spark Checking Review

The Spark Business Checking account from Capital One is one of the country’s best small business checking account options, and it includes many features that led to its selection on this small business checking account comparison and ranking.

Capital One is a diverse bank, offering a range of products and services to not only small business but also consumers and commercial entities.

Capital One is a Fortune 500 company and one of the top 10 largest banks in the U.S. based on deposits. It’s headquartered in McLean, Virginia, and serves the needs of clients throughout not only the U.S. but also Canada and the U.K.

Image Source: Best Small Business Bank Accounts

Key Factors That Led Us to Rank This as a Best Small Business Bank Account

The list below highlights some of the reasons the Spark Business Checking account was included on this list of the best business accounts for small business.

No Limits

The foundation of the Spark Business Checking account, and what makes it so unique, is the concept of “no limits.”

It’s designed to give owners the freedom to run their business in the way they see fit, without restrictions and limitations, including minimum balance requirements, monthly fees, ATM fees, and monthly transaction fees or limits.

One of the key features of Spark Business is free electronic invoicing and bill pay, making this account a best business checking account for businesses that utilize online resources.

Business Benefits

The Spark Business account offers the following features and benefits that make it ideal for busy small business owners who want to focus on their operations and profitability, rather than their banking:

- Deposits are available the next day

- Enrollees receive a free debit card

- Digital tools include free online bill pay

- You can link your digital Spark Business Savings account for overdraft protection

- Deposit checks with a photo from your smartphone

- You’ll have access to 40,000 fee-free ATMs throughout the country

- Take advantage of convenient and free electronic invoicing

Online Invoicing

Invoicing is an essential part of operating a business because it’s how you maintain cash flow and make sure you’re being paid.

Rather than using several outside programs to manage the sending and tracking of invoices, enrollees in Spark Business Checking can instead use their bank account to manage invoices, all from their mobile device.

They have the ability to send electronic invoices to customers, receive notifications when they’re paid, and also set up automatic payment reminders for bills.

Spark Business Savings

Spark Business Checking customers can also open a Spark Savings account, which offers some of the best savings rates in the country, which is currently 1.00% APY for 12 months.

This account can be linked to your Spark Checking account to protect you against overdraft fees and returned checks, and it carries no monthly service charges or minimum balance requirements.

You can also access your Spark Business savings account anytime and anywhere using the mobile app.

Don’t Miss: Best Ways to Open a Business Checking Account Online | Guide | What You Need to Know

Chase Performance Business Checking Review

Chase is a U.S.-based consumer and commercial banking business with assets of $2.4 trillion, as well as global operations.

Chase serves almost half of America’s households, and their services range from personal and small business banking to investment and mortgages. There are 5,200 Chase branches and 16,000 ATMs.

Unlike many of the other names on this list, which are the best small business checking accounts, the Chase Performance Business Checking account is designed specifically for the needs of mid-sized organizations.

Key Factors That Enabled This Account to Rank as a Top Business Checking Account

Highlighted below are some of the key reasons the Chase Performance Business Checking account was included in this business bank account comparison and ranking.

Online Banking and Bill Pay

When you enroll in any of the business checking account options from Chase, you receive access to online account management and bill pay, which makes it simple and fast to manage your business finances from anywhere.

Some of the features of online business banking with Chase include:

- Fraud protection

- Paperless statements

- Access Manager lets you set up multiple users to manage your account

- You can download account activity to Quicken, QuickBooks, and Microsoft spreadsheet software

- Account alerts receivable by text, email, or phone if your account is overdrawn, goes below a certain balance level, or approaches any custom alert you create

Cash Flow Control

One of the critical reasons the Chase Performance Business Checking account was selected for this business bank account comparison are the cash flow tools that help business owners manage their business with payable and receivable services.

Cash flow tools and services that come along with enrollment in the Performance Business Checking account include:

- QuickDeposit so you can deposit checks online, anywhere and at any time

- ACH collections

- Online bill pay

- Wire transfers

- Basic payroll and other payroll solutions

- Account transfers between your Chase accounts, as well as external transfers

- Access to Chase QuickPay, which lets you send money to anyone, anywhere

Tax Payment Services

Account holders with business accounts from Chase, including Performance Checking, can utilize tax payment services. You can pay your FICA and other federal taxes through Chase online, which is secure and saves business owners time and effort.

You can directly deposit your payments with the IRS, and also use your online banking to see up to 13 months of payment history. This gives accountholders a great sense of visibility and control over their tax payments, making sure nothing slips through the cracks.

Also, there are minimal fees, and business account holders pay just $5 per month for the service, no matter how many payments they’re using it to make.

Features

The specific features of the Performance Business Checking account that led to its inclusion in this ranking of the best business checking accounts include the following:

- The monthly service fee is waived when you maintain qualifying business deposit balances of $50,000

- You’re allowed up to 350 transactions each monthly statement cycle without a fee

- You can make up to $20,000 in cash deposits each month without an additional fee

- Two domestic wire transfers are included per month at no charge

- You have constant access to online banking as well as the Premier Service Line phone-based banking service from Chase

Citibank CitiBusiness Flexible Checking Review

Citibank serves more than 110 million customers in cities located in 19 countries throughout the world, and there are more than 3,000 branches in the world’s top 100 cities.

In 2015, Citi had more than $300 billion in deposits and $139 billion in average assets. Citi is also the world’s largest credit card issuer.

Citi offers many products and services designed for businesses, including the CitiBusiness Flexible Checking Account, which is one of our selections for the best small business checking account.

Key Factors That Allowed This Account to Rank as One of the Best Business Bank Accounts for Small Business

When considering the broad criteria and creating this best small business checking account comparison, the following are some of the reasons the CitiBusiness Flexible Checking Account was included as one of the best business accounts for small business finances.

Receivables Management

Business accounts from Citi include a number of features designed to help business owners better control cash management, including how they receive money to make sure cash flow is always optimized.

Some of the receivables features that come with Citi business checking accounts include:

- Popmoney for Small Business, which is an electronic payment and invoicing system

- Citi Merchant services make it easier for customers to pay using more methods, which is convenient and can improve sales

- Remote Check Deposit

- CitiBusiness Lockbox lets you receive funds faster from paper checks when Citibank receives them on your behalf at a designated P.O. Box

Payroll Manager

How and when you pay your employees is one of the most important aspects of running a business, so CitiBusiness products include Payroll Manager, which makes it easy to manage the details.

With Payroll Manager, you can take advantage of an affordable service that leads to payroll processing in seconds. The service also includes the ability to calculate and file payroll taxes on the behalf of your business.

Flexibility

As the name implies, this particular CitiBusiness account is designed for business owners who want versatility and flexibility in how they bank. This account is designed for businesses with a high number of transactions each month and average monthly balances of at least $10,000.

It’s ideal for businesses with 300 to 500 transactions each month, and when the minimum balance is maintained, there are no monthly fees.

Users also enjoy no withdrawal fee at Citibank ATMs and FDIC insurance protection.

Diverse Services

When you enroll in a CitiBusiness Flexible Checking Account, you receive access to the following features and benefits:

- CitiBusiness Debit Card

- CitiBusiness Checking Plus Overdraft Protection

- CitiBusiness Safety Check

- CitiBusiness Preferred Banking

- Earnings Credit

- Cash Management Service

- Access to CitiBusiness Online banking

Popular Article: Best Banks for Small Business Accounts | PNC vs Chase vs Wells Fargo Small Business Banking Reviews

First National Bank 300 Class Checking Review

First National Bank was founded in 1857, and since that time, they have served the needs of a range of customers and have grown to be the largest privately-owned bank holding company in the U.S. First National Bank has $20 billion in assets and serves seven states throughout the U.S.

The FNB Business 300 Class Checking account is a flexible banking solution designed for a range of businesses, which allows them to manage their money more effectively and efficiently.

Key Factors That Enabled Us to Rank This as One of the Best Business Checking Accounts for Small Business

When creating this best small business checking account comparison, the following are some of the reasons the FNB 300 Class Checking account was included in this ranking.

Free Transactions

With Business 300 Class Checking from FNB, account holders receive 300 free transactions per month, and the fee is only $0.25 after those initial free transactions.

There is no monthly maintenance fee for customers who maintain a $5,000 minimum balance, and if this balance isn’t maintained, the maintenance fee is only $10 per month.

The fee can also be waived with a monthly balance of $15,000 in all related business deposit accounts held at First National Bank.

Business Debit Cards

Holders of the Business 300 Class Checking account from First National Bank receive a free Visa Business Debit card. This debit card allows users to make up to $5,000 per day in purchases from merchants, or access up to $1,000 per day in cash from ATMs.

The Business Debit Card is also beneficial because it provides simplified record-keeping for business owners, excellent security, universal acceptance throughout the world, and zero liability fraud protection.

Online Banking

Business account holders at First National Bank have access to Online Banking, which lets account holders manage their business accounts in a way that’s safe, secure, and convenient, at any time.

It’s ideal for busy business owners who are on the go but want to maximize control and visibility of their finances.

Features of FNB Online Banking include:

- Dashboard that lets account holders view all of their frequently used accounts, plus “quick links” to the services they use most often

- Account details include balances, transaction reviews, check images, and download activity

- View tax and account statements online

- Receive email alerts on account status

- Place, cancel, and renew Stop Payments on checks

- Manage users based on accounts, tasks, and authority

Money Movement Services

When enrolled in the FNB 300 Class Checking account, which is designed as both a small business checking account as well as an option for mid-sized businesses, account holders have the opportunity to take advantage of money movement services.

These services are designed to give business owners more control and convenience over how their finances and money are managed.

Features include the option to expedite cash flow, as well as simplified management of transactions and accounts.

Users can set notifications, alerts and various reminders that will be automatically sent to their mobile device, or their email, and these services include the option to create customized permissions, as well as company and payee profiles.

Specifically, money movement services that are available to business checking account holders at FNB include BillPay, Payroll, and Invoicing.

HSBC Business Checking Review

HSBC is a banking and financial institution founded in 1865, initially as a way to create trade between the West and Asia.

Today, HSBC is one of the top financial institutions in the U.S. with more than 37 million customers. The approach of all banking services provided by HSBC, including business banking, is intended to create long-term relationships with customers.

HSBC Business Checking is designed specifically for business owners who want powerful financial tools and services, combined with the international capabilities and offerings that define HSBC.

Key Factors Leading Us to Rank This as One of the Best Business Bank Accounts for Small Business

The list below represents some of the reasons HSBC Business Checking was selected for this best small business checking account comparison and ranking.

Business Protection

One of the many reasons the HSBC Business Checking account was chosen as a best bank account for small business is because it allows for life insurance and succession planning–two key components of HSBC’s Business Protection.

In creating this small business bank account, HSBC acknowledges that people are often the most important resource that a business can have. As such, HSBC offers life insurance for key employees, with policy death benefits for:

- Recruiting

- Training

- Impact on profits

- And more

Succession planning helps protect businesses through events like retirement, disability, or death of a co-owner.

Opening a business checking account with HSBC provides powerful tools for businesses to stay ahead of road blocks and effectively plan for the future, making this a dynamic checking account for small and large businesses alike.

HSBCnet

Customers who take advantage of small business checking accounts from HSBC, including the signature Business Checking account, also have access to HSBCnet, which is the bank’s award-winning online banking portal.

HSBCnet lets business clients pay bills, stop payments, view account balances, and more — from anywhere. You can start and manage global payments and receivables, as well as investments.

Some of the features include online payments in USD or foreign currency, the ability to see real-time transaction reporting, email alerts, and options to make deposits and transfer funds between accounts.

Cash Management Services

The HSBC Business Checking Account includes several cash management services to ensure streamlined and smooth operations for business owners. Some of these features and functionalities include:

- Installation of payment terminals

- Lowered discounts on card payments

- Next business day funding availability by linking your Business Checking account

- Electronic payment authorization to protect accounts from unauthorized ACH debits/credits

- Wire transfers

- Controlled disbursement to eliminate confusion when funding check payments

HSBC MasterCard BusinessCard

When you opt to take advantage of the Business Checking account from HSBC, which is one of the best bank accounts for small business as well as larger organizations, you can apply to receive an HSBC MasterCard BusinessCard®.

This card is designed to be an ideal cash management tool for businesses and lets you maximize cash flow while simultaneously earning rewards points.

You can issue cards to individual employees, and a specific spending limit can be set. A monthly cardholder statement is issued for each user, and there’s company-level billing, which makes reconciliation easy.

Other features include a year-end summary statement, and when you enroll in the Rewards Program, you can earn points that are put toward air travel, restaurants, retailers, and more.

Read More: Best Business Bank Account This Year | Chase vs Wells Fargo vs Bank of America Business Account

Free Wealth & Finance Software - Get Yours Now ►

PNC Analysis Business Checking Review

PNC has been serving the diverse financial and banking needs of customers for more than 160 years. PNC services are designed for anyone from individuals and small businesses to corporations and government organizations, and they provide specific services that include deposits, lending, cash management, and investment options.

PNC has more than 8 million consumer and small business customers throughout the country, with a strong national presence in 19 states and the District of Columbia.

Selected for this small business bank account comparison and ranking, the PNC Analysis Business Checking account is ideal for businesses that have higher transaction volumes, multiple checking accounts, or larger balances.

Key Factors That Enabled This to Rank As one of the Best Business Bank Accounts for Small Business

Below are some of the primary reasons PNC’s Analysis Business Checking account was included in this business bank account comparison.

Cash Flow Solutions

One of the key benefits of the PNC Analysis Business Checking account are the cash flow solutions. With Cash Flow Insight—Receivables, account holders can create branded invoices online, track the money that’s expected, see payment activity and schedule reminders, for a small monthly fee.

Other Cash Flow Solutions available in conjunction with this particular small business checking account include:

- PNC Merchant services for next-day funding on payment processing transactions deposited to a PNC business checking account

- DepositNow is a remote deposit solution for businesses

- Cash Flow Insight for Payables includes the ability to pay, schedule, and archive bills quickly and easily

- Cash Flow Insight—Base is a program option that lets you gain insight to make strong and more informed financial decisions

Simplicity

When you do your banking with PNC, the goal is to make it as fast, easy, and manageable as possible for business owners. One way PNC offers ease-of-use is through the ability to link multiple PNC business checking accounts together.

This improves consolidation, streamlines bookkeeping, and minimizes service charges. Users can also view all of these accounts through their free online banking services.

Offset Account Fees

One feature that’s unique to the offerings of the PNC Analysis Business Checking account is the option to have checking that “pays for itself.”

When you make deposits or maintain certain deposit balances, you earn credits, and these credits are then applied to reduce or even entirely offset the cost of banking services.

Additionally, the PNC Purchase Payback program allows business customers to earn cash back for purchases, and you pay for only the banking services you use each month. There is no charge for paper statements, and there are no ATM transaction fees at PNC Bank ATMs and non-PNC Bank ATMs.

PNC Bank Business Debit Card

When you enroll in the PNC Analysis Business Checking account, you receive the PNC Bank Visa Business Debit Card, and this is considered a free benefit.

Features of this card include:

- This Business Debit Card gives account holders the freedom and flexibility to make purchases almost anywhere worldwide, and there aren’t the limits you might find when writing checks.

- It includes built-in Zero Liability Fraud Protection

- Purchase Security ensures purchases can automatically be protected from loss, theft, damage or fire.

- You can use your debit card to make deposits, transfer funds, or get cash conveniently.

- You won’t have to reconcile balances or find receipts, since every PNC Debit Card purchase shows up in your Mobile and Online Banking, and this includes access to Cash Flow Insight.

- You can quickly pay bills with your Business Debit Card.

- Earn cash back with the PNC Purchase Payback program.

- Receive automatic discounts with Visa SavingsEdge.

Free Budgeting Software for AdvisoryHQ Readers - Get It Now!

SunTrust Analyzed Business Checking Review

One of the leading banking institutions in the U.S., SunTrust offers a variety of small business checking accounts and other solutions so customers can more effectively optimize their cash flow, manage receivables, grow, and simplify payments.

SunTrust offers not only a range of diverse and targeted small business products, but also a small business resource center which can guide customers to those products that are right for their needs.

SunTrust is one of the largest banks in the nation, with total assets of $205 billion

Key Factors That Led Us to Rank This as A Top Best Small Business Checking Account

Essential reasons the SunTrust Analyzed Business Checking account was included in this ranking of the best small business checking options are listed below.

Receivables Management

As any business owner knows, managing accounts receivables is one of the most important parts of a complete financial picture, but it can be difficult to do, particularly when managing the day-to-day aspects of business operations.

All of the SunTrust business checking account options include specific tools and features aimed at simplifying receivables.

For example, with electronic receivables such as online check depositing, ACH pre-authorized debit, and online bill presentment and payment, it’s incredibly easy to speed up your receivables from anywhere and at any time.

Account holders can also manage receivables manually with Lockbox Services, which are ideal for business-to-business payments or a low volume of high-dollar amount payments.

Online Cash Manager Services

For many small businesses and mid-sized organizations, the ability to manage their checking accounts online is a crucial part of efficient financial management.

Banking with SunTrust provides a wealth of powerful online management tools, including:

- Download account data and information to account management software

- Make real-time transfers to SunTrust accounts

- Submit stop payment requests to individual or multiple checks

- SunTrust Business Mobile app provides on-the-go money management

- Schedule, edit, and pay bills online

- Manage employee and payroll information and pay with direct deposit or check

- Manage disbursements, collections, tax payments, and direct deposits with ACH transactions

Low and Offset Fees

Analyzed Business Checking is designed for businesses that have moderate to high transaction volumes, complex cash management requirements, and high checking balances.

As a result, this high-tier checking account features many benefits, including the ability to take advantage of the Earnings Credit Rate, which can lead to the reduction or elimination of service charges.

When you take advantage of this small business checking account, you can also utilize a la carte pricing, which removes the need to sustain specified balance levels or keep your activity within a pre-determined threshold.

SunTrust Business Debit Card

Along with the Analyzed Business Checking account comes the ability to use a SunTrust MasterCard Business Debit Card. This card makes it easy to purchase without interest, and business owners can not only use it to access money themselves, but also designated employees.

Each card includes an embedded EMV chip for added layers of security against fraud and MasterCard safety features including Zero Liability; plus, you can earn rewards for your business spending as well as automatic rebates when you take advantage of the MasterCard Easy Savings program.

Business accountholders can also upgrade to a Delta SkyMiles World Debit Card to earn miles on every purchase made with the debit card.

Related: Free Business Checking Accounts for Small Businesses | Guide | How to Find and Open Free Business Accounts

Free Wealth Management for AdvisoryHQ Readers

TD Bank Business Premier Checking Review

Offering both personal and business banking solutions, TD Bank is ranked as one of the ten largest American banks, with a history that spans more than 150 years.

Along with retail banking, TD offers a full range of both small business and commercial solutions and products, and it maintains about 1,300 locations throughout most regions in the U.S.

Small business checking account and savings account options are designed to help customers meet their specific goals and be in line with their business phase, whether they’re just starting, working on growing their business, or planning to sell it.

Key Factors Considered When Ranking This as One of the Best Business Accounts for Small Business

Below are the primary reasons the TD Bank Business Premier Checking account was included in this business bank account comparison.

TD BusinessDirect Mobile App

When you opt to use this leading small business checking account, you can also download and access the state-of-the-art BusinessDirect Mobile App. The BusinessDirect App lets you bank with the highest levels of security including advanced encryption, user authentication, and firewalls.

Other features of the BusinessDirect app include:

- You can quickly view deposits, loans, and credit card balances

- Account history and pending transactions are shown in real time

- You can transfer funds, pay single bills, or make deposits

- Get answers to frequently asked questions

- Locate the nearest TD Bank location or ATM

- Report a lost, stolen, or damaged debit or credit card

Business Debit Cards

Business debit cards are designed as a way to conveniently manage money and records, and reduce the need for petty cash. When you hold a Business Premier Checking account from TD Bank and use an accompanying debit card, you can receive as many as 15 cards with no fee.

You can then customize a daily cash withdrawal and purchase limit for each card to maintain control over the spending of your employees.

Your debit card can be used anywhere Visa is accepted, and it includes the Visa Zero Liability policy and continuous fraud monitoring. No enrollment is necessary.

Business debit card users also get exclusive discounts when they make purchases.

Fee Waiver

The TD Business Premier Checking account requires only a $200 minimum deposit to open, and while it does have a monthly maintenance fee, this can be waived. Users have to meet one of four requirements.

The first is to have $40,000 in combined business deposits and one personal checking account. The second option is to have an active TD Merchant Services account.

The third possibility to waive the monthly maintenance fee is to have an active TD Digital Express account, or finally, account holders can have a TD Bank Small Business Loan or Line of Credit.

A significant benefit of using the Premier Checking account is the ability to combine business deposit balances and one personal checking account balance in order to take advantage of discounts on your most-used services.

High Volume of Transactions

The TD Business Premier is one of the best small business bank account options because it’s flexible and can be used by companies that have a high volume of transactions in a given statement cycle period.

Enrolled business members can take advantage of up to 500 free items paid and/or deposited per statement cycle.

As additional bonuses for Premier Checking members, there are waived fees for money orders and official checks.

Free Money Management Software

U.S. Bank Platinum Business Package Review

U.S. Bank is part of U.S. Bancorp, which includes four core business areas: consumer and small business banking, wholesale banking and commercial real estate, wealth management and securities services, and finally, payment services.

Along with offering some of the best business bank accounts for small business, other products include credit and financing, payment acceptance, and employee services, all of which fall under the larger umbrella of business services from U.S. Bank.

One account in particular, the Platinum Business Package, is included in this small business checking account comparison.

Key Factors That Led to The Inclusion of This as A Best Small Business Checking Option

Below are some of the features and benefits of the U.S. Bank Platinum Business Package that led to its inclusion on this small business checking account comparison and ranking.

Preferred Interest Rates on Cash Flow Manager

Cash Flow Manager is a line of credit that helps small business owners make sure they’re able to meet their income and finance needs on a short-term basis.

Cash Flow Manager is a line of credit that you can borrow against when needed, so essentially you get the benefit of accessible, fast cash to put toward things like operating expenses or new growth opportunities. When you pay the balance, your available credit goes back up.

Lines up to $250,000 are available, the application process is easy, and the minimum payment can be taken directly from your U.S. Bank business checking account.

For account holders of the Platinum Business Checking option from U.S. Bank, there is a special preferred interest rate.

Business Edge Debit Card

U.S. Bank customers who open a Platinum Business Package will receive a U.S. Bank Business Edge Debit Card. This card is designed specifically for the management, spending, and cash needs of businesses.

It can be used to make purchases anywhere Visa is accepted, and it offers the opportunity to maintain a greater sense of control over cash and business expenditures.

Business owners can effortlessly monitor card account activity by setting up custom email and text alerts or by using online banking.

First-Year Waiver on Business Reserve Line

Since the U.S. Bank Platinum Business Package is the top-tier business checking account option, there are a number of perks, and one of those is a one-year waiver on the Business Reserve Line.

The Business Reserve Line is an overdraft protection option for business owners that can protect you against things like late payments and the burden of unexpected expenses. The Business Reserve Line is an unsecured line of credit linked to a business checking account.

Funds are automatically advanced into the business checking if the balance falls below zero, so cash flow is protected and business owners can avoid expensive overdraft fees.

Free DepositPoint Transactions

DepositPoint is a service offered to some U.S. Bank account holders, which allows them to deposit checks anytime using the U.S. Bank mobile app.

It’s a fast, safe way to make deposits, and it can be particularly beneficial for business owners because they don’t have to spend time or risk security issues because of carrying checks all around town.

When checks are deposited before 9 p.m. CT, the full is amount is typically available the next business day.

For those U.S. Bank customers with a Platinum Business Checking account, these transactions are free.

Wells Fargo Business Choice Checking Review

Wells Fargo is a U.S. financial institution with $1.9 trillion in assets and a long history dating back to 1852. Along with offering some of the best business checking account options, Wells Fargo also offers insurance, retail banking, investments, mortgage, and commercial services.

Wells Fargo maintains over 8,600 locations and 13,000 ATMs, with headquarters in San Francisco.

One of the top Wells Fargo small business checking accounts is Business Choice Checking, which is designed to offer flexibility and versatility, along with great value.

Key Factors That Led to Our Ranking of This Account as a Best Small Business Checking Option

Detailed below are key reasons the Wells Fargo Business Choice Checking account was included in this small business bank account comparison.

Business Bill Pay

When you’re a Business Choice account holder, you can enroll in Business Bill Pay, which is a fast and simplified way not just to make payments on behalf of your business, but also to track your payment history in a centralized, secure place.

Not only can you pay bills on the go, but you also have the advantage of Wells Fargo’s Payment Guarantee, which ensures your payments are sent on time, every time.

You can also make recurring payments with your business debit card and set up automatic business bill payments.

Wells Fargo Works for Small Business

Wells Fargo Works for Small Business is a program designed specifically for small business owners that includes not only financial services and products but also valuable resources and guides.

This is a comprehensive online resource center that includes guides for every step of a business phase, ranging from starting your business to growing your business.

It outlines stories of Wells Fargo business customers, as well as comprehensive frameworks to do everything from obtaining credit for your business to turning ideas into business plans.

Monthly Service Fee Waiver

When business owners enroll in Business Choice Checking, they have the opportunity to avoid the $14 monthly service fee by adhering to only one of the following criteria:

- Maintain a $7,500 average ledger balance or

- Maintain $10,000 in combined balances or

- Make 10 or more business debit card purchases and/or payments from the business checking account or

- Link the business account to a Direct Pay service or

- Perform qualifying transactions from a linked Wells Fargo Merchant Services account or

- Perform qualifying transactions from a linked Wells Fargo Business Payroll Services account

Online Cash Flow Tools

With Wells Fargo business checking accounts, including the Business Choice Checking, customers have access to online spending and cash flow tools.

One of these is the Business Spending Report, which lets business owners track their purchases made with not just their checking account, but also their credit card and Bill Pay.

This ensures customers can stay on top of business expenses as everything is automatically organized or sorted, with spending broken into categories.

Additionally, deposits are tracked, and you can gain clearer insight into your business spending and overall financial picture with graphs and charts.

Don’t Miss: Best Small Business Bank Accounts for Small Businesses | Chase vs. Wells vs. Bank of America Small Business Accounts

Wells Fargo Platinum Business Checking Review

Wells Fargo is one of the most well-known and widely recognized financial institutions in the U.S., and many of their services cater to the needs of business clients.

Small business checking accounts are just one product available from Wells Fargo. Others include financing and credit, tools and services to help businesses make and receive payments, and options to manage payroll and employees.

Wells Fargo Platinum Business Checking is one of the best bank accounts for small business that offers robust features and benefits.

Key Factors That Led to Our Ranking of This as One of the Best Business Bank Accounts for Small Business

The list below represents some of the main reasons Wells Fargo’s Platinum Business Checking was included in this ranking of the best bank account for small business.

Interest

The Platinum Business Checking account from Wells Fargo is the only name on this small business bank account comparison that includes interest.

This account is a checking account, but it’s also interest-bearing on collected balances over $25,000, so account holders can put their money to work.

You can also choose to take advantage of a Business Savings Account or Business Time Account when you open a Platinum Business Checking account from Wells Fargo so that you can earn additional interest.

Wells Fargo Merchant Services

Account holders with a Platinum Business Checking account will have access to a variety of discounts and perks on merchant services payment processing from Wells Fargo. For example, customers can take advantage of customized and flexible payment processing solutions.

You can also take advantage of new technologies including mobile payments like Apple Pay and AndroidPay, and you can work with the Wells Fargo team to receive expertise and guidance ensuring efficiency for your business operations and finances.

Money Map

Money Map is a set of tools available to certain business account holders at Wells Fargo that allows them to gain more control of their business expenses, plan more effectively for future needs, and improve their cash flow.

One of the Money Map tools available to business customers of Wells Fargo is the Business Spending Report, which lets account holders monitor their business expenses, manage deposits, and see visual insights in the form of graphs and charts.

Another tool is the Budget Watch, which is designed so that Platinum Business Checking account holders can create budget goals in key categories, view their spending compared to their budget, receive budget alerts, and see their progress in graphs and charts.

Fee-Free Options

The Wells Fargo Platinum Business Checking Account carries with it several different options to waive fees, as well as free perks that come automatically for account holders.

To waive the monthly service charges, customers should have one of the following for each fee period:

- The account should maintain a $25,000 average ledger balance or

- There should be $40,000 in combined balances, which can include business checking, CDs, credit, and savings

As well as these options to waive the monthly service fee, the Platinum Business Checking account also includes the first 500 monthly transactions at no charge and the first $20,000 deposited each month is free of charge as well.

Conclusion—Top 12 Business Checking Accounts

When you’re a business owner, whether it’s a small or a mid-sized organization, there is perhaps nothing so important as how you manage your finances.

When you’re choosing the best business checking account or the best business bank accounts for small business, it’s essential that you consider some important criteria.

Some of this criteria includes the fees charged, whether or not those can be waived, the reputation of the bank itself, how accessible the bank is in terms of ATMs, locations, online and mobile banking, and how much support the account offers to business customers.

These are some of the most vital elements considered in the creation of this best small business checking account comparison and ranking.

Each of the above names represents not only an excellent business checking service, but also a financial institution that is exemplary and offers all types of business owners the resources they need to focus on growth.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.