Guide: Free Business Banking (Chase, Citi, PNC, Wells Fargo Business Banking Reviews )

Do you own a business, and are you interested in business banking to separate your personal funds from business funds? That is a wise choice.

Why? Business banking accounts keep your business funds in their own location so you know exactly what money is from, and for, your business.

However, business banking can get expensive depending on the size of your business and how much of a cash flow it has. If you do not have a free business banking account, you could be subject to fees with each transaction or monthly maintenance fees, all of which add up to a substantial number by month’s end.

Source: Town & Country Bank Midwest

These fees lead many business owners to combine their personal and business banking accounts to avoid the fees, which is a risky financial move. Additionally, you could create significant tax issues for yourself if you do not keep your accounts separated, such as the higher risk of audits and loss of possible deductions to save you money.

Consider looking for a free business banking account to separate your business funds from your personal funds. This guide will tell you what is business banking, define “free business banking,” and compare our picks for the best banks for online business banking.

Wells Fargo, Citibank, Chase, and PNC business banking are among the top banks for free business accounts and excellent business banking reviews. This guide will compare their options and detail on how to get free business banking with each bank.

See Also: Top Best Banks for Small Business Banking | Reviews & Comparison

What Is Business Banking?

Business banking, also known as corporate banking, provides small and large businesses with financial products, like checking accounts and credit cards. The term “business banking” also refers to the handling of business loans and mortgages, cash management services, and trading.

Business owners should opt for a business bank account, like the Chase business banking account, rather than using a personal bank account for business transactions. Not only does mingling the accounts make it difficult to separate personal from business funds, but it also can cost owners more in taxes later on.

What is business banking beneficial for during tax time? A business account, like the PNC business banking account, keeps all of your business transactions together in one place, so it is easier to track your income and expenses. Additionally, you will qualify for more business tax deductions when you can prove your expenses from your business banking account.

Clients will also view your business as more professional when their payments are made to a Chase or PNC business banking account, for example, rather than a personal account. If you use a personal bank account, you risk others viewing your business as more of a hobby rather than a professional business.

Does Free Business Banking Exist?

Unfortunately, many business owners opt for personal rather than business bank accounts because business banking can be expensive. In addition to fees per transaction, several banks charge business accounts fees for monthly maintenance, dropping below a large minimum balance, or not making enough transactions or too many transactions.

With all of these fees imposed on business accounts, is it possible to get free business banking? Absolutely.

Some banks, like Citizens Bank, offer completely free checking for businesses with no maintenance fees or minimum balance. However, most completely free business banking accounts cater to smaller businesses with less than 200 transactions per month.

Source: Business News Daily

Businesses that make more transactions every month will want to find free business banking solutions to handle transactions and funds on a larger scale.

There are many banks and credit unions that offer free business banking to businesses that keep a specific daily minimum balance, enroll in electronic statements, or stay within a required amount of transactions per month.

Chase business banking, for example, decreases its $12 monthly maintenance fee to $10 when you enroll in paperless statements, but waives the fee altogether when you keep your daily balance at $1,500 or above. Chase business banking also offers free business banking solutions for mid-size and larger companies with more than 200 transactions per month.

Don’t Miss: Best Bad Credit Business Loan Lenders | Get Start-Up Business Loans with Bad Credit

What Are the Best Banks for Online Business Banking?

For the purposes of this guide and business banking reviews, we will focus on the best online business banking solutions for small, mid-size, and large businesses with free business banking options available.

In this guide, we will be looking at the following business banking options with outstanding business banking reviews and multiple options for business banking accounts:

- PNC Business Banking: PNC Bank offers free solutions for PNC small business banking and large business banking. PNC business banking has four types of checking accounts to meet the needs of various types of businesses. PNC business banking offers free solutions for each type of business account.

- Wells Fargo Business Banking: Wells Fargo has four types of business accounts fit for different business sizes and transaction activities. Wells Fargo business banking is one of the top-rated by reviewers for its checking and credit solutions. Wells Fargo offers free checking to its business customers with a variety of options, like maintaining a specific average balance or linking to a Wells Fargo Direct Pay account.

- Chase Business Banking: An excellent solution for small or large businesses is Chase business banking online. With three different checking options for small, medium, or large businesses, Chase business banking is one of the most versatile solutions. Chase business banking online also offers free banking for each of its types of checking accounts.

- Citibank Business Banking: Offering some of the best variety in business account solutions is Citibank business banking. Citibank has four business checking account options and several other business financial accounts to satisfy most business needs. Additionally, Citibank waives fees for keeping minimum daily balances or staying within the specified number of monthly transactions.

PNC Business Banking Review

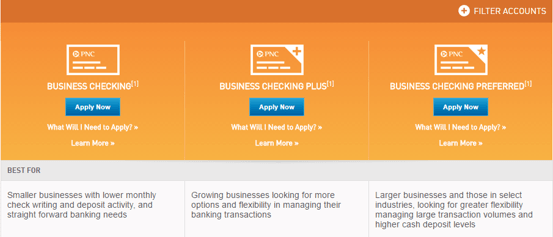

PNC business banking is among the top choices for the best business banking accounts. Not only does it offer three checking accounts for businesses of different sizes, but each of the PNC business banking accounts has easily waived fees for meeting certain monthly requirements.

Source: PNC Bank

The PNC small business banking account, known as Business Checking, is for businesses with low monthly transactions and deposits. If you maintain a balance of at least $1,500 per month in your PNC small business banking account or link your PNC business credit card with purchases of $1,000 to your account, PNC Bank will waive your monthly fee of $12.

The PNC business banking accounts for larger businesses are Business Checking Plus and Business Checking Preferred. Business Checking Plus requires a linked PNC Bank credit card with $2,000 in purchases, a minimum $5,000 balance per month, or maintain other PNC Bank business services, the monthly fee of $20 will be waived.

To waive the $50 fee for Business Checking Preferred, PNC Bank’s large business banking account, you have to make at least $3,000 in purchases on your PNC Bank credit card, maintain a minimum balance of $25,000, or maintain a qualified PNC Bank business service.

Related: Top Banks for Free Business Checking | Ranking & Review

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Wells Fargo Business Banking Review

Wells Fargo offers unique business banking solutions for all business sizes, from start-up to high transaction volume businesses. Its bank accounts for small to large businesses can have monthly fees waived by meeting Wells Fargo requirements. The only business account that does not offer free business banking is the Analyzed Business Checking account, which has a monthly fee of $20.

To avoid monthly fees with business banking from Wells Fargo, each account should maintain the average required daily balance, make a minimum number of transactions per month, or link to another Wells Fargo financial product, as examples.

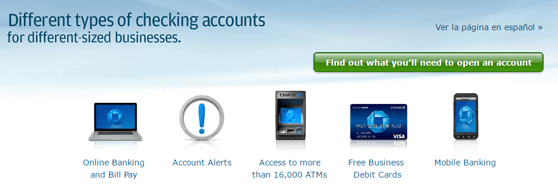

If you meet these requirements, you can easily have a free business bank account every month. Additionally, Wells Fargo also offers free online business banking and bill pay for all of its business banking customers.

Chase Business Banking Review

With Chase business banking, you have three options for checking accounts for your business, depending on its size and transaction volume. Chase Total Business Checking® is a solution for smaller businesses with 200 or fewer transactions per month.

Chase Performance Business CheckingSM and Chase Platinum Business CheckingSM can handle up to 350 and 500 transactions per month, respectively, to avoid service fees. However, there are other ways you can avoid monthly maintenance fees through Chase business banking.

Source: Chase

Chase business banking allows you to lower maintenance fees when you enroll in paperless statements, which is a benefit most of its competitors do not offer. Additionally, you can avoid monthly fees by maintaining the required minimum balance for each Chase business banking account.

Chase also helps you stay on top of your business finances for free by offering free Chase business banking online. Here, you can view account alerts, access your statements, and pay bills from your PC or mobile device.

You will also save money with a Chase business account by linking your account to a free Business Debit card with access to more than 16,000 ATMs where you can use your card for free. Chase Business Debit cards offer fraud protection and account alerts so you can stay in the loop with your account with Chase business banking online.

Popular Article: Top Best Business Checking Accounts |Ranking | Best Bank Accounts

Citibank Business Banking Review

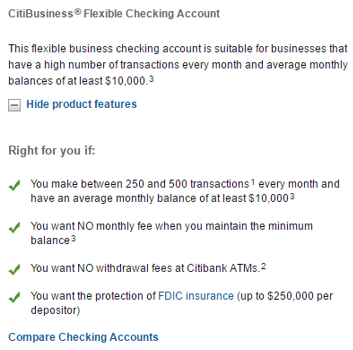

The bank with possibly the most variety in business solutions is Citibank business banking. Citibank offers several solutions for small to large businesses, so your business account can grow alongside your business. Small businesses can avoid monthly fees by making fewer than 250 transactions, maintain a minimum required balance, and using Citibank ATMs for withdrawals.

Source: Citibank

Larger businesses can, likewise, maintain a free business banking account with Citibank by maintaining larger minimum balances, keeping their number of transactions with a specified range, and using their Citibank debit cards at no-fee Citibank ATMs.

Citibank also offers interest-bearing business banking accounts for businesses with a very low number of monthly transactions who want to see their balances grow with interest.

This is a unique solution for businesses that many business banking institutions do not offer. Citibank’s interest-bearing account is completely free when you maintain an average minimum balance of $10,000.

The interest rate for this account is disclosed when you speak to a Citibank representative, so if you are interested in a CitiBusiness® Interest Checking Account, you can call your local branch to discuss the terms for your business.

Conclusion

When looking at what is business banking and how it can help you and your business, consider the benefits of a business account versus a personal bank account to track your business finances. Although many personal bank accounts are free, they also do not offer your business any benefits.

Completely free business banking is difficult to come by for mid-size to larger businesses and is typically geared toward start-ups and other small businesses. However, if your business has a large volume of transactions and high balances each month, you can still qualify for free banking for businesses.

Our business banking reviews outline our top picks for the best free business account solutions. Each of these accounts can provide free banking for businesses when they meet simple, specific requirements each month. We hope that one of these solutions will work well for you and your business.

Read More: Top Best Online Business Banks |Ranking & Review

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.