2017 RANKING & REVIEWS

TOP RANKING BEST ONLINE BUSINESS BANK ACCOUNTS

Finding the Best Online Banks for Business Accounts

Opening a business checking account online, or any online business bank account, offers a high-level of flexibility and versatility.

Online banking solutions also often feature the lowest fees and the highest interest rates, and they provide a simplified way for business owners to manage every aspect of their finances.

Rather than spending time traveling to the bank to make deposits or handle banking business, it can be done online, from a desktop or even a mobile device.

The article below highlights the advantages of online banking for businesses and ranks the top places to open an online business bank account.

This list is diverse. It includes the best online-only business banking options, as well as traditional banks that offer some of the best online business checking accounts.

Also included on our list and review are online-only banks with personal account options that can be simultaneously well-suited to the needs of freelancers, contractors, and very small business owners.

Award Emblem: Top 12 Best Online Business Banks

The diversity of this list is designed to give business owners a broad range of online banking options to suit their unique needs, regardless of where their priorities lie.

AdvisoryHQ’s List of the Top 12 Best Online Business Banks

List is sorted alphabetically (click any of the bank names below to go directly to the detailed review section for that online business bank):

- Alliant Credit Union

- Ally Bank

- Bank5 Connect

- BOFI Federal Bank

- Capital One

- CBB Bank

- Discover Online Bank

- Everbank

- FirstBank

- First Internet Bank

- Synchrony Financial

- Union Bank

Click here for 2016’s ranking of the Top 12 Best Online Business Banks

Top 12 Best Online Business Banks | Brief Comparison & Ranking

Best Online Business Banks | Highlighted Features |

| Alliant Credit Union | Versatile & robust online banking tools |

| Ally Bank | Fee-free checking & award-winning customer service |

| Bank5 Connect | Affordable checking & high-interest savings accounts |

| Bofl Federal Bank | Business-specific cash management tools |

| Capital One | Dynamic business rewards credit card |

| CBB Bank | Business checking options for low & high transaction volumes |

| Discover Bank | No-fee, cash back checking options |

| Everbank | Reliable & affordable merchant services |

| FirstBank | Combined business & personal account management |

| First Internet Bank | Comprehensive treasury management services |

| Synchrony Bank | Flexible terms & high interest yields |

| Union Bank | Zero Balance accounts help simplify daily cash management |

Table: Top 12 Best Online Business Banks | Above list is sorted alphabetically

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review — Top Ranking Best Online Banks for Small Business

Below, please find a detailed review of each online bank on our list of best online banks for small business. We have highlighted some of the factors that allowed these online business bank accounts to score so high in our selection ranking.

See Also: Best Banks for Small Business Banking | Ranking | Best Banks to Open a Business Account With

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Alliant Credit Union Review

Alliant Credit Union is a member-created and member-owned financial institution that operates as a not-for-profit cooperative.

Alliant was founded in 1935, manages more than $9.3 billion in assets, and has over 335,000 members, making it one of the largest credit unions in the U.S.

The service mission at Alliant is to provide members with the opportunities they need to take control of their financial future, to promote well-being among members and the community, and to create a source of credit at fair and reasonable interest rates.

While Alliant is primarily an online bank, it does have headquarters in Chicago and 12 service centers located in the U.S.

Although Alliant does not provide business-specific accounts, their robust banking tools, advanced security features, and competitive business loans make Alliant a great choice for freelancers, contractors, and very small business owners to consider.

Key Factors That Enabled This to Rank as a Best Online Bank for Small Business

Some of the key reasons Alliant Credit Union was included in this ranking of the best options for online small business banking are listed below.

Access

Since Alliant operates primarily as an online credit union, accessibility and convenience are primary benefits of banking with this organization.

The Alliant Online Banking platform allows members to perform a wide range of banking tasks, including:

- Withdrawal by check

- Transfer between accounts and other members

- Pay bills with no limits and no monthly fees

- Cancel or change a scheduled payment

- Deposit a check

- Check balances

- View eStatements

- View transaction details for up to 2 years

- Pay an Alliant loan

- Set up notifications

- Use Personal Financial Management tools

- View and print application, transaction forms, and tax documents

- Open a new account, order checks, or apply for a loan

Advanced Security

As a selection for one of the best options for web banking for business, Alliant Credit Union offers advanced security to protect members’ safety and privacy.

The NCUA federally insures all Alliant accounts up to $250,000, which is the same amount of insurance provided by the FDIC to bank accounts not held at a credit union.

The message system that’s an essential component of Alliant’s Online Banking is 100% secure, and all sensitive data is removed before the Alliant team replies.

There are advanced online and physical security measures that comply with federal regulations and that are also leading within the industry.

Finally, Alliant offers the utmost in protection of confidentiality for all non-public personal information about members. Only the Alliant employees who have a specific need to know information about members can access it.

Business Loans

Although Alliant does not offer business-specific checking or savings accounts, they do offer business loans for their members.

Business loans through Alliant are unique because applicants receive a fast response, and most of them are closed within 60-90 days, ensuring that business owners get the money they need quickly.

Since Alliant is a not-for-profit credit union, they also have the ability to offer competitive terms and interest rates to business owners. These loans feature prepayment flexibility, with no penalties on conventional commercial mortgage loans.

Ally Bank Review

Ranked as the “Best Online Bank” in 2016 by Kiplinger’s Personal Finance magazine, Ally has over $70 billion in deposits, making it one of the largest banks to open a business checking account online.

Ally prides itself on providing the highest level of customer service, even without branch locations, thanks to their support team as well as their leading-edge technology.

Core values that are essential to everything Ally does include looking externally, executing with excellence, acting with professionalism, and delivering results.

While Ally doesn’t offer accounts specifically designed for business, because their accounts are flexible and based wholly online, they can easily be utilized for the needs of a variety of small businesses.

Image Source: Best Online Business Banks

Key Factors That Led Us to Rank This as a Best Online Bank for Small Business

The list below represents essential reasons Ally Bank was selected for this ranking of the best options to open a business account online.

Convenience and Customer Service

Ally’s customer service is not only award winning—it’s also available 24/7 to address whatever needs or questions customers may have. When you’re a client of Ally, you can contact the support and service team by phone, live chat, or email.

You can determine whether or not it’s a good time to call by checking the Ally website or mobile app for wait times, though wait times are typically less than one minute.

The team that backs this online bank is highly trained on products, and each call or question is followed by personal care to make sure everything is going smoothly.

Ally works hard to combine the in-person experience of traditional branch banking with the convenience of an online bank.

Rates

When you use Ally, you get one of the biggest advantages of a top online bank, which are great rates. Since Ally doesn’t have the overhead costs of traditional branch banks, they can then pass that on to customers in the form of the most competitive rates.

If you open an interest-bearing account, it’s compounded daily, so as a small business owner, you can watch your money grow more quickly.

There are many different savings options including traditional savings accounts, as well as CDs and IRAs. You can also link an existing U.S. bank account to your Ally savings account to make simplified transfers.

Fees

Critical to everything Ally does is a sense of transparency, and this includes in their fees. Everyday services and transactions are free for Ally Bank clients, including:

- Monthly maintenance fees

- ACH transfers to a non-Ally Bank account

- Overdraft transfer service

- Debit MasterCard

- Incoming wires

- Official and cashier’s checks

- Ally Bank standard checks

- Postage-paid deposit envelopes

Ally eCheck Deposit

An important reason Ally was selected for this ranking as one of the best online banks for small business is convenience.

This includes the Ally eCheck Deposit option, which can help busy business owners save a great deal of time making trips back and forth to the bank for deposits.

With this service, all account holders, including business owners, can deposit funds by simply taking a picture on their mobile device.

Direct deposits can be set up, and online accounts from Ally are equipped to receive incoming wire transfers from any bank in the U.S.

If necessary, account holders can also make mail-in deposits using postage-paid envelopes.

Don’t Miss: Best Business Checking Accounts | Ranking | Review of the Best Accounts for Small Businesses

Bank5 Connect Review

Bank5 Connect is an online bank that offers excellent customer service, and because of the low overhead costs, it can provide clients with highly competitive rates.

Bank5 offers everything available from a traditional bank, including checking and savings accounts, CDs, and more.

Since Bank5 Connect doesn’t offer business-specific accounts, this online bank is ideal for very new small businesses, as they’re just starting out in the growth phase, as well as freelancers and contractors.

It can also be a good option for business savings accounts since rates are so competitive.

Key Factors That Enabled This to Rank as a Top Online Small Business Banking Option

Below are some of the primary reasons Bank5 Connect was selected for this ranking of valuable places to open a business account online.

High-Interest Checking

Bank5 Connect features a high-interest checking account that was named as the Best Checking Account of 2017 by GOBankingRates.com.

This checking account allows clients to have money accessible when they need it, but they’re also simultaneously earning on the cash set aside in the account.

This particular account includes no monthly maintenance fee, free online and mobile banking, free eStatements, and access to free ATMs. The minimum balance to open the account is only $10, and the minimum balance to earn interest is only $100.

Mobile Banking

Mobile Banking is an essential part of what Bank5 Connect does, and it’s perfect for small business owners who are short on time and on the go. They can manage their banking and finances directly from their mobile device.

Tasks that are accessible through the Bank5 Connect mobile banking app include basic account overviews, transferring funds, and bill pay.

Users can also make deposits and manage direct deposits.

Bill Pay

Most operators of very small businesses, as well as freelancers and contractors, require some type of Bill Pay option, and with Bank5 Connect’s Online Bill Pay, it’s possible to simplify payments that are made personally and on behalf of your business.

Online Bill Pay lets users set up their monthly bills to be automatically paid from their checking account, and individual bills can be scheduled on or before their due date.

Funds are transferred directly from the account, and users can also set up recurring payments.

Savings

Bank5 offers not only checking options, but also high-interest savings accounts, which can be a good way for owners and operators of very small businesses to put their unused money to good use.

A Bank5 high-interest savings account includes free online banking and eStatements, as well as access to free mobile banking.

Savings accounts can also be linked to Bank5 Connect checking accounts to cover overdrafts, and the minimum balance to open one of these accounts is only $10.

Six withdrawals or transfers are permitted during each monthly statement cycle.

BofI Federal Bank Review

BofI Federal Bank is a unique financial service company that specializes in not only personal but also business banking, serving customers throughout the U.S.

There is only one physical BofI location in San Diego, and this online-only business banking solution manages about $8.7 billion in assets.

BofI is able to offer lower costs and higher interest rates to customers because they don’t have a branch-based system.

While some of the banks on our list don’t offer specific business accounts but are still versatile enough to be used by small businesses, BofI offers a diverse service area specifically for business clients.

Key Factors That Allowed This Bank to Rank as a Top Place to Open a Business Checking Account Online

When comparing the best online business bank accounts and the best online business checking account options, below are the key reasons BofI was included in this ranking.

Business Checking

BofI offers several online business checking options, ideal for a range of needs. For those clients who want to open a business checking account online, the options at BofI include the following:

- Basic Business Checking: This account is designed for growing businesses with moderate account activity. It includes up to 200 free items per month, free bill pay, and has no monthly maintenance fee.

- Business Interest: With this account, business owners receive up to 50 free items per month, no monthly maintenance fee with a $5,000 average daily balance, and tiered interest rates.

- Analyzed Business: With this account, holders are issued an earnings credit based on their collected account balance, and it’s ideal for businesses that have high monthly account balances and a significant transaction volume.

Cash Management

As a dedicated bank offering not only online business checking accounts with no fees but also a full selection of online small business banking solutions, BofI also features cash management solutions.

These are designed to help businesses maximize their investment returns, mitigate risks, avoid fraud, and also optimize their receivables and how they process payments.

Cash management solutions from BofI include:

- ACH origination

- BAI Data Service

- Bill Pay Premium

- Lockbox

- Merchant remote deposit capture

- Payment portal

- ACH Positive Pay

- Wire transfer

- Zero balance accounts

Business Money Market

Alongside the three online business checking account options available from BofI, there are also savings solutions. Businesses can open a business account online to manage their company’s funds including the Business Money Market Savings account.

This provides higher interest and is ideal if you’ll be conducting limited transactions. Some check-writing privileges come with this online business bank account, offering a level of liquidity.

Other features and benefits include very competitive tiered interest rates, Remote Deposit from anywhere, free online banking, an associated debit card, free online images of statements and checks, and the minimum opening deposit is only $1,000, while the minimum balance is $5,000.

Bill Pay Premium

When you open a business checking account online, or another type of account from BofI, you can also participate in Bill Pay Premium. Bill Pay Premium allows business owners to save time and money by eliminating the need to write paper checks.

This cash management solution lets businesses streamline how they pay bills by centralizing it in one location. This service can be used to pay employees and vendors, create invoices, and make tax payments.

Related: Top Banks for Free Business Checking | Ranking | Comparison Review of Free Business Accounts

Capital One Review

Capital One is a leading provider of credit and lending services at the personal level, but they also offer online-only banking options to individuals and businesses.

The services available to business customers are called Spark Business, and these products and services are designed to offer flexibility and low-cost banking for clients.

Capital One is a Fortune 500 company that’s ranked as one of the top 10 largest banks in the U.S. based on deposits, and they do offer some branch and location-based banking, as well as their robust online options.

Image Source: Capital One

Key Factors That Enabled Us to Rank This as One of the Best Online Banks for Small Business

Below are some of the important reasons Capital One was selected as one of the best online banks for small business.

Spark Business Checking

Spark Business Checking is a signature offering from Capital One, and it’s one of the best online business checking accounts.

Spark Business Checking is a digital account offering freedom and versatility, thanks to the elimination of traditional restrictions and limitations. When you’re looking for a business checking account online, this level of flexibility is often necessary.

Spark Business Checking includes the following features and benefits:

- No monthly transaction fees or limits

- No minimum balance required

- No monthly fees

- No fees on usage of Allpoint ATMs

- Free debit card

- Free online bill pay

- Deposits are available the next day

Spark Business Savings

Spark Business Savings is also included as part of this ranking as one of the best online business accounts.

Spark Business Savings allows account holders to earn a competitive annual interest rate, which is even higher during the first year after the initial online business bank account opening.

There are no monthly service fees, no minimum balance is required, and account holders can link this savings account to their Spark Business Checking for the delivery of overdraft protection.

This business savings account can also be accessed anywhere from the Spark Business mobile app.

Online Invoicing & Bill Pay

Those account holders who utilize the online-only business banking options from Capital One’s Spark Business program will receive access to a variety of digital tools, designed to save time, money and make business management easier.

These include:

- Account tracking: Business account holders can view and manage their online business bank accounts from a centralized, streamlined dashboard.

- Online invoices: Business account holders can send electronic invoices to customers, receive notifications when they’re viewed and paid, and also create customized automatic payment reminders for any bills.

- Bill pay: This feature allows users not just to pay bills online, but also schedule payments and pay other businesses as well as individuals directly.

- Mobile deposits: Using this tool, account holders can deposit their business checks directly into their account from their smartphone.

Small Business Credit Cards

In addition to online business checking accounts with no fees, Spark Business also includes small business credit cards.

The Spark® Cash Back Rewards card features unlimited 2% cash back, as well as a $500 cash bonus. With the Spark® Miles Rewards card, account holders receive unlimited 2x miles rewards with select programs or unlimited 1.5x miles on business purchases.

There’s also the opportunity to receive a one-time bonus of 50,000 miles with the Spark Miles card, or 20,000 miles with Spark Miles Select.

CBB Bank Review

CBB Bank is a full-service business bank that opened in 2005 and is currently headquartered in Los Angeles.

The majority of CBB’s services are offered online, and this bank is guided by primary principles which include professionalism, personal service, passion, and pride.

CBB’s business services include checking, business savings and CDs, Small Business Administration lending, general business lending, and account services.

Image Source: CBB Bank

Key Factors That Led to The Inclusion of This as A Top Bank for an Online Business Bank Account

Listed below are critical reasons CBB was included in this ranking of the best places to open business accounts online.

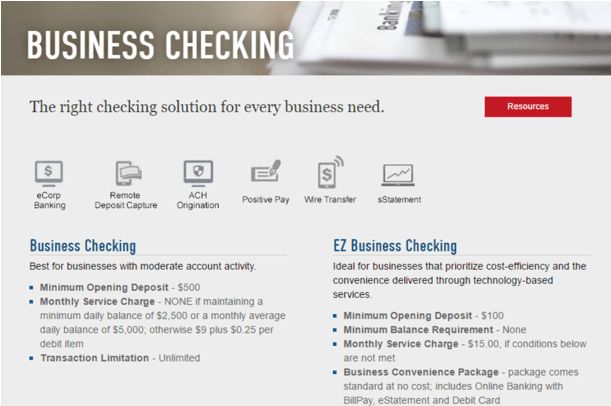

EZ Business Checking

One of the signature online business bank accounts available from CBB is EZ Business Checking, designed for businesses searching for cost-efficiency and convenience delivered through leading-edge technology.

Features of EZ Business Checking include:

- The minimum opening deposit is only $100

- There is no minimum balance requirement

- The Business Convenience Package is standard, comes at no cost, and includes Online Banking with BillPay, eStatements, and a debit card

- There is a maximum of 30 checks per month, making this a great low-cost option for businesses with low transaction volume

High-Level Business Checking

As well as the basic and simple EZ Business Checking, CBB also offers some of the best online business checking accounts for businesses with more complex needs or a higher transaction volume each month.

One of these online small business banking options is Business Analysis Checking. This is also a cost-effective way for businesses with high checking balances and more needs to offset their monthly fees, and there are no transaction limits.

With Business Super Now, customers can earn interest on checking accounts, and there are unlimited transactions. This option is only available to particular business entities.

Cash Management Services

To cater to the unique needs of businesses, CBB offers Cash Management Services, which allow business clients to collect and manage short-term cash.

The Cash Management Services from CBB are designed to ensure business customers can manage their balances, retrieve the information they need regarding their accounts, send electronic payments securely, make deposits from their office, avoid fraud, and mitigate risk.

Specifically, Cash Management Services available from CBB include:

- Business e-Banking

- Remote deposit services

- ACH origination service

- Check review before payment

Business Debit Card

One of the reasons CBB was selected as offering the best online business checking options is because these accounts come with a business debit card that includes Scorecard Rewards.

With the Scorecards Rewards, users can earn points for every signature-based transaction made with the debit card. Users can then redeem their points online, where they’ll have access to hundreds of retailers and millions of choices for redemption.

A business debit card from CBB is also eligible for use at the surcharge-free MoneyPass ATM network.

Popular Article: Best Credit Unions for Business | Ranking | Review of the Best Credit Unions That Offer Business Accounts

Free Wealth & Finance Software - Get Yours Now ►

Discover Online Bank Review

Discover Online Bank is part of the larger Discover Corporation, which is well-known as being one of the top credit card providers.

As well as Discover-branded credit cards, this company also offers private student loans, personal loans, home equity loans, deposit accounts, and money market and CD accounts.

Discover prides itself on providing a simple, straightforward way to bank with no hidden fees or gimmicks, and the majority of the features are free, making this a great online small business banking option for startups that are just beginning and that have limited banking requirements or transactions.

Key Factors Leading Us to Rank This as One of the Best Online Banks for Small Business

Below are some of the distinctive features and benefits of banking with Discover that led to its inclusion on this list of online banks that can be used by small businesses.

Free Checking Account Benefits

While Discover doesn’t offer a specific business checking account option, their basic checking account can be used by startups and very small businesses, as well as freelancers and contractors who operate their own business.

With a Discover online bank checking account comes the following features and benefits:

- FDIC insurance up to the maximum allowed by law

- No monthly maintenance fee

- Account activity can be viewed online

- Mobile check deposit

- ATM withdrawals are available

- Free checks

- Free online transfers

- Online bill pay

Account holders can also earn up to $120 in cash back each year, the number of transactions is unlimited each month, and there is no monthly balance requirement.

Cashback Checking

The signature Cashback Checking option from Discover offers a number of benefits, including the possible $120 per year listed above. This account also offers other exclusive rewards for Discover customers, all with no monthly fees or monthly balance requirements.

Participants can build on their bonus by adding their cash back reward to the Cashback Bonus account of their Discover card.

To open this account, all that’s required is entering your information and taxpayer ID to fund your account, and then you’ll receive a confirmation email. Your request checks and debit card will then be received via mail.

Savings Accounts

Savings accounts are also part of the offerings available through Discover’s online banking platform.

When you enroll, you’ll receive an interest rate that’s 5x the national savings average, and there are no monthly balance requirements or monthly fees for maintenance.

The minimum opening deposit is only $500, and the interest is compounded daily and paid monthly.

Money Market

A Money Market account from Discover includes high yields and liquidity, thanks to flexible access to cash.

The tiered interest rate is designed to be highly competitive, and account holders have access to their money by ATM, debit, or check. There are more than 60,000 free ATMs available to Discover account holders.

Other free services include replacement debit cards, expedited delivery on replacement cards, official bank checks, check reordering, and account closure.

The minimum deposit to open a Discover Money Market is $2,500, and there are no minimum balance fees as long as that amount is above $2,500.

Free Budgeting Software for AdvisoryHQ Readers - Get It Now!

EverBank Review

EverBank is a bank that has some locations in Florida, but this financial institution primarily serves clients through their online options, available to account holders throughout the U.S.

EverBank strives to offer forward-thinking, innovative ways for clients to not just bank but also borrow and invest.

Small business banking solutions from EverBank are designed to offer flexibility and low costs. There are three signature accounts available from EverBank, specifically for businesses, and this includes two checking options as well as a money market account.

Key Factors That Enabled This to Rank as a Best Online Bank for Small Business

Below highlights some of the reasons EverBank was included in this ranking of the best online banks for small business.

Small Business Checking

This online business checking account is designed specifically for sole proprietors, with the goal of improving the productivity of their money through a high yield and no monthly account fees.

Account holders receive access to a full range of banking solutions that make it easier and more efficient to manage their money.

It requires $1,500 to open this account, and there are unlimited ATM reimbursements with a minimum balance. This account also lets businesses owners deposit checks from their office.

This online business checking account includes access to online payroll, bill pay, foreign and domestic wires, mobile check deposits, eStatements, and more.

Business Money Market Account

EverBank offers not only some of the best online business checking options, but they also provide a dynamic Business Money market account.

The Business Money Market account is designed to put savings to work in a productive way with competitive rates.

It requires a $1,500 minimum opening balance, includes six withrawals a month, and there is no monthly account fee if a $5,000 minimum balance is required.

This account can also be linked to a business checking account to provide overdraft protection.

Merchant Services

EverBank offers standard online small business banking as well as merchant services.

Merchant services from EverBank are designed to ensure business owners are productive and efficient while providing the best payment options to customers, backed by the best support.

EverBank uses Elavon as a third-party payment services provider. Features of merchant services from EverBank include:

- Fast and secure authorization

- Payments are deposited the next day

- Low equipment pricing and leasing options

- Widely varied reporting features

- 24/7 support and account access

Access full reporting at any time including chargeback and retrieval status reports and deposit reports.

Yield Pledge Checking

Another of the best online business accounts available from EverBank is Yield Pledge Checking. Yield Pledge Checking is a high-yield checking account that keeps yields in the top 5% of Competitive Accounts.

This account requires only a $1,500 deposit to open, includes mobile check deposits, and carries no monthly fees. It also boasts free bill pay options, unlimited ATM fee reimbursements with a minimum balance, and an Apple Pay supported debit card.

Deposits can be made online, through the mobile app, or by sending the bank a paper check. It’s also possible to make one-time and recurring deposits by online transfer.

Read More: Best Bad Credit Business Loan Lenders | Get Startup Business Loans with Bad Credit

Free Wealth Management for AdvisoryHQ Readers

FirstBank Review

FirstBank is based in Colorado, and while they do have more than 115 branch locations, they also offer a full suite of online services that can be utilized by anyone in the country.

FirstBank works to promote concepts of financial stability and excellent customer service and has done so since their founding in 1963.

First Bank’s online services allow users to do almost everything without having to visit a branch, and they have a specific platform for business clients. Business clients can take advantage of checking and money market products.

Key Factors That Led Us to Rank This as One of the Top Free Business Bank Accounts

Detailed below are key reasons FirstBank was selected as an excellent option to open a business checking account online.

Combined Business & Personal Accounts

For those business owners who wish to streamline how they manage their business and personal finances, FirstBank offers excellent options.

With Combined Personal and Business Account Access, users can log onto FirstBank’s online banking platform to view account details for their business accounts, enroll online, pay bills online, and set up email and account text alerts.

Users can also access their eSave accounts online, deposit checks, and view their business and personal accounts with a single login.

Finally, another convenient option available to these account holders is the ability to transfer funds between business and personal accounts.

Internet Cash Management

Internet Cash Management is an option from FirstBank that allows business account holders to maintain a sense of control over their business accounts in a way that’s efficient and convenient, from their own office or on the go.

Internet Cash Management options from FirstBank include (but are not limited to):

Account Management

You can view all FirstBank business account balances and detailed account activity, which includes deposits, checks, and debit card transactions made on business cards.

Account holders can also see images of canceled checks, transfer funds, search for particular transactions, and request email notifications. Activity can also be downloaded into account software including QuickBooks and Quicken.

Desktop Teller

With this service, business account holders can deposit checks into their business account from their computer without leaving the office. Cash flow can be improved by depositing checks every day, and there is a reduced risk of fraud.

Automated Clearing House (ACH) Origination Module

This optimal service lets business account holders download or manually input their electronic transactions.

It can simplify payroll through the inclusion of direct deposit, and you can pay federal and state taxes electronically.

Internet Cash Management Mobile App

As well as offering Internet Cash Management services via desktop computers, FirstBank also has an Internet Cash Management mobile app, ideal for business owners who are on the go.

The app is free, and it offers the following features and benefits:

- On-the-go access and control: Business owners can approve wires, transfers and ACH batches from anywhere, and initiate and schedule transfers directly from the app.

- Insight: Business owners can gain critical insight into their day-to-day transactions.

- Support: FirstBank customer support backs the app.

- Loans: Users can schedule payments on existing FirstBank loans.

- Viewing checks: Users of the app can view check and deposit images.

Business Checking

The signature Business Checking account from FirstBank is designed for higher transaction volumes, which FirstBank defines as more than 150 items. It’s perfect for larger small businesses as well as mid-sized organizations.

It has a $0 minimum balance, and while there is a $12 monthly maintenance fee, this can be waived by participating in Earnings Credit options.

For smaller businesses with fewer monthly transactions, there is the Free Business Checking account. This is designed for businesses that have fewer than 150 transactions a month, and there is no minimum balance or monthly service charges.

Free Money Management Software

First Internet Bank Review

First Internet Bank offers both personal and business banking solutions and services. First IB was founded in 1999, and currently provides service to customers in 50 states.

Unlike some of the other web banking for business options on this ranking, First IB maintains absolutely no branch locations, which allows them to deliver the best possible rates to customers. The parent company of First IB is First Internet Bancorp, which trades on NASDAQ.

First IB offers not only business banking and deposit accounts but also commercial and real estate lending options for a variety of businesses.

Key Factors Considered When Ranking This as One of the Best Online-Only Business Banking Companies

The list below represents some of the main reasons First Internet Bank was included in this ranking of the best banks for online-only business checking and other business accounts.

Business Checking

When you open a business checking account online, key considerations are likely the fees, the convenience and the features and offerings. First IB addresses all of these areas successfully, which is why they’re ranked as offering one of the best online business checking accounts.

The Small Business Checking account from First IB includes the following features and benefits:

- Business owners can open an account with as little as $500

- Transactions are unlimited and free

- Users can make deposits using iScan or Remote Deposit Capture

- Offers access to online and mobile banking

- Treasury management services can be included upon request

- Business debit cards are available for authorized signers

- Free electronic statements

In addition to the Small Business Checking account, the Commercial Premium Checking account is also available. This includes 300 free transactions, remote deposit options, treasury management, and online bill pay options.

Money Market Savings

For business owners who want to maximize their unused cash, there is the Business Money Market Savings account.

This can be opened with as little as $100, and since First IB is an online bank for small business, they’re able to offer very competitive interest rates.

The monthly maintenance fee is low, and if a $4,000 average daily balance is maintained, this is waived. Six transactions are allowed per month, and sole proprietors can take advantage of the option to have an ATM card.

Treasury Management Services & Payments

First Internet Bank is unique from many of the other names on this ranking of the best places to open a business account online because it offers not only standard services, but also comprehensive, business-centric options like treasury management and payments.

These treasury management services let businesses improve their operational efficiency and optimize their cash flow through the availability of in-depth reporting and access.

These services offer the following capabilities:

- Balance and detailed reports

- Stop payments

- Internal deposit account transfers

- ACH origination including disbursements and collection

- Multi-Factor Authentication, which is the most secure way to prevent fraud

- Security Key

- QuickBooks, Quicken, and Comma Separated Value file features

Business Lending and Financing

As well as being an excellent place to open a business checking account online, First Internet Bank also features lending and financing tailored to the needs of small and mid-sized businesses.

These products and services include highly competitive rates along with flexible tools.

Business lending options from First IB include commercial lending to provide working capital lines of credit, commercial real estate lending, and credit tenant leasing, which operates as acquisition financing for real estate investors.

Related: Free Business Checking Accounts | Guide | How to Get Business Checking for Free

Synchrony Bank Review

Synchrony Bank is a technology-driven bank that brings top-quality services to not only businesses but also personal customers.

As a part of Synchrony Financial, this bank boasts more than 80 years of experience in the financial services industry.

One of the reasons Synchrony can excel and remain one of the best online banks is not only because of their excellent services and technology but also their competitive rates.

Everything Synchrony does is driven by a passion for innovation, as well as a desire to engage customers.

Key Factors That Led to Our Ranking of This Bank as a Top Place to Open a Business Account Online

Synchrony was included in this ranking of the best places to open an online business bank account for the following reasons.

Focus on Savings

Synchrony is unique from the other names on this ranking with online-only business checking because they don’t offer those services. Instead, Synchrony is ideal for the business owner who wants a separate online account just for savings.

Interest rates are competitive, and it’s convenient to set money aside for a variety of savings account options, which is something a lot of customers of Synchrony prefer.

Synchrony has often been recognized for their great rates, safety, customer service, and banking products from Bankrate.com, Kiplinger, NerdWallet, and more.

Perks

Uniquely, in addition to general account features, Synchrony offers customers a variety of creative perks that grow depending on how much a client has deposited with this financial institution.

For example, if you have a Synchrony Silver account, which includes deposit balances ranging from $10,000 to $49,999.99, you receive hotel discounts.

For the highest level savers that hold Diamond accounts, there are discounts on hotels, theme parks, black car service, and amenities including spas, golf clubs, and restaurants.

Diamond account holders also receive access to VIP events, free identity theft resolution services, and more.

As your deposits and time spent banking with Synchrony grow, so do your perks for banking with this online-based financial services provider.

CDs

CDs are one of the top product offerings from Synchrony because of the flexible terms and high interest rates. Synchrony Bank CDs include the following:

- Award-winning features and rates that are above the national average

- Customers can choose their terms, depending on how much liquidity they require, with terms ranging from 3 months to 60 months

- Minimum deposit requirement is only $2,000 to open an account

- FDIC Insurance up to $250,000 per depositor, per insured bank, for each individual ownership category

- View and manage accounts using the online banking portal

- Account holders also have access to a banking representative

High-Yield Savings

Also available to business clients who want a value-creating, convenient savings option from Synchrony is a high-yield savings account. These accounts deliver fast and easy access to cash, the rates are excellent, and these are convenient accounts.

Withdrawals can be completed online, over the phone, or using an ATM card, and account holders can manage their money with the online banking portal.

There is no minimum balance requirement or monthly service fee, and there is FDIC Insurance up to $250,000 per depositor for each ownership category.

Union Bank Review

Union Bank is a full-service financial institution that offers branch locations plus comprehensive online banking solutions aimed at the needs of diverse small businesses.

Branch banking is available in California, Oregon, and Washington, but online business checking and other services are available to clients throughout the country.

Union Bank has assets of $120 billion, and it’s a member of the Mitsubishi UFG Financial Group, which is one of the largest financial institutions in the world, with assets in the hundreds of trillions.

Key Factors That Led to Our Ranking of This as One of the Best Banks for Online Business Bank Accounts

Union Bank was included in this ranking of the best places to open a business checking account online for the following reasons.

Quicken & QuickBooks

When you open an online business bank account at Union Bank, you can also take advantage of integration with Quicken or QuickBooks.

When customers have Quicken or QuickBooks, they can then use Web Connect, Express Web Connect, and Online Banking with Software to integrate account information between the two platforms.

With Web Connect, customers manually download their Union Bank Online Banking files, which is how they record their balances and transactions.

With Express Web Connect, customers enter their Union Bank online Banking User ID and password into their Quicken software. The software then uses that information to create a direct connection, which automatically downloads account balance and transaction information.

Using Online Banking with Software, also called Direct Connect, users connect to Union Bank directly from Quicken or QuickBooks.

Small Business Online Bill Pay

Union Bank’s Small Business Online Bill Pay option offers the following features and benefits:

- There is no fee for enrollment.

- It takes most payments just one or two business days to arrive at their destination.

- You can pay anyone you choose who’s based in the U.S. as a small business owner, including vendors, local suppliers, and more.

- Add payees quickly and easily with the Automated Add Payee feature.

- Schedule payments ranging from one-time and same-day to recurring.

- You can authorize various users, so they have access to information on payees and payments.

Paperless Online Banking

Union Bank features options to help business owners streamline how they manage and maintain their records through paperless online banking options.

These options include:

Online Statements

With online statements, small business owners can monitor, verify, and reconcile all of their account activity.

This feature also allows small business account holders to get email notifications when their statements are ready, download and save account statements, and view up to seven years of statements.

Online Check Images

When you do your small business banking with Union, you can view check images online and also search for images of paid checks and deposit tickets.

This lets you keep track of posted checks, confirm information, verify that payments have been received, and also avoid the risk that comes with financial documents being lost or stolen.

Tax Documents

As online banking customers of Union, small business customers can view and print prior-year tax documents by logging into their online banking account.

Zero Balance Accounts

Zero Balance Accounts are designed to help small business owners minimize their unused balances and put money to better use.

Funds are put in a single account through automatic transfers on a nightly basis. This simplifies how small business owners handle daily cash management, accounts, and reconciliation.

Other benefits include reduced administrative costs, the ability to manage transactions from a single account, consolidated deposits for the best possible interest rates, and it makes it easier to track cash flow with detailed account statements.

Conclusion—Top 12 Best Online Business Bank Accounts

Many small business owners are constantly searching for banks and accounts that will simplify how they manage their money, allowing them to focus their attention elsewhere.

That’s one of the many reasons online business checking and banking options have become so popular for small business owners.

Managing a business checking account online provides flexibility and versatility, it allows for on-the-go financial management, and it often also means higher interest rates on deposit accounts.

The above ranking of the best online business accounts and the best online banks for small business includes diverse financial institutions. Some of the names on the ranking are online-only business banking centers, while others are brick-and-mortar banks that put an emphasis on online options.

Many of the names on this list have specific business accounts, while others are better suited to sole proprietors who are searching for online banking options that will be well-suited to both their personal and business needs.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.