2017 RANKING OF TOP CREDIT UNIONS

Intro: 2017 Ranking and Reviews of the Top Credit Unions in BC

They may look like a bank. Their services may be the same. Credit unions may even have similar operation styles to a bank.

So what’s the difference between credit unions in Canada and banks? What is it about British Columbia and Vancouver credit unions that make them so appealing to consumers?

Consider this: When you use a bank as your primary financial institution, the shareholders are running the show. Sure, they may not be making the day-to-day decisions, but they’re ultimately who matters to the bank executives.

What does this mean for the customers of the bank? It means they’re not the priority, which is exactly why banks not just in Canada but throughout North America have gained a reputation as being profit-driven, even to the detriment of customers.

Award Emblem: Best Credit Unions in Vancouver

Award Emblem: Best Credit Unions in Vancouver

The result is often higher fees, less-than-satisfactory services and production options, and incredibly high interest rates on loans, with lower interest rates on deposits and investments.

By contrast, the credit unions in Canada offer a viable alternative to the profit-driven model of the conventional bank.

There are more than 620 credit unions in Canada today, with nearly 3,000 branches and more than 10 million members. Each of these members serves not just as a customer of the credit union, but also as an owner. There are no shareholders of these financial cooperatives, and any profit the credit union sees is then reinvested back into the members.

Credit unions operate on a model of autonomy and independence, accountability to members, and transparency.

It’s with these concepts in mind that we created this list of the top credit unions in Vancouver. This list includes not only the credit unions in Vancouver proper but also top institutions from surrounding areas in British Columbia.

These credit unions of BC excel in providing an outstanding experience for members, the utmost in customer service, all while remaining dedicated to the core concepts that make them distinctive from other financial institutions.

List of the Best Credit Unions in Vancouver

This list is sorted alphabetically (click any of the below names to go directly to the detailed review for that credit union).

- CCEC Credit Union

- Coast Capital Savings

- Community Savings Credit Union

- G+F Financial Group

- Greater Vancouver Community Credit Union (GVC)

- Kootenay Savings Credit Union

- North Peace Savings and Credit Union

- Vancity Credit Union

- VP Credit Union

Related:

- Permission to Use Your FREE Award Emblems

- Promoting Your “Top Ranking” Award Emblem and Recognition

- Can Anyone Request a Review of a Credit Union?

- Do Credit Unions Have a Say in Their Review & Ranking?

- Can Credit Unions Request Corrections & Additions to Their Reviews?

Methodology for Selecting Top Banks and Credit Unions

The process to identify, evaluate, and rank the top credit unions in Vancouver is an exhaustive one, where the focus is on two things: high-level research and the consumer. We begin the process by researching all of the Vancouver credit unions. We then compare this research to a detailed set of criteria, based on the factors the average Canadian consumer would find most valuable.

Some of these criteria include fees and the cost of banking with the credit union, the reputation for customer service, how financially sound a Vancouver credit union might be, and things like convenience and accessibility.

Click here for a detailed explanation of our methodology: AdvisoryHQ’s Methodology for Selecting Top Banks and Credit Unions.

Top Credit Unions in Vancouver, BC | Ranking Comparison

Credit Unions | Website |

| CCEC Credit Union | http://www.ccec.bc.ca/ |

| Coast Capital Savings Credit Union | https://www.coastcapitalsavings.com/Personal/ |

| Community Savings Credit Union | https://www.comsavings.com/Personal/ |

| G&F Financial Group | https://www.gffg.com/ |

| Greater Vancouver Community Credit Union (GVC Credit Union) | https://www.gvccu.com/Personal/ |

| Kootenay Savings Credit Union | https://www.kscu.com/ |

| North Peace Savings and Credit Union | https://www.npscu.ca/ |

| Vancity Credit Union | https://www.vancity.com/ |

| VP Credit Union | http://www.vpcu.com/ |

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Detailed Review—Top Ranking Credit Unions in Vancouver

After carefully considering Vancouver credit unions, we created the following list of the top 9. As you continue reading, you’ll find detailed reviews for each of our picks, as well as specifics of some of the factors we used in our decision-making process.

CCEC Credit Union Review

CCEC Credit Union was chartered in 1976 by a group who found they had trouble obtaining capital through conventional financial organizations. Since that time CCEC has grown and expanded, but they remain dedicated to selecting a credit committee elected from the membership.

Also important are bi-annual general meetings, which provide an opportunity for members to discuss the issues they see as important.

The mission of this Vancouver credit union is to meet the financial needs of members, enhance small businesses and non-profits in the community, and offer leadership to foster what they call economic democracy not only in the credit union system but also the community.

Key Factors That Allowed This to Rank as A Top Credit Union in Vancouver

The details below briefly touch on some key reasons CCEC is part of this ranking of the leading credit unions in BC and Vancouver.

Personal Loans

For members who want to borrow money, there are personal loans available, which offer guaranteed competitive interest rates and extensive options. Some of the benefits of obtaining a personal loan from CCEC include:

- Flexible payment dates can be arranged, so they’re convenient for the member

- There is no penalty for pre-payment of a personal loan

- There is no minimum loan amount

- CCEC strives to make repaying a personal loan easy through options such as payroll deductions and automatic transfers

- CCEC offers life, disability, and critical illness insurance on all personal loans

Mortgages

Often when a consumer visits a conventional bank with the hopes of obtaining a mortgage, they’re disappointed with the experience. The interest rates can be high, and there can be many obstacles that come between them and homeownership, with very little guidance or personal support offered by the staff of the bank.

At CCEC, not only are residential mortgages available, but the interest rates are highly competitive, and the employees strive to deliver individualized service and helpful attention to members. A representative from the credit union can meet with the member to discuss the most valuable mortgage option for them.

Mortgages may be available with as little as five percent down.

Also available is the CreditMaster mortgage, which lets borrowers utilize the equity they have in their home.

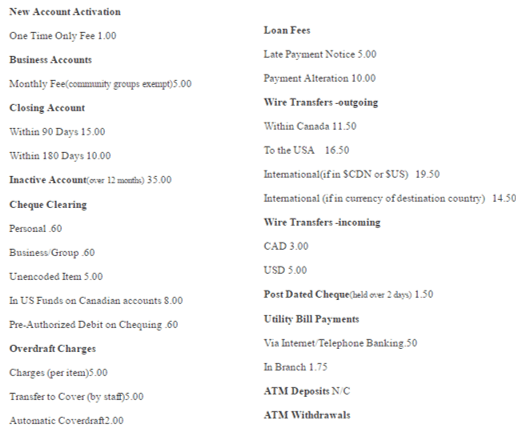

Transparent Fees

For so many members, one of the most important considerations in deciding whether to stick with their bank or move to a credit union is fees.

Not only does CCEC Credit Union strive to keep fees low and costs affordable for members, but they are also highly transparent with what members are charged. They can visit their website for a full breakdown of all product and service fees, as compared to having to search through some deeply hidden fine print on a banking statement.

Source: CCEC Credit Union

Internet Banking

MemberDirect online banking provides a safe and secure way for members of this Vancouver credit union to manage their finances. CCEC online banking includes the ability to pay bills and transfer funds.

Members can also search their accounts for certain activities.

Also available with the internet portal is mobile banking.

CCEC’s mobile banking lets members get instant account balances, which can be useful at the register before making a purchase. Members can also see all recent account activity through CCEC mobile banking.

Related: Great Western Bank Ranking & Review

With a Board of Directors elected by the membership and more than $16.8 billion in assets, Coast Capital Savings is a financially sound credit union, dedicated to serving as a leading corporate citizen, and a builder of the communities served. Coast Capital has British Columbia roots dating back to the 1940s when community credit unions were established to provide more equitability and accessibility in banking.

This Vancouver credit union features a full line-up of services that include not only day-to-day banking options but also investments, business banking, and lending. Coast Capital now has more than 532,000 members throughout not only Metro Vancouver but also Fraser Valley, Vancouver Island, and the Okanagan.

Key Factors Considered When Ranking This as a Top Credit Union in Vancouver

When considering the best credit union in BC, and more specifically, Vancouver credit unions, the following are some reasons Coast Capital is included in this ranking.

Where You’re at Money Chat

An exclusive member offering, The Where You’re At Money Chat is a perk that helps simplify money management and financial issues. With the Money Chat, members of this credit union can get an overview of their financial health, whether that’s business or personal. The Money Chat also includes ways to improve your financial situation.

Money Chats can be used to create a budget or make a plan to pay down debt. They’re also perfect for gaining guidance on how to grow the money you have and protect what you’re most interested in safeguarding.

Source: The Where You’re At Money Chat

The Money Chat is based on principles of Four Money Basics, which are manage, save, grow and protect.

All members do is complete an online form to schedule a money chat, and then they’ll be contacted to confirm their appointment.

Business Banking

Not every credit union is going to offer business banking and products in addition to personal, so this is one area where Coast Capital is unique. This can be particularly valuable if you’re a business owner who wants to simplify your finances and combine them at one institution.

Business members of Coast Capital can take advantage of options like the Deposit-for-Free Business Account, which has a low fee, unlimited deposits and transfers, and unlimited pre-authorized payments.

Also available to business members are business credit cards, merchant services, lines of credit, wire transfers, and foreign exchange services.

Free Chequing

Members of this long-standing and well-respected Vancouver credit union receive free chequing privileges. All of the necessary components of a chequing account, such as withdrawals, transfers, ATM transactions, payments, and the actual writing of cheques are free.

There are unlimited day-to-day transactions available to free chequing account holders, and you gain access to conveniences such as free online cheque images, and free in-branch, online, or phone bill payments.

In addition to the standard free chequing account, the Coast US Chequing account also has no monthly fee, and all transaction fees are waived with a minimum monthly balance of $1,000. This account is ideal for people who do most of their transactions in U.S. dollars and want to earn interest.

Coast Mobile Banking App

The Coast Capital Savings App is available through the Google Play Store and the Apple App Store. It’s free and includes the following features and benefits:

- Use QuickView to see account balances on the home screen without logging in

- View transaction history

- Access messages and reminders

- Add and pay bills

- Deposit checks with Deposit On-the-Go

- Transfer funds between accounts

- Send and receive funds with INTERAC e-Transfer

- Use calculators including mortgage, loan, and foreign exchange

- Find a branch or ATM

- Designed to prevent unauthorized access with transmission via 128-bit encryption technology

Community Savings Credit Union Review

Community Savings Credit Union was started by a small group of people in 1944, and the field of membership is open to anyone who’s interested in their services and financial products. The mission of Community Savings is to “offer a fair opportunity at a better life” to members. This is achieved through providing top-quality banking products and investments, all created in the best interest of members.

This credit union in BC is the 16th largest and has assets of more than $454 million. There is a head office as well as six branches in convenient locations throughout Metro Vancouver and Victoria.

Key Factors Leading Us to Rank This as a Top Credit Union in Vancouver

Below are details of why Community Savings was selected as a pick for a best credit union in BC.

Helpful Hands Program

The Helpful Hands program is designed with the idea that people can encounter financial hardships or struggles, often through no fault of their own. This innovative program was designed to help those members regain their financial footing.

Some of the financial challenges that may be addressed include lost jobs or reduced hours, parental leave, having too much high-interest debt, or a sudden death or illness.

Some of the solutions that may be introduced through the Helpful Hands program include postponing loans, postponing service fees, early redemption, or consolidation to lower monthly payments.

Other possible options include lines of credit, optimizing accounts with a free analysis of chequing and savings, amortization, or the Blend and Extend program for mortgages.

Source: Community Savings Helpful Hands

Member Benefits

When a consumer opts to become a member of Community Savings, they may realize some or all of the following benefits:

- Community Savings is financially sound and includes full-service products

- Because of the size of this Vancouver credit union, members receive personalized attention, and the employees often know members by name

- Community Savings belongs to the second-largest ATM network in BC

- The in-branch design of community savings ensures that members rarely have to wait in line

- Members receive free insurance on most items they buy with a cheque or Member Card

Switching Bonus

A unique potential benefit available to new members of Community Savings is a $300 switching bonus. When a new member switches to the credit union, they can receive $200 for opening an account and setting up a recurring, pre-authorized debit or credit transaction, and then $100 for opening an approved lending or deposit product.

This is in addition to the Carefree Switch Service.

Carefree Switch Service is complimentary, and it includes Community Service handling the paperwork to make the move to their institution as fast and easy as possible for the new member.

Community Service will take care of transferring pre-authorized payments, they will update billers, and they’ll transfer current automatic pre-authorized deposits.

With Carefree Switch Service, the credit union will also provide the new member with a completed payroll form, set up online bill payment vendors, reroute government deposits, transfer your remaining account balance and arrange to have your current accounts closed.

RRSP Loans

This leader among credit unions in BC, and more specifically Vancouver, offers RRSP loans and lines of credit that allow members to maximize their tax benefits and start earning interest right away.

One of these is the RRSP Catch-Up Loan, designed for members who haven’t taken full advantage of their allowable contribution. This Catch-Up Loan can be taken out for 100% of the RRSP being purchased, and terms range from one to five years.

All RRSP loans are paid via Automatic Deduction, and life and disability insurance are available for this product.

Popular Article: Best Credit Unions in the US (Top Ranking List and Reviews)

G+F Financial Group has been serving the diverse financial needs of Metro Vancouver members since 1940, including both personal and business banking products. The vision of G+F is defined as aspiring to enrich lives through creating and nurturing financially empowered communities.

Regarding the mission of G+F, that is not only the financial empowerment of members but doing so through personalized solutions and advice, combined with passion and innovation. Specific services available to members of G+F include insurance, investment products, deposit accounts, and credit cards.

Key Factors That Enabled This to Rank as One of the Best Credit Unions in Vancouver

Key reasons G+F is considered among the best credit unions of BC are listed below.

Member Card

Members of G+F can access their credit union account and make purchases at Interac retailers using the Member Card Debit Card. This card is part of a credit union network so that members can access tens of thousands of surcharge-free ATMs not only in Canada but also in the U.S.

The Member Card is not only a convenient way to obtain cash and make purchases; you can also use it to access your credit union account to make deposits without surcharges.

Members automatically have Buyer Protection and Extended Warranty with their Member Card, meaning purchases are covered for a full 90 days.

Investing

As part of their pledge to be a full-service financial provider, G+F offers a variety of investment products, including term deposits, which provide guaranteed growth over a certain period of time. These term deposits have terms that vary from 30 days to five years, and larger deposits are incentivized.

G+F offers a full selection of mutual funds through Credential Asset Management.

Other investment products available to members of this credit union in Vancouver include RRSPs, RESPs, RRIFs, and tax-free savings accounts.

Brokerage services are also offered, so members have access to sound, future-driven financial advice from experts.

Residential Mortgages

As purchasing a home is likely the biggest and most significant investment a person will make during their lifetime, it’s an area of service G+F takes very seriously. They also seek to offer exclusive benefits to members who obtain a mortgage through them.

Mortgage products from G+F include not only a competitive interest rate, but there are open and closed mortgage options, with flexible repayment plans that can be monthly, semi-monthly, bi-weekly, or weekly. Terms range from six months to seven years, and there is a double-up payment option.

Mortgages are re-advanceable, assumable, and portable. There are also options to include life, disability, critical illness and loss of employment insurance when obtaining a mortgage from G+F.

Ways to Bank

In today’s fast-paced and hectic environment, G+F understand that providing the utmost in convenience and accessibility are imperative, and this is one of the reasons this credit union in BC is ranked highly.

They offer a range of ways to bank so that a member is certain to find the option that works best for them.

With online banking, members can access their account anytime and perform transactions including checking balances, downloading statements, viewing cleared cheques, paying bills, and transferring money. Mobile banking includes many of the same functionalities.

The Member Hub is a phone banking service where representatives answer member concerns or questions six days a week, and of course, there’s also in-branch, face-to-face banking.

Read More: Top Banks in Canada – Ranking | Best High Interest Savings Accounts – Canada

Greater Vancouver Community Credit Union Review

With chequing, savings accounts, loans, mortgages, and more, Greater Vancouver Community Credit Union (GVC) is one of the oldest credit unions in BC. GVC has about 6900 members and four branches throughout the lower mainland. GVC was one of the first credit union study clubs organized in the area in the 1930s.

In 1940, GVC Credit Union received its charter. GVC offers 100% protection on deposits through the Credit Union Deposit Insurance Corporation of British Columbia. All members have democratic voting rights, so they determine the direction the credit union takes.

Key Factors That Led Us to Rank This as One of the Top Vancouver Credit Unions

Some of the pivotal reasons GVC Credit Union was selected as one of the top Vancouver credit unions are included in the list below.

Equity Shares

In 1997, GVC Credit Union introduced a new program, which was called Patronage Equity Shares. This new class of shares was designed to allow the credit union to share earnings with member-owners based on the amount of business that’s done with the credit union.

This means that a person may find they have additional financial perks offered to them, based on their membership. For example, a percentage of the interest paid on a personal loan could be given as a rebate, or the chequing account service charges could be waived for a month.

Personal US Account

Along with several other convenient and value-creating checking accounts available from this leading Vancouver credit union, one option is the Personal US Account. This is designed to offer members flexibility when it comes to handling US funds.

The benefit is not only that it’s a convenient account, but it also helps lower the costs associated with exchanging Canadian dollars when rebates are unfavorable. This account features US currency exchange, money orders, and American Express US Traveler’s Cheques.

This account also features tiered interest paid quarterly.

Personal Chequing Accounts

If you’re not looking for an account that provides favorable US dollar exchanges but do want a valuable chequing account for your personal needs, there are many options available from GVC.

All accounts include free deposit and withdrawal transactions at any GVC ATM, free MemberDirect online banking access, telephone banking access, and overdraft protection.

A few of the specific accounts available include:

- Real Chequing Account: This features a low monthly fee and is billed as an all-in-one account. The fee includes unlimited cheque transactions, Interac Direct Payments, pre-authorized debits and credits, online bill payments and more. This account also includes a line of credit that’s available for $2 per month with application and approval. If a minimum balance of $2000 is maintained, the monthly fee is waived.

- Personal Chequing Account: This is ideal for the budget-conscious member, featuring unlimited cheque writing privileges and a monthly statement with canceled cheque images.

- Golden Account: This is for members aged 55 and over, and it includes the features of a Personal Chequing account, but with no monthly fee.

- Premium Chequing: This account is for members with a high balance. All charges can be waived if the balance is more than $1,000, and a line of credit of up to $5,000 is available with approval.

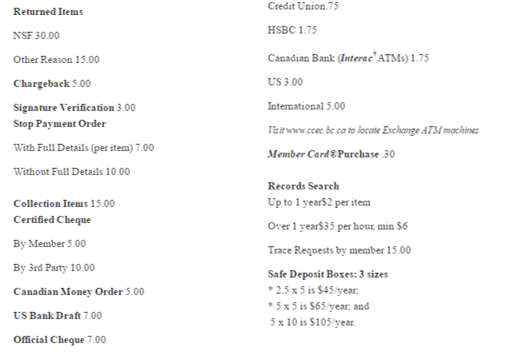

Rewards Credit Cards

Members of this credit union in Vancouver may be eligible for one of several credit cards, including options that offer rewards. One of the signature cards from GVC is the Choice Rewards World Elite MasterCard. This card features two Choice Rewards points for every dollar spent.

There’s a full package of insurance available, and points can be redeemed for unrestricted travel, merchandise, or cash.

Also available is the Gold Choice Rewards MasterCard, which earns one Choice Rewards point for every dollar spent.

As well as high-value rewards cards, GVC features value cards with low fees and rates, and cards that are ideal for students.

Source: GVC Value Cards

Related: Top UK Banks | Ranking | Biggest British Banks & Best Banks in the UK

Kootenay Savings Credit Union Review

Kootenay Savings Credit Union was formed in 1969 through the coming together of three existing credit unions. This integration represented the first of its kind in British Columbia. Throughout the years, Kootenay has grown and expanded but has recently made moves to focus more heavily on technology-based services.

Now, Kootenay Savings has corporate offices in Trail and eleven branches throughout the East and West Kootenay. This credit union in BC has more than $1 billion in assets and 39,000 members.

Key Factors That Led to Our Ranking of This as One of the Best Credit Unions in BC

When reviewing the credit unions of BC, the following are some reasons Kootenay Savings ranks highly.

Profit Sharing

Kootenay rewards the loyalty of members and fosters the mutual spirit of cooperation so essential to the success of credit unions through profit sharing. Since profit sharing was introduced in 1992, Kootenay reports it has shared more than $69.8 million with members.

In the recent year, they shared $479,425, which represents a 1% dividend for members.

Members can withdraw up to 20% of the balance in their profit sharing account to spend as they please, and the rest can then be invested in an RRSP, which provides tax-deferred earning opportunities and, simultaneously, tax credits.

STUDY Package

The STUDY Package is an exclusive offering from this credit union in BC, featuring everything college students need to bank successfully and manage their finances. This full-service bank account includes low fees, flexible student loans, credit cards and more.

STUDY integrates online, mobile and telephone banking, which is perfect for students leaving home.

It includes up to a $45,000 student line of credit for students attending school full-time, and they can borrow up to $15,000 the first year and an additional $10,000 during the next three years. The rate is as low as a prime lending rate, and interest is paid only while in school and for one year after. After one year, the loan becomes a personal loan.

This also includes a student credit card and a Member Card debit card.

For a low monthly fee, the STUDY Package includes free debit card purchases, free savings withdrawals, free MasterCard debits, and more.

MasterPlan

MasterPlan is designed to be the ultimate in streamlined, all-in-one accounts available to members of this selection for a best credit union in BC. Whether you opt for the pay-as-you-go Lite version of the account, or the Prestige account with all the bells and whistles, all MasterPlan accounts include:

- Optional overdraft protection or line of credit

- ATM access

- A Member Card Debit Card

- A comprehensive, free eStatement provided on a monthly basis

- Free cheque images available online

- Free deposits

- Free pre-authorized deposits

- Free mobile and online banking

- Free access to telephone banking

Business

In addition to personal banking, Kootenay Savings features a full selection of business products, perfect for simplifying how banking is done. These products are tailored to any business, regardless of the phase it’s in.

If you’re just starting your business, Kootenay offers business and community accounts. For managing a business, there are business and merchant services, as well as employee banking products and insurance.

In terms of growing a business, there are borrowing, investing, and leasing options.

Also available through this credit union in BC is Small Business Online Banking and the Business MasterCard.

Don’t Miss: Best Banks in Florida (Ranking & Review)

North Peace Savings and Credit Union Review

North Peace Savings & Credit Union is a credit union in BC that strives to provide democratic, ethical, and innovative financial products and services. The slogan of this credit union in BC is “It’s Your Life. Build it Here.” As part of this, NPSCU strives to encourage the success and well-being of all member-owners, as well as the staff and the community.

North Peace was founded in 1947 and has grown to become one of the most significant financial institutions in northern British Columbia. As well as promoting concepts of economic well-being for members and the community, NPSCU also works to promote environmental and social well-being.

Key Factors That Enabled This to Rank as a Best Credit Union in BC

When comparing credit unions in BC, below are some ways NPSCU excels.

Cash Bonuses

Just for joining, NPSCU will give new members $200. New members simply sign up on getyourshare.ca and select the promotion credit union they want to join. The offers are $200 when an account is opened and set up with a recurring, preauthorized payment or deposit, or $200 for transferring a business chequing account.

Once the account is opened, and the requirements are fulfilled, the new member receives the bonus.

If you’re already a member, you can receive bonuses as well, by referring new members. For each friend who’s referred and who opens an account, the current member receives a $25 credit.

Source: North Peace Savings & Credit Union

B.Free Personal Account

A signature offering from this credit union in BC, the B.Free Personal Account is designed to be convenient, hassle-free, and free of extra fees and charges. This account has not only no monthly fee, but transactions are unlimited. The account is also packed with a range of features to suit diverse financial and day-to-day needs.

This account includes free cheque clearing, transfers, debit card transactions, payments, and withdrawals.

There is no minimum balance required, and members can access more than 2,400 ATMs across Canada through the EXCHANGE network.

It also features the option to attach a line of credit to the account to cover overdrafts and unexpected expenses.

Also optional is the addition of a $5 bundle to this account, which lets users have unlimited Interac eTransfers, and unlimited Canadian non-credit union ATM withdrawals.

Investing

Offered through North Peace Financial Planning Services Ltd., there are investment products available to members, and professional service and advisement are also offered.

The financial planning philosophy of North Peace is one based on conservative moves, and the goal of this service is to help members understand risks and manage and minimize them.

Some of the investment products available through North Peace Financial Planning Services include:

- Tax-Free Savings Accounts: These accounts are an investment opportunity not requiring the holder to pay taxes on their interest earnings. Funds can be withdrawn at any time without penalties as well. This is a flexible account that doesn’t have restrictions or time constraints.

- AgriInvest: This is an investment option used to manage small income declines, and it can be a supportive means to mitigate risk or improve income from the market.

- Term Deposits: Term deposits offer a secure, stable, and reliable way to invest with competitive rates and peace of mind.

Platinum Plan Savings

Another signature account option available from NPSCU, the Platinum Plan Savings account is for members who want accessibility but also high interest rates. It’s like a term deposit but with more flexibility.

This account features an annual floating interest rate, which is paid monthly. This account allows for five free transfers to other NPSCU accounts per month. It also has no minimum balance requirement, no monthly fee, and deposits and transfers in are free.

This account is available in U.S. funds and is available for registered products.

Vancity describes itself as a “values-based financial cooperative,” with more than 519,000 member-owners. There are 59 branches of this credit union in Metro Vancouver, as well as the Fraser Valley, Victoria, Squamish, and Alert Bay. Vancity has assets of nearly $20 billion and has thousands of employees.

It was founded in 1946 to serve everyone, and it joined the Global Alliance for Banking on Values in 2010. Vancity shares 30% of net profits with members and community, adding up to profit-sharing of more than $287 million since 1994.

Key Factors That Led Us to Rank This as a Top Vancouver Credit Union

Below are some of the most pertinent reasons Vancity was included in this review and ranking of credit unions in Vancouver.

Values-Based Banking

As mentioned, Vancity strives to provide values-based banking. This is important to understand when looking at why this is one of the best Vancouver credit unions. Vancity is committed to changing how banking is done, with the ultimate goal of creating an environment where members and local communities can thrive in all areas.

In 2013, member deposits went toward the support of thousands of financial literacy seminars, helped provide access to basic banking services for thousands, and funded affordable housing.

Vancity is part of the Global Alliance for Banking on Values, which has a presence in 25 countries and services 20 million clients.

Vancity uses Ethical Principals to guide business relationships and identification of opportunities, and they are the largest private-sector Canadian organization supporting the Living Wage.

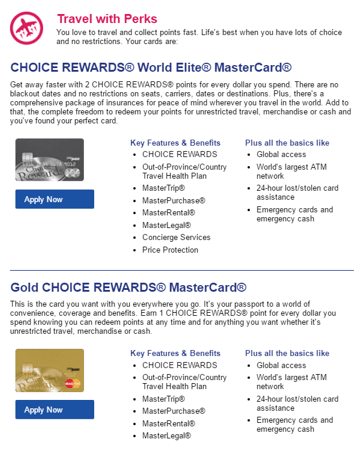

Vancity Fair and Fast Loan

A new product available from this credit union in Vancouver is the Fair and Fast Loan, which is an alternative to a payday loan that provides fast funding, no fees, and a low interest rate.

This is designed to be a middle ground between an expensive and often predatory payday loan and a traditional loan. The goal of Vancity when offering these loans is to provide members with the financial footing they need to develop a stronger financial future.

The Fair and Fast loan features a flexible payback period, ranging from two months to two years, and it’s a good way to establish a strong credit history. Approvals are fast, within the same day, and the treatment during the approval process is meant to make sure members feel like people, rather than just a number.

Source: Vancity Loan Calculator

Home Energy Loans

Another ethical, unique, and valuable lending product available from this Vancouver credit union is the Vancity Home Energy Loan, which offers homeowners opportunities to become more energy-efficient.

This personal loan features a prime+1% rate for up to 15 years, so members can save money as compared to a conventional loan. It can be paid back through flexible options, and not only will the loan help homeowners to be more conscious of the environment, but they can also save money as a result of the changes.

Examples of renovations this loan could be used for include insulation, space heating, draft proofing, windows and doors, and the addition of solar panels to hot water or solar electric systems.

Electronic Package

Vancity offers quite a few chequing accounts, but one of the signature options is the Electronic Package. This chequing account includes unlimited transactions available every day, as long as you maintain a minimum monthly balance greater than $1,000.

Along with no transaction fee, if you maintain this minimum balance, you don’t pay a monthly fee. In fact, all fees are waived.

Other features of this straightforward account include unlimited free debit card transactions and the option to pay bills, make mobile deposits, and transfer funds from and between Vancity accounts. Cheque images are also included in monthly statements.

Popular Article: Best Banks in New York | Ranking of Banks in NYC, Buffalo, etc.

VP Credit Union was originally founded in 1944 to serve the financial needs of Vancouver police officers. The membership field has since expanded to include employees affiliated with the Provincial Courts and E-Comm corporation, sworn and servicing members of the South Coast Transit Authority Police, members of all BC Municipal Police Departments, and members of the RCMP in BC.

VP Credit Union strive to maintain excellent service and the same dedication to protecting the interests of members that this Vancouver credit union was founded on.

Key Factors That Enabled Us to Rank This as a Top Credit Union in Vancouver

When considering the many credit unions in Vancouver, the following are some of the criteria that went into the inclusion of VPCU on this list.

Conveniences

In addition to banking products and services, VP Credit Union offers many extra services and conveniences designed to enhance the lives and finances of members.

These include:

- Bill Payment: This online service can be used to make payments to approved vendors quickly and easily

- Foreign Currency: Members can take advantage of favorable exchange rates when they’re planning to travel, including to the US

- Pre-Authorized Transfer: This service lets members have their funds transferred on a regular basis to internal and external accounts

- Payroll Deposit: Payroll and government cheques or other types of income cheques can be directly deposited into accounts, which can help avoid delays and make sure members have faster access to funds

- Payroll Deduction: This service is designed to help members build a robust investment account or reduce loan balances by having part of their cheque automatically sent to a destination

HyperWallet

Members of this credit union in Vancouver have the opportunity to take advantage of HyperWallet, which is a third-party payment platform.

HyperWallet payments can be made online through Member Direct. This means members can quickly and easily add cash to their virtual wallet and send it to any financial institution on the continent.

With HyperWallet, members can also directly email cash to friends or family members, calculate foreign exchange rates, send or receive auction payments, or use it to send and receive a variety of business payments.

Personal Savings

VP Credit Union offers many diverse and flexible savings options. These include:

- Special Savings is a basic account that carries no service charge and features interest that’s paid semi-annually.

- Plan 24 is a daily interest savings account created by credit unions in Canada. Interest is calculated on the closing balance and paid on a quarterly basis.

- Membership Shares is the foundational account that grants membership, and it entitles the account holder to participate in elections and votes. Dividends and patronage refunds are paid into this account.

Other personal savings accounts include Equity Shares, Investment Equity Shares, Participation Equity Shares, and Kirby Kangaroo Club.

Online Loan Application

Loan options available to members of VP Credit Union include personal loans, mortgages, and lines of credit.

To make the entire process as smooth and hassle-free as possible for members, they can apply online for a loan or line of credit, as long as they’re eligible for an account with VPCU.

All members do is download the loan application from the website, fill it out, and email it back. They attach a copy of their most recent paystub or T4 stub from the prior year, and VP Credit Union will work to process the loan in a timely way.

Often, consumers feel like they’re backed into a financial corner by the conventional banking system. From fee hikes on the most basic of accounts to the inability to obtain financing at a reasonable price, banks are often full of obstacles for the customers who rely on them.

Fortunately, there are credit unions in Canada designed to help consumers sidestep these banking pitfalls, and instead build a stronger financial future for themselves, while gaining access to the products and services they need.

The Vancouver credit unions and the credit unions in BC that are included on this ranking excel in many areas, but above all, they provide an ethical banking alternative that also promotes financial value.

List of the Best Credit Unions in Vancouver

This list is sorted alphabetically (click any of the below names to go directly to the detailed review for that credit union).

- CCEC Credit Union

- Coast Capital Savings

- Community Savings Credit Union

- G+F Financial Group

- Greater Vancouver Community Credit Union (GVC)

- Kootenay Savings Credit Union

- North Peace Savings and Credit Union

- Vancity Credit Union

- VP Credit Union

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.