2017 RANKING & REVIEWS

TOP RANKING BEST INDEX FUNDS

The Top Index Funds to Invest in for a Great 2017

When people are looking for a lower cost investment that doesn’t need a lot of time to keep up with, index fund investing is a popular choice. The best index funds are designed to replicate the performance of a given stock index, such as the S&P 500®, but you can generally invest for less with index funds.

The time savings comes in because these low-cost index funds are not actively managed like some other types of investments. There is no need to pick winners from losers because most index mutual funds are already targeting a well-established index.

Award Emblem: Top 6 Best Index Funds

The top index funds either own each asset in the index they’re trying to replicate or hold similar securities in order to achieve similar growth results; there is a specific pool of investments in the best performing index funds which make up the portfolio. This is why they aren’t “actively” managed — it’s already pulling in well-performing stocks from the benchmark index.

In a study by Morningstar, researchers found that actively managed funds perfomed worse overall than their passive counterparts. In their comparison of a 10-year timeframe ending December 2014, the lowest cost index funds in the study had a success rate of 28 percent, while the high-cost, actively managed funds had a success rate of 18.6 percent.

For this article, we’ve chosen the best performing index funds that you should check out for 2017. We will review their performance, which index they are mirroring, and some important index investing questions and pros and cons of investing in index funds.

See Also: Top Credit Cards | Ranking & Reviews

AdvisoryHQ’s List of the Top 6 Best Index Funds

List is sorted alphabetically (click any of the index fund names below to go directly to the detailed review section for that index fund):

- Fidelity® 500 Index Fund – Investor Class (FUSEX)

- iShares Core S&P Total U.S. Stock Market ETF (ITOT)

- Schwab U.S. Dividend Equity ETF™ (SCHD)

- SPDR® S&P® Bank ETF (KBE)

- Vanguard 500 Index Fund Admiral Shares (VFIAX)

- Vanguard Total World Stock ETF (VT)

Top 6 Best Performing Index Funds | Brief Comparison & Ranking

Top Index Funds | Average 3-year Annual Returns | Expense Ratio | Index It Tracks |

| Fidelity® 500 Index Fund – Investor Class (FUSEX) | 8.98% | 0.09% | S&P® 500 Index |

| iShares Core S&P Total U.S. Stock Market ETF (ITOT) | 10.82% | 0.03% | S&P® Total Market Index |

| Schwab U.S. Dividend Equity ETF™ (SCHD) | 8.91% | 0.07% | Dow Jones U.S. Dividend 100 Index |

| SPDR® S&P® Bank ETF (KBE) | 9.81% | 0.35% | S&P® Banks Select Industry Index |

| Vanguard 500 Index Fund Admiral Shares (VFIAX) | 9.03% | 0.05% | S&P® 500 Index |

| Vanguard Total World Stock ETF (VT) | 5.56% | 0.14% | FTSE Global All Cap Index |

Index Fund Investing FAQ | Expense Ratio & Index Fund Definition Basics

There are some key definitions you’ll want to understand before you buy index funds. Terms like “expense ratio” and “average annual returns” are comparisons you’ll want to make when you look through a list of index funds so that you’re making the right choice for your financial future.

First, let’s take a deeper look at how index funds are defined.

Index Fund Definition

As we mentioned, index mutual funds are made to mirror the performance of a well-known and established fund. Their portfolio consists of stocks, bonds, or other securities. It usually costs less to buy index funds, and you also spread your liability out over several investments in the portfolio rather than just a few stocks.

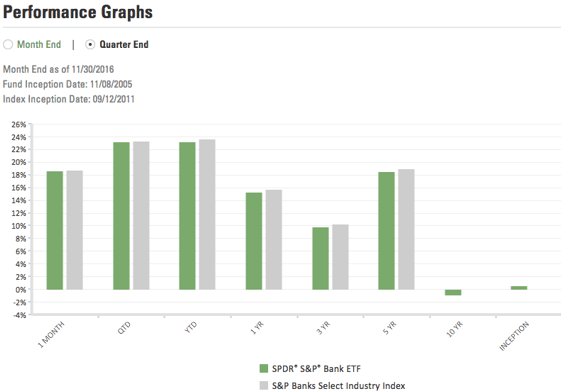

Image Source: SPDR® Top Index Funds Comparison

When you research index investing, you’ll often see a chart showing the performance of the low-cost index funds as compared to the index they are tracking and trying to match in performance.

Expense Ratio Definition

You’ll see the term expense ratio used when you’re reviewing the best performing index funds. The expense ratio of index funds is the total percentage of fund assets used for administrative, management, advertising (12b-1 fee), and all other expenses. An expense ratio of 1% per year means that each year 1% of the fund’s total assets will be used to cover expenses.

Because the best index funds are more passively managed, they will typically have a lower expense ratio than actively managed funds. The lower the expense ratio, typically, the better for index fund investing.

Average Annual Returns Definition

Another important figure to know when you’re choosing low-cost index funds is the average annual returns (AAR). This is a percentage used when reporting the historical return or gains average over a particular time period for index funds. The higher, the better.

When you’re investing in index funds and reviewing this figure, it’s good to look at both the longer-term AAR and the average since the fund’s inception to get the best overall picture. This also gives you insight into which are the most reliable top index funds over time.

Index Fund Investing FAQ | Pros and Cons of Index Investing

While lower costs and less time to manage your portfolio sound great, there are both pros and cons to consider when you’re investing in index funds. Just like any other investment, not all index funds are created equal, so here are a few things you’ll want to consider before you buy index funds.

Image Source: Index Fund Investing

Index Mutual Funds Pros

- Lower cost

- Outperform actively managed portfolios over time

- You don’t need to know a lot about investing

- Diversification over multiple securities

- Low operating expenses

- Can protect you if one particular stock plunges

Index Mutual Funds Cons

- Potential loss due to “rebalancing” of an individual stock

- Possible tracking error from main index being mirrored

- Slower to adjust to valuation changes

- Less personal involvement in stock picks

Don’t Miss: Top Capital One Credit Cards | Ranking | Compare Best Capital One Credit Card Offers & Promotions (Reviews)

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Best Index Funds

Below, please find a detailed review of each product on our list of best performing index funds. We have highlighted some of the factors that allowed these top index funds to score so highly in our selection ranking.

Fidelity® 500 Index Fund – Investor Class (FUSEX) Review

Fidelity® has been around since 1946, when it was founded as a management and research company. The company has over 25 million individual customers and manages approximately $5.5 trillion in total customer assets.

The Fidelity® 500 Index Fund – Investor Class makes our top list of index funds for a few reasons. They’ve had a steady growth rate since 2009, closely following along with the S&P® 500 Index. Average annual returns over its lifetime for index investing customers are a healthy 9.95%.

Key Index Fund Investing Factors for FUSEX:

- Minimum to invest: $2,500

- Expense ratio: 0.09%

- Turnover ratio: 4.0%

- Morningstar Rating: 4 out of 5 stars

This is one of the low-cost index funds that is heavily weighted in the information technology sector, which makes up 21.44% of the portfolio, followed by health care (13.85%), financials (13.19%), consumer discretionary (12.14%), consumer staples (9.96%), industrials (9.89%), and a few other market sectors.

iShares Core S&P Total U.S. Stock Market ETF (ITOT) Review

If you’re looking for exchange traded funds with a reputation of outperforming over 80% of mutual funds, then you’ll be interested in this iShares® by BlackRock® index investing option. BlackRock® was founded in 1988 and has grown to managing over $5.1 trillion in assets.

We chose their iShares Core S&P Total U.S. Stock Market ETF for our best index funds ranking because of the strong core mix of small to large companies and the low expense ratio. At just 0.03% they have the lowest on our list of index funds.

Key Index Fund Investing Factors for ITOT:

- No minum to invest is noted

- Expense ratio, 0.03%

- Turnover ratio, 14.0%

- Morningstar Rating, 4 out of 5 stars

The average annual return rates are attractive when compared to other best performing index funds. The average since inception is 7.48%, with the 1 year to 5 year being between 10.82% to 16.30%. The top two market sectors in the portfolio are information technology (20.07%) and financials (15.43%).

Related: Top Best Credit Cards (Comparison & Ranking) | Compare Credit Card Rewards, Travel Points, Rates & Benefits

Schwab U.S. Dividend Equity ETF™ (SCHD) Review

Of course the name Charles Schwab has become nearly synonymous with investment products since the company was first started in 1973. They manage over $2.73 trillion in client assets and they offer over 200 zero commission ETFs.

Image Source: Schwab Top Index Funds

Their Schwab U.S. Dividend Equity ETF™ has zero shareholder fees paid from the investment and the expense ratio is 0.07%, reasonable when compared to other index funds. One of the reasons it made our top list of index funds is because of the excellent average annual return since inception of 19.04%.

The index that you would be tracking when investing in index funds like this one is the Dow Jones U.S. Dividend 100™ Index, which represents 100 high-dividend-paying U.S. companies with a record of consistently paying dividends to shareholders.

Key Index Fund Investing Factors for SCHD:

- No minimum to invest is noted

- Expense ratio, 0.07%

- Turnover ratio, 22.0%

- Morningstar Rating, 4 out of 5 stars

When investing in index funds with dividends in mind, this one is laser-focused for dividend payouts. The criteria for a stock to be included in the portfolio is to have sustained at least 10 consecutive years of dividend payments, have a minimum float-adjusted market capitalization of 500 million USD, and meet minimum liquidity criteria.

SPDR® S&P® Bank ETF (KBE) Review

State Street Global Advisors has been around for nearly four dedades and is the investment management arm of State Street Corporation. The firm has approximately $2.3 trillion in assets under management.

Their SPDR® S&P® Bank ETF is one of the low-cost index funds that they offer. This one is designed to correspond generally to the performance of the S&P® Banks Select Industry Index. We like this for index investing because of how closely it tracks with the target index.

Although the annual average return since inception is just 0.50%, the estimated 5-year annual average return is 18.50%. Another reason it’s on our top list of index funds is the 3-5 year earnings per share (EPS) growth, which is estimated at 9.52%.

Key Index Fund Investing Factors for KBE:

- No minimum to invest is noted

- Expense ratio, 0.35%

- Turnover ratio, 40.0%

- Morningstar Rating, 2 out of 5 stars

At first glance, people might not see this as an index fund definition of top performer, but we think it could be a dark horse, currently flying under the radar but with promise for the future.

Popular Article: Best Credit Cards for Students with No Credit or Bad, Poor or No Credit History

Vanguard 500 Index Fund Admiral Shares (VFIAX) Review

Vanguard is well-respected in the financial world and a favorite of businessman Warren Buffett. The company has been helping customers invest since 1975 and prides itself on integrity and serving its investors first.

This is one of the two index mutual funds from Vanguard on our top list of index funds, and it is the higher priced of the two: $208.89 as of 12/21/16. The Vanguard 500 Index Fund Admiral Shares has had an excellent growth trajectory since November 2008 and has a average annual return since inception of 5.12%.

Key Index Fund Investing Factors for VFIAX:

- Minimum to invest: $10,000

- Expense ratio: 0.05%

- Turnover ratio: 3.0%

- Morningstar Rating: 4 out of 5 stars

When investing in index funds that are higher priced, you can rest assured knowing that this one has an excellent history and tracks very closely with the benchmark S&P® 500 Index.

Free Wealth & Finance Software - Get Yours Now ►

Vanguard Total World Stock ETF (VT) Review

This Vanguard choice as one of the best index funds for investing is much more affordable than the VFIAX. The Vanguard Total World Stock ETF is currently at $61.42 per share and does not have a minimum investment.

Image Source: Best Performing Index Funds

The portfolio, which tracks the FTSE Global All Cap Index, is made up of a regional allocation of North America (57.30%), Europe (19.50%), Pacific (14.10%), Emerging Markets (8.80%), Middle East (0.20%), and other regions (0.10%). So this is one of the best performing index funds if you want to diversify globally.

Key Index Fund Investing Factors for VT:

- No minimum to invest is noted

- Expense ratio: 0.14%

- Turnover ratio: 7.0%

- Morningstar Rating: 3 out of 5 stars

The annual average return since inception is 4.46%, with the 5-year average at 9.09%. Vanguard has the distinction of having several of their top index funds, including this one, listed on Forbes “Best ETFs” Rankings.

Read More: Top Credit Cards for Miles | Ranking | Best Miles Credit Card Reviews

Conclusion – Top 6 Best Index Funds

With so many low-cost index funds to choose from, it can sometimes be difficult to pick out the best performing index funds from the rest. But if you know some of the key factors to look for, such as average annual return rate, expense ratio, and growth rate, it can be easier to do a comparison.

Knowing which index that the index mutual funds are tracking is also important to understanding where to buy index funds. Check the fund it’s tracking to fully understand the makeup of the products in the portfolio you’re buying into.

We hope our list of index funds that track well with their benchmark has been a helpful guide to learning more about investing in index funds. They not only generally cost less than other direct investing and take less time to manage; top index funds are also shown to outperform many others over time.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.