What Is Wallethub? The Benefits of Utilizing a Financial Management Service

Wallethub is an online financial management tool that monitors and reports users’ credit report and credit score. Consumers can use Wallethub to access updated, real-time information about their credit and their up-to-date Wallethub credit score.

With a plethora of free online financial management services to choose from, it is obvious that consumers have become savvy in checking their credit report and score often.

Since your credit score helps lenders to decide whether or not to loan you money, you must check for misreported information, and to help prevent fraud or identity theft. Monitoring your credit information can also help you take steps to improve your credit, if needed.

Wallethub Reviews

Federal law states that everyone is entitled to an annual free credit report from each of the three credit bureaus. While it is important to check your credit report from each credit bureau annually, the free annual report has its limitations.

The annual reports from each agency do not provide a credit score, and once you have checked them, you will not have access to your full credit reports until the next year.

Services like the Wallethub credit score and report can fill in the gaps by providing you with your credit information as often as you access the site. Wallethub also provides other services beyond merely granting access to your credit report and score. Instead of existing just as a means to check your credit report, Wallethub is a financial tool designed to help you manage your credit over time. While the Wallethub credit score and report is the main feature of the site, the service seeks to give financial advice to help you improve your credit.

Wallethub Review: What Exactly Does Wallethub Offer?

Wallethub offers a multitude of free services for their users:

- Free credit report from Transunion

- Free Wallethub credit score

- 24/7 free credit monitoring

- A forum and community of other users and financial experts

- Calculators and planning tools

- Articles and advice on the best financial services and products

- Free Wallethub App from Apple’s App Store

It should be noted that your Wallethub credit score and credit report is taken from Transunion. With Wallethub, you are unable to see your reports from the other credit reporting agencies, Equifax and Experian.

On Wallethub’s FAQ question page, a user asked Wallethub directly about accessing their credit report from the other bureaus. Wallethub responded to this inquiry by stating that, “many credit score and credit report providers only offer data from one of the three credit bureaus.”

Another important point to consider is that your Wallethub credit score is not a FICO credit score; instead, it is a Vantage 3.0 Credit Score. Arguably, FICO is the most familiar credit score to most people. However, lenders can use their own criteria and formula in order to calculate a credit score on which to base their lending decisions. In fact, there are many different types of credit scores, but the popularity of the Vantage 3.0 Score is growing fast.

According to Wallethub contributor John S. Kiernan in his article, “Credit Karma vs. FICO: How Their Scores Compare,” Kiernan argues that “neither type of credit score is inherently better than the other.” Even though the FICO score is the best known type of score, the Wallethub score is a valuable score that will give you an indication of the health of your overall credit standing.

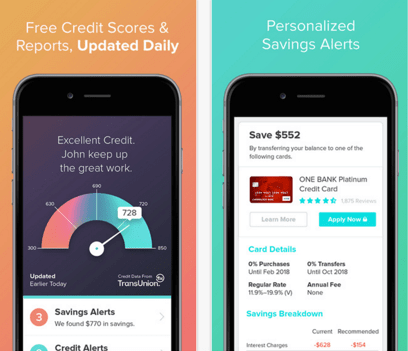

Lastly, the Wallethub app, available in the App Store, allows users to access your credit report and score conveniently on your iPhone or iPad. Additionally, you can receive alerts regarding your credit monitoring on your iPhone or iPad without having to go to your computer. As shown below, you will notice that the Wallethub app has a simple interface that clearly shows you your Wallethub credit score.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Please note that the Wallethub app is not currently supported by the Google Play store for Android devices. According to Wallethub’s Twitter page, the Wallethub app just launched on June 21, 2016, and was one of the top trending apps on the App Store in the first day it was introduced. There is no word just yet on when the Wallethub app will be available for Android devices.

What Exactly Does Wallethub Offer

Don’t Miss: Consumer Credit Counseling Service – What You Should Know Before Using Them

What Makes Your Wallethub Score and Report Different from Other Similar Services?

With many similar financial management platforms available, you might be wondering, “What makes Wallethub’s credit score and report different?” What makes your Wallethub score and credit information different is the fact that it is updated daily. Even though the information may not change from one day to the next, your Wallethub score is updated around the clock. Most other sites update weekly or quarterly, but every day that you log in to Wallethub, you know that you will have the freshest information available.

Furthermore, Wallethub’s main objective is to give the consumer information and tools to improve “financial fitness.” The company’s focus is not primarily to sell you affiliate products but to give you the best advice to improve your financial status.

Related: Credit Karma Complaints | What You Should Know Before Using the Site

Is Wallethub Legit? Can a Credit Monitoring Site Offer So Much for Free?

At this point, you might be thinking that what Wallethub offers is too good to be true. You may be worried that you will sign up to be a user, only to find out that you will be charged a monthly rate after a free trial period. After all, one of the three major reporting agencies, Experian, does just this.

Can the Wallethub free credit score and report (and everything else) really be free? In short, yes.

It is absolutely free to sign up for Wallethub’s credit score and report, and no credit cards are required to join. You will have to provide your Social Security number, but only for the purposes of locating your financial information and confirming your identity.

But how can you get a free Wallethub credit score when other services charge for credit scores? The company must make its money from someplace.

The answer is rather simple: Wallethub sells advertising to business affiliates. Financial companies can buy premium placements for their ads, and Wallethub will display those ads to you in the form of “Personalized Savings Alerts.”

One advantage signing up for the Wallethub credit score and credit monitoring is that they will not send you endless emails trying to sell you products from different companies. Instead, they organize and display offers from companies that can save you money. You can also search the Wallethub website to compare offers so that you can make the best financial decisions.

In the end, Wallethub’s objective is to provide the consumer with the best tools and all of the financial information they need. The Wallethub credit score, report, and report monitoring are provided with the intention that the user can gain valuable information and advice in order to make the best financial decisions.

Popular Article: Credit Karma Reviews | Is Credit Karma Accurate, Legit & Really Free?

How Secure Is Your Wallethub Credit Score and Financial Information?

Can you be sure that your financial information is safe with Wallethub? Absolutely. You must feel confident that a company will keep your information safe. With so many incidents of websites being hacked, it is only natural to feel nervous about your information online. Fortunately, your Wallethub credit score and report are encrypted. The platform uses “https” Web addresses and 128-bit encryption. This is the same level of security that your bank uses to protect your financial information online.

Furthermore, Wallethub has additional safeguards in place to protect user’s accounts and information. According to Wallethub’s Privacy Policy, all information you enter about yourself at sign-up will be made anonymous when it’s saved by Wallethub servers.

The site also limits the access and use of Social Security numbers and does not give them to third parties, except as permitted by law. The site does not display account numbers on the screen, and the connection is secured through SSL encryption, firewalls, and password protections to guard against the loss or discovery of your private information.

Wallethub does warn of the conventional wisdom that not all connections over the internet are absolutely secure. Any site, no matter how secure, can be vulnerable to attacks. Wallethub does everything it can to prevent your information from being taken by someone else. You can rest assured that your Wallethub credit score, report, and all your information is as safe as it is on any other site that stores financial information.

Free Wealth & Finance Software - Get Yours Now ►

Wallethub Review: Final Thoughts

Your Wallethub credit score and report may not include all three reports from the major credit bureaus, but the service still provides a wealth of useful information and advice to its users. Wallethub’s free credit score and report, along with 24/7 crediting monitoring, are excellent ways to keep tabs on your credit and financial health.

It is easy to log online and purchase your FICO score each time you want to check up on your credit, but your Wallethub score is updated daily, free of charge. Wallethub serves as a way to constantly monitor your credit in a way that makes paying for your FICO score a waste of money. Most importantly, Wallethub serves as a useful financial tool that not only lets you check in on your credit, but also gives you advice on how to continually improve it.

The support you will receive from Wallethub, its financial advisors, and the community of members, are additional reasons to sign up, instead of merely checking your free annual credit report. The Wallethub free credit score and report does more than just provide the free score and report; it also strives to arm users with the very best advice, information, and support available so that users can benefit the most from access to their credit information.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.