Guide: Wedding Loans & How to Pay for a Wedding

Weddings can be extremely expensive. Unless you have high-paying jobs, a lot of savings, or parents who are willing to spend a lot of money for your wedding, you may have to fall back on another form of financing: a marriage loan.

When you add in the cost of engagement ring financing, wedding ring financing, and the honeymoon, a wedding can quickly become the most expensive event you will experience in your lifetime. Paying for a wedding can put added strain on a relationship before the wedding even happens.

Wedding Loans

Can you get a loan for a wedding? Absolutely. This article will explain how to pay for a wedding and engagement using a marriage loan.

A marriage loan can help you afford everything from your rings to your dress to the ceremony and honeymoon afterward, yet they are not commonly discussed as an option. Wedding grants are also available to couples who need some extra money for their dream wedding.

We will also show you where you can find the best loans for wedding purposes, how to get engagement ring financing and wedding ring financing, and how to find wedding loans for people with bad credit. We want you to be able to afford your wedding with the help of this wedding loan guide!

See Also: What Is a Contingent Beneficiary? Overview and Definition

How Expensive Are Weddings?

With the average wedding costing just over $33,000, it should not be a surprise that many couples wonder, “How do people pay for weddings?”

The average cost of a wedding in the U.S.:

- Alabama: $25,500

- Arkansas: $21,800

- Arizona: $29,400

- California: $39,000

- Colorado: $30,000

- Connecticut: $41,000

- Delaware: $34,900

- DC: $40,600

- Florida: $30,600

- Georgia: $30,900

- Hawaii: $32,900

- Idaho: $19,800

- Iowa: $22,600

- Illinois: $39,700

- Indiana: $22,800

- Kentucky: $23,900

- Kansas: $22,400

- Louisiana: $33,900

- Maine: $33,500

- Maryland: $33,800

- Massachusetts: $43,600

- Michigan: $29,700

- Minnesota: $28,800

- Mississippi: $23,800

- Missouri: $26,600

- Montana: $23,000

- Nebraska: $23,300

- Nevada: $22,500

- New Hampshire: $32,100

- New Jersey: $53,400

- New Mexico: $25,600

- New York: $48,600

- North Carolina: $29,500

- North Dakota & South Dakota: $29,200

- Ohio: $29,300

- Oklahoma: $21,200

- Oregon: $22,400

- Pennsylvania: $35,900

- Rhode Island: $49,800

- South Carolina: $30,600

- Tennessee: $26,900

- Texas: $30,200

- Utah: $19,700

- Vermont: $38,300

- Virginia: $33,300

- Washington: $25,600

- West Virginia: $26,500

- Wisconsin: $27,800

- Wyoming: $19,800

Couples may envision a wedding ceremony without envisioning all the small details. Paying for a wedding is much more than paying for the ceremony. It is also the cost of bridal party apparel, bachelor and bachelorette parties, wedding invitations, photography, and more.

The costs can add up fast, leaving couples to worry about engagement ring financing, honeymoon costs, and more, in addition to the wedding details.

How Do People Pay for Weddings?

With all of these expensive details, how do people pay for weddings?

Some couples opt for the traditional way of paying for a wedding with the bride’s family paying the majority of the costs. But this is not always easy for the bride’s family; not every set of parents has that kind of money, and they could risk going into debt with wedding loans.

Those who do not want to rely on parents to afford a wedding may look into other ways for paying for a wedding. This can include cutting costs wherever possible, strict budgeting, or using credit cards.

How to Pay for A Wedding?

But these payment methods can take a long time to actually afford a wedding. If you do not want to wait months, or even years, until your budget allows for your dream wedding, what are your options? Can you get a loan for a wedding to cover what you cannot afford right away?

Loans for wedding ceremonies are quite common, but they may not be something you have heard of. This is probably because how people pay for their weddings is not typically discussed with their wedding guests. But a marriage loan can help you afford everything from your rings to your dress to your reception.

Now, we will discuss the many ways you can use a marriage loan to help fund the wedding of your dreams. There are even bad credit wedding loans to help those in any financial situation afford a wedding.

Don’t Miss: Key Questions to Ask a Financial Advisor Before Using their Services

Engagement Ring Financing and Wedding Ring Financing

Can you get a loan for a wedding ring or engagement ring? If you have ever gone to a jeweler to search for the perfect engagement ring or set of wedding bands, you may have been offered engagement ring or wedding ring financing.

These financing plans are, essentially, loans for wedding costs. When you finance an engagement ring or wedding ring, you will pay for the cost plus interest over the course of several months or years.

Kay Jewelers, for example, offers engagement ring financing for 12 months with 20% down if you buy a ring worth $500 or more.

Some couples, instead, choose to take out loans for wedding rings and engagement rings because personal loans can sometimes have longer terms for lower monthly payments or a better interest rate.

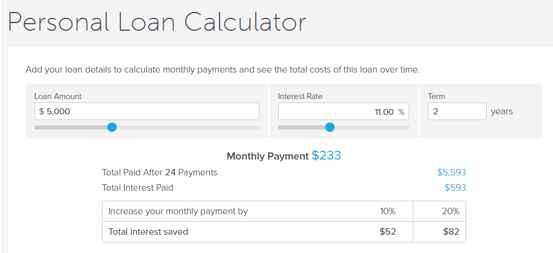

On average, an engagement ring costs $4,758 in 2016. That’s almost $5,000 a couple has to spend before the wedding takes place. Using a personal loan calculator, you can find out how much per month you will be spending on the average-priced engagement ring for a personal marriage loan.

Loans for Weddings

For example, a $4,758 ring with taxes would be about a $5,000 sale. A $5,000 personal wedding loan for an engagement ring or wedding bands with an 11% interest rate and a term of 2 years will cost $233 per month, and you will pay almost $600 in interest.

But, if the cost of a monthly personal marriage loan for a ring makes sense for you financially rather than paying the cost upfront, be sure to add it in with the other potential costs you will have from other wedding loans.

Wedding Loans for Dress Financing

Wedding dress costs, on average, range from about $800 to $3,000, making them another expensive part of paying for a wedding. Fortunately, there are a few different ways you can make your dream wedding dress affordable, such as taking out a personal wedding loan, using a credit card, or finding a bridal shop that offers financing.

Your credit card can act as a marriage loan to cover the cost of a wedding dress, especially if you choose to sell your wedding dress later. If you do, you’ll get a good amount of your purchase back minus interest, provided the dress is in excellent condition. You can use your proceeds to pay off your credit card debt.

Some bridal shops have in-store financing, either through a credit line or a personal wedding loan. David’s Bridal, for example, offers credit card financing as a marriage loan for your wedding dress to help make paying for a wedding more affordable.

Related: Cost of a Financial Advisor. How Expensive Are Financial Advisors?

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Wedding Loans for People with Bad Credit

If you suffer from bad credit, you might feel like wedding financing will not be an option for you. How do people pay for weddings with bad credit?

Fortunately, there are bad credit wedding loans available, although they may tack on higher interest rates for risky customers. Still, they might be the best option for wedding loans for people with bad credit who cannot qualify for a regular wedding loan.

Carpe offers bad credit wedding loans to those with a credit score of at least 600. Although Carpe states that, with a better credit score and higher income, you can qualify for the lowest interest rates, you may still find a loan that can help you afford your wedding.

LifeHouse Financial also offers wedding loans for people with bad credit through unsecured, secured, or co-signer options. Its unsecured loans can range from 12 months to 5 years, so you can find a loan that fits within your monthly budget.

You also have the option of searching for personal loans to use as bad credit wedding loans rather than loans specifically for weddings. Most lenders of personal loans allow you to use the funds for a variety of purposes, weddings included, and you may be able to find better rates from traditional lenders.

Is a Marriage Loan Worth the Cost?

We know the answer to “Can you get a loan for a wedding?” is a yes. But, is a marriage loan a good idea, or can it turn out to be too costly in the long run?

Loans for wedding costs are typically helpful for those with good credit and higher incomes because they usually qualify for better interest rates on loans. Bad credit wedding loans can force you to pay extremely high interest rates, leading to higher monthly payments, which could put you into further debt over the course of your loan.

Wedding loans also put you in a situation where you are in debt before you have your wedding ceremony. So, you are starting your marriage in debt, potentially by tens of thousands of dollars.

However, for those who can qualify for low interest rates but do not have the up-front costs to cover a wedding and its details, a wedding loan can be the perfect solution to finance the wedding of your dreams.

Popular Article: What Is a Stocks & Shares ISA? Who Can Open an Account?

Paying for a Wedding with Wedding Grants and Sponsors

For other couples who do not qualify for low interest rates and cannot afford high monthly payments, there is another option. You have probably heard of grants for college or entrepreneurs, but have you heard of wedding grants when learning how to pay for a wedding?

Wedding grants are real, and they could be your best chance at affording your dream wedding. You will have to meet specific requirements to qualify for different wedding grants.

Wish Upon a Wedding, for example, requires that at least one person in the couple is diagnosed with a terminal illness or has another life-threatening circumstance that is preventing the couple from marrying when they want to. This non-profit organization gives grants to these couples who qualify so they will not be left worrying about how to pay for a wedding on top of their stressful circumstances.

Another form of wedding grants is through the use of wedding sponsors. Wedding sponsors can be individuals or companies who provide you with free things for your wedding in exchange for the free advertising they get by having their products front and center. For example, you could have your wedding dress sponsored by a bridal company. You get your dress for free, and the company gets advertisement when you tell your guests where you got it.

How to Find the Best Wedding Loans

If grants and sponsors are not for you, and you would still rather have a wedding loan, let’s look at some ways to find the best marriage loan for your situation.

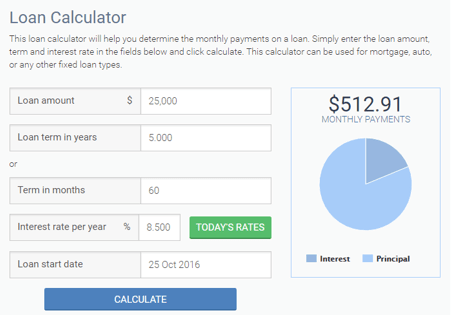

For the most success with finding a competitive rate for a marriage loan, consider using a free online loan search to match you with loan offers from different lenders whose pre-qualifications you meet.

Peerform and Bankrate provide solid personal loan searches for you to find funds to use as a wedding loan. Plug in your basic information, including your credit score and income information, and these search tools can help you compare offers for a marriage loan.

Paying for a Wedding

Once you find loan offers you are interested in, consider using a free online calculator to help you determine what personal wedding loan terms are the best for you, short-term and long-term.

Read More: What Is Self-Build Insurance—UK? Definition

Conclusion

A marriage loan can be the perfect solution to afford the perfect wedding for the right couple. Those with higher incomes and better credit scores will qualify for the best interest rates. However, bad credit wedding loans can put you further into debt than you bargained for before your wedding ceremony is over.

Consider searching for a wedding sponsor or grant, using credit cards, or turning to family and friends before getting a wedding loan. These can help you keep costs down to avoid putting your marriage into debt at its beginning.

But, if a wedding loan is your best option, look for those with the lowest rates and compare them well before settling on a loan. Doing so will put you in the best shape for your financial future while still being able to afford a beautiful wedding.

Image Sources:

- http://www.gogroom.com/index.php/wedding-insurance/

- https://smartasset.com/personal-loans/personal-loan-calculator

- https://www.bankrate.com/calculators/mortgages/loan-calculator.aspx?ic_id=home_calculator_personal-loan_globalnav

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.