Introduction: The Importance of Choosing between a 15-Year vs. 30-Year Mortgage

Buying a home is without a doubt one of the biggest financial decisions that most people will ever make.

When you find a home that you love, making the decision to visit the bank to search for financing is both exciting and terrifying all at the same time. If the bank does accept to finance your home, you will likely have to choose between a 30- vs. 15- year mortgage.

While the 30-year mortgage has become the standard financial tool that most families accept, more and more people have begun to consider other mortgage options.

A 15-year mortgage vs. 30 is a tough decision to make, with both pros and cons for each option. In all likelihood, the decision between a 15-year vs. 30-year mortgage will be one of the most important financial decisions that you will ever make.

15-Year vs. 30-Year Mortgage

In this brief article, AdvisoryHQ will give you all the information you need to know on a 15- vs. 30-year mortgage. We begin by explaining what a 15-year or 30-year mortgage is. Next, we turn our attention to our attention to both the pros and the cons of a 30-year vs. 15-year mortgage.

Since choosing between a 30- vs. 15-year mortgage will likely affect your financial livelihood and your family life, we also look at the financial and family considerations that you should take into account when choosing a 15-year mortgage vs. 30. Finally, we offer some advice regarding what factors and features you should be on the lookout for in regards to a 15-year mortgage vs. 30-year. By the end of this article you should have all the information you need to make an informed decision between a 15- or 30-year mortgage.

See Also: Top Corporate Credit Cards | Ranking

What Is a 15-Year or 30-Year Mortgage?

The difference between a 15-year mortgage vs. 30-year mortgage is essentially the payment term. Both a 15-year vs. 30-year mortgage have similar conditions and guidelines. While the 30-year mortgage is the much more common option, a 15-year mortgage is also offered by almost every bank or financial institution that offers mortgages.

Both a 15-year and a 30-year mortgage are lending instruments to help you finance the cost of your home. Unless you inherited a fortune and have several hundred thousand dollars laying around, chances are that you will need to find financing options to get you into your home.

For most people, purchasing a home either with a 15-year or 30-year mortgage is one the biggest financial commitments that they will ever make. At the same time, a 15-year or 30-year mortgage is also an incredible investment. Since the housing market is continually gaining value over time, either a 15-year vs. 30-year mortgage will both allow you to gather significant equity.

A $300,000 home that you purchase today with the financing help of a 15- or 30-year mortgage will likely be worth much more than that in the future. Even if you don’t completely pay off your 15-year or 30-year mortgage, the equity that you have built up through constant monthly payments will offer you significant economic return if you ever decide to sell your house.

Contrasting a 15 vs. 30 Year Mortgage

At the most basic level, a 15- vs. 30-year mortgage basically comes down to how much you can pay per month. The monthly payment on a 15-year mortgage vs. 30 will be significantly higher because of the shorter term. In both a 30-year and a 15-year mortgage, however, you will be paying interest and capital on your loan for a significant number of years. Below we will explore some of the pros and cons of a 15-year vs. 30-year mortgage.

Don’t Miss: Top Continuous & Daily Compound Interest Calculators

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Pros and Cons of a 15-Year Mortgage

When it comes to a 15- vs. 30-year mortgage, the main factor that most people look at is the monthly payment amount. The difference between a 15- vs. 30-year mortgage in terms of monthly payments is one of the reasons that the majority of people out there opt for the 30-year mortgage.

Because the term on a 15-year mortgage is half that of the 30-year mortgage, you will obviously be paying more per month. While common knowledge would think that the monthly payment on a 15-year vs. 30-year mortgage would be double the price, that isn’t exactly true.

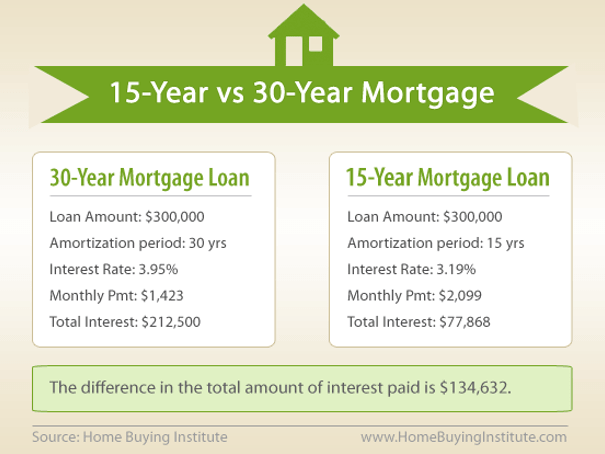

The figure above shows a common comparison of the main financing factors in a 15-year mortgage vs. 30-year mortgage. As you can see, for a typical $300,000 home, there is about a $900 difference in average monthly payment on a 30- vs. 15-year mortgage.

The reason that the monthly payment on a 15-year mortgage is not double that of a 30-year mortgage is twofold. Firstly, because you will be paying off your loan quicker in a 15-vs. 30-year mortgage, the bank will most likely offer you a lower interest rate. Secondly, due to the shorter term, you will pay much less interest on a 15-year vs. 30-year mortgage.

On a 30-year mortgage, the first couple of years of your payments will go toward paying off your interest before the capital on the home itself. In the figure above, you can see that on a 15-year mortgage vs. 30-year, there is a more than $130,000 difference in the final home cost due to the differences in interest paid.

According to Investopedia, “in a 30-year loan, of course, that balance shrinks much more slowly—effectively, you’re renting the same amount of money for more than twice as long. (It’s more than twice as long, rather than just twice as long, because in a 30-year mortgage, the principal balance does not decline at as fast a rate as in a 15-year loan.) When the interest rate is 4%, a borrower actually pays almost 2.2 times more interest to borrow the same amount of principal over 30 years compared to a 15-year loan.”

One of the main benefits of opting for a 15-year mortgage vs. 30-year, then, is that you will effectively be paying much less for the same house. If you can handle the higher monthly payments, you will also be getting out of debt quicker through choosing a 15-year vs. 30-year mortgage.

The faster you get out of debt, the more equity that you will build up, and your overall financial situation will be more stable. Though many people do tend to shy away from the 15-year mortgage due to the higher monthly payment, in a 15-year mortgage vs. 30, the 15-year mortgage is generally the smarter financial decision.

Related: Best Salary Calculators | Ranking | Top Net & Gross Salary Calculators

Pros and Cons of a 30-Year Mortgage

Of course, if you don’t have the steady income to pay the higher monthly payment that comes with the 15-year vs. 30-year mortgage, then the 30-year mortgage is the best option for you. Many financial counselors advise that if you opt for the 15- vs. 30-year mortgage, then it is important to have a savings account that is at least equal to what you make in a year.

You never know when an unexpected financial obligation might come up, and if you don’t have the savings built up, the higher monthly payment that comes with the 15-year mortgage vs. 30-year mortgage could cost you dearly.

The main drawback to the 30- vs. 15-year mortgage, of course, is that you will be paying more over time. If, however, you have a steady job for the long haul, the lower monthly payments that come with a 30-year vs. 15-year mortgage can free up more cash for other expenses and financial obligations.

Additionally, if you are a savvy investor, the money that you save from lower monthly payments that come with a 30-year vs. 15-year mortgage could potentially be invested in hot markets and make you more than what you are saving.

Financial Factors that Affect Your Choice between a 15- or 30-Year Mortgage

Whether you choose a 15-year or 30-year mortgage, you are bound to feel the financial stress of taking on a long-term debt. Both a 15-year or 30-year mortgage will most likely be your number one financial opportunity over a long period of time.

Factors That Affect Your Choice – 15 Year Mortgage vs. 30 Year Mortgage

Your current financial situation and the direction that your financial life is taking will both be some of the deciding factors of whether you choose a 15-year or 30-year mortgage.

If you are lucky enough to have a high-paying, steady job that allows you to pay for the higher monthly payment that comes with a 15-year vs. 30-year mortgage, then it definitely makes sense to go with the 15-year mortgage. If, however, you don’t feel like you have adequate job security and might face a future lay off, the lower payments that come with a 30- vs. 15-year mortgage are probably your best bet.

Popular Article: Best Compounded Monthly Calculators

Family Considerations When Choosing a 15-Year Mortgage vs. 30-Year

Having a steady high-paying job, however, isn’t enough to ensure that you have enough financial stability to opt for the 15-year vs. 30-year mortgage. There are a number of other expenses that come up in life that you need to take into consideration when choosing between a 15-year or 30-year mortgage.

If you have a family and are want to try and help put your kids through college, the cost of financing a college education should come onto your radar when choosing between a 15-year or 30-year mortgage.

Let’s say that your oldest child is 10 years old when you take out a 15-year mortgage on a new home. When he’s 18 you will be halfway through your mortgage. If he chooses to go to an expensive private college where tuition hovers around $40,000 a year, will you have enough extra income to pay his college bills and still pay the high monthly payment that comes with a 15- vs. 30-year mortgage?

What to Look for in a 30-Year vs. 15-Year Mortgage

If you are still undecided on whether to opt for a 15-year or 30-year mortgage, it is important to consider two main factors that will help you decide between a 15-year or 30-year mortgage.

- Interest Rate: The bank should offer you a considerably lower interest rate for a 15-year vs. 30-year mortgage. This is one of the main factors that will help you save money on the total cost of your home. If the bank is offering you a significantly lower rate due to your credit score or some other factor, you might be better off going with a 30-year mortgage.

- Prepayment Penalties: If you don’t feel that you have a stable enough financial situation to opt for a 15- vs. 30-year mortgage, it might be in your best interest to take the 30-year mortgage and make higher than required monthly payments. Your extra monthly payment can be directed to the capital instead of the interest. However, you need to find out first whether there is any sort of prepayment penalty on your 15-year or 30-year mortgage as this could cost you dearly.

Read More: Calculate Debt Payoff, Consolidation, & Payments

Free Wealth & Finance Software - Get Yours Now ►

Conclusion—The Importance of Deciding between a 15-Year Mortgage vs. 30-Year Mortgage for a Solid Financial Future

Purchasing a home is an exciting time for everyone. Making the trip to the bank to negotiate financing for your dream home can be nerve-wracking, however. Making sure that you have all the information on a 15-year or 30-year mortgage is an important step to help you make a quality, informed decision that is best for you and your family.

Choosing between a 15-year vs. 30-year mortgage will depend on a number of factors including your personal financial situation, your job security and opportunities for promotion and potential family expenses down the road.

When making the decision between a 15- vs. 30-year mortgage, the important thing is to make sure that you feel comfortable with whatever you decide. There is nothing worse than carrying a worry with you for the entire term of a 15-year or 30-year mortgage. Taking the time to consider all the factors between a 15-year vs. 30-year mortgage will allow you to enjoy your new home and feel confident in your financial future.

Image Sources:

- https://cdn.pixabay.com/photo/2016/05/21/21/52/house-1407562_960_720.jpg

- http://www.homebuyinginstitute.com/mortgage/15-30-mortgage-170/

- https://localfirstbank.com/article/15-year-vs-30-year-the-ultimate-mortgage-showdown/

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.