5 Ways to Get Mortgage Loans With Bad Credit or Poor Credit

About 6 months ago, the homeownership rate in the U.S. dropped to 63.5%. In the last 48 years, the lowest this percentage has been was 63.4%. Why are we approaching a low point of nearly half a century?

The answer is multifaceted; we’ve seen a recession, stock market declines, floundering consumer confidence, and stagnant wages amid increased CPI values.

Image Source: Pexels

However, at the same time, we’ve seen impressively low mortgage rates. Today, the 30-year fixed national average mortgage rate is just 3.35%. This makes a mortgage more affordable than it’s been in decades. So why are fewer people becoming homeowners?

The answer is credit. Some experts believe that a minimum credit score of 650 is needed to secure home mortgage loans or even bad credit mortgage loans.

While the national average is hovering around 695, there are still many below this number who are in search of a bad credit mortgage. Even those representing an average of 695 are only 40 points above this critical line. This may necessitate a larger down payment than many can afford. This is where a bad credit mortgage loan discussion is helpful.

In this article, we’ll look at some of the methods one can use to obtain a mortgage loan with poor credit — essentially, this is a bad credit mortgage. A diminished score doesn’t put you out of the game; it only requires you play it a little differently for a mortgage loan for bad credit.

See Also: FHA Mortgage Rates Today | Where to Find FHA Loan Daily Rates

1. Target a Federal Housing Administration Loan

This is a program built for those in search of a bad credit mortgage. The FHA works with a specific list of lenders to help empower those in need of a mortgage loan with bad credit. This is a good way to achieve a bad credit mortgage because the FHA also works with Housing for the U.S. Department of Housing and Urban Development (HUD). This means that those with low scores (upper end of the 500 range) will still have an opportunity to engage is a bad credit mortgage loan. The benefits here are concentrated in three areas:

- A lower down payment

- Lower closing costs

- Flexible credit parameters

A lower down payment for a bad credit mortgage can be as low as 3.5%. This is far more affordable than the more conventional 20% expected in normal cases. This lower down payment requires a minimum score of 580. Those who are below 580 can still obtain a bad credit mortgage, however, the required down payment increases to 10% of the value of the home.

Those who have suffered a bankruptcy or foreclosure are not automatically disqualified from FHA mortgage loans. This is the flexible nature of the program that makes it such an attractive offer for those in need of a bad credit mortgage loan.

Additionally, the insurance on an FHA mortgage is just 0.5% of the total mortgage value. This is affordable for most. The FHA has set no minimum income for those seeking a mortgage loan for bad credit. When evaluating your borrowing limit, the FHA will use the following numbers:

- Salary

- Other income

- Property tax

- Hazard insurance

- Auto payment

- Credit card bills

- Loan term

- Interest rate

The FHA also reviews the debt-to-income ratio of the applicant as well as their FICO score and repayment history when assessing these bad credit mortgage loans. These factors might not prevent your loan, but they will change some of the parameters of your total borrowing ability.

Don’t Miss: Buying a Home with Poor Credit | Guide to Buy a House with Bad Credit

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

2. Find a Cosigner

This option is sometimes called a “non-occupant cosigner.” This is a big ask from someone seeking a bad credit mortgage loan. Why? You’re asking someone who will not enjoy any of the benefits of the home to take on the responsibility of the loan. If you’re already on the path of a bad credit mortgage, the cosigner probably understands that you exhibit some real risk.

Make sure you and the cosigner understand the full extent of the risk associated with this kind of a mortgage loan for bad credit. A missed payment can mean that the cosigner will experience:

- A diminished credit score

- Pursuit by the bank

The cosigner is in the hot seat of a bad credit mortgage loan when they add their name to the documentation. The cosigner, while not part of the title, will experience a “hard pull” on their credit, which has a mild but visible impact on their credit. When combining this bad credit mortgage with the FHA option discussed above, note some key requirements. These specific mortgage loans with bad credit carry some requirements:

- The property must be a single-family residence

- The non-occupant cosigner must be a close relative (e.g. parent, in-law, or sibling).

- There can be no more than two non-occupant cosigners

This is not a cure-all for the bad credit mortgage problem. Remember, the bank will often focus on the lower of the two credit scores when making their final decision. A cosigner will be even less effective in a mortgage loan for bad credit if you have experienced a foreclosure or a bankruptcy in the past.

This method of obtaining a mortgage loan with bad credit is often best for those who have a slightly poor or underdeveloped credit history. When approaching someone to become a cosigner, remember that their involvement in this mortgage loan for bad credit can be temporary. After enough time has lapsed on the mortgage with bad credit and a significant portion of the house is paid off, the cosigner can request to have their name removed. This frees the cosigner from the risks associated with a bad credit mortgage loan.

Related: The Best HELOC Rates & Loans Guide | What Is a HELOC? How Does it Work?

3. Save to Pay More

A poor credit score will cost you. However, if you can prepare for these elevated costs, you may still be able to get a mortgage loan for bad credit. Fees will mount as your credit score lowers. However, the biggest expense will be the interest rate. If you can devise a plan to budget for a higher monthly mortgage payment, you can get around the bad credit mortgage hurdle.

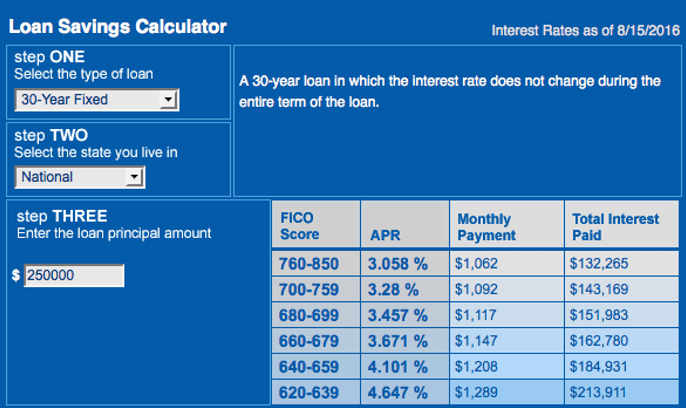

Consider the comparison of a borrower with a superior score of 760 and a bad credit loan mortgage borrower with a score of just 620. If these two people, with all other factors equal, obtain a $250,000 mortgage loan, they will each experience vastly different interest rates.

The 760 score holder can expect an interest rate of 3.05%, while the lower score holder of 620 will face a higher financing charge of 4.64%. How does this play out for the additional total interest paid on a mortgage loan for bad credit? The lower score holder will pay $81,646 more in total financing. Their total, lifetime charge for having this lower rate will be $213,911, while the borrower with the better score will pay only $132,265. Consider the chart below.

Image Source: Myfico

The bottom line: a bad credit mortgage loan costs more money. If you have ways to free up additional funds, you can overcome a bad score.

Of course, the long-term solution is to slowly rebuild your credit until your score improves on your bad credit loan mortgage. This takes time but ultimately will be far less expensive than the bad credit mortgage alternative. Many people are surprised that a credit score can be increased substantially within one year. Here are ways to boost your score to tackle the bad credit mortgage problem:

- Set all credit card payments to automatic deduction

- Use one card for gas and groceries and pay it off on time every month

- See if a parent will add you to their card as an authorized user to reap good credit

- Pay any outstanding collections

- Obtain and keep any proof of credit payoffs

- Check all dispute items on your free credit report for errors and have removed

This is the most responsible way to get a mortgage loan for bad credit. Your score is not a static number; it moves. You decide which way it moves. One year of practicing good habits for a better score will vastly outweigh the many years of higher interest rates.

4. Improve Your Debt-to-Income Ratio

This is a quick method for making you a more viable candidate for a home loan. Put simply, this is a method of reducing the debt you owe relative to the credit (income) you have available.

As discussed above, the first way to do this is to work down the total balances owed on your credit cards.

A bad credit mortgage is often a bad deal for the borrower. You can improve both the deal and your score simultaneously with a reduced debt-to-income ratio for a mortgage loan with bad credit.

There are many services available to help you achieve this goal of avoiding a true bad credit mortgage loan. One example is credit card consolidation plans.

Instead of engaging in a bad credit mortgage, consider consolidating all of your credit card debt into one installment loan. You can do this and avoid a mortgage loan for bad credit by using your local bank.

This kind of practice will likely have a low abandonment rate because it simplifies your finances.

Paying off debt is the best way to improve your ratio. However, you can also improve this number by obtaining an increase in credit. It is important to note that this is not an invitation to actually use the increased credit. This would be counterproductive and dangerous, while also pushing you closer to a bad credit mortgage loan.

Popular Article: What Is a Home Equity Loan and Line of Credit? This Year’s Guide

5. Get Started, Then Refinance

In earlier sections of this article, we looked at getting into a mortgage loan for bad credit by paying more in interest. Refinancing works in conjunction with this step.

The concept is to just get started with a bad credit mortgage loan even if the terms are unsatisfactory. Over time, if you’re able to repair and restore your credit, you can enjoy the more favorable terms you were looking for in the first place.

Mortgage loans for bad credit are a stepping-stone to a better deal. When you choose to refinance your bad credit mortgage with a credit score that is significantly higher than what you had in the beginning, you’ll find that the interest rate improves.

Think of mortgage loans for bad credit as a punishment today for sins of the past. You are paying more on your bad credit mortgage because of your past behavior.

However, this doesn’t mean you’re stuck in this part of your history. Start a new chapter today and build on it. In the future, you’ll find that mortgage loans for bad credit are transient in nature and the very system that punishes for the past will reward in the future.

Interest rates have been on a steady decline in recent years. Borrowers today are poised for some of the best interest rates available in generations. Bad credit mortgage loans put the borrower on a path that is difficult to deviate from. If you view these mortgage loans for bad credit as a strategic step in a longer game, you may do very well in the end.

A Composite Approach

Obtaining a bad credit mortgage is not easy. It is not a fast process. The best approach to mortgage loans for bad credit is to consider a plan of attack on many fronts. This means combining the idea of a cosigner with the responsibility needed to make the refinancing plan a viable reality.

This means using the FHA to get in a home, then working to improve your credit score with the financial flexibility that comes with lower interest payments each month.

In aggregate, these techniques can move you past the most painful parts of bad credit mortgage loans so that the loan you end with is better than the one you started with. Obtaining a mortgage with bad credit is a way to prove, over the long term, that you can do better.

Mortgages for bad credit are designed to quantify the risk you present as someone with poor payment history. You can show the lender how their risk in extending you a bad credit loan mortgage dissolves over time. Mortgages for bad credit are not mortgages for bad people.

Read More: Selling A Home? Here’s the Full Guide on How to Sell Your Own Home

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.