Intro: Barclaycard Review | Objective Review of Barclay Rewards, MasterCard, and Rates

This article will examine Barclaycard and its credit card services. With so many credit card companies to choose from, it can be difficult to decide which one is right for you. Barclaycard is an increasingly popular option, and many consumers are asking questions about this company.

In particular, people want to know more about Barclaycard’s most popular offering, the Barclaycard Rewards MasterCard.

There are countless Barclaycard reviews available online. However, it can be difficult to determine which Barclaycard reviews pertain to which products and to extract the information that is relevant for you. That’s where Advisory HQ comes in. We have carefully surveyed the field of Barclaycard reviews, and now, we want to share our findings.

This article will provide an overview of the company followed by a Barclaycard review that covers the majority of its card services. We will provide a Barclay credit card review that summarizes all available credit cards. Finally, we’ll delve into an in-depth Barclaycard Rewards MasterCard review to offer a detailed look at Barclaycard’s most popular credit card.

What to expect from this article:

- Overview of Barclaycard

- Barclaycard Credit Card Review

- In-depth Barclaycard MasterCard Review

- Barclaycard Review Summary

See Also: Barclays Review – What Is Barclays & What You Need to Know! (Online Banking & Savings Account)

Overview of Barclaycard

Barclaycard is a credit card provider headquartered in the U.K. The company is backed by Barclays PLC, a large multinational banking and financial services company. Barclaycard was the first company to introduce a credit card to the U.K. in 1966.

However, it was not until 2004, via the acquisition of Juniper Financial Corporation, that Barclaycard was able to enter the U.S. credit card market. It has since become one of the top ten credit card issuers in the U.S. in terms of purchase volume.

So, what is so great about Barclaycard credit cards? One of the best places to find out what is beneficial about Barclaycard credit cards is in Barclaycard reviews. Our in-depth Barclaycard review will tell you everything you need to know to decide if a Barclaycard credit card is right for you.

Barclaycard Credit Card Review

If you’re wondering what Barclaycard has to offer in terms of credit card choice, this section of our Barclay credit card review has all the details. Barclaycard has a range of options, including a cash back credit card and various travel rewards cards. Here is a summary table of the most popular of these cards:

Card | Regular | Annual | Points and Rewards |

16.24% | $89 (waived | 50,000 bonus miles on $3,000 in first 90 days; 2X miles all purchases; 1X miles on other purchases; 5% miles back on redemptions | |

CashForward™ World MasterCard® | 14.99% | $0 | $100 cash rewards bonus on $500 in first 90 days; 1.5% cash rewards on every purchase; 5% cash rewards on redemptions |

Rewards MasterCard® | 25.24% | $0 | 2X points on gas, utilities and groceries; 1X points on other purchases |

Arrival World MasterCard® | 16.24% | $0 | 20,000 bonus miles on $1,000 in first 90 days; 2X miles on travel and dining; 1X miles on other purchases; 5% miles back on redemptions |

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

In addition to the above cards, Barclaycard also offers a wide variety of Visa and MasterCard credit cards that represent partnerships with well-known companies including JetBlue, NFL, Choice Privileges, Carnival and Priceline.

Image source: Home.barclaycardus.com

While most of these cards offer bonus points or points on general purchases, they are all geared toward specific rewards. Most cards carry no annual fee and the rates offered are generally comparable to similar rewards cards. If one of these partner companies is one you intend to spend with, then a partnership Barclaycard credit card could be a great option for you.

We have carefully studied the Barclay Credit Card reviews from sites such as Credit Karma and Card Hub. The vast majority of negative Barclaycard reviews pertain to reviewers having been rejected upon application for a credit card. Similarly, the vast majority of positive Barclaycard reviews talk about having applications accepted. Of course, there are many criteria which a credit card issuer will consider during the application process. The number of rejected or accepted applications is not necessarily a reflection of the quality of their service.

Looking past these types of reviews and by extracting the relevant information from the numerous Barclaycard reviews we can provide the following list of pros and cons for Barclaycard credit card offerings:

Pros (Positive Barclay Credit Card Review)

- Most carry no annual fees

- Fast application process

- Complimentary online FICO credit score access

- Easy to manage accounts online

- Fast communication in case of suspicious transactions

- Attractive online interface

Cons (Negative Barclay Credit Card Review)

- Approval criteria is unclear

- High incidence of mistaken fraud alerts on travel cards

- Customer service is sometimes less than satisfactory

Don’t Miss: Bank5 Connect Review – Pros & Cons of Using Bank5 Connect (Reviews)

Barclay Rewards MasterCard® Reviews

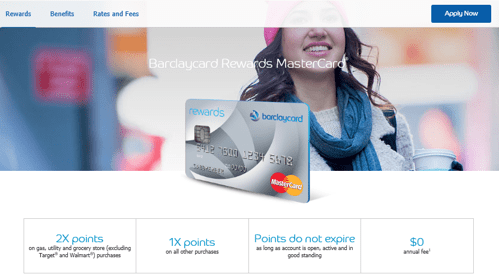

One of the most popular Barclaycard credit cards and the subject of many Barclay MasterCard reviews is the Barclaycard Rewards MasterCard®.

This credit card is aimed at consumers with average credit scores, particularly those who want to improve their credit rating. It offers two points for every $1 spent on gas, groceries, and utilities and one point per $1 on everything else. This points system is considered very attractive for a credit card in this category.

While the points system is attractive, the card also carries a high interest rate, currently 25.24% APR. This means that this card is not a good choice for those who plan to carry a balance. In addition to the high APR, there is also a balance transfer fee of 3%, so it is not recommended if you are thinking of transferring a balance from another card.

Another fee to be aware of if you’re planning to spend with internationally based merchants is the 3% foreign transaction fee.

Here is a breakdown of the Barclaycard Rewards MasterCard®:

- Two points for every $1 spent on gas, utilities, and groceries (note that Wal-Mart and Target are excluded)

- One point for every $1 spent on all other purchases

- Points do not expire as long as account is open, active, and in good standing

- 0% annual fee

- Redeem rewards for deposits to a U.S. checking or savings account, statement credits, or gift cards, starting at 1,000 points for $10

- No limit to the number of points you can earn

- Free online access to FICO Credit Score

- Access to future credit line increase reviews

- 3% balance transfer fee

- 3% foreign transaction fee

So is this card really a good choice? We have taken into account all of the information provided in Barclay Rewards MasterCard® reviews from various sites including Credit Karma (3.4 stars in 1,091 reviews) and Card Hub (3 stars in 1,458 reviews).

So, Why Is This Card So Popular?

One of the main drivers for people choosing this card is that it is highly recommended for people who want to improve their credit score. Indeed, credit score improvement is the subject of many Barclay Rewards MasterCard® reviews, both positive and negative.

Credit Karma says, “The Barclaycard Rewards MasterCard® is a quality credit card that gives consumers a chance to rebuild or establish credit while also earning rewards.”

Card Hub in turn says, “The Barclaycard Rewards MasterCard® is one of the best credit cards for fair credit, offering a potentially no-cost option for qualified applicants to continue their credit-building efforts while enjoying rewards that are above average for the credit-card market as a whole.”

Indeed many positive Barclay MasterCard reviews talk about how quickly they saw their credit score increase after they began using the rewards card.

What Do the Negative Barclay Rewards MasterCard® Reviews Say?

As with other Barclaycard credit cards, the vast majority of negative Barclay Rewards MasterCard® Reviews pertain to being denied for the credit card. In turn most of these reviews cite being told by Credit Karma that they had a good chance of acceptance. This discrepancy is not necessarily Barclaycard’s fault. However, it does indicate a less than clear set of approval criteria.

It should be noted that a large number of positive Barclay MasterCard reviews commend Barclaycard’s reconsideration department. It appears that lots of people have had luck in appealing their initial rejections and have gone on to have their applications accepted by the department.

Of the negative Barclay MasterCard reviews from actual cardholders, there are several main complaints. The most common theme of complaints in Barclay MasterCard reviews from actual cardholders pertains to credit line increases. Some Barclaycard reviews have complained of the company lowering or increasing limits without warning.

In the case of lowering limits, the major complaint is that there is sometimes no explanation. In the case of increasing limits, the major grievance is that the company performs inquiries resulting in hard pulls on credit reports and subsequently lower credit scores. For this reason, it may be worth noting on your account if you want to halt any potential automatic limit increases.

Image source: Barclaycardus.com

By analysis of the various Barclay Rewards MasterCard® reviews we can offer the following summary list of pros and cons:

Pros (Positive Barclaycard MasterCard review)

- Attractive rewards system compared with similar cards

- Easy to manage account online

- Free FICO credit score access

- Mobile app is excellent

- Receive e-mail alerts when a payment is due

- Good for rebuilding credit score

- Good reconsideration department

Cons (Negative Barclaycard MasterCard review)

- Payments may be held for up to 15 business days

- Hard pulls on credit rating for limit increases

- Online customer service is sometimes lacking

- Approval criteria is unclear

*** During our research for this article, Barclaycard Rewards MasterCard® was still a part of Barclaycard’s offer. Barclayca

Related: About RBS – What Is RBS? (Complaints, News & Reviews)

Free Wealth & Finance Software - Get Yours Now ►

Barclaycard Review Summary

After reading this Barclaycard review, you should have a good sense of whether or not this company is right for you. Overall, this is a highly reputable institution with the advantage of longevity on the world banking stage, though less so in the U.S. market.

Barclaycard offers credit cards in conjunction with some sought-after partners offering excellent choices in markets such as airline travel and accommodation. In general, Barclaycard reviews regarding their partnership credit cards are positive.

Barclaycard’s popular Rewards MasterCard® is the subject of many positive Barclaycard reviews and is a great option for a general rewards card for those with a fair credit score. For rejected applicants, the reconsideration department is recommended as a worthwhile option.

For successful applicants who want to improve their credit score, it may be worth noting on the account that automatic limit increases should be blocked. This should avoid any unnecessary hard pulls that may result in a lower credit score.

In general, the Barclaycard reviews we have studied have been positive. The majority of negative Barclaycard reviews have been regarding rejection of applications, which is a common complaint about most credit card companies.

One thing to note is that there is often a disparity between credit scores within both accepted and rejected applications. Anyone applying for a credit card should be aware that their credit score alone is not an absolute indicator of acceptance.

We hope you have found this Barclay credit card review helpful.

Popular Article: Huntington Bank Reviews – What You Need to Know Before Using Huntington Bancshares

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.