Overview: Barclays US Reviews | What You Should Know About US Barclays

Barclays US is a relatively new entity to the United States, offering a host of products from its online-only banking program. With only one brick-and-mortar location, the US Barclays bank gives you the freedom to perform all of your banking from the comfort of your own computer chair.

With the popularity of online banks on the rise, consumers are starting to ask more questions about what banks like Barclays USA can provide.

What sort of programs does Barclays Bank USA offer? What are the Barclays credit card US choices? What do Barclays reviews have to say about the customer experience?

In our objective Barclays review, we will answer all of the above questions and more to give you a detailed overview of Barclays Bank US and why you might want to consider switching to this bank.

Image Source: BigStock

What Is Barclays Bank US?

Understanding the relevant history behind your financial institution, including Barclays Bank US, can help you to make wise investment decisions. Barclays US was originally founded in London but has expanded to the United States recently, mostly as an online financial institution.

Barclays reviews label it as an online banking option, though the US Barclays branch does have one brick-and-mortar location in Delaware. As a result of maintaining only one physical location, there are no ATM networks for Barclays Bank USA which can be a significant drawback for someone who anticipates making frequent withdrawals.

Spend some time browsing around the US Barclays website and you’ll find one surprising omission from the services it offers: checking accounts. For customers interested in a one-stop shop for their banking, this omission probably won’t land Barclays USA at the top of their lists. However, to make up for the lack, it does have top ratings on Barclays reviews for its Barclays Bank US savings accounts, Dream Accounts, and CD rates.

Barclays Bank USA also offers a number of credit card programs tailored to meet individual expectations. You can choose from several Barclays credit card US programs with rewards specific to certain retailers, vendors, and travel accommodations as well as generic cash back rewards. Overall, Barclays Bank US features great savings accounts and the Barclays US card, which may make up for what it lacks in its non-existent checking accounts.

See Also: Sallie Mae Reviews (Loan Forgiveness, Student Loans, & Account Reviews)

Barclays US Savings Accounts

Barclays Bank USA offers a host of impressive options for savings accounts. Online financial institutions can often provide higher interest rates than their brick-and-mortar counterparts, and, in that respect, Barclays USA doesn’t disappoint. The US Barclays online savings account features a 1% APY – twelve times the national average, according to Bankrate’s 2016 Passbook and Statement Savings Study.

Where do its savings accounts fall when it comes to Barclays reviews? NerdWallet’s Barclay reviews ranks it fairly high, with 4.5 out of five stars. The NerdWallet Barclays review claims that the account is beneficial for individuals who prefer to keep their US Barclays savings account separate from their checking account and to manage it either online or via phone. The Barclays Bank USA savings account doesn’t have a monthly maintenance fee or minimum balance, and its Dream Account offers even more options.

Barclays reviews have great things to say about the Dream Account, which gives you a 1.05% APY as well as a bonus. After six months of deposits or six months of leaving the money untouched, Barclays Bank US offers a 2.5 percent bonus on the interest earned. The Barclays reviews on WalletHub gave the Dream Account a four-star rating. The Dream Account landed on GOBankingRate’s 10 Best Savings Accounts for 2015.

Children can even open their own savings account at Barclays Bank US, alongside their parents. Having their own online savings account or Dream Account through Barclays US can be a great choice to begin teaching them the value of savings.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Barclays Review of Online CDs

US Barclays includes a CD (or certificate of deposit) program with high rates, even for an online financial institution. You can choose to deposit your money at Barclays Bank US with no minimum balance, no monthly fees, and daily compounded interest. Select from a short-term CD (3 months) all the way up to a significantly more long-term CD (five years).

You can create a CD at almost any bank, but what do the Barclays reviews say about its specific program? Is it any better than what other financial institutions can provide?

Barclays reviews point out that the Barclays Bank USA offers great interest rates – some of the best around. It received a 4.5 out of five-star score on one Barclays review, with cons listed as early withdrawal penalties and automatic renewal on mature CDS just fourteen days later.

Barclays USA also made it onto the GOBankingRate list of the top ten CD accounts for 2015, which featured high praise in its specific Barclays review. This Barclays review pointed out that it does have a lower interest rate than some accounts on the list, but it requires no minimum and has many flexible choices. The freedom gives customers more peace of mind and makes it more likely that their US Barclays CDs will reach maturity.

Don’t Miss: First Internet Bank Reviews – Should You Use Them? (Internet Banking & Online Bank Reviews)

Barclays US Card Options

The Barclays US card partners with various companies and brands to help you accumulate rewards catered to your specific interests. With a Barclays credit card US, you can choose how you want your rewards to stack up by selecting a card centered on a Barclays Bank USA partner.

Love to travel? Choose its travel and entertainment version of the Barclays US card that partners with Carnival World MasterCard. Prefer to spend a quiet afternoon in the bookstore? No problem – Barclays Bank US also partners with Barnes and Noble for gift cards and discounts on store purchases. Below is a list of other partnerships that the Barclays credit card US can offer:

- Diamond Resorts International

- Priceline rewards

- Wyndham Rewards

- L.L. Bean

- NFL Extra Points

- Princess Cruises

It has two major Barclays US card options that most Barclays reviews discuss: the Barclays US card Rewards MasterCard and the Cash Forward World MasterCard. In the next section of our Barclays review, we will look more into the details, benefits, and disadvantages of each type of Barclays US card.

Barclays US Card Rewards MasterCard

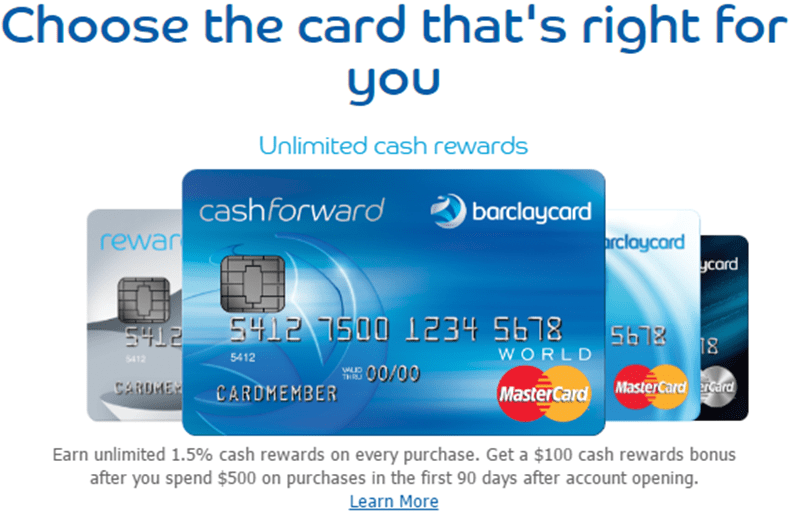

Image Source: Barclays

Image Source: Barclays

Barclays US Rewards MasterCard offers twice the points on gas, utility, and grocery store purchases and one times the points on all other purchases. After an accumulation of 1,000 points, you can redeem the Barclays US card rewards for $10, applied to your statement credit, a gift card or a savings or checking account transfer.

CardHub’s Barclays review recommends the Barclays US card Rewards MasterCard because it requires only fair credit for approval. Its Barclays reviews also highlight that there is no annual fee and a free FICO score is provided – a wonderful tool for those working to build their credit. However, its Barclays review is also quick to point out that the Barclays US card Rewards MasterCard also has an above-average APR rate (25.24 percent variable APR) which does not lend itself well to financing or maintaining a revolving balance.

A Barclays review from CardHub rated the card solidly average, with a three out of five-star score. Its Barclays review collected nearly 1,500 Barclays reviews from consumers who have personal experience using the card and its rewards program. Few members gave the card a low score, with only 24 percent giving their Barclays review less than three stars.

Credit Karma’s collection of Barclays reviews revealed similar findings. After 1,000 Barclays reviews based on the application process, customer service, and cardholder ratings, the Rewards MasterCard received 3.4 stars out of a possible total of five.

*** During our research for this article, Barclaycard Rewards MasterCard® was still a part of Barclaycard’s offer. Barclayca

Related: Huntington Bank Reviews – What You Need to Know Before Using Huntington Bancshares

Barclays Credit Card US: Cash Forward World MasterCard

Image Source: Barclays

What separates the Barclays credit card US Rewards MasterCard from the Cash Forward World MasterCard? Like the Rewards MasterCard, the CashForward Barclays US card includes no annual fee and provides users an opportunity to earn cash back. You’ll enjoy 1.5 percent cash back on all of your purchases, but you also receive a five percent bonus towards your next redemption when you trade in your rewards.

Nerd Wallet’s Barclays review points out one major difference between the two cards: the Cash Forward offers an introductory promotion with 0 percent APR for a full year. Afterwards, the interest does increase, anywhere from 15.24 to 23.24 percent, but it’s a great opportunity to take advantage of some interest-free financing.

According to the same Barclays review, the downside is that you do need to have excellent credit to qualify. US News concluded that you would need a credit score between 690 and 720 in order to qualify, according to its Barclays review. You also must wait until you reach a $50 minimum to redeem your cash back points.

Barclays Review: What Makes Barclays US a Great Bank?

Is US Barclays bank for you? If you’re searching for a bank that highlights savings as its primary function, then the Barclays reviews would lead you to a positive conclusion. While it has nothing to offer someone interested in a full banking experience, due to its lack of checking accounts, the Barclays USA savings account options give customers plenty of flexibility, great interest rates, and a number of options to keep them satisfied.

Barclays reviews rank it as one of the top banks for its savings accounts and CD options, and Barclays US card reviews are also favorable. Consider whether an online financial institution would meet your personal needs. If it does, then our Barclays review would indicate that Barclays US bank might be a great fit for your personal banking (or at least your savings) needs.

Popular Article: About RBS – What Is RBS? (Complaints, News & Reviews)

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.