2017 RANKING & REVIEWS

TOP RANKING BEST APR CALCULATORS

2017 Guide: Using an APR Calculator to Keep Your Budget in Line

When you are taking out a loan, do you know what your annual percentage rate (APR) is? Before you answer, your APR is not the same as your interest rate. Now can you answer that question?

Chances are that you cannot. Lenders often report working with clients who simply do not understand APRs or think that they measure the same thing as an interest rate does. Unfortunately, knowing your APR is important when you are taking out a loan. It is a broader measure of the total cost of a mortgage or car loan that reflects not only the interest rate, but other costs as well.

The truth is, calculating APR can be a difficult task that few know how to master. If you lack a financial background, you likely don’t know how to calculate APR. This can make the process seem even more daunting.

Award Emblem: Top 6 Best APR Calculators

Thankfully, you can use an APR loan calculator to help you calculate APR. An APR interest calculator will allow you to input some information and let the calculator do the rest.

One drawback to this is that there are many options out there for a loan APR calculator. You can get an APR mortgage calculator or a car loan APR calculator from countless websites. The trick is finding the best APR payment calculator out there.

When going through the process of looking for an APR mortgage calculator, you likely have many questions, including:

- What is an APR payment calculator?

- Is calculating APR difficult?

- What will a loan APR calculator tell me?

- What information do I need to know to use a car loan APR calculator?

- What should you look for in an APR interest calculator?

- Is there a difference between a car loan APR calculator and an APR mortgage calculator?

- What are the best APR loan calculators for calculating APR?

Throughout this 2017 guide, we will answer the questions you have surrounding the use of an APR calculator. We will explain how they work and what to look for in a mortgage annual percentage rate calculator. Finally, we will provide a detailed review of the six best APR loan calculators to help the calculation process run as smoothly as possible for you.

See Also: Gold Delta SkyMiles® Business Card vs. Ink Business Preferred? Credit Card vs. CitiBusiness® vs. Wells Fargo Business Card

Advisory HQ’s List of Top 6 Best APR Calculators

List is sorted alphabetically (click any of the loan APR calculators below to go directly to the detailed review section for that APR loan calculator):

Top 6 Best Car & Mortgage APR Calculators | Brief Comparison & Ranking

Car & Mortgage APR Calculators | Ease of Use (1–5) | Number of Inputs | Outputs |

| Bankrate | 4 | 7 | Loan APR, Total Payments, Total Interest |

| Calculate Stuff | 5 | 5 | APR, Monthly Payment, Total Payments, Finance Charge |

| Calculator Soup | 3.5 | 8 | APR, Total Finance Charges, Total Payments, Total Interest, Etc. |

| eFunda | 4 | 4 | APR, Monthly Payment, Total Payment, Total Interest |

| Money-Zine | 4.5 | 5 | Total Loan Fees, Monthly Payment, APR |

| The Calculator Site | 3.5 | 8 | Loan Payments, Total Payable, APR, Chart with Loan Repayments by Month |

Table: Top 6 Best Mortgage & Car APR Calculators / Above list is sorted alphabetically

How to Calculate APR

Calculating APR is no easy task. While many consider APR and interest rates to be the same thing, they are not.

An interest rate is the cost of borrowing the principal loan amount and is expressed in a percentage. An APR includes the interest rate, as well as other costs, such as closing costs and discount points. Taking these variables into consideration to calculate APR is not easy.

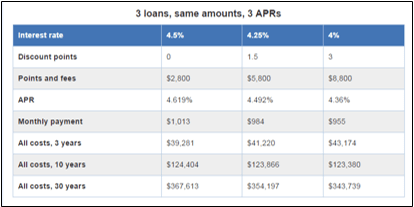

You may want to shrug off calculating APR, but the chart below shows how three loans of the same amount can have drastically different APRs and total costs.

Image Source: Bankrate

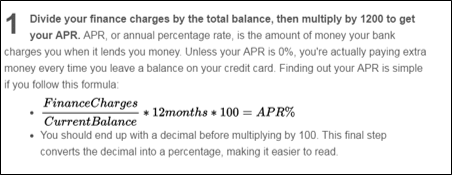

When you are looking to determine APR, you simply use to following formula:

Image Source: WikiHow

The tricky part is knowing all of the information and how the variables interplay. That is why using a mortgage or car APR calculator when taking out a loan is a smart move.

Don’t Miss: Best Loan Payoff Calculators | Ranking | Debt, Loan, and Early Payoff Calculators

Features to Consider in a Car or Mortgage Annual Percentage Rate Calculator

So many financial institutions, banks, and finance-based websites offer some version of a car or mortgage APR calculator. However, not every car APR calculator is created equally, which is why you need to be careful when selecting one.

Image Source: Mobile Cuisine

Like most things in life, people have different preferences when it comes to selecting an APR calculator for their calculations. The car APR calculator that works for you might not be the best car loan APR calculator for someone else. This is something to keep in mind when going through your search.

There are different variables to take into consideration, like the output, how easy-to-use the mortgage APR calculator is, and how variables need to be inputted.

When looking for an APR calculator, be sure to consider the following:

- User interface

- Complexity of calculator

- Number & type of inputs

- Type of information generated

As you can see, there are several variables to look into when choosing which car or mortgage APR calculator to use. You should select an APR calculator that is simple to use, but it also needs to have the right inputs for the level of complexity you require.

One mortgage or car APR calculator might be more complex and require more inputs, but it generally gives you a more accurate calculation. Knowing the level of complexity that you require is something to consider seriously.

Also, be sure to select an APR calculator with clearly defined inputs. Don’t waste time trying to decide what numbers you should be inputting into the car APR calculator—be sure that the variables are well defined.

Finally, choose a mortgage APR calculator that generates the information you need. Some calculators offer some information, providing charts or explanations, while others just generate a simple number. Which do you prefer?

Overall, choosing a simple APR calculator that is easy to understand and use will make your calculations go much faster.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Advisory HQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review—Top Ranking Best Mortgage & Car APR Calculators

Below, please find the detailed review of each APR payment calculator on our list of APR interest calculators. We have highlighted some of the factors that allowed these car and mortgage annual percentage rate calculators to score so high in our selection ranking.

Related: How to Find the Best Reverse Mortgage Calculators

Bankrate Review

Bankrate offers a simple-to-use mortgage or car APR calculator. You will need to input just seven things to have results generated.

By entering loan amount, term in years, interest rate, amortization type, origination fee percent, points paid, and other fees, the mortgage APR calculator generates outputs.

You will be shown the loan APR, total payments, and the total interest over the life of the loan. Bankrate also supplies a graph that shows a breakdown of interest and principal for the total cost of the loan.

We love that Bankrate offers a thorough description of each variable that goes into the mortgage APR calculator. This means that you won’t waste time squabbling over what figures to enter into the calculator.

Bottom Line

If you are looking for a simple APR calculator, Bankrate delivers. It is easy to input variables, and they are clearly defined.

Calculate Stuff Review

Calculate Stuff is about as easy APR calculators come. You can use this one as either a mortgage or car APR calculator, so the versatility is nice.

This car APR calculator only requires you to enter five amounts. Though they are not defined, the inputs are self-explanatory. You will enter the loan amount, interest rate, term in years, finance charges that are added to the loan amount, and the prepaid finance charges that are paid separately.

Upon hitting calculate, the APR calculator generates the APR, monthly payment, finance charge, and total cost of the loan over the term.

Bottom Line

There is nothing flashy about the car or mortgage APR calculator offered by Calculate Stuff, but it is by far one of the easiest to use. If you need to calculate APR quickly, Calculator Stuff provides a nice tool to do just that.

Calculator Soup Review

With just eight inputs required, the Calculator Soup APR calculator is one of the best on the Internet.

You will need to enter the loan amount, interest rate, type of compounding, number and frequency of payments, as well as a few additional fees. The APR calculator will then generate a table of values that you can use for budgeting purposes.

The table includes the calculated APR, total financial charges, amount financed, total payments, total loan, monthly payment, total interest, and total financing fees.

What we love about this is that you can also create an amortization schedule to see how the loan is payed off over time.

Bottom Line

The mortgage or car APR calculator offered by Calculator Soup is a good option for anyone looking for a variety of information to be generated. With the option for view an amortization table as well, Calculator Soup can be a great tool for you.

Popular Article: Air Force vs. Guard vs. Navy Retirement Calculators | Comparison Reviews

eFunda Review

A name you probably haven’t heard before, eFunda offers a nice APR calculator. It shows the formula for calculating APR, so you can follow along if you’d like as well.

The great thing about the eFunda calculator is that you don’t need to enter more than four pieces of information. By putting in your loan amount, extra cost, interest rate, and number of months, the car or mortgage APR calculator will show your APR.

This calculator also shows your monthly payment, total payment, and total interest, with the ability to view a detailed payoff schedule as well.

Quick and easy is what the eFunda APR calculator is all about. If you want results fast, try the eFunda option.

Money-Zine Review

Another name that isn’t as popular as others, Money-Zine has a loan APR calculator that can be a great tool for you. You can use this one for car or mortgage APR calculations, and there are only five inputs.

The inputs are total loan amount, annual interest rate, term of the loan in years, application/processing fees, and other fees. What’s great about this loan APR calculator is that there are thorough definitions of the variables listed below, to avoid confusion.

The results generated are total loan fees, monthly payments, and the APR. If you aren’t looking for more than that, Money-Zine might be the tool for you.

Bottom Line

Overall, Money-Zine offers a simple loan APR calculator. There isn’t anything flashy about it, but with clearly defined inputs, it might be a good option for you.

Free Wealth & Finance Software - Get Yours Now ►

The Calculator Site Review

The Calculator Site offers a litany of financial calculators, one of which can calculate APR.

By entering the currency, loan amount, annual interest rate, months, initial deposit, extra fees, loan start date, and ending balloon payment, this APR calculator generates a variety of helpful information.

Not only will you be able to see the loan payments, total payable, and APR, but you can also view a graph of the results. The Calculator Site also offers a chart showing the loan payoff schedule, which is great for budgetary purposes.

Bottom Line

Though the Calculator Site has a few more inputs than others on the list, the amount of information generated more than makes up for it. If you need a variety of information, this might be the APR calculator for you.

Read More: Which Is the Best Mortgage Calculator? Google vs. Trulia vs. Bank of America

Conclusion—Top 6 Best Car and Mortgage APR Calculators

Taking out a car or mortgage loan is no simple task. There are countless steps to take through the process. You go from determining what you can afford all the way to selecting the home or car that you would like to own before crossing the t’s and dotting the i’s.

Somewhere in the middle of all of that, you will likely need to apply for a loan. You know what monthly payments you can afford, but calculating monthly payments from a total loan amount can be tricky. Interest rates are one thing, but how do APRs play into things?

An annual percentage rate is certainly something you need to figure out your total monthly payment, since it takes into account interest, some closing costs, and even other fees. This number will give you the most accurate monthly payment for budgetary consideration, but how do you calculate it?

With an APR calculator, you can determine the APR for mortgages, cars, and other loans. This tool can help you calculate your monthly payments in much more detail, which will give you a more accurate picture of what house or car you can actually afford.

The trick is choosing the best APR calculator for you when there are so many options on the Internet.

Image Source: Tweak Your Biz

With so many options available, when trying to select a mortgage or car APR calculator, consider the following:

- User interface

- Complexity of calculator

- Number & type of inputs

- Type of information generated

Be sure that you choose an APR calculator that takes into account the level of detail you require, as well as having well-defined inputs. You don’t want to struggle with what numbers to input where in your mortgage APR calculator.

Take the time to consider a few options for a mortgage or car APR calculator before you select the one that will help get you into your new home or car.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.