2017 RANKING & REVIEWS

BEST AUTO LOAN CALCULATOR

AND AUTO PAYMENT CALCULATOR TOOLS

What Should You Know About Auto Loans and Auto Loan Calculator Tools?

Before using an auto loan calculator, an auto payment calculator, or an auto refinance calculator, it’s essential to do research on the basics of an auto loan.

Many people will start by finding the car they want, and then start researching financing and using an auto payment calculator, but most financial professionals recommend you cover the financing first, and then shop for cars.

Award Emblem: Top 6 Best Auto Loan Calculators

The following are a few core elements of car loans that you should know before you start trying to calculate an auto loan.

- Car loans are a way to purchase a vehicle, whether it’s new or used, and you pay back the money you borrow over time.

- The original loan amount is called the principal, and then lenders charge interest each month as a fee for borrowing their money. That’s why you would use an auto interest calculator. An auto interest calculator would help you determine how much the full cost of your auto loan would be, including interest.

- The term of a car loan can vary and is usually anywhere from 36 months to 60 months. If you opt for a 60-month term, you may have lower monthly payments, but you will probably pay more throughout the duration of your loan.

Some of the reasons you might use an auto loan calculator include:

- As mentioned, you might use an auto interest calculator to see how much you would pay in interest, and also to compare interest rates to see how they would impact your payments and the amount you pay throughout the entire loan term.

- An auto payment calculator can show you how much your monthly payments would be, often including taxes, fees, and all other associated costs.

- With a car payoff calculator, you can determine how paying off your car loan more quickly might be financially advantageous.

- An auto refinance calculator is used to show how refinancing your original auto loan might reduce your payments.

See Also: Tips for Finding the Top Amortization Calculators & Schedules | Guide to Loan Amortization

AdvisoryHQ’s List of Top 6 Best Auto Finance Calculator Tools

List is sorted alphabetically (click any of the credit card names below to go directly to the detailed review section for that auto loan calculator):

- Amortization Schedule from Financial-Calculators.com

- Auto Refinance Calculator from Bank of America

- Bankrate Car Early Payoff Calculator

- Bankrate Down Payment Calculator

- Car Loan Comparison Calculator from Navy Federal

- Car Payment Calculator from Nationwide

Top 6 Auto Loan Calculator Tools | Brief Comparison & Ranking

Best Auto Loan Calculators | Used for | Inputs | Best for |

| Amortization Schedule from Financial-Calculators.com | Calculating payments and interest over time | Loan amount Number of Payments Payment amount Annual interest rate | Consumers considering buying or refinancing a vehicle |

| Auto Refinance Calculator from Bank of America | Comparing current loan with refinanced loan | Current loan balance, monthly payment, and interest rate Refinance amount, term, and interest rate | Useful for consumers considering an auto loan refinance |

| Bankrate Car Early Payoff Calculator | Calculating how much money and time are saved by paying an auto loan early | Number of months remaining Loan term in months Auto loan amount Additional monthly payment Annual interest rate | People who have extra money that could be put toward their auto payment or who want to eliminate debt more quickly |

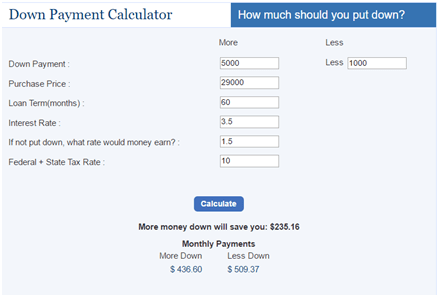

| Bankrate Down Payment Calculator | Comparing higher and lower down payments | Down payment (more and less) Purchase price Loan term Interest rate Federal and state tax rate | This is flexible and usable by anyone who is planning to purchase a vehicle with a down payment |

| Car Loan Comparison Calculator from Navy Federal | Side-by-side comparison of loans | Purchase price Down payment Loan terms (for two loans) | For consumers who are comparing loans or who are considering refinancing |

| Car Payment Calculator from Nationwide | Calculating monthly payments and lifetime interest | Loan amount Down payment or trade-in Interest rate Term | Useful for shopping for an auto loan, comparing terms, and knowing how much of a loan you can afford |

Table: Top 6 Auto Loan Calculator Tools | Above list is sorted alphabetically

How Should You Choose an Auto Loan?

An auto loan calculator can be a great tool to help you choose the best possible financing for a car.

In addition to using an auto finance calculator, the following are some specific considerations to keep in mind as you compare loan offers.

- Know your budget before you visit a dealership. That’s why using an auto finance calculator is valuable to do before you start shopping. You need to have a firm idea of your budget to avoid being talked into something you can’t afford when you get to the dealership.

- Don’t necessarily think you have to get financing from the dealership. Often, you’ll find better interest rates with financial institutions such as credit unions than you will at the dealership, so keep this in mind and compare terms and interest rates with an auto finance calculator.

- Know your credit score before working with a lender. Your credit score is one of the primary things your interest rate will be based on, so if you know it before you talk to a lender, you’ll have strength to negotiate.

- Go for the shortest terms you can reasonably afford. As mentioned above, you’ll notice when using an auto payment calculator that the longer the term of your loan, the less you’ll pay monthly, but you will pay quite a bit more over the long-term due to interest charges. Choose a loan with the shortest terms that give you a payment that’s doable for you each month.

Should You Refinance Your Auto Loan?

Another reason you might be using an auto loan calculator or a finance car calculator is to determine whether or not you should refinance. When you refinance an auto loan, you usually get a new loan at a lower interest rate.

Image Source: Pexels

Along with using an auto refinance calculator to see how refinancing could impact your monthly payment, you should also consider some other factors before you decide to make this move.

The first is whether or not you can actually get a better interest rate. Many people refinance because when the originally got their auto loan, their credit score was lower, but they’ve since improved it, and they believe they can get a better interest rate.

After using an auto refinance calculator, you might also consider this option if you’re simply in a different financial situation and need a lower monthly payment.

After you use an auto refinance calculator, you should also give careful consideration to whether or not you would qualify for a lower interest rate.

What Should Your Credit Score Be to Get an Auto Loan?

Along with using an auto payment calculator to calculate auto loan options, one of the most important things you can do before shopping for vehicles is to know your credit score. Your credit score affects not only whether you’re able to get an auto loan, but also your interest rate.

An excellent credit score is generally anything above 720, at least regarding auto loans. Anything above 700 is seen as good credit in the eyes of most auto financing lenders, and the minimum score for many car lenders is 640-680, although this varies.

If you have excellent or even good credit, you have more bargaining power as you get financing to purchase a car. You may be able to get very competitive terms or a low interest rate, particularly if you also have a significant down payment.

If your credit is less than good or excellent, you may still be able to get financing, but it may be at a higher interest rate. You may also need to put down a higher down payment to get financing.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Auto Finance Calculator Tools

Below, please find the detailed review of each account on our list of the top tools to calculate auto loan options. We have highlighted some of the factors that allowed these auto loan calculator tools to score so well in our selection ranking.

Don’t Miss: Which Is the Best Mortgage Calculator? Zillow? Bankrate? SmartAsset? | Calculators with PMI, Taxes, & Insurance

Amortization Schedule from Financial-Calculators.com Review

Financial-calculators.com is an online resource offering dozens of financial calculators that are designed for simplicity but also flexibility in their use. The calculators available on this site work across devices, and they’re all free. Some of the calculators available through Financial-calculators.com include business and investment calculators, tax calculators, and a range of loan and lending calculators. This includes tools that can be used to calculate auto payment options and schedules.

The Amortization Schedule Calculator isn’t a specific auto payment calculator, but it can be useful for seeing what your car payments might look like over time, as you make periodic payments. Amortization means that at the beginning of a loan, a larger portion of the payment goes toward the interest, and over time it then starts going toward the principal. Most car loans are amortized.

Key Factors That Led to Our Ranking of This as a Best Auto Payment Calculator

Features and benefits of this auto loans calculator are detailed below.

Features and Use

Amortization may sound like a complicated word, but it simply means that debt is paid off through a series of periodic payments. The Amortization Schedule Calculator is one of the most popular financial calculators on Financial-calculators.com, and input includes the following:

- Loan amount

- Annual interest rate

- Number of payments (which would be related to loan terms for an auto loan)

- Payment amount

You can also enter things such as loan date, payment frequency, when the first payment is due, and whether the interest is compounding, although this isn’t necessarily relevant with an auto loan calculator.

Then, once you calculate the input values you add, you can see a breakdown of your payments throughout the entirety of your loan.

Benefits

This auto finance calculator is included on this list of the best auto loans calculator options because it is excellent for giving buyers a clear picture of what they’re paying in interest each month and throughout each year of their loan.

Other benefits of this as an auto payment calculator include:

- The Amortization Schedule breaks down, in detail, your payments that are being made each month and shows you your loan balance for each month that’s included in your loan term.

- You can view the results as a graph that shows a comparison of your annual interest versus your annual principal that you pay each year of your loan.

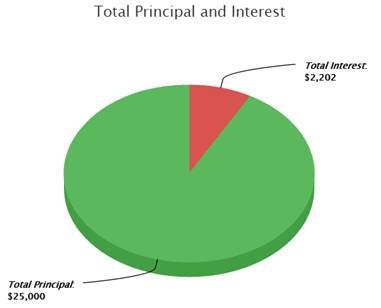

- Results also include a pie chart showing how much you pay in total for your loan, your payoff date, and your total interest.

Image Source: Financial-Calculators.com

Who It’s Good for

This auto loan calculator is included in this ranking of the best ways to calculate auto payment options because it’s flexible and versatile.

It is good for someone who’s thinking about financing a new vehicle, but it can also be a good auto refinance calculator because it can show you how much you’re currently paying in interest and what that will cost you when your loan is entirely paid off.

It’s a good, clear way to see the true costs of your auto loan and make decisions regarding interest.

Related: The Best Military Retirement Calculators for Active & Reserve Military Personnel

Auto Refinance Calculator from Bank of America Review

As mentioned at the start of this ranking of the best auto finance calculator tools and car payoff calculator options, refinancing an auto loan can be valuable. Refinancing an auto loan can be advantageous if you bought your vehicle when interest rates were higher, or if your credit score was lower when you originally purchased it.

Bank of America features an excellent auto refinance calculator, backed by the reputation and financial strength of this bank, based in Charlotte, N.C. This auto refinance calculator is a good tool because it’s simple but effective in the information it provides.

Key Factors That Led to Our Ranking of This as a Best Auto Refinance Calculator

Some of the features and benefits of the Auto Loan Refinance Calculator from Bank of America are detailed below.

Features and Use

This auto refinance calculator is designed to let users quickly and easily see the impact refinance could have by comparing their current loan with a refinanced loan.

To begin, users add their current loan information. This includes their loan balance, their monthly payment, and their interest rate.

They then add their refinance loan information, including the refinance amount, the term of the loan in months, and the interest rate.

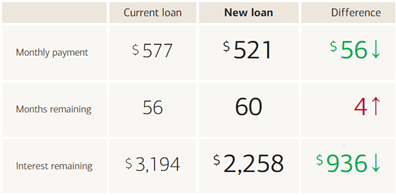

Once you calculate the totals, you get an easy-to-read chart that shows you the difference in not only your monthly payment but also the months and the interest remaining.

Image Source: Bank of America

Benefits

The primary advantage of this auto refinance calculator from Bank of America is that it provides users with a clear cut chart that outlines whether or not refinancing is a good option for them.

Other benefits of this auto refinance calculator include:

- It shows a breakdown highlighting not just the differences in the monthly payment you would get with refinancing, but also the months and interest remaining, for a more in-depth idea of whether or not refinancing is a smart financial decision

- Bank of America also offers affiliated education resources to help consumers make personal finance decisions. For example, below this auto refinance calculator, they cover topics such as when to refinance a car.

- You can also shop refinancing loans directly on the Bank of America site if you choose.

Who It’s Good for

This auto refinance calculator is useful if you’re ready to refinance and want an accurate breakdown of the advantages, as well as if you’re just starting to consider it.

This auto refinance calculator is ideal for consumers who might have experienced a change in their finances or credit score since they purchased their vehicle, as well as people who are simply looking for ways to lower their monthly payment or shorten the terms of their auto loan.

Bankrate is an online resource that specializes in featuring current rates and information regarding a variety of lending products. You can visit Bankrate to find daily updates on interest rates, as well as original content related to personal finance. Bankrate also features an extensive selection of financial calculators, including auto finance calculator options. Other calculators available from Bankrate are offered in categories including mortgage, retirement, tax, debt management, and investment.

The Car Payoff Calculator from Bankrate is designed to show consumers the impact paying off their car loan could have in terms of saving them money and shortening their loan term.

Key Factors That Led to Our Ranking of This as a Best Car Payoff Calculator

The following are details of why this is ranked as an excellent car payoff calculator.

Features and Use

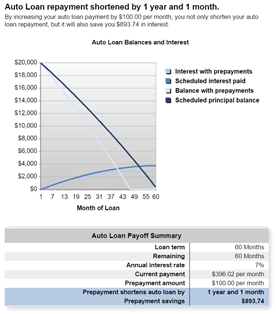

When a consumer increases their monthly payments, it can save money in interest, and it can also make the loan term shorter. This car payoff calculator from Bankrate is designed to help consumers see the specific impact accelerating payments could have on their car loan.

Input with this car payoff calculator includes:

- Number of months remaining

- Loan term in months

- Auto loan amount

- Additional monthly payment amount

- Annual interest rate

- Current payment

The results of this car payoff calculator include a length of time that indicates how much your loan repayment will be shortened, as well as a number representing total monetary savings.

Benefits

The main benefit of this car payoff calculator from Bankrate is the fact that it can motivate consumers to make faster payments on their car loan. Car loans are calculated with something called the simple interest method, which means the interest paid each month is based on the outstanding balance of the loan.

The earlier a consumer pays off the loan or the faster they pay it down, the more they’ll save in interest payments.

Additionally, when you use a car payoff calculator and make the decision to accelerate your car loan payments, you’ll have more free money available each month, which can be invested or put toward something that earns interest or benefits.

Who It’s Good for

This car payoff calculator can be useful for someone who has an existing car loan but may also have extra money that could be put toward paying it off. It shows in clear terms whether or not it’s a financially valuable option to do that. The car payoff calculator from Bankrate is also beneficial if you are working on paying off your debt and want to decide what debt to pay first.

This car payoff calculator can also be great if you like detailed reporting. All Bankrate calculators, including this auto loan calculator, have comprehensive, in-depth reporting that includes a variety of charts and graphs explaining the calculation results.

Popular Article: How to Find the Best Personal Loan Calculator to Calculate Payments & Interest (USA)

Bankrate Down Payment Calculator Review

Bankrate offers not only the car payoff calculator listed above but also a great auto loans calculator that focuses on down payments. Not all auto loan calculator tools include options for factoring a down payment into the equation, but this can be an important component of auto financing.

Image Source: Bankrate

This auto loan calculator with down payment input lets users experiment with down payments and see how different amounts might impact the overall financing of a new vehicle.

Key Factors That Led to Our Ranking of This as a Best Monthly Auto Payment Calculator

Features, uses, and benefits of the Bankrate Down Payment Calculator that led to its listing on this ranking of top auto finance calculator options are detailed below.

Features and Use

Among monthly auto payment calculator and auto interest calculator options, few offer input relating to down payment, and that’s what sets this auto loan calculator with down payment input apart.

The traditional idea is that consumers pay 20% down on a vehicle purchase, but in reality, most people make much smaller down payments.

With this auto finance calculator, users can experiment with different down payment amounts to see how it will affect their interest rate and the term of their loan.

The input with this auto payment calculator and auto interest calculator also includes purchase price, loan term in months, interest rate, and the federal and state tax rate.

There’s also an input field for the interest rate your money could earn if not used as a down payment included with this auto loan rate calculator.

Benefits

One of the most notable benefits of this tool to calculate auto loan options is the fact that it provides a comparison. Users can enter both a lower and higher down payment at the same time, and the results show the comparative breakdown between each down payment.

This is unique because you get a side-by-side perspective, rather than having to compare each separately.

Other benefits of this tool to calculate auto loan options include:

- One of the calculations included with this auto loans calculator is a total of the money you’ll save by putting more money down.

- You can also see a side-by-side comparison of your monthly payments with more down versus less down when you use this finance car calculator.

- This monthly auto payment calculator is distinctive because it factors both federal and state taxes into the entire equation.

Image Source: Bankrate

Who It’s Good for

This finance car calculator and auto loan calculator with down payment input is flexible and good for almost anyone considering the purchase of a vehicle.

It simply lets you experiment with different down payment options and see how it will affect your payment; there is really no limit to who would be helped by this auto payment calculator.

It’s also simple and easy-to-use, with straightforward input values and results.

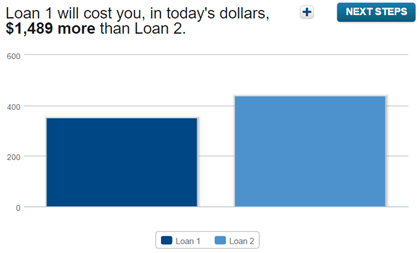

Car Loan Comparison Calculator from Navy Federal Review

Navy Federal is a military credit union serving the financial needs of members of the Armed Forces and their families. They are a full-service financial institution offering products and services, including checking and savings accounts, investments, and loans — including auto loans. Along with lending, Navy Federal also features tools to help members and the public be more financially educated and responsible.

Their Car Loan Comparison Calculator is included in this ranking of the best tools to calculate auto payment options and the best overall auto finance calculator tools.

Key Factors That Led to Our Ranking of This as a Top Auto Payment Calculator

Features and benefits of the Navy Federal Car Loan Comparison Calculator leading to its ranking on this list of the best tools to calculate auto payment options are detailed below.

Features and Uses

As the name implies, the specific purpose of this auto loan calculator and auto loan rate calculator is actually to compare two different loans.

This finance car calculator features a side-by-side comparison showing, in financial terms, which loan would be better out of two separate options.

The input required for each loan on this auto finance calculator is simple and includes purchase price, down payment, loan terms in months, and interest rate.

There are also input options for state and federal tax rate and savings rate included with this tool to calculate auto payment options.

Benefits

First, the main advantage of this finance car calculator and auto interest calculator is the comparative aspect. It’s a great shopping tool if you’re looking at two different car loan options and you want to see which one makes the most financial sense.

This auto loan rate calculator and auto payment calculator is also good because it shows you three different outcomes with written results and also graph versions. The first outcome included on this finance car calculator is a cost difference.

This takes into account everything from interest rates to tax rates and shows which loan is less expensive, all factors considered.

The next comparative aspect of this tool to calculate auto loan options shows which loan will have lower payments.

Finally, each loan result also includes an amortization payment schedule.

Image Source: Navy Federal

Who It’s Good for

This tool to calculate auto loan options is valuable for people who have good credit, as they often have the opportunity to choose from multiple loan offers when they’re buying a car.

It’s also good if you’re currently shopping auto loans or comparing options from different sources — for example, a credit union loan offer versus an option from the dealership.

This is also a good auto finance calculator if you want to compare loans with taxes included since that is an input option.

Finally, this can also serve as an auto refinance calculator, because you could enter the original loan information with refinancing information to get a side-by-side comparison.

Read More: Top Credit Cards for Miles | Ranking | Best Miles Credit Card Reviews

Car Payment Calculator from Nationwide Review

Nationwide is one of the nation’s leading providers of insurance products. In addition to insurance including auto insurance, Nationwide also offers services related to banking, retirement, and investing. Nationwide is recognized as one of the largest financial and insurance services companies in the U.S., with a history dating back 85 years.

The Car Payment Calculator from Nationwide is a tool used to calculate auto loan options and calculate auto payment possibilities before getting a car loan. This auto loan calculator can also be used as an auto interest calculator.

Key Factors That Led to Our Ranking of This as a Best Auto Payment Calculator

When comparing tools to calculate auto loan payment possibilities, the following are specifics of why this was selected as one of the best monthly auto payment calculator tools.

Features and Uses

This auto loans calculator and auto loan rate calculator from Nationwide is designed for use before applying for an auto loan. It’s an auto payment calculator that shows consumers whether or not they’ll be able to afford the potential monthly payments of a new loan.

To use this auto payment calculator, consumers enter their anticipated loan amount, including fees for taxes and the title, as well as the down payment or trade-in amount they’ll have, interest rate percentage, and the loan term in months.

The results of this monthly auto payment calculator then show estimated monthly car loan payment amounts as well as total lifetime interest.

Benefits

The first benefit of this tool to calculate auto loan options is the fact that you can include all of the relevant financial information pertaining to an auto loan with comprehensive input options. This includes down payment or trade-in amount, as well taxes and title fees.

That gives a more complete picture of how much an auto loan will really cost with this auto finance calculator.

Another benefit of using this auto loan rate calculator is the ability to see the amount of interest you’ll pay over the lifetime of the loan.

You can also switch over within the same auto loan calculator to use an auto refinance calculator.

Who It’s Good for

As with many of the auto finance calculator and car payoff calculator options on this ranking, this particular finance car calculator is valuable for a variety of purposes and for most consumers considering an auto loan.

It’s also good if you’re weighing whether or not the terms of a particular loan are good, since you can see not just specific monthly payments, but also the total amount of interest you might pay.

Many people are surprised when they realize how much they end up paying in interest for a loan, so the lifetime interest calculator feature is useful.

Related: Top Navy Federal Credit Cards | Ranking | Best NFCU Secured, Rewards, Cash Back Credit Cards

Conclusion—Top 6 Auto Loan Calculator and Auto Payment Calculator Tools

Aside from a mortgage, an auto loan is usually the second largest purchase most consumers make. That means it’s incredibly important to do your homework before applying for a loan to ensure you’re getting a good deal and a manageable monthly payment.

An auto loan calculator or auto finance calculator can be a great resource and research tool during the car buying process.

When you calculate auto loan options using an auto interest calculator or an auto payment calculator, you’ll get a realistic and often very accurate idea of how much your loan will really cost, both regarding monthly payments as well as throughout the lifetime of the loan, helping you make a smarter financing decision.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.