2017 RANKING & REVIEWS

THE BEST COMPOUND INTEREST CALCULATOR TOOLS

Finding the Best Compound Calculators. How Is Compounding Interest Calculated?

A compound interest calculator or a compounding calculator is a tool used to calculate a specific type of interest.

A compound interest calculator shows users how much they’ll earn or pay when interest is calculated on the initial principal amount and the accumulated interest of past periods of a loan or deposits. Compound interest is also referred to as interest on interest.

If you look at a compounding calculator for a savings or investment account, you’ll see that you can earn much more quickly than if you only earned interest on the principal over time.

At the same time, compound interest on a loan can be detrimental, since the interest is accumulating more quickly, making it more difficult for you to pay back the loan.

Award Emblem: Best Compound Interest Rate Calculators

An important component to consider when you’re looking at compound interest rate calculators isn’t just the interest rate itself but is also the compounding period. This may be daily, monthly, or yearly.

When you use a compound interest calculator, you’ll see that it’s better for interest to compound more frequently if it’s on a savings account. For example, quarterly is going to be more beneficial than annually.

On the other hand, if you’re using a compounding calculator to calculate compound interest on a loan or credit card account, the less it compounds, the better.

The following ranking covers the best compound interest rate calculators used to calculate compound interest.

See Also: The Best UK Mortgage Payment Calculators | Lloyds vs TSB vs Tesco vs Woolwich

What Is the Difference Between Simple and Compound Interest?

The above introduction to this ranking of the best compound interest rate calculators covers the generalities of a compound calculator and compound interest, but it’s also essential to understand the difference between simple and compound interest, particularly if you’re thinking of opening a new savings, investment, or loan account.

Image source: Pixabay

Simple interest is, as the name implies, a basic way for your money to grow or for interest to be charged on a loan or credit card.

The calculation for simple interest is as follows: Principal Balance x Interest Rate. You can then look at the product, whether it’s a deposit, investment, or loan account, and multiply that by the number of years to see your long-term return.

With compound interest, when you use a compounding calculator, you’ll get a figure that shows the amount you earn from your initial investment or what you must pay on your principal loan balance and what you earn on the interest you’ve already accrued.

The compound interest formula used with a compound interest rate calculator is quite a bit more complex than a simple interest rate calculator. The formula is A=P(1+r/n)nt. P represents the principal, r is the interest rate, n is the number of times the interest compounds per year, and t represents the number of years.

Most car and home loans charge simple interest, which is beneficial for the borrower. On the other hand, if you’re an investor, when you calculate compound interest, you’ll see how much more quickly it will allow your money to grow.

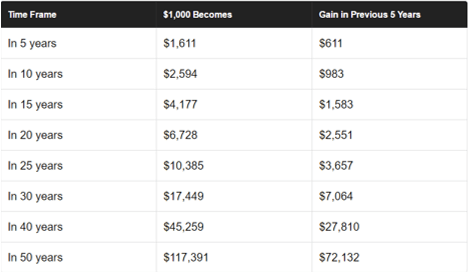

The following chart from Motley Fool shows what can happen with a $1,000 investment growing at 10% annually when you calculate compound interest.

What Kind of Accounts Earn Compound Interest?

You may have read the above details of compound interest rate calculators and compound growth calculator tools and decided you’d like to open an investment account that earns compounded interested. While they are beneficial for savers and investors, not every account is going to offer compounding interest.

Image Source: Motley Fool

The following are some examples of accounts that might calculate compound interest.

- Some savings accounts will offer compound interest, but also other bank accounts including CDs and money market accounts.

- There are options called zero coupon bonds where you would use compound interest rate calculators.

- In addition to savings accounts from banks, you might also use a compound interest formula calculator for certain non-interest-bearing investments. If you invest in dividend-paying stocks, and then reinvest the dividends you earn, your shares grow and earn their own dividend payments. It’s a similar idea to using a compounding calculator for a bank account.

Tips for Maximizing Compounding Interest Accounts

If you’re considering opening an account that features compound interest, there are ways to maximize your investment and make sure you’re getting the most possible earning potential. Below are some tips to do that:

- If you experiment with a compound interest calculator or a compound growth calculator, you’ll see that this type of interest works best for long-term investments. The longer you can keep your money in an account that earns compounding interest, the better. You could earn substantially higher returns without doing any work or making any effort.

- After looking at a compound interest calculator, you’ll see that you’re going to be able to significantly grow your money if you start investing earlier in your life. Of course, it’s never too late to start saving, but if you use a compound calculator, you’ll probably be astonished at how much you can earn if you start investing in your 20s and 30s and leave your money in that compounding interest account for years or decades.

- Choose the shortest compounding period you can find. You’ll see when using a compound interest calculator online that you’re going to earn a lot more a lot faster if you choose an account that compounds interest monthly, for example, rather than quarterly or annually.

- If you start plugging figures into a compound interest rate calculator, you’ll also see what an impact making regular contributions to your account can have over time, so whenever you have available money to deposit, it’s best to do that with a compounding interest account.

Don’t Miss: Which Is the Best Mortgage Calculator? Zillow? Bankrate? SmartAsset? | Calculators with PMI, Taxes, & Insurance

AdvisoryHQ’s List of Top 6 Best Compound Interest Rate Calculators

List is sorted alphabetically (click any of the credit card names below to go directly to the detailed review section for that compound interest calculator):

Top 6 Best Compound Interest Rate Calculators

| Compound Interest Rate Calculators | Used for | Inputs | Best for |

| Bankrate | Long-term savings strategy calculations | Starting amount Years to save Rate of return Additional contributions and frequency Compounding intervals | Long-term savings planning and detailed yearly and monthly reporting |

| CalculateStuff.com | Calculating compounding interest accounts | Initial investment Interest rate Regular investment term Compounded term Start date | Long-term investors or people with compounding interest loans |

| Investor.gov | Calculating long-term savings or savings goals | Initial investment Contributions Interest rate Compounding rate | People who have specific savings goals and long-term savers |

| The Calculator Site | Looking at the impact of withdrawals and deposits on compound accounts | Currency Base amount APR Calculation period Monthly deposits or withdrawals Inflation Compound interval | Retirees or people who are planning for retirement |

| Financial Mentor | Comparing compounding intervals | Beginning account balance Monthly additions APR Compounding interval Number of years to grow | Consumers who want a simple way to compare compounding intervals and monthly additions |

| NerdWallet | Comparing contributions and compound frequency | Initial deposit Contributions Investment time span Estimated date of return Compound frequency | This is a versatile calculator that works well for a variety of account and loan types |

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Compounding Calculator Tools

Below, please find the detailed review of each calculator on our list of the top tools to calculate compound interest rate. We have highlighted some of the factors that allowed these compound interest calculator tools to score so well in our selection ranking.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Bankrate Review

Bankrate is an online publisher of financial and economic news and information, and it has become one of the go-to online resources for all things related to money and personal finances. Bankrate specializes in offering information and rates on various consumer loans, and they also have financial calculators, including not only a compounding calculator but other options as well.

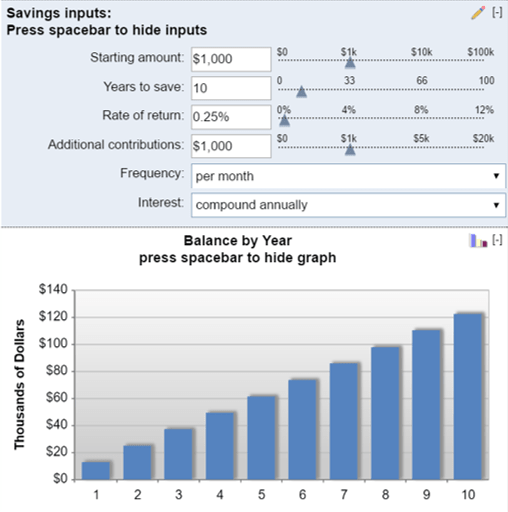

Image Source: Bankrate

In addition to the compounding calculator on Bankrate, users will find options, such as mortgage calculators, auto loan and lease calculators, savings calculators, loan comparison calculators, and more.

Key Factors That Led to Our Ranking of This as a Best Compound Calculator

Highlighted below are reasons the Bankrate Compound Interest Calculator is ranked as one of the best tools to calculate compound interest.

Features and Use

The Bankrate Compound Interest Calculator focuses on helping users calculate compound interest on a savings account. It’s for investors who want to save money over a long period of time as a means of accumulating wealth. This compound interest rate calculator can also be used to show how even the smallest of regular deposits over time can add up significantly.

Inputs included with this compound interest calculator are:

- Starting amount

- Years to save

- Rate of return

- Annual contributions

- Frequency of contributions

- How often interest compounds

Results of this compound growth calculator are shown in written form as well as graphically. Users can also view a comprehensive report with this compound interest formula calculator.

Benefits

The benefit of this compound interest rate calculator is primarily its detailed results. The full report shows a bar graph of your estimated balance — not just at the end of the time period you specify, but it breaks it down by year as well.

It also divides the results into the total amount you’ve contributed versus the total at the end of the investment and highlights the total interest.

Another benefit of this Bankrate compound interest formula calculator, aside from detailed reporting, are the definitions included with the calculator. Bankrate is great at serving as an educational resource for users, so there are in-depth explanations of each relevant input term below the calculator.

Who It’s Good for

To begin, this compound interest calculator and compound growth calculator is ideal for someone who wants to experiment with different savings options. For example, if you’re considering saving $1,000 annually versus $2,000 each year, this is a great calculator because it allows you to play around and then see different ways your money can grow.

This compound interest rate calculator is also good for long-term investors since it gives a year-by-year view of what your account growth would look like, given particular factors.

Finally, the Bankrate compound calculator is also great if you want a detailed, yearly breakdown of your savings versus your interest. You can see precisely not just what your balance would be, but also what your interest earnings would be each year.

Related: The Best Home Equity Calculators & Equity Line of Credit Calculator Websites

CalculateStuff.com Review

CalculateStuff.com is an online resource for all things calculator-related. They have online calculators not just for personal finance, but for education-related topics and many others. Some of their most popular calculators include not only the Compound Interest Calculator, but the auto loan calculator, BMI calculator, and the percent-to-decimal calculator.

Image Source: Calculate Stuff

The collection of calculators on CalculateStuff.com continues to grow, and there are new options added to the site on a regular basis.

Key Factors That Led to Our Ranking of This as a Best Compound Interest Calculator

Features, benefits, and uses of this compound interest calculator online are listed below.

Features and Use

The Compound Interest Calculator from Calculate Stuff is simple and straightforward, yet provides detailed reporting.

The inputs required with this compound calculator include:

- Initial investment

- Interest rate

- Regular investment and rate of investment

- Term

- Compounding period

- Start date

Once you enter that information, you will get a graph that breaks down how much your investment will eventually be worth.

Benefits

There are several ways you can view your results with this compounding calculator, which is one of the biggest benefits of using it.

You can see a numerical value for how much your investment will be worth after a preset amount of time, but you can also view both a pie chart and a bar graph. Each breaks down your initial investment, your regular investment, and the interest you earn.

There is also a highly detailed numerical table that shows how much investment, interest, and balance you will have each year of your investment period.

Additionally, you can see a monthly breakdown showing the same information for every month of every year of your investment term.

Who It’s Good for

This tool to calculate compound interest is good first and foremost for long-term investors. It gives you not just one figure showing how much you can have saved over a period of time; it offers highly detailed estimates over the months and the years. It’s specifically aimed at the needs of long-term investors.

This compound calculator can also be good not just if you’re saving money in a compounding interest account, but also if you want a compound interest loan calculator.

It can inversely show you not how much you’re earning, but how much you’re paying and how much you’ll pay over time, which is useful to motivate you to pay off this debt more quickly or to refinance.

Investor.gov Review

Investor.gov is an online resource operated by the U.S. Securities and Exchange Commission. This website is a go-to resource for all kinds of investors, and it includes a database where users can search investment professionals to find out about their credentials and registration status. The site also includes investor alerts and bulletins, as well as guidance, red flags to fraud, and financial planning tools.

One of the most popular financial planning tools available on Investor.gov is the Compound Interest Calculator and Savings Goal Calculator, which is included in this ranking of the best compound investment calculator tools.

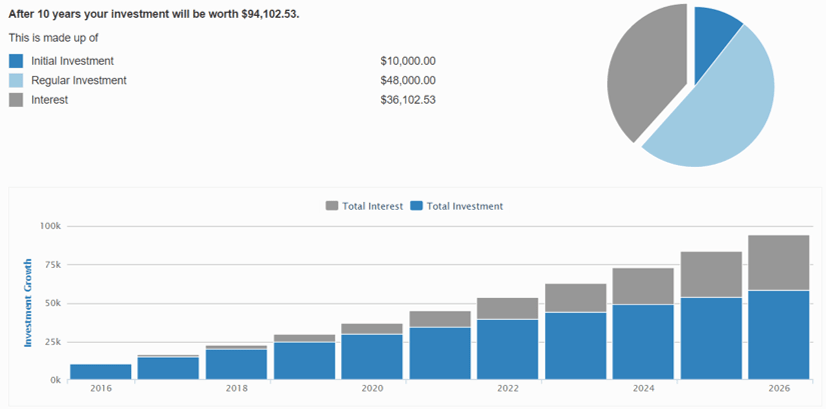

Image Source: Investor.gov

Key Factors That Led to Our Ranking of This as a Best Online Compound Interest Calculator

This compound interest calculator is included in this ranking of the leading compound interest formula calculator tools for the following reasons.

Features and Use

This compound growth calculator and compound investment calculator is a free tool that lets users see how much they can grow their money with compounded interest. It also allows users to calculate how much money they would need to contribute every month to reach a specific savings goal they outline.

There are two different components to this compound interest rate calculator and compound growth calculator.

The first is a compound interest calculator with inputs including:

- Initial investment

- Contributions

- Interest rate

- Number of times per year it would be compounded

The other aspect of this compound investment calculator is called the Savings Goal Calculator.

Here, inputs include:

- Savings goal

- Initial investment

- Growth over time

- Interest rate

- Frequency at which interest will be compounded

Benefits

This compounding calculator and compound growth calculator is useful if you want to see two different perspectives on saving money. The first perspective is in-line with many of the other compound calculator options on this ranking because it shows how much you will earn over time, depending on factors like contributions you make and how frequently you contribute to your account. This part of this compound calculator could also be used as a compound interest loan calculator.

On the other hand, this calculator also includes the option to approach how you calculate compound interest a different way.

With the savings goal calculator, you can see how long it would take you to reach a specific financial goal, rather than seeing how much you would have over time. For example, if you wanted to have $100,000 saved after ten years, you can use this part of the compounding calculator to see what you need to be saving and what type of account you would need to select.

Who It’s Good for

This compound interest rate calculator is useful for long-term savers, as well as people with specific savings goals in mind. That can be helpful if you’re planning for retirement, for example, and you want to know how much you need to contribute to your savings account each month.

It’s also good for people who are relatively inexperienced with a compound interest calculator because this compound growth calculator is easy to use, features explanations for all of the input terms, and has an intuitive interface.

It’s also a good compound interest calculator online if you want to be able to see a line graph version of your results that breaks down your savings over the amount of time you plan to save.

Popular Article: The Best Military Retirement Calculators for Active & Reserve Military Personnel

The Calculator Site Review

The Calculator Site is an online resource that provides a range of free financial calculators, as well as tools for converting to metric values and other conversion tools. Some of the popular free calculators available in addition to the compounding calculator include car loan calculators, credit card payment calculators, interest rate calculators, and more.

Image Source: The Calculator Site

Image Source: The Calculator Site

There are also options for retirement planning, percentage calculators, and even calculators related to personal health such as a Body Mass Index Calculator. In addition to financial calculators like the compound interest calculator, The Calculator Site also features original content and articles on topics relevant to site visitors.

Key Factors That Led to Our Ranking of This as a Best Compound Calculator

Listed below are features and benefits of the Compound Interest Calculator from The Calculator Site, which is one of the best compound interest formula calculator options available.

Features and Use

The Compound Interest Calculator, one of the best compound investment calculator options, is a popular way to look at compound interest earned on savings. It features monthly interest breakdowns and the flexibility to factor regular monthly deposits or withdrawals into the figures.

The input needed for this compound investment calculator and online compound interest calculator include:

- Currency

- Base amount

- Annual interest rate

- Calculation period

- Regular monthly deposits or withdrawals

- Inflation

- Compound intervals

Users can also move to the included standard calculator. This is a simplified compounding calculator and compound growth calculator, with inputs that include:

- Currency

- Principal amount

- Annual interest rate

- Calculation period

- Compound interval

Benefits

The first advantage of this compound investment calculator and compound interest calculator online is the flexibility it offers. You can look at a more sophisticated version of this compound calculator that lets you factor in things like regular deposits or withdrawals and inflation, or you can use the basic version.

This is one of the only compound interest rate calculators on this ranking of the best online compound interest calculator options that provides the ability not just to factor in deposits but also withdrawals.

There is also flexibility in how you can view the results when you use this compound interest calculator online. You can view a chart version of the results, which includes a yearly breakdown of interest for the year, total interest, and the balance. You can also view a graph of results, which shows an analysis of balance and total interest.

This compound interest calculator was also included in this ranking of the best options to calculate compound interest rate growth because it features a detailed information section explaining terms used in the compounding calculator, how to understand the results, and the formula used for compound interest.

Who It’s Good for

This compound growth calculator and online compound interest calculator is flexible enough to be useful for anyone who either already has an account with compounding interest or is considering one.

What’s unique about this compounding calculator as compared to other compound interest rate calculators, however, is that it’s also ideal for people who are in retirement or are approaching retirement.

This compound interest rate calculator includes the option to factor in withdrawals which retirees often make, and also to integrate inflation, which is another critical issue for retirees.

Read More: Which Is the Best Mortgage Calculator? Google vs. Trulia vs. Bank of America

Financial Mentor Review

Financial Mentor is an online resource designed to help average consumers make better financial decisions, maximize their investment strategies, build wealth, and have more freedom through their money-related decisions. This website features retirement planning guides that are easy to understand, investment advice, and retirement planning tools.

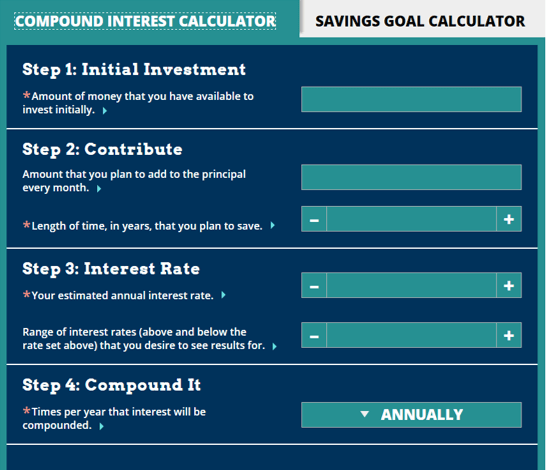

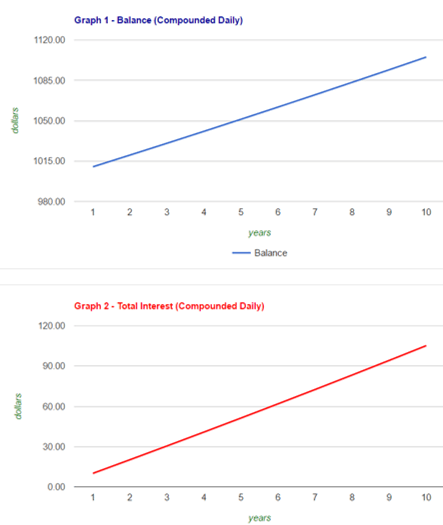

Image Source: Financial Mentor

Image Source: Financial Mentor

Financial Mentor also features many financial calculators, including the Compound Interest Calculator. Other calculators available from Financial Mentor include retirement calculators, auto loan calculators, loan calculators, and credit card and debt payoff calculators.

Key Factors That Led to Our Ranking of This as a Top Compounding Calculator

Uses, features, and benefits of this compound interest rate calculator that led to its ranking on this list of the best compound interest rate calculators are detailed below.

Features and Uses

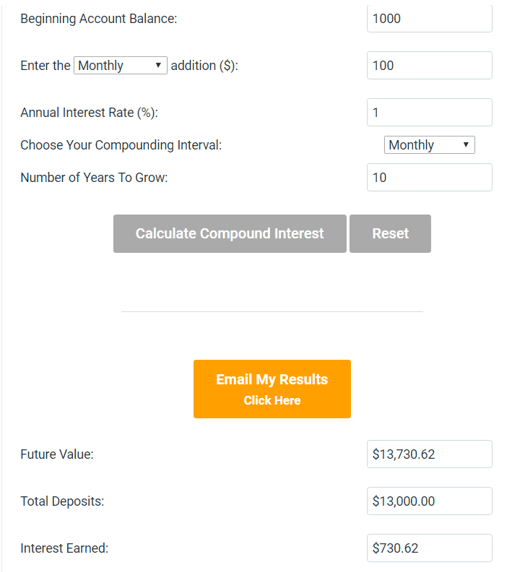

The goal of this compound interest rate calculator is to help users experiment with deposit intervals and compounding intervals, with options ranging from daily to annually. This online compound interest calculator is designed to help users compare expected earnings on different investment scenarios.

To use this compound interest calculator online, users first enter their beginning balance, regular deposit amount and specified interval, interest rate, compounding interval, and the number of years they anticipate growing their investment.

Benefits

This compound interest rate calculator and compound interest loan calculator is flexible enough to be used both for savings and investment accounts as well as loans with compounded interest.

It also provides the versatility to compare different scenarios based on the additions made to an account, as well as the compounding interval and the number of years the account has to grow.

Another benefit of using this compound interest loan calculator and compound interest rate calculator is the provision of an in-depth guide to compound interest that comes with the calculator.

It includes an explanation of how compound interest works, simple versus compound interest, and how to take advantage of compound interest. It also has a guide to comparing investments highlighting the importance of compounding intervals.

This compound interest formula calculator also includes the convenience of being able to have your results emailed directly to you.

Who It’s Good for

This is a good compound interest calculator and compound interest rate calculator for someone who wants simple, easy-to-understand inputs, detailed explanations of concepts and terms, and someone who primarily wants to compare compounding intervals.

It shows how much of an impact different compounding intervals can have on interest earned over time.

It should be noted, however, that this compound interest calculator online resource isn’t good if you want a graphical representation of your interest earnings over time.

Related: Best Starter, First, Beginner Credit Cards for Beginners | Ranking | Good First Credit Cards

NerdWallet Review

The NerdWallet website provides information including credit card deals, as well as comparisons of insurance, mortgage rates, and other things related to personal finance. The goal of the content and tools offered by NerdWallet is to help users save time while reducing their monthly payments. It’s also an online resource that strives to help consumers ensure they’re making the best possible financial decisions.

Image Source: NerdWallet

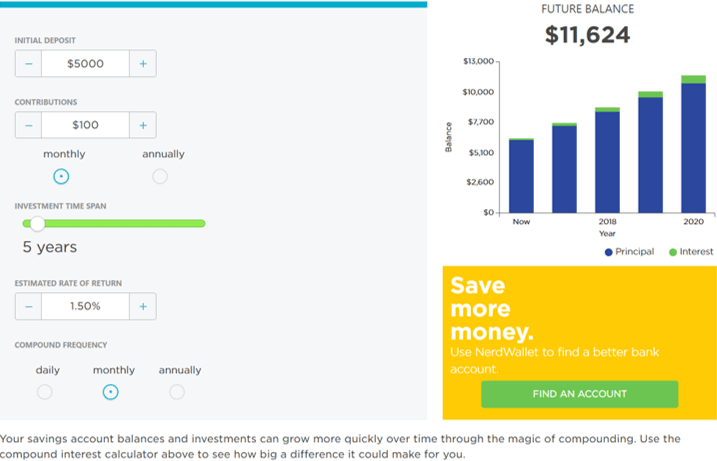

The NerdWallet Compound Interest Calculator is a great tool not just to see how much you can earn or how much you might pay in compounding interest, but also to use as a stepping stone to then choose the right bank account or investment account for you.

Key Factors That Led to Our Ranking of This as a Best Compounding Calculator

When comparing compound interest rate calculators, the following are specifics of why the NerdWallet compounding calculator ranks well.

Features and Uses

This tool to calculate compound interest rate difference is useful for many reasons. To begin using this tool to calculate compound interest rate options, enter the following:

- Initial deposit

- Contributions

- Frequency of contributions

- Investment time span

- Estimated rate of return

- Compound frequency (daily, monthly, or annually)

The results of this compound investment calculator and compound interest loan calculator are shown numerically and also as a graph.

Benefits

This compounding calculator is a good option to use if you’re searching for a compound investment calculator that lets you easily compare differences in monthly contributions. For example, you can quickly compare and see how much you could earn with a $100 monthly deposit versus a $200 monthly deposit.

You can also include a sample rate of return in this compound growth calculator, and you can use NerdWallet’s rate comparison tools to get that figure quickly and easily.

This compound interest formula calculator is also beneficial since it includes not only a number representing your possible future balance but also a bar graph that compares your balance over the years, as well as a breakdown of your principal versus your interest.

Who It’s Good for

This tool to calculate compound interest rate and contribution differences is useful for anyone who wants a calculator that’s straightforward and easy to use.

It’s also good if you want to start comparing interest rates and account options at the same time, since that’s what NerdWallet specializes in.

This is also an excellent compounding calculator if you’re trying to decide the amount of contribution and how regularly you should make it if you have an existing compounding interest account.

Conclusion—Top 6 Compound Interest Rate Calculators

There are two ways to look at compound interest and two reasons you might use a compound interest calculator.

When applied to savings and investment accounts, compound interest is considered a beneficial, easy way to build wealth. With this type of compound interest, you would use a compound growth calculator to see how much interest builds based not only on your principal but on the interest you accrue. If you can find a compound interest account with good terms, it’s an excellent option.

On the other hand, you might be using a compound interest loan calculator. This would apply to loans that charge compounding interest, and it becomes very hard to pay off the loan as a result. You might use a compound interest rate calculator to see just how much that loan is costing you, particularly if you’re considering refinancing.

The above compound interest rate calculators are some of the best regarding ease-of-use, features, valuable reporting, and flexibility.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.