2017 RANKING & REVIEWS

TOP RANKING CREDIT CARD COMPANIES

What Are the Top Credit Card Companies?

Credit cards are one of the biggest components of the overall personal finance market, and with so many choices increasingly available, people spend quite a bit of time shopping for the right cards and deals for their needs.

In addition to looking at the specifics of individual cards, it’s also important to compare the major credit card companies.

So, what should the average consumer think about when performing a credit card search and creating a comparison of different credit card companies?

The first thing to understand before delving into an in-depth credit card company comparison is that there are credit card networks that issue credit cards as well as banks and credit unions that issue cards from these networks. For example, American Express is one of the credit card companies on this list that issues cards directly, but there might also be banks that issue branded American Express cards.

Award Emblem: Top 10 Credit Card Companies

A specific consideration to keep in mind when comparing different credit card companies is their level of acceptance in the U.S. and around the world. For example, American Express tends to be less commonly accepted than Visa and MasterCard, both in the U.S. and in foreign countries.

Other specific things you might keep in mind as you’re looking at big credit card companies is whether or not they offer specific security protection to customers, such as fraud protection and recovery services.

Many of the best credit card companies will also offer additional discounts and services consumers find attractive, including extended warranties on products purchased with cards and concierge-level customer service.

See Also: Top Best Zero Interest Balance Transfer Credit Cards | Ranking | Interest Free Balance Transfer Cards

AdvisoryHQ’s List of the Top 10 Credit Card Companies

List is sorted alphabetically (click any of the credit card names below to go directly to the detailed review section for that credit card):

Top 10 Best Credit Card Companies | Brief Comparison

Credit Card Company | # of Cards | Networks Offered | Popular Cards |

| American Express | 20 | American Express | Blue Cash Everyday® Card |

| Bank of America | 23 | Visa | |

| Capital One | 12 | Visa | |

| Chase | 22 | Visa | Chase Freedom UnlimitedSM credit card |

| Discover | 7 | Discover | |

| HSBC | 4 | MasterCard | HSBC Premier World MasterCard® credit card |

| PNC | 4 | Visa | PNC Core℠ Visa® |

| SunTrust | 4 | MasterCard | |

| USAA | 14 | Visa American Express | Preferred Cash Rewards Visa Signature® |

| Wells Fargo | 10 | Visa American Express | Wells Fargo Cash Wise Visa® Card |

Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Best Credit Card Companies and Largest Credit Card Companies

Below, please find the detailed review of each card on our list of top credit card companies.We have highlighted some of the factors that allowed these credit card companies to score so well in our selection ranking.

Don’t Miss: Top Best Airline Credit Cards | Ranking | Best Airlines Miles Credit Cards (Reviews)

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

American Express Review

American Express is a global financial services company offering not only some of the country’s leading credit cards for individuals but also for businesses. American Express, along with being one of the top credit card companies in the world, also offers various payment, travel, and expense management solutions. This is the largest credit card issuer by purchase volume.

American Express also features one of the largest travel networks in the world, and it is well-known not just for being one of the biggest credit card companies but also for its innovative, leading-edge customer loyalty programs.

Key Factors That Led to Our Ranking of This as One of the Top Credit Card Companies

The following are some of the main reasons American Express was included in this credit card company comparison and list of credit card companies.

Rewards Cards

What readers will find by reviewing this credit card company comparison is that most of the names of the major credit cards companies offer very strong rewards options. Rewards cards let consumers earn points, cash back, and merchandise just for using their cards, and it was an important point of focus in the creation of this credit card companies list.

American Express does really well in this area because it not only offers rewards cards but also a variety of program options.

For example, rewards programs are divided into three main categories: travel, cash back, and rewards points.

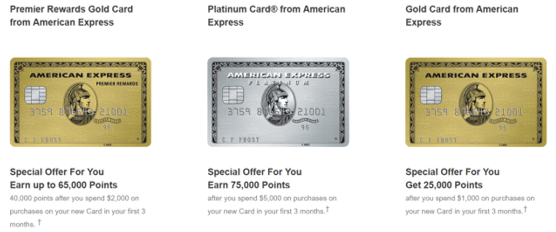

Travel Cards

As mentioned, American Express is a best credit card company for many reasons, including its rewards programs as well as travel card offerings. This is really thought of as one of the leading credit card companies in terms of travel cards, including options such as:

- Premier Rewards Gold Card from American Express: This card offers 40,000 points after spending $2,000 on purchases on the card made within the first two months and has no introductory annual fee.

- Gold Delta SkyMiles® Credit Card: This American Express Card is an excellent option for frequent flyers, and it earns 30,000 Bonus Miles after a user makes $1,000 in purchases within the first three months. There are also statement credits for making Delta purchases.

- Platinum Delta SkyMiles® Credit Card: This card earns the cardholder 5,000 Medallion Qualification Miles and 35,000 bonus miles after making $1,000 in purchases on the card within the first three months.

These are just a few of the travel cards available from American Express, one of the biggest credit card companies.

Source: American Express

Shopping and Entertainment Benefits

At American Express, one of the top 10 credit card companies and also one of the biggest credit card companies, there are many different tiers of cards. Some are basic everyday spending cards while others are high-limit travel rewards cards that are in the Platinum category.

Regardless of the type of card you have from American Express, you receive certain benefits, including shopping and entertainment perks.

Furthermore, the Extended Warranty program provides protection for items purchased with a qualifying American Express card after the manufacturer’s warranty runs out.

These cards also include the Shoprunner service which offers free two-day shipping on qualifying purchases from more than 140 online retailers.

Platinum Concierge

Among all of the major credit card companies on this list, American Express ranks incredibly well regarding customer service. Its cards come with certain levels of concierge service, and the Platinum Card Concierge is one of its premier offerings.

With a platinum card, the Concierge staff is available at any time to serve as a personal resource for cardholders, whether it’s getting reservations at the newest and hottest restaurants or securing event tickets.

There is also a Platinum Travel Service offering customized travel planning and assistance from expert Travel Counselors.

Related: Top Best Prepaid Debit Cards | Ranking, Including Prepaid Debit Cards With No Fees

Bank of America Review

Along with being one of the country’s biggest credit card companies and frequently ranked as one of the best credit card companies, Bank of America is also a commercial bank, with a presence around the world and headquarters in Charlotte, NC. Based on revenue, it’s one of the largest companies in the U.S. and in the world.

In addition to business, consumer, and institutional banking products and services, Bank of America is also well known for its many credit card offerings and rewards programs.

Key Factors That Led to Our Ranking of This as One of the Top 10 Credit Card Companies

When comparing some of the big names of credit card companies for this credit card company comparison, the following are main reasons Bank of America is ranked as one of the top 10 credit card companies.

Preferred Rewards

This leader among the largest credit card companies and best credit card companies offers a variety of rewards cards which will be highlighted below. In addition, it also has something called the Preferred Rewards program.

Preferred Rewards is an added bonus to make credit cards even more valuable for customers. When a Bank of America customer enrolls in Preferred Rewards, he or she can get 25% or more as a reward bonus on all eligible Bank of America credit cards.

Source: Bank of America

Also, members can receive additional benefits and rewards along with their everyday banking. To participate in this program, customers need to have a qualifying Bank of America deposit account and/or a Merrill Edge or Merrill Lynch investment account.

Categories

When researching and ultimately coming up with the names for this list of good credit card companies and big credit card companies, diversity in the offerings and types of cards was relevant. Bank of America also demonstrates a high number of unique credit card offerings to suit a broad range of needs.

The credit card categories offered by Bank of America, one of the biggest credit card companies, include:

- Cash rewards credit cards

- Travel and airline rewards cards

- Lower interest rate credit cards

- Build or rebuild credit

- Credit cards for students

- Points rewards credit cards

- Credit cards with no annual fee

Build or Rebuild Credit

A lot of the companies on this list of the major credit card companies and the top credit card companies have cards designed for people with good to excellent credit. These cards are valuable and often have lower interest rates and added perks and benefits for cardholders, but sometimes consumers need something to build or rebuild their credit, and Bank of America offers this in addition to its high-level cards for people with good credit.

One such option is the BankAmericard® Secured Card, designed to help people establish or repair bad credit. It’s a secured card that offers cardholders the opportunity after 12 months to have their history reviewed and determine whether or not they can then move to an unsecured card.

Bank of America also offers the BankAmericard Cash Rewards™ for Students, designed for people with no or limited credit history, among several other student card options.

Customized Credit Card Offers

One reason consumers tend to look at credit card company comparison lists and research the names of credit card companies is because there are so many options. Even once you’ve narrowed down to the top credit card companies, it can be difficult to know which specific card or offer is right for you.

Bank of America offers a unique tool that can be helpful to consumers. They only need to answer a few simple questions to check whether or not they qualify or can be matched with customized credit card offers.

It’s not a credit card application but rather gives consumers an overview of the cards that could work best for their needs and lifestyle.

Popular Article: Top Best First Credit Card for Young Adults, Teenagers, First-Timers & Beginners | Ranking and Comparison

Capital One Review

Capital One is a bank offering consumer and business-driven products and services. This Fortune 500 company is a widely recognized name in the American financial services industry, and Capital One is one of the 10 largest banks in the country based on deposits. Capital One is headquartered in McLean, Virginia.

Capital One is particularly known for its excellent cash back and travel rewards credit cards, including options like the Venture® and Quicksilver® Cards. It also features business rewards cards, cards for average or building credit, and even rewards cards for people with an average credit level.

Key Factors That Led to Our Ranking of This as One of the Top Credit Card Companies

When looking at Capital One as a best credit card company, the following are some details that led to its ranking.

Rewards

Among credit card companies, Capital One is often ranked as a best credit card company because of its robust rewards programs and offerings. Capital One rewards can be used for nearly anything a consumer wants, they don’t expire, and cardholders can redeem them online or with the Capital One mobile banking app.

Two of the most popular rewards cards offered by this best credit card company are the Venture® and Quicksilver® Cards.

The Quicksilver® Card earns unlimited 1.5% cash back on every purchase a cardholder makes, and that cash back can be redeemed in any amount at anytime. It can be used for a check, statement credit or gift card.

For travelers, there is the Venture® which earns unlimited miles on daily purchases and can be used for airline tickets, car rentals, travel packages, cruises, hotels, and more.

Visa Signature Benefits

Capital One cards are beneficial for many reasons that led to the ranking of this company on this list of good credit card companies. One reason is that the cards offered are Visa, which is one of the most accepted card services around the world.

Visa cards from Capital One also come with the following Visa Signature Benefits:

- Complimentary travel upgrades and special savings opportunities at hotels, spas, and resorts

- Complimentary concierge service 24 hours a day

- Special access and preferred seating at popular sporting events, concerts, and more

- Shopping discounts at top retailers and online merchants

- Extended warranty protection

- 24-hour travel assistance service

Capital One Features

In addition to being appointed with Visa Signature Benefits, all of the cards from Capital One also have other exclusive features from this company itself. As both one of the biggest credit card companies and best credit card companies, Capital One ensures cardholders have all of the security, peace of mind, and coverage they need.

Capital One cards include no foreign transaction fees when making a purchase outside of the U.S., regardless of the type of card you have. They also include $0 fraud liability and coverage if a card is ever lost or stolen.

Cardholders from this leader among the major credit card companies also can customize security alerts to be sent to them by email or text message in case there is an issue with their account.

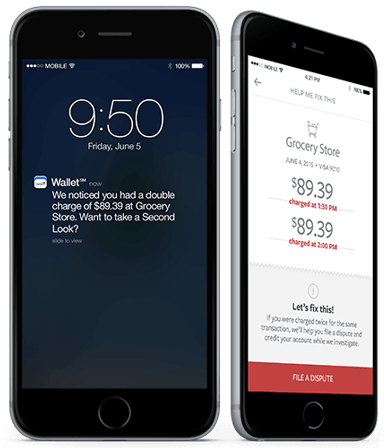

Second Look

When people are comparing different credit card companies, security is a significant concern in most cases. Consumers want to find the best credit card company that not only offers things like rewards and cash back programs but also puts a lot of focus on keeping customers and their cards secure.

Source: Capital One

Capital One provides this through offerings like Second Look. The Second Look program, typically offered with most Capital One cards, identifies potential mistake charges on credit card bills such as a duplicate charge. If an incorrect item shows up, Capital One will work to get it taken care of.

Second Look alerts can be sent by email, and there are also options for push notification and alerts available through the Capital One mobile app.

There is no need to enroll or sign up for Second Look.

Read More: Top Best Interest-Free Credit Cards | Ranking | Best Zero Interest Credit Cards (Reviews)

Chase Review

Chase leads the way in terms of being an innovative and best credit card company, with diverse offerings and unique features that many consumers find compelling as they compare different credit card companies.

In general, Chase is a leading bank serving almost half of all the households in the U.S. It offers checking accounts, savings accounts and CDs, mortgages and loans, and, of course, it is also one of the top credit card companies. Many of the personal credit cards from this best credit card company feature rewards and cashback opportunities as well as low fees and introductory offers.

Key Factors That Led to Our Ranking of This as One of the Best Credit Card Companies

Specific reasons Chase is ranked as not only one of the largest credit card companies but also one of the top credit card companies are detailed below.

New Cardmember Offers

One of the first things you’re likely to notice about Chase as you compare all of the available cards from this best credit card company is its excellent new cardmember offers. The specifics of these offers may change from time to time, but essentially all of the cards offered have them.

For example, the Chase Freedom UnlimitedSM credit card is one of the most popular products available, and it currently features a $150 bonus after cardholders spend $500 on purchases in the first three months from account opening. It also includes a 0% APR for 15 months from the account opening on purchases and balance transfers.

Balance Transfers

Often, consumers aren’t necessarily looking for the best credit card for purchases but are instead more interested in looking at top credit card companies offering balance transfer options.

Balance transfer cards allow consumers to transfer balances from other cards, consolidating them onto a single card, often with a better rate.

With Chase, there are five different balance transfer cards that can help consumers save on interest, particularly thanks to the low introductory rates.

A good example of a prime balance transfer card from Chase is the Chase Slate® credit card, which features a new cardmember offer of paying no balance transfer fee when the balance is transferred during the first 60 days after the account is opened.

Source: Chase Slate® credit card

Travel Cards

In addition to being one of the major credit card companies focusing on offering valuable balance transfer cards, Chase is also one of the best credit card companies for travel cards. Chase customers can choose a travel card that will reward them not only for making travel purchases but also everyday purchases, including groceries, gas, and dining.

These points are broken into two primary categories: airline credit cards and hotel credit cards.

One of the most popular travel cards from Chase, one of the top 10 credit card companies our list, is the Chase Sapphire Preferred® credit card. It features 50,000 bonus points after spending $4,000 in purchases during the first three months of opening your account, which comes to $625 to put toward travel through Chase Ultimate Rewards.

Foreign Transaction Fees

Certain consumers are searching for a list of credit companies that offer benefits like rewards programs and security in addition to low fees, particularly on foreign transactions. If you’re someone who travels outside of the country frequently, foreign transaction fees can be a big consideration, particularly with the average fee being several percentage points of purchases.

Chase excelled in many ways on this ranking of the largest credit card companies and one way was due to its diverse selection of cards with no foreign transaction fees.

It has 14 cards with no foreign transaction fees, allowing for fee-free purchases outside of the U.S.

Related: Top Credit Cards for Low Credit Scores | Reviews | Best, Fastest Ways to Build Credit

Discover Review

Discover, a financial services company and well-known name among credit card companies, has a long history of providing innovative credit card products. In fact, Discover introduced the first cash rewards card in 1986, and it continues to work to deliver new, value-creating products to consumers. Discover has also expanded its offerings to include banking services and payment solutions for businesses.

There are seven total cards offered by Discover, including its signature Discover it® Cash Credit Card which helps cardholders get 4% cash back in new bonus categories every quarter and 1% cash back on all other purchases.

Key Factors That Led to Our Ranking of This as One of the Top 10 Credit Card Companies

When looking at big credit card companies, the list below shows some of the major reasons Discover is part of this list of good credit card companies.

Cashback Bonus

One of the areas Discover specializes in is the delivery of high-value rewards cards that are on par or competitive with some of the country’s top cards from major credit card companies. It also has an offering called the Cashback Bonus which is automatically earned on every purchase.

Cardholders from this leader among different credit card companies get a 5% Cashback Bonus for every dollar spent in rotating categories up to the quarterly maximum. There are also opportunities to gain exclusive coupons and offers through Discover Deals.

Cashback Bonus rewards never expire and can be used to redeem for gift cards and e-certificates instantly at amazon.com checkout or for cash in the form of a statement credit or electronic deposit to a bank account.

Card Benefits

Discover, a longtime innovator among credit card companies, includes a suite of benefits with every card it offers.

One of these benefits is called Purchase Protection, which means Discover will cover stolen or damaged purchases up to $500 if they’re damaged or stolen within 90 days of purchase.

Price Protection is a service where Discover will refund the difference up to $500 on eligible items if a cardholder finds a lower price at any store within 90 days of purchase.

Other exclusive benefits available to cardholders from Discover, one of the largest credit companies, are extended warranty protection, a return guarantee, and Discover Deals so that cardholders can save money both in stores and online.

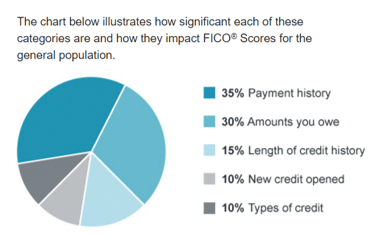

FICO Scores

Knowing where you stand regarding your finances and credit history are essential, and Discover offers cardholders access to their FICO credit score for free. A FICO score is a three-digit number that shows an individual’s credit risk, and it’s used by 90% of U.S. lenders.

FICO scores provided by Discover show both positive and negative information. This service is provided as a perk to cardholders so they can know what’s happening with their credit and avoid surprises.

In addition to providing general free access to current FICO scores, Discover also lets cardholders see their previous scores and key factors within the last 12 months on the company’s mobile app.

Source: FICO Scores

Value

Discover is among the top credit card companies on this list because it places emphasis on creating value for the cardholder. This is accomplished in many different ways, including low or no fees on many cards.

For example, with the signature card offered by this best credit card company, the Discover it® Cash credit card, there is no late fee on the first payment and no fee for going over the limit. Additionally, paying late won’t raise the cardholder’s APR, and there are no foreign transaction fees.

Security is also pivotal with Discover cards and includes not only free FICO monitoring but also 100% US-based customer service, account freezing that can be turned on or off in the mobile app, and $0 fraud liability.

HSBC Review

Offering personal and business banking solutions, HSBC leads the way in the U.S., not only due to being ranked as one of the good credit card companies but also for its deposit accounts and other banking products. HSBC is one of the largest financial services companies in the world, with 45 million customers and a network that spans 71 countries.

HSBC features four distinct credit card options, all of which are MasterCard, so cardholders enjoy nearly universal acceptance as well as benefits, like rewards and security protections. These cards feature competitive fees and interest rates, rewards, and benefits related to travel and shopping.

Rewards

The signature and most popular card available from HSBC is the HSBC Premier World MasterCard® credit card, designed for Premier clients and with an outstanding rewards program. This card includes an introductory offer of 40,000 Rewards Program Bonus points for new Premier World MasterCard® credit card clients who spend at least $2,500 in new net card purchases in the first three months after they open their account.

Additionally, this card includes one point for every new net dollar in credit card purchases. There are no point expiration dates or caps on earnings.

The HSBC Advance MasterCard® credit card and HSBC Platinum MasterCard® with Rewards credit card also earn rewards from this leader among major credit card companies and the best credit card companies.

Competitive Rates

No one wants to spend more than they should or have to when they use their credit card, which is why fees and interest rates are top priorities when considering different credit card companies and choosing the best credit card company for you. HSBC stacks up well regarding having great introductory rates and offers, competitive overall interest rates, and low fees.

For example, most of the cards available from HSBC, a leader on this list of credit card companies, feature a 0% introductory APR on credit card purchases and balance transfers for the first year after account opening. There are also no annual fees or foreign transaction fees.

Even after the introductory period, the interest rate remains competitive, and the minimum APR is currently 13.24%.

HSBC Premier Privileges

If customers have an eligible credit card from HSBC, they may also have access to Premier advantages. The Premier program from this leader among major credit card companies strives to provide a level of value for cardholders that is beyond what they can find with many other credit card companies.

The program includes access to travel, dining, shopping, and entertainment offers from around the world through usage of an HSBC Premier Card.

Security

HSBC puts a lot of focus on being one of the most secure credit card companies, and it has a global network of security experts always working to make sure credit card customers are protected against fraudulent activity.

Its dedicated security team monitors banking activity, and if there is a potential issue,it’s addressed immediately.

There is also a $0 liability online guarantee that protects cardholders from unauthorized online charges. During travel, if a cardholder loses his or her card or it’s stolen, HSBC will send an emergency temporary card replacement or a same-day cash advance to almost anywhere in the world.

Don’t Miss: Top Best Frequent Flyer Credit Card Offers | Ranking | Best Credit Cards for Travel Rewards

Free Wealth & Finance Software - Get Yours Now ►

PNC Review

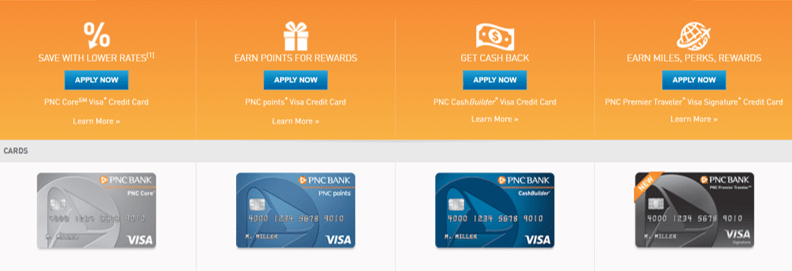

PNC has a history as a leading financial services company that goes back more than 160 years. There are more than six million small business and consumer customers that are part of the retail business of PNC, and this bank has locations in 19 states, with 2,600 branches.

In a general sense, some of the perks and benefits of PNC cards that led to its inclusion on this list of the best credit card companies include lower interest rates, rewards options, cash, and travel benefits. These cards also include features like introductory offers for extended periods.

Source: PNC

Key Factors That Led to Our Ranking of This as One of Best Credit Card Companies

Among major credit card companies, PNC was included on this credit card companies list for reasons like the ones named below.

Introductory Periods

Among the big credit card companies, there is a general tendency to offer special introductory rates in terms of interest. These introductory rates will usually apply to purchases, balance transfers or both.

PNC is no exception among major credit card companies, but it actually exceeds many credit card companies regarding the length of its introductory periods, particularly for the PNC CoreSM Visa® Credit Card. This card is specifically tailored to the needs of consumers who want a card that is simple and lets them save money.

The introductory 0% APR is offered for an extended period of 15 billing cycles following account opening.

Online Card Management

PNC is well-known among different credit card companies, as well as the biggest credit card companies, due to its extensive online account management options. Consumers can keep track of their PNC credit cards in every aspect through online and mobile banking.

Some of the options that can be managed online or via the mobile app include:

- Complete account summaries, including balance, available credit, credit limit, cash advance balance, APR, and previous statement information

- View up to 13 months of posted transactions

- Search for specific transactions

- Export information to financial software

- Pay your credit card with a funds transfer from a PNC account

- Request a credit limit increase

- Dispute a transaction

- Set up real-time email or text alerts

- View reward balances

- Redeem rewards

Bonus Points

PNC isn’t just one of the top credit card companies in terms of offering rewards. In addition to the standard rewards available on its credit cards, PNC also ranked well on this credit card company comparison because of the opportunities it offers for earning bonus rewards.

For example, with rewards cards from PNC, cardholders can get a 75% bonus on base points earned in a billing cycle, representing the highest possible reward level for having a PNC Virtual Wallet with a Performance Select or PNC Performance Select Checking Account.

Some cardholders can also earn a 50% bonus on base points earned in a billing cycle with a PNC Virtual Wallet with Performance Spend or PNC Performance Checking Account.

Finally, cardholders may be eligible for a 25% bonus on base points earned with a billing cycle by simply having a PNC Virtual Wallet.

Bonus Miles

PNC is not only known as being one of the major credit card companies that offers cashback rewards. It’s also a good credit card company for travel rewards, thanks to the newly introduced PNC Premier Traveler® Visa Signature Credit Card.

This card includes miles, rewards, and a better travel experience. Currently, there is also an offer from this best credit card company to earn 30,000 bonus miles when someone opens a new credit card account and makes $3,000 or more in qualifying purchases in the first three billing cycles after opening the account.

Other features of this card available from PNC, one of the top credit card companies, include earnings of 2 miles for every $1 on all qualifying purchases and no foreign transaction fees.

Free Budgeting Software for AdvisoryHQ Readers - Get It Now!

SunTrust Review

SunTrust is one of the biggest and most well-established financial services companies in the nation in addition to being one of the big credit card companies. SunTrust also has other services designed to meet the needs of consumers, including deposit accounts and loans as well as consumer and business clients.

In terms of being a good credit card company for personal credit cards, SunTrust features a family of cards that are packed with features and benefits from cash rewards to travel rewards and several other options.

Key Factors That Led to Our Ranking of This as One of the Good Credit Card Companies

Among the major credit card companies, SunTrust was included on this credit card companies list for reasons like the ones below.

Prime Rewards Credit Card

The availability of the Prime Rewards Credit Card is really worth mentioning on its own while ranking good credit card companies. This card offered from SunTrust is unique in many ways, including the three years locked in at the Prime Rate. This isn’t something afforded by any of the other credit card companies named on this credit card company comparison.

Three years at the introductory rate means the card is currently locked in at an incredibly low 3.50% APR applicable to balance transfers made in the first 60 days. Even after that three-year period, the variable APR is currently at a minimum rate of only 10.49%.

This is an excellent card option for balance transfers and is one of the premier transfer cards offered by any of the best credit card companies named on this credit card company comparison.

Travel Rewards

Also available from SunTrust, among the names of credit card companies on this list, is an outstanding travel rewards card, simply called the Travel Rewards Credit Card.

This card offers a fantastic 5% cashback rate on up to $6,000 spent on travel purchases in the first year after opening the account. That’s not the only cashback offer from this best credit card company option, however.

Cardholders also receive 3% unlimited cash back on travel purchases that qualify after the introductory bonus cash back and then 1% unlimited cash back on other qualifying purchases at all times. The card also carries a 0.0% APR on purchases and balance transfers for the first 15 months.

Flexible Rewards

S0metimes, credit card customers will think they’ve found a list of credit card companies offering great rewards options, but once they have the card, they find that redeeming their rewards isn’t what they expected.

One of the prime benefits of SunTrust in terms of good credit card company options is the flexibility of its rewards redemption.

There are hundreds of redemption options, including cash back, travel, gift cards, merchandise, and more. There is no fee associated with the Rewards program, and users can log onto the SunTrust Rewards website to browse their options, making it fast, easy, and fun.

Secured Credit Card

Along with generally offering great rewards credit cards, another reason SunTrust is included on this credit card companies list of good credit card companies is that it not only offers a Secured Credit Card for people who need to build or rebuild their credit, but it is also a rewards card.

This card features 2% cash back on up to $6,000 spent annually on qualifying purchases in the gas and grocery categories. It also includes 1% unlimited cash back on other qualifying purchases.

Having options like these was important in the creation of this credit card company comparison of good credit card companies because it gives all consumers the opportunity to not only learn healthy financial habits and build their credit but to simultaneously earn rewards while doing so.

Popular Article: Top Best Credit Cards for College Students| Ranking | Best College Student Credit Cards

Free Wealth Management for AdvisoryHQ Readers

USAA Review

USAA is distinctive from many of the other financial institutions in this ranking of the largest credit card companies and best credit card companies. Since 1922, USAA has been a bank and financial services provider that works specifically with and for the military community and their families. It offers excellent products and services to people that are affiliated with the military community, and one area of its banking service is specifically for credit card provision.

Regarding being one of the top credit card companies on this comprehensive list of credit card companies, USAA offers variety and sought-after features with its cards as well as cards aimed specifically at providing rewards or low interest rates.

Key Factors That Led to Our Ranking of This as One of the Top Credit Card Companies

Among good credit card companies and big credit card companies, USAA ranks well for some of the following reasons.

American Express Cards

Aside from cards that come directly from American Express, very few credit card companies, including most of the names of credit card companies on this list, offer American Express cards. American Express is preferred by some consumers due to its excellent customer service and rewards offered.

USAA is unique because it offers both Visa and American Express cards.

A couple of the American Express cards provided by this best credit card company include the Cashback Rewards Plus American Express® Card and the Cashback Rewards American Express® Card.

Low Rate

When creating this credit card companies list of major credit card companies and top credit card companies, USAA did well for many reasons including its diversity of available cards. There are card options for nearly any need, and one area it specializes in is the provision of a low-rate card.

The USAA Rate Advantage Visa Platinum® Card has not only one of the lowest interest rates of any card offered by USAA, but the minimum current interest rate for purchases and transfers is 7.15%, lower than what’s offered by most cards at different credit card companies.

This card also features no annual fee and no penalty APR.

Source: USAA

Cash Back

Cashback offers from big credit card companies are a tremendous draw for consumers right now. Consumers find that they can actually make money from credit card companies if they pay off their balance each month.

USAA performed well on this credit card companies list and credit card company comparison because it offers several cashback credit cards, all of which have competitive percentage rates and are packed with other benefits as well.

To give an example, the Preferred Cash Rewards Visa Signature® Card lets cardholders earn 1.5% cash back on every purchase with no limit to the amount they can earn. It’s easy to redeem cash rewards anytime online or by mobile device, there is no annual fee, and interest rates remain low even after the introductory period.

Military Member Benefits

A facet of selecting USAA as compared to other names of credit card companies on this credit card companies list is that it works specifically with the military community. This means there are cards available designed to offer more value to military members and their families, and USAA also bases its customer service on the needs of military personnel and veterans.

For example, during an active-duty deployment, a cardholder can receive a special lowered interest rate and some of the fees waived on his or her USAA credit card, which applies to the current balance, new purchases, and cash advances for up to 15 months when deployed.

Free Money Management Software

Wells Fargo Review

Wells Fargo is a bank with a long history that started more than 160 years ago. Since then, Wells Fargo has been working to lead the way as innovators in banking. It has grown to have a presence throughout the country in the 21st century and has also developed an extensive and diverse portfolio of products and services, including making a name as one of the big credit card companies.

Wells Fargo has ten excellent credit card options that include a flexible rewards program as well as many other benefits.

Key Factors That Led to Our Ranking of This as One of the Top Credit Card Companies

Among the big credit card companies, Wells Fargo ranks well because of reasons listed below.

Go Far Rewards

As with the other names of credit card companies included on this list of the top 10 credit card companies, Wells Fargo does have a rewards program, dubbed “Go Far Rewards.”

Go Far Rewards is designed to be a flexible program that fits the life of cardholders in the ways they need it to.

The three elements of the Go Far Rewards program, one of the number one reasons Wells Fargo is named as one of the best credit card companies, include:

- Pay It Down: The idea is that every little bit helps. Unique from other credit card companies, participants in the rewards program at Wells Fargo can use their rewards to meet financial goals. This can include using them as a credit to a qualifying Wells Fargo account, such as a personal or home loan.

- Pay It Forward: Rewards can be used to donate to charities.

- Reward Yourself: Cardholders can do everything from getting cash at ATMs to booking a vacation using their rewards from this leader among major credit card companies.

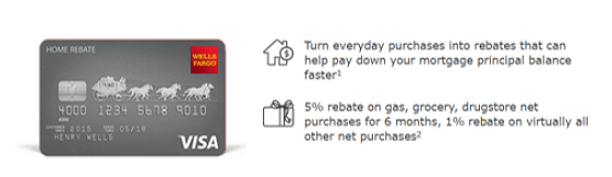

Wells Fargo Home Rebate Card®

When ranking the major credit card companies to include on this ranking of the top 10 credit card companies, unique credit cards and services were considered. One of the distinctive cards from Wells Fargo is the Wells Fargo Home Rebate Card®.

This card can be used to transform everyday purchases on things such as gas and grocery store visits into rebates that are then used to pay mortgage principal amounts faster for Wells Fargo homeowners.

For example, there is a rebate rate of 5% for gas, grocery, and drugstore net purchases for the first six months.

Source: Wells Fargo Home Rebate Card®

Bonus Rewards

Some of the credit cards available from Wells Fargo, one of the best credit card companies, include bonus reward options. This is the case with cards like the Wells Fargo Propel American Express® Card.

With this card, as an example, there is a 10% available annual bonus on non-bonus rewards when the cardholder maintains a qualifying Wells Fargo checking or savings account. This is in addition to the excellent rewards-earning opportunities available with this card, such as 3x points at gas stations and 2x points at restaurants.

Another card currently featuring bonus points is the Wells Fargo Propel 365 American Express® Card, which features 20,000 bonus points if a cardholder spends $3,000 in net purchases in the first three months after opening the account.

Competitive Rates and Fees

Essential to why Wells Fargo is included on this list of credit card companies that are known as the top credit card companies is because its cards represent competitive fees and interest rates.

For example, the Wells Fargo Cash Wise Visa® Card is a straightforward cash rewards card with unlimited rewards on net purchases, no category restrictions or quarterly signups, and no annual fee.

This card represents the lowest possible intro APR on purchase and balance transfers available from Wells Fargo. Furthermore, it also includes account protections, such as zero liability protection and fraud monitoring alerts.

Conclusion—Top 10 Best Credit Card Companies

The above list of the top 10 credit card companies represents a broad list of different credit card companies, each of which is likely to hold appeal for a diverse set of consumers.

Image Source: Pixabay

The major credit card companies listed above excel in areas such as offering many different options, competitive interest rates, and introductory and bonus offers.

These are not just the largest credit card companies – they also have a strong reputation among consumers, continuing to innovate and lead the way when it comes to providing the most valuable and desirable products and services for cardholders.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.