2017 RANKING & REVIEWS

THE BEST DIVIDEND ETFS AND HIGH YIELD ETFS

Finding the Best Dividend ETFS (What Is a High Dividend ETF?)

An exchange-traded fund, or an ETF, is a basket of stocks that provides diversification and the opportunity to invest across a variety of companies or sectors easily and relatively inexpensively.

More specifically, a high dividend ETF is an investment product that invests only in a basket of high-dividend-paying stocks. As with other ETFs, a high dividend ETF is managed around an index, although there may be certain qualities that are sought out in the specific stocks.

The stocks in the best dividend ETFs are selected based on their dividend yield, and depending upon the dividend paying ETF, investors may be able to create a stream of income from their investment in these products.

With some dividend ETFs, the dividend goes directly back into a brokerage account, while with other options, the dividend may be used to buy more shares of the ETF.

Award Emblem: Best Dividend ETFs

The primary advantages of a high dividend ETF include the revenue that’s earned from them, as well as the fact that they’re generally considered to be lower risk and more stable than other forms of investment. The top dividend ETFs also serve as a way to integrate diversification into a portfolio, and they can protect against inflation.

While a high dividend ETF does have many advantages, there are possible disadvantages as well.

For example, even the top dividend ETFs may not always outperform rates of inflation, and companies can decide to eliminate their dividend if it’s in their best interest. That’s why it’s important for investors to look for top dividend ETFs with stocks from companies that have a history of paying dividends.

The following ranking and review of the best dividend ETFs focuses on high yield dividend ETFs and shows investors some of the best products for earning income based on past performance and analysts’ reviews and outlooks.

See Also: Top Credit Cards for Fair Credit | Ranking & Reviews | Best Fair Credit Credit Cards

AdvisoryHQ’s List of the Top 10 Best Dividend ETFs

List is sorted alphabetically (click any of the ETF names below to go directly to the detailed review section for the dividend ETF):

- Alerian MLP ETF

- Guggenheim Bullet Shares 2020 HY CorpBond ETF

- iShares Mortgage Real Estate Capped ETF

- iShares U.S. Preferred Stock ETF

- PowerShares CEF Composite Portfolio

- Schwab US Dividend Equity ETF

- SPDR® Nuveen S&P High Yield MuniBond ETF

- SPDR® S&P® Dividend ETF

- Vanguard Dividend Appreciation ETF

- Vanguard High Dividend Yield ETF

Top 10 Best Dividend ETFs| Brief Comparison

Top Dividend ETFs | Ticker | Dividend Yield | Expense Ratio |

| Alerian MLP ETF | AMLP | ||

| Guggenheim Bullet Shares 2020 HY CorpBond ETF | BSJK | ||

| iShares Mortgage Real Estate Capped ETF | REM | ||

| iShares U.S. Preferred Stock ETF | PFF | ||

| PowerShares CEF Composition Portfolio | PCEF | ||

| Schwab US Dividend Equity ETF | SCHD | ||

| SPDR Nuveen S&P High Yield MuniBond ETF | HYMB | ||

| SPDR® S&P® Dividend ETF | SDY | ||

| Vanguard Dividend Appreciation ETF | VIG | ||

| Vanguard High Dividend Yield ETF | VYM |

Table: Top 10 Best Dividend ETFs | Above list is sorted alphabetically

Detailed Overview of What to Consider When Selecting a High Dividend ETF

There are a couple of key things to keep in mind when selecting the best dividend ETF and high yield ETFs, regardless of your particular investment or income-earning goals.

First, when you opt for a dividend ETF as opposed to a single dividend-earning stock, you are going to see lower yields. However, most investors find this trade-off is worth it because of the level of diversification they get with dividend ETFs.

Image Source: Pixabay

Also, many investors make the mistake of only looking at the ETF dividend or yield when making investment decisions, but it’s critical to also think about consistency. Investors should look for the top dividend ETFs that are also paid by companies with a long history of meeting dividend commitments to investors.

There are companies that have a history of stopping their dividend payments and then restarting them, and these are companies that should be avoided as you select the best dividend ETF.

Also, while you might find a high dividend ETF with some of the most competitive yields, this is also likely to represent a lot of volatility. You may look at the Beta, which is a measure of the level of volatility, before making an investment decision.

It may be that you’re okay with volatility in exchange for the potential of higher yields, but if you’re retired and depending on an ETF dividend payment as a primary source of income, you might consider lower yields in exchange for more stability.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Best Dividend ETFs

Below, please find the detailed review of each of the top dividend ETFs on our list of the best dividend ETFs. We have highlighted some of the factors that allowed these dividend-paying ETFs to score so well in our selection ranking.

Don’t Miss: Top Canadian Credit Cards | Ranking | Best Canadian Rewards and Low Interest Credit Cards

Alerian MLP ETF (AMLP) Review

The Alerian MLP ETF (AMLP) is from ALPS Funds, and the objective of this dividend ETF is to provide returns and performance that correspond to the price and yield performance of the Alerian MLP Infrastructure Index, which is the underlying index for this particular top dividend ETF.

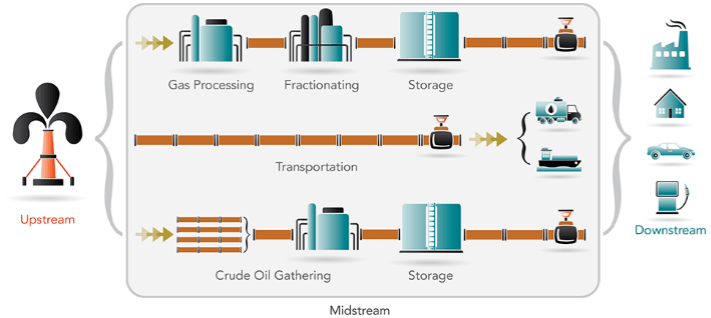

The Alerian MLP ETF provides exposure to this particular index, which is a capped, capitalization-weighted composite of infrastructure Master Limited Partnerships (MLPs).

These MLPs earn most of their cash flow from commodities in the areas of transportation, storage, and processing of energy. Overall, the stocks making up this top dividend ETF are based on U.S. energy infrastructure and its development over the coming years and decades.

MLPs are responsible for the operation and development of infrastructure assets in the U.S. This can include processing plants, pipelines and storage facilities.

Image Source: ALPS Funds

Key Factors That Led to Our Ranking of This as One of the Best Dividend ETFs

Portfolio details and other characteristics of the Alerian MLP ETF that led to its inclusion on this ranking of the top dividend ETFs, and the leading ETFs that pay dividends are highlighted below.

Portfolio

This ETF features the NYSE Arca as its listing exchange, and its inception date is 8/24/2010. As one of the leading high dividend ETFs, the Alerian MLP features dividends that are paid quarterly and a current volume of 6,604,477.

Top holdings with this best dividend ETF include the following:

- Magellan Midstream Partners LP

- Enterprise Products Partners LP

- Energy Transfer Partners LP

- Plains All American Pipeline LP

- Williams Partners LP

- Buckeye Partners LP

- MPLX LP

- ONEOK Partners LP

- Sunoco Logistics Partners LP

- Enbridge Energy Partners LP

- Western Gas Partners LP

Other holdings include EQT Midstream Partners LP, Genesis Energy LP, Tesoro Logistics LP, and DCP Midstream Partners LP, as of 12/27/2016.

The companies included with this dividend paying ETF are included with energy growth and development in mind. The thought is that energy drives growth, and this dividend ETF focuses on the infrastructure required during the production of natural gas and oil in the U.S.

Performance, Cost, and Risk

The performance of this dividend paying ETF was somewhat down over the past year because of the declining price of oil. Many investors and analysts are predicting it’s going to be a top-performer over the coming years, particularly with the new administration taking over the U.S. government and their likelihood of putting an increased focus on energy development.

Despite the declines in oil prices over recent years, the Alerian MLP ETF still saw an annualized NAV of 11.38% over the past year, and CNBC recently cited its yield as 11.5% at one point in 2016, making this an incredibly high dividend ETF. Currently, the ETF dividend yield with AMLP is 8.02%.

The current prospectus puts expenses at 0.85%, and the principal investment strategy is passive.

Key investment risks with this dividend paying ETF include general investment risk, market risk based on market conditions, the tax status of the fund, and deferred tax liability.

There are also risks related to after-tax tracking error from the performance of the underlying index, and there is industry-specific risk including reduced volumes of natural gas or other energy commodities, new construction risks, and a risk that comes with a sustained reduction in the demand for crude oil and natural gas.

Guggenheim Bullet Shares 2020 High Yield Corporate Bond ETF (BSJK) Review

The Guggenheim Bullet Shares 2020 High Yield Corporate Bond ETF (BSJK) is named as the number-three high-yield bond ETF by U.S. News and World Report, scoring particularly well in holdings diversity and costs. This leader among the best dividend ETFs is passively managed and generally corresponds to the performance of the Nasdaq BulletShares® USD High Yield Corporate Bond 2020 Index, which is a high yield corporate bond index.

According to the prospectus of this high dividend ETF, at least 80% of total assets are invested in core securities of the index, including high yield securities.

The index itself shows the performance of held-to-maturity U.S. high yield corporate bonds, with maturities in the year 2020. It provides a good option for long-term investors, and in 2020, its year of maturity, the proceeds are reinvested in cash.

Key Factors That Led to Our Ranking of This as One of the Top Dividend ETFs

The Guggenheim Bullet Shares 2020 High Yield Corporate Bond ETF is included in this ranking of the top dividend ETFs and the leading ETFs that pay dividends for reasons like the ones detailed below.

Portfolio

The BSJK dividend ETF is designed to correspond to the BulletShares® USD High Yield Corporate Bond 2020 Index, and it integrates the benefits of the bond’s monthly income, final distribution at maturity, and yield. Some of the advantages of this high dividend ETF include liquidity, transparency, and cost-effectiveness.

It delivers targeted exposure so that investors can create tailored portfolios based on their goals and level of preferred risk, and it’s also designed as a simplified way to build bond ladders and manage interest rate risk.

As of 12/27/2016, the top fund holdings with this high dividend ETF include:

- Reynolds Group

- Softbank Group Corp

- Clear Channel Worldwide

- Valeant Pharmaceuticals

- CSC Holdings LLC

- Tenet Healthcare Corp

- Citgo Holding Corp

- Fiat Chrysler Automotive

There are currently 194 securities, made up primarily of bonds with BB ratings, B ratings, and some other ratings.

Top fund sectors included with this best dividend ETF include communications, energy, consumer non-cyclical, consumer cyclical, basic materials, capital goods, financials, and technology.

Performance, Cost, and Risk

As of 12/23/2016, the 30-day SEC yield on this dividend paying ETF was 4.95%, and the distribution rate was 5.32%. The weighted average yield to maturity is 5.27%, and the weighted average yield to worst is 4.72%.

YTD cumulative total returns as of 9/30/2016 were 11.68% before taxes on shares held or sold.

The gross expense ratio is 0.43%, and the net expense ratio is 0.42%.

According to current charts, BSJK has a yield of 5.14%, a 3-year Beta score of 0.29, and net assets of 240.64 million.

Some of the key areas of risk that should be considered with this ETF dividend product include:

- Interest rate risk

- Credit/default risk

- High yield securities risk

- Asset class risk

- Call risk/prepayment risk

- Income risk

- Extension risk

- Liquidity risk

Related: Top Credit Cards | Ranking & Reviews

iShares Mortgage Real Estate Capped ETF (REM) Review

Before exploring the specifics of the iShares Mortgage Real Estate Capped ETF, and what led to its inclusion on this list of the best dividend ETFs and high yield dividend ETFs, it can be useful to explore what a capped ETF is.

A capped index is one that has a limit on the weight of any individual security. This means this particular best dividend ETF features a structure where the weight of any component can’t exceed a maximum percentage.

This is designed so that no one security can have a more significant influence on the index than any other, and the same concept is reflected in the ETF, as it is in the index itself. The overall investment objective of this dividend ETF is to give investors exposure to REITs that hold mortgages, both residential and commercial. A REIT, or Real Estate Investment Trust, is a company that either owns or provides financing for real estate generating income. This is why these ETFs are able to pay dividends.

Key Factors That Led to Our Ranking of This as One of the Top Dividend ETFs

REM is included in this ranking of the best high yield dividend ETFs for reasons detailed below.

Portfolio

As mentioned in the introduction to this dividend paying ETF, the primary investment objective is to track a market-cap-weighted index of both residential and commercial mortgage REITs.

This concentrated portfolio includes the majority of assets in the top 10 holdings, making it a narrow, niche-based investment option.

This dividend ETF provides not only exposure to the domestic real estate sectors but also direct real estate investment with REITs that trade in the same manner as stocks.

Some of the key holdings include:

- Annaly Capital Management REIT Inc.

- AGNC Investment REIT Corp

- Starwood Property Trust REIT Inc.

- New Residential Investment REIT Co.

- Two Harbors Investment REIT Corp

- Chimera Investment Corp

- Blackstone Mortgage Trust REIT CLA

Nearly the entire exposure breakdown of this dividend ETF is based on Mortgage REITs, and there is a small percentage in diversified REITs.

Performance, Costs, and Risk

To begin, the net assets of this best dividend ETF as of 12/27/2016 were $1,176,656,463, and the benchmark index is the FTSE NAREIT All Mortgage Capped Index. There are currently 36 holdings and an equity beta of 0.93.

The distribution yield as of November 30, 2016 was 11.04%, and the 30-day SEC yield was 6.40%. The expense ratio is 0.48%.

The total one-year return is 18.07, and the after-tax pre-liquidity percentage is 12.80.

Some of the principal risks that should be considered with this best dividend ETF include:

- There is the potential for underperformance by securities in the Underlying Index or the Fund’s portfolio.

- A limited number of institutions can act as Authorized Participants.

- There is the risk due to concentration of the Fund, including the potential for adverse events that could heavily impact the real estate market.

- There is also a financial sector risk and an index-related risk with this top dividend ETF.

iShares U.S. Preferred Stock ETF (PFF) Review

The objective of the iShares U.S. Preferred Stock ETF (PFF) is to deliver an investment product that closely tracks the results of the S&P U.S. Preferred Stock Index. This dividend ETF is considered one of the best dividend ETFs because it provides investors with contact to U.S. preferred stocks, which have benefits that are similar to both bonds and stocks.

This leader among top dividend ETFs offers access to the preferred stock market in one unified and cost-effective fund, and it is a good way for investors to gain an income competitive to what would be found with high yield bonds.

PFF is one of the most widely-held and popular preferred stock ETFs, and it was launched by BlackRock in 2007.

Key Factors That Led to Our Ranking of This as One of the Top Dividend ETFs

Features of the PFF, which is one of the best dividend ETFs on this ranking of high dividend ETF options, are detailed below.

Portfolio

The index tracked by PFF, one of the best high yield ETFs and an overall leader among ETFs that pay dividends is the S&P U.S. Preferred Stock Index.

This Index includes stocks listed on the New York Stock Exchange or the NASDAQ Exchange. The fund invests not only in the stocks that are part of the underlying index but also in other securities or options that the fund manager believes will most accurately track the underlying Index.

This dividend paying ETF is widely diversified, with no single stock account for more than about 3% of the total portfolio.

Some of the top holdings of this best dividend ETF as of the end of December 2016 include:

- Wells Fargo & Company Series L

- HSBC Holdings PLC

- Allergan PLC

- GMAC Capital Trust I

- Barclays Bank PLC

- CitiGroup Capital XII

- T-Mobile

The majority of exposure with this high dividend ETF is domestically-based in the U.S., with a minimal amount of exposure to the UK and Netherlands-based stocks.

Performance, Cost, and Risk

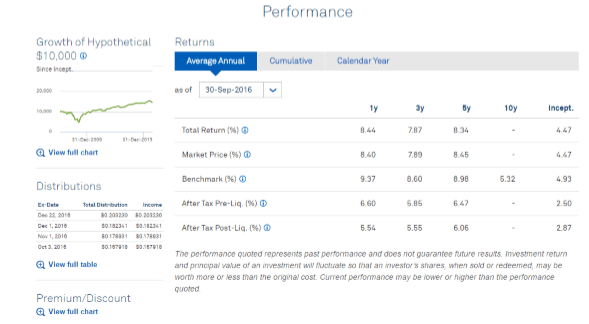

As of December 2016, there were 295 holdings that were part of this high dividend ETF. The equity beta is low at 0.18, and the distribution yield as of November 30, 2016, was 5.46%, while the 30-day SEC yield was 5.50%.

The expense ratio is also relatively low, at 0.47% as of the current prospectus.

Total one-year returns are 8.44%, three-year returns are 7.87%, and five-year returns are 8.34%.

Details of some of the principal risks that may come with investment in this ETF dividend product include:

- Asset Class Risk: There is the potential for securities and assets in either the underlying Index or the Fund to underperform compared to financial markets or asset classes.

- Financials Sector Risk: This high dividend ETF is focused on the financial sector, and there are any number of events that could negatively impact this sector including governmental, economic and credit-related events. Other possible impacting events could be related to changes in interest rate or lower levels of liquidity in credit markets.

- Equity Securities Risk: According to the prospectus for this dividend ETF, there is the potential that equity securities can show volatility in their values, more so than other asset classes.

Image Source: iShares

Popular Article: Top Zero Interest Balance Transfer Credit Cards | Ranking | Interest Free Balance Transfer Cards

PowerShares CEF Composite Portfolio (PCEF) Review

Based on the S-Network Composite Closed-End Fund Index, the PowerShares CEF Income Composite Portfolio is a high dividend ETF with at least 90% of total assets invested in securities of the funds that are part of the S-Network Index.

This is described by Invesco as a “fund of funds,” because investments are placed in assets in the common shares of funds included as part of the index. This is in comparison to assets being invested in individual securities.

The S-Network Composite Index includes closed-end funds invested in investment-grade, taxable, fixed-income securities. The Index also includes high-yield, fixed-income securities that are taxable. This particular dividend-paying ETF is rebalanced quarterly, as is the Index.

Key Factors That Led to Our Ranking of This as One of the Top Dividend ETFs

Among high-yield ETFs and dividend paying ETFs, the following are reasons PCEF is named on this ranking of the best dividend EFTs.

Portfolio

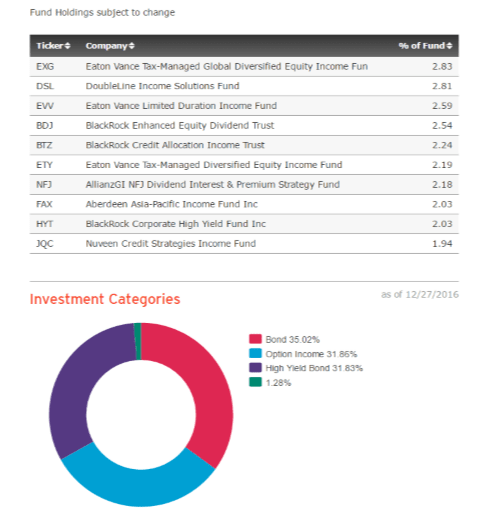

This dividend ETF tracks an Index that contains three categories of closed-end funds, all of which are focused on yields.

These types of funds include option-writing, investment-grade fixed income, and high-yield fixed income. The larger CEFs and the ones trading at a discount are weighted more heavily in the portfolio of this dividend ETF.

There is excellent diversification across this best dividend ETF, with none of the holdings account for more than three percent of the total fund.

Some of the top companies include Eaton Vance Tax-Managed Global Diversified Equity Income Fund, DoubleLine Income Solutions Fund, BlackRock Enhanced Equity Dividend Trust, and Nuveen Credit Strategies Income Fund.

The investment categories are spread almost equally among bonds, option income, and high yield bond.

Image Source: Invesco

Performance, Cost, Risk

Before going into the specifics of the performance, cost, and risk associated with this high dividend ETF, it should be noted that it’s one of the most expensive dividend ETFs on this ranking, with a total expense ratio of 1.94%. This high dividend ETF also has relatively little liquidity.

With that being said, it still continues to be ranked as one of the best dividend ETFs because it has a large number of funds, with no products making up a significant percentage. This is actually one of the most preferred high dividend ETF options for investors searching for high yield dividend ETFs.

The current dividend yield is 8.56%, YTD, there is an index history of 11.71% with this high dividend ETF; the S&P 500 Index is only at 9.97%. At one year, this index history is 12.01%, and at three years, it’s 5.68%.

According to the prospectus, the primary risk associated with this high dividend ETF is the funds of funds risk, meaning that investment performance depends on underlying funds and the fact that shareholders will take on double fees as a result.

There are also risks associated with non-investment grade securities if the issuer isn’t able to meet payment obligations, and there are inherent risks related to investing in closed-end funds as well.

Schwab U.S. Dividend Equity ETF (SCHD) Review

The Schwab U.S. Dividend Equity ETF (SCHD) is one of the lowest-cost high dividend options on this ranking of the best dividend paying ETFs. In addition to excellent cost efficiency, which will be discussed in more detail below, this leader among high yield ETFs is designed for current income as well as capital appreciation.

It’s also favored by investors who want a diversified stream of income as part of their portfolio.

This low-cost top dividend ETF tracks, before fees and expenses, the Dow Jones U.S. Dividend 100 Index, and the companies that are part of this index have a long track record of consistency in their dividend payments, which is a big reason this is part of this ranking of the best dividend ETFs.

Key Factors That Led to Our Ranking of This as One of the Top Dividend ETFs

Among high-yield ETFs and dividend paying ETFs, the Schwab U.S. Dividend Equity ETF ranks well and is included in this ranking of the best dividend ETFs for reasons cited below.

Portfolio

One of the most unique things about this as compared to many other high yield dividend ETFs is the fact that it includes only firms with at least a 10-year history of paying dividends.

This is something important that was mentioned at the start of this ranking of ETFs that pay dividends and top dividend ETFs.

Often, investors will see high yield dividend ETFs, but they don’t consider the payment history of the companies; then, after they buy into the high yield ETF, one or more of the companies might actually stop paying dividends.

That’s something investors don’t necessarily have to worry about with this high dividend ETF since an established dividend-paying history is such a critical component of the selection of firms.

The portfolio is rebalanced annually, and it has strong underlying liquidity.

Some of the main holdings of this top dividend ETF include the Intex Corp, Johnson + Johnson Common Stock, Verizon Common Stock, Pfizer Inc. Common Stock, Chevron Corp Common Stock, and Microsoft Corp Common Stock.

Performance, Cost, and Risk

After-tax returns for SCHD are 13.23% over three years pre-liquidation and 10.92% post-liquidation. The market price has gone up 21.04% over the past year and 11.02% over the past three years. This very closely mirrors the performance of the Dow Jones U.S. Dividend 100 Index.

The expense ratio is tiny compared to almost all other dividend ETFs on this ranking of the leading dividend ETFs at 0.07%.

With that being said, the dividend yield is currently only 2.68%, so while there are many benefits to this best dividend ETF, the yields aren’t as high as some of the more expensive or volatile names on this ranking of the best dividend ETFs.

The fund isn’t actively managed, so it follows securities included in the index, which can bring downturn risks.

Additionally, with large and mid-cap stocks, there is the tendency for them to go down in value based on conditions of the market and the general economy. There are also risks in terms of tracking error, derivatives, and liquidity.

Read More: Top Airline Credit Cards | Ranking | Best Airlines Miles Credit Cards (Reviews)

SPDR Nuveen S&P High Yield MuniBond ETF (HYMB) Review

Municipal bonds are something investors can turn to if they want to preserve capital while simultaneously creating an income stream that’s tax-free. A municipal bond is a debt obligation, with the issuer being a government entity.

When an investor chooses a product made up of municipal bonds, they’re loaning money to the government entity that’s the issuer, and they’re getting interest payments in exchange for that loan.

When the bond reaches its date of maturity, the original investment is returned. That’s how this dividend ETF can pay yields. The SPDR Nuveen S&P High Yield MuniBond ETF (HYMB) strives to provide results that correspond to the S&P Municipal Yield Index, before fees and expenses.

Key Factors That Led to Our Ranking of This as One of the Top Dividend ETFs

The following features define this high dividend ETF, included on this ranking of the best high dividend ETFs.

Portfolio

As mentioned, this ETF dividend-paying product seeks to follow the S&P Municipal Yield Index. It features extended maturities so that yields are maximized, which is why it’s ranked as a top dividend ETF and one of the best high dividend ETFs.

This ETF is varied regarding how risk is approached, and it allocates around 40% of assets to investment-grade bonds that have either A or BBB ratings.

There are also assets allocated to local government entities from Puerto Rico, however, so that level of risk exposure is something for investors to consider when they’re thinking about investing in this leader among high dividend ETFs.

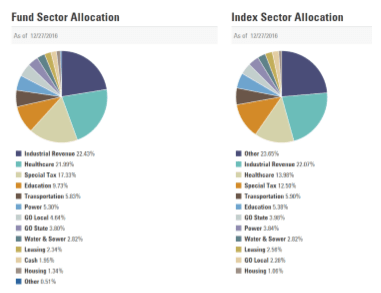

Sector allocation is focused on industrial revenue, healthcare, and special tax. There are also sector allocations to education, transportation, and power.

Image Source: SPDRS

Performance, Costs, and Risk

In terms of maturity and performance, the HYMB is one of the dividend ETFs on this ranking that’s well-suited to long-term investors. It has a healthy balance between investment-grade and junk bonds, mitigating exposure, and risk.

Regarding performance, it also closely follows the S&P Municipal Yield Index, which is the primary objective with this ETF dividend paying investment product. For example, YTD the NAV for this dividend paying ETF is 1.64%, while it’s 2.62% for the S&P Municipal Yield Index.

The current yield is 4.19%, while the expense ratio is 0.45%.

Some of the principal risks associated with this leader among dividend ETFs include below-investment-grade securities risk and debt securities risk.

Often called junk bonds, these lower-quality debt securities are speculative, and there is a higher level of risk in terms of default as compared to investment-grade debt securities.

SPDR® S&P® Dividend ETF (SDY) Review

The SPDR® S&P® Dividend ETF is a fund that seeks to track the S&P High Yield Dividend Aristocrats Index. This Index measures how companies in the S&P Composite 1500 are performing. These companies have a managed dividend policy that includes consistency and increasing dividends every year for at least a period of 20 years.

The SDY is a leader among most of the dividend ETFs and high yield dividend ETFs because it does require that companies have such a long period of consistency of not only paying dividends but paying increasing dividends.

This dividend paying ETF takes a sampling investment strategy, which means it doesn’t have to purchase all of the securities that are part of the Index. Instead, the Fund may include a subset of securities that can still show the same level of risk, return, and key characteristics of the underlying index.

Key Factors That Led to Our Ranking of This as One of the Top Dividend ETFs

When comparing high dividend ETFs and dividend paying ETFs, the following are features and characteristics of SDY that led to its ranking on this list of the best dividend ETF options.

Portfolio

Currently, this best dividend ETF includes 108 holdings and a weighted average market cap of $51,323,06 million. It includes quarterly distributions and was established on 11/08/2005. None of the top holdings that are part of the portfolio of this dividend ETF account for more than 2.5% of the total fund currently.

The top company holdings currently include:

- AT&T Inc.

- People’s United Financial Inc.

- HCP Inc.

- Chevron Corporation

- Emerson Electric Co.

- Nucor Corporation

- International Business Machines Corporation

- Caterpillar Inc.

- Target Corporation

- T. Rowe Price Group

The sector allocation is almost evenly divided into industrials and financials; other sectors include consumer staples, utilities, materials, consumer discretionary, real estate, healthcare, IT, energy, and telecommunication services.

It should be noted that the sector allocation with this particular dividend ETF doesn’t weigh heavily in favor of technology companies since many of them are newer companies and aren’t able to meet the standard of paying increasing dividends for 20 years.

Performance, Risks, and Cost

The SDY has shown relatively strong performance levels, and as of 11/30/2016, this leader among dividend ETFs had a NAV of 4.64% for the month. YTD it’s 17.89%, and for one year it’s 15.99%.

The gross expense ratio is relatively low at 0.35%.

The current dividend yield is 3.27%, which is modest compared to some of the names on this ranking of high yield dividend ETFs, but it is still a reasonable amount.

The primary risks that come with this leader among dividend ETFs include:

- Sometimes securities that pay dividends can become less favorable in the market, leading to declining performance.

- Equity investment risk represents the fact that market prices may go up or they may drop, and it’s difficult to predict what will happen. Declines could happen for any number of reasons, ranging from the issuer to general market conditions.

- Another area of risk cited in the prospectus of this dividend ETF is the fact that financial services companies can experience issues related to government regulations.

Related: Top Prepaid Debit Cards | Ranking, Including Prepaid Debit Cards With No Fees

Vanguard Dividend Appreciation ETF (VIG) Review

The Vanguard Dividend Appreciation ETF (VIG) is an ETF dividend option that tracks the performance of the NASDAQ US Dividend Achievers Select Index. This fully invested fund has a passively managed investment strategy, and it focuses on large-cap equities, as well as stocks that have a consistent record of growing over the years.

The benchmark includes domestic common stocks that have demonstrated increases in dividends for at least ten years in a row, and it doesn’t include stocks that have minimal potential to increase dividends.

This particular pick for one of the top dividend ETFs doesn’t include REITs, and the sector allocation is almost evenly divided between industrials and consumer goods.

Key Factors That Led to Our Ranking of This as One of the Top Dividend ETFs

Among ETFs that pay dividends and high-yield ETFs, the VIG ranks well for some of the reasons listed below.

Portfolio

As mentioned in the introduction to this best dividend ETF, the VIG focuses allocation weight on industrials and consumer goods. Other sectors where assets are allocated with this leader among dividend ETFs include consumer services, health care, technology, and financials.

Top 10 holdings with this top dividend ETF include:

- Microsoft Corp

- Johnson & Johnson

- PepsiCo Inc.

- Coca-Cola Co.

- McDonald’s Corp.

- 3M Co.

- Medtronic plc

- Walgreens Boots Alliance Inc.

- United Technologies Corp.

- CVS Health Corp

Currently, the top 10 companies represent 29.8% of net assets with this dividend ETF.

For the most part, the portfolio of this dividend ETF is focused on larger companies, with no one stock making up a majority of the portfolio because the investment strategy is based on traditional market cap weighting.

It’s widely diversified, and very few of the assets are invested in risky technology companies.

Performance, Costs, and Risk

When looking across multiple years, the VIG has pretty closely matched the performance of the S&P 500. NAV YTD for VIG is 9.55% as compared to the Benchmark of 9.63%, and at five years it’s 13.95% as compared to the Benchmark of 14.02%.

Over the past year, if an investor were to have $100,000 invested in this best dividend ETF, they would have seen a NAV total return of 9.7%.

The expense ratio with this dividend paying ETF is very low at 0.09%, and the current dividend yield is 2.69%.

Some of the principal risks of this top dividend ETF include:

- Stock market risk: This is the general chance that overall stock prices could decline, which could lead to losses for the investor.

- Investment style risk: The prospectus for this dividend paying ETF includes investment style risk, referring to the possibility that returns will be lower than returns from the overall stock market.

- Asset concentration risk: The Fund’s target index could be affected significantly by a bad showing of just a few stocks.

Don’t Miss: Top Interest-Free Credit Cards | Ranking | Best Zero Interest Credit Cards (Reviews)

Vanguard High Dividend Yield EFT (VYM) Review

The Vanguard High Dividend Yield ETF (VYM) is one of the best dividend ETFs for investors who want a conservative investment opportunity. It tracks the FTSE High Dividend Yield Index. This Index features high-dividend-paying domestic companies. It doesn’t include REITs, and the asset allocation is weighted based on market cap.

The primary characteristic many investors find appealing about this dividend paying ETF is the diversification, and they also tend to favor the low costs.

The underlying Index includes common stocks, which of course, are dominated by high dividend yields.

The investment approach undertaken with this best dividend ETF and leader among high yield ETFs is passive management and full-replication.

Key Factors That Led to Our Ranking of This as One of the Top Dividend ETFs

When comparing ETFs that pay dividends and high yield dividend ETFs, the following are specific features of the VYM that make it unique and help it rank as one of the best dividend ETFs.

Portfolio

Currently, this leader among high-yield ETFs includes 420 stocks as compared to the 415 making up the FTSE High Dividend Yield Index. The turnover rate was 7.3% in the fiscal year ending in October, and the fund’s total net assets were $22.7 billion.

In terms of sectors, the focus of this leader among high yield ETFs is on consumer goods, industrials, technology, health care, and financials. It also includes utilities, telecommunications, oil and gas, consumer services, and basic materials.

Some of the companies representing the top holdings with this leader among high-yield ETFs include Microsoft, Exxon, Johnson & Johnson, JPMorgan Chase & Co., General Electric Co., and Wells Fargo & Co.

Performance, Cost, and Risk

When looking at measures of volatility as of 11/30/2016, the Beta rating for the FTSE High Dividend High Yield Index is 1.00. Average annual returns as of 11/30/2016 with this dividend ETF were 12.51% at one year, 9.72% at three years, and 14.39% at five years.

This dividend paying ETF is also appealing among ETFs that pay dividends because it is low-cost, with an expense ratio of 0.09%.

The current dividend yield is 2.70%.

There is a relatively high level of risk associated with this best dividend ETF, although with its low costs and diversification, that doesn’t deter many investors from this dividend paying ETF.

Some of the possible areas of risk to consider with this leader among high-yield ETFs include general stock market risk, as well as investment style risk. There is always the chance that stocks paying dividends will fall behind the overall stock market.

Popular Article: Top Credit Cards for Low Credit Scores | Reviews | Best, Fastest Ways to Build Credit

Conclusion — Top 10 Best Dividend ETFs

Top dividend ETFs and the leading high yield dividend ETFs represent a unique opportunity for investors. These dividend paying ETFs provide automatic diversification, which offers some shield against risks inherent in investing, and they also tend to be cost-effective for investors and traders.

Regarding dividend ETFs specifically, investors have the opportunity to not only gain access to a managed and diverse portfolio, but they also earn income which comes in the form of dividends.

While there are many advantages to a high dividend ETF and high yield ETFs, they aren’t without potential downsides. For example, high dividend ETFs may represent a greater degree of risk than other forms of investment, or the dividends may come to an end.

The above ranking of the top dividend ETFs focuses on the best dividend ETF products that not only represent diversification and strong performance, but also consistency over time.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.