2017 RANKING & REVIEWS

TOP RANKING FINANCIAL PLANNING SOFTWARE FOR ADVISORS

Intro—Finding the Best Financial Planning Software for Financial Advisors

Cash flow analysis, net worth analysis, college and education funding, multigenerational wealth transfer, estate planning, retirement planning—you name it, and enterprising financial advisors and advisory firms will service it in the name of comprehensive planning.

Without the proper financial advisor software, however, financial advisors can wind up getting dragged through labor-intensive minutia. This minutia drains away untold amounts of time that could otherwise be spent doing what all financial advisors would rather do: directly consult with clients.

Award Emblem: Top 5 Best Financial Advisor Software

Some Key Features to Consider When Selecting a Top Financial Planning Software for Advisors

The system you have in place as a financial advisor must be efficient. It must be fast, certainly fast enough to satisfy the nature of the transient, go-go clientele. Your financial advisor software must be integrated and, consequently, as automated as possible.

Today’s financial planning clients may hire you to give them advice about their money. They may even hire you for portfolio management.

Software for financial advisors can do all of this, but it will be for nought if you shut your clients out of the goings-on with their accounts: you would be remiss to purchase, train, and implement any financial planning tools for advisors that don’t allow for an interactive client experience.

Add in the fact that keeping clients involved in your processes maintains a certain level of transparency that can foster trust and long-term client relationships.

All in all, you need the best financial planning software that money can buy. The problem is that financial advisors–and the best financial advisor software–are much like their clients: They come in a variety of flavors, budgets, and needs.

That super-high-powered piece of financial planning software that a multi-staffed advisory firm can afford will be off the table for many small firms or solo practices.

It’s with these divergent needs in mind, among other factors, that we compiled our list of the top five best financial planning software for financial advisors. Take a look and see how upgrading your financial planning software may take you and your firm to the next level.

AdvisoryHQ’s List of the Top 5 Best Financial Planning Software for Advisors

List is sorted alphabetically (click any of the finance software names below to go directly to the detailed review section for that finance planning software):

Top 5 Best Financial Planning Software for Advisors | Brief Comparison & Ranking

Financial Software | Highlighted Features |

| eMoney | Specializes in creating digital advisory software and platforms |

| Envestment Finance Logix | Strong emphasis on client participation |

| Money Tree | Abundance of support and training tools |

| MoneyGuidePro | Web-based practice management financial software |

| Redtail CRM | Engineered specifically to control client data, documents, and correspondence |

Table: Top 5 Best Financial Planning Software | Above list is sorted alphabetically

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review—Top Ranking Best Financial Planning Software for Advisors

Below, please find the detailed review of each best financial software on our list of financial planning software for advisors. We have highlighted some of the factors that allowed these financial planning software to score so high in our selection ranking.

See Also: CountAbout Reviews | Guide | Online Budget Alternative to Quicken & Mint

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

eMoney Review

What Is eMoney Advisor?

eMoney Advisor is a financial planning software firm that specializes in creating digital advisory software and platforms to financial advisors. They have one office in Radnor, Pennsylvania, and another in San Diego, California.

eMoney Advisors was founded in 2000 by Edmond Walters, a financial advisor who specialized in high net-worth individuals and families. Walters sought to create a single practice management tool that not only made financial advisory more efficient for the professional advisor but for the client as well.

With that in mind, eMoney created their signature advisor software known as emX. eMoney describes emX as “the most advanced planning and practice management tool in the industry.” They also provide client-portal functioning to be used by clients to directly connect with their advisors, enabling both advisor and client to connect to and review client details within the same software.

eMoney Advisor has grown so much that it now counts more than 360 members on staff. Over 38,000 financial professionals have registered to use the emX software in servicing more than 1 million clients. EmX users stretch across three countries and all 50 of the United States. To date, eMoney Advisor manages $2.5 trillion in AUM (Assets Under Management).

But eMoney advisors supply more than their top financial planning software for advisors. They also specialize in branded media for use in client relations. Some of this media includes celebrity-narrated videos that explain the advisors’ services, logo animation, celebrity-narrated on-hold messages, and more.

Read on for more about eMoney Advisor, the emX software, and why we ranked it top on our list of best financial planning software for financial advisors.

Image Source: eMoney Advisor

Why Choose EmX Financial Planner Software for Financial Advisors?

EmX software is a powerful financial advisory tool that enables financial advisors to provide a high-end client experience.

EmX provides financial advisors with the following capabilities:

- Goal-based planning to focus on each client’s unique needs

- Aggregated accounts from global institutions in one place

- Secure, unlimited document storage

- Practice management to help you maximize operations while staying flexible and open to challenges and innovation

- Advanced planning

- Cash flow planning

- Estate planning

- Investment planning

- Retirement planning

The emX financial advisor software provides profound analytics and metrics designed to help you comprehend every nuance of client finances. This helps you provide superior advice and guidance when consulting with clients on their financial futures.

emX functions just as powerfully for you, offering key metrics that let you see the health of your practice in one aggregated, streamlined dashboard.

You have the ability to print more than 200 customized reports. You can shape each piece of advice to your clients for maximum clarity, breaking down what they need to know in an easy, understandable format.

As a top software for financial advisors, emX can send email and text alerts for your to-do lists. Combined with the Vault feature and one-stop dashboard displays, eMoney Advisor has crafted their emX tool to keep you organized and efficient in your day-to-day operations.

This financial planner software also comes with TouchPoint, a timeline tool that lets you keep an audit trail for each client account. As an additional benefit, you can also employ the emX screen sharing capability.

This lets clients see your computer display as you discuss their account with them. No more having to rely on both parties having complete paperwork in front of them throughout the consultation.

As mentioned above, eMoney Advisors provides branded media to financial advisors for a more customized, professional experience for clients. Some examples of the branded media offered through the emX platform include, but are not limited to, the following:

- Over 20 high-definition videos narrated by celebrities that cover mission statements, robo-advisors, appeals to target audiences, client education, information security, software tours, and more

- Animated logos customized to your brand

- On-hold audio messaging narrated by celebrities

- Analytics to track the popularity of your campaigns

- Customized, professionally-designed, on-demand print materials for company books, information sheets, sales concepts, reports, and more

Is eMoney Advisor Financial Software Offered in Tiered Subscriptions?

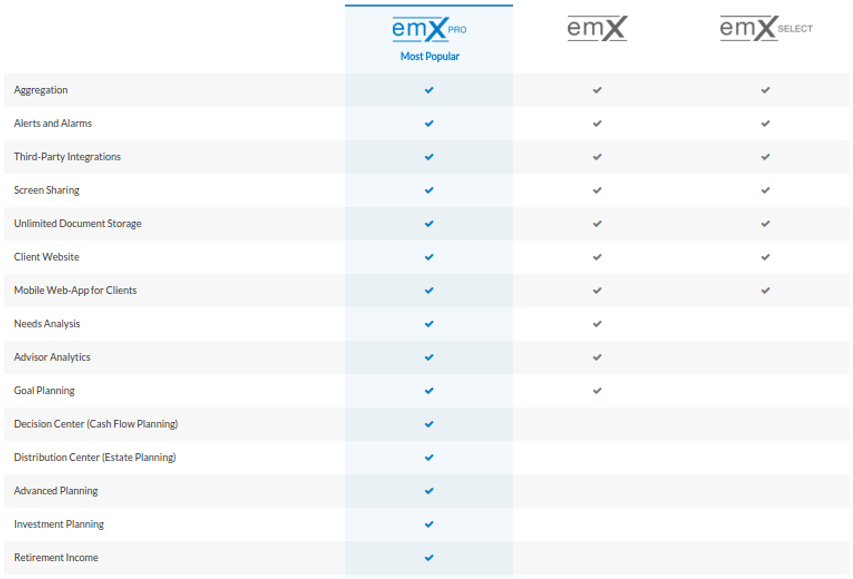

eMoney Advisor makes their emX advisor software available in three distinct subscriptions and prices:

- emX SELECT, $162 per user/month

- emX, $216 per user/month

- emX PRO, $324 per user/month

emX SELECT and emX come with restricted capabilities compared to emX PRO. eMoney Advisor offers these tiered subscription plans because they know that not every financial advisor will need the same power and extensive range of functions.

They want to meet the needs of as many advisors as possible while acknowledging their varied budgetary considerations. The three subscriptions, along with their capabilities, are compared below:

Image Source: eMoney

What Tools Does emX Provide to Financial Advisory Clients?

As a top financial planner software, emX allows clients to login to view their accounts through a client-side portal. Unlike the financial advisor portal, clients do not manipulate or change the majority of the data in the emX system.

For the most part, the clients enjoy a view-only portal. The exception is in the software’s ability to set savings and spending budgets at the client’s discretion.

Some of the features provided to clients through this top financial planning software for advisors include:

- Consolidated dashboard with real-time updates to let clients view all their accounts in one place

- Monitor spending habits and cash flow to help clients check their progress toward future goals

- Detailed information designed to educate clients about their investments through interactive charts and in-depth summaries

- Workshops that provide insight into the client’s spending and what changes they can make to reach their goals faster or more efficiently

- Educational resources such as videos, articles, and more aimed at empowering clients through self-education

- Online access to their accounts with Internet connectivity

Does eMoney Advisors Provide Software Training?

eMoney gives you a nice range of options when it comes to mastering the emX software and staying on top of issues or problems that may arise during your use of it.

- Training. We especially like that eMoney gives you so many options when it comes to learning their software. You can enroll in traditional classroom training, Internet-based training, or eMoney’s very own eMoney University.

- Customer support. Talk to a real human Monday through Friday from 8am to 11pm Eastern Standard Time.

- eMoney blog. Keep abreast of the latest features and developments with emX as well as industry trends. eMoney also encourages clients to utilize the blog as a forum for meeting and discussion with other users.

- Video newsletter. eMoney sends out a video newsletter every month highlighting and detailing updates to emX. Tips and best practices are included to maximize your efficiency with the software.

eMoney also offers finance professionals their optional Data Entry Services. Client information entry, financial data entry, and document organization are a few of the ways in which Data Entry Services team members assist financial advisors through the Data Entry Services feature.

This allows you to focus on assisting your clients and fine-tuning their financial plans rather than spend excess time on paperwork and data entry.

Does eMoney Advisor Offer a Free Trial?

eMoney offers a free trial of their emX software. Details about the trial aren’t forthcoming on the website. Rather, they are restricted to users who sign up to receive a video demonstration of the software before proceeding with the free trial.

How Does eMoney Advisor Protect Client Information?

eMoney protects you and your clients’ information several ways, including:

- High level security protocols

- Systems providing backup disaster recovery in the event of lost or missing data

- 256-bit encryption, double the encryption of most other financial services providers

- Data is housed in a database that is segmented, secure, and dedicated to individual clients

- Non-transactional nature of the emX software provides an added layer of security by not revealing or transmitting specific financial details

Does eMoney Advisor Provide Customer Reviews on Their Site?

Verbatim testimonials by satisfied customers are posted in brief on the site. However, perhaps what’s more powerful are the results of surveys conducted with financial advisors who’ve used their software.

According to eMoney, the following percentages are accurate and reflect the success of their program with financial advisors:

- 93%– Percentage of financial advisors who vouch that eMoney’s software helped grow their business.

- 87%– Percentage of eMoney software users who claim the program helped cut business costs.

- 83%– Percentage of financial advisors who credit the eMoney software with increasing leads and converting them into new business.

- 79%– Percentage of users who reported an increase in revenue and profits by using eMoney software.

Don’t Miss: Best Personal Finance Apps | Ranking | Top Finance Trackers & Management Apps

Envestnet Finance Logix® Review

What Is Envestnet Finance Logix®?

Envestnet Finance Logix® is a financial planning software firm founded in 1998.

The firm focuses on the creation of integrated enterprise and financial advisor software with a strong emphasis on client participation. Some of the company’s clientele includes banks and trusts, broker-dealers, insurance companies, Registered Investment Advisors (RIA), asset managers, and tech and services providers.

What Are the Features of Finance Logix® Financial Planning Software for Investment Managers?

The features of Finance Logix® financial planning software can be divided into the following three categories:

- Advisor portal

- Client tools

- Add-ons

Advisor Portal

Regarding the Advisor Portal, financial advisors who use the Finance Logix® financial planning software can consult their clients across several areas. These include:

- Retirement planning

- Insurance planning

- Asset allocation

- Education planning

- Estate planning

- Interactive plan (“What if” scenarios modulated by advisor)

- Cash flow analysis

- Goal-based planning

- Data integrations

- Advisor document vault

- Efficiency tools

Client Tools

The Client Tools is the client-facing side of Finance Logix® financial planning software. The capabilities built therein include:

- Client interview

- Dynamic, streamlined dashboard

- Client calendar

- Email and text alerts

- Client document vault

- Interactive plan (“What if” scenarios modulated by client)

Add-Ons

Finance Logix® Add-ons offer the following services:

- Data aggregation

- FinaMetrica risk tolerance tool

- Shared client database for small offices

Branding & Set-Up Services

Finally, for a one-time, nonrefundable charge, Finance Logix® will perform branding and set-up services. These services feature the following:

- Branding on your browser and all printed reports

- Personalized, branded login page on your client portal

- Branded advisor portal

- Branded financial plans in printed form

- Prominent display of your company dealer’s associations and all member disclosures on your login page and financial reports

What Is the Cost for Finance Logix® Financial Planning Software for Financial Planners?

Pricing information for Finance Logix® financial planning software is not made available to the public.

However, we do know that the License Agreement is for one year and comes with the option of monthly or annual payments. If you aren’t satisfied with Finance Logix® financial planning software, you may cancel your plan within the first 30 days for a full refund.

For more information on how to request a quote for Finance Logix® financial planning software, visit the Finance Logix® “Our Offerings” page.

What Is the Finance Logix® Framework?

The Finance Logix® framework involves seven components that synergize and optimize both the advisor-facing and client-facing ends of their financial planning software.

These seven components are:

- Client portal

- Comprehensive financial planning

- Efficiency tools

- Integration data exchange

- Client/advisor communication

- Document management

- Presentation & reporting

The specific variables that make up each component above can be seen on the graph below.

Image Source: Our Framework

More details about specific variables within the Finance Logix® framework can be found by visiting their “Our Framework” page.

How Secure Is Client Data with Finance Logix® Financial Planning Software for Financial Planners?

All information back and forth between your computer and Finance Logix® servers is protected via 256-bit SSL (Secure Socket Layer) encryption, a financial industry standard.

Your data is housed on an SQL server operating under NT Authentication. In other words, only authenticated, registered users can access the data on Finance Logix® servers.

Not only that, but your data is also safeguarded behind a firewall. Your information can only be accessed exclusively through the Finance Logix® interface since each client financial plan is housed in the form of an encrypted string.

Finance Logix® and their integration partners also transmit data via an encrypted SSL channel. Non-public web services are also used, meaning that the service will only respond to a specific IP address.

All data aggregation information collected by Finance Logix® is non-actionable, meaning no sensitive information is collected during aggregation. This is because Finance Logix® cannot initiate financial transactions.

Finance Logix® Integration Partners and Featured Broker Dealers

A listing of every integration partner and featured broker dealer would be too exhaustive to duplicate here.

If you wish to view a complete listing of Finance Logix® integration partners, you may visit their Technology Partners page.

For a complete listing of their broker dealers, you may visit the Finance Logix® Featured Broker Dealers page.

Does Finance Logix® Offer a Free Trial?

Finance Logix® gives you 30 days to try out their software for free. Financial planning software for advisors often come with a standard 30-day guarantee, but Finance Logix® does one better.

You also have 30 days after initial payment to request a refund if you’re not satisfied. In effect, this gives you a total of 60 days to try out the software free of charge.

What Support and Training Does Finance Logix® Offer for their Financial Planning Software for Advisors?

Finance Logix® provides the following support, training, and education opportunities for users:

- Email support

- Phone support Monday through Friday, 8am to 6pm Mountain Time

- Searchable Knowledge Base

- Scheduled training via webinar

- Archived webinars

- How-to videos

- Video interviews

- Sample reports

- Printed brochures

- Case studies

Related: Best Mobile Credit Card Readers | Ranking | Portable Credit Card Readers for Phones

Money Tree Review

What Is Money Tree Financial Planner Software?

Money Tree Software provides financial planning software to financial advisors and financial services professionals. The firm is located in Corvallis, Oregon.

The company was founded in 1981 by a team of financial planners. They had the goal of empowering advisors with multiple financial advisory solutions inside an ever-changing and growing industry.

To meet these objectives, Money Tree provides two primary software programs: Silver Financial Planner and TOTAL Planning Suite. More information about these programs can be found below.

What Financial Planning Software Does Money Tree Offer?

As mentioned above, Money Tree markets two primary software packages, Silver Financial Planner and TOTAL Planning Suite.

Within the TOTAL Planning Suite are the Silver Financial Planner and two additional software programs: Easy Money Power Planner and Golden Years Cash Flow. There is additional software entitled Secure Online Planning Survey that is not included within either package.

The differences between the Silver Planner, Easy Money, and Golden Years programs are highlighted below.

Silver Financial Planner

The Silver Financial Planner software is an easy, streamlined alternative for financial advisors who don’t want or need higher-powered software and its attendant costs.

The Silver package performs the basic needs and tasks for a majority of financial advisors. Because of this, it is quite affordable and attractive to smaller firms or solo advisory practices.

Some of the capabilities inherent in the Silver Financial Planner include:

- Ability to graphically illustrate various retirement scenarios

- Resolve retirement gaps

- Real-time updates that emphasize opportunities to maximize client plans

- Visually represent wealth accrual, retirement savings, and retirement withdrawals

- Demonstrate client insurance needs

- Prepare for social security claiming opportunities by running potential claim combinations in advance

- College and education funding with input from tuition and housing database

- Maximize existing client plan by comparing/contrasting with at least three different scenarios

- Reveal retirement probabilities and inherent risk by running 10,000 Monte Carlo simulations

TOTAL Planning Suite

The TOTAL Planning Suite, in contrast to the Silver Planner, offers everything from the Silver package plus much, much more. This package is geared toward bigger financial planning companies or established, high-traffic solo firms.

To break down the best features of Money Tree’s TOTAL financial planning software package, it’s best to review the component parts individually. This includes advantages of the TOTAL Planning Suite online platform, including Easy Money Power Planner, and Golden Years Cash Flow.

By purchasing TOTAL Planning Suite over Silver Financial Planner, you receive the following benefits:

- Cloud-based operations that allow you to build, collaborate, and deliver client plans from anywhere

- Third-party integrations

- Data summaries

- Ability to control how other users interact with the program and share information

- Client access portal

- Bank-level SSL encryption

- Physical data security

- Site customization and company branding

Easy Money Power Planner

The highlights of the Easy Money Power Planner include the capabilities of Silver Financial Planner plus:

- Evaluate needs for life insurance, disability, and LTC

- Estimate benefits for Social Security and pensions

- Factor stock options, rental real estate, and debt into clients’ retirement needs

- Future change tables

- Provide multiple solutions to shortfalls

- Analyze net worth and cash flow

- Multiple asset opportunities, including inherited IRAs, stock options, and rental real estate, among others

- 10,000 Monte Carlo simulations (including Fat Tail)

Golden Years Cash Flow

As the name implies, Golden Years Cash Flow is designed to help your clients with their annual distribution and tax analysis needs. The software is primarily geared toward retired or pre-retired clients with an emphasis on income, expenses, disbursements, asset growth, and taxes.

Below are some of the features available in the Golden Years Cash Flow software and, by extension, the TOTAL Planning Suite.

- Detailed cash flow analysis, including drawdowns and tax implications

- Annual tax analysis

- Models for irregular income and expenses due to unforeseen life events

- Ability to include inherited IRA RMDs along with rental real estate

- Graphically illustrate fund sources and fund usage

- Control drawdowns according to asset

- Audit trails for streamlined verification

Secure Online Planning Survey

The last piece of financial planning software offered by Money Tree is the Secure Online Planning Survey. This is a web-based tool designed to gather client data while providing secure transmission.

Features of the Secure Online Planning Survey include:

- Survey files encrypted and password protected

- Transmitted directly to you upon completion

- 20-minute average completion time for clients

- Imports into and can be opened with either software package

What Level of Security Does Money Tree Provide?

Money Tree’s servers are secured within a safe, controlled environment and guarded from unauthorized access. Personal financial data is encrypted through the SSL (Secure Socket Layer) protocol.

Does Money Tree Provide Support or Training For Their Financial Planning Software?

Money Tree backs up their software with an abundance of support and training tools, including:

- Tutorials

- Videos

- Workshops

- Sample reports

- Tech tips

- Training classes

- User guides

- Ready-made documents for client data-gathering

- Toll-free telephone support Monday through Friday from 6:30am to 5pm Pacific Time

What Do the Money Tree Financial Planning Software Programs Cost?

Money Tree financial planning software is priced in three different ways: Initial purchase, desktop yearly renewal, and online yearly renewal.

Silver Financial Planner costs:

- Initial purchase: $495

- Desktop yearly renewal: $195

- Online yearly renewal: $371

TOTAL Single Approach costs:

- Initial purchase: $895

- Desktop yearly renewal: $350

- Online yearly renewal: $649

TOTAL Planning Suite (Easy Money & Golden Years together) costs:

- Initial purchase: $1342

- Online yearly renewal: $999

- Desktop yearly renewal: $700

Does Money Tree Software Provide a Free Trial?

Money Tree Software lets you try out their software free for 30 days. This applies to both their web-based and their desktop software.

Popular Article: Best Credit Card Readers | Free, Top, Cheapest CC Readers

MoneyGuidePro Review

What Is MoneyGuidePro?

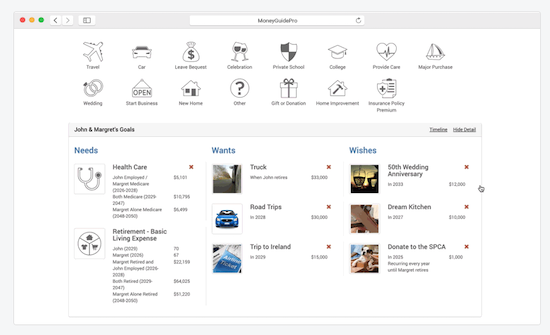

MoneyGuidePro is a web-based practice management software licensed to financial advisors by software developer PIEtech.

PIEtech stands for “Plan” better, “Invest” smarter, and “Enjoy” life more. As a firm, they started in 1985 for the sole purpose of building better financial services software. They continue to focus on improving not only the lives of financial advisory clients but the financial advisors as well.

With this in mind, PIEtech developed MoneyGuidePro in 2000 as one of the first practice management tools to harness the Internet’s potential.

Since its inception, MoneyGuidePro has made significant strides in financial planning software for advisors. In 2016, Financial Planning magazine found that 33.8% of advisors used MoneyGuidePro as their advisor software of choice.

What Features Come with MoneyGuidePro?

MoneyGuidePro lets you enjoy a very broad, diverse array of features missing from many other financial planning software for professionals. Combined with the third-party integrations and add-ons, MoneyGuidePro rounds out your ability to service clients with leading-edge technology.

Some of the program’s features include:

- Health Care Costs. Helps you strategize with clients to include health care coverage in their financial plans.

- Social Security Maximization. Lets you show clients the impact Social Security income withdrawal will have on their finances whether they draw income earlier than planned or later on in life.

- Play Zone®. A retirement income planning software for investment advisors that lets you and your clients experiment with variables such as retirement age, goal allotment, investment strategy, and savings. Test different scenarios to better inform clients and assist in making their decisions easier.

- Risk. Help your clients determine the likelihood of reaching their goals by simply and easily demonstrating how risks and loss tolerance can impact their financial plan.

- Recommended Scenario. A tool that displays your client’s current plan juxtaposed beside four different views of their financial plan and confidence zone.

Advisor Software Add-Ons

As if these services weren’t enough, PIEtech offers add-ons which aim to reduce the learning curve for MoneyGuidePro and help you start using the program to assist your clients as soon as possible.

A few examples include:

MyMoneyGuide®

With myMoneyGuide®, prospects take 90 minutes to craft their own financial plans using a version of MoneyGuidePro designed just for clients. Once completed, the prospects can follow a link to their personalized landing page and request help in reviewing, modifying, and implementing their plans.

Note that myMoneyGuide® is an add-on and not a standalone service; myMoneyGuide® can only be utilized by financial advisors who purchase MoneyGuidePro.

Best Interest Scout℠

This highly customizable tool is meant to help firms reach a large number of clients to confirm that they are invested in their best interests. It uses a standardized process to get the required information and send data to your CRM, MoneyGuidePro, or other financial tools.

Firms that can benefit most from Best Interest Scout include:

- Wirehouses

- Banks

- Insurance companies

- Mutual fund companies

- RIAs

- Regional broker-dealers

- Credit unions

Image Source: MoneyGuidePro

What Is the Cost to Use MoneyGuidePro?

MoneyGuidePro does not make their pricing information public, though the advisor software is available for purchase in two different licenses:

- Independent/RIA licenses: Meant for less than 50 users

- Enterprise license: Covers an entire firm with over 50 users

Additional information can be requested by contacting MoneyGuidePro via phone or email.

Does MoneyGuidePro Offer a Free Trial?

There are no free trials. However, PIEtech does allow you to view a demo of MoneyGuidePro. Demos are available by submitting a request form here.

Does MoneyGuidePro Provide Client Testimonials?

There is an entire page on the MoneyGuidePro website dedicated to client testimonials. There are several reviews, each given by financial planning and financial services professionals who used the service to great benefit within their practices.

To read the testimonials in detail, visit MoneyGuidePro’s Testimonials page.

What Training and Support Does PIEtech Offer for MoneyGuidePro?

PIEtech gives you quite a few avenues for learning and implementing the MoneyGuidePro system. These include:

- Live Training. If you’re the kind of person who does better with a live human instructor, PIEtech offers schedules for both web-based and in-person training.

- Newsletter. Stay up-to-date on the latest industry news and new advisor software features.

- Customer Support. Available Monday through Friday from 9am to 6pm Eastern Time.

- Third-Party Integration. Link your MoneyGuidePro software to third-party software to delegate tasks and save you time.

The following graph represents an exhaustive listing of third-party integrations for MoneyGuidePro:

Image Source: Integrations page

A complete categorization of integrated software can be found on MoneyGuidePro’s features page.

How Secure Is MoneyGuidePro?

You and your clients’ information is protected through several layers of security.

- Symantec SSL encryption. Encryption ranges from 128-bit to 256-bit when allowed by subscribers’ browsers.

- Secure location. The servers housing you and your clients’ data are closely monitored inside a secure data center in Virginia. Biometrics, keycard, and PIN code-based access supply additional layers of security.

- Disaster recovery. PIEtech performs daily backup of critical data. Weekly backups are performed and stored off-site of the data center for secure disaster recovery.

- Secure Socket Layer protocol. Data traveling between your clients’ computers and the servers is encrypted. Public and private encryption is also applied.

- Limited identifiable information. MoneyGuidePro restricts the amount of personally identifiable information that they collect. This minimizes the chances of your sensitive financial data being associated or linked back to you. This restricted information includes first and last name, date of birth, state of residence, and email address (optional). MoneyGuidePro also lets you insert a fictitious last name for your clients.

Read More: Best Card Readers | Ranking | Top Magnetic, Portable, Payment, Bank Debit and Card Readers

Redtail Technology Review

What is Redtail Technology?

Redtail Technology is a provider of web-based client relationship management, imaging, and emailing software for financial services professionals. The company was founded in 2003 and headquartered in Gold River, California, just outside Sacramento.

The company cultivates what they call a “WYSIWYG” (what you see is what you get) attitude. They bring pets to work and ensure that play is part of every work day. They feel that proper play is “one-half of the same coin” when it comes to complementing their dedicated work ethic.

The firm name was inspired by Tucker, a redtail retriever.

What Does Redtail CRM Do?

Whereas many of the other providers of the top five financial planning software for financial advisors specialize in software that creates financial plans for investors, Redtail CRM is engineered specifically to control client data, documents, and correspondence.

It’s known as “client relationship management,” and Redtail CRM allows financial advisors and their staff to more effectively manage workflow within client accounts. Some of the features of the program include:

- Track detailed client data

- Tag client records

- Categorize and archive records

- Customizable client reports

- Reminders of client anniversaries, birthdays, and reviews

- Disaster recovery/data backup

- Bulk emails

- Free advisor support

- Seminar management

- Automated data entry

- Intuitive, streamlined dashboard

- Integrations with a wide range of partners and services

Who Are Redtail’s Integration Partners?

Redtail sports a very impressive list of integration partners. The list is too exhaustive to reproduce here. However, the categories of service provided by these partners can be viewed below.

For your convenience, we included a small sampling of partners beside each category.

- Financial Custodians (Schwab, Fidelity, TD Ameritrade, etc.)

- Forms (IPS Advisor Pro, Laser App Software)

- Financial Planning (eMoney Advisor, MoneyGuidePro, and Money Tree Software, among many others)

- Document Storage (CITRIX ShareFile, Trumpet, Docupace Technologies)

- Data Aggregation (Advent, AssetBook, Orion Advisor Services, LLC)

- Email Compliance (Cerado, Global Relay, Smarsh)

- Marketing (Advisors Gateway, AdvisorWebsites.com, MailChimp)

- Voice Dictation (Copytalk, MobileAssistant, Voice2Insight)

- Investment Research (Advisory World, Morningstar)

- Portfolio Analysis (FinaMetrica, Pocket Risk, Riskalyze)

- VoIP (JIVE, Monmouth Telecom)

A complete listing of Redtail’s integration partners can be viewed by visiting their Partners page.

What Is Redtail Imaging?

Redtail Imaging provides document storage solutions to Redtail CRM clients. With Redtail Imaging, financial advisors can gain control over the organization, archiving, and retrieval of client documents within a smooth, intuitive interface. Advisors don’t have to worry about losing a client document again, not to mention getting lost trying to find said documents.

By utilizing predefined folders within each Redtail CRM user’s dedicated storage, Redtail Imaging is able to keep a full and open access to all archived images. Not only that, but Redtail guarantees a retention policy with no loss and no time limit. Redtail Imaging will completely retain your images at all times.

Furthermore, Redtail Imaging compiles an exhaustive and complete audit trail of user interactions with the Imaging and CRM systems. You will always have a record of who accessed the software, when, where, and for what reason.

Redtail automatically burns all changes initiated by users to WORM media. They do this per the Record Retention requirements of SEC-17a-(4).

What Is Redtail Email?

Redmail Email Archive and Retention lets financial advisors and their assistants’ record, store, and quickly retrieve all client correspondence.

Redtail Email integrates with Redtail CRM to link user correspondence to client accounts. And when Redtail says “all” correspondence, they really do mean “all.” The Email Archive and Retention program comes with no limits on storage or archiving.

To make the program even more flexible, Redtail made it compatible with a variety of email accounts. This includes POP3, IMAP4, or MAPI mailboxes. It is also available anywhere you happen to travel provided you have an Internet connection.

How Much Does Redtail Cost?

Redtail CRM, Redtail Imaging, and Redtail Email are priced separately.

- Redtail Email costs $8/month, per account

- Redtail Imaging costs $49/month for 10 gigabytes

- Redtail CRM costs $99/month per database, up to 15 users

Redtail’s pricing structure, including the noteworthy features of each package, is shown below.

Image Source: Redtail Technology

What Training and Support Does Redtail Offer?

Redtail offers many different training opportunities for you to learn their software directly from the firm itself, located within the Redtail HelpDesk. Check out the vast array of advisor software support below:

- They post a schedule of live webinars that allows you to sit in on a class no matter how far away you may live.

- There is also a growing archive of recorded webinars preserved for posterity. If you miss a live webinar, Redtail lets you catch up later.

- They provide Redtail University: Basics 101 to new users who need to get up to speed on the fundamentals of the program.

- Advisors and their assistants also have the option to attend Redtail University (RTU), a one-day conference held several times a year throughout the country. (See more about Redtail University below.)

- Articles & tutorials on using Classic Redtail Imaging.

- Webinars related to Redtail CRM.

- Knowledge base for setting up Redtail Email.

- Support articles and videos using Redtail Mobile.

- Tips and helpful articles in the Redtail blog.

- Phone support Monday through Friday from 5am to 5pm Pacific Time.

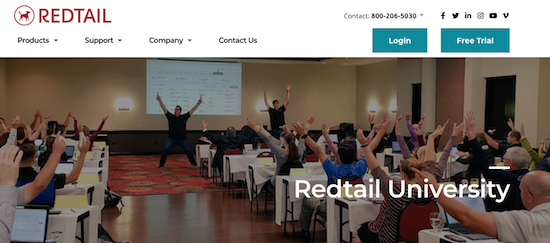

What Is Redtail University?

One of the unique ways that Redtail seeks to educate financial advisors in the use of its software is through Redtail University. Redtail University, or RTU, is a workshop attended by advisors and staff who want to learn the ins and outs of Redtail software by the very people who developed it.

Redtail employs what they call “Redtail Knowledge Ninjas” at the workshop to answer your questions. Sessions are conducted specifically for financial advisors who need to know how to craft client plans and manipulate the analytics within Redtail software.

Another session is held for staff who will assist the advisors in operating the software. In this session, the more common features are explained and demonstrated.

Image Source: Redtail University

Does Redtail Offer a Free Trial?

A free, 30-day, fully-functional trial of the Redtail software is available by request. Sign-up is required at the Free Trial page.

Does Redtail Have a Mobile App?

Redtail has a mobile app and is tablet-friendly, too. Anywhere you have an Internet connection, Redtail is available to you.

What Security Does Redtail Provide?

Redtail provides a number of different security layers to protect financial advisors’ information as well as that of their clients.

- Off-Site Data Centers house all user information and are split between two locations: Sacramento, California, and Phoenix, Arizona. Both centers comply with the Telecommunications Industry Association’s requirements for security and protection.

- Data backup is performed every night. While no firm can guarantee absolute 100% data recovery, Redtail can promise 99% uptime. This gives you a greater sense of safety and stability with Redtail software.

- Firewall and intrusion detection helps Redtail block access to your information as well as notify them in the event someone tries to break in. Additional security is provided by a third-party monitoring service, as well.

- SSL Security in the form of 256-bit encryption ensures that every piece of data being transmitted is done with the highest level of security. Redtail goes even further, however, by replacing their encryption keys annually rather than renewing them.

Free Wealth & Finance Software - Get Yours Now ►

Conclusion – Top 5 Best Financial Planning Software for Advisors

For the most part, our list of the top five best financial advisor software includes programs with free trials. You don’t like it, you put it “back on the shelf,” so to speak. No muss, no fuss.

But even more critically, most budgetary constraints are well represented on this list. We showed you software that can do most everything you could possibly ask financial planning software to do.

Maybe you want it to provide a branded client experience. Or automate your data entry while managing other aspects of your client relationship. Or perhaps you want to stress-proof your client plans by running multiple scenarios against them.

Whatever service you need, this list highlights the very best financial planning software for financial planners that can do the job. No matter which software you choose, you’re getting well-rounded, client-centric, advisor-friendly financial planning software—the kind that eases your workload and makes you look better in the eyes of your clients.

And at the end of the day, what’s more important than client satisfaction? Request a free trial from one of these great software solutions today and see how they can optimize your practice.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.