2017 RANKING & REVIEWS

TOP RANKING BEST HOMEOWNERS’ INSURANCE

Choosing One of the Best Home Insurance Companies for Peace of Mind in 2017

Our homes feel like our safe spaces: where we raise families, host friends, and relax after long days. But, as we all know, unexpected dangers can always creep up. That is why choosing the best home insurance from top home insurance providers is so important.

That is why we have created an ultimate guide to the top 6 best home insurance companies for 2017—your one-stop shop for researching top home insurance coverage.

Award Emblem: Top 6 Best Home Insurance Companies

Read through our rankings and ratings below to feel confident about whom you choose for home owners insurance.

For each of the home insurance companies on the list, we will show home insurance company ratings from other institutions. Then we will include our own home insurance reviews for each home insurance broker.

The combination of this information will help you feel confident that you have chosen one of the best home insurance companies that offers exactly what you and your household needs in terms of safety and security.

See Also: Top Commerce Bank Credit Cards | Reviews | Commerce Bank Rewards, Secured, Business Cards

AdvisoryHQ’s List of the Top 6 Best Home Insurance Companies

List is sorted alphabetically (click any of the home insurance names below to go directly to the detailed review section for that home insurance):

Top 6 Best Home Insurance Providers | Brief Comparison

Best Home Insurance Companies | AM Best Financial Grade | Insure.Com Value | J.D Power Overall Satisfaction |

| Amica | A++ | N/A | 5 out of 5 |

| Erie Insurance | A+ | 88.7 out of 100 | 4 out of 5 |

| The Hartford | A+ | 89.1 out of 100 | 3 out of 5 |

| Metlife | A+ | N/A | 3 out of 5 |

| Nationwide | A+ | 84.7 out of 100 | 3 out of 5 |

| State Farm | A++ | 89.3 out of 100 | 3 out of 5 |

Table: Top 6 Best Home Insurance Companies | Above list is sorted alphabetically

Is Homeowners’ Insurance Required?

While you are not legally obligated to have homeowners’ insurance from home insurance providers, many lenders will require it if you have a home loan through their company.

Though those without a mortgage are free to forego a home insurance policy, it may be a good idea to opt for home insurance coverage anyway.

Image Source: Pixabay

The average cost of a home in the United States is $188,900. Yet more than half of Americans have a savings account with less than $1,000. As you can see, skipping out on the best home insurance could be a recipe for disaster.

Since high home costs is not the type of money most people have in their savings accounts to rebuild or buy a new home in the case of disaster, homeowners’ insurance is so valuable.

What Homeowners’ Insurance Covers & Does Not Cover

We know that those who own homes should get homeowners’ insurance, but what exactly does that provide? It is important to understand what comes along with a home insurance policy before we dive into the best home insurance companies.

Home insurance coverage often covers your home and your possessions under the conditions below. Double-check with your home insurance agent that your policy does indeed provide this coverage:

- Fire

- Lightning

- Windstorms (other than those who live in hurricane-prone areas)

- Hail (in some locations)

- Smoke

- Theft/burglary/vandalism (check your policy for specifics)

As Nerdwallet explains, homeowners’ insurance probably will not cover a few issues that could cost serious money. Of course it is important to check with your home insurance agent first, as some policies may have special coverage additions.

- Ground movement

- Flooding

- Mold

- Basic wear and tear

- Infestations (example: termites)

- Nuclear hazards

- Government actions (example: government confiscation)

- Dangerous dogs

- Wind damage if you live in an area with hurricanes

You will need to acquire other forms of insurance to cover these issues. Alternatively, you could make it a priority to have a savings account with enough money to cover these situations in case the need arises.

Don’t Miss: Top Store Credit Cards | Ranking | Best Department Store & Retail Cards (Reviews)

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review—Top Ranking Best Homeowners’ Insurance

Below, please find a detailed review of each home insurance broker on our list of home insurance reviews. We have highlighted some of the factors that allowed these home insurance companies to score so high in our selection ranking.

Amica Review

First up on our list of home insurance reviews is Amica. Amica has some of the highest home insurance company ratings among the best home insurance companies in 2017.

As the J.D. Power award recipient in the category of homeowners insurance’ for 2016, this home insurance broker was awarded a perfect 5 out of 5 for all best home insurance categories:

- Overall satisfaction

- Policy offerings

- Price

- Billing

- Interaction

- Claims

Amica offers dividend growth along with their home building insurance. This helps you save money by getting a dividend payment at the end of the year. Amica also offers home building insurance discounts for many situations including:

- Multi-line discount: Savings when you bundle with auto insurance

- Alarm system: Credits if you have security systems

- Automatic detection devices: Credits if you have home monitoring systems (example: temperature monitoring)

- New/remodeled home credit

- AutoPay credit

Amica has a market share of around 0.74% among all home insurance providers, making it the smallest of the best home insurance companies we will discuss.

Erie Insurance Review

Of the top home insurance providers on this list, Erie Insurance has some of the highest home insurance company ratings across the board. It even received 4 out of 5 stars from J.D. Power’s best home insurance category in 2016.

Credio’s homeowners’ insurance category labels Erie as “very affordable” when it comes to the best home insurance companies. In fact, it is the only best home insurance option on this list with that label.

Some of the company highlights worth noting on Erie’s website include:

- Living expenses policy: They pay living expenses if you have to live elsewhere

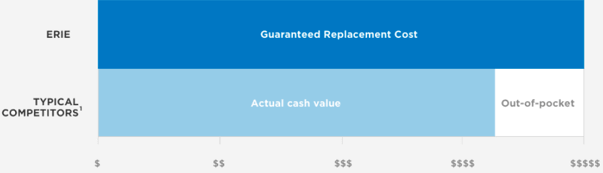

- Guaranteed replacement cost: Covers the actual replacement cost of property instead of only the actual cash value

- Liability: Helps you if you hurt somebody or hurt someone’s property

Image Source: Erie Insurance

An Erie home insurance policy can be discounted with the following features:

- Fire, burglary alarm, sprinkler system credit

- Advanced quote discount

- Multi-policy discount

Erie Insurance has a market share of around 1.5% among all home insurance providers.

Related: Top HSBC Credit Card Promotions | Reviews | HSBC Dining, Travel, Hotel & Other Promos Cards

The Hartford Review

Next up in our home insurance reviews is The Hartford. This homeowners’ insurance is brought in a partnership with AARP (American Association of Retired Persons).

This means AARP chose to partner with The Hartford over other best home insurance companies. However, people of any age can still benefit from this best home insurance.

Some discounts you can receive from this home insurance broker include:

- Bundle home and auto coverage: Join your policies and save up to 20%

- Home security or protective devices credits: Install protective technology (like alarms) and save

- Renewal credit: Save after keeping your home insurance policy with Hartford after four years

- Retiree credit: Also available to those who work less than 24 hours a week, so ask your home insurance agent about details

The Hartford has a market share of around 1.4% among all home insurance providers.

Metlife Review

Metlife also made it on our list of best home insurance companies for 2017. Reviews.com gave Metlife the highest home insurance company ratings when it came to “highest standard coverage.”

This is seen on their website, where Metlife boasts home insurance coverage with “customizable coverage” that “offers peace of mind.”

Some of the homeowners’ insurance discounts you can get through this company are:

- Safety discounts: Install fire alarms, fire extinguishers, sprinkler systems

- Bundle: Join your auto with your home insurance policy to save up to 10%

- Group discounts: Ask a home insurance agent what is available in your area in terms of employers/associations offering group deals

- Higher deductibles: Choose higher deductibles for your home insurance coverage, so you can save significant costs on your monthly premium

Metlife has a market share of around 1.36% among all home insurance providers.

Popular Article: Top Credit Card Companies | Ranking & Reviews | Best Card Providers

Nationwide Review

Next up on our list of top home insurance providers is Nationwide. As one of the best home insurance companies, Nationwide has a few unique features including:

Image Source: Nationwide

- Brand-New Belongings: If a damaged/destroyed/stolen item in your home is covered by Nationwide, you will get actual cash value replacement. On top of that, if the replacement ends up costing more, simply send the receipt in for full reimbursement.

- Plenti: As Nationwide’s partner, Plenti can help you earn points as you pay your homeowners’ insurance premiums.

Discounts from this home building insurance choice include:

- Multi-policy discount

- Protective device discount

- Claims-free discount

- Age of insured discount

Nationwide has a market share of around 3.78% among all home insurance providers, making it the second largest of the home insurance companies we included on this list.

Free Wealth & Finance Software - Get Yours Now ►

State Farm Review

We are finishing up our look at the best home insurance companies by looking at State Farm, another highly rated company.

State Farm offers a bundle deal when you combine your auto insurance with your home insurance coverage. According to their website, you can save up to $800 a year by doing this car/homeowners’ insurance bundle.

Other discounts through State Farm’s home building insurance include:

- Home Alert Protection Discount: Save money on your home insurance policy when you install fire, smoke, or burglar alarms or home monitoring systems.

- Roofing Discount: Save money on your home insurance policy if you install a particular type of impact-resistant roofing products. Contact a home insurance agent for more info.

- Higher Deductible: State Farm allows you to choose higher deductibles for your home insurance coverage, so you can save significant cost on your monthly premium.

State Farm has a market share of around 20.85% among all home insurance providers, making it the largest of the home insurance companies we are including.

Read More: Top Gas Credit Cards for Bad Credit, Poor, Fair & No Credit | Ranking & Reviews

Conclusion—Top 6 Best Home Insurance Companies

Now that you have read the home insurance reviews for each of the top home insurance providers of 2017, it is time to figure out who you would like to go through for your own home insurance policy.

To find your best home insurance choice, your next step is to either:

- Fill out homeowners’ insurance quotes online

- Contact a local home insurance agent from the home insurance providers you are most interested in

This is how you will be able to learn exactly what you can expect to pay each month or each year for home insurance coverage. Monthly premium costs will depend upon the size of your home, the total cost of your personal belongings, your location, and many other unique factors.

Once you have a personalized quote from each of the potential companies, you can choose your homeowners’ insurance with confidence. The best home insurance will be yours this year.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.