2017 RANKING & REVIEWS

BEST IRA ACCOUNTS

Reviewing the Best IRA Accounts in 2017. But First, What Is an IRA Account?

Before delving into the specifics of the best IRA accounts and the best IRA companies, it’s good to first have a general understanding of the basics of an IRA account.

An IRA is an Individual Retirement Account. It’s designed to provide an easy way for people to save for retirement while getting tax advantages at the same time.

Award Emblem: Best IRA Accounts and Best IRA Companies

As opposed to a 401(k), which is provided by a company for employees, an IRA is usually an account a person opens on their own, including people who are small business owners and self-employed. Not all IRAs are the same, and IRA savings account options include:

- Traditional IRAs

- Roth IRAs

- SEP IRAs

- Simple IRAs

It’s important to realize that not everyone can open every type of IRA, or they may not be eligible to open an IRA at all. There are eligibility restrictions to open an IRA brokerage account, largely dependent on employment status and income of the individual.

If you are eligible to open an IRA account, there are also limits on how much can be contributed to an IRA account each year, and if an account holder wants to take the money out before the predetermined retirement age, there are financial penalties for doing so.

The following ranking and review covers not only the specifics of what a Roth IRA account is, as well as a traditional IRA account, but also the best Roth IRA accounts and the best IRA companies providing these accounts.

See Also: IRA Contribution Limits | Guide to Roth IRA, SEP, and Traditional IRA Contribution Limits

What Is a Traditional IRA?

While there are several types of IRA savings account options, the two most commonly used are the Traditional IRA and the Roth IRA Account.

A Traditional IRA is a retirement account for individuals into which money is contributed, and that money then grows tax-deferred. When withdrawals are made after the age of 59 1/2, they’re treated as income at that current point in time.

Contributions to a Traditional IRA may be tax-deductible, and while distributions can be taken after age 59 ½ without a penalty while being taxed, the account holder must take distributions by the time they are age 70 ½.

When someone starts to fund their Traditional IRA account, they can use their earnings, roll over an old 401(k), or transfer a different IRA.

Anyone who earns an income can contribute to this particular type of IRA savings account, and investment options include:

- Mutual funds

- Stocks

- Bonds

- ETFs

- CDs

- Money market funds

What Are Roth IRA Accounts?

As opposed to a Traditional IRA Account, with a Roth IRA account, there are no up-front tax deductions for the contributions made; as long as the proper requirements are followed, distributions aren’t taxed.

A Roth IRA account is also unique because contributions can be withdrawn at any time without taxes or penalties.

Image Source: Pixabay

This particular IRA savings account can be most beneficial for people who think their tax rate will increase over their lifetime. Roth IRAs are frequently the retirement account of choice for younger people and people who are just starting out in the workforce and aren’t making a lot of money yet. They’re also good for anyone who wants to have less of a tax burden during their retirement years.

Contributions can be made to a Roth IRA account at any age as long as the person making contributions is doing so from their earned income.

However, it should be noted that a Roth IRA account does have eligibility limits and requirements, so if your income is too high, you may not be able to contribute to this particular type of IRA account.

Don’t Miss: The Best Places to Open a Roth IRA | Guide | How & Where to Open an IRA

List of Top 6 Best IRA Accounts and Best IRA Providers

List is sorted alphabetically (click any of the IRA account names below to go directly to the detailed review section for that IRA account):

Top 6 Best IRA Accounts and Best IRA Companies| Brief Comparison

IRA Provider | Minimum Investment | Management Fee | Promotion |

| Betterment | $0 | Tiered 0.25%-0.50% | Up to 6 months free management depending on deposit |

| E*TRADE | $0 | $9.99 per trade with discounts for volume | Up to $600 and 60 days of commission-free trades with a deposit of $10,000 or more |

| Scottrade | $0 | $7 per trade | Up to $2,000 cash back and 50 free trades (depending on amount of deposit) |

| TD Ameritrade | $0 | $9.99 per trade | Up to $600 cash bonus (depending on amount of deposit) |

| TradeKing | $0 | $4.95 per trade | $1,000 in free trade commissions (depending on amount of deposit) |

| Vanguard | $0 | $7 for the first 25 trades per year | None |

Where Should You Open an IRA Savings Account?

Now that you understand some of the benefits of both types of IRA savings account options, you may be considering opening an IRA account. To do that, consider the following:

- What are the account fees? Some of the best IRA providers don’t have any account fees, or they may be very low.

- You probably want to look for the best IRA companies that feature mutual funds with no transaction fees, and exchange-traded funds (ETFs) that don’t carry a commission.

- Search for the best Roth IRA companies and traditional IRA companies with low account minimums. Look at the fine print carefully because many of the online IRA brokerage account providers may require a certain minimum investment. If you don’t have enough money to meet that minimum right away, your money may be sidelined in a cash account until you do. If you only have a small amount of money to begin investing, you should look for the best IRA companies with no minimum investment or that match your budget.

- What is the customer service like? When you’re investing in an IRA account online, particularly if you’re just starting out, you’ll likely need a fair amount of customer service, so look for IRA brokerage account providers that offer superior customer service.

- Consider whether or not you’re selecting one of the best IRA companies that also offers robo-advising. For people just starting out with their IRA account, robo-advising can be great because it offers them optimized, computer-driven investments based on their personalized goals.

There are many other things to consider as you look for the best IRA companies and the best IRA accounts, but the above are some general guidelines that can help you get started.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Best IRA Companies and Best IRA Accounts

Below, please find the detailed review of each card on our list of best IRA companies. We have highlighted some of the factors that allowed these best Roth IRA companies and best overall IRA companies to score so well in our selection ranking.

Betterment Review

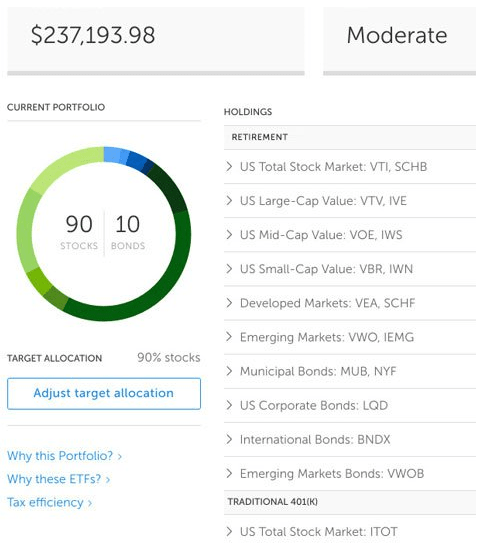

A technology-driven investment and trading platform, Betterment is also one of the best IRA providers with a focus on helping investors enjoy lower fees and a better overall experience. Since Betterment is an online company based on innovative technology, they can make fast, customized recommendations for customers while keeping fees low.

Betterment is a robo-advising platform that has a portfolio designed to maximize returns at every risk level. There are features like automatic rebalancing and diversification that give customers an excellent investment experience that’s effortless and delivers financially. Essentially, Betterment is the best place to open a Roth IRA if you want to be an uninvolved investor.

Key Factors That Led to Our Ranking of This as One of the Best IRA Providers

When looking at the best IRA companies and the best Roth IRA accounts, Betterment excels for the following reasons.

Fees

Betterment offers some of the lowest fees in the industry, and the more a person invests with Betterment, the lower their fee rate is. Some of the ways Betterment excels in terms of fees and is ranked as one of the best Roth IRA companies and one of the best IRA savings account providers include:

- There are no transaction fees to buy and sell securities

- No transaction fees for depositing or withdrawing from an account

- There are no rebalancing fees, although accounts are regularly and automatically rebalanced

- The technology provided by Betterment allows them to charge only a fraction of what a traditional financial manager would charge

For example, for a flat rate of 0.25% annually, investors can enjoy automated portfolio management, investing features, award-winning customer support, and investing advice–all with no minimum balance requirement.

If you wish to speak with a CFP or licensed financial expert, Betterment fees will either be 0.40% or 0.50% annually, depending upon your desired level of engagement. Minimum balances do apply for these fee structures.

Rollover Benefits

One of the specific reasons Betterment is included in this ranking of the best IRA companies and a place for the best Roth IRA accounts and other types of IRA accounts is because of their rollover options and benefits.

The more a customer rolls over, the more time they get for free.

If a customer starts a rollover in their first thirty days, they get free time. For example, if the rollover amount ranges from $10,000 to $99,999, the account holder gets a bonus month free. If they have a rollover amount of $100,000 to $499,999, they get two months free.

Betterment also offers a service called Rollover Concierge, available to help customers seven days a week as they roll over their retirement assets. Betterment support staff will speak to a customer’s current provider to ensure the transition is smooth and seamless.

Personalized Advice

What’s great about Betterment is, as mentioned, that it’s a best place to open a Roth IRA account and one of the best IRA providers because of the set-it-and-forget-it approach customers can take with their investing. It’s perfect for novices and anyone who simply doesn’t want to have to think about their retirement account because everything is automatic, including rebalancing.

Betterment also features personalized, goal-driven advice.

They make recommendations to customers opening an IRA brokerage account, including a Roth IRA account. These recommendations are based on the time horizon of the investor and as a result their optimal level of risk.

Money is automatically then invested across a diversified portfolio of ETFs.

Image Source: Betterment

Tax-Coordinated Portfolio

Another way Betterment is unique and stands out as one of the best Roth IRA account options and an excellent option for all of the best IRA accounts is their Tax-Coordinated Portfolio, which takes a smart, efficient approach that’s optimal regarding taxes.

It works across all of a customer’s long-term investments, including their Roth IRA accounts and traditional IRAs.

This strategy has been shown to boost after-tax returns by 0.48% each year on average. Over 30 years, this is an extra 15%.

Related: TD Ameritrade IRA vs. Fidelity IRA vs. Vanguard IRA Accounts |Comparison Reviews

E*TRADE Review

E*TRADE is an online financial services company and one of the original leaders in the online brokerage industry. E*TRADE was one of the first platforms to offer the opportunity to make an electronic trade by a retail investor more than 30 years ago, and since that time, the company has been leading in terms of providing digital investment and financial solutions that are accessible and realistic.

E*TRADE was founded in 1982 and is headquartered in New York City. What’s unique about E*TRADE, despite its digital platform and online reputation, is that along with being one of the best IRA companies online, it also has 30 retail branches across the U.S.

Key Factors That Led to Our Ranking of This as One of the Best IRA Companies

Key reasons E*TRADE is named as a best place to open a Roth IRA and one of the overall best IRA brokerage account options are named below.

Easy-To-Use Platforms

When investors are looking at the best Roth IRA providers and the leading places for the best IRA accounts, a top concern can be convenience and ease-of-use, particularly in today’s digitally-driven investment environment. This is one of many places E*TRADE excels.

E*TRADE’s technology and platforms are designed for everyone from long-term investors to short-term investors, and everything in between.

They have three easy-to-use trading platforms, including E*TRADE Pro, which offers the utmost in speed and performance. They also have ETRADE.com, which is easy to use, and E*TRADE Mobile, which brings the power to consumers wherever they may be.

Fees and Value

When looking at fees and value, one of the first things to note about E*TRADE is that there is no account minimum required for an IRA account, opening this leader among the best IRA companies up to more people.

Also, E*TRADE features a diverse selection of mutual funds with no transaction fees, as well as a selection of ETFs that are commission-free.

It’s free for customers to access valuable research and data, and there is a tiered commission structure that rewards frequent traders based on volume.

OneStop Rollover IRA

One particular product worth mentioning from E*TRADE that is one of the best IRA brokerage account options is the OneStop Rollover IRA. This lets investors rollover their 401(k) or 403(b) into an E*TRADE Securities IRA and then enroll in a professionally managed account.

This invests the IRA in an Adaptive Portfolio, which lets customers input their goals, time horizon, and risk tolerance and then get a diversified, managed portfolio based on their individual requirements. It can be customized by selecting ETFs or a hybrid of ETFs and mutual funds, and it includes responsive technology and access to an Investment Advisor Representative.

There is an offer as of this writing that lets new customers enroll and have the advisory fee waived for the first six months.

There are tax advantages, and the portfolio is continuously monitored and automatically rebalanced.

Specialized Customer Support

As mentioned at the start of this review of the best Roth IRA accounts, the best Roth IRA companies, and the overall best IRA companies, customer service is important. This can be especially true for new investors, but even very experienced investors often need support and service.

This is one of the many places E*TRADE excels as one of the best Roth IRA providers and one of the leading providers of other IRA account options.

E*TRADE offers customers access to specialized 24/7 service and support as well as advanced security, including the E*TRADE Complete Protection Guarantee.

Scottrade Review

Scottrade is part of the privately-held financial services firm Scottrade Financial Services, Inc. They have a history of more than 35 years of providing customers with banking and investment options and services designed to help them achieve their own personal level of financial success. Scottrade boasts a streamlined approach to investing.

They offer everything from self-directed tools to technologically advanced trading platforms, all of which are designed to help clients reach their goals. Regarding retirement solutions, Scottrade is not only one of the best Roth IRA companies, but they also offer some of the other best IRA accounts and a range of unique investment products.

Key Factors That Led to Our Ranking of This as One of the Best IRA Providers and Best IRA Companies

As part of the process to review and rank the best Roth IRA accounts and other types of IRA account options, the following are key features of Scottrade that stood out.

Reinvestment Options

Scottrade is unique among many other of the best IRA companies, the best Roth IRA accounts, and the best IRA providers because they put a lot of emphasis and focus on offering reinvestment opportunities.

When someone has a 401(k) or workplace savings plan with a former employer, Scottrade offers the opportunity to create a Rollover IRA.

As one of the best Roth IRA providers and best IRA providers overall, Scottrade features the following benefits for clients who roll over their previous plan into a Scottrade IRA:

- 50 free trades on qualifying deposits of $10,000 to $24,999

- $100 cash bonus and 50 free trades on deposits of $25,000 to $49,999

- $200 cash bonus and 50 free trades on qualifying deposits of $50,000 to $99,999

Beyond that, the cash bonuses continue to go up to $2,000 on qualifying deposits, and there continues to be 50 free trades included as well.

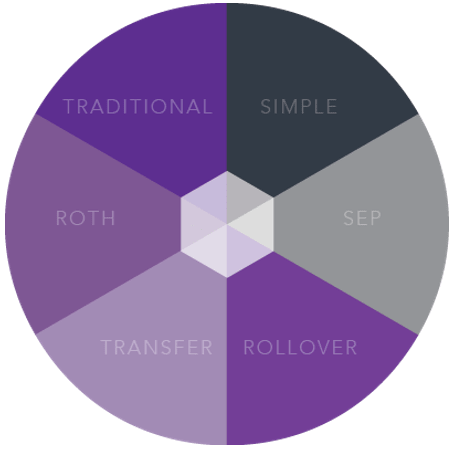

IRA Options

One of the most appealing things about Scottrade in terms of being one of the best IRA companies is the large number of options to suit the needs of nearly any investor. They have a variety of account types including Roth IRA accounts, but also the following:

- Traditional and Roth IRA accounts rollovers

- Traditional IRAs

- SEP IRA accounts

- Simple IRAs

As well as having a broad variety of the best IRA accounts available, Scottrade also features exclusive tools and guides to help people make the right choice. Some of the retirement tools and calculators include the investment calculator, the retirement calculator, and the IRA calculator.

There’s also something unique called the IRA Decision Tree, which asks people to answer brief questions to guide them in the direction of the right IRA savings account.

Image Source: Scottrade

Low Fees

When someone is searching for the best Roth IRA accounts and the overall best IRA providers, pricing and fees are an important consideration. Scottrade excels on this list of the best Roth IRA account providers and the best places to open an IRA account because they have not only low fees but also transparency.

To begin, Scottrade doesn’t charge an account opening fee. They also don’t have an account maintenance fee or an inactivity fee.

Their online trading fee is among the lowest among other Roth IRA account providers and Traditional IRA providers as well, at $7 per trade.

Also, there are more than 3,100 mutual funds available with no transaction fee.

Customer Service and Satisfaction

Perhaps one of the most notable things about Scottrade that led them to be named as a best place to open a Roth IRA or any other kind of IRA brokerage account is their high level of customer service and satisfaction.

Scottrade has the most retail locations around the U.S. as compared to other best IRA companies named on this list, and they are also consistently awarded for customer satisfaction.

For example, Scottrade was recently named highest in overall satisfaction by the J.D. Power 2016 U.S. Self-Directed Investor Satisfaction Study. They achieved the highest satisfaction scores in Interaction, Account Information, and Trading Charges and Fees.

Popular Article: Top Best Corporate Credit Cards | Ranking | Compare the Best Company, Corporate, and Business Cards

TD Ameritrade Review

TD Ameritrade offers a broad selection of funds that are tradable without paying commissions or fees, and TD Ameritrade also excels in terms of customer service, account minimum requirements, and their availability of local offices. TD Ameritrade has a history that spans more than 40 years, and they offer one of the most powerful platforms in the online investment industry and extensive investment choices.

Image Source: TD Ameritrade

TD Ameritrade also offers all types of the best IRA accounts, including the Traditional IRA, the Roth IRA and the Rollover and SEP IRAs, among other options.

Key Factors That Led to Our Ranking of This as a Best Place to Open a Roth IRA or Traditional IRA

Detailed below are specifics of why TD Ameritrade is included in this ranking of the best Roth IRA accounts and the best overall IRA companies.

No Account Minimum

When you want to open an IRA account but you’re on a budget, which may be particularly true when you’re looking for the best Roth IRA account, the required account minimum is a key consideration. If you choose Roth IRA accounts with an account minimum that’s beyond the amount you have to contribute, it’s essentially useless for you.

That’s one of the key reasons TD Ameritrade is included in this ranking of the best Roth IRA companies and the best IRA companies overall. TD Ameritrade doesn’t have an account minimum, so investors have access to the best Roth IRA accounts and the best overall accounts with any initial contribution amount.

Free Trade Promotions

TD Ameritrade not only offers some of the best IRA accounts and is one of the best Roth IRA providers, but they offer customers exceptional value in their transparent pricing and also their regular promotions.

For example, right now, TD Ameritrade is offering the ability to trade commission-free for 60 days and get up to $600 cash back. When a new customer opens an account, they get 60 days of commission-free trading with a deposit of $3,000 or more.

Then, as their deposits go up, they still get the 60 days of commission-free trading and also cash back, up to the amount of $600.

Investment Choices

TD Ameritrade excels in many ways for anyone searching for the best place to open a Roth IRA or the best IRA providers. One of these ways is through their wide variety of investment choices. When you opt to go with TD Ameritrade to open a Roth IRA account or any other type of IRA, you can choose from more than 100 commission-free ETFs.

TD Ameritrade also offers fixed income products and no-transaction-fee mutual funds, among many other options.

To help investors make the right decisions, TD Ameritrade features exclusive education tools and resources from videos and webcasts to tools that help select the right retirement products and plans, such as the IRA Selection Tool.

Everything TD Ameritrade offers is also backed by third-party research from Morningstar Investment Management, S&P Capital IQ, and Market Edge.

All Experience Levels

As a final note, TD Ameritrade is included on this list of the best IRA accounts and the best IRA providers because it’s a good platform for all experience levels. TD Ameritrade features 24/7 customer services and excellent tools and educational resources to empower novice investors.

As much as there are tools for new investors, there are also things that more experienced investors enjoy, such as the availability of their market-leading trading platform called thinkorswim.

TD Ameritrade has been ranked as number one by Barron’s for Long-Term Investing and Novices, and it was also ranked as the Best Online Broker for Long-Term Investors by Barron’s in 2015.

Read More: Ways to Find the Best IRA Companies & Providers | Guide to Finding the Top IRA Providers

TradeKing Review

TradeKing is a leading online broker that is frequently named as a best Roth IRA account provider and one of the providers of the best IRA accounts overall. TradeKing is perhaps best known for the low fees and the sense of value all people get, including when they open a Roth IRA account or another type of IRA account.

TradeKing also features an excellent suite of trading tools, although it should be noted that this online broker is better for people who are interested in independence. As compared to some of the other best Roth IRA companies and best IRA accounts options, TradeKing tends to be more focused on self-directed investment options, although customer service is still ranked as being excellent.

Key Factors That Led to Our Ranking of This as One of Best IRA Companies

TradeKing is one of the best Roth IRA companies and one of the leading places to open the best IRA accounts for the reasons listed below.

Pricing

One of the biggest reasons TradeKing is often named as one of the best Roth IRA account companies and one of the best IRA providers is because of their low, simple pricing structure. Their pricing is clear and transparent, and there are no hidden fees or surprises, which is something most consumers are looking for when they are searching for the best Roth IRA providers and the leading IRA savings account options.

TradeKing charges $4.95 per trade for stock trades and 65 cents per contract for options trades plus a small base charge.

There is also no IRA annual fee, and other fees are minimal as well. There is no account minimum, either.

Tools

When someone opens an IRA account with TradeKing, for example, when they select one of their best Roth IRA accounts, they have immediate access to TradeKing’s award-winning suite of trading tools and research. Barron’s has awarded TradeKing for their tools and technology and named this as one of the best web-based brokers.

Some of the tools available from TradeKing, a best place to open a Roth IRA or other types of IRA savings accounts, include:

- Options pricing calculator

- Probability calculator

- Profit + loss calculator

- Stock, ETF + mutual fund screener

- Options and strategy scanners

- Maxit tax manager

- TradeKing LIVE

- Technical analysis

Customer Service

TradeKing is often ranked as not just having some of the best Roth IRA accounts and other types of the best IRA accounts, but it’s also one of the best IRA companies because of the superior customer service they offer. SmartMoney voted TradeKing #1 in customer service for several consecutive years, and customers can reach the support team by phone, live online chat for instant broker access, or emails.

The team at TradeKing is made up of expert, specialized brokers. This ensures that when a customer has a question about their IRA brokerage account, such as Roth IRA accounts, they’re getting help from someone who can answer their questions in a direct way and knows what they’re talking about.

Not only is the customer service from TradeKing backed by unparalleled expertise, but it’s also quick and responsive to get answers.

Trader Network

One of the most unique aspects of selecting TradeKing to open a Roth IRA account or another type of IRA brokerage account is something they call the Trader Network.

The online trading network from TradeKing lets traders connect with one another and share their ideas and strategies. They can also see the moves other traders are making and what their performance is like.

Specifics of what the Trader Network offers include:

- Account holders can see the stocks and options that are most actively traded

- They can get insights from other traders as well as industry experts and professionals

- The Trade Note feature lets traders tell other traders and investors why they made the specific decisions they did

- There are options for traders to get together with other people who have similar interests and investment experience levels to their own

Free Wealth & Finance Software - Get Yours Now ►

Vanguard Review

Vanguard is one of the largest investment companies in the world, featuring tools and resources for personal investments as well as people searching for retirement plans, such as Roth IRA accounts. Vanguard has 16 locations throughout the world, and they pride themselves on creating wealth for clients while keeping costs low.

Vanguard also strives to be a company focused on the needs of clients, with an approach based on strong investment principles and integrity. Vanguard has more than 20 million clients, and they serve the needs of individuals, participants in employer-sponsored retirement plans, financial advisors, and institutional advisors.

Key Factors That Led to Our Ranking of This as One of the Best IRA Companies

Whether someone is searching for the best Roth IRA account or another one of the best IRA savings account options, the following are key reasons Vanguard excels in the provision of the best IRA accounts.

Quality Funds

Whether you’re searching for the best Roth IRA accounts or another type of IRA savings account, it’s important that they offer high-quality funds, because that’s ultimately going to determine the performance of your IRA account.

Vanguard excels in the area of delivering high-quality funds at excellent prices.

According to Vanguard, 92% of their mutual funds and ETFs have performed better than peer-group averages over the past year. This level of performance is an important reason Vanguard is named on this list of the best Roth IRA accounts and the best IRA providers in general.

Vanguard also offers a sense of stability, having been in business since 1975, with a reputation for being one of the largest mutual fund companies in the world.

Broad Fund Options

If you’re searching for the best place to open a Roth IRA or the best Roth IRA accounts and other IRA accounts, Vanguard is an ideal option because of their wide variety of fund options.

For example, the best IRA accounts options at Vanguard include all-in-one Target Retirement Funds, as well as a choice of more than 200 commission-free Vanguard Mutual Funds and ETFs.

There are competitive trading commissions on non-Vanguard mutual funds and ETFs as well, and individual stocks, bonds, and securities.

Low Costs

As mentioned in the introduction to Vanguard as one of the best Roth IRA providers and best IRA providers in general, this company has some of the lowest costs available. The average expense ratio for a Vanguard fund is 82% less than the industry average.

These funds don’t have sales loads or sales commissions.

There are also no account service fees when clients register for secure access to the website, and they receive their documents electronically. There are no account service fees, and even when a customer decides to invest in individual stocks, bonds, or mutual funds from other companies, the fees remain very low.

Simplicity

When choosing the best IRA providers and the best IRA savings account options to include on this ranking of the best IRA companies, ease-of-use and convenience were important. This is just one more area where Vanguard excels.

There are just a few steps to setting up one of the best IRA accounts available from Vanguard. For example, if you’re looking for the best Roth IRA account or a Traditional IRA, you can do your research and compare your options on the Vanguard site.

Then, you can either choose an All-In-One fund or customize your portfolio.

You can start with as little as $1,000 and move money directly from your bank to your Roth IRA account or another type of IRA savings account you set up with Vanguard. You can also avoid the $20 annual account service fee when you register online and sign up for e-Deliver.

Funding for one of these IRA accounts from this selection for one of the best IRA companies can come from a check or electronic transfer, from moving an old employer plan into a Vanguard IRA, or from moving an IRA from another company to Vanguard.

Related: Roth vs Traditional IRA vs 401(k) |Things to Know Before Choosing a Roth IRA vs a Traditional IRA

Conclusion—Top 6 Best IRA Companies and Best IRA Accounts

Whether you’re looking for the best Roth IRA accounts or another type of IRA savings account, these are undoubtedly one of the best and easiest ways you can prepare for your retirement and save money over the long-term.

All of the best IRA accounts and the best IRA companies listed above have distinctive features and characteristics, but they also have some things in common that led to their ranking as one of the best IRA providers or a best place to open a Roth IRA or traditional IRA.

Some of the common features between the best IRA accounts and the best IRA companies on this ranking include low fees and transparency in the costs they charge account holders; a wide variety of mutual funds, ETFs, and other investment options; great customer service; convenient technology and digital account management —plus, they also offer tools and resources to educate clients.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.