2017 RANKING & REVIEWS

THE BEST MONEY MARKET ACCOUNTS

Finding the Best Money Market Accounts in 2017

Before going into details and reviewing the best money market accounts and the leading high yield money market accounts, it’s important for consumers to first have an understanding of the money market account definition.

Money Market Account Definition

What are money market accounts?

Money market accounts are very much like a savings account, with a few key differences. The number one difference between the top money market accounts and a regular savings account are the interest rates. Money markets are designed to save larger amounts of money, and they tend to have higher interest rate yields than a savings account.

Award Emblem: Best Money Market Accounts & High Yield Money Market Accounts

As is the case with a savings account, a money market savings account offers consumers some degree of protection for their money. There are options for check writing and cash withdrawals, although the federal government limits these, as it does with savings accounts.

Money market accounts aren’t based on the stock market, and they can’t lose value if there is a decline in the market. Instead, they simply earn money based on the current interest rates. The FDIC protects them at banks and the National Credit Union Administration at credit unions.

The following is a more in-depth explanation of the money market account definition as well as an overview of the best money market accounts. This ranking of money market accounts covers not only the top money market accounts but also specifics of why they’re included in this ranking in order to help consumers find the right account for their needs.

What Are the Benefits of a Money Market Savings Account?

A money market deposit account is a type of savings account that provides a certain level of stability and security to account holders, as mentioned in the above money market account definition.

A money market savings account, first and foremost, doesn’t carry risk like other forms of investment do. When you open a money market savings account, you’re simply putting your money into an account that’s protected by the federal government, with insured deposits up to a certain amount. That money stays in your account and earns interest over time.

Unlike investment funds, your money can’t decline based on the stock market which is ideal for people who want peace of mind, those who aren’t interested in investing or individuals that want to save money in addition to their investments.

Money market account rates are determined by a couple of different factors, including the average interest rate of the country as well as the individual bank and how much a person has deposited in his or her account. Regardless, money market account interest rates tend to be higher than a standard savings account which is one of their biggest advantages.

There also tends to be a certain level of flexibility when consumers choose some of the best money market account options. As opposed to other savings options, such as a CD, there are no time frames the money has to be kept in money market accounts. Furthermore, account holders typically have withdrawal privileges, and they can often write checks and make debit card transactions from the account.

It’s great if someone is looking for a way to earn higher-than-average interest on their idle money while also being able to maintain some level of access to their cash.

How Should You Choose the Best Money Market Account?

Almost every bank, credit union, and retail financial institution offers money market deposit account options. So how do you choose the best money market account for your needs?

The following are some key considerations to keep in mind as you select the best money market accounts or the top high-interest money market account.

- What are the money market account interest rates? This is probably the first thing most people consider as they review top money market accounts because money market account rates determine how much your money will grow. Often, consumers will find the best high-interest money market account options with online banks, but they might want in-person service and convenience offered by branch banking.

- What are the minimum deposit requirements? To open top money market accounts, most financial institutions have a minimum deposit requirement. To earn higher money market account rates, a larger deposit is required, so it’s important to consider this as you select the best money market account.

- Are there balance requirements? In addition to looking for high yield money market accounts and minimum deposit requirements that meet your needs, think about whether or not there are balance requirements. Some banks and financial institutions will charge fees on money market accounts if a minimum deposit level isn’t maintained.

- What are the withdrawal limits? There are federal regulations that determine how many withdrawals can be made on a money market deposit account, but these may vary based on the bank as well. Also, in addition to limitations on withdrawals and transactions, some banks will charge fees if limits on money market accounts are exceeded.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Should You Open a Money Market Deposit Account or a Savings Account?

You may still be wondering whether one of the top money market accounts is right for you or if you should go with a standard savings account.

The first thing to consider is how much accessibility you need to your money. Money market savings account options actually tend to offer more accessibility to your money, particularly if you want check writing or debit card privileges connected with the account.

Image Source: Pixabay

While the number of transactions may be limited, with most savings accounts, there is less accessibility to your funds than what you would find with the best money market accounts.

Another key consideration is how much interest you hope to earn. If you just have a little cash you want to set aside in case of emergencies, a savings account may be sufficient. On the other hand, if you have a large amount of money you’d like to earn interest on gradually, you might opt for one of the top money market accounts.

If you don’t have a lot of money to put in a money market account, it may not only mean less interest; the bank might also penalize you in terms of fees.

Don’t Miss: Compare Student Bank Accounts | Top Tips to Compare Bank Accounts for Students

AdvisoryHQ’s List of Top 6 Best Money Market Accounts and High Yield Money Market Accounts

List is sorted alphabetically (click any of the money market names below to go directly to the detailed review section for that best money market account):

- Ally Money Market Account

- Bank of America Rewards Money Market Savings

- Capital One 360® Money Market Account

- Discover Bank Money Market Account

- EverBank Yield Pledge® Money Market

- Sallie Mae Money Market Account

Top 6 Top Money Market Accounts

Money Market Account | Interest Rate | Minimum Initial Deposit | Minimum Balance Requirement |

| Ally Money Market Account | 0.85% | $0 | $0 |

| Bank of America Rewards Money Market Savings | 0.03%-0.06% | $25 | $2,500 (to avoid monthly maintenance fee) |

| Capital One 360® Money Market Account | 0.60%-1.00% | $0 | $0 |

| Discover Bank Money Market Account | 0.80%-0.85% | $2,500 | $2,500 (to avoid monthly fee) |

| EverBankYield Pledge® Money Market | 1.11% (1-year introductory rate) | $5,000 | $0 |

| Sallie Mae Money Market Account | 0.90% | $0 | $0 |

Table: Top 6 Best Money Market Accounts| Above list is sorted alphabetically

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Money Market Accounts and High Yield Money Market Accounts

Below, please find a detailed review of each account on our list of the top money market accounts. We have highlighted some of the factors that allowed these best money market accounts to score so well in our selection ranking.

Ally Money Market Account Review

Ally is one of the leading online-only banks in the U.S., offering a full lineup of services and account options, paired with competitive fees and rates offered due to the low overhead of the bank. Ally features everything from competitive savings and CD accounts to mobile banking, credit cards, and auto financing.

Ally is an award-winning bank known not only for some of the most competitive rates on the top money market accounts and other deposit accounts but also excellent customer service and a forward-thinking approach.

Key Factors That Led to Our Ranking of This as a Best Money Market Account

The following are specifics highlighting why the Ally Money Market Account is ranked as one of the best money market accounts.

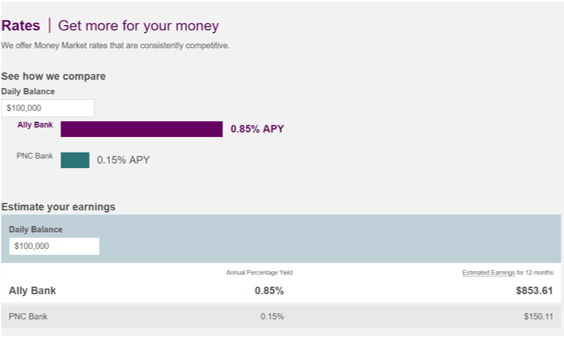

Rates

Money market account rates are typically one of the first things consumers look at as they’re deciding on the best money market account for their needs. At Ally, some of the most competitive high-interest money market account rates are offered, demonstrating why an online bank is so appealing to a broad base of consumers.

Currently, the APY is 0.85% which is significantly higher than many other banks’ offerings.

That means, for example, if someone had a daily balance of $100,000 in an Ally Money Market account, he or she could earn more than $850 in a year.

It is important to note the APY is variable and can change over time.

Image source: Ally

Fees

Even if you choose one of the high yield money market accounts with excellent interest rates, if you’re being charged very high fees, it’s going to significantly cut into those earnings. That’s why this ranking of the best money market account options focuses not only on the money market account rates but also on factors, such as fees, that can impact earnings.

Ally excels not only in terms of offering high yield money market accounts but also regarding fees.

There are no fees for the following:

- Monthly maintenance fees

- ACH transfers to a non-Ally Bank account

- Debit card fees

- Ally Bank standard checks

- Deposits and withdrawals

- Statement copies online

Features

Along with having no monthly maintenance fees, the Ally Money Market account is included in this ranking of the top money market accounts and best high yield money market accounts due to all the added features of this account that make it an easy way to watch your savings grow.

It includes unlimited deposits and ATM withdrawals as well as up to 6 additional transactions.

Checks can be deposited into the account remotely with Ally eCheck Deposit, and interest is compounded daily which means faster growth.

The FDIC insures deposits up to the maximum amount allowed by law, and there are also options for account holders to maximize their level of coverage.

Convenience

Sometimes, when consumers hear “online bank,” they become concerned that they’re not going to get the same level of support, service, and convenience they would get if they chose a bank with a strong brick-and-mortar presence, but Ally strives to cut through this perception.

It offers a variety of different options for consumers to open accounts, deposit money, and manage their accounts from anywhere as well as 24/7 live customer care.

Customers can make deposits using Ally eCheck Deposit or ACH transfers. They can also transfer funds between Ally Bank and non-Ally Bank accounts and use any Allpoint ATM in the U.S. to get cash for free. There are more than 43,000 Allpoint ATMs in the U.S., and Ally will reimburse customers up to $10 per statement cycle for fees charged at other nationwide ATMs.

Furthermore, customers can manage their account anytime and anywhere with online and mobile banking.

Related: Top Best Credit Cards to Build Credit | Ranking & Reviews | Credit Cards for Building Credit

Bank of America Rewards Money Market Savings Review

The Bank of America Rewards Money Market Savings account doesn’t have one of the highest money market account rates as compared to many online bank options, but it was included in this ranking for a few key reasons. In particular, this account is great for people that already have an existing relationship with Bank of America because they’re rewarded with higher money market account rates.

It’s also good for consumers that are looking for a brick-and-mortar bank with many locations throughout the country as well as people that want to be able to combine all of their accounts in one location. Bank of America features everything from home mortgages to basic checking accounts and has one of the biggest presences of all banks in the U.S. It was beneficial to include this particular money market account on this ranking of the top money market accounts to show consumers great options in addition to strictly online bank products.

Key Factors That Led to Our Ranking of This as One of the Best Money Market Accounts

The Bank of America Rewards Money Market Savings account is includedin this ranking of the top money market accounts for reasons listed below.

Preferred Rewards

As mentioned, while this may not necessarily be a high-interest money market account, it is named as a best money market account for many reasons including the ability to earn higher interest rates for your relationship with Bank of America.

The standard interest rate is currently 0.03% on this best money market account, and there are opportunities for Preferred Rewards clients to earn an interest rate booster.

For Gold-level clients, the Preferred Rewards APY is 0.04%, Platinum level is 0.05%, and Platinum Honors is 0.06%.

As compared to Bank of America savings accounts, the money market account rates are also higher.

Fees

There is a $12 monthly maintenance fee for this particular money market deposit account, but Bank of America features several simple ways to have that fee waived. To begin, the fee can be waived for account holders that maintain a minimum daily balance of at least $2,500 which is relatively low by money market standards.

The fee can also be waived if account holders link their Bank of America Interest Checking account to their Rewards Money Market Savings Account.

Finally, the money fee is waived for account holders that are a Bank of America Preferred Rewards client.

The required opening deposit is also only $25 with this money market savings account.

Keep the Change® Savings

Bank of America is a leader and innovator in the financial services industry, and one of their unique features available with their money market accounts is the ability to take part in the Keep the Change® savings program.

With this program, once account holders open a money market deposit account, they can link it with this program and then make their usual purchases with their Bank of America debit card. Bank of America will then automatically round up their purchases to the next dollar.

The difference is transferred from a checking account to a savings account, making it easy and effortless to grow your savings more quickly.

Convenience and Other Benefits

As mentioned above, this best money market account isn’t necessarily one of the high yield money market accounts on this ranking, but there are advantages to this account, and one of the big ones is complete convenience.

To begin, Bank of America not only offers 24-hour online access – it also has thousands of ATMs and branch locations throughout the country.

Other benefits of this particular best money market account include:

- Award-winning mobile banking

- Automatic transfers options

- Overdraft protection

- Mobile check deposits

- Easy transfers between accounts or to people

Capital One 360® Money Market Review

Capital One 360 is an online version of Capital One bank that features 24/7 online and mobile device access. Uniquely, Capital One 360 also features 11 Capital One Cafes throughout the country. The goal of all of the products and services featured by 360 is to improve convenience and save customers time. Capital One 360 includes options for checking, savings, and investing.

All of the Capital One 360 products, including the Capital One 360® Money Market excel regarding the value customers receive. This value comes from low or non-existent fees and some of the most competitive earnings rates on applicable products.

Key Factors That Led to Our Ranking of This as One of the Best Money Market Accounts

The Capital One 360 Money Market account was included on this list of the best high yield money market account options for the reasons listed below.

Competitive Rates

As has been mentioned throughout this review of the top money market accounts and the leading high yield money market accounts, interest rates and earning potential are a primary consideration when selecting the best money market account.

This is one of the strongest points of the Capital One 360 Money Market account. This online account features one of the best money market account rates in the nation, and it’s tiered to provide higher money market account interest rates for higher balances.

This high-interest money market account earns 1.00% APY for balances of $10,000 or more. For account balances of $0 to $9,999.99, the APY is currently 0.60%.

Fees and Flexibility

As compared to other money market deposit account options, the Capital One 360 account features some of the most flexibile and straightforward offerings.

To begin, this money market deposit account includes no fees whatsoever. This fee-free account lets customers ensure they’re maximizing their earning potential with their money market savings account, without paying high fees.

This account is also unique because it’s flexible. There are no requirements to this account being fee-free nor are there are hidden costs or complexities. This money market savings account doesn’t have any minimum deposit or balance requirements either. It’s just a basic, valuable way to save money and earn one of the most competitive money market account interest rates.

Mobile App

Since the Capital One 360 Money Market Account is one of the high yield money market accounts that’s based online, the mobile app and online tools are among some of the best in the industry.

The Money Market Account can be accessed through the mobile app that includes features like CreditWise, a free service to see your credit score and uncover what’s having the biggest impact on your rating.

The Mobile App also features Mobile Check Deposit so you can take pictures of checks and deposit them directly into your account as well as the Capital One Wallet to take charge of your spending and enhanced transactions shown in a snapshot version with full details.

Image Source: Capital One

Simple Signup and Transfers

In line with the concept that it’s incredibly easy to have this particular money market savings account, when you go with a Capital One 360 Money Market account, you can sign up online within about five minutes.

Also, when you open this best money market account, you provide your checking account information that is used to fund your initial deposit, and then a link is automatically established. That link can be used to transfer funds between accounts quickly.

Customers can also sign into their online banking or call the Interactive Phone Service to initiate a deposit or withdrawal. Customers with a 360 Money Market account can also get access to cash at more than 38,000 free Allpoint ATMs nationwide.

Popular Article: Best Student Checking Accounts – Chase vs. TD Bank vs. Capital One

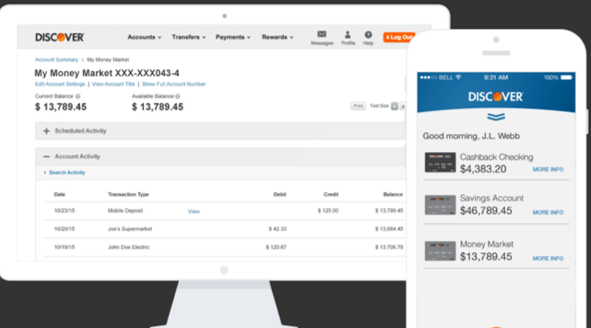

Discover Bank Money Market Account Review

Discover Bank is an efficient, inexpensive way to bank online, offering checking, savings, money market, CD, and IRA accounts. It’s ideal for consumers who want convenience and low fees, like so many of the other online banks offer on this ranking of the top money market accounts. Deposits are protected by the FDIC, giving customers peace of mind and a sense of security when they store their money with Discover.

Discover Bank has no monthly fees, free withdrawals at more than 60,000 ATMs, and a variety of other services designed to help customers save money while getting the service and products they need.

Image Source: Discover

Key Factors That Led to Our Ranking of This as a Best Money Market Account

The following details highlight why this was selected as one of the best money market accounts.

High Yields

As was covered when looking at the money market account definition, one of the primary differentiating factors between various money market accounts are the money market account interest rates. Discover, like the other online banks on this list of the top money market accounts, features very competitive money market account rates.

To begin, this high-interest money market account features a 0.80% APY on balances under $100,000.

For balances that are $100,000 and above, there is a 0.85% APY.

Low Fees and Transparency

The Discover account is one of the best money market accounts for many reasons, including the value it provides customers. This value comes in the form of low or nonexistent fees and a continual sense of transparency. The following are always free and have no fee with this money market savings account:

- ATM usage in the U.S.

- Replacement debit cards

- Account closure

- Expedited delivery for replacement cards

- Official bank checks

- Check reorder

The minimum deposit to open the account is only $2,500, and as long as the average daily balance is above $2,500, there is no account fee each month. If the daily balance of this money market deposit account falls below $2,500, the minimum balance account fee is only $10 per statement cycle.

Easy Opening

As with everything offered by Discover Bank, it’s incredibly easy to open one of its high yield money market accounts. To begin, you simply enter some basic information on the Discover Bank website, including your address and contact information.

Then, you fund your account with as little as a $2,500 opening deposit. You can fund your account by check or by transferring funds from an existing account.

Once you’ve set up the account and funded it, you receive a confirmation email and a Welcome Kit. After opening your account, you can easily manage it online and with your mobile device, and you can also quickly access your cash by ATM, debit card or check.

Mobile Banking

When you decide to open a best money market account at an online-only bank, it’s important that it has offerings such as robust mobile banking, and that’s the case with Discover. The Discover Mobile App lets users quickly log in with their fingerprint or a fast four-digit password.

They can deposit checks into their money market savings account by taking a photo, and the Quick View option lets them check balances and account activity without logging in. The app also features an ATM locator.

You can also move money in and out of your money market deposit account easily with a few taps, pay bills, view your money market account activity, and see all of your Discover accounts in one streamlined location.

Read More: Best Savings Account for Students | Chase vs. Bank of America vs. TD Bank

EverBank Yield Pledge Money Market Account Review

EverBank, along with offering one of the best money market accounts and the most competitive money market account interest rates, is one of the premier online banks. EverBank is headquartered in Jacksonville, Florida, and it is recognized as one of the original pioneers in the Internet banking industry.

Today, EverBank offers both personal and business banking as well as lending and investment products and services. It offers one of the largest selections of options as compared to other online banks, and among those options are its money market accounts.

Key Factors That Led to Our Ranking of This as One of Top Money Market Accounts

The Yield Pledge® Money Market account is part of this ranking of the top high yield money market accounts and the overall best money market accounts for the reasons cited below.

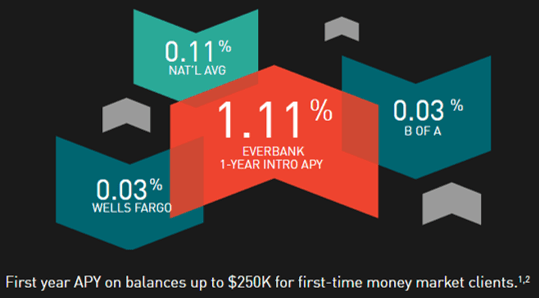

Top Rates

One of the primary ways EverBank is unique from other banks is due to its highly competitive interest rates, and its money market account is no exception.

Based on the Yield Pledge, the EverBank Money Market never has yields that are any less than the top 5% of Competitive Accounts. What this means is that account holders know they’re getting a high-interest money market account because EverBank promises it will always be in the top 5% of yields.

Currently, the one-year introductory APY is 1.11% while the national average on money market accounts is 0.11%. The first-year introductory APY is on balances up to $250,000 for first-time money market clients.

Image Source: Everbank

IRA Eligible

EverBank’s best money market accounts are IRA eligible. This means IRA account holders can give their cash a boost with the Yield Pledge Money Market account which is secure and a high yield option that allows account holders to see their money grow more quickly.

EverBank uniquely allows its most popular accounts to be opened as IRAs to improve savings strategies, and that’s the case with this best money market account.

Along with top 5% yields, with IRA eligibility, there is no risk to principal and no annual account fee. It also requires only $5,000 to open, making this a great cash strategy.

Fees

EverBank is always looking for ways to remain competitive and several steps ahead of other banks and providers of money market accounts. One way it does this is through low or no-fee offerings.

While there are a few fees consumers might have to pay, EverBank makes sure it’s not overcharging customers for access to their money.

For example, when a customer opens one of these top money market accounts, there are no monthly account fees. If an account holder has a balance at or above $5,000, the bank will reimburse him or her for ATM fees from other banks.

There is no overdraft transfer fee or online and mobile check deposit fee and no fee for using online bill pay.

Online and Mobile Solutions

Of course, as one of the original pioneers of online banking, EverBank features excellent online and mobile tools and functionality. When a consumer opens one of the high-interest money market account products with EverBank, he or she gains access to all of the online and mobile solutions that set EverBank apart.

For example, the free mobile app not only lets consumers track their money market on the go but also allows them to make fast, simple deposits. The app can also be used to find an ATM, make internal transfers, and pay bills.

Mobile payment options include Apple Pay so that account holders can pay merchants with the tap of their mobile device, and money can be sent securely to friends and family with the People Pay feature.

Related: Ways to Open Checking Accounts Online | Online Banks with High Yields & High Savings Rates

Sallie Mae Money Market Account Review

Sallie Mae is perhaps best-known for offering student loans, but it also has certain banking products such as high-yield money market accounts. Sallie Mae, along with featuring student loans, specializes in offering savings opportunities that have great rates and low or no fees. These savings options include not only one of the best money market account options but also a “GoalSaver Account” and CDs.

Sallie Mae is a member of the FDIC, and it works to help Americans plan, save, and pay for college education.

Key Factors That Led to Our Ranking of This as One of the Best Money Market Accounts

When comparing money market accounts and money market account rates, the following are specifics of why the Sallie Mae Money Market account is included in this ranking of top money market accounts.

Competitive Rates

The money market account rates on this leader among high yield money market accounts are excellent, and it’s those rates that are one of the most appealing things about this money market deposit account.

The Sallie Mae Money Market Account has a current 0.90% interest rate which is about 11x the national average.

This high-interest money market account includes interest that’s compounded daily and paid monthly.

Account Management

There are several aspects of this leader among the top money market accounts that make it easy to manage the account. To begin, account holders can write checks directly from their account which is something that’s not available from every money market savings account.

There is also easy, centralized online account management available 24 hours a day.

The one thing that should be noted, however, is that, unlike the other names on this list of the best money market accounts, this best money market account has no options to access ATMs for free if you need to withdraw cash from your account.

If that isn’t a concern for you as you select the best money market account, then this can be an excellent option. The lack of ATM withdrawals is really one of the only downsides of this best money market account.

Requirements and Fees

As with most of the products and services available from Sallie Mae, this particular money market savings account is designed to give the account holder a maximum amount of value.

With that in mind, along with being a high-interest money market account, this option also has no minimum balance requirement. Additionally, there are no monthly fees, so account holders can easily maximize their savings with this best money market account.

Electronic transfers are free, and this account includes six free withdrawals per month.

Along with being an inexpensive account, this best money market account is also flexible in its requirements and guidelines.

Easy Account Opening

Like most of the online best money market accounts named on this ranking, Sallie Mae’s best money market account is an excellent option because it is entirely managed online, including the account opening.

You don’t have to visit a branch or fill out a lengthy application to get this money market savings account.

Instead, you just enter some brief information, and you can then easily transfer money to fund your new money market deposit account, although there are no opening deposit requirements.

If you’re an existing customer of Sallie Mae, it’s even easier to open this best money market account by logging into your online banking account.

Conclusion—Top 6 Top Money Market Accounts and High Yield Money Market Accounts

Money market accounts are advantageous and a preferred method of saving money for some customers because they’re a low-risk, secure way to invest money. Each of the above top money market accounts included in this ranking have some things in common.

The common features of the best money market accounts include:

- Comparatively high money market account rates

- These money market accounts have low fees

- Low initial deposit requirements

- Plenty of online accessibility and mobile options for easy money management

- Strong customer service

These are just a few of the ways the above best money market accounts excel as an excellent option for any consumer who wants to securely save money while earning a modest return without risk.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.