2017 RANKING & REVIEWS

TOP RANKING BEST MUTUAL FUNDS COMPANIES

Finding the Best Mutual Funds Companies?

This list of mutual fund companies and mutual fund comparison isn’t just a comparison of the largest mutual fund companies.

Instead, it also serves as a guide to mutual funds in general, helping investors whether they’re novices or experienced, to select the best mutual fund companies to invest with.

Award Emblem: Best Mutual Fund Companies

To begin, the following are some features of a mutual fund, which is what you’ll find offered by these mutual fund companies:

- A mutual fund is a method of investing that lets people put their money together with other investors and then purchase a portfolio which can include stocks, bonds, and securities

- A mutual fund’s price is determined by the value of the securities in the portfolio, divided by the number of outstanding shares in the fund

- Many investors opt to go with actively managed mutual funds, which is why it’s important to explore the mutual fund companies. With actively managed mutual funds, whether or not shares are bought or sold is made by portfolio managers, based on research.

- Mutual funds and the top 10 mutual fund companies on this mutual fund comparison tend to provide valuable investment opportunities for individuals, because it’s cost-effective, and you can easily diversify your portfolio.

There are several considerations to keep in mind as you compare mutual funds, but two of the most important are performance and fees, both of which were carefully weighed when creating this list of the top 10 mutual fund companies.

AdvisoryHQ’s List of the Top 10 Best Mutual Fund Companies

List is sorted alphabetically (click any of the names below to go directly to the detailed review section for the mutual fund companies):

- BlackRock

- Capital Group (American Funds)

- Dreyfus

- E*TRADE

- Fidelity

- Franklin Templeton

- Invesco

- Merrill Edge

- Pimco Funds

- The Vanguard Group

Image Source: Pixabay

Top 10 Best Mutual Fund Companies | Brief Comparison

Top 10 Mutual Fund Companies | Total Assets | Number of Funds | Featured Funds |

| BlackRock | 619 | BGF Global Allocation Fund BGF Global Multi-Asset Income Fund BGF Global Equity Income Fund | |

| Capital Group (American Funds) | 58 | The New Economy Fund The New Perspective Fund The Growth Fund of America | |

| Dreyfus | $260 billion | More than 140 | Dreyfus Municipal Bond Fund Dreyfus Equity Income Fund Dreyfus Balanced Opportunity Fund |

| E*TRADE | 8,000 | Oakmark Investor T.Rowe Price Value Jensen Quality Growth | |

| Fidelity | 10,000 | Fidelity Select Semiconductors Fidelity Select Medical Equipment Fidelity Real Estate Investment | |

| Franklin Templeton | 113 | Franklin Adjustable U.S. Government Securities Fund-A Franklin Balanced Fund-A Franklin Balance Sheet Investment Fund-A | |

| Invesco | 93 | Invesco Floating Rate Fund Invesco All Cap Market Neutral Fund Invesco Balanced-Risk Commodity Strategy Fund | |

| Merrill Edge | thousands in total, and 5,000 with no fees | US Global World Precious Minerals Fidelity Select Semiconductors T. Rowe Price Health Sciences | |

| PIMCO Funds | 506 | All Asset All Authority Fund Emerging Local Bond Fund GNMA Fund | |

| Vanguard | 127 | Intermediate-Term Investment-Grade Fund Balanced Index Admiral Shares Fund International Value Fund |

Detailed Overview of How to Compare Mutual Funds

Along with looking at the top mutual fund companies and the largest mutual fund companies, it’s important to think about how to choose the actual fund.

While every investor’s goals and approach are going to be unique, the following are some key things to keep in mind as you select not only the best mutual fund company but the best mutual fund.

First, do you want to invest in a mutual fund because you want a substantial return, or do you want income? This will help you decide the type of mutual fund you should invest in.

You may also consider whether or not you want a no-load mutual fund. Many of the names on this list of mutual fund companies feature excellent no-load options, which means there is no commission made by anyone when you invest in the fund. It’s also important for the consumer to make sure there are no hidden fees on the back-end.

You should also look for mutual fund investment companies that offer mutual funds with an established history. Most financial and investment professionals recommend only investing in mutual funds with at least five years of strong performance history.

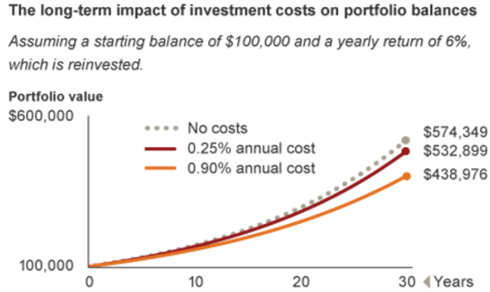

Another key thing to keep in mind when selecting mutual fund investment companies and specific mutual funds is the expense ratio.

This is a figure that outlines the cost required for the mutual fund to achieve its performance level. If there is a higher expense ratio for a mutual fund, that means the fund has to perform higher than other competitive funds.

These are just a few of the many things to keep in mind as you select the top mutual fund companies and the best funds.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated credit cards, financial accounts, firms, products, and services.

Don’t Miss: Top Prepaid Credit Cards | Ranking | Prepaid Credit Cards That Build Credit

Detailed Review – Top Ranking Best Mutual Fund Companies

Below, please find the detailed review of each mutual fund company on our list of mutual fund companies. We have highlighted some of the factors that allowed these top mutual fund companies to score so well in our selection ranking.

BlackRock Review

An American investment firm, BlackRock is based in New York City and is known as one of the leading investment firms in the world. BlackRock is an investment and best mutual fund company that strives to invest in a way that addresses needs of clients. They have 135 investment teams in 30 countries.

Clients of BlackRock, one of the largest mutual fund companies, include individuals saving for retirement, people who want to build wealth, and governmental organizations, companies, and foundations. The focus at BlackRock is on long-term sustainability and responsibility.

Key Factors That Led to Our Ranking of This as One of the Top Mutual Fund Companies

Among the largest mutual fund companies, the following are some reasons BlackRock is ranked on this mutual fund comparison.

Options

Undoubtedly, BlackRock is not just one of the biggest investment firms, but also one of the largest mutual fund companies in the world. Along with looking at their excellent mutual fund performance comparison, investors will notice there are an extensive number of mutual fund options from which to choose with BlackRock.

There are 619 total funds. You can search for the best funds based on asset class, such as equity, fixed income, or multi-asset.

You can also choose mutual funds from this pick for one of the top mutual fund companies based on investment strategy or region. Popular strategies available from BlackRock, one of the largest on this mutual fund comparison, include:

- Alternatives

- Managing volatility

- Navigating bonds

- Generating income

- Active and index

- College savings

- Defined contribution

Image Source: BlackRock

Performance

Important in the creation of this ranking of the top mutual fund companies was to look at a mutual fund performance comparison. The mutual funds from BlackRock perform well and have a long, established history.

Some of the top performing specific mutual funds from BlackRock in 2016 include:

- BGF Global Allocation Fund: This fund available from Blackrock, one of the biggest mutual fund companies on this mutual fund comparison, has delivered a cumulative return of more than 268% since launching in 1997, along with offering 1/3 less risk than the global equity market.

- BGF Global Multi-Asset Income Fund: This is described by BlackRock as an “all-in-one solution” designed for uncertain markets.

- BGF Global Equity Income Fund: this provides an option for people who want a mutual fund that pays dividends and features sustainable yields, along with consistency.

Who It’s Good for

BlackRock is a best mutual fund company for people who are searching for a wide variety of options, as well as established funds with plenty of opportunities for researching long-term returns.

This best mutual fund company is also good for someone who wants a sense of stability and intends to invest in mutual funds as part of a long-term strategy. BlackRock tends to offer high-quality funds, as well as a sense of stability which can be useful for investors in uncertain times.

Finally, Blackrock is one of the leading mutual fund companies if you want to have a strong balance between opportunities and risk, thanks to the range of solutions.

Capital Group (American Funds) Review

Capital Group is the parent company of its subsidiary, American Funds, which is one of the leading families of mutual funds. Capital Group was founded in 1931 and is ranked as one of the biggest and largest investment management companies in the world, with $1.39 trillion in assets under management and headquarters in Los Angeles.

The overarching goal at Capital Group is the focus on the delivery of consistent and superior results for long-term investors. Capital Group achieves this through a combination of high-conviction portfolios, in-depth research, and individual accountability. American Funds is the third largest mutual fund family.

Key Factors That Led to Our Ranking of This as One of the Top Mutual Fund Companies

Reasons Capital Group and its subsidiary American Funds are included in this ranking of the top 10 mutual fund companies are detailed below, useful as you compare mutual funds and companies.

Options

American Funds offers 58 different funds, which are divided into the following groupings:

- Growth

- Growth & Income

- Equity-Income

- Balanced

- Bond

- Tax-Exempt Bond

- Money Market

- Portfolio Series

- Retirement Income Portfolio Series

- Retirement Target-Date

Investors can research each individual fund offered from this selection for one of the top 10 mutual fund companies, or they can opt to compare up to five different funds on the American Funds website, side-by-side, looking at criteria including returns, ratings, risk, and holdings.

Along with a selection of top-performing, quality mutual funds, Capital Group and American Funds were included on this ranking of mutual fund companies because they are known for lower-than-average fees relative to other families.

Performance

American Funds is the third largest mutual fund family, and it has more than $1.3 trillion in assets under management. American Funds also has an A-rating with Morningstar for fees, corporate culture, and fund manager incentives.

Portfolio managers at American Funds have an average of 27 years of investment experience, and an average of 22 years’ experience at the company as of the end of 2014.

Some of the top-performing growth funds available from this selection for one of the biggest mutual fund companies and best mutual fund companies include:

- The New Economy Fund: The New Economy Fund is a long-term capital appreciation product, and the focus of this fund is on identifying companies that can benefit from new technology innovations. It invests primarily in U.S. companies, although some of the asset allocation may go to foreign companies. The four managers of the funds have been with it for nearly two decades.

- New Perspective Fund: This top-performing fund from American Funds, one of the top 10 mutual fund companies, provides long-term capital appreciation. As you compare mutual funds, you’ll see it features investment in both U.S. and international blue-chip firms.

- The Growth Fund of America: This is primarily invested in large-cap firms. It’s used for investors looking for capital growth.

Image Source: American Funds

Who It’s Good for

American Funds is ideal for investors looking for a best mutual fund company offering active management of portfolios. Most of the mutual funds are managed by people who have been with not only the company but the fund for many years. American Funds is also recognized for having fund managers who invest their money in the funds they’re responsible for managing.

American Funds features multiple managers for each fund and a team of researchers also backs the funds, all of which leads to diversity in perspectives for the best possible approach to investment.

Related: Compare Credit Cards | Ranking | Top Credit Cards (Comparison & Reviews)

Dreyfus Review

Dreyfus is a BNY Mellon Company that serves as an investment firm for financial advisors, institutional investors and consultants, cash management professionals, and individual investors. Dreyfus has been leading the way regarding mutual fund investing since its establishment in 1951.

Retail investors have access to many mutual funds from 13 diversified, global investment boutiques that are part of BNY Mellon. These products include international and domestic equity, fixed income alternatives, cash management strategies, and retirement-based mutual funds. Dreyfus also includes Dreyfus Retail Direct and BNY Mellon Cash Investment Strategies.

Key Factors That Led to Our Ranking of This as One of the Top Mutual Fund Companies

Reasons Dreyfus is included on this list of the largest mutual fund companies and the top 10 mutual fund companies are detailed below, and the list is useful as you compare mutual funds.

Options

Dreyfus has been a long-term leader in terms of mutual fund companies for U.S. investors. They offer retail investors access to more than 140 mutual funds currently and simple tools to compare mutual funds. Dreyfus was the first company to offer an incorporated, tax-exempt municipal bond fund, a short-term, high-yield fund, and a simplified prospectus. They were also one of the first companies to provide online Money Market Fund trading.

Mutual funds from Dreyfus can be divided into categories including fixed income, alternatives, equities, and real assets.

In terms of Boutique Strategy funds offered by this best mutual fund company, options include:

- Alcentra

- CenterSquare

- Fayez Sarofim

- Newton

- Walter Scott

- The Boston Company

- EACM

- Mellon Capital

- Standish

Equity class options available from Dreyfus, one of the top mutual fund companies and one of the best mutual fund companies on this mutual fund comparison, include:

- Large Cap-Growth

- Large Cap-Blend

- Mid Cap-Value

- Small Cap-Growth

- Small Cap-Blend

- Global/International-Value

- Large Cap-Value

- Mid Cap-Growth

- Mid Cap-Blend

- Small Cap-Value

- Global/International-Growth

- Global/International-Blend

Performance

Dreyfus is recognized as one of the biggest mutual fund companies as well as the best mutual fund companies when looking at a mutual fund comparison.

They classify their mutual funds based on performance and ratings from Morningstar.

They feature many four- and five-star rated mutual funds, including the following:

- Dreyfus AMT-Free Municipal Bond Fund

- Dreyfus California AMT-Free Municipal Bond Fund

- Dreyfus/Standish Global Fixed Income Fund

- Dreyfus Balanced Opportunity Fund

- Dreyfus Equity Income Fund

- Dreyfus Growth and Income Fund

Who It’s Good for

Dreyfus is included on this list of mutual fund companies and mutual fund comparison for many reasons, including the diversity of their mutual fund offerings that address a variety of sectors, investment styles, and sectors.

Dreyfus is also an ideal and best mutual fund company for investors who not only want diversity in their options but who want international investment opportunity, expert guidance, and top-quality products.

Dreyfus strives to help investors who want sophistication in their investment products, but also want the know-how to help them make smart decisions in the face of an environment that changes incredibly quickly.

This is also one of the top mutual fund companies for investors who are looking for boutique specialization.

Popular Article: Top Retail Credit Cards | Ranking | Best Retail Store Credit Cards for Bad Credit & Good Credit

E*TRADE Review

E*TRADE is a leading online investment brokerage platform for retail investors. E*TRADE is one of the innovators in the world of online brokerages, and the company executed the first-ever electronic trade made by an individual investor over 30 years ago.

The goal of E*TRADE is to provide individual investors with the tools, resources, and other materials they need to achieve their goals in the short- and long-term. This digital platform is paired with industry-licensed representatives and financial consultants as well, and there are 30 E*TRADE branches around the U.S.

Key Factors That Led to Our Ranking of This as One of the Top Mutual Fund Companies

E*TRADE is one of the best mutual fund companies on this mutual fund comparison for the reasons below.

Image Source: E*TRADE

Options

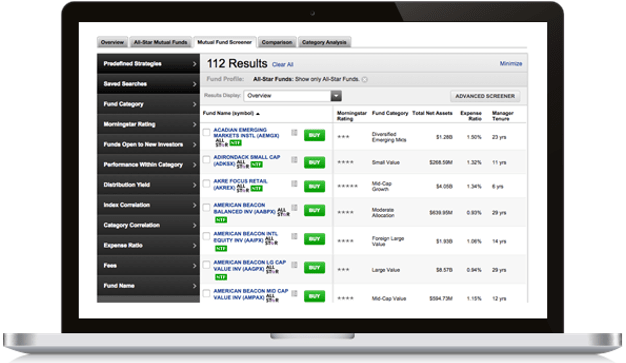

For investors primarily concerned with options as they compare mutual funds and choose the best mutual fund company for their needs, E*TRADE represents an excellent brokerage.

E*TRADE features an astounding 8,000 available mutual funds, and of those, 2,500 are no-load, no-transaction fee mutual funds.

These investments are selected and managed by professionals, providing an easy way to diversify a portfolio and save money on the cost of transaction fees or commissions. They’re also created around specific market strategies.

The signature E*TRADE Fund Screener can be used to choose the right options, and the All-Star Funds list includes top performers.

Investors can also receive guidance from E*TRADE Financial Consultants. The ability of E*TRADE to integrate extensive options, digital convenience, and personalized assistance are key reasons it’s named one of the best mutual fund companies on this list of mutual fund companies.

Performance

A signature offering available from E*TRADE, one of the largest mutual fund companies and one of the top mutual fund companies, is their Exclusive All-Start List. This list provides an easy way for investors to find pre-selected funds that are top performers.

All-Star Funds will usually have at least a three-year track record. They also compare well against their peers based on historical performance and consistency. Asset growth and size have to be structured based on sound investment principles, and a well-balanced investment firm must support them.

The current E*TRADE All-Star List includes 132 funds, divided into categories including:

- Domestic large

- Domestic mid and small

- International

- Fixed income

- Balanced

Who It’s Good for

It should be noted that E*TRADE is different from many other names on this list of mutual fund companies and mutual fund company rankings because they offer options from companies that actually put together mutual funds, such as T.Rowe Price.

At the same time, it was important to include E*TRADE on this list of the best mutual fund companies because while they don’t offer their own mutual funds, it’s an excellent resource for anyone who wants convenience and to take a hands-off approach to investing in funds.

It can be a good option whether an investor wants hands-off, automated investing or seeks some level of customization available.

E*TRADE is also a useful resource for investors primarily concerned with sourcing no-load mutual funds.

Fidelity Investments Review

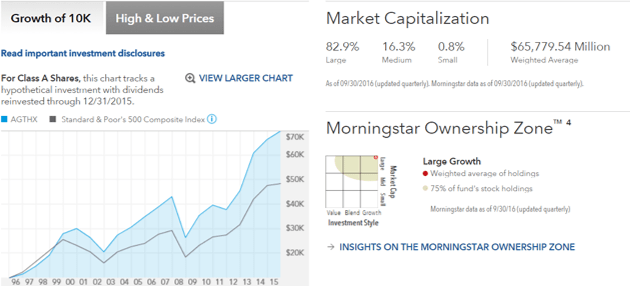

Fidelity Investments has been rated as a number one overall broker by outlets like Barron’s and Investor’s Business Daily because of their research, trade execution, and tools. Fidelity Investments features a wide variety of retirement products, as well as mutual funds based on global research.

Fidelity has 25 million customers, and $2.1 trillion in global assets under management, as well as $5.1 trillion in total client assets. The company includes divisions for personal investing, workplace investing, and institutional asset management. Fidelity also has a history of almost 70 years in the business of investing and mutual funds.

Key Factors That Led to Our Ranking of This as One of the Top Mutual Fund Companies

Among the top mutual fund companies, the following are reasons Fidelity is named as one of the best mutual fund companies on this comparison of mutual fund companies.

Options

Three of the general reasons Fidelity is named not only as one of the biggest mutual fund companies but also one of the top 10 mutual fund companies is because they have a long history, and their diverse investment opportunities are backed by globally-driven research.

In fact, Fidelity has one of the most extensive and industry-leading research departments.

Additionally, the Fidelity Fund Portfolios include the option to take a hands-off approach or options for people who want to select their funds personally.

The two main categories offered by Fidelity are Fidelity Income Fund Portfolios and Diversified Fund Portfolios.

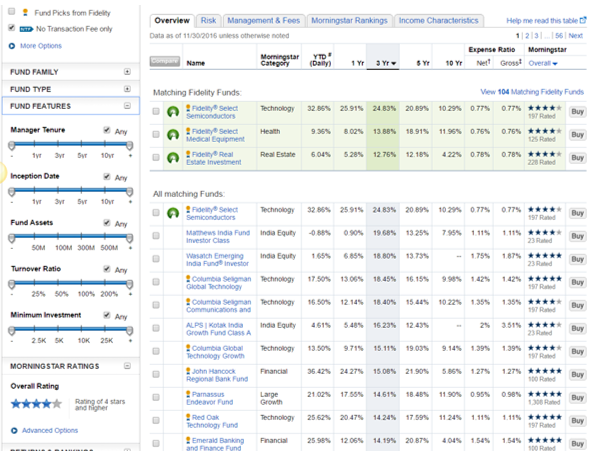

The Fidelity FundsNetwork includes more than 10,000 funds both from Fidelity and from other companies, and many have no transaction fees.

Fidelity also offers options ranging from domestic funds to international mutual funds, which you’ll see as you compare mutual funds.

Performance

As mentioned, Fidelity Investment leads the way among the mutual fund companies and top mutual fund companies not only in terms of their breadth of options but also because of their research. Every fund at Fidelity is hand-picked by an expert, and there are reasonable purchase price options as well.

Many of the funds offered by Fidelity are high performers according to Morningstar ratings.

Some of the Fidelity mutual funds that are rated well by Morningstar include Fidelity Select Semiconductors, Matthews India Fund Investor Class, and Columbia Seligman Global Technology.

Fidelity is also unique because, in addition to being able to search for and compare mutual funds based on returns and rankings, there are other mutual fund comparison options available, such as the ability to search based on volatility.

There are also other unique search criteria that can help investors look beyond the basics of performance, such as manager tenure, inception date, fund assets, turnover ratio, and minimum investment.

Image Source: Fidelity

Who It’s Good for

Fidelity Investments is one of the best mutual fund companies overall on this list of mutual fund companies.

It’s a good mutual fund investment company for a broad range of investors, but it can be particularly good if you’re looking for a full variety of options.

Fidelity Investments is also useful if you’re unsure of what you want; their website search filtering options are among the most advanced and sophisticated of any on this list of mutual fund company rankings. It gives people an excellent opportunity to pinpoint exactly what they want in a mutual fund.

Finally, Fidelity Investments can be one of the top mutual fund companies for anyone searching for no-transaction-fee mutual funds, since they have so many options available, which you’ll see as you compare mutual funds and mutual fund companies.

Read More: Top Credit Unions Credit Cards | Ranking | Best CU Secured & Unsecured Credit Card Offers

Free Wealth & Finance Software - Get Yours Now ►

Franklin Templeton Review

Franklin Templeton has been handling asset management for clients since 1947, including retail, high-net-worth, and institutional clients. They work to bring together excellent investment teams in a unified firm, meaning expertise is specialized across a variety of asset classes. Because of the multiple manager structure, Franklin Templeton is able to offer unique styles to clients with broad capabilities.

Investment products offered by Franklin Templeton include not only mutual funds but also private funds, separately managed accounts, and ETFs.

Key Factors That Led to Our Ranking of This as One of the Top Mutual Fund Companies

Among mutual fund companies, Franklin Templeton also ranks as one of the best mutual fund companies for the reasons highlighted below.

Options

Unlike some of the other names on this ranking of mutual fund companies and the top 10 mutual fund companies, all of the mutual funds offered by Franklin Templeton are their own, and they feature 113 distinctive and valuable mutual funds, many of which are highly rated by Morningstar.

They can be searched for and divided by asset class, investment category, region, Morningstar rating, and share class, making it easy to compare mutual funds.

There are also options to search based on sales charges.

Investment category options are extensive with Franklin Templeton, one of the leading mutual fund investment companies, and include:

- Balanced/hybrid

- Blend

- Commodities

- Currency

- Multi-sector

- Multi-strategy

- Municipal bonds

- Target date

Performance

The Franklin Templeton mutual funds are designed to be high performers because they are created with industry-leading investment expertise.

Areas of expertise available from Franklin Templeton, one of the top 10 mutual fund companies, include:

- Research-driven equity strategies that go across styles and geographies and are based on avoiding short-term trends and instead are focused on long-term performance

- Fixed income options can be tailored to specific news of client investors, and the focus is on independent research and the inclusion of multiple viewpoints

- Multi-asset strategies are designed to offer a high level of diversification and also cushion the potential volatility that can come with single asset class investment strategies

- Alternative investment options are built based on new return sources and conservative processes that are risk-controlled

Who It’s Good for

Franklin Templeton is one of the leading mutual fund companies on this mutual fund comparison if you want a high degree of personalization and guidance based on extensive research and expertise.

Franklin Templeton offers some of the industry’s biggest funds, and this is also a best mutual fund company if you’re looking for a high level of sophistication regarding investment styles and diversification.

Franklin Templeton mutual funds also tend to be sought after by investors who want a certain level of established prestige in their portfolio.

Free Budgeting Software for AdvisoryHQ Readers - Get It Now!

Invesco Review

Headquartered in Atlanta, Invesco is a worldwide investment services and mutual fund company with regional offices in more than 20 countries. Invesco defines their approach as high-conviction, meaning they help clients go beyond the limitations of typical market benchmarks to achieve their desired objectives.

Invesco strives to create products that are created from investments that have particular features, including low volatility, quality, and strong fundamentals. Along with financial products such as mutual funds, Invesco also offers college savings plans and retirement plans.

Key Factors That Led to Our Ranking of This as One of the Top 10 Mutual Fund Companies

Invesco is included on this list of mutual fund companies ranked as the top 10 mutual fund companies for reasons cited below.

Options

Invesco is one of the top 10 mutual fund companies and is included in this mutual fund performance comparison for many reasons, including their selection. They feature actively-managed, domestic, international and global, fixed-income, and specialty mutual funds.

Clients can browse all funds or search options based on whether or not they’re classified as alternatives, equity, balanced, or fixed income funds.

Each of the mutual funds features a Morningstar rating and a simplified statement of the objective of the fund, such as long-term growth of capital and current income.

Available on the Invesco website is also a prospectus, fact sheet, and profile sheet for each mutual fund available from this best mutual fund company.

Performance

As with the other companies included on this list of mutual fund companies ranked as the best mutual fund companies, Invesco has many very high-performing funds.

Some of their top performers include:

- Invesco Floating Rate Fund

- Invesco Senior Loan Fund

- Invesco Balanced-Risk Commodity Strategy Fund

- Invesco All Cap Market Neutral Fund

- Invesco Global Targeted Returns Fund

- Invesco Long/Short Equity Fund

The performance of the mutual funds available from Invesco, a best mutual fund company, is based on the unique approach used by this firm.

At Invesco, portfolio managers select investments based on the fundamentals of a company and assessing financial strength, rather than only looking at the size of the company.

Who It’s Good for

Invesco is ideal for investors who are searching for a best mutual fund company offering a focus on diversification, as well as the signature high-conviction approach to investing.

What this means is that portfolio managers choose companies based on financial strength, high-quality fundamentals, and tools that will allow them to see exact exposure to various investment factors.

Invesco is also good if you heavily consider total assets, because of their size, and if you want a best mutual fund company that prides itself on taking a disciplined approach.

Related: Top Store Credit Cards | Ranking | Best Department Store & Retail Cards (Reviews)

Free Wealth Management for AdvisoryHQ Readers

Merrill Edge Review

Along with considering the largest mutual fund companies and the best mutual fund companies offering their own mutual funds, also taken into account for these mutual fund company rankings were platforms providing convenience and ease-of-use as well as low costs, and these are areas where Merrill Edge performs well.

Merrill Edge is an investment platform integrated with Bank of America banking, offering users access to a full selection of investment products, independent research, and tools that are designed to be user-friendly.

Key Factors That Led to Our Ranking of This as One of the Top 10 Mutual Fund Companies

Among the top mutual fund companies, Merrill Edge is part of this list of mutual fund companies for reasons detailed below.

Options

Clients of Merrill Edge, one of the best mutual fund companies and a leader in terms of mutual fund performance comparison options, offers unique ways to invest. One option available to clients is called Merrill Edge Select Funds. These are funds that are pre-screened by Merrill Lynch, and they are excellent for taking any uncertainty out of investing in mutual funds.

Also available from this leader among the mutual fund companies is something called Merrill Edge Select Portfolios.

With this option, investors can invest in managed portfolios that are diversified, pre-screened, and regularly adjusted by the Merrill Lynch professional team.

Merrill Edge prides itself on offering funds for any and all types of investors. This includes actively managed funds and options that are designed to be low-cost without load or transaction fees.

Performance

When a client invests with Merrill Edge, they have thousands of mutual fund options to choose from, available from popular fund families.

To help make the selection of high-performing mutual funds even easier, Merrill Edge offers sophisticated tools to help select funds.

Through the Merrill Edge screening process, clients are assured they’re finding top-quality, high-performing funds for self-directed investors.

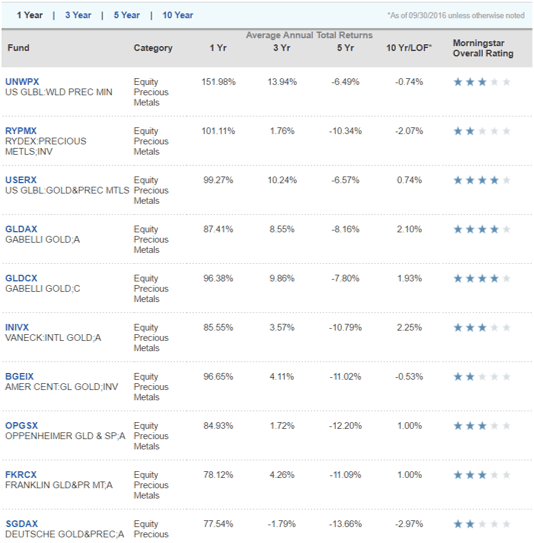

Merrill Edge also categorizes the top mutual fund performers they have available, and this list is regularly updated and is divided based on one-, three-, five- and 10-year returns.

Some of the current top-performing funds available from Merrill Edge, one of the largest mutual fund companies and one of the top 10 mutual fund companies, include:

- US Global World Precious Metals

- Franklin Gold and Precious Metals

- Oppenheimer Gold and Precious Metals

- Fidelity Advanced Semiconductors

- Fidelity Select Biotechnology

- T. Rowe Price Health Sciences

Who It’s Good for

Merrill Edge is one of the best mutual fund companies and was included on this list of mutual fund company rankings because it’s excellent for newer investors or people who want to be self-directed but also want the benefits that come with having access to carefully vetted, pre-screened mutual funds.

Merrill Edge is also one of the leaders on this list of mutual fund companies for investors who want constant convenience and accessibility.

Finally, this is ranked as one of the top 10 mutual fund companies in addition to being one of the biggest mutual fund companies because Merrill Edge features robust and comprehensive independent research and analysis, investor education, and excellent investor services whenever it may be needed.

Image Source: Merrill Edge

Free Money Management Software

PIMCO Review

PIMCO is a global investment firm that outlines its primary focus as preserving and enhancing the assets of clients. PIMCO offers investment management services for individuals, financial advisors, and institutions including corporations, central banks, universities, and more.

PIMCO has been approaching investing holistically for more than 40 years, and the company was originally founded in Newport Beach, California, in 1971. Since that time, PIMCO, named as one of our largest mutual fund companies and best mutual fund companies, has grown to include offices in 11 countries and a team of more than 2,200 experts.

Key Factors That Led to Our Ranking of This as One of the Top 10 Mutual Fund Companies

When creating a mutual fund performance comparison and reviewing the mutual fund companies, the following are particular reasons PIMCO is included on this list of mutual fund company rankings.

Options

PIMCO features 506 of its own mutual funds. This is in comparison to a name like Merrill Edge, which doesn’t offer its own mutual funds, but instead is one of the best mutual fund companies to source and invest in a wide variety of funds from different companies.

PIMCO’s selection of leading-edge mutual funds can be searched and broken down into categories including:

- Performance

- Price and yields

- Fund facts

- Morningstar rating

- Lipper rankings

The many mutual fund options available from PIMCO, one of the largest mutual fund companies on this mutual fund performance comparison, can also be filtered by solution. Solution-based offerings from PIMCO include:

- Access to global markets

- Asset allocation

- Capital appreciation

- Capital preservation

- Cash management

- Income

- Inflation projection

- Retirement

- Tax efficiency

Performance

PIMCO is known around the world for featuring high-performing mutual funds. There are two primary classifications clients can look at if their primary objective when selecting a mutual fund from PIMCO is performance.

The first would be to consider Morningstar Ratings.

Current well-rated mutual funds available from PIMCO, as named by Morningstar, include:

- All Asset All Authority Fund ranked for tactical allocation

- Dividend and Income Fund ranked as world allocation

- Emerging Local Bond Fund ranked by Morningstar in the emerging markets and local-currency bond category

- Emergency Markets Currency Fund from the Morningstar multicurrency category

- GNMA Fund from the intermediate government category

Who It’s Good for

PIMCO is an excellent and best mutual fund company for investors who want sophisticated solutions and mutual fund product options with a global focus. It’s also good for solutions-driven investors who want to choose mutual funds that meet specific objectives.

It’s one of the best mutual fund companies for investors who want a highly specialized, boutique approach to investing in mutual funds.

Finally, PIMCO is unique even from the other names on this list of mutual fund companies because of the high level of manager involvement. The managers are experts who focus on one mutual fund, and you can search for funds based on the name of the manager.

Don’t Miss: Top Low-Interest Credit Cards | Ranking | Low APR Credit Cards with Low-Interest Rates (Reviews)

Vanguard Review

Vanguard is a client-centric investment company that strives to put clients first in all that they do and with all the products they offer. Some of the things that set Vanguard apart and define them as one of the top mutual fund companies and best mutual fund companies include the fact that they have a long history that includes launching the first index mutual fund.

There are more than 14,000 experts who are part of the Vanguard team at locations around the world, and Vanguard serves the distinctive needs of more than 20 million clients, including individuals, participants in employer-sponsored retirement plans, financial advisors, and institutional advisors.

Key Factors That Led to Our Ranking of This as One of the Top 10 Mutual Fund Companies

When looking at a mutual fund performance comparison and ranking the largest mutual fund companies, the following are specifics of why Vanguard is included on this list of mutual fund company rankings.

Options

Vanguard, like the rest of the names on this list of mutual fund companies, features many different mutual fund choices, and the goal is ultimately to help clients maximize their money through low costs, superior fund management, and high-level service.

There are 127 total Vanguard funds, which can be divided by asset class.

In addition to these mutual fund options, Vanguard also features the Vanguard Select Funds. These are a list of mutual funds compiled by the Vanguard Portfolio Review Department.

The criteria used to review and rank the Select Funds includes:

- Total market index funds

- Diversification

- Size

- Longevity

The Portfolio Review Department then monitors all Vanguard Funds including the Select Funds and meets annually to re-evaluate the list.

Performance

According to Vanguard, 93% of their no-load mutual funds performed better in their peer group averages over the past years, and in general, Vanguard mutual funds tend to have a competitive, long-term performance history.

In addition to overall performance, Vanguard is included on this list of mutual fund companies because they are one of the best in terms of keeping costs low.

The average Vanguard no-load mutual fund expense ratio is 82% lower than the industry average, so not only are clients getting top-performing mutual funds, but less is being taken out for expenses.

Who It’s Good for

First and foremost, Vanguard is one of the best mutual fund companies for investors that are looking for a large selection of no-load and low-cost mutual funds.

Account service fees are waived when clients register for access to the Vanguard website and sign up to receive account documents electronically.

Also, only a limited number of Vanguard funds charge fees for buying and selling shares.

Vanguard mutual funds never charge front-end or back-end loads or other sales commissions, and clients have commission-free trading when they buy and sell Vanguard mutual funds.

Finally, Vanguard is one of the best mutual fund companies if you want low investment minimums. It starts at $1,000 for Vanguard STAR Funds and $3,000 for most other Vanguard funds.

Image Source: Vanguard

Conclusion — Top 10 Best Mutual Fund Companies

Mutual funds represent a unique opportunity for investors. They’re carefully selected groups of securities that provide automatic diversification and, in many cases, competitive returns and low costs.

Some of the features of the above best mutual fund companies and the largest mutual fund companies included on this list of mutual fund companies include:

- Ample mutual fund options with different goals and in a range of asset classes

- Many options for no-load and low-fee mutual funds

- Excellent reputations

- High-performing mutual funds

- Superior customer service

Some of the mutual fund companies on this mutual fund performance comparison and comparison of the biggest mutual fund companies include options not only for companies that offer their own mutual funds, but also options like E*TRADE, which serves as a trading platform for mutual funds from other companies.

Ultimately, the goal of this ranking of the best mutual fund companies and the biggest mutual fund companies is to provide investors with an overview of the best mutual fund investment companies and to serve as a guide to investing in mutual funds in general.

Popular Article: Top Points Credit Cards | Ranking | Best Credit Cards for Reward Points

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.