2017 RANKING & REVIEWS

TOP RANKING BEST MUTUAL FUNDS TO BUY

2017 Guide to the Top 5 Mutual Funds

Diversifying your portfolio can sound like a difficult endeavor to undertake. The reality is that it can be a challenge if you’re attempting to cherry-pick individual stocks and shares that you believe will do well in the coming days, months, or years.

Experts often recommend including some of the top 5 mutual funds into your investment strategy to help you easily diversify your holdings. While you can certainly find many mutual fund comparison tool options online, you should be able to quickly identify good mutual funds when you see them.

A mutual fund investment is a smart way to invest in items you may not be able to access on your own. That being said, it’s important to compare mutual funds before making a decision about your long-term investment commitments.

Award Emblem: Top 5 Best Mutual Funds to Buy

AdvisoryHQ knows just how overwhelming the investment market can be, so we’re here to help. Join us for an in-depth mutual fund comparison as we explore the best mutual funds to buy for the upcoming year. We’ll help you compare mutual fund performance, overall cost, and the type of investments available through each of these good mutual funds.

If you’ve been wanting to learn more about what it takes to select some of the top 5 mutual funds, you’ll find all of the information right at your fingertips in our reviews below.

AdvisoryHQ’s List of the Top 5 Best Mutual Funds to Buy

List is sorted alphabetically (click any of the fund names below to go directly to the detailed review section for that mutual fund):

- Fidelity® Balanced (FBALX)

- Fidelity® Contrafund® (FCNTX)

- Schwab® S&P 500 Index (SWPPX)

- T. Rowe Price Capital Opportunity Fund (PRCOX)

- Vanguard High Dividend Yield Index Fund (VHDYX)

Image Source: Pexels

Top 5 Best Mutual Funds to Buy | Brief Comparison & Ranking

Best Mutual Funds | Initial Investment | 5-Year Average Annual Return |

Fidelity® Balanced | $2,500 | 9.88% |

Fidelity® Contrafund® | $2,500 | 13.10% |

Schwab® S&P 500 Index | $100 | 14.34% |

T. Rowe Price Capital Opportunity Fund | $2,500 | 14.22% |

Vanguard High Dividend Yield Index Fund | $3,000 | 14.27% |

Table: Top 5 Mutual Funds | Above list is sorted alphabetically

Mutual Funds Definition

Investing in mutual funds is often discussed as a smart investing strategy to help diversify your portfolio beyond what you could do with individual stocks and bonds. However, most consumers are still left wondering exactly what the mutual fund definition is.

Quite simply, a mutual fund allows you to chip in toward the purchase of many different stocks and bonds that you may not be able to afford to purchase all on your own. With many investors coming together to make one large purchase, mutual fund investment creates a highly effective investment portfolio.

It’s important to note that, while your mutual fund may include stocks for various companies, you will not personally own those shares. You will only own shares of the good mutual funds that you opt to make a sizeable investment into.

When you’re beginning to compare mutual funds, you’ll notice that each one has a slightly different buy-in and maintenance rate. You are usually required to invest a larger sum of money upfront and then to maintain your shares with additional contributions each month. These specifics will vary based on the specifics of the top 5 mutual funds you’re considering.

Once you’re familiar with the mutual fund definition, you need to know how to go about investing in this type of portfolio.

They can usually be purchased in one of two ways: from the fund companies themselves or through a separate market.

Purchasing directly through the fund company is likely to be the most cost-effective solution. A mutual fund investment can sometimes have transaction fees when buying or selling. These costs are more prevalent when purchased through an additional market, similar to a brokerage.

If you already have a financial planner or broker for other investments, these individuals may be able to handle your mutual fund investment as well. They are trained to offer insight into the best mutual funds to buy, and they can handle the investment portion of things for you as well.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Best Mutual Funds to Buy

Below, please find the detailed review of each fund on our list of the top five mutual funds. We have highlighted some of the factors that allowed these good mutual funds to score so highly in our selection ranking.

Don’t Miss: Top Best Credit Cards | Ranking & Reviews

Fidelity® Balanced (FBALX) Review

With low expenses and high returns, the Fidelity® Balanced Fund is a top pick in a mutual fund comparison. According to its Morningstar rating, the FBALX mutual fund comes in with an overall four-star rating.

The objective is a critical component to examine when you compare mutual funds, and the Fidelity® Balanced Fund has one that appeals to most consumers and investors. It aims to gain income and capital growth through investing with a reasonable amount of risk. According to the statistics found in our mutual fund comparison, it seems to be achieving this end with only medium risk levels but high rates of return.

Perhaps even more important to mention in a mutual fund comparison is that this option comes with no transaction fees. When you compare mutual funds, though, it does have a high initial investment of $2,500.

Investment Strategy

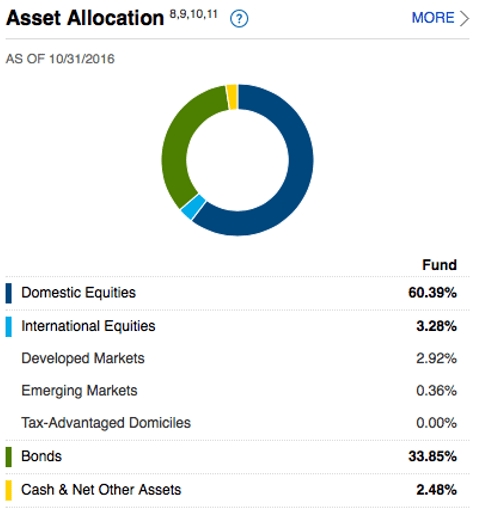

Most consumers want to know exactly where their money is going when doing a mutual fund comparison. In terms of the FBALX asset allocation, over 60% is invested in domestic equities. The next largest chunk (33.8%) is invested into bonds. Relatively small percentages are allocated toward international equities and cash or net other assets.

Image Source: Fidelity

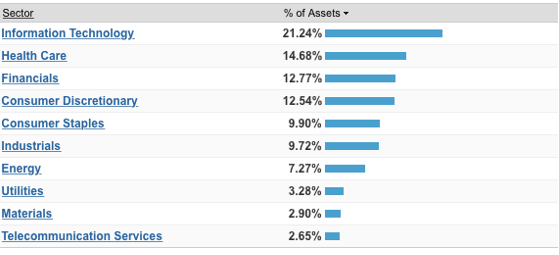

Within those broad categories, you can also see which of the major market sectors are most heavily represented in their mutual fund comparison. The top five sectors included in this portfolio are:

- Information technology

- Healthcare

- Financials

- Consumer discretionary

- Consumer staples

Performance

As of the end of 2016, this mutual fund had extremely positive average annual returns for their YTD daily returns all the way up to the 10-year mark. The YTD (daily) returns have an impressive 7.16% while the five-year returns are coming in even higher at 9.88%.

Looking further into the past, it has an average annual return of just 5.86%. This number is substantially lower than the returns at the five-year mark, but it is still a significant return on investment over such a lengthy period of time.

Related: Top Best Zero Interest Balance Transfer Credit Cards | Ranking | Interest Free Balance Transfer Cards

Fidelity® Contrafund® (FCNTX) Review

The Fidelity® Contrafund® comes with an average rate of return, low expenses, and a medium risk category. One of the top 5 mutual funds, the FCNTX does have a high Morningstar rating (four stars) and high average annual returns to back it up.

The aim on this mutual fund investment is simply to seek out capital appreciation. Growth stocks and value stocks are highly considered to play into their investment strategy toward this end. However, this isn’t all of the holdings worth mentioning when you compare mutual funds.

Another key feature to mention regarding this Fidelity® fund is that it does not have a transaction fee. It comes with a relatively high initial investment by some standards when you compare mutual funds ($2,500), but it is comprised of some very large-name stocks and does not require any additional investment on a monthly basis.

Investment Strategy

Focused on large growth, their top ten holdings comprise a total of 33.19% of the portfolio. These holdings are all relatively well-known to consumers and investors, making it easy to consider them part of a mutual fund comparison. Top holdings include shares of Facebook, Berkshire Hathaway, Amazon, Google, Apple, Visa, United Health, Microsoft, and Wells Fargo.

More than 90% of the holdings in one of the best mutual funds to buy such as this one are allocated toward domestic equities. The second largest allocation at just over 7% is invested in international equities.

Similar to the investment strategy available through the Fidelity® Balanced Fund, their major market sectors include:

- Information technology

- Consumer discretionary

- Financials

- Healthcare

- Industrials

Performance

When it comes to the performance piece of a mutual fund comparison, it’s important to note that the FCNTX comes in as one of the best mutual funds to buy. With a YTD (daily) average annual return of 4.81%, this large-growth fund has done well for itself.

When you look at longer periods of time, the trend continues:

Schwab® S&P 500 Index (SWPPX) Review

The Schwab® S&P 500 Index is easily one of the top 5 mutual funds that you should consider buying into for 2017. It has maintained high Morningstar ratings (not quite one of the 5 star mutual funds) over the last decade, with above average returns and below average risk levels.

The SWPPX is categorized as a large blend mutual fund, meaning that they typically represent the overall stock market. Because they tend to invest mostly in the domestic assets, their returns typically mirror the S&P 500® Index. This is critical to note when you compare mutual funds.

This is one of the best mutual funds to buy in part because of how easy it is for investors to gain access to it. Minimum initial investments begin at just $100 with subsequent investment opportunities available for just $1 increments. There are no transaction fees when purchased directly through Schwab®, which is important when you compare mutual funds.

Investment Strategy

Their investment strategy aims primarily to feature stocks from the S&P 500® Index that have good returns. Their top ten holdings all include large name companies that most investors would feel comfortable purchasing shares of (if they could afford them on their own):

- Apple

- Microsoft

- Exxon

- Amazon

- Johnson & Johnson

The sectors represented by their overall investment strategy shouldn’t come as a huge surprise to investors who are trying to compare mutual funds, either. They represent most of the more popular sectors included in the top 5 mutual funds. Their biggest investment sector is in information technology with the others displayed in the graph below.

Image Source: Schwab

Performance

The SWPPX fund has had a good run since its inception back in 1997. Over its lifetime, it has an average annual return of just under 7% (6.97%). Their most recent one-year return came in at 7.95%, while their five-year return was at 14.34%.

Over the course of the last decade, the average annual return was just slightly lower than the overall return since its inception. Average annual returns this high are a huge factor when we decided to include this in our ranking of the top 5 mutual funds.

Popular Article: Top Best First Credit Card for Young Adults, Teenagers, First-Timers & Beginners | Ranking and Comparison

T. Rowe Price Capital Opportunity Fund (Review PRCOX)

With a history of being one of the few 5 star mutual funds, the T. Rowe Price Capital Opportunity Fund has been demoted in the past year, but it is still one of the best mutual funds to buy. It aims for long-term capital growth through domestic stock investment.

This is one of the top 5 mutual funds with its 4-star Morningstar rating. In their three-year review, it had been granted the coveted 5-star rating, but since its inception, it has always maintained at least four stars.

We should point out in this mutual fund comparison that the PRCOX requires a sizeable initial investment (though not the largest out of our top 5 mutual funds). In order to open an account, you’ll need a $2,500 initial investment with $100 increments necessary for additional deposits.

Investment Strategy

When investing in mutual funds, you have to look at the major investment strategy. The major investment strategy included with the T. Rowe Price Capital Opportunity Fund is to invest most of its assets into the domestic stock market. To this end, they have 96.4% of the funds allocated into domestic stock with just 2.7% in foreign stock.

A common theme among the best mutual funds to buy (and a great mutual fund comparison tool) is their major market sectors considered for investments. The bulk of their investments are categorized as information technology (21.8%) with the next three categories falling close behind. Healthcare, financials and consumer discretionary sectors are all top considerations as well.

Their top ten holdings also closely resemble those of other funds included in our mutual fund comparison. They include the likes of Amazon, Apple, Facebook, Microsoft, Citigroup, and JPMorgan & Chase. Investing in mutual funds allows you to have access to stocks such as these without the hefty cost of purchasing them individually on your own.

Performance

When you need to compare mutual fund performance, the T. Rowe Price Capital Opportunity Fund has relatively high average annual returns:

Especially when you look at the mutual fund performance comparison for other best mutual funds to buy , their average annual return since inception is significantly higher. This is a large factor in what allowed us to include it in our mutual fund comparison of the top 5 mutual funds.

Vanguard High Dividend Yield Index Fund (VHDYX) Review

Another of the best mutual funds to buy that comes in just shy of 5 star-mutual funds is the Vanguard High Dividend Yield Index Fund. It actively seeks out stocks from a variety of sectors, primarily within the U.S. market, to find the largest dividends and returns. Best suited for investors looking to compare mutual funds with high volatility, the VHDYX fund is good for long-term investment strategies.

Another of the top 5 mutual funds that is categorized as a large value fund, the focus is primarily on investing in companies that promise the highest yields. It uses a passive management style to track performance and repeat the target index.

With a medium to high initial investment in a mutual fund comparison, the Vanguard High Dividend Yield Index Fund requires a $3,000 initial investment at minimum. There is no purchase fee, but for individuals who do not use their account as an education savings account or retirement savings account, there is a $20 annual account service fee.

Investment Strategy

Because the objective is to seek out shares of companies that promise the highest dividend yields, most of the investments made through VHDYX fund will be in domestic stocks. The major sectors represented through their portfolio include financials, industrials, consumer goods, healthcare, and oil and gas.

As a result, their ten largest holdings as of the end of November 2016 are representative of these major market sectors. This is part of what makes this one of the best mutual funds to buy. Their largest holdings are companies that consumers feel relatively confident in:

- Microsoft

- Exxon Mobil Corporation

- Johnson & Johnson

- JPMorgan Chase & Co.

- General Electric Co.

- Wells Fargo

- AT&T

- Proctor & Gamble

Performance

Is this really one of the best mutual funds to buy? The mutual fund performance comparison will to tell you fairly quickly. In the past year, the average annual returns were significantly higher than some of the other best mutual funds to buy. They came in at 12.42%, which is a substantial increase when you compare mutual fund performance.

Furthermore, their three-year annual returns were also large at 9.64%, and five-year returns came in at 14.27%.

Over the course of a full decade, it becomes easier to compare mutual fund performance with some of the top 5 mutual funds available. It comes in at 6.98%, a value that is the same as its average annual returns since its inception in just 2006.

Read More: Top Best Airline Credit Cards | Ranking | Best Airlines Miles Credit Cards (Reviews)

Free Wealth & Finance Software - Get Yours Now ►

Conclusion—Top 5 Best Mutual Funds to Buy

Savvy investors know that adding any of the top 5 mutual funds to your portfolio can increase your return on your investment. These diversified portfolios grant you access to stocks and shares you may not be able to otherwise obtain. However, it is critical to compare mutual funds to determine which are the best mutual funds to buy.

There is no simple answer about which are the best mutual funds to buy. The perfect addition to your investment portfolio depends on your desired risk factor and how much you expect to receive back on your initial investment. You can use some of these factors as a mutual fund comparison tool to see which lines up with your personal needs best.

Pay close attention to the mutual fund performance comparison, but bear in mind that past success cannot always determine future success when it comes to investments.

Which of the funds in our mutual fund comparison suits your portfolio the best? It’s time for you to add some of these good mutual funds to your investment portfolio.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.