2017 RANKING & REVIEWS

THE BEST PAYROLL CALCULATOR AND ONLINE PAYROLL CALCULATOR TOOLS

Finding the Best Payroll Calculators in 2017

There are a few primary reasons you might need to use a payroll calculator, also commonly referred to as a payroll tax calculator. You may be a small business owner who needs to calculate payroll taxes for your business.

An online payroll calculator can be a free, convenient way to calculate payroll taxes, and these payroll calculator tools will also show you the specifics of how to calculate payroll in many instances.

You may also need a free paycheck calculator or online payroll calculator if you have household employees, such as a nanny. A payroll calculator can be an excellent tool to ensure you’re withholding the proper amount of taxes and paying your household employees the correct way.

Award Emblem: Best Online Payroll Calculators

Sometimes employees may also use an online payroll calculator to see how much their take-home pay is with each check versus what they’re paying in payroll taxes.

So what is payroll? Learning how to calculate payroll is an important thing to do if you employ people, whether it’s one employee or fifty.

Payroll can refer to the distribution of paychecks and the maintenance of financial records for employees including their salary or wages, tax withholdings, bonuses, and things like sick time.

Payroll can also refer to the total earnings of all of your employees within a fiscal year.

When you use a payroll calculator, you’re probably in the midst of “doing payroll.” This just means you’re doing the accounting and taking the necessary steps to calculate payroll taxes, hours worked, or salary due, and you’re then writing and distributing checks.

This ranking and review of the best online payroll calculator and payroll tax calculator tools will highlight some of the best online options to calculate payroll taxes, and it will also feature more specifics on how to calculate payroll.

See Also: Top Low-Interest Credit Cards | Ranking | Low APR Credit Cards with Low Interest Rates (Reviews)

AdvisoryHQ’s List of Top 6 Best Payroll Calculator and Payroll Tax Calculator Tools

List is sorted alphabetically (click any of the calculator names below to go directly to the detailed review section for that payroll calculator):

- ADP Hourly Paycheck Calculator

- Bankrate Payroll Deductions Calculator

- Care.com Paycheck Calculator

- eSmart Free Calculator

- Self-Employment Tax Calculator

- SurePayroll Salary Paycheck Calculator

Image Source: Pixabay

Top 6 Best Online Payroll Calculator Tools | Brief Comparison & Ranking

Top Online Payroll Calculators | Used For | Key Inputs | Best For |

| ADP Hourly Paycheck Calculator | Hourly payroll | State and federal withholding General pay information | Employers with hourly employees |

| Bankrate Payroll Deductions Calculator | Comparing payroll deductions | Current and possible new paycheck allowances, withholdings, taxes, and deductions | Used by employees who want to compare deductions and how they impact their pay |

| Care.com Paycheck Calculator | Calculating nanny taxes | Care budget How much care needed Zip code | Employers hiring a nanny or another in-home employee, or employees who want to calculate their take-home pay |

| eSmart Free Calculator | This is a payroll tax calculator and net pay calculator | State and federal withholding Earnings and compensation Deductions | This payroll tax calculator can be used by employers and employees and can be used to then directly print checks and records |

| Self-Employment Tax Calculator | Self-employment tax calculations | Profits and wages CRP payments (if applicable) | Self-employed individuals, freelancers, and contractors are likely to find this useful |

| SurePayroll Salary Paycheck Calculator | Payroll calculations for salaried employees | Gross pay information Federal and state filing and allowance information Exemptions Deductions | Useful for employers of salaried workers, as well as salary employees |

Table: Top 6 Best Payroll Calculator and Payroll Tax Calculator Tools | Above list is sorted alphabetically

Detailed Overview of How to Calculate Payroll

Learning how to calculate payroll can be a challenge for many employers, which is why they often outsource payroll to a third-party firm or professional.

Along with hiring an accountant or someone who specializes in payroll, you can calculate payroll on your own using an online payroll calculator, or you might have a full-service software platform that helps you manage paying your employees.

While the steps required to calculate payroll taxes and pay employees can be complex and vary depending on the business and the employees, some of the basics of learning how to calculate payroll include the following:

- Employers set forth wages or a salary for each employee, and they determine a pay date, which usually ranges from weekly to once every two weeks.

- When an employer uses a payroll calculator, they begin by calculating the total pay for that period. This could include calculating hours worked or salary. Then, the employer has to calculate payroll taxes which include Social Security and Medicare, also called FICA taxes, and federal and state income taxes.

- In addition to taking the time to calculate payroll taxes, the employer may also have to manage and deduct other withholdings, such as health care contributions.

- After looking at wages or salary and withholdings, there are other steps that an employer must take when calculating payroll. They have to put the amounts they deducted from the employees’ checks aside so that they can then pay their taxes using that money.

What Are Payroll Taxes?

One of the most important aspects of learning how to calculate payroll is about calculating payroll taxes. A payroll tax calculator can help with this, but employers still need to have a firm understanding of what taxes they’re responsible for paying and how to withhold them from employee paychecks.

Payroll taxes, in simplest terms, are those taxes employers pay on the wages of their employees. These taxes go toward programs like Social Security and Medicare, and they make up one of the largest sources of revenue for the U.S.

While employers are ultimately responsible for making the payments of payroll taxes, employees are usually paying almost the entirety of the amount owed, since it’s withheld from their wages or salary.

Some of the specific withholdings that may be deducted as you calculate payroll taxes include:

- Federal Income Taxes: The amount withheld is based on the information provided on the employee’s W-4 as well as gross pay per pay period.

- FICA: As mentioned above, FICA refers to taxes that go toward Social Security and Medicare.

- Federal Unemployment Taxes: This amount isn’t withheld from a paycheck, but the employer pays this amount based on the gross pay of an employee.

Don’t Miss: Best Vehicle Finance Calculators | Guide | Finding the Best Vehicle Loan Calculators

What to Consider When Using a Payroll Calculator

Before you can start using an online payroll calculator or a free paycheck calculator, you need to have a payroll system set up. A payroll system can help you make sure you’re following all laws and regulations and that you avoid penalties from the IRS for doing things incorrectly.

Some of the things to consider when using a payroll calculator and setting up a payroll system include the following:

- You will need an Employer Identification Number, which you must apply for and be assigned by the IRS. This is the number you will use to report taxes, and it’s included in all your communication with the IRS.

- In addition to your EIN, you may also need IDs at the state or local level.

- Are the people who work for you considered employees or independent contractors? There are vast differences in how you would pay each group of workers, so ensure that you’re clear on the category into which the people working for you fall.

- Your employees will need to complete a W-4, which will help you make sure you withhold the right amount of taxes when you use a payroll calculator or calculate payroll taxes.

- You will need to have records and documentation outlining the specifics of how your employees are compensated. This is an important aspect of the steps required to calculate payroll taxes and calculating payroll in general. You’ll want to have a streamlined system for things such as calculating hours worked, overtime, and more.

- Once you have the above in place, and you start using a payroll calculator to pay employees, you should also keep detailed records of everything including W-2s, tax forms you’ve already filed, and information on all tax deposits you make.

- You’ll be required to report payroll taxes either quarterly or annually, and you can determine which is required of you by looking at the IRS guidelines for employers.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review—Top Ranking Best Online Payroll Calculator Tools

Below, please find the detailed review of each calculator on our list of the top tools for calculating payroll. We have highlighted some of the factors that allowed these payroll calculator tools to score so well in our selection ranking.

ADP Hourly Paycheck Calculator Review

ADP is a payroll services provider of cloud-based Human Capital Management platforms that streamline not only payroll but also HR, talent management, and benefits administration. ADP has more than 610,000 clients around the world and serves the needs of businesses of all sizes.

With a history spanning more than 60 years, ADP features not only innovative services and platforms but also a range of free tools, such as an online payroll calculator. Along with the payroll hours calculator featured on this ranking, other online payroll calculator tools from ADP include a gross pay calculator, salary paycheck calculator, and an employee stock option calculator.

Image Source: ADP

Key Factors That Led to Our Ranking of This as a Best Online Payroll Calculator

Among available payroll tax calculator and free paycheck calculator tools, the ADP Hourly Paycheck Calculator was ranked on this review for reasons listed below.

Features and Use

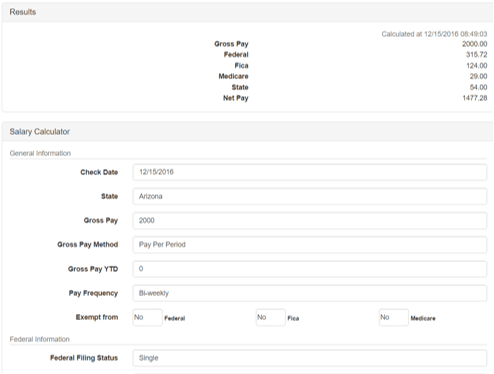

This payroll estimator and payroll hours calculator from ADP is, as the name implies, designed to calculate payroll taxes and amounts for hourly employees.

Some of the input information needed to use this payroll hours calculator and payroll estimator include:

- State

- Rates information

- Gross pay

- Gross pay method

- Gross pay YTD

- Pay frequency

- Exemptions (Federal, FICA, Medicare)

- Federal filing status, federal allowances, federal withholding

- Additional state withholding, state-elected percentage rate, state exemption

- Voluntary deductions

The results you get when using this payroll hours calculator include gross pay, federal withholdings, FICA and Medicare withholdings, state withholdings, and then a figure of net pay.

Benefits

The first benefit of this online payroll calculator and payroll hours calculator is that it’s specifically focused on hourly employees. This is important when selecting a free paycheck calculator because the withholding and calculations for an hourly employee are different than a salaried employee.

Another benefit of this payroll hours calculator and payroll check calculator is the ability to customize it based on state so that you can get a complete view of all withholdings at not just the federal but also the state and even the local levels.

This online payroll calculator also features the ability to include voluntary deductions, which can be customized, and you can print a complete report, which is ideal for maintaining payroll records conveniently.

Who It’s Good For

This online payroll calculator is versatile and is useful for anyone who has hourly employees. It’s also good if you have state taxes that need to be withheld, or if you need to include customized voluntary deductions.

It’s a relatively simple and straightforward version of an employee payroll calculator, the inputs are direct and easy to understand, and there’s a lot of flexibility that makes this a great payroll tax calculator for any business with employees paid by the hour.

It should be noted, however, that while this is a good basic, free paycheck calculator, it doesn’t include detailed reporting. It only includes the basics of gross pay, withholdings, and net pay.

If you’re looking for a payroll hours calculator or payroll estimator with more detailed reporting, there are other options on this ranking of the best payroll calculator tools.

Related: Best Auto Loan Payoff Calculator | Guide | How to Find & Use the Best Car Loan Payoff Calculators

Bankrate Payroll Deductions Calculator Review

Bankrate is an online resource that features breaking news and original content on financial topics related to mortgages, refinancing, bank rates, credit cards, personal loans, and auto loans. Bankrate makes it easy to search for various financial products and find current rates on those products, and in addition to rates and content, Bankrate also features useful calculator tools.

Along with personal finance calculators, Bankrate features payroll calculator and payroll tax calculator options, including the Payroll Deductions Calculator.

Key Factors That Led to Our Ranking of This as a Best Online Payroll Calculator

Features and benefits of the Payroll Deductions Calculator that led to its ranking on this list of the best payroll check calculator options are detailed below.

Features and Use

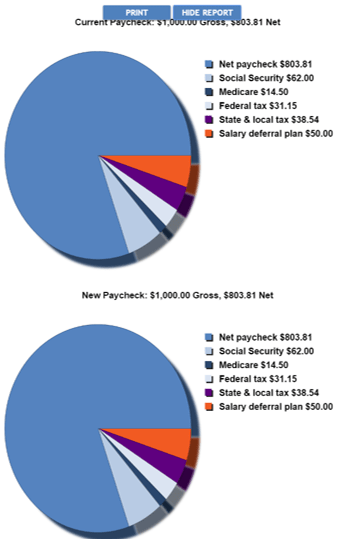

The Bankrate online payroll calculator and payroll estimator is unique from many of the other payroll calculator tools on this ranking because it can be used by employees or employers.

In fact, the primary objective of this free paycheck calculator is to help employees enter their current payroll information and their deductions, and then compare them to other possible deductions.

This payroll check calculator and employee payroll calculator will then show the user how changing their withholdings or even their filing status or retirement savings could impact their take-home pay.

Some of the input information required with this employee payroll calculator includes:

- Year-to-date income

- Pay period

- Filing status

- Gross pay

- Number of allowances

- Retirement plan withholding

- State and local taxes

- Pre and post-tax deductions and post-tax reimbursements

- New paycheck information

The results include a breakdown of your new paycheck including your gross and net pay, as well as a number representing how much more or less your new paycheck would be.

Benefits

The first big benefit of this employee payroll calculator and payroll check calculator is that it is unique from the other names on this ranking because employees can use it. It is a payroll calculator that can show users the optimal deductions to include on their paycheck if they want to increase their take-home pay.

This employee payroll calculator is also excellent because it features some of the most detailed reporting available with any payroll calculators.

Users can not only see how their deductions impact their net and gross pay, but there are also pie charts that break down how much the employee is paying in:

- Social Security

- Medicare

- Federal taxes

- State and local taxes

- Salary deferral plans

The detailed reporting option also breaks down a table summary of current earnings and other information, new earnings, and the difference.

Image Source: Bankrate

Who It’s Good For

This employee payroll calculator is versatile and good for use by employees to see how they could raise their amount of take-home pay by changing their deductions.

This free paycheck calculator can also be used by employers if they want detailed reporting showing them the amount of taxes that are being withheld from each of their employees’ paychecks.

It’s an all-around excellent online payroll calculator for detailed reporting, and the reports can be printed conveniently as well and maintained for records.

Care.com Nanny Tax Review

Care.com is an online resource that connects people with employees and contractors for household and family-related jobs. For example, users can log onto Care.com and find childcare employees including babysitters and nannies, as well as senior care, pet care, and housekeeping employees. It can also be used as a job portal for employees looking for families who need help.

As well as being a link between employers and employees, Care.com also offers easy ways for people to pay their employees or to get paid, and along with that comes their HomePay Nanny Tax Calculator.

Key Factors That Led to Our Ranking of This as a Best Free Paycheck Calculator

Some of the reasons this free paycheck calculator is included in this ranking of the best online payroll calculator options are detailed below.

Features and Use

The Nanny Tax Calculator is designed to help employers estimate how much they will spend in payroll costs, nanny taxes, and what their potential tax breaks would be for hiring a nanny.

To begin, users enter their care budget per week, month or year. For example, a user could enter $500 per week or $25,000 per year that they are able to spend on their nanny’s pay.

Then, the user enters how many hours per week of care they need, how many children need care, and their zip code. There is also a category that asks whether the employer has a Flexible Spending Account, which is offered by some employees as a way to help them pay for the costs of childcare.

The results then show the gross pay the nanny would receive, as well as taxes that would be paid and the take-home pay of the nanny or caregiver.

Benefits

Often families don’t realize they need to withhold payroll taxes from the paycheck of their nanny or the employees that work in their home, or they may not understand just how much of their nanny’s paycheck may go to payroll taxes.

This is a simple, easy-to-use calculator that not only helps families calculate payroll taxes for their nanny or household employees, but it can help them decide on a budget that they’re able to pay those employees. It’s also beneficial because it shows potential tax breaks and allows for the factoring in of a Flexible Spending Account.

This is also a good free paycheck calculator because it breaks down the hourly pay of the employee.

Who It’s Good For

It was important to include an online payroll calculator on this ranking that wasn’t just for small businesses but could be used by individuals who employ people in their home, and this is an excellent option.

It’s good not just for people who have nannies or caregivers, but anyone who has employees who work in their home.

This free paycheck calculator can be used to calculate payroll taxes by the employer and can also be used for nannies and other types of domestic employees to see how much they will be making before taking a position.

Image Source: Care.com

Popular Article: Which Is the Best Mortgage Calculator? Zillow? Bankrate? SmartAsset? | Calculators with PMI, Taxes & Insurance

eSmart Free Calculator Review

eSmart is an online payroll and paycheck management system. With eSmart Online Payroll Management, users get access to a system that makes it fast and easy to management payroll. There are features including the ability to create and print paychecks and paystubs, automatically calculate payroll taxes, and generate IRS and state payroll forms.

In addition, eSmart features a free paycheck calculator that can be used to also save paychecks, calculate payroll taxes, and manage payroll.

Key Factors That Led to Our Ranking of This as a Best Free Paycheck Calculator

The eSmart Free Paycheck Calculator includes the following features and benefits, listed below.

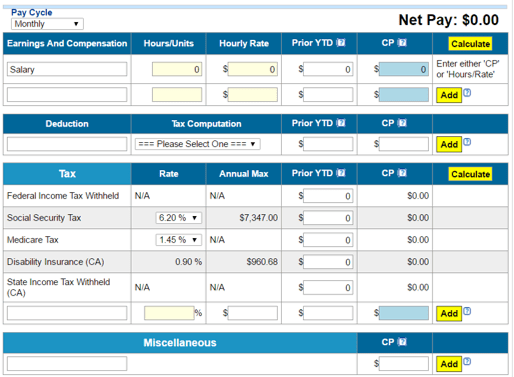

Features and Use

This free paycheck calculator is designed to calculate payroll taxes and net pay in a way that’s fast and convenient, as well as flexible.

This payroll calculator online tool features the ability to calculate both federal and state tax withholding for paychecks.

It can be used for hourly, monthly, or annual pay rates, and it can also incorporate bonuses and other earnings.

Some of the inputs that can be included with this payroll calculator online include:

- Federal withholding information

- State withholding information

- Pay cycle

- Earnings and compensation

- Deductions

The results calculation then includes a figure of net pay as well as other relevant information.

Benefits

This payroll check calculator is a useful tool because it’s flexible enough for hourly and salaried employees, and it also features options for special deductions. It can be used with public employees or exempt employees, and the year-to-previous period feature helps users ensure their calculations are accurate.

This free paycheck calculator can also be used to compute and prepare paychecks, and pay stubs can be printed with detailed summaries. Paychecks can also be printed on blank check stocks by registering.

There is also the option to print a PDF copy of results, which is excellent for recordkeeping.

Another benefit of this comprehensive payroll check calculator is that it can help you learn the details of how to calculate payroll because each of the input values has detailed explanations.

Who It’s Good For

The free paycheck calculator and payroll tax calculator from eSmart can be used by employers in any state, regardless of the type of employees they have. It can also be used for public employees and exempt employees.

Along with offering the ability for employers to use this payroll tax calculator and payroll estimator, it can also be used by employees who want to compare their net pay with differences in allowances, marital status, or income levels.

Image Source: eSmart

Self-Employment Tax Calculator Review

Important in the creation of this ranking of the best online payroll calculator, payroll tax calculator, and payroll hours calculator tools was the inclusion of diverse calculators, each with their own objectives and features. That’s why the Self-Employment Tax Calculator from Free-Online-Calculator-Use.com was included.

Free-Online-Calculator-Use.com is a website featuring one of the biggest selections of calculators for everything from health to taxes to personal finance. It’s not just a good site for finding tools, but also information and guides.

Key Factors That Led to Our Ranking of This as a Top Payroll Tax Calculator

Among payroll calculators and tools used to learn how to calculate payroll, the following are reasons the Self-Employment Tax Calculator is on this review and ranking.

Features and Uses

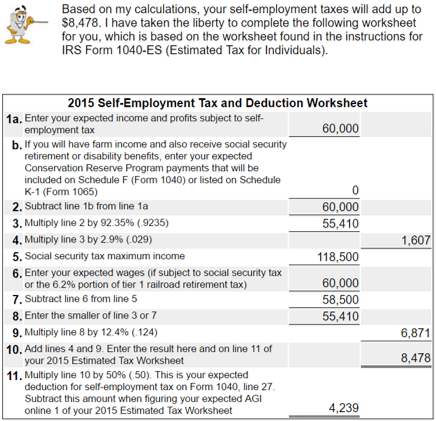

When someone is self-employed, they’re responsible for paying the entirety of their Medicare and Social Security. It refers to matching the amount you pay as your own employer, to the amount you would pay as your employee.

Anyone who earns more than $400 a year from a business needs to pay self-employment taxes on the profits generated by that business.

With this free payroll tax calculator and payroll estimator, users begin by entering their expected profits that would be subject to self-employment taxes. They can then enter the Conservation Reserve Program payments they have if applicable, and any wages they expect to receive.

Benefits

First and foremost, this payroll tax calculator is ranked among the best payroll calculators because it specifically focuses on self-employment taxes, which is a gray area for many people that can lead to penalties and interest being charged by the IRS.

This payroll estimator is also excellent among payroll calculators because of the level of in-depth explanations offered throughout. There are detailed written instructions for completing the input fields that are part of this payroll tax calculator, and also a comprehensive glossary of terms with information pertinent to self-employed individuals.

Once you calculate your results using this payroll estimator and payroll tax calculator, you get a Self-Employment Tax and Deduction Worksheet, which is based on the worksheet for the IRS Form 1040-ES.

This makes it extremely easy to file your taxes when the time comes, plus you’ll know what you owe and any possible deductions you may be eligible for.

Image Source: Free-Online-Calculator-Use.com

Who It’s Good For

This payroll tax calculator is excellent for anyone who is self-employed with their own business. It’s also great for people who work as freelancers or contractors.

If you’re new to understanding how to pay your self-employment taxes, this is one of the most helpful, in-depth resources you’re going to find, with detailed explanations that are useful for everyone from newly self-employed people or contractors, to long-time self-employed individuals.

There is also a chart included with current self-employment tax rates.

Read More: The Best UK Mortgage Payment Calculators | Lloyds vs. TSB vs. Tesco vs. Woolwich

Free Wealth & Finance Software - Get Yours Now ►

SurePayroll Salary Paycheck Calculator Review

SurePayroll is a company that provides automated payroll services to businesses regardless of number of employees, payroll frequency or payroll type. As well as the payroll services offered by SurePayroll, the company also features resources on payroll rules and regulations by state, original articles, a payroll blog, and calculators.

For this review and ranking of the leading payroll calculators, the Salary Paycheck Calculator is included, and it’s the only salary-specific calculator on this ranking of the leading payroll check calculator options and payroll calculator online tools.

Key Factors That Led to Our Ranking of This as a Best Tool for Calculating Payroll

Among payroll calculator online tools and options for calculating payroll, the below list highlights some of the reasons this is one of the best options.

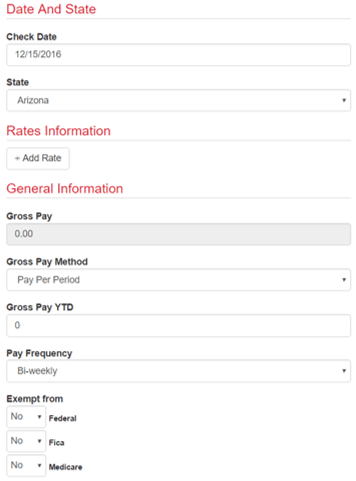

Features and Uses

A salaried employee is someone who gets paid a particular way, and classifying employees correctly is an important part of ensuring you’re following relevant employment laws. A salaried employee is paid based on an annual amount.

Rather than being paid based on an hourly wage, the person’s salary is divided between pay periods, based on 2080 hours in a year. Many salaried employees receive a contract outlining the details of their employment.

With the salary calculator, one of the best tools for calculating payroll of salaried employees, users enter the following information:

- State

- Gross pay and gross pay method

- Gross pay YTD

- Pay frequency

- Exemptions

- Federal filing status and allowances

- Federal withholding

- State withholding

- Deductions

Then the calculations break down gross pay, taxes paid, and net pay for the salaried employee.

Benefits

The main advantage of this tool for calculating payroll is that it’s specifically geared toward salaried employees, rather than hourly wage employees.

It’s also very easy to use and gives a simple but accurate estimate of gross pay, federal withholding, FICA withholding, Medicare, state withholding, and net pay.

It’s also good that this payroll estimator includes the option to factor individual state and local taxes into the results, and a report of the results can be printed with the click of a button.

Who It’s Good For

Of course, this payroll calculator and payroll estimator is great for employers with salaried employees, but it can also be good for the employees themselves.

It is a good way for employees who receive a salary to gain more insight into their pay, experiment with possible deductions, and see how much they’re receiving in pre-tax pay.

This calculator is also good for looking at the impact possible raises could have, differences in 401(k) contributions, changes in premium deductions, and more.

Image Source: SurePayroll

Conclusion—Top 6 Best Payroll Calculators

The following is a summary of the key features and uses of the payroll calculators and online payroll calculator tools included in this ranking:

- ADP Hourly Paycheck Calculator: This is a free paycheck calculator specifically designed to be a payroll hours calculator for employees who are paid by the hour. It’s versatile and easy to use.

- Bankrate Payroll Deductions Calculator: This employee payroll calculator is designed as a way to experiment with deductions and see how to increase take-home pay. It’s for employees, more so than employers.

- Care.com Paycheck Calculator: From a leading resource for in-home employees, this online payroll calculator is excellent for calculating payroll taxes for nannies and other domestic employees.

- eSmart Free Calculator: This is one of the most in-depth overall free paycheck calculators on this ranking. It offers extensive input and reporting for a variety of employees and situations.

- Self-Employment Tax Calculator: This payroll tax calculator is excellent not only for people who own their own businesses but for freelancers and contractors.

- SurePayroll Salary Paycheck Calculator: This straightforward tool for calculating payroll is specifically for salaried employees, as opposed to hourly wage earners.

Related: Top Best Unsecured Credit Cards for Bad & Poor Credit with No Deposit| Ranking & Comparison Reviews

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.