Guide to the Best Vehicle Loan & Finance Calculators

Purchasing a new car can mean incurring a new monthly payment that you’ll need to fit neatly into your existing budget. How can you make sure you can afford that shiny new (or maybe new-to-you) car that you’ve had your eye on?

A vehicle finance calculator can help you assess exactly how much car you can comfortably afford by projecting the monthly payment you can expect.

Image Source: Vehicle Loan Calculator

Of course, a good vehicle loan calculator has other functions that you might find useful as well. Many of these vehicle finance calculators can include a vehicle repayment calculator for making extra payments, an affordability calculator, and an interest calculator.

It all depends on what you need to figure out, but we’re positive there’s a vehicle repayment calculator out there to suit all of your needs.

AdvisoryHQ wants to set you up on the path to success with your next auto loan and car purchase. Our comprehensive guide to finding the best vehicle finance calculators will certainly give you a greater sense of confidence when it comes to your financial future.

See Also: Which Is the Best UK Mortgage Calculator? BBC? Halifax? Barclays? Nationwide?

What Can You Afford?

Before you get too far along the road to purchasing a new car, you should know what the maximum amount of money you can comfortably spend would be. At this point, we assume that you already have a detailed monthly budget to assess where your cash flow is headed and to see what remains at the end of the month.

What you can comfortably afford depends greatly on the rest of your finances. You can calculate vehicle payment options all day long, but if you don’t know what you can afford, it won’t be of any use to you.

Depending on your income and your current amount of debt and expenditures, most experts would recommend spending no more than ten to twenty percent of your take-home pay on a car payment.

Remaining closer to the ten percent standard for a car payment, you can have more left over at the end of the month for a savings fund, emergencies or extra cash for going out to eat or taking a vacation. There’s a lot to be said for having some discretionary income left when your bills are paid for the month.

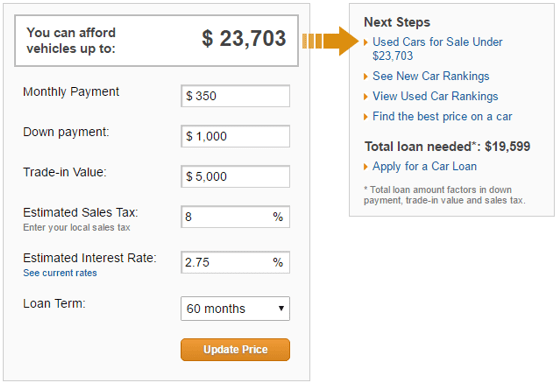

Image Source: Vehicle Finance Calculator

Once you figure out what this number translates to for you or your family, it’s time to take a closer look at how much the overall vehicle should cost. This is where a vehicle price calculator can come in handy. Many of the best vehicle finance calculators are designed to help you determine affordability as well as just being a vehicle loan calculator.

In this vehicle loan calculator from US News & World Report, you can enter your desired monthly payment to find a projected car value. You need very little information to make good use of its vehicle finance calculator for affordability.

All you’ll need to know is your desired monthly payment, your down payment amount and trade-in value, estimated local sales tax, an interest rate, and your desired loan term.

With all of that information handy, its vehicle price calculator comes up with a grand total of the maximum amount of car you can afford. It will even link you to used cars for sale under that amount, rankings for various new and used cars, and tell you the total loan amount that you need (after factoring in your down payment, trade-in value, and sales tax).

Don’t Miss: Tips for Finding the Top Amortization Calculators & Schedules | Guide to Loan Amortization

Paying off Your Loan Early

Not everyone wants to maximize the full length of their loan term, especially when a term can last for more than five years.

Opting to pay off your auto loan early gives you a sense of financial freedom, and it can save you a ton of money on interest. How much would you need to pay extra and how often would you need to make payments to end your loan a year early? Two years early?

A good vehicle repayment calculator can assist you with figuring out what you would need to pay and do in order to end your auto loan on your terms.

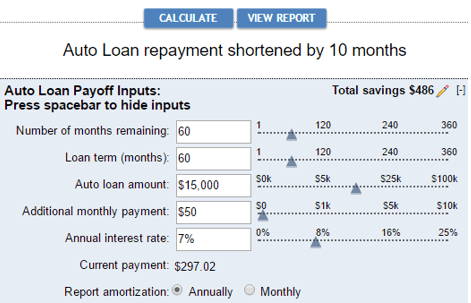

Bankrate offers a vehicle repayment calculator that allows for input on additional monthly payments. You only need a few basic pieces of information in order to make use of its vehicle repayment calculator:

- Original loan term and the months remaining

- Auto loan amount (your original principal)

- Current annual interest rate

- Additional monthly payment

Do you have an extra $50 leftover at the end of every month that you want to consistently contribute toward your auto loan?

Bankrate’s vehicle repayment calculator makes it easy to see how quickly you would pay off your loan as well as how much you would save. For example, on a $15,000 auto loan with a sixty-month term and equal time remaining at seven percent interest, a $50 additional monthly payment would shorten the loan by ten months and save close to $500.

Image Source: Vehicle Loan Calculator

Utilizing a vehicle repayment calculator, such as this one by Bankrate, does make it difficult if you were hoping to see exactly what you would need to pay to end your loan sooner by a specific amount of time.

Bankrate’s vehicle loan payment calculator is best used for individuals who don’t mind spending some time playing with the numbers or who know exactly how much extra they would like to contribute each month. In this scenario, the Bankrate vehicle price calculator allows you to very quickly and easily assess how much sooner you could end your loan term.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Find a Vehicle Interest Calculator

Knowing your interest rate is a critical piece of the puzzle when you’re making good use of vehicle finance calculators. However, if you haven’t signed on the dotted line for an auto loan yet, how do you know what the interest rate will be? You don’t want to make random guesses because it can seriously affect the results of a vehicle monthly payment calculator. It may mean the difference between being able to afford a car and risking a future default on the loan.

The good news is that many of the available vehicle finance calculators can also double as a vehicle interest calculator.

With basic data regarding the type of car loan that you’re interested in, a vehicle interest calculator can match you with potential lenders so you can view their current best interest rates. A great example of a vehicle loan calculator that provides this option is the APR calculator available from Kelley Blue Book or the vehicle monthly payment calculator from Bankrate.

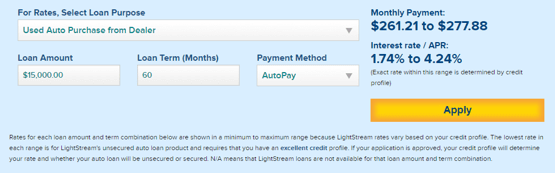

Kelley Blue Book

You need to detail where you’re purchasing the car, your loan amount, estimated loan term, and your payment method (autopay or invoice) for the vehicle loan payment calculator to work.

It provides you with a range of what you could pay per month as well as a range of interest rates. The rates, provided by Lightstream financing, are subject to your creditworthiness, with lower rates corresponding to higher credit scores.

This vehicle payment calculator is a top choice because it does account for the fact that not all users will have stellar credit. Instead of giving you a neatly summed up answer, it forces you to consider the implications of having a lower credit score and a higher interest rate.

In many cases, the range between the low interest rate and high interest rate will not heavily affect your monthly payment. However, it is better to find out prior to your purchase via a vehicle payment calculator rather than on an invoice in the mail after the fact.

Image Source: Vehicle Repayment Calculator

Bankrate

Bankrate also offers a separate vehicle monthly payment calculator that pulls the best local rates for your area. After you input the basic information into its vehicle finance calculator, it will pull up several lenders that give you a variety of rates. It allows you to learn more about various lenders that could be of assistance to you and where their rates fall in comparison to one another.

This is an advantage over the Kelley Blue Book vehicle finance calculator because the KBB version only looks at a range of rates provided by one lender. If you do not qualify for an auto loan through Lightstream or you prefer the terms and conditions of a different lender, it does not allow you to make comparisons.

Related: Best Credit Cards for College Students| Ranking | Best College Student Credit Cards

Count the Cost

An area where many of the vehicle finance calculators fall short is in helping you to count the initial cost of purchasing a new car for yourself.

A vehicle monthly payment calculator can assist you in deciding whether that new automobile will fit comfortably into your budget, but it doesn’t tell you whether you have enough in savings to afford the car when you first walk into the dealership. In order to use these vehicle price calculator options more effectively, we’ve put together a list of costs you should consider first:

- Trade-in value: The car you have, even if it is a rusty old clunker, probably holds some kind of value. Whether you choose to sell it privately, sell it for scrap or trade it in at the dealership, it’s critical to know what your car is worth. In addition to a vehicle loan calculator, Kelley Blue Book has long been a trusted source for figuring out the current value of your vehicle. You can see the different amounts you might be able to command based on the different selling scenarios and the condition of your car.

- Down payment: The larger your down payment is, the less money you will need to borrow when you take out an auto loan. Along that same vein, that also means that a vehicle loan payment calculator could produce a much lower number with a few thousand dollars extra knocked off your principal. If you have the capability of scraping together some more money from your savings to contribute toward the initial purchase, it may be beneficial for you in the long run. If you plan to purchase a new model, experts recommend putting down at least twenty percent of the vehicle value to avoid owing more than the car is worth.

- Taxes and tags: No matter where you purchase your car, there are certain to be a few miscellaneous fees that a vehicle loan calculator won’t be able to account for. Paying for these extra fees, plus your taxes and tags, can really add up. Will you have enough to cover them? The vehicle loan calculator from US News & World Report gives you some idea of the cost by accounting for sales tax.

Purchasing a car, whether it’s new or used, comes with a host of costs that aren’t always accounted for. Even the most thorough vehicle finance calculators can’t account for some of these, especially as the cost for taxes and tags can vary from location to location.

The miscellaneous fees and potential upgrades or service plans offered by dealerships would be hard to include in a vehicle repayment calculator as well. Consumer Reports advises that these items can account for an additional ten percent toward the upfront cost of purchasing a vehicle.

Make sure that you save up enough money to cover the cost of these items before the need arises. It may mean purchasing a less expensive car or trying to calculate vehicle payment choices based off of a lower down payment amount. Whatever you need to do, you should be aware of the additional costs and arrive at the dealership or sale financially prepared.

Popular Article: How to Find the Best Personal Loan Calculator to Calculate Payments & Interest (USA)

Owing on a Trade-in

You already own a car, but it’s time to upgrade to a newer model. What happens if you still owe on your current vehicle? The good news is that there are vehicle finance calculators that can accommodate the possibility that you may not be free and clear on your current car.

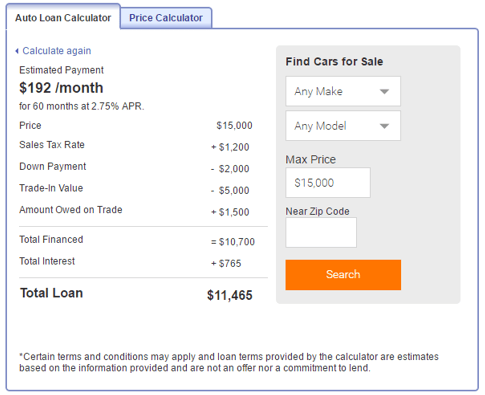

This vehicle payment calculator from Autotrader allows you to input all of your basic information (interest rate, purchase price, sales tax, and down payment amount) along with a couple of additional features we feel are worth mentioning.

It has a separate line item for the trade-in value of your current car, closely followed by a question regarding how much is still owed on that trade.

Image Source: Vehicle Payment Calculator

If you needed to get a realistic idea of how your current debt is going to affect your vehicle loan payment calculator, this option gives you a clearer picture.

Its vehicle loan calculator takes your full financial picture into account in order to give you a total loan amount comprised of the amount you will need to finance and the total amount of interest you will owe over the course of the loan.

Arguably, you could calculate this roughly on your own without its vehicle finance calculator. All you would need to do is add the extra value of what you owe on your current loan to the total amount you need to finance.

You could also find the difference between what the trade-in value on your current car is and what you owe on it still. That would be the overall trade-in value you can expect to count towards the credit on your vehicle financing.

Conclusion

Vehicle finance calculators can be wonderful tools to help you determine what you can comfortably afford when it comes time to purchase a new vehicle.

You can calculate anything from how much car you can afford to a rough estimate for your interest rate with the right vehicle repayment calculator. A vehicle repayment calculator can even be used to help you pay off your auto loan early.

Making the most of the available tools sets you up for peace of mind and future financial success. A vehicle price calculator forces you to take a closer look at your monthly budget and the overall value of the car you can afford.

Without utilizing a vehicle finance calculator, it can be difficult to accurately determine what kind of car or how much car you can truly afford and to calculate vehicle payment options.

Take your time to explore several vehicle finance calculators with this list of some of the top choices for a vehicle loan calculator. We’re confident that using these vehicle finance calculators will help to set you up for success when you purchase your next car.

Read More: The Best Retirement Calculators | Guide | Top Retirement Savings & Income Calculator

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.