2017 RANKING & REVIEWS

BEST UK TAX CALCULATORS & UK MORTGAGE CALCULATORS

Easily Calculate Your Finances with a UK Income Tax Calculator or UK Loan Calculator

Keeping track of your finances is not always easy to do on your own. Sometimes, the use of a free online calculator gives you just the right amount of help to balance and control your finances.

Income tax in the UK can be tricky to calculate. If you recently experienced a change in income, and you are planning for your next home, a UK tax calculator or UK loan calculator can help you significantly. With these tools, you can calculate the gross wage you need to afford the home of your dreams.

Award Emblem: Top 6 Best UK Tax, Income & Mortgage Calculators

Fortunately, all it takes is a few minutes of time to input your information into a loan repayment UK calculator or income tax UK calculator to calculate potential mortgage payments or tax in the UK.

This ranking guide features the six best UK salary tax calculators and UK loan calculator options, all free to use online. They are easy to understand and, when used together, you can easily calculate income tax in the UK to help you plan your budget according to your take-home wages and mortgage.

See Also: Best Luxury Credit Cards | Reviews | Top Exclusive Credit Cards

AdvisoryHQ’s List of the Top 6 Best UK Income Tax Calculators, UK Mortgage Calculators, and UK Pay Calculators

List is sorted alphabetically (click any of the calculator names below to go directly to the detailed review section for that calculator):

Top 6 Best UK Tax Calculators, Mortgage Calculators, and Pay Calculators | Brief Comparison & Ranking

Calculator Names | Minimal or Detailed | Has Visuals | Allows Comparisons |

Calculator.net | Detailed | Yes | No |

Listen to Taxman | Minimal | No | Yes |

Money Saving Expert | Can be both | No | Yes |

Money SuperMarket | Minimal | No | No |

Nationwide | Minimal | No | Yes |

UK Tax Calculators | Can be both | Yes | Yes |

Table: Top 6 Best UK Tax Calculators, Mortgage Calculators, and UK Pay Calculators | Above list is sorted alphabetically

How Can You Use a UK Income Tax Calculator, Wage Calculator, or UK Mortgage Calculator to Your Advantage?

The reason that we are combining the best UK tax calculators with the best UK loan calculators is because tax in the UK directly affects your wages, which affects the mortgage you can afford.

Image Source: Kiplinger

By using a UK wage calculator to calculate your income tax in the UK, you can find your take-home pay. From this point, you can turn to a UK loan calculator to calculate your potential mortgage options. Both types of calculators work together to help you create a budget for your future home.

Start with using a UK pay calculator that we list in this ranking. They will take into consideration your current wages and tax in the UK and give you results that detail your tax amount and take-home pay.

Then, find the loan repayment UK calculator from this ranking that benefits you the most. Use information from a few mortgages that you are considering, taking into account your take-home pay and other financial responsibilities. Use the free UK mortgage calculator to find the perfect, affordable mortgage for you.

The best way to for budget for your mortgage is to remember the 25% plan. To ensure that you give yourself enough wiggle room each month, figure out 25% of the take-home pay you calculated with the UK income tax calculator.

This amount is what you should strive to stay under for your mortgage, property taxes, and home insurance costs combined. A loan repayment UK calculator will help you determine what amount of house you can afford based on this plan.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review—Top-Ranking Best UK Tax Calculators, Mortgage Calculators, and UK Wage Calculators

Below, please find a detailed review of each calculator on our list of UK salary tax calculators and UK loan calculators. We have highlighted some of the factors that allowed these income tax UK calculators and loan repayment UK calculators to score so high in our selection ranking.

Don’t Miss: Tips for Finding the Top Amortization Calculators & Schedules | Guide to Loan Amortization

Calculator.net Review

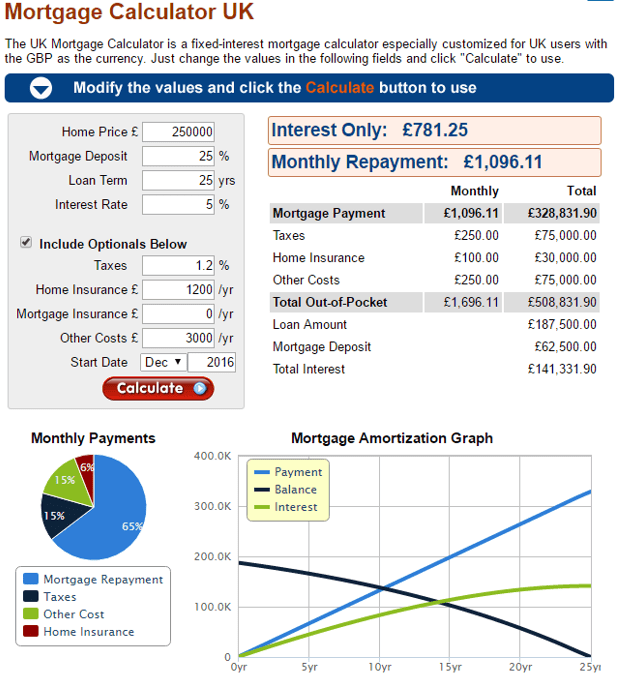

The Calculator.net Mortgage Calculator UK is one of several calculators offered on the website. This UK loan calculator is perfect for calculating monthly payments on the mortgage loans you are considering.

Image Source: Calculator.net

The UK mortgage calculator uses the amount of the loan, loan term, interest rate, and down payment to calculate your costs. You can also choose to add in optional information, like taxes and home insurance costs, for a more accurate result.

How Is This Calculator Different?

This calculator can be used as both a UK tax calculator and mortgage calculator. When you add your tax percentage, the UK tax calculator will show you how much you will pay each month, and in total, in property taxes. You will also see the same information from the UK mortgage calculator for home insurance and mortgage payment.

This calculator also provides an amortization graph as a visual of your balance versus interest and payment through the life of your loan. This is one of the simplest UK loan calculators to use, yet it provides an excellent, accurate result.

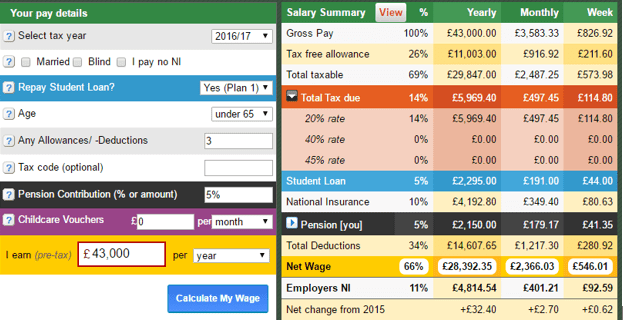

Listen to Taxman Review

Listen to Tax Man provides a UK tax calculator perfect for those in need of finding out their yearly, monthly, or weekly gross and net wages. This UK wage calculator uses your wages from a period you choose, like hourly or monthly. It then provides detailed information in a comparison chart to compare the pay periods you choose, like weekly or yearly.

Image Source: Listen to Tax Man

You can choose to input additional information, like your tax code, pension contribution, or childcare vouchers, into the UK salary tax calculator. The income tax UK calculator will then calculate your income tax in the UK within different tax brackets so you can get the most accurate results for your take-home pay.

How Is This Calculator Different?

With this UK tax calculator, you can view tax information from previous years if you want to compare them with current tax rates. This can help you see how your salary has changed from year to year to help you better predict your future take-home pay in relation to your mortgage payments.

Related: Finding the Best Home Loan Calculators | Top Home Mortgage & Home Equity Calculators

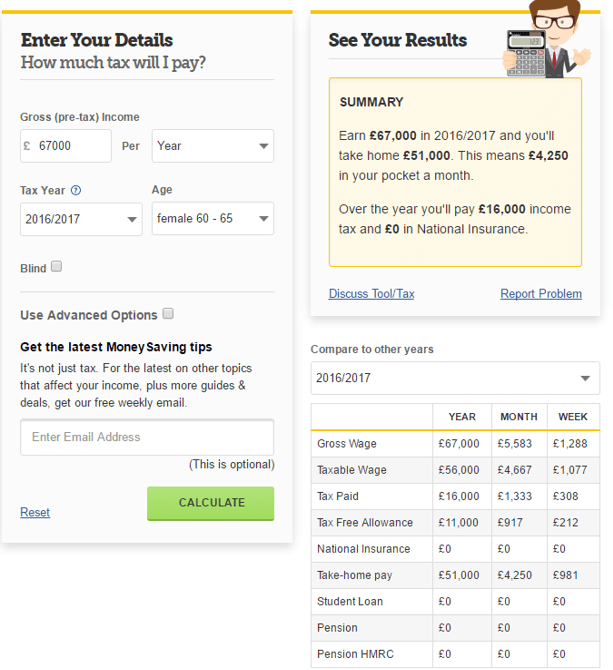

Money Saving Expert Review

Money Saving Expert provides an easy-to-use UK income tax calculator with detailed results. This calculator uses the tax rates from the current tax year to determine the most up-to-date results. Your results are displayed as a comparison table with your yearly, monthly, and weekly gross and net incomes and tax information.

Image Source: Money Saving Expert

How Is This Calculator Different?

This UK income tax calculator can be as simple or advanced as you want. The calculator has an Advanced Options box, where you can add in your tax code, pensions, student loan information, and more advanced tax options. Or, leave the Advanced Options box unchecked for a simplified input using your age and wages.

You can also use the Money Saving Expert calculator to see your results using tax rates from previous years if you need to compare them. Your results table will show you the differences between yearly, monthly, and weekly pay periods for the options you choose.

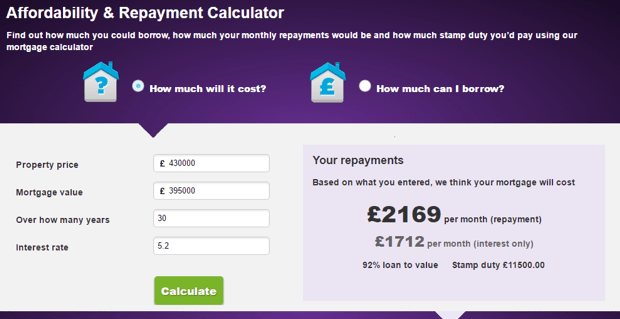

Money SuperMarket Review

Money Super Market offers a very simple UK mortgage calculator that takes into consideration your property price, mortgage value, loan term, and interest rate. You can easily play around with numbers to see what amount of mortgage may work for you, in terms of a monthly payment.

Image Source: Money Super Market

The calculator results will show you your monthly payment in an easy-to-understand box, including stamp duty amount, if applicable.

How Is This Calculator Different?

You can switch calculations on this UK mortgage calculator to find out how much you can afford to borrow for your mortgage. This calculation bases its results simply on your and your co-borrower’s gross income.

If you are trying to be conservative in your mortgage spending, and you only want a certain amount of your income considered, enter that amount instead. Your results will show a typical range, based on your income, that you can spend on a mortgage.

Popular Article: Best Mortgage Payment Calculators | Tips to Find Top Calculators to Estimate & Calculate Mortgage Payments

Nationwide Review

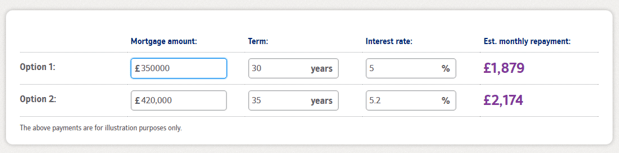

The UK bank, Nationwide, provides you an excellent way to compare mortgage options with its easy-to-use UK mortgage calculator. This calculator uses mortgage amounts, loan terms, and interest rates to easily compare two options.

Image Source: Nationwide

Since it does not offer a lot of details, such as property tax in the UK or housing insurance, this calculator is best for those researching prospective mortgages. It provides a quick result using the most important information for an easy comparison between two loans.

How Is This Calculator Different?

Nationwide also provides a mortgage affordability calculator option that is much more detailed if you want to learn how much house you can afford. This UK mortgage calculator asks for information about your potential new home, your income and expenses, and other details that will help calculate the most accurate result.

Read More: How to Find the Best Mortgage Refinance Calculator with Taxes And Insurance

Free Wealth & Finance Software - Get Yours Now ►

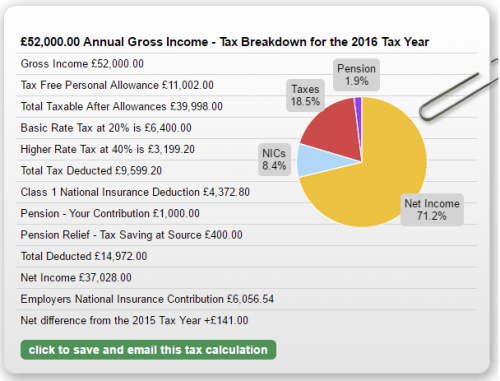

UK Tax Calculators Review

UK Tax Calculators is detail-oriented, providing every piece of information you need to know about your taxes from your yearly, monthly, or weekly pay.

You can opt for the simplified version, which still uses a lot of information for accurate results, or choose the advanced version. The advanced UK tax calculator will ask you for more information regarding your pension, student loans, bonuses, and more.

Image Source: UK Tax Calculators

The UK salary tax calculator then displays your results in a handy comparison table. You will see your gross and net wages, tax information, insurance, and more, compared side-by-side annually, monthly, and weekly, or another period that you choose.

How Is This Calculator Different?

This UK income tax calculator provides more visuals than other UK wage calculators. In fact, the calculator displays your results in a pie graph, bar graph, line graph, and more, so you can choose which visuals work best for your needs.

The UK tax calculator even details where exactly your tax money goes for taxes, such as transportation and welfare taxes. If you want to see how your current salary’s taxes would have changed over the past 10 years, you can view these results in a line graph.

Conclusion—Top 6 UK Income Tax Calculators and UK Mortgage Calculators

A UK pay calculator and UK loan calculator, when used together, can be extremely beneficial in obtaining a new mortgage to purchase a home. You must understand your current income to know what you can afford for a new mortgage.

An income tax UK calculator will help you determine the net pay that you have to work with before you obtain your mortgage. Then, you can use those results to help you calculate the mortgage you can afford with a UK mortgage calculator.

A loan repayment UK calculator can also help you quickly compare mortgages as you research. Most mortgages have different interest rates and loan terms, even if they are for the same amount of money. A calculator will aid you in finding the terms that work within your budget.

Make use of the 6 best UK tax calculators and mortgage calculators in this ranking guide. They are all free to use and can significantly increase your ability to understand your finances, create a budget, and plan for the purchase of your future home.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.