Introduction: Finding the Best Mortgage Refinance Calculator

During times when interest rates are low, using a mortgage refinance calculator to see how much you might save by refinancing your home can be advantageous. If you originally financed at a rate just a percentage or two higher than what’s currently available, using a refinance mortgage calculator can show you exactly how much money you’d save by refinancing at a lower rate.

Some people research a refinance mortgage rates calculator because they want to lower their monthly expenses, and others want to see what the mortgage cash out refinance calculator shows them about paying off their home loan faster. Either way, using an online mortgage refinance loan calculator can be the first step to taking advantage of low interest rates for a better financial future.

In this article, we are going to talk about the benefits of using a home mortgage refinance calculator to see how much you could save by refinancing your mortgage loan at a lower interest rate. We will also show you how to find the best refinance mortgage calculator with taxes and insurance, explain what a mortgage refinance breakeven calculator is, and give you a full listing and explanation of the different types of refinance mortgage loan calculator tools out there that show how much you can save.

See Also: The Best Home Equity Calculators & Equity Line of Credit Calculator Websites

Why Refinance? | Using a Refinance Mortgage Calculator

For some people, the thought of going through the loan process again to refinance their home makes them want to stay with the loan they have. But if you take some time to review a mortgage refinance calculator with taxes included, you may be surprised at the savings to be had for just a little extra paperwork. Understanding the difference that just a few percentage points in the interest rate on your loan can mean in a monthly payment or payoff term is exactly what a mortgage refinance savings calculator can tell you — even before you visit a lender.

First, it is helpful to understand why it might be a good idea to refinance, and it’s all about saving money. When the U.S. Federal Reserve sets low interest rates, including a lower Fed Funds Rate, the rate that banks and other lenders use to set the interest rates they offer borrowers must follow suit. When the mortgage rate you can get on a new loan is lower than your current loan, a refinance mortgage calculator with taxes can show you what that means for you, which could be a monthly payment $200 or more less or a pay-off many years sooner than you planned.

Image source: Pexels

Reasons to refinance and check out a mortgage refinance calculator:

- Reduce your loan interest rate

- Lower monthly mortgage payment

- Shorten the term of a home loan

- Refinance from an adjustable-rate mortgage to a fixed-rate mortgage

- Cash out home equity

Don’t Miss: Finding the Best Home Loan Calculators | Top Home Mortgage & Home Equity Calculators

The Two Main Types of Refinances | Finding a Refinance Mortgage Rates Calculator

In order to locate the mortgage refinance loan calculator that is going to give you the information you need to make a decision, it’s important to understand the two main types of refinances, Rate and Term and Cash Out. A mortgage cash out refinance calculator will give you slightly different details than a mortgage refinance savings calculator, so knowing which type of refinance you are interested in can ensure you choose the best mortgage refinance calculator for your needs.

- Rate and Term Refinancing: This type of refinance is when you’re interested in reducing your interest rate in order to save money on your monthly payment or reduce the overall term of your loan. A refinance mortgage calculator with taxes and insurance can help give you the information you need for this refinance type.

- Cash Out Refinancing: This type of refinancing is when you refinance a new mortgage for more than is owed on your current loan and take the difference in cash to either pay off debt or finance a new business or investment. In this case, you would want to look for a mortgage cash out refinance calculator.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Inputs You Need for a Home Mortgage Refinance Calculator

There are a few important data points that it will be helpful for you to know ahead of time before using a refinance mortgage calculator with taxes and insurance. Don’t worry if you don’t have all the information upfront; many refinance mortgage loan calculator tools will allow you to use estimates to get a rough idea. Of course, the more detailed information that you have about your mortgage loan and refinance goals, the more accurate output you’ll get from the mortgage refinance savings calculator.

Some of the information is used specifically for a mortgage cash out refinance calculator, when you want to refinance in order to have extra cash, and other information is used for a mortgage refinance savings calculator when you want to see how much money you can save on a monthly payment. Don’t let all the information scare you, though; you can enter just a few bits of information into a mortgage refinance calculator with taxes and get the basics of what you need to know.

Typical information input into a refinance mortgage calculator with taxes and more:

- Original loan amount

- Original loan term

- Original loan annual interest rate

- Balance left on current mortgage

- Years left on current mortgage

- New loan amount

- New loan term

- New loan annual interest rate

- Cash that you want to take out

Potential cost/fee related inputs for a refinance mortgage rates calculator:

- Points (also known as discount points, equal to 1% of your mortgage amount)

- Application/Loan origination fee

- Attorney’s fees

- Title search

- Appraisal fee

- Local fees (taxes or transfers)

- Credit check fee

- Title insurance

- Inspections

- Document preparation

Related: Best Online Financial Advisors (Human Advisor, Robo-Advisor, and Hybrid)

Top 10 Home Mortgage Refinance Calculator Sites

Here we will give you a list of the top 10 refinance mortgage loan calculator sites that we have found online, the information they include, and where to find them. Some of the mortgage refinance calculator with taxes forms will be located on general finance websites or bank/lender websites, giving you a personalized option for a refinance mortgage calculator that connects directly to a lender’s rates.

It can also be a good idea to use more than one refinance mortgage rates calculator when doing your initial estimates, because some provide more data than others and some have very nice visual graphs with their mortgage refinance loan calculator that make it easy to understand your potential savings both short-term and over the life of the loan.

1. Bankrate Mortgage Refinance Calculator

Who they are: Bankrate is a leading aggregator of financial rate information with over 40 years of experience in the financial publishing industry. They publish rate data along with original and objective personal finance content for consumers.

Mortgage Refinance Breakeven Calculator – Tells you how long it will take to break even on a mortgage refinance and gives you details on monthly payment savings.

Refinance Mortgage Calculator with Taxes and Insurance – Gives you an overall picture on monthly payment savings and costs. It includes inputs like points, application fee, title insurance, and other fees.

Mortgage Refinance Calculator for Loan-to-Value – Helps you get a picture of where you are on your mortgage and whether you are too far upside-down to refinance under the Home Affordable Refinancing Program (HARP).

2. Fannie Mae Mortgage Refinance Calculator

Who they are: The Federal National Mortgage Association is a government-sponsored enterprise that provides financial products and services, including financing for mortgage lenders.

Refinance Mortgage Calculator – Allows you to input typical information on your current mortgage and other costs, like HOA fees, and provides you with details on term and cost savings. This is a refinance mortgage calculator with taxes and insurance.

Image source: Zillow

3. Zillow Mortgage Refinance Calculator

Who they are: Zillow is a leading real estate and rental online marketplace and serves the full lifecycle of owning and living in a home: buying, selling, renting, financing, remodeling, and more.

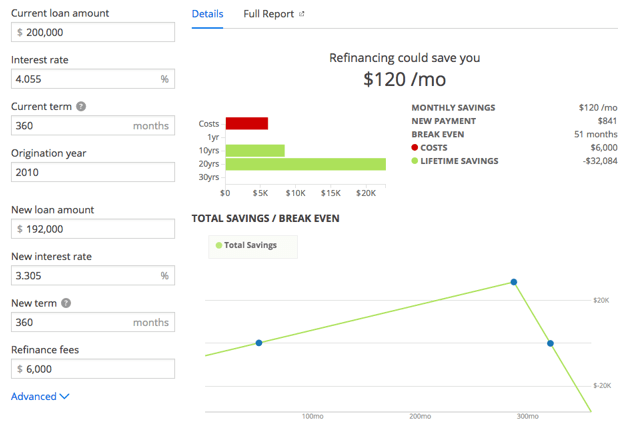

Mortgage Refinance Savings Calculator – This is a fairly straightforward refinance mortgage calculator with a nice graph that shows total savings/break even information. If you click the “advanced” tab at the bottom of the form, you can get details from the mortgage cash out refinance calculator field.

4. Bank of America Mortgage Refinance Calculator

Who they are: One of the nation’s leading financial institutions providing banking, investing, mortgages, other loans, and a number of other financial services.

Custom Rate Refinance Mortgage Loan Calculator – If you’re looking to save time and know the rate a bank would offer you on a refinancing, this home mortgage refinance calculator makes it easy to give just a little information and get a quick custom rate back, which is specific to Bank of America.

5. Chase Mortgage Refinance Calculator

Who they are: JPMorgan Chase and Co., known simply as “Chase,” serves nearly half of America’s households with a broad range of financial services, including banking, credit cards, mortgages, auto financing, investment advice, and more.

Mortgage Refinance Breakeven Calculator – Chase has an easy-to-use refinance mortgage calculator with sliders to change values that has a handy graph showing current loan and refinanced loan savings side-by-side.

Popular Article: LPL Financial Reviews | What You Need to Know about LPL Financial

6. Realtor.com Mortgage Refinance Calculator

Who they are: Realtor.com is operated by Move, Inc. and is one of the best known websites for buying, selling, and renting homes. It is also the official website of the National Association of REALTORS®.

Mortgage Refinance Savings Calculator – This is a fairly easy-to-use refinance mortgage calculator, and it has a really nice display that gives you all the pertinent data on your monthly savings, lifetime savings, and break even point on the new loan.

7. SmartAsset Mortgage Refinance Calculator

Who they are: SmartAsset provides multiple online tools for a variety of personal finance needs, such as home buying, retirement, investing, taxes, and loans. Their company’s mission is “transparency through technology,” and their goal is to help simplify complex financial questions.

Easy Mortgage Refinance Loan Calculator – If you want to go through a simple step-by-step with just a few fields served up at a time, then this refinance mortgage calculator is for you. It can be much less overwhelming than some of the multi-input forms.

8. U.S. Mortgage Calculator Refinance Mortgage Calculator with Taxes and Insurance

Who they are: While there is not a lot listed about who runs the site, it appears to be dedicated specifically to mortgage calculators, including a mortgage guide and handy Anroid app for download.

Refinance Mortgage Calculator with Taxes – If you’re interested in getting all the details of taxes, insurance, and PMI, on a new refinanced mortgage loan, then you will really like this refinance mortgage calculator with taxes and insurance. It includes a nice charted breakdown of expenses, payments, taxes, PMI, and insurance for any loan.

9. Nationwide Refinance Mortgage Calculator with Taxes and Insurance

Who they are: Nationwide is one of the largest providers of insurance and financial services in the U.S. and is a Fortune 100 company. They provide multiple insurance and financial services, including mortgages.

Refinance Mortgage Calculator with Taxes, Insurance – You may want to see both taxes and insurance on your refinancing calculation but find calculator #8 a bit too daunting. If so, then this refinance mortgage calculator with taxes and insurance will be right up your alley. It includes minimal inputs and adds the options for including annual home insurance and property taxes.

10. Lending Tree Refinance Mortgage Calculator with Taxes

Who they are: Lending Tree is one of the nation’s largest lending institutions and helps people field multiple offers from a network of lenders for home, auto, personal, and other types of loans.

Mortgage Refinance Calculator with Taxes – Lending Tree adds an extra benefit to their refinance mortgage calculator by asking for your credit score range, so they can show you what potential rate offers would be from their third-party lenders. The display has an easy-to-read pie chart that includes property taxes and homeowner’s insurance.

Read More: First Financial Reviews – What You Need to Know! (Personal & Loan Reviews)

Conclusion | How to Find the Best Mortgage Refinance Calculator

Deciding whether or not to refinance your home is an important decision. The timing can be critical if you want to save the most money you can. Luckily, there are several types of refinance mortgage calculator tools online that can make the decision an easier one by giving you all the data you need for an informed decision.

Image source: Pexels

Whether you like the more complicated refinance mortgage calculator with taxes and insurance or need a mortgage refinance breakeven calculator to find that break even point, or even if you want to take out some cash and are looking for a mortgage cash out refinance calculator, there are several great ones that can give you the information you’re looking for. Make the decision an easy one by utilizing one of the top mortgage refinance calculator tools above. You just might find that a refinance can save you much more than you thought.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.