2017 RANKING & REVIEWS

TOP RANKING WEEKLY TAX CALCULATORS

Using a Weekly Pay Calculator to Take Charge of Your Finances

Wouldn’t it be nice if the wage we were offered was actually what we saw on our weekly check? Due to factors such as taxes, withholdings, overtime adjustment, and more, we can often feel like we are left guessing what are paychecks will be each week. That is where an online weekly pay calculator or weekly tax calculator comes in handy.

These weekly payroll and weekly income tax calculator tools are available on various websites. And this guide’s main mission is to show you the top options for an income tax calculator online in 2017.

Award Emblem: Top 6 Best Weekly Tax & Weekly Pay Calculators

We will show you a couple simple and quick income tax calculator options, as well as some weekly income calculator choices that are more detailed and comprehensive.

Each of the six weekly payroll/weekly tax calculator websites has something unique that may appeal to the calculations you need with your specific paycheck set up. You will find a gross and net income tax calculator, a federal income tax rate calculator, a weekly compound interest calculator, and an income tax deductions calculator option.

In the end, one of these online weekly pay calculator options will help you figure out your finances and plan out your year with confidence and success in 2017.

See Also: Top Credit Cards for Low Credit Scores | Reviews | Best, Fastest Ways to Build Credit

AdvisoryHQ’s List of the Top 6 Best Weekly Pay Calculator or Weekly Tax Calculator Websites

List is sorted alphabetically (click any of the calculator names below to go directly to the detailed review section for that calculator):

Top 6 Best Weekly Pay Calculator Options | Brief Comparison & Ranking

Weekly Pay Calculator/ Weekly Tax Calculators | Calculate Gross Income? | Calculate Net Income? | Hourly Or Salary? | Unique Features |

Bankrate | YES | YES | Hourly | Provides a helpful pie chart to see income and tax info |

Dollars Per Hour | YES | NO | Hourly | Helps you calculate your overtime earnings |

iCalculator | YES | YES | Both | Offers calculators for various countries; breaks down by yearly, monthly, 2 weekly, etc. |

Paycheck City | YES | YES | Both | Allows you to figure out your paycheck by entering up to 6 different pay rates |

Paycheck Manager | NO | YES | Both | Comprehensive breakdown of all taxes and deductions |

Suburban Computer | YES | YES | Both | Provides a simple, quick income tax calculator for those who do not want to spend time |

Table: Top 6 Best Weekly Tax Calculator Websites| Above list is sorted alphabetically

Weekly Pay Calculator and Weekly Tax Calculator: What’s the Difference?

The only real difference between an online weekly pay calculator or an online weekly tax calculator (also refered to as a weekly income tax calculator) is that the first determines how much you will be paid weekly (whether gross or net), and the second figures out how much tax will be taken from your paycheck weekly.

Image Source: Pixabay

You will quickly see that we use the terms “weekly pay calculator” and “weekly tax calculator” (or “weekly income tax calculator”) pretty interchangeably throughout this list.

This is because most of the online calculators we highlight will figure out both your expected weekly pay as well as the taxes you can expect to be removed. If they don’t, however, we will make note of it.

Why an Online Weekly Pay Calculator?

Sure, it is technically possible to figure out your take-home pay using a handheld calculator instead of an online quick income tax calculator.

But first you will need to learn all the current tax rates for federal and state, you will need to know exactly how much social security will be removed, and you will need to know deductions and withholdings.

To make all of this easier and significantly quicker, you can simply enter all this data into one of these online weekly pay tax calculator websites and learn your estimated paycheck.

An income tax calculator online is, of course, entirely safe. You are not including any personal information to these online calculators, only figures. There is never any need to add names, account numbers, or any identifying information to any of these top individual income tax calculator/weekly tax calculator websites.

Don’t Miss: How to Find the Best Personal Loan Calculator to Calculate Payments & Interest (USA)

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, products, or calculators that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review—Top Ranking Best Weekly Income Tax Calculator or Pay Calculators

Below, please find a detailed review of each calculator on our list of quick income tax calculator choices. We have highlighted some of the factors that allowed these weekly pay tax calculator websites to score so high in our selection ranking.

Bankrate Review

Bankrate offers a weekly income tax calculator/paycheck calculator for those who earn hourly income. To begin with, you can enter all the current payroll information that you know, and then you can mark any deductions you may have.

This federal income tax rate calculator asks for the following information:

- Year-to-date income

- Filing status

- Pay period (this is where you can enter weekly)

- Number of allowances

- 401(k) or 403(b) withholding

- Employee paid health insurance

- State taxes and local taxes

- Other pre-tax deductions

- Post-tax deductions

- Post-tax reimbursements

- Regular hours worked

- Regular pay per hour

- Overtime hours worked

- Overtime pay per hour

- Other hours worked

- Other pay per hour

Once you have entered all of this information into the weekly income tax calculator/paycheck calculator, you will have a pie chart to show you where all your earned income will go. You will see a portion for your net paycheck, social security, Medicare, federal taxes, and so on.

While this is not the most quick income tax calculator on our list, it offers so many options that you can figure out exactly what you need to. It could be used as a weekly compound interest calculator, income tax deductions calculator, individual income tax calculator, or federal income tax rate calculator.

Dollars Per Hour Review

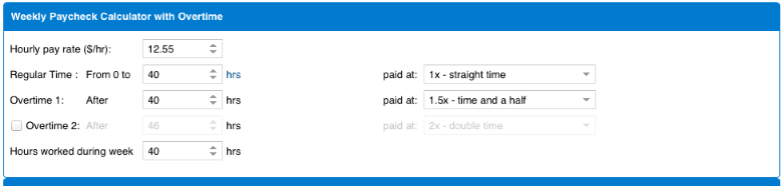

What makes the Dollars Per Hour income tax calculator online so unique is its ability to factor in overtime. Not only can you factor in one overtime rate, but also you can even factor in two.

Image Source: Dollars Per Hour

To use this quick income tax calculator, enter the following information:

- Hourly pay rate

- Regular time hours

- Overtime hours

- Overtime pay schedule (example: time and a half)

- Overtime part 2 hours

- Overtime part 2 pay schedule (example: double time)

Keep in mind, this is not a weekly income tax calculator or a net income tax calculator. The Dollars Per Hour calculator will only find your gross income, plus your added overtime.

A good way to use this weekly income calculator is to figure out your earnings with your added overtime. Then you can use that new number in a weekly tax calculator we mention on the list.

Related: The Best Retirement Calculators | Guide | Top Retirement Savings & Income Calculator

iCalculator Review

Next up on the list is the iCalculator net income tax calculator. This calculator has two special features that make this weekly tax calculator/pay calculator unique.

To begin with, you can choose to use this weekly income calculator to calculate pay in 8 countries (including the United States). Next, you can have a breakdown of both gross pay, net pay, and taxes in yearly, monthly, 4 weekly, 2 weekly, weekly, daily, or hourly installments.

This weekly pay tax calculator from iCalculator asks for the following information:

- Gross salary

- How often that salary is paid (yearly, monthly, hourly, etc.)

- Tax state

- Tax year

- Tax status/family

- Gross withholdings

- Gross tax-deferred retirement plan

- Gross cafeteria or other pre-tax plan

- Gross earned income tax credit

Once you are done, the iCalcualtor weekly income tax calculator/payroll calculator will give you a comprehensive and detailed overview of your income, your withholdings, your taxes, your state taxes, and more.

Paycheck City Review

The weekly pay tax calculator from Paycheck City has a unique feature that could help some people. You are able to figure out your gross income, net income, and tax payments with up to six different pay rates.

You enter the following information into the weekly income calculator:

- Tax year

- State of residence

- How many rates end up in your paycheck

- Each pay rate

- Each pay rate’s hours

- Gross pay (optional)

- Pay frequency (this is where it becomes weekly)

- Federal filing status

- Additional federal withholdings

- Exemptions

- Tax rate

- State withholdings

- Deductions

Once you have entered your info, you will have a list of estimates when it comes to your gross paycheck, net paycheck, and exactly all the taxes that will be taken out.

This means this calculator not only stands as a regular weekly income tax calculator/weekly pay calculator, but also an income tax deductions calculator, weekly compound interest calculator, federal income tax rate calculator, and more.

Paycheck Manager Review

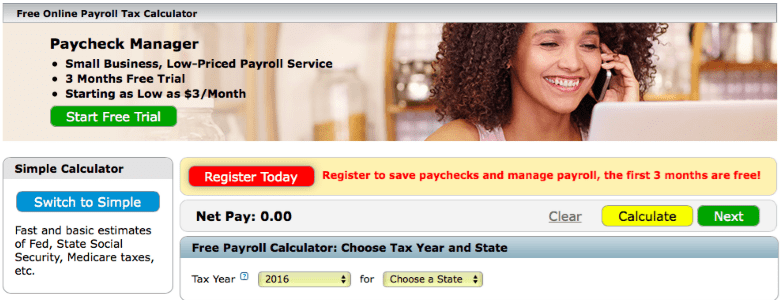

Next up we have the weekly tax calculator/weekly pay calculator from Paycheck Manager.

Image Source: Paycheck Manager

When it comes to using an income tax calculator online, this is one of the more comprehensive choices. It may take you a few minutes to fill out the information, but you will end up getting a detailed breakdown in the end.

You will need to include the following information on this weekly income calculator:

- Tax year

- State

- Martial status for federal

- Allowances for federal

- Martial status for state

- Allowances for state

- Pay cycle (weekly)

- Pay rate

- Time (per hour, per week, per month, per year)

- Hourly salary

- Annual salary

- Overtime rate and hours

- Non-tax deductions

- Federal income tax withholding

- Social security tax

- Medicare tax

- State income tax withheld

- After-tax adjustments

Once this information has gone into the individual income tax calculator, you will get a breakdown of exactly what your net paycheck should be. It will show you rates to expect for each and every category.

Popular Article: The Best UK Mortgage Payment Calculators | Lloyds vs. TSB vs. Tesco vs. Woolwich

Free Wealth & Finance Software - Get Yours Now ►

Suburban Computer Review

The final weekly pay calculator on our list comes from Suburban Computer.

The biggest benefit to their weekly income tax calculator/paycheck calculator is that it is simple and fast. There are significantly fewer areas to enter information. This means you may not get as detailed of a response, but you can use it quickly.

Add this information to the quick income tax calculator:

- Salary/hourly wages

- Pay frequency (weekly)

- Federal withholding

- State withholding

Suburban Computer will give you a breakdown of your salary, federal income tax, social security, Medicare, and state tax. What you will be left with is your net income from this net income tax calculator.

Read More: Which Is the Best UK Mortgage Calculator? BBC? Halifax? Barclays? Nationwide?

Conclusion—Top 6 Weekly Pay Calculator & Weekly Tax Calculator Choices

Now that you have seen our list of the top weekly pay calculator and weekly income tax calculator websites, you can bookmark and use the one that works best for your wage earnings.

Use this information from each individual income tax calculator and income tax deductions calculator to help plan for retirement or large purchases, pay your credit cards on time, set aside money for savings, and more.

The more you know about exactly how much you will bring home each week with your paycheck, the better you will be at managing your money.

Try one of these weekly pay tax calculator or weekly compound interest calculator choices today and get to know what to expect on every paycheck in 2017.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.